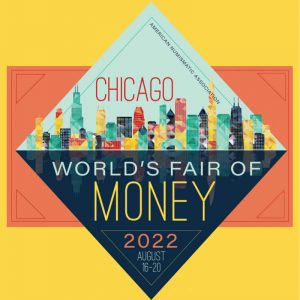

POLL: Are you ready for the World’s Fair of Money

We are now a week until the opening of the World’s Fair of Money. It has been a long time since I attended the World’s Fair of Money. After starting a business that finally hit its stride, the pandemic changed everything.

We are now a week until the opening of the World’s Fair of Money. It has been a long time since I attended the World’s Fair of Money. After starting a business that finally hit its stride, the pandemic changed everything.

It is 2022, and while the pandemic is still with us, vaccinations and testing have given us a sense of personal security, allowing the world to return to some semblance of “normal.” I hit my version of post-pandemic normal, and it’s time to add the World’s Fair of Money as part of my normal life.

You can find coins online. Aside from the many online auction sites, I receive advertisements from dealers via email that intrigues me. And while many of the advertisers are dealers I can trust, there is something about searching and buying coins in person than online buying cannot duplicate.

Over the years, I have been evolving my collection. I sold off my collection of Barber coins because they are no longer interesting to me. I sold off my old Morgan dollar collection because the collection was not as nice as I wanted, and I did not want to spend the time and money to upgrade the coins.

It might be time to revive my search for the finest Bicentennial collection. Although my Bicentennial is my only graded coin collection, there is something about the set I find intriguing. I could be in the market for an upgrade for some of my coins.

Then there’s my New York collection. What can I find that represents my hometown? Better still, what can I find from Brooklyn?

I cannot forget the books. As a collector also interested in history, I have been reading old books to learn the contemporary history behind coins, medals, tokens, and other numismatics. Like general history, the stories lose their details over time, and we lose the nuance of history that went into the decisions. The old books document history in a way that gets lost over time.

What else is available? I found the Somalia motorcycle coins many years ago at a World’s Fair of Money. Although I found my first GSA Blue Pack Peace Dollar at a National Money Show, I found several more at a World’s Fair of Money with different dates. Can I find something that I can say, “Oh… neat! Cool!”

What about you?

Are you going to the World's Fair of Money

Total Voters: 17

Weekly World Numismatic News for August 7, 2022

When my wife and I left today, we came home with a new family member. We welcomed Abe to our family four months after Tessa crossed the Rainbow Bridge.

When my wife and I left today, we came home with a new family member. We welcomed Abe to our family four months after Tessa crossed the Rainbow Bridge.

Rescuers found Abe Pugoda as a stray. The rescue organization said he was well behaved with many of the typical medical problems strays experience, and it appears that someone might have abandoned him.

One look at that face made it difficult to understand why someone would abandon Abe. He has a good disposition, moderate energy, and a sniffer that doesn’t stop. Abe is a Puggle, half pug, and half beagle. Doctors that examined him believe that he is 10 years old.

Abe has had an eventful first day in his new home. We know it will take time for us to become accustomed to each other. For us, we have another four-legged baby in the house and looking forward to having fun over the next few years together.

And now the news…

→ Read more at cbsnews.com

→ Read more at cbsnews.com

→ Read more at california18.com

→ Read more at california18.com

→ Read more at natureworldnews.com

→ Read more at natureworldnews.com

→ Read more at art-insider.com

→ Read more at art-insider.com

→ Read more at bbc.com

→ Read more at bbc.com

2024 Commemorative Coin Programs are Set

The Greatest Generation Commemorative Coin Act (H.R. 1057) was introduced last year by Rep. Marcy Kaptur (D-OH) to create a 2024 commemorative coin to raise money to care for the World War II memorial in Washington, D.C.

The commemorative program will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits to 50,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars. The bill sets surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar.

If the program sells out, the Friends of the National World War II Memorial will receive $9.5 million for maintenance and educational purposes.

