Aug 15, 2011 | coins, commemorative, legislative

Every week I check the progress of coin bills in winding its way through congress. As there are new bills or updates, I make sure the Coin Bills in the 112th Congress page is updated. Having not done so since congress went on their summer vacation, I decided to see if there was anyto change prior to their leaving Washington.

As opposed to previous congresses, the 112th congress has been pretty dull when it comes to coin legislation. Not only have fewer bills been introduced, but the bills that have been introduced have been sitting in committee going nowhere. That is until now.

According to the record, the National Baseball Hall of Fame Commemorative Coin Act (H.R. 2527) was voted out of the House Financial Services Committee by voice vote on July 20 and ordered to be reported to the House Floor for consideration. Although the bill was also referred to the House Budget Committee, House rules allow Speaker of the House John Boehner to schedule it for debate and vote on the House floor without consent of the Budget Committee.

Of all the coin-related bills introduced in the 112th congress, this is the only one that has had any action following introduction.

Other than directing the U.S. Mint to strike $5 gold coins, silver dollars, and clad half-dollars in recognition of the National Baseball Hall of Fame during 2015, H.R. 2527 requires the coin to be concave/convex to depict a baseball on the reverse and have a competition for the obverse. Read my prior post, “A Commem to Take Out to the Ball Game” for more on this bill.

Given the toxic nature of how both sides of the aisle has done business, it is good to see at least one committee can come together for at least one bill!

Jul 24, 2011 | commentary, dollar, legislative

Not to be outdone, Rep. Jackie Speier (D-CA12) with co-sponsor Rep. Jared Polis (D-CO2) introduced their own bill in the House of Representatives to end the Presidential $1 Coin Program. On the same day Sens. Vitter and DeMint introduced their bill, Speier and Polis introduced H.R. 2593, Wasteful Presidential Coin Act of 2011.

Don’t you love the way congress can editorialize in what is supposed to be serious laws?

But wait, there’s more!

The bill is essentially the same as the Senate version. However, in an attempt to become managers of the Federal Reserve coin rooms, Reps. Speier and Polis has added a new section to their version of the bill:

SEC. 3. RESTRICTION ON OVERPRODUCTION OF $1 COINS.

Section 5112 of title 31, United States Code, is amended by adding at the end the following new subsection:

`(w) Restriction on Overproduction of $1 Coins- Notwithstanding any other provision of this section, no $1 coin may be minted or issued under this section during any period in which the number of $1 coins issued, but not in circulation, is more than 10 percent of the number of $1 coins in circulation.’.

What Speier and Polis is saying is that they know better than the Federal Reserve on how to manage the coins in their possession. Should the Federal Reserve find that in the future they want to add stock to their coin rooms, like when congress actually does the right thing and end the printing of the $1 federal reserve note, the Federal Reserve could find itself in a shortage situation in trying to comply with the law.

This is the type of legal provision that has the potential to create unintended consequences. Further, I do not think that congress should manage the cash operations of the Federal Reserve. They can barely manage the nation’s budget, I do not want these people trying to manage the Fed.

Jul 21, 2011 | coins, commentary, dollar, legislative

On July 19, 2011, Sen. David Vitter (R-LA) and Sen. Jim DeMint (R-SC) introduced S. 1385, To terminate the $1 presidential coin program. Simply, the bill removes subsection n of Section 5112 of title 31 United States Code (31 U.S.C. § 5112), which is the law authorizing for the Presidential $1 Coin Program.

The bill reads as follows:

S 1385 IS

112th CONGRESS

1st Session

S. 1385

To terminate the $1 presidential coin program.

IN THE SENATE OF THE UNITED STATES

July 19, 2011

Mr. VITTER (for himself and Mr. DEMINT) introduced the following bill; which was read twice and referred to the Committee on Banking, Housing, and Urban Affairs

A BILL

To terminate the $1 presidential coin program.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,

SECTION 1. TERMINATION OF PRESIDENTIAL $1 COIN PROGRAM.

