Apr 22, 2022 | coin design, commemorative, silver

I am sponsoring

GOLD memberships for new and renewing memebers of the American Numismatic Association. This is a limited-time offer to celebrate

National Coin Week and the 131st anniversary of the American Numismatic Association. The offer expires on April 25, 2022. Call (800) 514-2646 or visit

info.money.org/ncw-2022-barman to take advantage of this offer. Be sure to apply code

NCW22SB at checkout!

Since National Coin Week is celebrating coin designs, we can recognize that the coin design can be a factor in collecting the coin. Let’s look at a coin in my collection only because of its design.

Since National Coin Week is celebrating coin designs, we can recognize that the coin design can be a factor in collecting the coin. Let’s look at a coin in my collection only because of its design.

Commemorative coins are a fundraising mechanism. An organization convinces a member of Congress to submit a bill to create a commemorative coin that will raise money. The authorizing legislation usually is tied to a milestone, even if it is late, so there is something to promote.

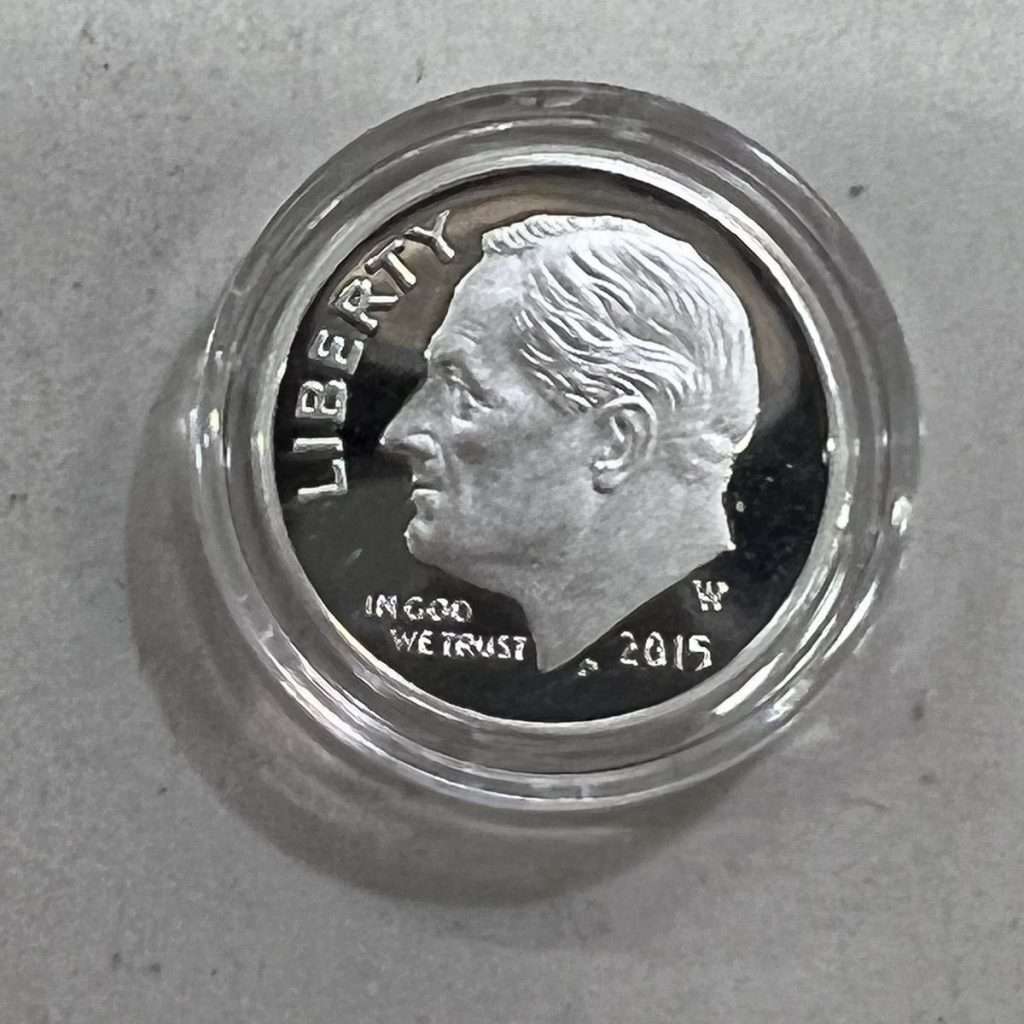

Although people collect commemorative coins, I collect those with subjects that interest me. But there was one commemorative coin I purchased because of the design. My collection includes the 2015 March of Dimes Commemorative Coin Set because of the coin’s design.

Produced for the celebration of the March of Dimes Foundation’s 75th anniversary, the design is a phenomenal work of art. It is the most appropriate image for any modern commemorative coin.

President Franklin D. Roosevelt created the National Foundation for Infantile Paralysis, now called the March of Dimes) in 1938 to fund research to cure polio. FDR fought the painful effects of polio throughout his life. After Drs. Jonas Salk and Albert Sabin developed a very effective vaccine, the Foundation changed its mission to prevent birth defects, prematurity, and infant mortality.

Fortunately, my family has not been touched by the issues that March of Dimes looks to correct, but it is a worthy cause to champion. Otherwise, it is not something that has personal meaning. But the reverse design is compelling.