H.R. 1057: Greatest Generation Commemorative Coin Act

Harriet Tubman Bicentennial Commemorative Coin Act (H.R. 1842) was introduced last year by Rep. Gregory Meeks (D-NY) to create a commemorative coin program to raise money to support museums remembering the legacy of Harriet Tubman.

The commemorative program will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits tp\o 50,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars. The bill sets surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar.

If the program sells out, the National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York, will receive $9.5 million ($4.625 million each) for maintenance and educational purposes.

H.R. 1842: Harriet Tubman Bicentennial Commemorative Coin Act

These are the only two numismatic-related bills passed by the 117th Congress.

Do you believe that Congress is actually doing something!

A quick update:

A quick update:

The National World War II Memorial Commemorative Coin Act (H.R. 1057) and Harriet Tubman Bicentennial Commemorative Coin Act (H.R. 1842) passed the Senate on a voice vote. The next stop is the president’s desk.

- H.R. 1057: Greatest Generation Commemorative Coin Act

Sponsor: Rep. Marcy Kaptur (D-OH)Summary: National World War II Memorial Commemorative Coin Act This bill directs the Department of the Treasury to mint and issue up to 50,000 $5 coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins in commemoration of the National World War II Memorial in the District of Columbia. The design of the coins shall be emblematic of the memorial and the service and sacrifice of American soldiers and civilians during World War II. All surcharges received from the sale of such coins shall be paid to the Friends of the National World War II Memorial to support the National Park Service in maintaining and repairing the memorial, and for educational and commemorative programs.Passed the House of Representatives with amendments — Jul 26, 2022

Passed the Senate with amendments — Jul 27, 2022

LAST ACTION: Message on Senate action sent to the House. — Jul 28, 2022

- H.R. 1842: Harriet Tubman Bicentennial Commemorative Coin Act

Sponsor: Rep. Gregory W. Meeks (D-NY)Summary: This bill directs the Department of the Treasury to mint and issue 50,000 $5 gold coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins emblematic of the legacy of Harriet Tubman as an abolitionist. The Secretary may issue coins under this bill only during the period of January 1, 2024, through December 31, 2024. All surcharges received by Treasury from the sale of such coins must be paid equally to the National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York, for the purpose of accomplishing and advancing their missions.Passed the House of Representatives — Jul 26, 2022

Passed the Senate with amendments — Jul 27, 2022

LAST ACTION: Message on Senate action sent to the House. — Jul 28, 2022

Weekly World Numismatic News for July 31, 2022

Scammers continue to sell counterfeit American Silver Eagles on Facebook because users keep buying them.

One of the issues that prevented me from writing a more substantive post is that I am investigating an alleged California-based site that is scamming people via Facebook. When I warned Facebook users it was a scam, the site owner sent a private message telling me I was a bad boy before turning off all means to comment or return messages.

Whoever is behind this site is trying to sell American Silver Eagles for below spot. The prices for these fakes have dropped to $14 as the price is silver is falling.

Please don’t fall for these scams. Tell your friends and relatives not to buy from them. It will not end well for anyone.

