May 26, 2022 | commentary, currency, policy

Changes to the Series 2013 $1 Note

For most of the 21st century, many groups have advocated for eliminating the $1 bill, while others provide a counterpoint to maintain the status quo. While the discussion of eliminating the note has economic and policy concerns that lawmakers must address, how would the U.S. government implement the policy?

The Federal Reserve Act of 1918 gives the Federal Reserve the authority to procure, distribute, and manage the nation’s currency supply. They must procure the paper money from the Treasury Department, but the Federal Reserve is required to tell Treasury how much money they need to print. But does the Fed determine which notes to print?

The law (12 U.S. Code § 418) says that the Treasury Department prints notes in “the denominations of $1, $2, $5, $10, $20, $50, $100, $500, $1,000, $5,000, $10,000 as may be required to supply the Federal Reserve banks.” The statement suggests that the Federal Reserve banks set the printing requirements. Does this mean that the Federal Reserve banks can tell Treasury that it no longer requires them to print the $1 note?

Series 1934 $1000 Federal Reserve Note

Although the denominations remain part of the law, the Federal Reserve Act gives the Federal Reserve latitude to manage the currency supply as it deems necessary. It was a policy enacted by the Treasury and Federal Reserve in tandem.

The agreement was not as easy as the history books want us to believe. In 1969, William McChesney “Bill” Martin was the Federal Reserve Chair. Martin was appointed by Harry S. Truman in 1951, fiercely guarded the Federal Reserve’s independence, and was known to push back against presidential policies with a minimalist approach to managing market factors. In the 1960s, Martin ran afoul of Lyndon Johnson and Richard Nixon for not doing more to help prevent a recession.

Following a meeting with Nixon in October 1969 about what his administration saw as an impending recession, Nixon announced that he would replace Martin when the Federal Reserve chair’s term expired on January 31, 1970.

It was not the first time the Federal Reserve changed United State currency without legislation. Since the formation of the Federal Reserve, the Federal Reserve authorized the printing of gold certificates, silver certificates, Legal Tender notes, Federal Reserve Banknotes, and the ongoing Federal Reserve Notes.

Before the formation of the Federal Reserve, the Treasury Department determined what currency to print and its design. Treasury Secretary Franklin MacVeagh proposed reducing the size of the currency paper in 1909. After years of study and discussion, Secretary Andrew Mellon approved new smaller designs issued in 1929. The change did not require new legislation.

Based on history, Treasury Secretary Janet Yellen and Chairman of the Federal Reserve Jerome Powell can decide to withdraw the $1 Federal Reserve Note from circulation. Powell can instruct the Federal Reserve Banks to stop issuing $1 bills and use the $1 coin instead. When the notes return to the Federal Reserve System, they can withdraw the notes and destroy them as they do with old currency.

Yellen can refuse by saying that she is following her boss’s policies, the President of the United States. But the Federal Reserve is an independent agency and does not have to ask for permission. By law, if the Federal Reserve does not order the printing of new $1 bills, the Bureau of Engraving and Printing will not print new currency.

Politics may prevent Yellen and Powell from making this decision, but they can do it and allow the United States to join the rest of the civilized world that no longer carries its unit currency in paper form.

May 25, 2022 | currency, Federal Reserve, policy

Would ending the circulation of the $100 Federal Reserve Note force the Russian people to pressure Putin over his Ukraine attack?

Would ending the circulation of the $100 Federal Reserve Note force the Russian people to pressure Putin over his Ukraine attack?

According to an opinion piece published in the Wall Street Journal by Markos Kounalakis (sorry, it’s behind a paywall), the sanctions on Russia are not reaching their people. Kounalakis believes that the United States should stop circulating the $100 bill to reach the people.

The United States dollar is the world’s reserve currency, and it is used as a safe store of wealth by people and companies. The Euro may represent an easily transactional currency, but the dollar is where the world turns for a store of wealth. In Russia, where the banks are not trusted, average citizens keep their savings in dollars.

According to the Federal Reserve, more than 661,500 pounds of $100 bills are in Russia as of 2019. Russians are stuffing them in a mattress and not using them for commerce.

Removing large-denomination currency from circulation is not new. In 1969, the Treasury withdrew the $500 and $1000 notes from circulation to make it more challenging for drug traffickers to move large amounts of cash.