The reverse was designed by Don Everhart and described on the U.S. Mint’s website, “The reverse (tails) design depicts a baby cuddled in the hand of a parent, representing the foundation’s dedication to the health of babies everywhere.” It is one of the most powerful images on a commemorative coin.

When I decided to add a version to my collection, I waited until the commemorative silver set was available. The set contains the commemorative silver dollar, a proof Roosevelt Dime, and a reverse-proof Roosevelt Dime. It was the reverse-proof dime that made the set attractive. The best-looking coins of the last ten years were reverse-proof and enhanced uncirculated coins.

Although the reverse proof and enhanced uncirculated are in the manufacturing processes, the final results highlight the coin’s design in a way that could not happen with any other process.

This set is included in my collection because of the phenomenally inspirational design of the reverse of the commemorative silver dollar and the reverse-proof silver dime.

All images are original and property of the author used under the Creative Commons license

CC BY-NC-SA 4.0.

Mar 15, 2022 | coins, Morgan, news, Peace, silver

The U.S. Mint announced that they would not produce the 2022 Morgan and Peace Dollars calling it a “calculated pause.”

The U.S. Mint announced that they would not produce the 2022 Morgan and Peace Dollars calling it a “calculated pause.”

According to their press release, the pandemic impacts their suppliers’ availability to deliver silver blanks. Although many areas are returning to pre-COVID operating standards, suppliers require additional time to increase production to meet the higher demands.

The Russian invasion of Ukraine should not affect the worldwide supply of silver and gold since their mines are depleted. However, higher energy prices will impact the mining, refining, and transport of these metals.

The law requires the U.S. Mint to strike American Silver Eagle bullion coins. The law authorizing the 2021 Morgan and Peace dollars does not require the U.S. Mint to produce those coins in other years. If there is a supply problem, the U.S. Mint will strike the required American Silver Eagle Coins and suspend the Morgan and Peace Dollars.

Although popular designs, does it matter if the U.S. Mint strikes the coins again? Would it be better for the hobby if the coins were a one-year tribute and faded into numismatic history?

Dec 19, 2021 | Britain, coins, gold, silver

It is the time of year for retrospectives, looking back on the good and bad of the past year. But there is still time left in the year, and there is still news to cover.

It is the time of year for retrospectives, looking back on the good and bad of the past year. But there is still time left in the year, and there is still news to cover.

Breaking late in the week, a Royal Proclamation passed to create a 50 pence coin to celebrate the 100th Anniversary of the British Broadcasting Company. The BBC was founded and made its first broadcast in 1922 on the recommendation of the General Post Office, which had problems managing broadcast licenses.

Gold has been hovering between $1760 and $1810 for the last two months. Although the gold spot price is close to the $1900 that some have predicted for the year-end price of gold, the $28 prediction of silver will fall short.

Silver has been on a steady fall since hitting $30 in February. Earlier in the year, the pandemic caused the closing of mines and processing facilities. The advancement of COVID-19 vaccines allows facilities to ramp up processing, and the increased supply allows prices to fall.

There are two weeks left in 2021 and time for more news.

And now the news…

December 16, 2021

If you like seeing ancient coins and understanding history through the coins, then Aloyseum, a museum at St Aloysius College in Mangaluru, is the place for you. Nearly 1,328 coins from 82 countries are on display.

→ Read more at

deccanherald.com

December 16, 2021

MANILA, Philippines – The decision of the Bangko Sentral ng Pilipinas (BSP) to exclude World War II heroes from the new P1,000 polymer banknotes met outrage from Filipinos. Descendants of Josefa Llanes Escoda, Vicente Lim, and Jose Abad Santos urged the BSP to keep the martyrs’ portraits and place the Philippine eagle – or other plants and animals the central bank wants to feature – on the other side of the bill.

→ Read more at

rappler.com

No news this week.

Nov 9, 2021 | coins, silver, US Mint

The U.S. Mint is currently holding a numismatic press availability via conference call. During the call, the U.S. Mint announced that they plan to continue the Morgan and Peace dollar programs in 2022 and beyond.

The U.S. Mint is currently holding a numismatic press availability via conference call. During the call, the U.S. Mint announced that they plan to continue the Morgan and Peace dollar programs in 2022 and beyond.

Although the products have not been finalized, it is possible that there may be different finishes, such as reverse proof, and additional products options including the production of the coins at other mint facilities.

Stay tuned for more from the U.S. Mint’s press availability.

Oct 20, 2021 | coins, Eagles, silver, US Mint

With everything that is going on, coin collecting is still a fun hobby, and there are a lot of coins to collect. I am proudest of my almost complete collection of proof American Silver Eagle coins.

From 1986 to 2019, my father bought two proof American Silver Eagle coins. One was for his collection, and the other was mine. When the U.S. Mint issued special sets, I would purchase one for myself and attempt to purchase one for my father. I was able to purchase the 25th Anniversary Set for myself but could never buy one for my father. On the secondary market, too many sets were broken up and graded, ruining the grandeur of the five-coin set.

I am missing the 1995-W American Silver Eagle.

