Jun 12, 2022 | cents, coins, news

1943-S Steel Cent

Copper was a crucial element in making bullets for the war efforts. With the production of war materials increasing, congress and the U.S. Mint thought that striking the cent using another metal would help. After testing different materials in 1942, the U.S. Mint selected a zinc-coated steel planchet. In 1943, the U.S. Mint produced 1,093,838,670 steel cents between the three mints.

The coins were not well received by the public. Their size and lighter weight caused many people to confuse the steel cent with the dime. The zinc coating would wear as the coin circulated, allowing rust to form on the steel.

With over 1 billion coins struck, there are plenty of opportunities to collect steel cents. At the time, some people saved rolls, and others put the coins aside because they did not like to use them. They can be purchased online or from many dealers.

When looking for steel cents for a collection, look for a coin that continues to show its zinc color. The zinc will be a semi-bright silvery color that does not have a very shiny look. Grey-looking and dark grey coins have been handled and should be less expensive.

Nice examples of Steel Cents are not expensive. With over 680 million struck in Philadelphia, uncirculated examples of those coins cost $2.50 – $3.00. There were over 210 million struck in Denver, uncirculated 1943-D steel cents will sell for $3.25 – $4.00. There were fewer steel cents struck in San Francisco. Over 190 million struck, uncirculated 1943-S coins cost $5.00 – 6.50.

When buying coins for your collection, be careful with coins that look shinier than others. These coins may be reprocessed Steel Cents. Reprocessed steel cents are real coins but have a new coating of polished zinc. While they are pretty coins, numismatists consider these coins damaged and advise not collecting them if you are looking for value.

Rather than continuing to use the steel planchet, the U.S. Mint used copper recovered from the spent shell casing used for ammunition. The shell casing came from the training fields in the United States and not from the battlefields.

In 1944 and 1945, spent ammunition provided the copper used to strike Lincoln Cents. These coins are known as shotgun case cents and are darker than other copper coins because the smelting process could not remove all of the impurities from the ammunition.

There are famous 1943 Lincoln Cents struck on copper planchets, and 1944 cents struck on steel. These are rare coins and not as readily available.

The 1943 Steel Cent is the only circulating coin ever produced by the United States Mint that does not contain copper. Collecting a complete three-coin set adds a historic coin to your collection at an affordable price.

And now the news…

June 6, 2022

Prague, Czech Republic – A rare ten-ducat coin dating from the 17th century sold for more than 10 million Czech crowns (about €4 million) at an auction held in Prague on Saturday. The ten-ducat coin was minted in Prague during the reign of Frederick the Great in the early 17th century.

→ Read more at

kafkadesk.org

June 7, 2022

Hyderabad: Security Printing and Minting Corporation of India Limited (SPMCIL) is organising Azadi Ka Amrit Mahotsav celebrations from June 6 to 13 in all its units. As a part of the celebrations, India Government Mint, Hyderabad, is inaugurating the coin museum at Saifabad Mint on June 7.

→ Read more at

thehansindia.com

June 7, 2022

Centuries-old shipwrecks complete with gold coin treasure have been discovered off Colombia. According to officials, Colombian naval officials conducting underwater monitoring of the long-sunken San Jose galleon discovered two other historical shipwrecks nearby.

→ Read more at

presstv.ir

June 8, 2022

A SELLER on eBay recently had some luck with his coin collection – selling it for nearly $3,500. The collection featured Lincoln steel pennies that mostly bared the 1943 dates, according to the seller.

→ Read more at

the-sun.com

June 10, 2022

The U.S. Mint released the first quarters featuring Wilma Mankiller, who was the first woman named Chief of the Cherokee Nation.

→ Read more at

poncacitynow.com

Jun 7, 2022 | auction, coins, grading

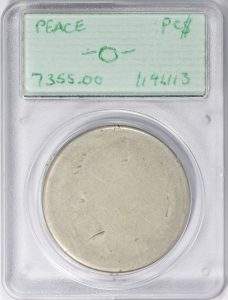

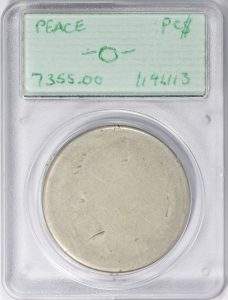

Peace Dollar with PCGS Prototype Handwritten Label

(Image courtesy of Great Collections)

That curiosity in history had me searching for the auction of a significant piece of numismatic history. An article appeared at Coin Week reporting that a sample PCGS Type 1 holder with a handwritten label was up for auction at Great Collections.