Section 5112 of title 31 United States Code, is amended by striking subsection (n) and inserting the following:

`(n) [Reserved.]’.

This is clearly an over reaction to the slanted report by NPR that suggests this is a taxpayer issue and not an issue of the broken monetary system in the United States. Rather than figure if this bill will properly achieve their purpose, Messrs. Vitter and DeMint wrote the most expedient bill regardless of its ramifications.

First, if this bill is passed, it will not do anything to relieve the oversupply of dollars being held by the Federal Reserve. All it will do is not increase the current supply leaving about $1 billion of coins in the Fed’s coin vaults and not circulating in the economy.

Another problem with the bill is that it leaves the First Spouse Gold Coin program in place. A closer look at the law shows that the First Spouse Program is codified in 31 U.S.C. § 5112(p). In order to stop the entire program, the bill would have to remove both subsections “n” and “p.”

Further, 31 U.S.C. § 5112(q) (subsection “q”) requires the U.S. Mint to promote the Presidential Dollar program and includes the requirements about the government and commercial acceptance of the coins. If the bill passes by removing subsection “n,” both the U.S. Mint and Federal Reserve will have difficulty complying with this law.

For numismatists who have been collecting Presidential Dollars, this bill’s passage will end the program early leaving us with a partial series. Teachers who use the coins and the good materials produced by the U.S. Mint to help teach history will have to find different tangible aids than coins. Coins would be a better teaching aid since it is tangible and money gets everyone’s attention.

The ONLY way to reduce the oversupply of dollars being held in the Federal Reserve coin vaults is to eliminate the $1 Federal Reserve Note. With out the paper, coins become the currency of the realm and will start to circulate.

I am sure that within a day someone will send a comment saying that Americans like paper and do not like coins. While there are segments of the population that will complain, Americans are resilient and will adapt. We can adapt to anything that the government can do and be successful. We can adapt to anything that market forces place on us and bees successful. We went from an all cash society to adding credit cards; cell phones are now everywhere as compared to 10 years ago; we have survived many changes in the economy; we went from leaded gas to unleaded; transit tokens to electronic metro passes; and now many cities are moving to paying for parking electronically rather than feeding quarters into meters. Americans adapt to change all of the time. Now it is time for all Americans to dig into their souls and change their currency habits for the good of the country.

Jul 17, 2011 | coins, commemorative, legislative, US Mint

In a very rare show of bipartisan ship in the House of Representatives, Rep. Richard Hanna (R-NY24) introduced H.R. 2527, National Baseball Hall of Fame Commemorative Coin Act. Hanna, whose district includes Cooperstown, submitted the bill with 293 sponsors, including the entire New York delegation from both parties. This might be the first coin-related legislation to see action in the 112th congress.

In a very rare show of bipartisan ship in the House of Representatives, Rep. Richard Hanna (R-NY24) introduced H.R. 2527, National Baseball Hall of Fame Commemorative Coin Act. Hanna, whose district includes Cooperstown, submitted the bill with 293 sponsors, including the entire New York delegation from both parties. This might be the first coin-related legislation to see action in the 112th congress.

The National Baseball Hall of Fame and Museum opened in Cooperstown, New York on June 12, 1939. Its first inductees class include five payers who many consider amongst the greatest who have ever played professional baseball. These inductees were (in alphabetical order):

Tyrus Raymond “Ty” Cobb, also known as “The Georgia Peach,” set 90 Major League Baseball Records including highest career batting average (.367) and most career batting titles (12) which he still holds today. His 24-year career was also memorable for his surly temperament and aggressive playing style. When he was voted in to National Baseball Hall of Fame on its inaugural ballot in 1936, he received 222 out of a possible 226 votes, the most of this entry class. The other four votes were probably from sportswriters Cobb made upset during the course of his career.