Although there have been problems with the U.S. Mint’s e-commerce site, I have been able to keep up with my American Silver Eagle collection. Recently, the U.S. Mint shipped the American Silver Eagle Reverse Proof Two-Coin Set. My set arrived before I left town for the weekend.

Like many collectors, I love the look of reverse-proof coins. The shiny devices make the design stand out. When I show the coins to non-collectors, the coins make an impression.

What does not make an impression is the package.

For a set that costs $175, the package feels cheap. The insert is cheap plastic that holds onto the coin so tight that the coin is difficult to remove. The box is thinner cardboard, and it is not in a clamshell box, like other sets. The package appears as if the U.S. Mint modified it from a copper-nickel clad proof coin.

The U.S. Mint might think that the package does not matter. There will be collectors that will take the coins out of the package and send them to a third-party grading service. This attitude does not consider those who prefer to keep the coins in the original government package (OGP).

My entire collection of American Silver Eagle proof coins is in its OGP. The 2021 set looks like an afterthought next to the 2013 West Point and 2012 San Francisco two-coin sets.

At least the coins are gorgeous!

Sep 13, 2021 | coins, Eagles, silver, US Mint

I like big silver coins.

I like big silver coins.

Some like gold. Others like copper. I like silver.

Since 1986, I have been collecting American Silver Eagle Proof coins. It is a collection my later father started for me and, until 2019, purchased the individual proof coins. I supplemented the collection with the special sets that the U.S. Mint issued, but it is a nearly complete set of proof coins in their original government package.

Although I have to find the 1995-W anniversary set for the elusive 1995-W American Silver Eagle, I have been trying to keep the collection up to date. It is why I hung up on a business call to make sure I was logged in to the U.S. Mint website to purchase the Reverse Proof Two-Coin Set.

By 11:58 AM, I was on the page for the set. As the time counted down to noon, I refreshed the page waiting for the Add-to-Bag button.

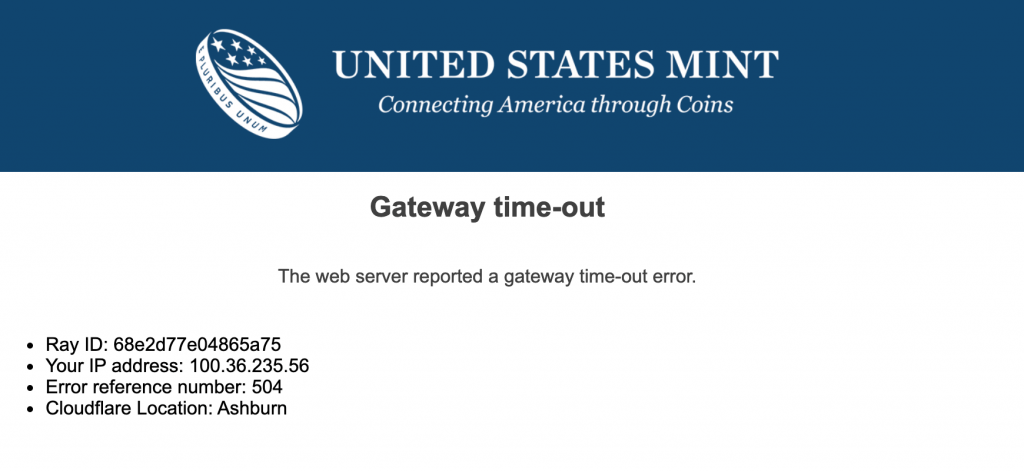

I am probably not the only one pushing the refresh button two minutes until noon. Until the Add-to-Bag button appeared, the system was responsive. Of course, the page was likely cached by Cloudflare or my ISP (Comcast), but it was responsive. At the stroke of noon, all that ended.

The first thing we notice is that someone rebranded the Cloudflare gateway error page. Although I do not have inside information, I would bet that Cloudflare told the U.S. Mint to make it so that they don’t get blamed.

I wonder if Cloudflare demanded the U.S. Mint rebrand their gateway error page so that they don’t get the blame?

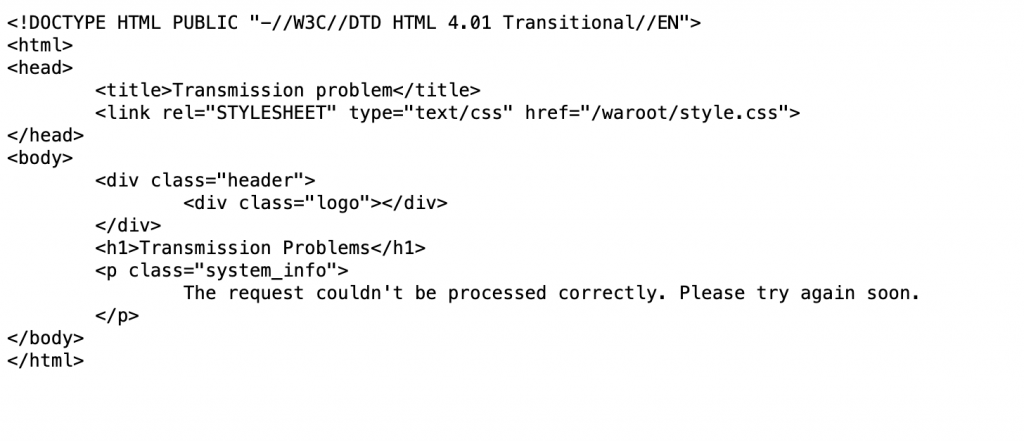

Another change is the HTML file that appeared as a text file. Under Safari, the file type kept downloading the information to my Downloads folder. Under Firefox, one of the systems in the chain treated me to a small HTML file.