In 2016, some economists made a case to stop circulating the $100 bill and the €500 banknote, even claiming the €500 note was nicknamed the “Bin Laden.” Eventually, the European Central Bank (ECB) stopped circulating the €500 banknote in 2018. But that has not stopped their use by criminals since the ECB has not demonetized the notes.

Even if the United States wanted to stop the circulation of $100 notes in Russia, it would not be an easy process. First, who would have the authority to make this determination? According to the Federal Reserve Act of 1918, it is the Federal Reserve’s job to manage circulating currency independently. The law that created the Office of the Comptroller of the Currency (OCC) allows this Treasury bureau to oversee the mechanisms that go into currency movement.

The government has more latitude over managing currency than coins. The law requires the U.S. Mint to strike cents, 5-cents, dimes, quarter dollars, half-dollars, and dollar coins (31 U.S. Code § 5111). On the other hand, the law (12 U.S. Code § 418) sets the denomination types, but it does not require the Federal Reserve to circulate all denominations.

If the President decides that it is in the best interest of U.S. foreign policy to stop the circulation of $100 notes, the Federal Reserve must decide if it is in the best interest of the Federal Reserve System to do so. However, the law complicates the matter by having the OCC oversee the institutions managing the currency. The blurry line between the authority of the Treasury Department and the independence of the Federal Reserve could create tension.

Should the policy regarding issuing $100 Federal Reserve Notes change, currency collectors may find opportunities to collect $100 notes.

Oct 6, 2021 | coins, Federal Reserve, policy, US Mint

The $1 trillion coin concept turns up like a bad penny.

Also turning up are all pundits, politicos, reporters, and sycophants explaining why the U.S. Mint should or should not strike the coin. The problem is that EVERYONE IS WRONG!

Let’s look at the FACTS.

FACT: Before a coin leaves the U.S. Mint, the purchaser must pay for the coin.

The Federal Reserve purchases business strike coins at face value. The money is deposited in the U.S. Mint’s Public Enterprise Fund.

Collectors pay for collector coins through the U.S. Mint’s retail and e-commerce operations. When the money is collected, they deposit the funds in the U.S. Mint’s Public Enterprise Fund.

FACT: The United States Mint has successfully argued in court that a coin is not legal tender until it is paid for.

After the U.S. Mint discovered the existence of several 1933 Double Eagle coins that were supposedly melted, the Secret Service investigated and seized several coins. Through the 1950s, government lawyers argued that the coins were government property since the coin was never monetized.

During the case of the Farouk-Fenton double eagle coin, the government used the same argument. Even though there was an export license for the coin issued to King Farouk of Egypt, the government maintained that the lack of monetization made the coin illegal.

As part of the $7,590,020 paid for the 1933 Double Eagle in 2002, $20 of the purchase price was paid to the U.S. Government to monetize the coin. When Sotheby’s sold the coin in June for $18,872,250, the coin came with a certificate from the U.S. Mint declaring its Legal Tender status.

If the U.S. Mint does not monetize a coin until someone or entity buys it, then how will striking a $1 trillion coin help anything?

Even as crazy as government generally accepted accounting principles (GAAP) may appear to the commercial market, Government GAAP still requires double-entry bookkeeping. In double-entry bookkeeping, if an asset is added to one part of the ledger, there must be a debit on another.

Forget the political arguments about the debt. When the government needs money, it sells bonds to finance its obligation. The bond is the created asset, as the coin. The asset is purchased, adding cash to the general treasury. In bookkeeping terms, an asset entry and an associated debit entry.

Who is going to buy the coin?

The Federal Reserve is not going to buy the coin. Bonds, warrants, and other investments have tangible returns. The investments have value and can be traded on the equity markets keeping the books balanced. What happens if $1 trillion is tied up in a non-investing asset?

If the Federal Reserve buys the coin, the general treasury may see a $1 trillion windfall, but the Federal Reserve will have $1 trillion less economic power. It is $1 trillion less in short-term loans to large financial institutions and quantitative easing that is keeping the economy in control.

If the Federal Reserve buys the $1 trillion coin, it will create a $1 trillion hole in the economy.

The U.S. Gross Domestic Product (GDP), the monetary value of all goods and services, is estimated at $22.675 trillion. Taking $1 trillion out of the economy will reduce the economy by 4.4-percent.

