Aug 6, 2022 | coins, commemorative, legislative

World War II Memorial from the Washington Monument

The Greatest Generation Commemorative Coin Act (H.R. 1057) was introduced last year by Rep. Marcy Kaptur (D-OH) to create a 2024 commemorative coin to raise money to care for the World War II memorial in Washington, D.C.

The commemorative program will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits to 50,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars. The bill sets surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar.

If the program sells out, the Friends of the National World War II Memorial will receive $9.5 million for maintenance and educational purposes.

H.R. 1057: Greatest Generation Commemorative Coin Act

Summary: National World War II Memorial Commemorative Coin Act This bill directs the Department of the Treasury to mint and issue up to 50,000 $5 coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins in commemoration of the National World War II Memorial in the District of Columbia. The design of the coins shall be emblematic of the memorial and the service and sacrifice of American soldiers and civilians during World War II. All surcharges received from the sale of such coins shall be paid to the Friends of the National World War II Memorial to support the National Park Service in maintaining and repairing the memorial, and for educational and commemorative programs.

Introduced in House — Feb 15, 2021

Referred to the House Committee on Financial Services. — Feb 15, 2021

Sponsor introductory remarks on measure. (CR E134) — Feb 15, 2021

Ms. Waters moved to suspend the rules and pass the bill, as amended. — Jul 26, 2022

Considered under suspension of the rules. — Jul 26, 2022

DEBATE – The House proceeded with forty minutes of debate on H.R. 1057. — Jul 26, 2022

On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. — Jul 26, 2022

Passed/agreed to in House: On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. — Jul 26, 2022

Motion to reconsider laid on the table Agreed to without objection. — Jul 26, 2022

Received in the Senate, read twice, considered, read the third time, and passed without amendment by Voice Vote. — Jul 27, 2022

Passed/agreed to in Senate: Received in the Senate, read twice, considered, read the third time, and passed without amendment by Voice Vote. — Jul 27, 2022

Message on Senate action sent to the House. — Jul 28, 2022

Presented to President. — Aug 2, 2022

Signed by President. — Aug 3, 2022

Became Public Law No: 117-162. — Aug 3, 2022

Harriet Tubman Bicentennial Commemorative Coin Act (H.R. 1842) was introduced last year by Rep. Gregory Meeks (D-NY) to create a commemorative coin program to raise money to support museums remembering the legacy of Harriet Tubman.

The commemorative program will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits tp\o 50,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars. The bill sets surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar.

If the program sells out, the National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York, will receive $9.5 million ($4.625 million each) for maintenance and educational purposes.

H.R. 1842: Harriet Tubman Bicentennial Commemorative Coin Act

Summary: This bill directs the Department of the Treasury to mint and issue 50,000 $5 gold coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins emblematic of the legacy of Harriet Tubman as an abolitionist. The Secretary may issue coins under this bill only during the period of January 1, 2024, through December 31, 2024. All surcharges received by Treasury from the sale of such coins must be paid equally to the National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York, for the purpose of accomplishing and advancing their missions.

Introduced in House — Mar 11, 2021

Referred to the House Committee on Financial Services. — Mar 11, 2021

Ms. Waters moved to suspend the rules and pass the bill. — Jul 26, 2022

Considered under suspension of the rules. — Jul 26, 2022

DEBATE – The House proceeded with forty minutes of debate on H.R. 1842. — Jul 26, 2022

On motion to suspend the rules and pass the bill Agreed to by voice vote. — Jul 26, 2022

Passed/agreed to in House: On motion to suspend the rules and pass the bill Agreed to by voice vote. — Jul 26, 2022

Motion to reconsider laid on the table Agreed to without objection. — Jul 26, 2022

Received in the Senate, read twice, considered, read the third time, and passed without amendment by Voice Vote. — Jul 27, 2022

Passed/agreed to in Senate: Received in the Senate, read twice, considered, read the third time, and passed without amendment by Voice Vote. — Jul 27, 2022

Message on Senate action sent to the House. — Jul 28, 2022

Presented to President. — Aug 2, 2022

Signed by President. — Aug 3, 2022

Became Public Law No: 117-163. — Aug 3, 2022

These are the only two numismatic-related bills passed by the 117th Congress.