And now the news…

→ Read more at timesofisrael.com

→ Read more at timesofisrael.com

→ Read more at money.usnews.com

→ Read more at money.usnews.com

Facebook Advertising: Understand Who You Are Buying From

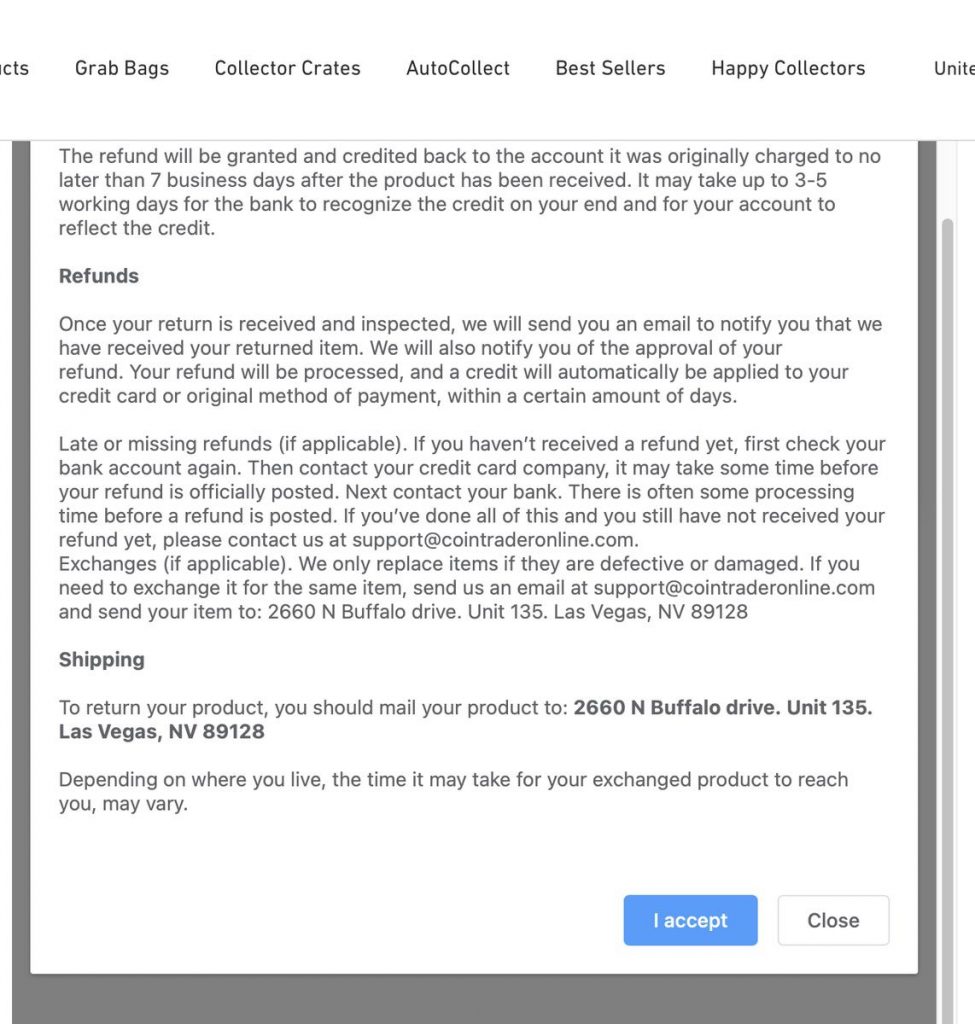

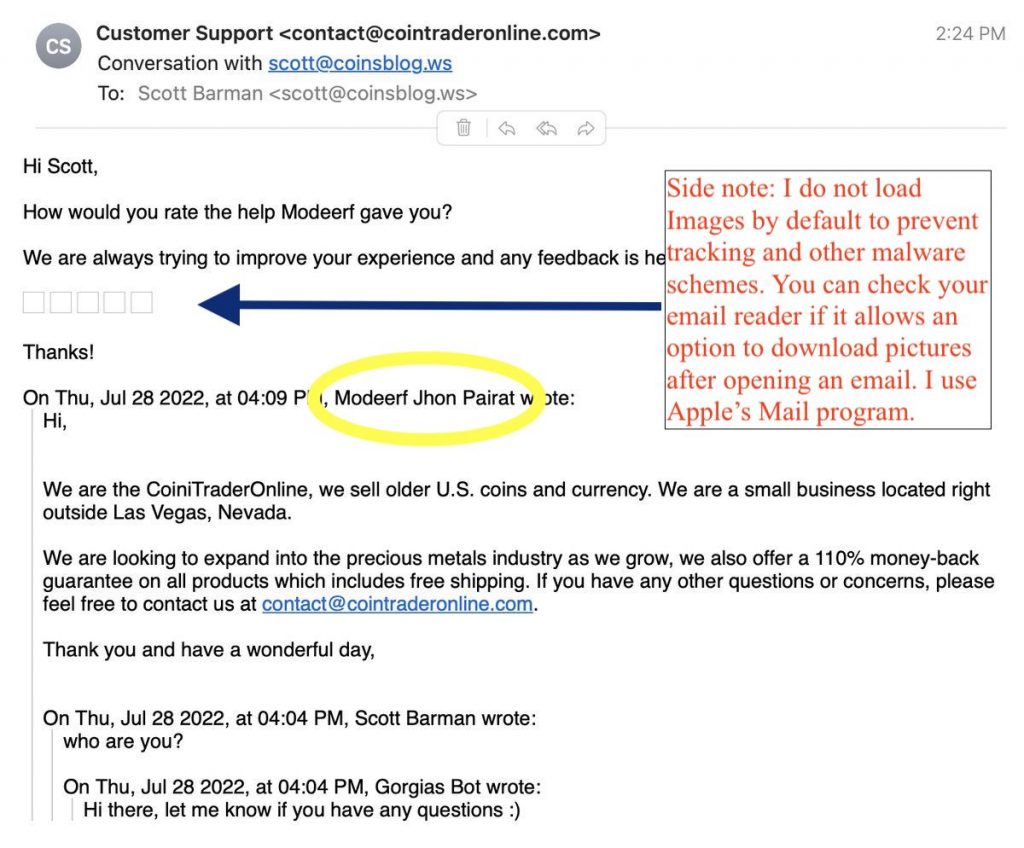

A site called cointraderonline.com (I purposely did not make it a link; please do not visit the site) began advertising heavily on Facebook. The ad, whose image appears here, says that the purchaser will buy a “US Vault Bag” that is “Packed With Unsearched US Coins.” The ad and the site say that there is a 60-Day Return policy.

I have been advising people not to purchase from this site. Unfortunately, some did not seek advice before purchasing. When they received their bag, the results were less than satisfying.

Buyers of the Vault Bags report that they received bags that contain at least 50-percent copper coins with the rest common silver coins. Buyers describe the coins as being heavily circulated, some with scratches and dings, along with very worn and dateless Buffalo Nickels. Although the owner of this site may not have searched the hoard they used to fill the bags, the product appears to lack key or semi-key dates and higher-grade material based on reports from several people.

One person tried to return the coins on their 60-day return policy. The buyer mailed the coins to a Las Vegas address with tracking from the US Postal Service. The package was delivered, but the person did not receive a refund.

The Investigation

Finding information about the company from their website was difficult. The “About Us” page contains very little useful information about the company. Still, the page uses a few images from elsewhere on the Internet. A random sample of images found several duplicates on other sites using a Google Image search. Many are stock images that the web designer could have purchased from legitimate sources. However, the number of images used to make the website pretty without being functional is an area I find concerning.