As the Great Recession of 2008 raged, the GDP lost 1-percent of its value by 2009. If a one percent drop caused the most significant economic calamity since the Great Depression, what will happen if the GDP contracts by more than 4-percent?

Of course, Congress can pass a law that changes how the U.S. Mint determines the legal tender status of coinage they manufacture. But the likelihood of that happening is about the same as the U.S. Mint striking a $1 trillion coin.

Jan 26, 2021 | currency, news, policy

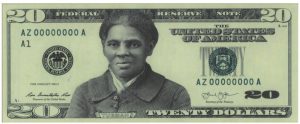

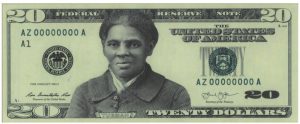

During a White House press briefing, the press secretary announced the “Treasury Department is taking steps to resume efforts to put Harriet Tubman on the front of the new $20 notes.”

During a White House press briefing, the press secretary announced the “Treasury Department is taking steps to resume efforts to put Harriet Tubman on the front of the new $20 notes.”

Creating the new $20 Federal Reserve Notes with a portrait of the abolitionist began in 2016 to have Tubman appear on the $20 note by 2020, the 100th Anniversary of the 19th Amendment. Although the Bureau of Engraving and Printing continued to work on the project, Treasury Secretary Steven Mnuchin eventually announced that a future administration would decide if having her portrait was appropriate. Mnuchin targeted 2030 as the earliest a new $20 note would appear.

Sources report that Mnuchin delayed the stoppage of the process as long as possible. He knew that the president did not support this change. After the announcement, sources report that the work continued without permission.

Although the source did not know the engraving status, it is speculated that the intaglio printing plates for the new $20 notes may be ready before the end of the year.

When the plates are ready, they will include the signature of Treasury Secretary Janet Yellen. The Senate approved Yellen’s appointment on an 84-15 vote. She will be the 78th Treasury Secretary and the first woman in that role in the department’s 232-year history.

When the plates are ready, they will include the signature of Treasury Secretary Janet Yellen. The Senate approved Yellen’s appointment on an 84-15 vote. She will be the 78th Treasury Secretary and the first woman in that role in the department’s 232-year history.

Previously, Yellen was the Chair of the Council of Economic Advisers under Clinton, President of the Federal Reserve of San Francisco, and served on the Federal Reserve Board of Governors before being appointed the Board’s chair 2014.

If you like what you read, share, and show your support

Jan 25, 2021 | news, policy

On Wednesday, Joseph R. Biden Jr. became the 46th President of the United States. It was the 46th time since 1789 that a new President took the oath of office. Regardless of the circumstances leading up to the inauguration, this was the 59th ceremonial inauguration. There were eight other inaugurations following the death of presidents and Gerald Ford’s inauguration following Richard M. Nixon’s resignation.

On Wednesday, Joseph R. Biden Jr. became the 46th President of the United States. It was the 46th time since 1789 that a new President took the oath of office. Regardless of the circumstances leading up to the inauguration, this was the 59th ceremonial inauguration. There were eight other inaugurations following the death of presidents and Gerald Ford’s inauguration following Richard M. Nixon’s resignation.

For numismatics, the new administration means there will be leadership changes at the Department of the Treasury. The president nominated Janet Yellen as the Secretary of the Treasury. When confirmed, Yellen will become the 78th Treasury Secretary. The Series 2021 Federal Reserve Notes will feature Yellen’s signature on the right side.

Janet Yellen’s signature when she was Chair of the Federal Reserve Board

The president has not nominated a Treasurer of the United States. Currently, the office has been vacant since the resignation of Jovita Carranza in January 2020. When the Senate approves a nominee, that person’s signature will appear on the Federal Reserve Notes’ left side.

Officially, the Director of the U.S. Mint is an appointment of five years. David J. Ryder, the current director, was confirmed in April 2018. Ryder can serve until 2023. Although Ryder could have resigned at the end of the previous administration, he chose not to. It is unclear if Ryder, a Republican, will continue to serve as Director. The U.S. Mint’s press office responded to a question about Ryder’s plans:

Information about Director Ryder’s tenure is not available at this time. We hope to have an update in the coming weeks.

Finally, the Director of the Bureau of Engraving and Printing is not an appointed position. BEP’s Directors are members of the government’s Senior Executive Service as career government employees. Len Olijar is the current and 25th Director of the Bureau of Engraving and Printing.