According to the auction description, it is a prototype holder for a very worn Peace dollar to show how a coin with a worn date could be certified by PCGS. The handwritten label was produced in 1989 or 1990, with PCGS confirming the label’s authenticity.

The label is a demonstration of the growing pains experienced by PCGS. By 1989, PCGS was three years old and experienced an exception to its established procedures. Long before low-ball collecting, what does a company do with a low-grade coin?

The prototype holder with a coin that would likely grade PO-1 today is an artifact of numismatic history. Aside from its historical significance, it is just a cool item. The price as this is being written is $5,050. The auction ends Sunday, June 19, 2022, at 06:38 PM Pacific Time. Get your bids in!

EDITED: I am not the owner/seller of this slab and I am not a bidder in this auction. I was accused of shilling this auction by a reader via an email. It is featured here because I thought it was something interesting and, quite frankly, cool. I have no association with Great Collections except as a satisfied customer.

Jun 5, 2022 | Britain, news

The college-age child of a friend accepted a summer job in London and went early to witness the Queen’s Platinum Jubilee. Earlier today, I joined my friend on a video talk with the group of U.S. students staying in a London hotel.

The college-age child of a friend accepted a summer job in London and went early to witness the Queen’s Platinum Jubilee. Earlier today, I joined my friend on a video talk with the group of U.S. students staying in a London hotel.

During the discussion about the atmosphere around the streets of London, I asked about coins and medals that they encountered. All of the students found a 50 pence coin issued by the Royal Mint, and almost every shop and street vendor carried the coin they included in making change.

Other souvenirs the group collected are aluminum tokens with images commemorating the jubilee. The tokens were reminiscent of Mardi Gras tokens. Some found tokens that were the size of the old large penny with images of the Queen at various ages.

A few found currency-looking commemoratives, and they were designed as £70 notes with images of the Queen. The reverse has the name and address of a London business using the notes as an advertising opportunity.

The jubilee celebration is over, but the collectibles will live on.

And now the news…

May 31, 2022

JEDDAH: For artist Hisham Al-Najjar, painting on canvas or papers is conventional. Instead, the Jeddah-based artist uses pennies and other international coins as the backdrop for his impressive paintings.

→ Read more at

arabnews.com

June 1, 2022

There is a coin worth up to 40.000 Euro! It sounds crazy, but coin collecting also has these little rarities. Coins that, due to their unobtainability and value, are likely to be worthy of becoming part of the museum’s collection.

→ Read more at

hardwoodparoxysm.com

June 2, 2022

There's a new trend that has been sweeping YouTube with hundreds of videos — one that claims you can earn hundreds, or even thousands, of dollars with this hobby. It's called “coin roll hunting.” And it's pretty much exactly what you imagine it is: searching through rolls of coins to hunt for collectible and valuable coinage.

→ Read more at

outsiderclub.com

May 29, 2022 | news

National Purple Heart Hall of Honor 2022 Three-Coin Proof Coins (U.S. Mint Image)

Memorial Day took on national significance following World War I when the nation began to recognize all those who gave the ultimate sacrifice during all conflicts. By the end of World War II, most of the celebrations were renamed to Memorial Day. Memorial Day did not become an official holiday until 1967 with the passage of the Uniform Holidays Act (sometimes referred to as the Monday Holiday Bill). The law set Memorial Day to the last Monday in May, changing it from the traditional May 30.

The modern Memorial Day is a holiday celebrating the lives of those sacrificed in defense of the United States and its ideals at home and abroad. We honor the memories of those who paid the ultimate sacrifice so that we can collect what we like. They have gifted us the freedom so that I can write this blog and you can read and share it with others.

And now the news…

May 24, 2022

The Modiin haul. The seizure featured a historically significant silver shekel.

→ Read more at

news.artnet.com

May 25, 2022

The Royal Mint has created the largest ever coin in its 1,100-year history in celebration of the Queen's Platinum Jubilee.

→ Read more at

penarthtimes.co.uk

May 26, 2022 | commentary, currency, policy

Changes to the Series 2013 $1 Note

For most of the 21st century, many groups have advocated for eliminating the $1 bill, while others provide a counterpoint to maintain the status quo. While the discussion of eliminating the note has economic and policy concerns that lawmakers must address, how would the U.S. government implement the policy?

