WWWWoW!

My long nightmare is over!

I now have a “W” mintmark quarter!

And I acquired it the old fashioned way: I bought it!

Since the days that the Federal Reserve started to ship the quarters from the cash rooms, I have been looking for these elusive quarters. Every time I spend cash, I will examine every quarter returned in change. Every time I open a roll in my shop’s cash register, I avoid giving away any coin that looks shiny so that I can check the mintmark later.

I convinced my wife to save the change. She is also looking for W mintmark quarters.

But I could not help myself when I found that a club member added one to our monthly auction. From the opening bid until I won the coin, my hand stayed in the air. I was going to get that coin regardless of what it cost.

Ok, I had a limit to what I would spend, and it was $1 more than my final bid. But the competition stopped bidding, and the coin is now mine!

Just because I purchased a Lowell National Historic Park W mintmark coin does not mean I am stopping. There are four other coins issued in 2019 with W mintmarks.

The hunt continues!

DC Quarter and a Missed Opportunity

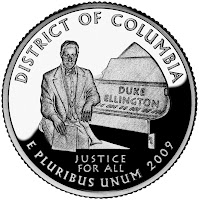

This week, the US Mint released the quarter for the District of Columbia that honors Edward Kennedy “Duke” Ellington. The Washington-born Ellington was one of the most influential musicians of the 20th century with a career that spanned 60 years until his death in 1974. Ellington was awarded the Presidential Medal of Freedom by President Richard Nixon in 1969.

This week, the US Mint released the quarter for the District of Columbia that honors Edward Kennedy “Duke” Ellington. The Washington-born Ellington was one of the most influential musicians of the 20th century with a career that spanned 60 years until his death in 1974. Ellington was awarded the Presidential Medal of Freedom by President Richard Nixon in 1969.

Ellington was a great musician and musical ambassador. His music was very popular amongst the Washington society crowd in the early part of the 20th century. When his career picked up, Ellington moved to New York City to take advantages of opportunities. Ellington reinvented his career twice and was working on new projects when he died on May 24, 1975.

Although Duke Ellington was a great musician and worthy of an honor, those who were involved with the District of Columbia quarter selection process missed an opportunity to properly honor the District and make a statement.

Following the passage of the budget bill that contained the provisions for the DC and Territories Quarters program, then Mayor Anthony Williams appointed a committee to determine the design of the DC Quarter. When the design descriptions were submitted to the US Mint for approval, they included the phrase “Taxation Without Representation.” The phrase, which is on District license plates, is a protest noting that US citizens who live and vote in Washington does not have a representative in congress, who levies taxes and has veto authority over the city’s mayor. The Mint rejected the design as being too political.

When the design was rejected, newly elected Mayor Adrian Fenty reconvened the committee to come up with a new design. Several designs were considered and put to a vote by District residents. The design honoring Duke Ellington won decisively.

Unfortunately, the best option for the quarter design was considered. If the District government was serious about getting their message out about the lack of congressional representation for Washingtonians, they could have sparked the conversation by selecting a design that honored Walter E. Washington, the first elected home-rule mayor of Washington, DC.

Washington, DC is the only world capital that is not represented in the government which it hosts. For nearly 200 years, congress has taken a pedantic view of Article 1, Section 8 of the US Constitution stating:

To exercise exclusive Legislation in all Cases whatsoever, over such District (not exceeding ten Miles square) as may, by Cession of particular States, and the acceptance of Congress, become the Seat of the Government of the United States

By doing this, congress has been giving the residents of the District of Columbia less rights and representation that any of the other states. Congress controls the District, its revenues, and its laws. Legislation passed by the city council and signed by the mayor has to be approved by a congressional committee before it becomes law.

The Georgia-born Walter Washington was appointed as Commissioner of the District of Columbia by President Lyndon B. Johnson in 1967. His early years were marred with race riots and other issues that he had problems dealing with because of the restrictions placed on the appointed commissioner. After much lobbying, congress passed the District of Columbia Self-Rule and Governmental Reorganization Act of 1973 that allowed the city to elect its own government. Washington was elected as the first mayor of Washington, DC.

The Georgia-born Walter Washington was appointed as Commissioner of the District of Columbia by President Lyndon B. Johnson in 1967. His early years were marred with race riots and other issues that he had problems dealing with because of the restrictions placed on the appointed commissioner. After much lobbying, congress passed the District of Columbia Self-Rule and Governmental Reorganization Act of 1973 that allowed the city to elect its own government. Washington was elected as the first mayor of Washington, DC.

If the District honored Walter Washington on its quarter, not only would it have been more appropriate from a historical perspective, it would have given the home-rule activists an opening to talk about their lack of representation in congress. People who have asked about this person on the quarter and they could have filled in the blanks. While it would not have been an overt message, it would have been subtle and shown intelligence with integrity.

I like Duke Ellington but Walter Washington would have been a better subject.

DC Quarter image courtesy of the US Mint.

Image of Walter E. Washington from Wikipedia.

Mint Guarantee Prices on Order

Following up on my post about the pricing policy at the US Mint for Ultra High Relief Saint Gaudens Double Eagle gold coins, Susan Headly is reporting that the Mint guarantees that the purchaser will pay the price of the coin as of when it was ordered. This means that if the price of gold rises before your order is fulfilled, your price will stay the same as when you ordered.

It also means that if the price of gold falls, your price will stay the same as when you ordered.

The Mint has a very liberal, 30-day return policy for all of its product. Purchasers can return any item in its original packaging within 30-days of purchase. If the prices go down after your coin is shipped, you can return the coin and re-order it at the lower price. Also, if the price drops before your order is shipped, you can cancel your order and re-order the coin at the lower price.