Tyrus Raymond “Ty” Cobb, also known as “The Georgia Peach,” set 90 Major League Baseball Records including highest career batting average (.367) and most career batting titles (12) which he still holds today. His 24-year career was also memorable for his surly temperament and aggressive playing style. When he was voted in to National Baseball Hall of Fame on its inaugural ballot in 1936, he received 222 out of a possible 226 votes, the most of this entry class. The other four votes were probably from sportswriters Cobb made upset during the course of his career. Walter “Big Train” Johnson played 21 years for the original Washington Senators, 1907-1927. Johnson is second in all time wins with 417 (Cy Young won 511) and is still the all-time career leader in shutouts with 110. Using scientific tests available at the time, Johnson’s fastball was clocked at over 91 miles per hour which was phenomenal for the time. His motion and fastball fooled many hitters, especially right handers. Many of his strikeout records lasted more than 50 years before being broken by future Hall of Famers Bob Gibson, Nolan Ryan, Steve Carlton, and Gaylord Perry.

Walter “Big Train” Johnson played 21 years for the original Washington Senators, 1907-1927. Johnson is second in all time wins with 417 (Cy Young won 511) and is still the all-time career leader in shutouts with 110. Using scientific tests available at the time, Johnson’s fastball was clocked at over 91 miles per hour which was phenomenal for the time. His motion and fastball fooled many hitters, especially right handers. Many of his strikeout records lasted more than 50 years before being broken by future Hall of Famers Bob Gibson, Nolan Ryan, Steve Carlton, and Gaylord Perry. Christy Mathewson holds the National League record for wins with 373. In 17 years, he won all but one of those games with the New York Giants. In 1916, Mathewson was traded to the Cincinnati Reds and became their manager. During his career, Mathewson was famous for his duels with Mordecai “Three Finger” Brown, mostly against the Chicago Cubs. Brown got the best of Mathewson 13-11 with one no-decision. Johnson’s career was cut short when he was accidentally gassed during World War I.

Christy Mathewson holds the National League record for wins with 373. In 17 years, he won all but one of those games with the New York Giants. In 1916, Mathewson was traded to the Cincinnati Reds and became their manager. During his career, Mathewson was famous for his duels with Mordecai “Three Finger” Brown, mostly against the Chicago Cubs. Brown got the best of Mathewson 13-11 with one no-decision. Johnson’s career was cut short when he was accidentally gassed during World War I. George Herman “Babe” Ruth, “the Bambino,” “the Sultan of Swat,” the former pitcher turned outfielder is largely credited for saving baseball after the Chicago Black Sox Scandal during the 1919 World Series. Baseball needed a new hero and Babe Ruth was there with a mighty bat. The sale of his contract from the Red Sox to the Yankees in December 1919 had been part of Red Sox lore and hung like an albatross until the BoSox won the World Series in 2004—which they beat the Yankees to get into the World Series after being down three games to one in the ALCS!

Babe Ruth was baseball’s first home run king. In 1921, Ruth hit 59 home runs while the Yankees shared the Polo Grounds with the Giants. That record stood until Ruth belted 60 for the “Murderer’s Row” team of 1927. It was a record that stood until Roger Maris hit 61 in 1961. His 714 career home runs served as a record until broken by Hank Aaron in 1974. Ruth’s .690 slugging percentage remains a record.

George Herman “Babe” Ruth, “the Bambino,” “the Sultan of Swat,” the former pitcher turned outfielder is largely credited for saving baseball after the Chicago Black Sox Scandal during the 1919 World Series. Baseball needed a new hero and Babe Ruth was there with a mighty bat. The sale of his contract from the Red Sox to the Yankees in December 1919 had been part of Red Sox lore and hung like an albatross until the BoSox won the World Series in 2004—which they beat the Yankees to get into the World Series after being down three games to one in the ALCS!

