Sep 28, 2012 | BEP, coins, currency, economy, Federal Reserve, legislative, policy, US Mint

Those of us here in the Washington, DC area who work with or for the Federal Government knows that this week is the home stretch to the end of the fiscal year. Many of us who work for the government are not directly involved with the political infighting that makes the national news. Federal employees are prohibited to be involved with politics by law and contractors usually have employer policies that limit their political activities.

One thing we worry about is the funding issues that have not been resolved. Although the news reported that congress has passed a continuing resolution to fund the government for six months, what the reports did not say is that the continuing funding are only at the levels negotiated last year which rolled back funding to Fiscal Year 2007 (FY07) levels. FY07 dollars do not have the same buying power as today’s dollars and the amount of work required by the laws passed by congress have increased.

You might have heard about the budget “sequestration.” Sequestration is the mechanism that was instituted as part of the Budget Control Act of 2011 to force congress to negotiate a budget or automatic, across the board cuts totaling $1.2 trillion will go into effect on January 1, 2013. Sequestration has made a lot of people in the DC area nervous because it will cause contractors to cut jobs. In fact, with the uncertainty of sequestration, large contractors, like Lockheed-Martin, are providing 90 day layoff notices they are required to give employees when defense and other security-related contracts are ended early.

For the money manufacturing operations under the Department of the Treasury, there should not be any problems from sequestration because the U.S. Mint and the Bureau of Engraving and Printing are profitable agencies that uses their profits for operations. If there are shortfalls in providing funding for operations, the Secretary of the Treasury is allowed to withdraw funds from the Public Enterprise Funds (the accounts where the profits are deposited).

Problems remain for both agencies. The most significant of the issues are the problems with printing the new $100 Federal Reserve Notes. BEP continues to report that the new notes have folding issues that have delayed their release for two years. Inquiries by numismatic industry news outlets have reported that the problems are still under investigation and that no new release date has been set.

The U.S. Mint recently reported striking problems with the First Spouse Gold Coins. Apparently, the design caused metal flow problems in trial strikes that caused delays in releasing the coins. While the U.S. Mint has said they rectified the problems, the coins have not been issued.

In addition to the coining problems, the U.S. Mint also suspended its attempt to update its technology infrastructure. After receiving the responses from a formal Request For Information (RFI), the U.S. Mint pulled back on its attempt to update its infrastructure and online ordering services to re-examine the requirements and the business processes that would be part of that contract. The U.S. Mint press office said that they had no further information other than what has been published. They did confirm that the RFI responses will not be released because they contain proprietary information that is protected from public release.

It is difficult to know whether the federal budget situation will effect the U.S. Mint and BEP or whether the attempt to reduce costs in order to ensure they do not access more money from their respective Public Enterprise Funds. This is because money in excess of budgeted operations plus a reserve must be withdrawn from these Public Enterprise Funds and deposited in to the general treasury accounts at the discretion of the Secretary of the Treasury (31 U.S.C. § 5136 for the U.S. Mint and 31 U.S.C. § 5142 for the BEP). It is reasonable to question the management of these funds in the light of the federal budget situation.

Right now, the way the BEP and the Federal Reserve has handled the situation with the new $100 note suggests there is more to that issue than meets the eye. Nether the BEP or the Fed are answering question and the BEP did not issue an annual report for 2011 which would have to report on the production of the $100 notes. Inquiries to the BEP were returned with a reply that the report “is not ready.”

The annual reports for both these bureaus will make for interesting reading, if the BEP produces one for 2012.

Sep 24, 2012 | advice, coins, counterfeit, legislative, policy

It was reported that the third-party grading service ANACS has found a counterfeit 1934 Peace Dollar. Although the coin appears to be made with a genuine planchet, indications of heavy polishing and other flaws seen under high magnification has ANACS questioning the coin’s authenticity.

Senior ANACS Numismatist Michael Fahey was interviewed for the Coin World article does not believe that the counterfeiters used a previously struck coin and that the dies were made using a transfer process.

NGC discovered the “Blundered O” not included in the VAM references.

Regardless of whether one point is valid or not, the fact of the matter is that the ANACS staff who examined the coin found a lot of evidence that leads them to believe the coin is counterfeit. Finding counterfeit coins that get by experienced dealers and nearly fools the graders is a serious matter for the hobby. This is why the Hobby Protection Act needs to be strengthened so that we can stop something like this from hurting the hobby.

I will remind everyone that it is not too late to write to your representative and ask him or her to support H.R. 5977 the Collectible Coin Protection Act. In short, the Collectible Coin Protection Act will allow collectors, dealers, and grading services to bring legal actions that are much more effective, with much stronger remedies than previously existed. It will allow those harmed to work with the Justice Department to bring criminal actions, where appropriate.

