If you missed the five-second commercial from Reddit after the halftime show, you missed their touting their service as a place to discuss things. Lately, Reddit has been famous for a sub-Reddit that helped promote the stocks of GameStop, AMC movie theaters, and BlackBerry. All companies whose business models have not kept up with technology or are suffering because of the pandemic.

If you missed the five-second commercial from Reddit after the halftime show, you missed their touting their service as a place to discuss things. Lately, Reddit has been famous for a sub-Reddit that helped promote the stocks of GameStop, AMC movie theaters, and BlackBerry. All companies whose business models have not kept up with technology or are suffering because of the pandemic.

An interesting aspect of this story is the Robinhood trading platform’s use to buy and sell these stocks. Robinhood is a no-commission trading service that many of the people participating in the sub-Reddit use to trade. Not only are they gaining free access to the markets, but they were able to cause significant losses amongst the large hedge funds. The hedge funds did not like losing money to what they considered non-professionals. The Reddit users called it the democratization of the markets.

Although these stocks have returned to more reasonable levels as compared to their earnings, people in the sub-Reddits are looking to make statements in other markets. One of the markets they are trying to work on is silver.

Precious metals continue to be a safe haven for uncertain markets. With the uncertainty of the markets and the Exchange Traded Funds (ETF) in the metals market and changes in some rules, investors demand access to physical metals.

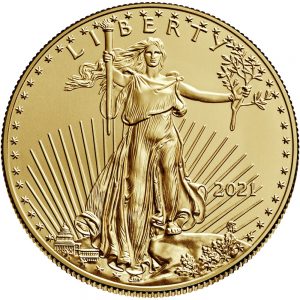

Rather than buying bullion, investors are buying legal tender coins. Even with the high numismatic premiums on precious metals coins, they are reporting limited supply. The highest demand is for the American Silver Eagle and the Canadian Silver Maple Leaf. Both mints are reporting record production of these coins.

When an ETF creates its market basket of stocks, the exchanges require that each of the stocks have specific minimum holdings of physical metals to back the prices. ETFs are finding they have to rebalance their portfolios since the funds holding the metals are not increasing their holdings as much as the general public. Their lack of buying is keeping the price of metals stable.

Dealers are reporting that individual and smaller institutional investors are buying silver. Although these buyers do not impact the broader market, they are impacting the numismatic premium. People are paying upwards of 35 percent over the spot price.

The rules will prevent the Reddit mob from manipulating the metals markets. However, until there is more certainty in the market, there will continue to be a high numismatic premium for bullion coins.

And now the news…

→ Read more at fxstreet.com

→ Read more at fxstreet.com

→ Read more at abc4.com

→ Read more at abc4.com

→ Read more at kitco.com

→ Read more at kitco.com

→ Read more at gazetteherald.co.uk

→ Read more at gazetteherald.co.uk