Under the hood HTML output as a web page?

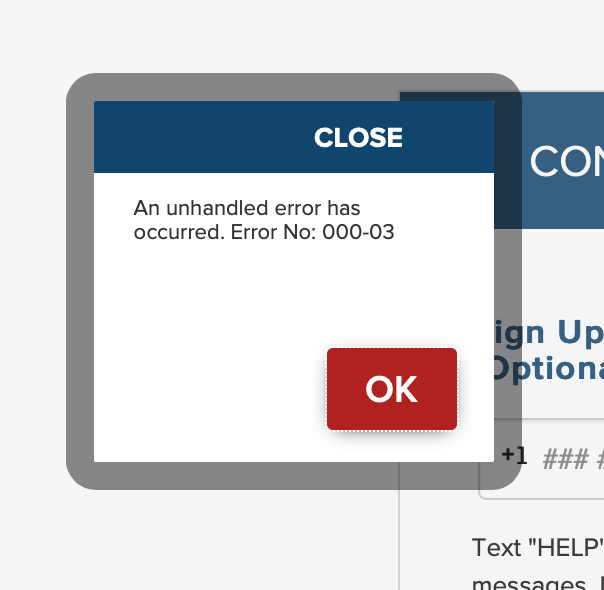

Somehow, a set made it into my bag, and I made it to the checkout page. I couldn’t use my stored credit card because I would see the Bad Gateway error. The card was next to me, and I furiously typed.

Suddenly, there was a new error. I don’t know what it means, but the U.S. Mint’s programmers did not know how to handle that error. How do I know that? The error message provided said so.

This is a new error. In my days as a programmer, we would be chastised for this type of error message!

According to several reports, the website crashed at the beginning of the process. It was difficult to tell, but the U.S. Mint admitted there were problems. They announced that there were products available at 1:19 PM on social media.

After stubborn persistance, I received the confirmation of my order at 12:48 PM.

I asked the U.S. Mint for comment. I will let you know what they say.

Jul 22, 2021 | security, silver, US Mint

This is the second article of three regarding the recent problems at the U.S. Mint.

It is as if the U.S. Mint did not learn a lot since the fiasco of the 2014 Kennedy Half Dollar 50th Anniversary Gold Coin release. (Image courtesy of ABC 7 News, Denver)

Last month, a discussion was held with a representative of the U.S. Mint’s communications department and a manufacturing supervisor to understand better the 2021 Morgan Dollar ordering failures. When asked about lessons learned from previous sales, they admitted to working at the U.S. Mint for four years or less and could not talk about previous issues.

After asking about lessons learned from the past with responses ringing like “not on my watch,” it brought to mind the first Numismatic Forum in 2016, where the only blogger in attendance asked whether the discussions would survive changes of leadership and administrations. Rhett Jeppson was nominated to be Director of the U.S. Mint but was never confirmed. Although there were three more Numismatic Forums, it is apparent that none of the discussions survived leadership changes.

Part of the problem is with the government’s Senior Executive Service (SES) program. Members of the SES are government employees hired to senior management positions within the federal government. They undergo special training in government leadership and understand how to lead their sections through policy changes. SES employees are supposed to be non-partisan government workers. There are also limited reasons for the SES to stay with the agency to build collective knowledge.

There are three ways an SES employee can be appointed. A career appointment is a merit position staffed by a qualified executive. A noncareer appointment is a temporary appointment and is subject to several restrictions, including the number of temporary appointees the government can hire. Finally, a limited appointment is hired for an 18 month to a three-year term. Rhett Jeppson’s role that made him the acting Director was the result of a limited appointment.

SES members are also encouraged to change agencies every four years. Although there are exceptions, the SES program is designed not to allow executives to become too powerful within the agencies. Forcing them to move reduces the risk of potential abuse of power.

As SES members come and go, the U.S. Mint loses the institutional knowledge they earned over the years. Experience working with members of the SES program shows that the new appointees rarely refer to documentation left by their predecessors. Their egos also have them ignoring employees and contractors with the institutional knowledge.

The U.S. Mint has resources in the numismatic community that can help teach them about the past. Having an engaged numismatic community available to help the U.S. Mint makes the bureau unique among government agencies. If their egos prevent them from reaching out to the numismatic community, the SES members can perform a web search on any topic to read what the numismatic press wrote about any issue.

During the discussion, the U.S. Mint emphasized how they wanted to work with the numismatic community and do their best to make the products accessible. While they will talk with members of the numismatic media, the U.S. Mint will not reach out for the community’s help.

The numismatic community wants the U.S. Mint to be able to support our collecting habits. They have a unique opportunity to engage a community willing to help. If the U.S. Mint wants to demonstrate that they are, they should set up a program of numismatic advisors to help them understand what went wrong in the past and how to make it better for the future.

If you like what you read, share, and show your support

Jul 21, 2021 | bullion, coins, silver, US Mint

This is the first article of three regarding the recent problems at the U.S. Mint.