The only way to ensure that H.R. 5977 becomes law, especially since we are approaching the end of this session in an election year, is to contact your member of congress will let them know that the numismatic community supports this Act and that their support is important. It can be worked on during the lame duck session and members of the Industry Council for Tangible Assets (ICTA) and the Gold and Silver Political Action Committee are working to see this law passed.

WE STILL NEED YOUR HELP!

There are only 11 co-sponsors of this bill as I write this post. We need more co-sponsors to get the attention of the House leadership.

First, see if your member of congress is not a sponsor of this legislation. The best way is to visit govtrack.us, scroll down and and select the “show cosponsors” link. If your representative is not there, here is a sample note to send them (complements of the ICTA):

As your constituent, I urge you to sign on as a co–sponsor of HR 5977, “The Collectible Coin Protection Act.” The bill was introduced on June 12 by Representatives Lamar Smith and Fred Upton, chairs of the Judiciary and Energy & Commerce Committees, respectively.

HR 5977 provides a means whereby US citizens can take legal action against purveyors of the high-quality counterfeit US coins entering our marketplace from China by expanding enforcement power of the Hobby Protection Act. The Hobby Protection Act has been in effect since its passage in December, 1975, but lacks enforcement power that HR 5977 now provides.

HR 5977 is revenue neutral and contains no controversial issues.

Please contact me if you have any questions or if I can provide any additional information. Thank you for your action on this.

Even though the House is not in session, members can still contact the Clerk of the House and ask that their name be added as a co-sponsor. The more names added, the better the chance that the bill will see action in the lame duck session.

Please take this opportunity and contact your representative today!

ADDED: If you do contact your representative, please leave a note here and let me know who you contacted. THANKS!

Image courtesy of NGC.

Aug 3, 2012 | coins, commemorative, legislative

The White House announced today that President Obama signed the National Baseball Hall of Fame Commemorative Coin Act into law (H.R. 2527). The law calls for the U.S. Mint to commemorate the the National Baseball Hall of Fame in Cooperstown, New York with a three-coin commemorative program consisting of a $5 gold coin (50,000 maximum mintage), $1 silver coin (400,000 maximum), and a clad half-dollar (750,000 maximum) struck as uncirculated coins or as proofs.

The White House announced today that President Obama signed the National Baseball Hall of Fame Commemorative Coin Act into law (H.R. 2527). The law calls for the U.S. Mint to commemorate the the National Baseball Hall of Fame in Cooperstown, New York with a three-coin commemorative program consisting of a $5 gold coin (50,000 maximum mintage), $1 silver coin (400,000 maximum), and a clad half-dollar (750,000 maximum) struck as uncirculated coins or as proofs.

The bill requires an open competition for a common obverse design “emblematic of the game of baseball” with a $5,000 minimum prize for the winning design. The common reverse will “depict a baseball similar to those used by Major League Baseball.”

Surcharges will be $35 per gold coin, $10 per silver coin, and $5 for the clad half-dollar to be paid to the National Baseball Hall of Fame for their continuing operations. If all the coins sell out, the Hall of Fame will receive $9.5 million for ongoing operations.

The bill was sent to the White House on July 25, 2012 and was signed today.

National Baseball Hall of Fame logo courtesy of the National Baseball Hall of Fame.

Jul 30, 2012 | BEP, coins, currency, education, legislative, policy, US Mint

There has been a lot of legislation passed by Congress that affects the coin and currency production in the United States. While some of it has been as mundane as changing the composition of coins or the approval of a commemorative coin, there are some that has had a significant impact on coin and currency production. Here is a list of those laws that had a major impact.

- Coinage Act of 1792

- The first coin-related law passed by congress and signed by President George Washington on April 2, 1792, establishes a mint, says that congress is the regulating authority of coins, and establishes the dollar as the unit of money. It made the United States one of the first countries to use a decimal system for currency and established legal tender laws. It is the foundation for the creation of the money production in the United States.

- Act of April 10, 1806

- This act regulates the legal tender value of foreign coins used in the United States.

- Act of April 21, 1806

- This act establishes the penalty for counterfeiting coins to be between three and five years of hard labor. Although there was no law regarding counterfeiting coins before this act, it was assumed that penalty was death because of the statements printed on colonial currency.

- Coinage Act of 1834

- This act changed the ratio of silver-to-gold weight from 15:1 that was established in the Coinage Act of 1792 to 16:1, setting the price of an ounce of gold to $20.67. This was done to strengthen the financial system after the Panic of 1833 and stem the tide of paper currency in favor of “hard money.” President Andrew Jackson signed this bill into law on June 27, 1834.