The Federal Reserve Act of 1918 gives the Federal Reserve the authority to procure, distribute, and manage the nation’s currency supply. They must procure the paper money from the Treasury Department, but the Federal Reserve is required to tell Treasury how much money they need to print. But does the Fed determine which notes to print?

The law (12 U.S. Code § 418) says that the Treasury Department prints notes in “the denominations of $1, $2, $5, $10, $20, $50, $100, $500, $1,000, $5,000, $10,000 as may be required to supply the Federal Reserve banks.” The statement suggests that the Federal Reserve banks set the printing requirements. Does this mean that the Federal Reserve banks can tell Treasury that it no longer requires them to print the $1 note?

Series 1934 $1000 Federal Reserve Note

Although the denominations remain part of the law, the Federal Reserve Act gives the Federal Reserve latitude to manage the currency supply as it deems necessary. It was a policy enacted by the Treasury and Federal Reserve in tandem.

The agreement was not as easy as the history books want us to believe. In 1969, William McChesney “Bill” Martin was the Federal Reserve Chair. Martin was appointed by Harry S. Truman in 1951, fiercely guarded the Federal Reserve’s independence, and was known to push back against presidential policies with a minimalist approach to managing market factors. In the 1960s, Martin ran afoul of Lyndon Johnson and Richard Nixon for not doing more to help prevent a recession.

Following a meeting with Nixon in October 1969 about what his administration saw as an impending recession, Nixon announced that he would replace Martin when the Federal Reserve chair’s term expired on January 31, 1970.

It was not the first time the Federal Reserve changed United State currency without legislation. Since the formation of the Federal Reserve, the Federal Reserve authorized the printing of gold certificates, silver certificates, Legal Tender notes, Federal Reserve Banknotes, and the ongoing Federal Reserve Notes.

Before the formation of the Federal Reserve, the Treasury Department determined what currency to print and its design. Treasury Secretary Franklin MacVeagh proposed reducing the size of the currency paper in 1909. After years of study and discussion, Secretary Andrew Mellon approved new smaller designs issued in 1929. The change did not require new legislation.

Based on history, Treasury Secretary Janet Yellen and Chairman of the Federal Reserve Jerome Powell can decide to withdraw the $1 Federal Reserve Note from circulation. Powell can instruct the Federal Reserve Banks to stop issuing $1 bills and use the $1 coin instead. When the notes return to the Federal Reserve System, they can withdraw the notes and destroy them as they do with old currency.

Yellen can refuse by saying that she is following her boss’s policies, the President of the United States. But the Federal Reserve is an independent agency and does not have to ask for permission. By law, if the Federal Reserve does not order the printing of new $1 bills, the Bureau of Engraving and Printing will not print new currency.

Politics may prevent Yellen and Powell from making this decision, but they can do it and allow the United States to join the rest of the civilized world that no longer carries its unit currency in paper form.

May 25, 2022 | currency, Federal Reserve, policy

Would ending the circulation of the $100 Federal Reserve Note force the Russian people to pressure Putin over his Ukraine attack?

Would ending the circulation of the $100 Federal Reserve Note force the Russian people to pressure Putin over his Ukraine attack?

According to an opinion piece published in the Wall Street Journal by Markos Kounalakis (sorry, it’s behind a paywall), the sanctions on Russia are not reaching their people. Kounalakis believes that the United States should stop circulating the $100 bill to reach the people.

The United States dollar is the world’s reserve currency, and it is used as a safe store of wealth by people and companies. The Euro may represent an easily transactional currency, but the dollar is where the world turns for a store of wealth. In Russia, where the banks are not trusted, average citizens keep their savings in dollars.

According to the Federal Reserve, more than 661,500 pounds of $100 bills are in Russia as of 2019. Russians are stuffing them in a mattress and not using them for commerce.

Removing large-denomination currency from circulation is not new. In 1969, the Treasury withdrew the $500 and $1000 notes from circulation to make it more challenging for drug traffickers to move large amounts of cash.

In 2016, some economists made a case to stop circulating the $100 bill and the €500 banknote, even claiming the €500 note was nicknamed the “Bin Laden.” Eventually, the European Central Bank (ECB) stopped circulating the €500 banknote in 2018. But that has not stopped their use by criminals since the ECB has not demonetized the notes.