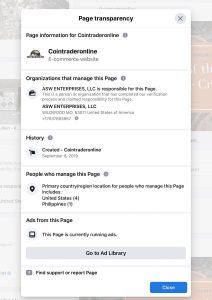

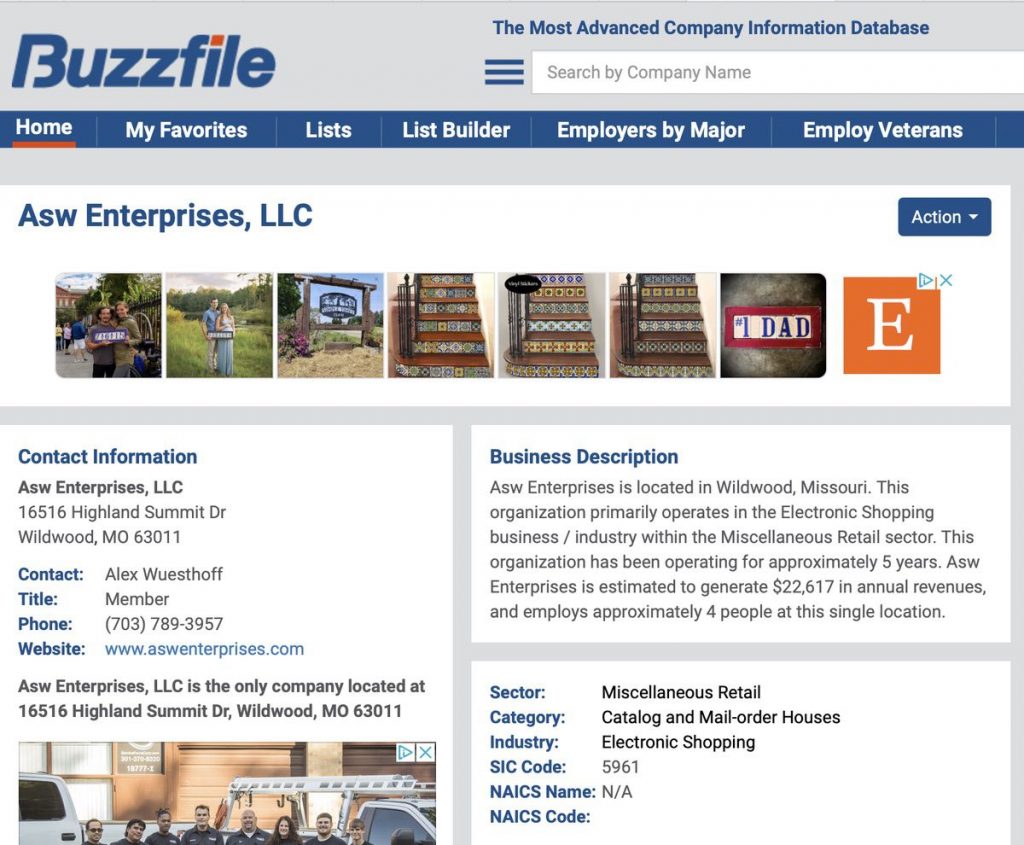

In previous posts, I make it clear that if you cannot find information about the company or the people behind the words suggests that you should not trust the site. The same is true in this case because you cannot find any information about this company. When I found the address to send returns and checked the address on Google, the “Suite” is an apartment complex northwest of the tourist and business areas.One tool Facebook provides is a “Page Transparency” section. You must go to the company’s main page to find the information. According to the information on the page, Facebook reports that “ASW ENTERPRISES, LLC” was verified as responsible for the page. ASW Enterprises is in Wildwood, Missouri, with a telephone number that has a 703 area code. The 703 area code maps the Northern Virginia suburbs of Washington, DC.

Hotfrog, a collector of business information, has the phone number listed on Facebook on record but also a St. Louis-area telephone number.

Using the St. Louis-area telephone number, a reverse search found a listing at hub.biz for an address in Baldwin, Missouri. The address is for a 4 bedroom, 4 bathroom, 2880 square foot home that Zillow says is worth $576,300 with what looks like it has a three-car garage. I wish I had a three-car garage!

A reverse lookup of the address and telephone number finds information about ASW Enterprises on Buzzfile. This information provides a person’s name that, when plugged into the ANA Dealers” directory, does not find a record. Although the site says that this person/business is a member of the ANA, he is not listed as a registered dealer in the ANA database they use for the Find a Dealer page.

The website on the Buzzfile page is for a company selling preparation materials for a Texas-based spelling competition. There is every indication that the website has nothing to do with the cointraderonline.com business.

The About page also says they are a National Silver Dollar Round Table member. Neither the company name nor the name of the person listed as the principal of ASW Enterprises is listed on the NSDRT membership page. I did not consult with the Certified Collectors Group (NCG/PCGS) to verify the membership claim.

