The Canadian Broadcast Company reported that a bank in Montreal refused the deposit of $800 in rolled coins.

The Canadian Broadcast Company reported that a bank in Montreal refused the deposit of $800 in rolled coins.

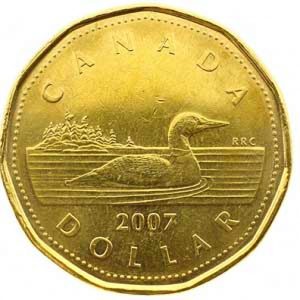

Julien Perrotte saves the coins he receives in change. Every year he will sort and roll the coins so that he can deposit them into his account at Laurentian Bank. This year, the bank told Perrotte that it was a new policy not to accept coins.

Canadian laws do not require banks to accept all legal tender coins or currencies. They can refuse to take any form of specie and only operate using electronic funds.

Laurentian Bank has taken advantage of these laws and no longer employ human tellers to accept cash. Customers can deposit currency and checks in their automated banking machines. The machines do not accept coins.

Before people begin to criticize Laurentian, this is starting to occur in the United States. Banks and other financial institutions are beginning to offer checking and other consumer banking services accessible online. They do not have branch offices.

The largest and most successful of the online banks is Ally. Anyone can open an Ally account and have access to the full line of banking services except you cannot deposit cash.

Then there are banks with physical presences that are transitioning to a model like Laurentian. Capital One Bank entered the consumer banking business when it started buying smaller banks in 2005. Today, Capital One is closing branches and consolidating teller operations in Capital One Cafes. Customers that do not live near Capital One Cafes can deposit currency and checks via an ATM but cannot deposit coins.

Does this mean we are heading toward a cashless society?

No! It means that the United States has an economy diverse enough to support new ideas in banking services while maintaining traditional banking operation. It is because the United States has a diverse economy that includes a cash-based transaction (see here and here) that will prevent our society from going cashless.

Rather than try to deal with Laurentian Bank’s new policy, Perrotte said he will be taking his business elsewhere.

I think the idea of Banks not accepting coin and or cash is appalling and extremely detrimental to the hobby long term. The less people use coin and currency the less familiar they become with coins. The chances of people discovering interesting coins disappears and the chances of new collectors developing diminish rapidly.

Innovative ideas in business are one thing, Allowing any business especially banks to provide less service is unwise and results in more control of the masses.

In our shop many people come in to sell accumulations, much of which is pocket change. Quite a few of those people need the money. we are now forced to give less than Face Value to cover labor and a discount to deposit. For years we gave full FV but now it’s too costly and this is unfair to all concerned because banks hide their greed behind what you call innovation!

Harry… you need to go back to read some of my posts on the topic because I do not endorse the concept of a cashless society. In my business, I understand the benefits of cash especially when at least 65% of my sales are cash sales!!