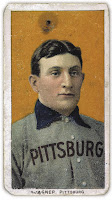

Babe Ruth was baseball’s first home run king. In 1921, Ruth hit 59 home runs while the Yankees shared the Polo Grounds with the Giants. That record stood until Ruth belted 60 for the “Murderer’s Row” team of 1927. It was a record that stood until Roger Maris hit 61 in 1961. His 714 career home runs served as a record until broken by Hank Aaron in 1974. Ruth’s .690 slugging percentage remains a record. Johannes Peter “Honus” Wagner was probably baseball’s first superstar. Playing most of his career with the Pittsburgh Pirates, Wagner won eight batting titles which is tied for the most in the National League with Tony Gwynn. One of the highlights of Wagner’s career was when the Pirates faced the Detroit Tigers in the 1909 World Series. The Tigers were lead by the 22-year old Ty Cobb. Vowing not to have the same poor showing as he did during the 1903 World Series, Wagner out hit Cobb .333 to .231 and stole six bases, setting a World Series record. At 35 years old, Wagner lead his Pirates to victory over the Tigers, 4-3. Wanger’s T206 Baseball card made by the American Tobacco Company is the most expensive baseball card in the world—only 57 are known to exist.

Johannes Peter “Honus” Wagner was probably baseball’s first superstar. Playing most of his career with the Pittsburgh Pirates, Wagner won eight batting titles which is tied for the most in the National League with Tony Gwynn. One of the highlights of Wagner’s career was when the Pirates faced the Detroit Tigers in the 1909 World Series. The Tigers were lead by the 22-year old Ty Cobb. Vowing not to have the same poor showing as he did during the 1903 World Series, Wagner out hit Cobb .333 to .231 and stole six bases, setting a World Series record. At 35 years old, Wagner lead his Pirates to victory over the Tigers, 4-3. Wanger’s T206 Baseball card made by the American Tobacco Company is the most expensive baseball card in the world—only 57 are known to exist.

There have been 205 former major leaguers, 27 executives, 35 Negro League players, 19 managers, and 9 umpires elected to the Hall of Fame. There are currently 63 living members. Exhibits include Women in Baseball, ¡Viva Baseball! celebrating baseball in Latin America and the Caribbean, and The Records Room that shows off the real equipment used to set Major League records.

Should the bill pass, it calls for the minting of 750,000 half-dollar clad coins, 400,000 $1 silver coins, and 50,000 $5 dollar gold coins in 2015. The sale of these coins will include a $35 surcharge for the gold coin, $10 for the silver dollar, and $5 for the clad half-dollar. The potential income of $9.5 million will be paid to the National Baseball Hall of Fame to help finance its operations.

According to the bill, the obverse design of the coin will require an open competition. “The competition shall be judged by an expert jury chaired by the Secretary and consisting of 3 members from the Citizens Coinage Advisory Committee who shall be elected by such Committee and 3 members from the Commission of Fine Arts who shall be elected by such Commission.” The bill said that the “Secretary shall determine compensation for the winning design, which shall be not less than $5,000.” Of course there is a catch. The bill says that the “Secretary may not accept a design for the competition unless a plaster model accompanies the design.”

For the reverse, the bill says the coins “shall depict a baseball similar to those used by Major League Baseball.”

But there is an interesting catch to the design specified in the bill. The bill wants the coin design “fashion[ed] similar to the 2009 International Year of Astronomy coins issued by Monnaie de Paris, the French (sic) Mint, so that the reverse of the coin is convex to more closely resemble a baseball and the obverse concave, providing a more dramatic display of the obverse design chosen.” This should give the U.S. Mint some use for the machinery they used to strike the 2009 Ultra High Relief Double Eagle Gold Coin.

With 293 co-sponsors from both sides of the aisle, there should be no reason for this this bill not to pass—but stranger things have happened with this congress already. The bill has been referred to the House Financial Services Committee where it will likely to be assigned to the Subcommittee on Domestic Monetary Policy and Technology chaired by Rep. Ron Paul (R-TX). In the “what could go wrong” category, Rep. Paul is not considered a friend to the U.S. Mint or its practices.