Even if the United States wanted to stop the circulation of $100 notes in Russia, it would not be an easy process. First, who would have the authority to make this determination? According to the Federal Reserve Act of 1918, it is the Federal Reserve’s job to manage circulating currency independently. The law that created the Office of the Comptroller of the Currency (OCC) allows this Treasury bureau to oversee the mechanisms that go into currency movement.

The government has more latitude over managing currency than coins. The law requires the U.S. Mint to strike cents, 5-cents, dimes, quarter dollars, half-dollars, and dollar coins (31 U.S. Code § 5111). On the other hand, the law (12 U.S. Code § 418) sets the denomination types, but it does not require the Federal Reserve to circulate all denominations.

If the President decides that it is in the best interest of U.S. foreign policy to stop the circulation of $100 notes, the Federal Reserve must decide if it is in the best interest of the Federal Reserve System to do so. However, the law complicates the matter by having the OCC oversee the institutions managing the currency. The blurry line between the authority of the Treasury Department and the independence of the Federal Reserve could create tension.

Should the policy regarding issuing $100 Federal Reserve Notes change, currency collectors may find opportunities to collect $100 notes.

May 24, 2022 | coins, commemorative, legislative

World War II Memorial from the Washington Monument

Without noticeable prompting or any other reason, the Senate Banking Committee discharged the Greatest Generation Memorial Act (S. 1596) and was passed by unanimous consent by the Senate.

If passed, the bill will require the minting of up to 50,000 $5 gold coins, 400,000 $1 silver coins, and 750,000 clad half-dollar coins in commemoration of the National World War II Memorial in Washington.

At the end of the sale, the Treasury will pay all surcharges ($35 per gold coin, $10 per silver dollar, and $5 per clad half-dollar) to the Friends of the National World War II Memorial to help maintain the memorial.

The Senate sent the bill to the House of Representatives, where it is being held at the desk because it was a bill not introduced by the majority party.

S. 1596: Greatest Generation Memorial Act

Summary: This bill directs the Department of the Treasury to mint and issue up to 50,000 $5 coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins in commemoration of the National World War II Memorial in the District of Columbia. The design of the coins shall be emblematic of the memorial and the service and sacrifice of American soldiers and civilians during World War II. All surcharges received from the sale of such coins shall be paid to the Friends of the National World War II Memorial to support the National Park Service in maintaining and repairing the memorial, and for educational and commemorative programs.

Introduced in Senate — May 12, 2021

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — May 12, 2021

Senate Committee on Banking, Housing, and Urban Affairs discharged by Unanimous Consent. — May 16, 2022

Passed Senate with an amendment by Unanimous Consent. (text of amendment in the nature of a substitute: CR S2515-2516) — May 16, 2022

Measure laid before Senate by unanimous consent. — May 16, 2022

Message on Senate action sent to the House. — May 17, 2022

May 23, 2022 | coins, news

Sorry… we are one day late for many reasons including just being tired. More to come.

One of the cans found as part of the Saddle Ridge Gold Coin Hoard

Of course, the metal detectorists are looking for treasures. Few save any of the coins they find. They will consign the coins to an auction and collect the payment. The coins will end up in the hands of collectors and museums that will enjoy them for years to come.

I have never been interested in exploring with a metal detector. In the United States, most finds are limited to the 200-300 years. Detectorists find belt buckles, watches, rings, some coins, and other items dropped along the way. But nothing compares to finding coins from over 1,000 years ago or medieval coins from 500 years ago.

These unburied coins are sometimes the only record of history. Recently, a hoard revealed a problem with inflation during the Roman Empire that taught historians about ancient economics.

I am not saying that there are no exciting finds in the United States. The Saddle Ridge Gold Hoard is a recent example, but the finds in England and the rest of Europe can change our knowledge of history.

I do not know if I will be able to go to Europe to see if I can find a treasure, but it is interesting to watch from afar.

And now the news…

May 13, 2022

One of only three known gold examples of the “Eid Mar” aureus A small but potent piece of history is up for sale in Zurich this month, when Numismatica Ars Classica offers one of only three known examples of the “Eid Mar” aureus, celebrating the “liberation” of Rome after the bloody assassination of the dictator Julius Caesar on the Ides of March in 44BC.

→ Read more at

ft.com

May 18, 2022

Britain’s Royal Mint unveiled a special new commemorative rainbow-colored 50 pence coin on Wednesday as a tribute to celebrate the 50th anniversary of the Pride UK movement. The coin, designed by east London artist and LGBTQ activist Dominique Holmes, uses state-of-the-art printing technology to emboss it with the colors of the Pride progress flag.