- Coinage Act of 1849

- Signed into law by President James K. Polk as one of his last acts as president on March 3, 1849, it established the use of gold for a $1 coin and the $20 gold double eagle coin. This act also refined the variances that were permissible for United States gold coinage. This act came largely because of the California Gold Rush.

- Coinage Act of 1857

- Signed into law by President Franklin Pierce February 21, 1857, this act repealed the legal tender status for foreign coins in the United States. It required the Treasury to exchange foreign coins at a market rate set by Treasury. This act discontinued the half-cent and reduced the size of the one-cent coin from 27mm (large cent) to the modern size of 19.05mm (small cent) that is still being used today.

- National Bank Act of 1863

- Originally known as the National Currency Act and signed into law by President Abraham Lincoln on February 25, 1863, it created a single currency standard for the United States where the notes would be backed by the United States Treasury and printed by the federal government. The result of this act lead to the establishment of the National Currency Bureau which was later rename to the Bureau of Engraving and Printing.

- Coinage Act of 1864

- This act changed the composition of the one-cent coin to bronze (0.95 copper, 0.05 tin and zinc) from 0.88 copper and 0.12 nickel. It authorized the minting of the two-cent coins with the motto “In God We Trust” to appear the first time on a United States coin. President Abraham Lincoln signed this act into law on April 22, 1864.

- Coinage Act of 1873

- Sometimes referred to as the “Crime of ’73,” demonetized silver and set the standard for gold as the backing of the national currency. This act placed the U.S. Mint under the jurisdiction of the Department of the Treasury and officially established four branch mints at Philadelphia, San Francisco, Carson City, and Denver. Two assay offices were established in New York and Boise City, Idaho. The act also ended the production of the half-dime, silver three-cent piece, and two-cent coin. President Ulysses S. Grant signed this act on February 12, 1873.

- Bland-Allison Act

- Named for Rep. Richard P Bland (D-MO) and Sen. William B. Allison (R-IA), the act required the Treasury Department to buy silver from western mines and put them into circulation as silver dollars. The act authorized the striking of the Morgan Dollar. President Rutherford B. Hayes vetoed the bill but congress overrode his veto on February 28, 1873.

- Sherman Silver Purchase Act

- Signed into law by President Benjamin Harrison on July 14, 1890 and named for Sen. John Sherman (R-OH), the law increased the amount of silver the government was required to purchase from western silver mines.

- Federal Reserve Act of 1913

- President Woodrow Wilson signed the Federal Reserve Act into law on December 23, 1913 that allowed the creation of the Federal Reserve System as the central bank of the United States. It also granted the Federal Reserve authority to issue Federal Reserve Notes and Federal Reserve Banknotes.

- Pittman Act

- Named for Sen. Key Pittman (D-NV) and signed into law by President Woodrow Wilson on April 23, 1918 authorized the conversion of up to 350 million silver dollars into bullion for sale or to be used to strike subsidiary coinage. The act required the government to buy all silver mined in the United States at a fixed price of $1 per ounce above market rate.

- Gold Reserve Act of 1934

- Even though Franklin D. Roosevelt as part of Executive Order 6102 ordered the withdrawal of gold from the economy on April 5, 1933, there was one challenge and one reissue of the executive order. Congress felt that the executive order needed codification and passed this act on January 30, 1934. Roosevelt signed the law the same day. The law withdrew all gold and gold certificates from circulation and outlawed most private possession of gold with the exception of some jewelry and collector coins. This act established the nominal price of gold to $35 per troy ounce.

- Public Law 84-851 (70 Stat. 732, H.J.Res. 396)

- On July 30, 1956, this law established the national motto of the United States to be “In God We Trust.” While the motto appeared on most coins of the time, the Bureau of Engraving and Printing phased it in on currency between 1957 and 1965.

- Coinage Act of 1965

- In response to the coin shortages caused by the rising silver prices, the act eliminated silver from circulating dimes, and quarters while reducing the amount of silver used to strike half-dollars from 90-percent to 40-percent for five years. After five years, the half-dollar would be struck using the same copper-nickel clad composition as the lower denominations. The act forbade the striking of silver dollars for five year ending an experiment with the striking of Peace Dollars in 1964. Finally, the act made all coins and currency produced in the United States and certain bank issues as legal tender–which reversed the 1876 demonetization of the Trade Dollar. Signed into law on July 23, 1965 by President Lyndon B. Johnson, it is seen as the dividing line between “classic” and “modern” coinage.

- Hobby Protection Act or 1973

- Signed into law by President Richard Nixon on November 29, 1973, this act requires that replica collectibles, including coins, be marked “plainly and permanently” with the word “COPY” to indicate that the item is not genuine. This act grants the Federal Trade Commission permission to take action against suppliers who violate this act.