And now the news…

January 15, 2021

Archaeologists have uncovered buried treasure on a farm in Hungary. A two-day expedition, led by the Ferenczy Museum's Balázs Nagy, has yielded the discovery of 7000 silver coins and four gold coins.

→ Read more at

9news.com.au

January 15, 2021

(CNN) — How can a $20 bill be worth over $57,000? Because of a printing mishap.

→ Read more at

cnn.com

January 19, 2021

Do you save quarters, pennies, silver dollars or other coins? Connect with our expert, Tim Heroux from The Boston Coin in Quincy at our next Ask The Expert event. Bring him your questions and learn more at this free event on how you, too, can improve your coin collecting knowledge.

→ Read more at

wgbh.org

January 19, 2021

If you’ve been attempting to invest in Rhodium but don’t want to jump through the various hoops that come with it, try investing digitally. Rhodium Coin is a cryptocurrency built on the Ethereum blockchain.

→ Read more at

qrius.com

January 21, 2021

Paestum, originally a Greek colony that was later conquered by the Romans, boasts three of the best-preserved Greek temples in the world [File: AFP]

→ Read more at

aljazeera.com

January 25, 2021

VCoins is an online old coin marketplace where you can purchase ancient coins for $2-$3 each in a lot of 20 or so. In the latest issue of Recomendo, my friend Kevin Kelly suggests that giving someone an inexpensive 2,000-year-old Roman, Greek, or Arabian coin is a great way to spark curiosity about the history and culture of those civilizations.

→ Read more at

boingboing.net

If you like what you read, share, and show your support

Sep 3, 2020 | coins, policy

During a class for my master’s degree, a professor was fond of reminding us that politics is a contact sport. He meant that metaphorically, but the point was direct. Politicians will do what they can to get their job done, regardless of the inside consequences.

During a class for my master’s degree, a professor was fond of reminding us that politics is a contact sport. He meant that metaphorically, but the point was direct. Politicians will do what they can to get their job done, regardless of the inside consequences.

Unfortunately, the contact sport has spilled out of the halls of congress into the mainstream. Regardless of whether the proposal has merit and the politician is proposing with good intension, the game no longer is about the substance but the team everyone is on.

S. 4326: 1921 Silver Dollar Coin Anniversary Act

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Jul 27, 2020

Introduced in Senate — Jul 27, 2020

For example, S. 4326, 1921 Silver Dollar Coin Anniversary Act, would allow the U.S. Mint to strike silver dollars to commemorate the 100th Anniversary of the last Morgan Dollar and the 100th Anniversary of the first Peace Dollar. The bill does not limit the number of coins, and does it have an end date.

The bill is not a commemorative coin act. It says that “all coins minted under this Act shall be considered to be numismatic items.” The bill does not add surcharges to the coins’ sale, and the government keeps the seignorage.

Given the popularity of the Morgan and Peace Dollars, it would be logical to consider that the amount of seignorage earned from their sale would provide a good windfall for the government. Give the collectors something to excited about and pocket some change by doing so. A bill like this should be a no-brainer. Right?

I contacted an old friend that has survived the last 20 years on Capitol Hill. Aside from wondering why he was not receiving battle pay, we talked about pending legislation. When I asked about the 1921 Silver Dollar Coin Anniversary Act, he laughed at me.

“If it passes the Senate, the only way it will make past the door of the House would be if (someone) is sick.”

The “(someone)” is one of several members of Congress on one of the teams known to use constitutional procedures against the other team. They have objected to coin-related bills passed by the Senate because they revenue-generating measures. They cite Article I Section 7 of the U.S. Constitution (All Bills for raising Revenue shall originate in the House of Representatives;) to block bills passed by the Senate.

Since a member of the red team introduced S. 4326, the blue team will block the bill from being introduced in the House. Unless the Speaker of the House can convince these members to withdraw their objections, this bill will not pass.

Not all is lost. A version of the bill (H.R. 6192) was introduced in March by Rep Andy Barr (R-KY). If the red and blue teams play nicely together and pass this version, the U.S. Mint may be selling 2021 Morgan and Peace Dollars next year.

H.R. 7995: To amend title 31, United States Code, to save Federal funds by authorizing changes to the composition of circulating coins, and for other purposes.