Economic analysts believe there is a silver shortage but that it is not critical. According to the supply chain reports, a sufficient supply of industrial silver for manufacturers to keep up with production. The reduction in computer chip production because of COVID-based plant shutdowns is the greatest threat to manufacturing.

Economic analysts believe there is a silver shortage but that it is not critical. According to the supply chain reports, a sufficient supply of industrial silver for manufacturers to keep up with production. The reduction in computer chip production because of COVID-based plant shutdowns is the greatest threat to manufacturing.

Jewelry and other businesses that use silver for their beauty are experiencing a slowdown but not to the extent of the computer chip industry. The industry has been able to use recycled silver fueled by people cashing in their scrap silver. One silver refiner reports that they have more work than they can process.

Although manufacturers have silver to maintain production, the U.S. Mint announced on May 28, 2021, that “The global silver shortage has driven demand for many of our bullion and numismatic products to record heights.”

On June 2, the U.S. Mint clarified their statement by saying, “In a message released Friday, May 28, we made reference to a global shortage of silver. In more precise terms, the silver shortage being experienced by the United States Mint pertains only to the supply of silver blanks among suppliers to the U.S. Mint.”

Why is the U.S. Mint different from the other industries?

The short answer is that the U.S. Mint is just another government agency subject to federal law.

The U.S. Mint is required to buy silver mined in the United States within one year of its mining (31 U.S. Code §5132(a)(2)(D)). Under this law, the U.S. Mint cannot use recycled silver or silver that the government has not purchased from the mines.

The U.S. Mint discontinued assay operations shortly after the passage of the Coinage Act of 1964. Since then, the bureau has bought the metals from other manufacturers, either sheets or already formed planchets. When the American Eagle Program started, the law required the U.S. Mint to use the silver in the Strategic and Critical Materials Stockpile. The U.S. Mint manufactured the planchets in West Point.

When the program depleted the Strategic Stockpile, Congress updated the law to require the U.S. Mint to use freshly mined silver. They found that it was more cost-effective to have a commercial vendor manufacture the planchets.

Hiring a commercial vendor to do work for the federal government is different from a business-to-business transaction. The government requires all contracts and contractors to follow the Federal Acquisition Regulations (FAR) to purchase goods and services.

For the government to contract with any company, a bidding and vetting process can last from weeks to years. The agency has to produce requirements, selection criteria and evaluate the proposals, called source selection.

Congress purposely made the process challenging to promote fairness in the bidding process and ensure the government pays a fair price. Unfortunately, the process is expensive and fraught with problems.

For the U.S. Mint, the problem is that FAR does not allow the latitude to find alternate vendors when there are supply issues.

The U.S. Mint has contracts with four vendors to make silver planchets. They have vetted the contractors, their processes and have contractual quality control measures to ensure the planchets comply with the Treasury’s legal and quality requirements. If the vendors cannot fulfill the U.S. Mint’s order, the law prevents them from looking for immediate alternatives.

According to the U.S. Mint, the suppliers of silver planchets had production slowdowns because of COVID-19 operating precautions. In addition to manufacturing issues, the mining operators also experienced slowdowns because of the same operating precautions. Every industry is experiencing supply chain interruptions.

Where the U.S. Mint could have done better was to order the planchets sooner. The U.S. Mint reported that agency attorneys refused to allow their purchasers to order planchets before the law was signed. The bill, H.R. 6192, was sent to the president on December 24, 2020. The president signed the bill into law on January 5, 2021 (Public Law No. 116-286).

When a law is signed, the White House will tell the appropriate Departments. If that does not happen, the agencies receive notice from the Government Printing Office (GPO) who publishes the laws. Like everything else, the GPO has experienced interruptions because of pandemic protocols.

According to a government attorney that works for the Inspector General’s office in a non-Treasury department, agencies have the latitude to work on anticipated laws. An example cited is that the IRS works on drafting forms and regulations based on the bills in progress to be ready for the filing season.

Although Congress did not do the U.S. Mint a favor by passing the bill on Christmas Eve, the White House did not do the U.S. Mint a favor by not letting the Treasury know they signed the bill. However, the leadership of the U.S. Mint allowed the lawyers to dictate operations. The lawyers are supposed to be advisors, not the last word.

If you like what you read, share, and show your support

May 16, 2021 | coins, markets, news, silver

It has been a long 16-months. During that time, a virus caused a worldwide pandemic still being felt in much of the world. Thanks to science and the government removing barriers that slow the development process, the pharmaceutical industry found vaccines to reduce infection rates.

It has been a long 16-months. During that time, a virus caused a worldwide pandemic still being felt in much of the world. Thanks to science and the government removing barriers that slow the development process, the pharmaceutical industry found vaccines to reduce infection rates.

The increase in vaccinations and the reduction of infections has government easing restrictions that shut down the country for three months in 2020. As the restrictions ease, coin shows are appearing. Small shows have been running for a few months, but last week, the ANA announced the World’s Fair of Money would go on.

Over the last six months, hobby and other spending have dramatically increased. The demand for goods has outpaced the supply. Big-ticket items like housing and vehicles are experiencing low inventories as people leave their homes and spend money. I regularly pass a few used car lots on my way to work, and their inventory is the lowest I have seen.