- Statue of Liberty-Ellis Island Commemorative Coin Act—Title II: Liberty Coins

- Signed by President Ronald Reagan on July 9, 1985, Title II of this act allowed for the U.S. Mint to establish the American Eagle Silver Bullion Program.

- Gold Bullion Coin Act of 1985

- A few months after the passage of the act to allow for silver bullion coins, this act was enacted on December 17, 1985 that lead to the establishment of the American Eagle Gold Bullion Program.

- 50 States Commemorative Coin Program Act

- Considered one of the most significant act affecting circulating coinage since the Coinage Act of 1965, this act lead to the very successful 50 State Quarters Program. Section 4 of the act, named the “United States $1 Coin Act of 1997” changed the composition of the one dollar coin to be “golden in color” which lead to the creation of the Sacagawea “Golden” Dollar. President Bill Clinton signed this bill into law on December 1, 1997.

Jul 17, 2012 | legal, legislative, policy, web

Concern is circulating through the numismatics industry after the Wall Street Journal published a story that the Republican Governors Association supports the collection of sales tax for Internet sales within their state.

The process started earlier this year as governors, looking for a way to close budget gaps, started to consider forcing companies like Amazon.com to collect sales taxes for goods shipped to their states. In February, New Jersey Governor Chris Christie (R) negotiated a deal with Amazon to collect sales taxes for purchases shipped to New Jersey. As part of that deal, Amazon will be opening a warehouse and shipping center in New Jersey.

What was not reported was that the reason Amazon opened a facility in New Jersey was that federal law currently prevents the collection of taxes for sales shipped across state lines for companies that do not have a presence in the state. Since Amazon now has a presence in New Jersey, they can collect sales taxes on purchases. Otherwise, federal law exempts Amazon and any other company selling on the Internet from paying sales taxes to states they have no presence in the state where the item was shipped.

Sales tax on Internet-based purchases will affect everyone that sells online including the eBay seller, coin dealers, auction houses, and bullion sellers. If you sell online, you will have to figure out how to collect sales taxes. While larger companies may have the facilities and resources to collect sales taxes and pay them to the state. The rest will have to work with a service provider to be compliant with the law. Any time a small business has to add new capabilities using an outside service, it will be an additional expense to the small business.

In the numismatics industry, most of the dealers are small businesses. Many work from their homes shipping orders throughout the country while others may work from shops with a local clientele that also provides some Internet sales.

Aside from the administrative overhead to collect taxes, states have different rules for what is taxable and what is not. Some states do not tax bullion sales while other states tax bullion sales, but do not tax them over a certain limit which could be different from state to state. Some states do not tax coin sales while other states do, but when the sales are lower than a threshold, which can change between states.

This will not only hurt numismatic sales, but all small business sales across the Internet.

While Governor Christie and his fellow governors look at Amazon as their fiscal savior, Joe’s Local Coin Shop that may do a few thousand dollars in sales from the Internet now has to figure out how to collect sales taxes for the states or stop taking Internet-based orders, reducing income. Talk about a “job killing tax plan!”

Three bills have been introduced into congress that will end the restrictions to collecting sales taxes on Internet-based sales:

- S. 1452—Main Street Fairness Act and its companion H.R. 2701. Not only will this bill open up the collection sales taxes across state boundaries, but it “asks” the states to create Unified Rules for collecting sales tax.

- H.R. 3179—Marketplace Equity Act: This bill will open cross state sales tax collection but has an exemption for small businesses. To qualify for the small business exemption, the company would have to sell less than $1 million nationwide and less than $100,000 in the state. However, the bill would allow the states to adjust these limits and affecting administrative costs to small businesses.

- S. 1832—Marketplace Fairness Act: Simiar to the Main Street Fairness Act, it has no exemptions for small businesses, but limits the sales tax to goods and services sold while exempting shipping and handling.

Adding these additional administrative burdens to small businesses in the dealer community will close or restrict interstate markets especially for the buyer in rural America who depends on Internet sales to build a collection. There will also be an impact with online auction sites that makes coins available from all over the country. It will drive up costs to run these auctions and drive sellers away.

Time is going to come when states will have to start to collect sales taxes from interstate sales. However, congress has to do its job as a regulator of interstate commerce to protect the small businesses, like coin dealers, from having to manage 50 different sales tax rules.

Contact your member of congress and let them know that if they are going to allow sales tax to be collected from Internet sales, they need to do their job under the commerce clause to prevent this from putting dealers out of business.

To find your member of the House of Representatives, go to house.gov and enter your zip code in the box on the upper right of the page. Follow the instructions to contact your representative.

For the Senate, go to senate.gov and use the pull-down menu at the top right of the page, select your state, press the “Go” button and click on your senator’s web form address and let them know what you think.