Aug 1, 2022 | coins, commemorative, legislative

A quick update:

A quick update:

The National World War II Memorial Commemorative Coin Act (H.R. 1057) and Harriet Tubman Bicentennial Commemorative Coin Act (H.R. 1842) passed the Senate on a voice vote. The next stop is the president’s desk.

- H.R. 1057: Greatest Generation Commemorative Coin Act

Sponsor: Rep. Marcy Kaptur (D-OH)

Summary: National World War II Memorial Commemorative Coin Act This bill directs the Department of the Treasury to mint and issue up to 50,000 $5 coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins in commemoration of the National World War II Memorial in the District of Columbia. The design of the coins shall be emblematic of the memorial and the service and sacrifice of American soldiers and civilians during World War II. All surcharges received from the sale of such coins shall be paid to the Friends of the National World War II Memorial to support the National Park Service in maintaining and repairing the memorial, and for educational and commemorative programs.

Passed the House of Representatives with amendments — Jul 26, 2022

Passed the Senate with amendments — Jul 27, 2022

LAST ACTION: Message on Senate action sent to the House. — Jul 28, 2022

- H.R. 1842: Harriet Tubman Bicentennial Commemorative Coin Act

Sponsor: Rep. Gregory W. Meeks (D-NY)

Summary: This bill directs the Department of the Treasury to mint and issue 50,000 $5 gold coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins emblematic of the legacy of Harriet Tubman as an abolitionist. The Secretary may issue coins under this bill only during the period of January 1, 2024, through December 31, 2024. All surcharges received by Treasury from the sale of such coins must be paid equally to the National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York, for the purpose of accomplishing and advancing their missions.