Although there is a potential for abuse, it is comforting for collectors that the US Mint follows market practices on price rises. However, it is up to you to lock in a lower price when the price falls.

While the US Mint has gone out of its way to explain its precious metals pricing policy, the Mint should make it clear what its policy is when purchasing backordered products.

Is The Mint Discouraging Gold Ownership?

Throughout the second half of 2008, the US Mint has had problems with the supply of gold coins for the collector and investor market. Gold American Eagle and Buffalo coins were is short supply causing the US Mint to suspend and limit gold sales before changing the pricing policy of all precious metal products. Could the US Mint be trying to discourage gold ownership?

Michael Zielinski, author of Coin Update and Mint News Blog, writes about this on the Seeking Alpha blog. Zielinski tracks the actions taken by the US Mint and their explanation for the actions noting that “the consequence of each action has been to limit or discourage gold ownership.”

Zielinski notes that the US Mint will be lowering the number of gold options by eliminating fractional issues and suspending the American Buffalo issue altogether.

“Whether or not it was the US Mint’s intention, every significant action they have taken since August has either limited gold availability, eliminated gold product options, or increased the cost of acquiring gold,” Zielinski writes. “Has it all just been a consequence of surging global demand for gold, supply chain mismanagement, and bad timing for policy decisions? Or is there something else going on here?”

Please read Zielinski’s full article at Seeking Alpha.

Ultra High Price Gouging With No Relief

If you have been watching the US Mint this week, you may have noticed that the 2009 Ultra High Relief Saint Gaudens Double Eagle started to sell on January 22, 2009.

With a limit of one coin per household, the catalog page advises “Orders will be processed on a first-in, first-out basis, and could potentially take up to six to nine months to complete based on gold blank availability.” (emphasis added) They further explain that the Mint will not charge your credit card until your order ships. This means that the coin could cost more than the current $1,189.00 price. With the changing price of gold and that the first coins will not be available until February 6, 2009.

According to the new precious metals pricing policy, the price of gold products will be adjusted based on the Thursday AM London Fix price. Since the price of gold on Thursday, January 22 was $847.75 per ounce, the current price of the coins will not change on Monday. However, the Friday AM Fix was $873.00 per ounce and the PM close was $875.75. If the price does not come down, the coin’s price could rise to $1,239.00 before one coin is delivered.

As a consumer, when I purchase a product, even if it is backordered, I am locked into the price at the time of the order. Even if the backordered item takes three months to fulfill, my price is guaranteed. In fact, if the price goes down many vendors will adjust the price to the new lower price. This is the definition of customer service.

The US Mint, being run by a bureaucrat, opens sales at one price that has the potential (based on current market conditions) to rise before the first coin is delivered two week later.

An opposing argument will be the fluctuating price of gold and market conditions. However, the Ultra High Relief coin is being sold as a collectible item, not as bullion. It is understandable if bullion changes based on market conditions, not for collectibles. Further, as the price of silver fluctuates, the Mint does not adjust the price of American Silver Eagle Proof or the annual silver sets when the spot price of silver changes. Did the Mint lower the price of silver products after the price plummeted from $20 per ounce?

Another reason that the Mint should not be adjusting the prices of collectible coins once ordered by the consumer is that the Mint has variability built in to the price. At the bottom of the new pricing tables is a note that says “cost of metal 71%-74%, cost to manufacture (including overhead) 11% – 14%, and margin 15%.” How does the cost of manufacture change so variably as the price changes?

After writing computer programs for many types of business, I had taken business courses to understand how business works. In the basic business courses I learned that when analyzing the overhead, most of the costs are fixed. Variable costs do not vary greatly with maybe the exception of the costs of energy. However, most of the variable costs are not based on a percentage of the costs. Overhead usually comes from fixed costs, such as facilities, machinery, labor, etc. Variable costs are based on the cost to produce a unit of the item. These variable costs include energy and material costs. However, the Mint is already saying that 71-74 percent of the price is based on the cost of the metal. So what are the variable costs in coin manufacture?

Let’s look at the numbers. Assuming an 11-percent cost of overhead at the low-end of the the Mint’s price range, the Mint is saying that when the price of gold is $800 per ounce, the cost to manufacture is $122. But when the price of gold rises to $900 per ounce, the cost to manufacture is $133. Considering that the variable cost of the metal is calculated separately, why does it cost the Mint $11 more to make this coins when the price of gold rises by $100?

Does it make sense that the US Mint can fix the cost of the manufacture of billions of Lincoln cents and complain that it they cost more than face value to manufacture but they cannot nail down the cost of a coin that will have significantly less population?

The formal notice of the price change was published in the Federal Register Volume 74, Number 3, pages 493-496 (GPO Access: [text] [PDF]). The notice does not explain the rationale for the percentages used nor does it fully explain the cost of manufacture.

I will be asking my representatives in congress to ask the Mint to justify their pricing. I may also submit a Freedom Of Information Act (FOIA) request as well. I will report what information I gather. In the mean time, maybe President Obama’s administration should review my suggestion as to how to pick a new Mint director.

A Quick Administrative Note

Change came in many forms on January 20, 2009. Not only was Barack Obama inaugurated as President of the United States, but his staff changed the official administration website WhiteHouse.gov. The downside to the change is that the web designers did not keep the same directory and file layout of the previous administration’s website. For this blog, it means that links about presidents that pointed to the White House website are broken and will not point to the page about the president.

It is not feasible to find and edit the links in over 300 postings. If you want to visit the pages about the presidents at the White House website, you can find them at www.whitehouse.gov/about/presidents. Future postings will point to the president biography pages as they are programmed today.

I apologize for the inconvenience, but I think it is a small annoyance to deal with!