Numismatics is also seeing a surge. Even though analysts note that lower sales of bullion coins from last year, the demand for collector coins has caused prices to skyrocket. Services that monitor online markets say that the 2021-W American Silver Eagle Proof coin price is averaging $140-160 or 100-percent over their issue price.

Because silver is in high demand, dealers are charging high premiums over the spot price and sellout out of their inventory. When I recently looked at buying circulated coins whose value is tied to the silver spot price, the premiums were the highest that I have seen.

It has been a long time since silver coins were this popular. There is no telling how high this market will go with the expanding market for non-circulated legal tender (NCLT) and bullion coins drawing people into collecting.

And now the news…

May 10, 2021

What do ancient coins tell us about the Omer period and the time of the Bar-Kochba revolt, when the 49 days between Passover and Shavuot became associated with death and mourning? According to the Bible, the seven weeks between the two holidays referred to as ‘omer’ – a unit of measure which was used to quantify the amount of produce to offer as a sacrifice to God – was not meant to carry any specific connotation other than its agricultural meaning.

→ Read more at

jpost.com

May 11, 2021

An early pandemic problem that plagued businesses is back: not enough change to go around. Why it matters: The pandemic broke America's coin flow. It has repercussions for millions that rely on it for daily transactions.

→ Read more at

axios.com

May 13, 2021

If you like what you read, share, and show your support

Apr 21, 2021 | Carson City, coins, dollar, silver

REMINDER:

REMINDER: If you are not a member of the ANA, I will pay your 2021 Gold Membership dues for the

first 25 readers of the Coin Collectors Blog who join during National Coin Week. All you have to do is click

this link and use the Promotion Code

NCW21SB when you check out.

For National Coin Week, all blog posts this will be about large dollar coins. The following is a about the GSA Morgans and the few in my collection.

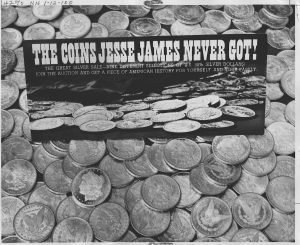

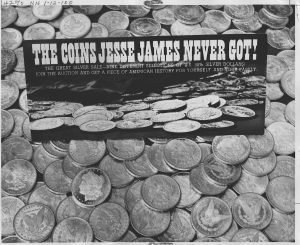

GSA Sale #3 stepped up its advertising (Image from u/GucciMamba666 on Reddit)

By 1964, the price of silver skyrocketed, making U.S. coins worth less than the metals used to make them. The economics led to a fiscal crisis that had the government rethinking the monetary system.

Silver coins were no longer required to back the U.S. dollar. Along with a law passed by Congress that ordered the General Services Administration to consolidate the government’s real estate usage came the discovery of the largest hoard in history.

Before the GSA started to clean out government-owned buildings, the government knew that they had stored silver coins in a few places. They did not know how many there were and the number of places they were stored.

Congress passed laws that caused over-production and hoarding. The Coinage Act of 1873, also called “The Crime of ’73,” caused a withdrawal of silver from the market. The Bland-Allison Act overturned it in 1878 that required the Treasury to purchase silver from U.S. mines to strike dollars for circulation. Since most silver mining was in Nevada, the Carson City Mint was striking more coins than needed.

The Sherman Silver Purchase Act became law in 1890. It raised the monthly amount of silver the Treasury purchased to 4.5 million ounces per month. The goal was to boost the economy to stem inflation. The law caused more dollars produced in Carson City with no place to distributed them.

To help Great Britain fund their war efforts, the Pittman Act authorized the melting of 350 million silver dollars to be sold at $1.00 per ounce. By the end of the war, over 270 million coins were melted for bullion. It was not enough to deplete the storage. The Act required the Mint to strike new coins with the silver repaid by Britain by 1933.

After several years of cleaning out vaults in different government-owned buildings, the GSA found 2,825,219 Morgan Dollars with the CC mintmark. They also found 112,145 coins from other branch mints. Within those additional coins, the GSA found 84,165 circulated Seated Liberty, Morgan, and Peace Dollars.

The government did not know what to do with the coins. Since they were in Treasury’s vaults, it was up to the Treasury to decide what to do with them. The Treasury’s role changed with the passage of the Federal Reserve Bank Act of 1913 and said that the best they could do was melt the coins. The U.S. Mint did not want the coins back since their job is to produce the coins. The Federal Reserve claimed it had no jurisdiction over the coins since the production and storage occurred before the formation of the Fed.

The GSA was the only agency that had experience liquidating government surplus. But these coins were not ordinary. Many collectors predicted that the sale of these coins would significantly change the numismatic market.