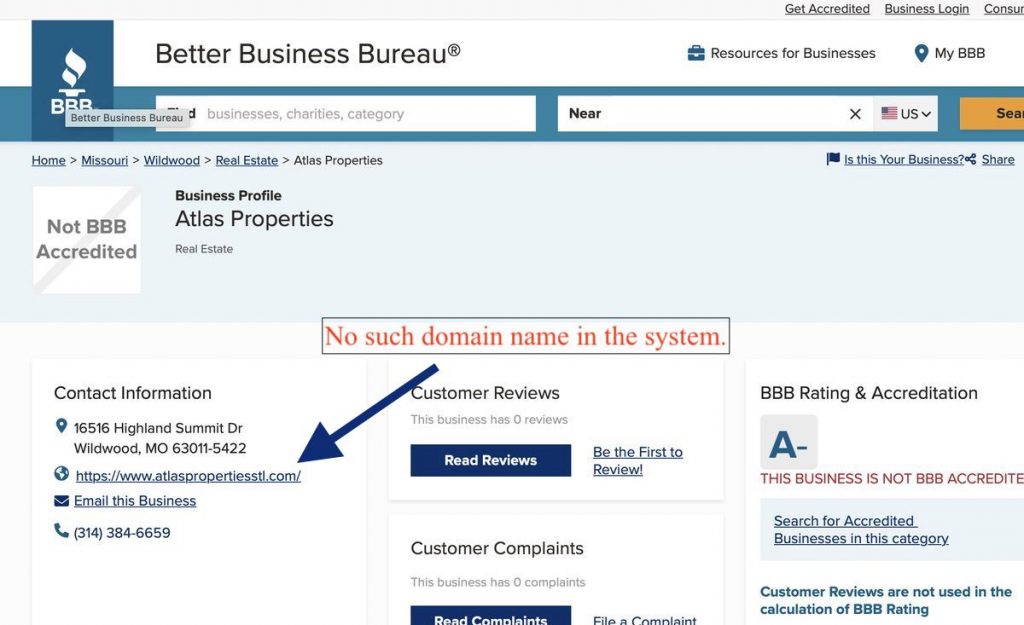

Finally, a reverse search of the person’s name suggests that this is not his only business venture. A Better Business Bureau entry suggests he is also involved with real estate. The finding was supported by a posting to a public message board looking for fellow investors in the St. Louis area.

There appears to be no connection between the owner listed on the Facebook Page Transparency page and the operation in Las Vegas.

I tried to send a message to the site owner via the chat option on the website. After receiving a response via email, I asked several follow-up questions that have been unanswered at this point. If they answer my questions, I will add the information here and in a new post.

I received an automated message from their system. It was formatted as a reply and included the name of the person that replied to my chat request. When I looked up the name in the email, I found public interactions of someone from the Philippines.

Having a support contract with someone offshore should not raise a concern. Still, when the return address is Las Vegas, and the company’s background information leads to the St. Louis area, it creates concern.

Should You Buy From this Site

My investigation suggests that the person behind the site may be an inexperienced young adult. The diverse information indicates that he is trying to find a way to earn a living. However, he must understand that online sellers have cheated too many coin collectors and that he should opt for transparency rather than pretty pictures on a website.

If you want to support someone trying to start a business, you may want to buy from this company. However, reports suggest that you will not receive value for your money.

Why Publish The Investigation Detail

An old proverb says, “Give a Man a Fish, and You Feed Him for a Day. Teach a Man To Fish, and You Feed Him for a Lifetime.” Rather than providing my opinion, showing you how to investigate sites you are unsure about will help you fight online fraud.

Scams with online shopping are a problem beyond numismatics. Although legitimate small businesses are selling online, there are many scammers. The above processes can help you investigate someone before spending your money.

Suggestions for Small E-Commerce Businesses

For small businesses, I would highly recommend that you be as transparent as possible. You should publish contact information and respond as quickly as possible. Let your buyers know a little about you. Who are you, and why are you in the business? Do you have a passion for what you are selling? Do you have a compelling story about why you are in business? I understand you are communicating with customers, but customers also want to have a connection with the people they do business with.

You have to generate a sense of trust with the customer, which gives you an advantage over a large online retailer. Give me a reason to trust you over the next-day shipping behemoth, and I could become a regular customer. Let the customers know they will deal with another person, not a big corporation riding down a South American river.

Finally, pretty websites are nice but if you are going to use stock photographs, use them sparingly. Stock photographs of coins, people supposedly looking the part they playing on your page might look good, but they come off as fake and as valuable as a cleaned coin. Do not fill up a page with images. Clear, concise, and accurate information is better than pictures.