Referred to the House Committee on Financial Services. — Aug 11, 2020

Introduced in House — Aug 11, 2020

Rep. Mark E. Amodei (R-NV) introduced H.R. 7995 in August. At this time, the Government Printing Office has not published the text of the bill. Judging by the title as introduced, the bill will require the U.S. Mint to change circulating coinage composition.

Without the text of the bill, it is impossible to judge its merits. I will see if this bill is worth discussing when the bill’s text is posted.

If you like what you read, share, and show your support

Jul 12, 2020 | ancient, coins, policy

Once again, the State Department is about to do something that negatively affects a part of numismatics. Even if you are not an ancient coin collector, the ability to collect and study ancient coins helps give all of us clarity into history.

Once again, the State Department is about to do something that negatively affects a part of numismatics. Even if you are not an ancient coin collector, the ability to collect and study ancient coins helps give all of us clarity into history.

If the State Department permits the Memorandum of Understanding with Italy to pass, it will signal an end to ancient collectors’ ability to participate in the hobby. First, it will be the restriction of ancient Roman coins, then others will follow. Soon, every coin will become cultural property and locked in a museum, never to be seen again.

I heard it explained that coins were never meant to be static items. The rulers of ancient lands intended for the coins to circulate with their image. It was supposed to tie people to the empire. It was so important to pay the soldiers and circulate the money that coiners accompanied many armies. They would strike coins using the looted material and move on to the next conquest.

Most of these coins are not rare or even scarce. They are common, often seeing hoards of hundreds and accumulation of thousands across Europe. Some of the scarce coins can be readily found on the market and in museums.

However, if we listened to the archeologist, every crumb they find from the ancient past belongs in a museum. The necessity to save every widow’s mite is like wanting to save the Cross of Coronado.

From Wayne Sayles, Executive Director of the Ancient Coin Collectors Guild:

ACCG needs your help in defending collector rights under the law – Please comment now! It’s fast and easier than ever. No need for elaborate arguments or research, others have already taken care of that. What we need now is to demonstrate that import restrictions on ancient coins affect a lot of caring people and law-abiding people from all walks of life and all political persuasions.

The deadline to send a comment to the Cultural Property Advisory Committee (CPAC) has been extended to July 14, 2020. Comments can be left at:

If you want more detailed information and a sample letter to the CPAC, read:

In fact, read it anyway. It contains a lot of useful information.

We should stand up for the hobby, whether you collect ancient coins or not!

Apr 1, 2020 | news, policy, silver

As part of an action-filled month, there was one numismatic-related bill introduced in congress. Rep. Andy Barr (R-KY) introduced the 1921 Silver Dollar Coin Anniversary Act (H.R. 6192) to allow the U.S. Mint to strike tributes to the 1921 Morgan and Peace Dollars.

As part of an action-filled month, there was one numismatic-related bill introduced in congress. Rep. Andy Barr (R-KY) introduced the 1921 Silver Dollar Coin Anniversary Act (H.R. 6192) to allow the U.S. Mint to strike tributes to the 1921 Morgan and Peace Dollars.

H.R. 6192 is a replacement for the 1921 Silver Dollar Commemorative Coin Act (H.R. 3757). That bill will die in committee because two commemorative coin bills are already the law. The Christa McAuliffe Commemorative Coin Act of 2019 (Public Law No. 116-65) and the National Law Enforcement Museum Commemorative Coin Act (as part of Public Law No. 116-94) will appear in 2021.

The new bill is different in that it is not a commemorative coin bill. It was introduced is a bullion bill, which means that the government will keep all of the seigniorage. It would have been nice to have a commemorative bill that would raise money for the ANA.

The bill also does not have an end date. If passed, the U.S. Mint can strike bullion Morgan and Peace silver dollars starting in 2021 and into eternity. Although reports claim that the U.S. Mint “does not currently have any intention of creating an ongoing program and issuing coins after 2021,” does not mean they will not change their mind.

The only change I would recommend is to amend the bill to be like the 24-karat gold bullion bill. Allow the U.S. Mint to use the Morgan and Peace dollar designs the first year but allow the U.S. Mint to come up with new designs every year. Consider how much more successful the 2017 Centennial Coins would have been if they were struck in silver.