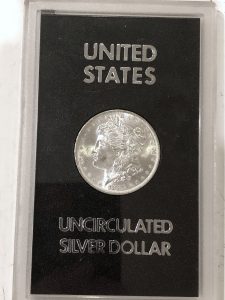

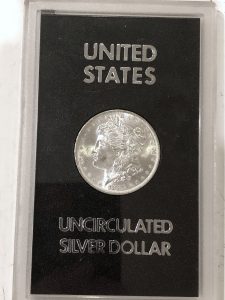

An 1884-O uncirculated Morgan Dollar from the GSA Sale

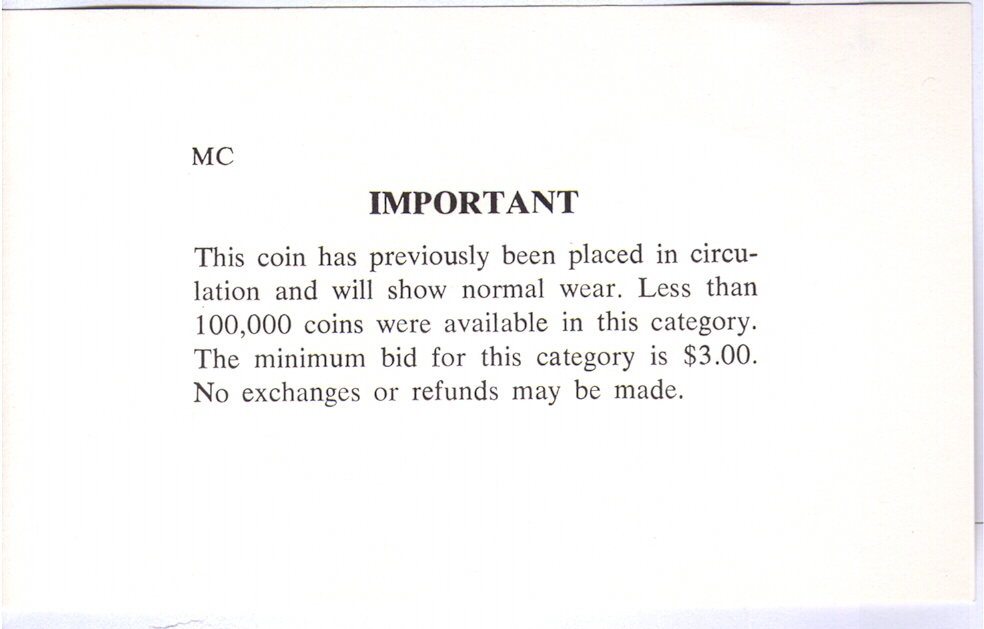

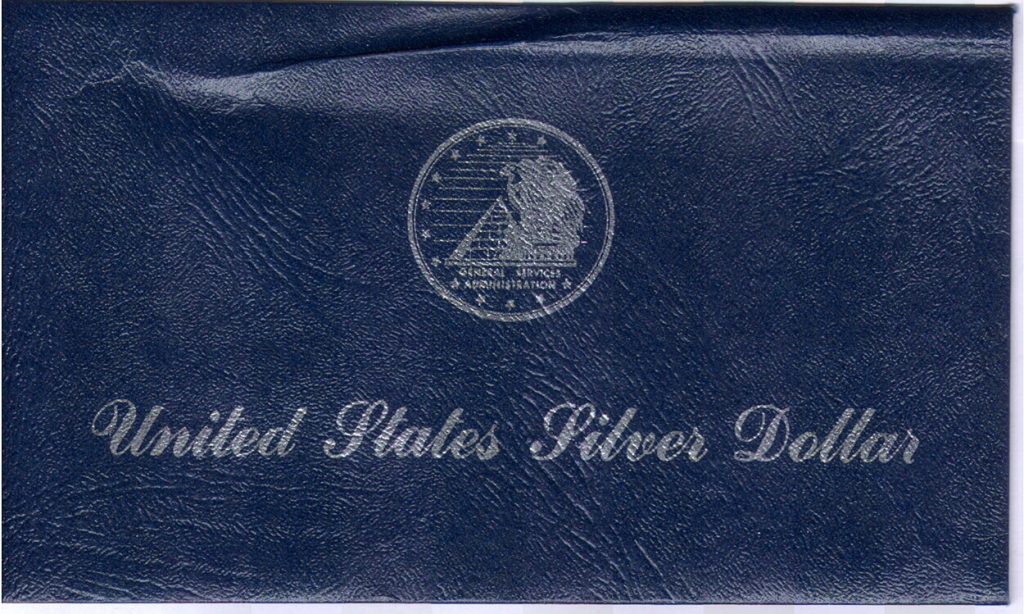

To sell these coins, the GSA created a special hardpack to hold the circulated coins. The hard-pack would be placed into a box with a certificate of authenticity, and the coins were made available through a mail-bid auction sale.

Coins struck in Carson City would be housed in a plastic case called a lens that said “Carson City” across the top. Other uncirculated coins were placed in a generic case. These coins are called GSA Morgans or GSA Non-CC Morgans.

For circulated coins, the GSA created the Soft Pack. The coins were sealed in mylar with a plastic token and placed in a blue envelope. Collectors refer to these coins as GSA Blue Packs. The GSA did not keep records of the number of Blue Packs sold. However, some have estimated that the GSA created about 100,000 Blue Packs.