The only way to help preserve our ability to continue to buy numismatics via the Internet from any dealer, anywhere!

May 29, 2012 | coin design, coins, legislative, US Mint

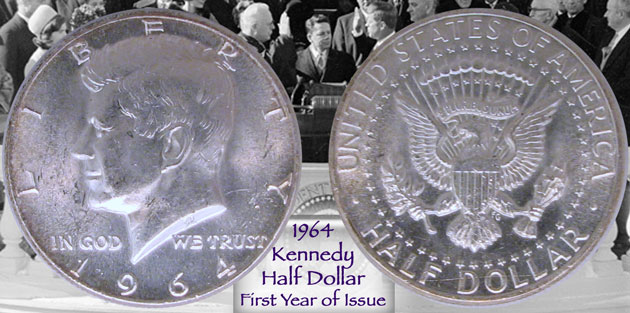

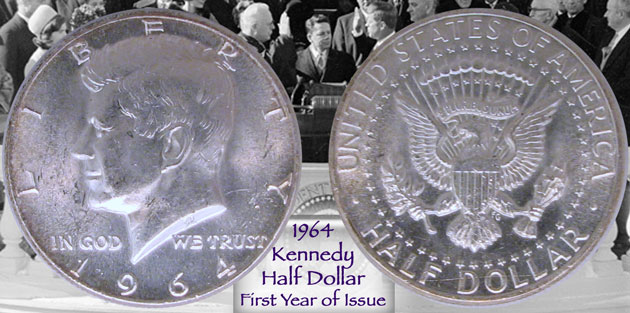

As our 35th President, John Fitzgerald Kennedy became the youngest person to ever be elected as President and the first Roman Catholic. At 43, Kennedy was the promise of a new future; a new vision that would have the United States leading the world in fighting the “common enemies of man: tyranny, poverty, disease, and war itself.” In his inaugural address, he called the nation to arm when he said, “Ask not what your country can do for you, ask what you can do for your country.”

From standing up to the Soviet Union’s Nikita Khrushchev, to the success in defense of the nation during the Cuban Missile Crisis, to the failures of the Bay of Pigs, the starting of the Peace Corps, and challenging the United States’ resolve using the space program by proclaiming, “We choose to go to the Moon in this decade and do the other things, not because they are easy, but because they are hard.” In over two years, Kennedy made an impact on this country in such a short period of time that one can wonder what would had happened if….

A few days after Kennedy’s assassination on November 22, 1963, U.S. Mint Director Eva Adams, Chief Engraver Gilroy Roberts reported that there was discussions about putting Kennedy’s portrait on a silver coin. Since Jacqueline Kennedy did not want to replace Washington’s portrait on the quarter, it was decided to use the half-dollar. Roberts used models from the inaugural medal for the obverse design and Assistant Engraver Frank Gasparro prepared the reverse design using the Presidential Seal.

A few days after Kennedy’s assassination on November 22, 1963, U.S. Mint Director Eva Adams, Chief Engraver Gilroy Roberts reported that there was discussions about putting Kennedy’s portrait on a silver coin. Since Jacqueline Kennedy did not want to replace Washington’s portrait on the quarter, it was decided to use the half-dollar. Roberts used models from the inaugural medal for the obverse design and Assistant Engraver Frank Gasparro prepared the reverse design using the Presidential Seal.

Since the law stated that coinage design could not be changed more often than 25 years, and that the Franklin Half was only 15 years old, it required Congress to authorize the change. The Act of December 30, 1963 (Public Law No. 88-253) allowed the design to be changed.

When the coin was released in 1964, the 90-percent silver coin was saved by a grieving nation wanting something that represented the fallen President. Over 273 million coins were struck in Philadelphia and 156 million in Denver. The composition was changed in 1965 with the introduction of clad coinage. Half dollars consisted of 40-percent silver that included a core made from 79-percent copper and 21-percent silver. In 1971, the composition was changed to current copper-nickel clad that is in use today.

There has been one design change to the coin and that occurred in 1975 and 1976 in honor of the American Revolution Bicentennial. A special reverse depicting Independence Hall in Philadelphia was designed by Seth G. Huntington. For both years, the obverse featured the dual date 1776-1976 in celebration.

There has been one design change to the coin and that occurred in 1975 and 1976 in honor of the American Revolution Bicentennial. A special reverse depicting Independence Hall in Philadelphia was designed by Seth G. Huntington. For both years, the obverse featured the dual date 1776-1976 in celebration.

John F. Kennedy would have been 95 years old on May 29, 2012.

Jan 5, 2012 | coins, commemorative, legislative

Commemorative coin programs are known to be able raise a lot of money for many organizations. This past year, congress authorized commemorative coins to support the Congressional Medal of Honor Foundation and the construction of the National Museum of the United States Army at Fort Belvoir. These and other organizations have greatly benefitted from collectors and other interested people buying commemoratives.