Passed the House of Representatives — Jul 26, 2022

Passed the Senate with amendments — Jul 27, 2022

LAST ACTION: Message on Senate action sent to the House. — Jul 28, 2022

Jul 31, 2022 | coins, news

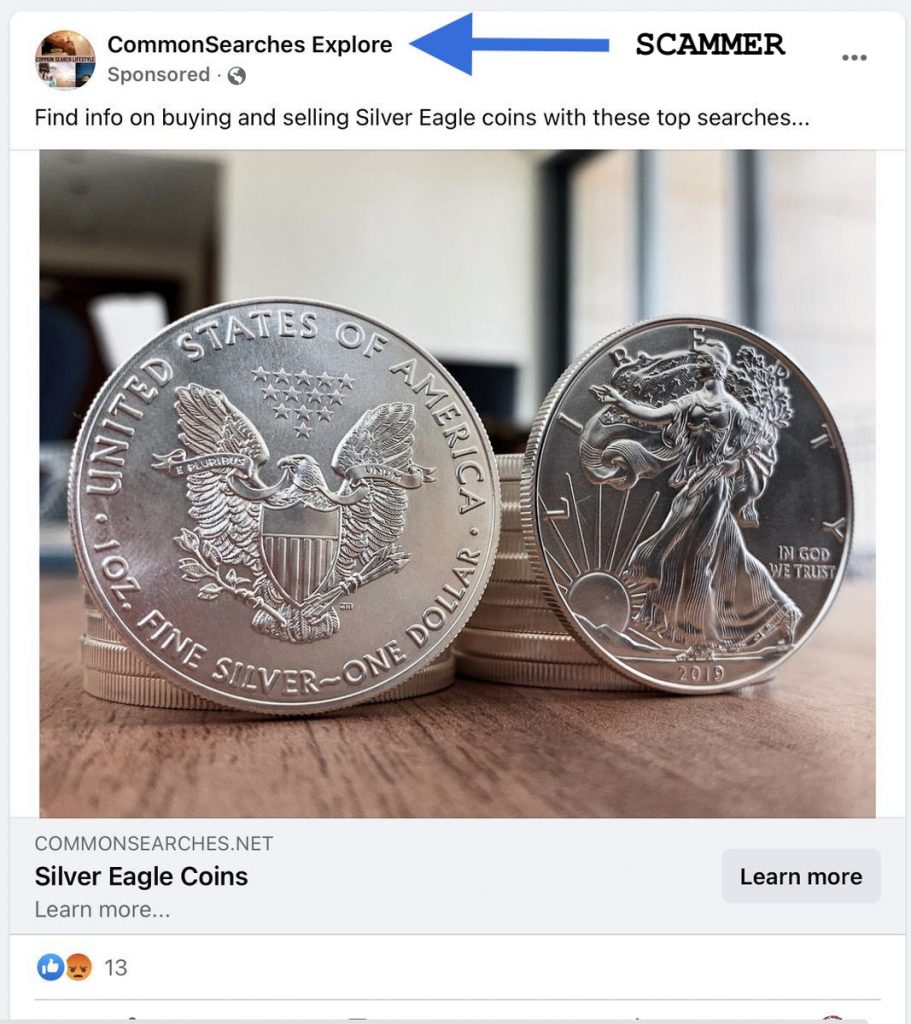

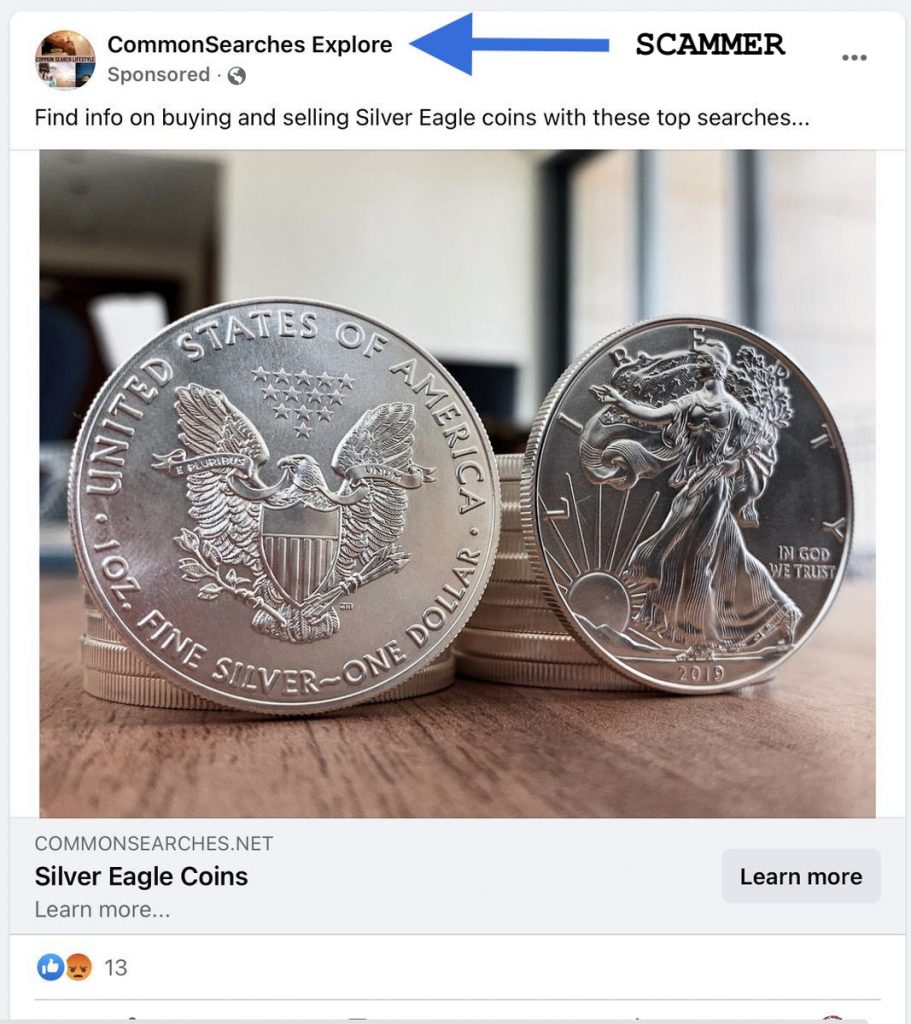

Scammers continue to sell counterfeit American Silver Eagles on Facebook because users keep buying them.