→ Read more at

nbcnews.com

May 20, 2022

When it comes to buying silver , coins are one of the most popular places to start. A coin collector or investor who is used to buying gold may like the idea of taking that same investment strategy and applying it to silver.

→ Read more at

menafn.com

May 20, 2022

About 1,800 antique coins, jewellery and stamps, pottery plates with inscriptions, and an ancient bronze figurine were seized this week at the home of a resident of the city of Modi’in in the centre of the country, the Israel Antiquities Authority (IAA) announced Thursday.

→ Read more at

jwire.com.au

May 15, 2022 | news

It has been an interesting week. I tried to keep up with the news and the collecting world, but a health issue sidelined me. Unfortunately, I was diagnosed with COVID. I am feeling better, but it does affect my breathing. I am glad I am fully vaccinated.

It has been an interesting week. I tried to keep up with the news and the collecting world, but a health issue sidelined me. Unfortunately, I was diagnosed with COVID. I am feeling better, but it does affect my breathing. I am glad I am fully vaccinated.

I was not completely sidelined. While trying to breathe, I was able to go online and find some interesting items online. The purchase taught me something about an area of numismatics that I did not know existed. It will be something I write about when I receive the new purchase.

During the week, the U.S. Mint mailed a package that arrived in my mailbox containing the Negro Leagues Baseball Commemorative Proof Set. The coins look better in hand than the U.S. Mint’s website images.

As the Paxlovid works to get me back in the game, it will take a few days to get everything back together, and I will be ready to get back to collecting.

Life is short. Have fun collecting.

And now the news…

May 10, 2022

On May 9, the Greater Toronto Area (GTA) Trans-National Serious and Organized Crime Section (TSOC) charged an Ontario resident with uttering counterfeit money and possession of counterfeit money after the Royal Canadian Mounted Police (RCMP) identified and seized approximately 10,000 counterfeit toonies.

→ Read more at

cottagelife.com

May 14, 2022

Remember when no one wants to touch the bills or coins for fear of getting caught COVID-19 (new coronavirus infection)Would you like to replace what was considered contaminated cash with a credit card?

→ Read more at

worldakkam.com

May 9, 2022 | books, coins, education, poll

I am getting ready to open the next chapter of my life, and I was thinking about how I can leverage my knowledge and experience to enhance the collecting community. As an experienced collector of all types and a dealer in areas other than numismatics, I learned a lot about collectors and their habits that could benefit a general audience.

I am getting ready to open the next chapter of my life, and I was thinking about how I can leverage my knowledge and experience to enhance the collecting community. As an experienced collector of all types and a dealer in areas other than numismatics, I learned a lot about collectors and their habits that could benefit a general audience.

As I was thinking about sharing my experiences, I wondered where most people learned about their collectibles. But the resources I had are different than those available today. Even the way we take in and understand knowledge is different. I thought it would be interesting to ask the numismatic community how they learn about collecting.

So let’s ask the question:

Loading ...

→ Read more at kafkadesk.org

→ Read more at kafkadesk.org

→ Read more at thehansindia.com

→ Read more at thehansindia.com

→ Read more at presstv.ir

→ Read more at presstv.ir

→ Read more at the-sun.com

→ Read more at the-sun.com

→ Read more at poncacitynow.com

→ Read more at poncacitynow.com

It has been an interesting week. I tried to keep up with the news and the collecting world, but a health issue sidelined me. Unfortunately, I was diagnosed with COVID. I am feeling better, but it does affect my breathing. I am glad I am fully vaccinated.

It has been an interesting week. I tried to keep up with the news and the collecting world, but a health issue sidelined me. Unfortunately, I was diagnosed with COVID. I am feeling better, but it does affect my breathing. I am glad I am fully vaccinated. I am getting ready to open the next chapter of my life, and I was thinking about how I can leverage my knowledge and experience to enhance the collecting community. As an experienced collector of all types and a dealer in areas other than numismatics, I learned a lot about collectors and their habits that could benefit a general audience.

I am getting ready to open the next chapter of my life, and I was thinking about how I can leverage my knowledge and experience to enhance the collecting community. As an experienced collector of all types and a dealer in areas other than numismatics, I learned a lot about collectors and their habits that could benefit a general audience.