The bill has also been referred to the House Budget Committee who has its hands full with other matters. Budget Committee Chairman Rep. Paul Ryan (R-WI) is also known not to be a fan of the government.

Neither Paul or Ryan are co-sponsors of this bill. Maybe they can put aside their partisan differences like others who have co-sponsored the bill since baseball is something we can all agree on. As a long time baseball fan, I would buy these commemoratives. I hope congress gives me the chance!

Baseball Hall of Fame image courtesy of the National Baseball Hall of Fame and Museum.

All other pictures courtesy of Wikimedia.

Apr 15, 2011 | legislative

The White House announced that President Obama signed H.R. 4, Comprehensive 1099 Taxpayer Protection and Repayment of Exchange Subsidy Overpayments Act of 2011. This law eliminates the requirement to file Form 1099 for sales more than $600.

The Form 1099 filing requirement was seen as a serious burden for small businesses. Since the vast majority of numismatic dealers are small businesses, it would have create a serious problem for the entire industry. Now that it is law, the reduction in paperwork and the reduced burden on numismatic dealers and other small businesses should be a relief.

Apr 8, 2011 | BEP, legislative, policy, US Mint

If congress cannot settle on a budget to keep the federal government operating past midnight on Friday, April 8, the U.S. Mint and the Bureau of Engraving and Printing will continue to operate. Even though both agencies are bureaus under the Department of the Treasury, both are funded through their respective Public Enterprise Funds. The Public Enterprise Funds contains the seignorage (profits) made from the manufacture of the money.

Although Treasury Department has not made any official announcements, the U.S. Mint did send a note to their employees in February. U.S. Mint employees were told that “unless specifically instructed otherwise, United States Mint employees are required to report to work as usual even if there is a government-wide shutdown.”

Regardless of what the non-federal political leaders say, the Washington, D.C. area is a essentially a company town. In addition to the agencies based in the District, there is a significant federal presence in Maryand and Virginia that will impact the communities where they are located. A shutdown will affect the area as far north as Baltimore, Fredericksburg to the south, and many border towns in West Virginia that host “remote” federal facilities. This does not include the commercial contractors that provide support and services to many federal agencies. I saw one estimate that said 80-percent of the DC Metro Area would be affected by a government shutdown.

I know I am not objective on this subject because it is personal. Not only will a government shutdown hurt the economy of everyone in the region, but it can affect me personally. Since my current project is essential in the long term it is not essential for the short term operations of the government. This means I could be furloughed with my colleagues a lot of other people in a similar situation.

Television news shows us stories about the small towns that lost its mill, plant, or factory and its economy crashes. The stories are all the same, the facility closes and the small town of a few thousand is devastated—almost to the point of turning it into a ghost town. If that happened to an area with over 5.5 million people, what will be the economic impact to the entire nation?

While I agree that we need to fix the budget, get rid of government waste, and figure out how to get out of debt for the overall economic health of the nation, drastic measures are not the way to do it. Very few people can kick any habit “cold turkey” and neither can the government. It will just bring pain and suffering to the people who will not have the money manufactured by the U.S. Mint and BEP to circulate in the economy necessary to promote growth.

Apr 6, 2011 | legislative

On a vote of 87-12 (1 not voting), the Senate passed the H.R. 4, Comprehensive 1099 Taxpayer Protection and Repayment of Exchange Subsidy Overpayments Act of 2011. Once signed, the law will eliminate the requirement to file Form 1099 for sales more than $600.

As required by law, the bill is sent to the House, back to the chamber that introduced the bill. Since there are minor differences between the versions passed by the House and Senate, the House can accept the Senate’s changes or request a conference committee to work out the differences. In this case, it is likely that the House will accept the minor wording changes. The bill will then be engrossed and sent to the President for his signature.