H.R. 6192: 1921 Silver Dollar Coin Anniversary Act

Introduced in House — Mar 11, 2020

Referred to the House Committee on Financial Services. — Mar 11, 2020

Mar 29, 2020 | bullion, news, policy

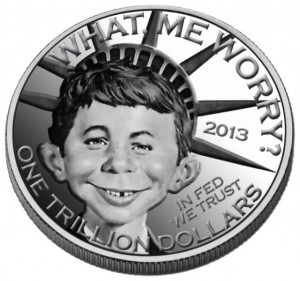

In 2013, Heritage Auctions asked the public to suggest names and and designs for the mythical $1 trillion coin. This was one of the proposals.

This time, the scheme was cooked up by Rep. Rashida Tlaib (D-MI), a freshman member of Congress. Apparently, Tlaib read that the Federal Reserve has more than a $2 trillion surplus. Rather than allow the Fed to use it to sure up financial systems in a crisis, she wants to transfer the money out of the semi-autonomous agency and put it in the general treasury to fund her version of a stimulus.

It is not the first time in the last ten years this idea came up. Back in late 2012, conservative pundits pushed Congress to do the same thing. The drumbeat for this idea became so loud that cooler heads finally prevailed, and the jokes about how to design such a coin quickly faded into history.

Tlaib is trying to learn from history by proposing that not only should the coins be struck but transferred to the Federal Reserve. By removing the $2 trillion liability from the Treasury Department’s books, it places the debt on the Federal Reserve.

If we were to ignore the law (31 U.S.C. §5136) will require the U.S. Mint to deposit the money int into the United States Mint Public Enterprise Fund, the costs of striking these coins including the design and administration is required to be deducted from the $2 trillion. It is a small percentage of the total, but it counts.

Then there is the question of operating capital. What will the Federal Reserve do if it needs the money to keep banks open during this crisis? By taking its operating capital, the Federal Reserve will have to raise money on a market that will become more restrictive when the United States central bank cannot perform. One analyst said it would be like tying the Fed’s arms and throwing them into the deep end of the pool. Everyone will panic, jump in to save them, and will drown.

To make the ensuing chaos even worse, to prevent the bank failures and to prop up the bank-related insurance programs, like the Federal Deposit Insurance Corporation (FDIC), Treasury will have to get very creative to fund the insurance program. Like they did in the late 1980s during the Savings and Loan fiasco, the Treasury had to sell bonds and bills to make the depositors whole. Back then, the economy was better, and there were willing buyers. Today, if the coronavirus crisis continues and worldwide investors become spooked because the Fed failed to help, the costs of that paper (interest rate) will skyrocket.

When the government borrows money on the open market at high interest rates, the payment for just the interest (servicing the debt) becomes part of the national debt.

Take two platinum coins and give them a face value of $1 trillion each. Make the Federal Reserve buy these coins. The result will be a ripple of actions disrupting everything, like when a stone is thrown in the middle of a calm lake.

There was a time when freshman members of Congress were pushed to the background and told to shut up and learn. It was to allow them to learn from more senior members and to prevent them from saying and doing stupid things. Maybe Congress should go back to that practice.

And now the news…

March 23, 2020

Two styles of silver coins at the Perth Mint. Photographer: Carla Gottgens/Bloomberg

→ Read more at

bloomberg.com

March 24, 2020

The fifth auction of coins from the legendary D. Brent Pogue Collection skyrocketed to a total of more than $15 million at Stack’s Bowers Galleries in Santa Ana last week.

→ Read more at

news.justcollecting.com

March 25, 2020

Stock market crash safety sought by concerned investors is coming in the form of shiny precious metals that include gleaming gold and silver coins. Even though stock market drops usually coincide with a price hike in gold and silver, both equities and precious metals soared on March 24 when the Dow Jones Industrial Average jumped 11.37%, or 2,112.98 points, to reach 20,685.04 for its biggest percentage gain since March 1933 and its largest point rise ever.

→ Read more at

stockinvestor.com

March 27, 2020

— A proposal to land the Apollo lunar module on the reverse side of a new $1 coin has been waved off by the committees reviewing the design.

The historic moon lander was among the three subjects considered for New York's dollar in the U.S.

→ Read more at

collectspace.com

March 27, 2020

Sales of retail gold coins are revealing just how desperate investors are to find a safe haven. People have always been willing to shell out more for retail coins than gold sold in the spot market. But that premium has more than doubled — and at times quadrupled — over the past two weeks as investors seek a safe place to park their cash in the face of global market turmoil.