-

-

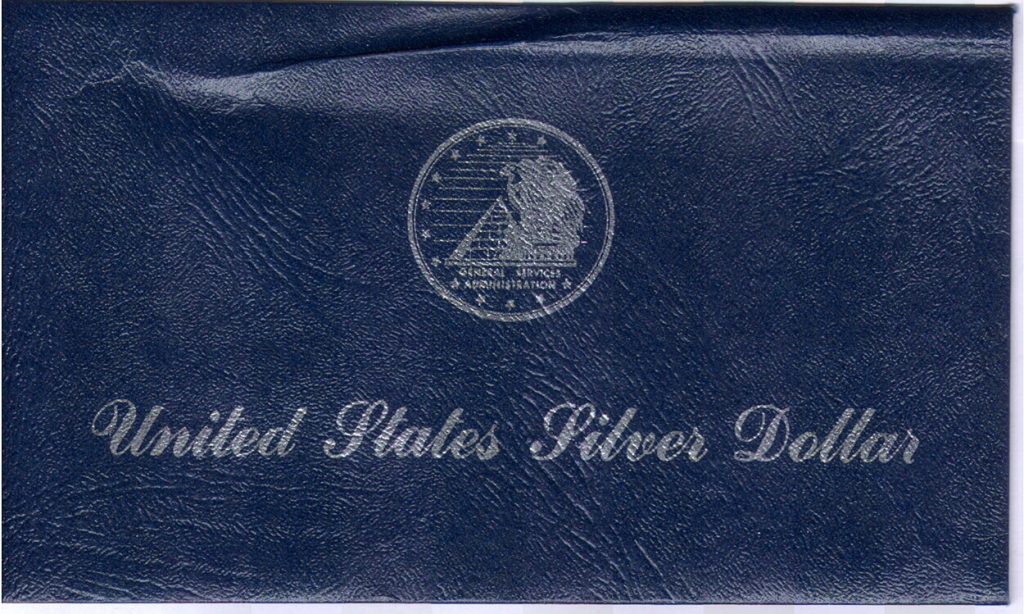

GSA Bluepack Envelope

-

-

1922 Peace Dollar in GSA Bluepack package

-

-

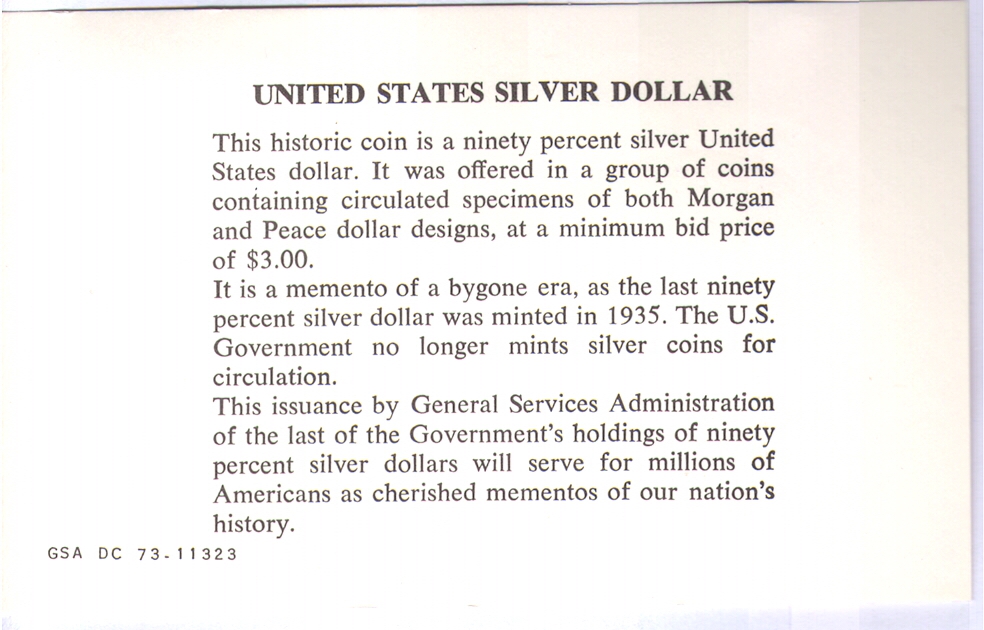

GSA Bluepack COA

-

-

GSA Information about the sale of the coins

From 1972 through 1980, the GSA held a series of eight sales. Most were mail-bid type auctions. The last two in 1980 were call-in bidding sales.

My father was cleaning his house, preparing to move into a condo before the pandemic shutdowns and found his GSA Morgan Dollars. He mailed the coins to me for my collection. Three are Carson City dollars, and one struck in New Orleans. My father purchased the coins during the first two GSA sales. He said that he tried to purchase more during the 1980 sales but was outbid.

L-to-R: 1882-CC, 1883-CC, and 1884-CC Morgan Dollars in GSA holders

I will eventually send the coins to NGC to have them graded in their original holder. For now, I found an online seller with four empty GSA boxes. Since I have the original Certificates of Authenticity, I will have complete packages.

GSA Preview Movie

Preview from the 1971 GSA movie about the hoard of silver dollars. As you watch the

video, think about what it might have taken for the GSA workers to sort through 3 million coins.

If you like what you read, share, and show your support

Since National Coin Week is celebrating coin designs, we can recognize that the coin design can be a factor in collecting the coin. Let’s look at a coin in my collection only because of its design.

Since National Coin Week is celebrating coin designs, we can recognize that the coin design can be a factor in collecting the coin. Let’s look at a coin in my collection only because of its design.

→ Read more at

→ Read more at