The Form 1099 filing requirement was seen as a serious burden for small businesses. Since the vast majority of numismatic dealers are small businesses, it would have create a serious problem for the entire industry. It is good that congress has taken these steps to repeal this law.

UPDATE (4/7)—The House accepted the one minor wording change and sent H.R. 4 to President Obama for his signature.

Apr 5, 2011 | legislative

Following the opening of the 428th Session of the Maryland General Assembly, Delegate Dana Stein (D-11th District) introduced House Bill 206, Sales and Use Tax Exemption for Precious Metal Bullion and Coins – Repeal. In short, the purpose of the bill was to remove the tax exempt status on all bullion and coin purchases in Maryland. This would cover the current exemption for sales over $1,000 and all sales at coin shows.

Days before the hearing, Whitman Publishing sent an email and posted a note on their website requesting help form Maryland collectors to contact the House Ways & Means Committee to oppose the bill. Whitman was rightfully worried that it would damage their investment in the thrice yearly Whitman Baltimore Expo. Essentially, Whitman was saying that if the law was repealed they would likely move their shows “to a friendlier state with no sales tax.” This would effect the loss of ancillary taxes at hotels, restaurants, and other establishments in the Inner Harbor that would be generated by show participants.

After being contacted by Whitman, I contacted my three delegates in the state legislature regardless of whether they were members of the Ways & Means Committee. One of my delegates is a member of that committee. On Monday, I received a letter from my delegate saying that the H.B. 206 was heard in committee and further action was a not scheduled. Since the session officially adjourns on April 11, it is expected H.B. 206 will die in committee.

Dana Stein, whose district covers northwest Baltimore County, or aids in his Annapolis office did not comment or return my call when contacted Monday afternoon.

Mar 28, 2011 | economy, legislative, policy

Bernard von NotHaus, creator of the Liberty Dollar, was convicted of counterfeiting for creating “coins resembling and similar to United States coins” and distributing them with the intent to “use [them] as current money.” The verdict was handed down by a federal jury in Statesville, NC on March 18, 2011. Von NotHaus is facing a maximum sentence of 20 years in prison and fines up to $500,000. Sentencing hearing will begin on April 4.

In an email to supporters, von NotHaus indicated that he will appeal his conviction.

A few days before the end of the trial, Rep. Ron Paul (R-TX) introduced H.R. 1098: Free Competition in Currency Act of 2011. Its stated purpose is “To repeal the legal tender laws, to prohibit taxation on certain coins and bullion, and to repeal superfluous sections related to coinage.”

During his Extensions of Remarks on March 15, 2011, Rep. Paul said, “At this country’s founding, there was no government controlled national currency. While the Constitution established the congressional power of minting coins, it was not until 1792 that the U.S. Mint was formally established. In the meantime, Americans made do with foreign silver and gold coins. Even after the Mint’s operations got underway, foreign coins continued to circulate within the United States, and did so for several decades.” Unfortunately, Rep. Paul learned the wrong lesson from history.

Starting with the statement that foreign coins continued to circulate for several decades, fails to recognize the real reason for this. Upon passage of the Constitution and prior to the passage of the Coinage Act of 1792, the new government realized that the they were not ready a would not be ready to supply coins to satisfy the needs of the new nation. Even after the passage of the first Coinage Act, congress realized that the U.S. Mint needed time to produce enough coins for the nation. Rather than plunging the economic potential of the new nation into chaos, the government continue to allow foreign coinage, specifically the Spanish Reales, to be used for commerce. This continued until the passage of the Coinage Act of 1857. Aside from authorizing the issuing of the small cent, which the U.S. Mint did by striking the Flying Eagle Cent, the law gave citizens two years to redeem their foreign money for the equivalent in U.S. coinage. By 1859, no foreign coins were circulating in the United States.