With that in mind, Dave Harper of Numismatic News has suggested that commemorative be issued to repair the Washington Monument that was damaged during the earthquake in the Washington, DC area on August 23, 2011.

Dave reports that $7.5 million was appropriated to the National Parks Service with hopes that it could be equally matched with private donations.

In 1986, the Statue of Liberty commemorative raised $81 million for the repairs needed before her 100th birthday. Why not do the same for the Washington Monument?

Harper suggests that the Washington Monument may not generate as much interest as the Statue of Liberty. That may be so, but why limit the the program to just the Washington Monument? How about a The National Monument Commemorative Coin Act of 2012?

The National Monument Commemorative Coin Act of 2012 will honor all of the United States’s national monuments, the U.S. Mint would issue one silver dollar commemorating all national monuments and five half-dollars commemorating various national monuments. The silver dollar could use the logo of the National Park Service that manages 76 of the 101 registered national monuments. As for the half-dollars, the suggested national monuments could include the Washington Monument, Mount Rushmore, the boyhood home of George Washington Carver, the Great Sequoia in Sequoia National Park, and the Navajo Monument on the Shonto plateau

Proceeds from the surcharges collected by the sales of these coins would be placed in a trust fund managed by the Department of the Interior that could only be used for the maintenance of all national monuments, including the Washington Monument.

If you think this is a good idea, please let your member of congress know. You can find your representative at the House website by entering your zip code +4 in the box on the upper right of the page. Use any of the information mentioned above to tell them how good of an idea this is.

Dec 23, 2011 | base metals, coins, legislative, US Mint

Let’s start with a trivia question:

What is the only coin (not pattern) struck by the U.S. Mint that contained no copper?

(cue “Jeopardy!” music)

Give up?

If you said the 1943 Lincoln Steel Cents, you are correct. Every other coin struck by the U.S. Mint has contained some amount of copper in the alloy. Even the 1942-1945 war-time alloy used for the Jefferson Nickel was changed from a copper-nickel alloy to one made of copper-silver-manganese.

After the bombing of Pearl Harbor by the Japanese on December 7, 1941, the next day congress passed a formal Declaration of War on Japan. Three days later, a Declaration of War was passed against Germany. Mobilization took a while and the United States did not formally enter the European theater until landing on Normandy Beach on June 6, 1944, better known as D-Day. Between those declaration and full-scale fighting in both Europe and the Pacific, copper was a critical element necessary to manufacture bullets for training.

Rather than using the copper for coins, the government had bullets manufactured. In order to ensure there was a supply of circulating currency, the U.S. Mint changed the composition of the cent to zinc coated steel. Similarly, to save the nickel needed to make other armaments, the Jefferson 5-Cent coin was changed to 56-percent copper, 35-percent silver, and 9-percent manganese.

To say that 1943 Steel Cent was a disaster would be an understatement. Because of its silver color, it was not accepted by the public. Also, since the steel was not treated, it oxidized quickly and became a dark, dirty color. After a while, the coins would begin to rust. In 1944, Lincoln cents were made using the spent shell casing picked up from the training fields. This continued through 1946, the end of World War II giving the coins the nickname of “Shotgun Cents.”

One other coin that was not made using copper was a 1974 Lincoln Cent pattern that was made of aluminum. The U.S. Mint struck over 1.5 million examples in 1973 in order to convince congress to allow them to circulate them. A few was given out to members of congress as part of the U.S. Mint’s lobbying effort. After the measure was defeated, the members of congress was supposed to return the coins. However, one coin was allegedly “dropped” by a senator and retrieved by U.S. Capitol Police Officer Albert Toven. The Toven Specimen was graded MS62 by PCGS in 2005. It is estimated that 18-44 more still exist but have yet to be discovered.

Today there is another issue. Since 2006, the cost of the metals to manufacture the current Lincoln Cent (99.2-percent zinc covered with .8-percent copper) and Jefferson Nickel (75-percent copper and 25-percent nickel) has raised its base cost to at least 150-percent of face value before considering manufacturing costs. The cost has caused several “discussions” about the fate of these coins—there are some who want to eliminate the cents; others want to change its composition; and there is a small group who understands the concept of the loss-leader and is willing to let it go as long as seignorage for other coins cover the costs.

First term Rep. Steve Stivers (R-OH) wants to settle the discussion by introducing two bills that if passed will change the composition of the one-cent and five-cent coins. Stivers introduced H.R. 3693, Cents and Sensibility Act, and H.R. 3694, Saving Taxpayer Expenditures by Employing Less (STEEL) Imported Nickel Act on December 15, 2011. Both bills are being co-sponsored by Reps. Tim Ryan (D-OH) and Pat Tiberi (R-OH).