→ Read more at

bloomberg.com

March 28, 2020

The frenzy to buy physical gold is driving demand for well-known coins like the Krugerrand, Maple Leaf, or American Eagle. A Swiss-issued coin is one of the few still to be had. The market for physical gold has dried up after four Swiss refineries were forced to shut due to the coronavirus, as finews.com reported on Tuesday.

→ Read more at

finews.com

Mar 3, 2020 | ANA, coins, commemorative, dollar, legislative, policy

The 2021 commemorative coin calendar is full and it does not include a commemorative Morgan or Peace silver dollar.

The 2021 commemorative coin calendar is full and it does not include a commemorative Morgan or Peace silver dollar.

Last October, Congress passed the Christa McAuliffe Commemorative Coin Act of 2019 (Public Law No. 116-65) to be issued in 2021. In December, they passed the National Law Enforcement Museum Commemorative Coin Act (as part of Public Law No. 116-94). With two commemorative coin programs in 2021, there is no room for the 1921 Silver Dollar Commemorative Coin Act.

The odds of Congress creating a third commemorative program for 2021 is less than 1-percent.

When H.R. 3757 was introduced, the American Numismatic Association sent out a press release and asked the members to write their member of Congress. The numismatic press also carried that mantle at the beginning. Some suggested that a commemorative Morgan Dollar could be struck at the former mint in Carson City.

But that was in July, 2019, prior to the World’s Fair of Money.

During the World’s Fair of Money, a new Board of Governors was installed to allegedly lead the ANA. Since then, there has been little said by the ANA about H.R. 3757. This is the opposite of the response lead by Farran Zerbe.

Zerbe’s proposal for what became the Peace Dollar led to the appointment of a committee that lobbied Congress for the coin’s creation. It was not an easy road for the proposal, but Zerbe persisted, and a bill was passed.

Zerbe, who was ANA President from 1908 t0 1910, showed extraordinary leadership in getting this bill passed.

Many others have stepped up to represent the community with the support of the ANA and the hobby. Amongst the community’s achievements are the Bicentennial coins and the 50 State Quarters program.

Where is that support today?

Where has the ANA been since August 2019?

Like the 1921 Peace Dollar, a 2021 commemorative coin would not only highlight history but make sure the public knows about the ANA’s place in that history. It would introduce new collectors to one of the 20th century’s best designs and the ANA at the same time.

Aside from the public relations boost, 40-percent of the program’s surcharge would be paid to the ANA. With a mintage limit of 500,000 coins with a surcharge of $10 per coin, a potential $2 million could have been added to the ANA’s treasury.

A one-time payment of $2 million would provide a cushion of 35-percent, based on the ANA’s published 2019 budget. It would furnish a down payment on new education initiatives and outreach to promote the ANA’s growth.

The ANA has been business-as-usual with little said from the current Board.

It is difficult to understand why the ANA Board of Governors would let this opportunity pass. Is this a sign of leadership we are to expect during its two-year term?

On Wednesday, Joseph R. Biden Jr. became the 46th President of the United States. It was the 46th time since 1789 that a new President took the oath of office. Regardless of the circumstances leading up to the inauguration, this was the 59th ceremonial inauguration. There were eight other inaugurations following the death of presidents and Gerald Ford’s inauguration following Richard M. Nixon’s resignation.

On Wednesday, Joseph R. Biden Jr. became the 46th President of the United States. It was the 46th time since 1789 that a new President took the oath of office. Regardless of the circumstances leading up to the inauguration, this was the 59th ceremonial inauguration. There were eight other inaugurations following the death of presidents and Gerald Ford’s inauguration following Richard M. Nixon’s resignation.

→ Read more at

→ Read more at  During a class for my master’s degree, a professor was fond of reminding us that politics is a contact sport. He meant that metaphorically, but the point was direct. Politicians will do what they can to get their job done, regardless of the inside consequences.

During a class for my master’s degree, a professor was fond of reminding us that politics is a contact sport. He meant that metaphorically, but the point was direct. Politicians will do what they can to get their job done, regardless of the inside consequences. Once again, the State Department is about to do something that negatively affects a part of numismatics. Even if you are not an ancient coin collector, the ability to collect and study ancient coins helps give all of us clarity into history.

Once again, the State Department is about to do something that negatively affects a part of numismatics. Even if you are not an ancient coin collector, the ability to collect and study ancient coins helps give all of us clarity into history.