In the years leading up to the Revolutionary War, the new colonies were hampered by a situation where King of England did not allow the colonies to control its own money or create its own monetary policy. In order to expand commerce, colonies issued paper notes. These notes functioned as currency but actually were bills of credit, short-term public loans to the government. For the first time, the money had no intrinsic value but was valued at the rate issued by the government of the colony in payment of debt. Every time the colonial government needed money to pay creditors, they authorized the printing of a specified quantity and denomination of notes. Laws authorizing the issuance of notes were called emissions. The emission laws also included a tax that was used to repay the bills of credit with interest.

As taxes were paid using the paper currency, the paper was retired. As the notes were removed from circulation, that meant less payments the government had to make. On the maturity date, people brought their notes to authorized agents who paid off the loan. Agents then turned the notes over to the colonial government for reimbursement plus a com- mission. Sometimes, colonies could not pay back the loan. They instead passed another emission law to cover the debt owed from the previous emission plus further operating expenses, buying back mature notes with new notes. The colonists accepted this system since it was easier than barter and there were never enough coins to meet commercial needs.

To maintain commerce, many of the notes were tied to the value of the Pound Sterling but the worth of the Pound Sterling was interpreted differently from colony to colony. Although the colonies accepted foreign coins, especially the Spanish silver reales, each colony set its own price of silver as based on its purchasing power. For example, the colonies of North Carolina and Virginia tied the reales’ value to the amount of tobacco that can be traded. This continued following the Revolutionary War so that commerce could continue and the new states could repay war debts.

After the failure of the Articles of Confederation to form that perfect union, the authors of U.S. Constitution understood the a union must be able to be supported out of the whole and not individual parts. It was best explained by James Madison in Federalist No. 44 when he wrote:

Had every State a right to regulate the value of its coin, there might be as many different currencies as States, and thus the intercourse among them would be impeded; retrospective alterations in its value might be made, and thus the citizens of other States be injured, and animosities be kindled among the States themselves. The subjects of foreign powers might suffer from the same cause, and hence the Union be discredited and embroiled by the indiscretion of a single member. No one of these mischiefs is less incident to a power in the States to emit paper money, than to coin gold or silver.

By reigning in the chaos caused by 13 different economic policies, the more perfect union turned this young country into an economic powerhouse that has surprised empires of years past.

The economic strength of the United States is based on strength of its currency that is backed by the full faith and credit of the U.S. government. While there are disagreements as to how to use and maintain that strength, the fact of the matter is that much of the world bases its economic stability on the full faith and credit of the U.S. Dollar. There are many economies that use Dollars as its primary means of exchange like most of the countries in Central America. Most of the world’s commodities are priced in dollars like oil and precious metals. And countries buy United States bonds to help back their currency like China.

By repealing the legal tender laws (31 U.S.C. § 5103), Rep. Paul is proposing to demonetize all United States coins and currency that could lead to a global economic collapse. Countries that use the dollar as their currency will not have a currency; currencies backed by the dollar will be worthless; and the price of world commodities will become unstable as the markets search for a new standard. As we have seen during the current economic crisis, instability causes prices to rise—see the prices of gold, silver, and oil.

H.R. 1098 was referred to the Committees on Financial Services, Ways and Means, and the Judiciary. Rep. Paul is chairman of the Domestic Monetary Policy and Technology Subcommittee under the Committee on Financial Services. Should this bill be successfully reported out of all three committees it would have to passed on the floor of the House of Representatives. If it passes the House, it is doubtful that the bill would pass in the Senate. This aspect of the sausage making process ensures that this bill will never pass. Regardless of what you think about United States monetary policy, it is not in anyone’s interest to plunge the world into economic chaos.

Dec 15, 2010 | coins, legislative

The White House announced that on December 14, President Barack Obama singed the American Eagle Palladium Bullion Coin Act of 2010 (H.R.6166) and the Coin Modernization, Oversight, and Continuity Act of 2010 (H.R.6162).

Read this article for more information about both laws.