H.R. 3693 is very straight forward. It says that the “1-cent coin shall be produced primarily of steel” and “shall be treated to impart a copper color to the appearance of the coins.” If the law is enacted, the coins will use only steel produced in the United States. If it is not possible to use U.S. manufactured steel, the reason has to be published in the Federal Register. The size of the coin will not change but the weight is allowed to be altered as necessary.

H.R. 3694 is similar to H.R. 3693 in that it strives to keep the 5-cent coin to look the same using U.S. manufactured steel. Where the bill differs is how the coins are to be designed for use in circulation. The three provisions required for the conversion is that whatever composition is used, the new alloy is not supposed “require more than 1 change to coin-accepting and coin-handling equipment to accommodate coins,” use the same alloy or specifications that is used by another country, and “require changes to coin-accepting or coin-handling equipment whatsoever to accommodate both coins produced with the new specifications.”

Every time there is a proposed change in the composition of U.S. coins, the one group that has the biggest say is the vending machine industry. When silver was removed from U.S. coins in the 1960s, the decision was made to use the current copper-nickel clad coins so that it produces the same electro-mechanical signature its silver counterparts. The electro-mechanical signature is the combination of the coin’s size, weight, and how electricity is conducted by the coin. If the coin can match the specifications, it is determined to be real (as opposed to a slug) and is accepted by the machine. Considering that steel has a different density from the copper-nickel alloy, the coin will have a different weight and be a stronger conductor of electricity. Steel coins may require two changes to vending machines making it nearly impossible to comply with the law. The vending machine lobby will not like the results of this bill and will lobby for its defeat.

Before considering other options, by saying that the coins cannot use the same alloy or specifications that is used by another country, the U.S. Mint could not consider using aluminum, especially since it is being used in Canada.

The professional organizations that cover the vending machine industry has not comment on these bills.

The bill was referred to the House Committee on Financial Services. Coin bills are referred to the Domestic Monetary Policy and Technology subcommittee, chaired by Rep. Ron Paul (R-TX). Aside from Rep. Paul’s current status as a candidate for the Republican nomination for president, he is known for not being a fan of using base-metals for coins and “wasting time” on coinage changes. Remember, it took a the members of this subcommittee to bring the measure to the Financial Services Committee as a whole to have the Baseball Hall of Fame Commemorative referred to the floor for a vote.

While H.R. 3693 and H.R. 3694 may make for an interesting discussion, politics suggests that these bills may never make it out of committee.

Oct 31, 2011 | ANA, CCAC, legislative, US Mint

In celebration of All-Hallows-Eve, the Coin Collectors Blog presents some of the 2011 numismatic trick-or-treat.

In celebration of All-Hallows-Eve, the Coin Collectors Blog presents some of the 2011 numismatic trick-or-treat.

25th Anniversary American Silver Eagle Set

TRICK: Anyone who tried to order the 25th Anniversary American Silver Eagle Set starting at 12:00 Noon ET on Thursday, October 27 found that the U.S. Mint provided the most recent trick by not being able to keep up with the ordering demand

TREAT: If you were able to order your set, it should be a fantastic collectible.

American Numismatic Association

TRICK: There is never a good way to handle certain personnel issues. But regardless of whose feelings were hurt, the last statement issued by the ANA Board of Directors was unnecessary, uncalled for, and really lacked and an adult approach to a tough situation.

TREAT: The ANA actually using social media to reach out to members and respond.

American Numismatic Association, Part II

TRICK: The ANA Board of Directors making a myopic decision on how to handle club tables at their shows. Rather than make simple rules saying that the tables must be staffed at all times except during meetings, the Board went beyond reasonableness and added restriction as to how many clubs could share a table.

TREAT: A regional organization could have one table with the support of member clubs and tangentially fit within the rules. After all, these are “members” under one umbrella organization and only members will be staffing the table without violating the ANA’s ridiculous rules.

Over productions of Presidential Dollars

TRICK: National Public Radio did a highly inaccurate story about how the Federal Reserve is holding more than $1 billion in dollar coins in its vaults costing the taxpayers money.

TREAT: Rep. David Schweikert (R-AZ) introducing H.R. 2977, the Currency Optimization, Innovation, and National Savings Act (COINS Act) to transition the U.S. from paper dollars to coins. Add to this the unconfirmed rumor that the “Super Committee” is considering adding this to their final bill.

The United States Mint

TRICK: Since the resignation of Ed Moy as Director of the U.S. Mint, the position has gone unfilled.

TREAT: Since being hired as Deputy Director on January 25, Richard Peterson has lead the U.S. Mint in a professional manner questioning whether the U.S. Mint really needs a politician as a director. As for the problems occurred while ordering the 25th Anniversary American Silver Eagle Set, it could be said that the systems not being able to keep up with the loads are a residual problem left over from the previous director not managing the technology properly.

CCAC Blueprint Report

TRICK: As a concept, the Citizens Coinage Advisory Committee’s report “A Blueprint for Advancing Artistic Creativity and Excellence in United States Coins and Medals” should not be controversial. However, it seems that the CCAC has found two ways of making a good idea irrelevant. First, the CCAC, whose first “C” stands for Citizens, forgot the citizens. They created the report and did not ask for comment from the citizens. Even though I provided comments, I was basically told, “Thanks, but no thanks.” It would be nice if they were inclusive. The other TRICK was that the report has appeared to have become shelfware—a document sitting on the shelf without impact.

TREAT: Even with the issues in the report, it is a step in the right direction and should be something the U.S. Mint should be working on now!

What are your numismatic trick-or-treats for 2011?

Image is of a 2007 $200 commemorative casino token from the Four Queens Hotel & Casino, Las Vegas, NV. Image is courtesy of the Silver Strikers Club. Details of this token can be found on the Silver Strikers Club website.

Sep 29, 2011 | currency, dollar, legislative

In a move that made the numismatic world notice, Rep. David Schweikert (R-AZ) introduced H.R. 2977, the Currency Optimization, Innovation, and National Savings Act (COINS Act). In short, the purpose of this bill is to transition the U.S. economy to using dollar coins. The bill is cosponsored by Reps. Jeb Hensarling (R-TX), Blaine Luetkemeyer (R-MO), Jim Renacci (R-OH), and Pat Tiberi (R-OH).

First provision of the bill is to remove the Susan B. Anthony Dollar from circulation. Under this provision, when a bank receives an Anthony Dollar, it is returned to the Federal Reserve and removed from circulation. The Federal Reserve then can sell the coins to dealers or to countries who are using the U.S. dollar as its primary currency. Removing the Anthony dollar from circulation will prevent the confusion between the golden colored dollars that would be in circulation. As part of this section of the bill, there are quarterly reporting requirements to congress that documents the progress of this bill.

As part of this first provision, the bill makes a subtle change to Section 5112(p)(2) of title 31, United States Code (31 U.S.C. 5112(p)(2)) to make the Board of Governors of the Federal Reserve a partner in the publicity of using the dollar coin. After all, the coins are being stored in their facility and it is in their best interest to have them circulated.

But the key provision of the bill is in Section 3 that outlines the transition to the use of dollar coins. At the beginning, the section makes it clear that purpose of the bill is to create a transition environment so that the coin replaces the paper note:

It is the policy of the United States that after $1 coins achieve sufficient market penetration such that consumers and retailers are comfortable using $1 coins and are able to obtain adequate supplies of $1 coins, $1 coins should replace $1 Federal Reserve notes as the only $1 monetary unit issued and circulated by the Federal Reserve System.

If this bill passes, Federal Reserve banks may continue to place into circulation $1 Federal Reserve notes until the number of dollar coins placed into circulation exceeds 600 million annually or four years after the bill is enacted, which ever comes first. During this transition phase, Federal Reserve banks cannot order new paper notes but may continue to circulate notes on hand. They are also to continue to follow their unfit currency policies by removing notes that are torn or otherwise unfit for circulation. These notes will be replaced by coins.

After the introduction of H.R. 2977, Sens. Scott Brown (R-MA) and John Kerry (D-MA) introduced S. 1624, the Currency Efficiency Act of 2011 to place a “restriction on overproduction of $1 coins.” However, this is seen as the Massachusetts senators sponsoring a bill in an attempt to protect a constituent, Crane & Co., the exclusive supplier of currency paper to the Bureau of Engraving and Printing.

H.R. 2977 appears to be the first bill introduced that creates a transition plan rather than advocating an abrupt end to the paper note. Considering the emotional response when people are polled, a four year transition is a good idea. It will give people a chance to get used to the coins while both circulate together. But if it passes, I will make the immediate transition and exclusively use coins.

If you agree with the COINS Act, and I hope you do, contact your representative to express your support for H.R. 2977. If you want a few talking points, you can say:

- The GAO reports that switching from paper to coins will save the government approximately $5.5 billion over 30 years

- If voted into law, this bill will reduce the $1.1 billion stockpile of coins in the Federal Reserve coin rooms. In this economy, adding $1.1 billion to the economy is better than having it sitting on the shelf.

- It will allow the United States to join the rest of the industrialized world, including the United Kingdom and the Eurozone whose currencies are worth more than ours, whose unit currency is represented as a coin

You can find out how to contact your representative at the House of Representatives website at house.gov.