One of the issues that prevented me from writing a more substantive post is that I am investigating an alleged California-based site that is scamming people via Facebook. When I warned Facebook users it was a scam, the site owner sent a private message telling me I was a bad boy before turning off all means to comment or return messages.

Whoever is behind this site is trying to sell American Silver Eagles for below spot. The prices for these fakes have dropped to $14 as the price is silver is falling.

Please don’t fall for these scams. Tell your friends and relatives not to buy from them. It will not end well for anyone.

And now the news…

July 25, 2022

A rare, 1,850-year-old bronze coin depicting the Roman Moon goddess Luna was recently found off the coast of Haifa, the Israel Antiques Authority said Monday. The coin shows Luna above a depiction of the zodiac sign Cancer.

→ Read more at

timesofisrael.com

July 26, 2022

Cash isn’t as popular as it used to be, but that hasn’t put counterfeiters out of business. A 2020 survey cited in a recent Federal Reserve report showed that showed U.S. consumers used cash for only 19% of their transactions.

→ Read more at

money.usnews.com

Jul 30, 2022 | advice, coins, education

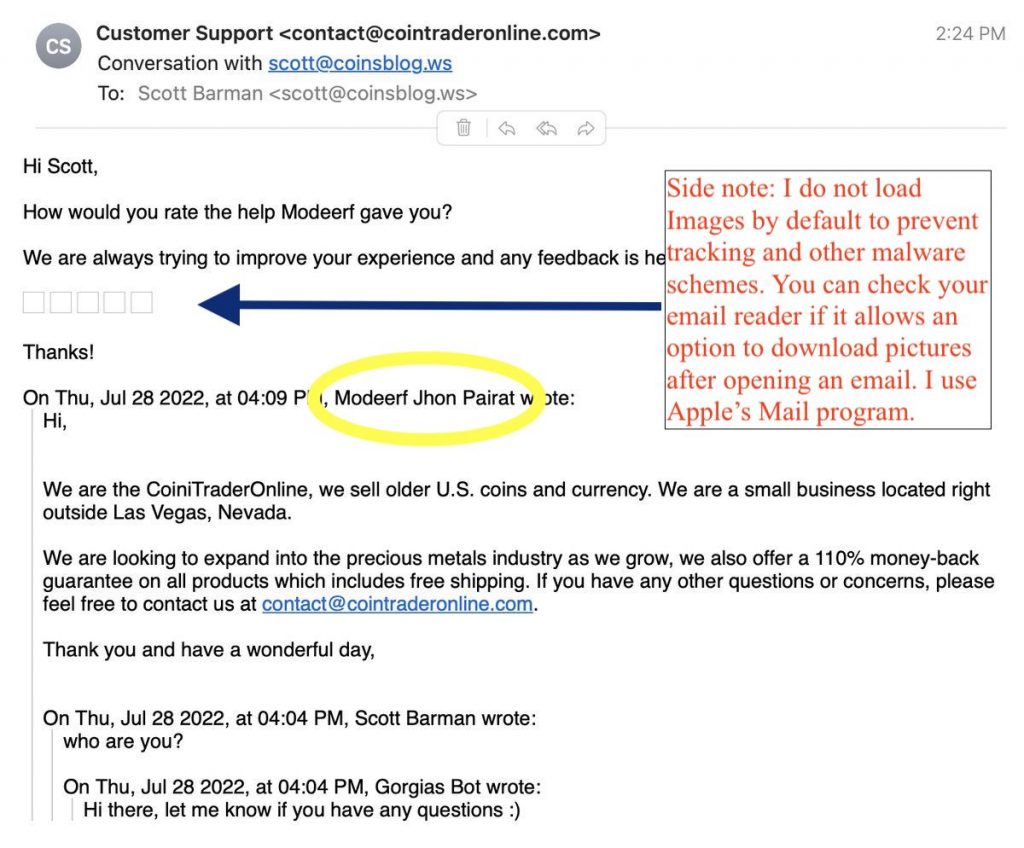

The ad appearing on Facebook

(click image to see a larger version)

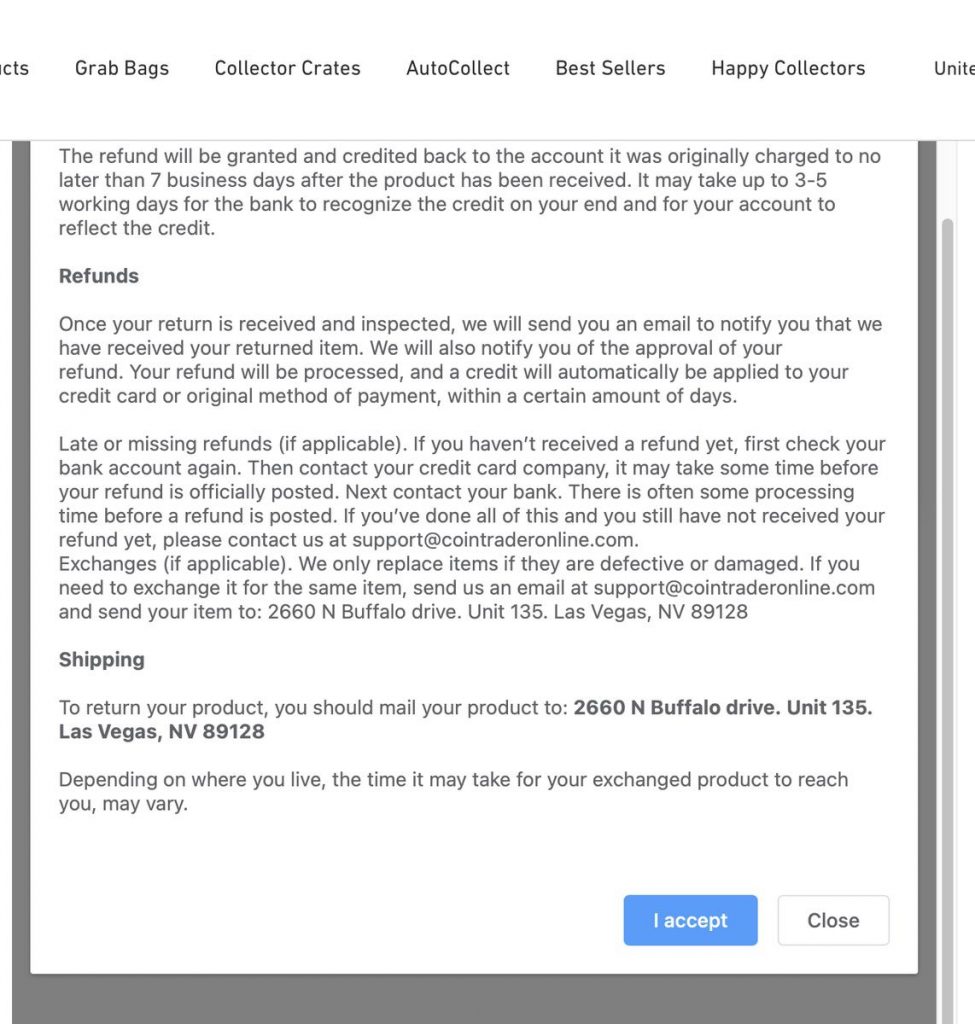

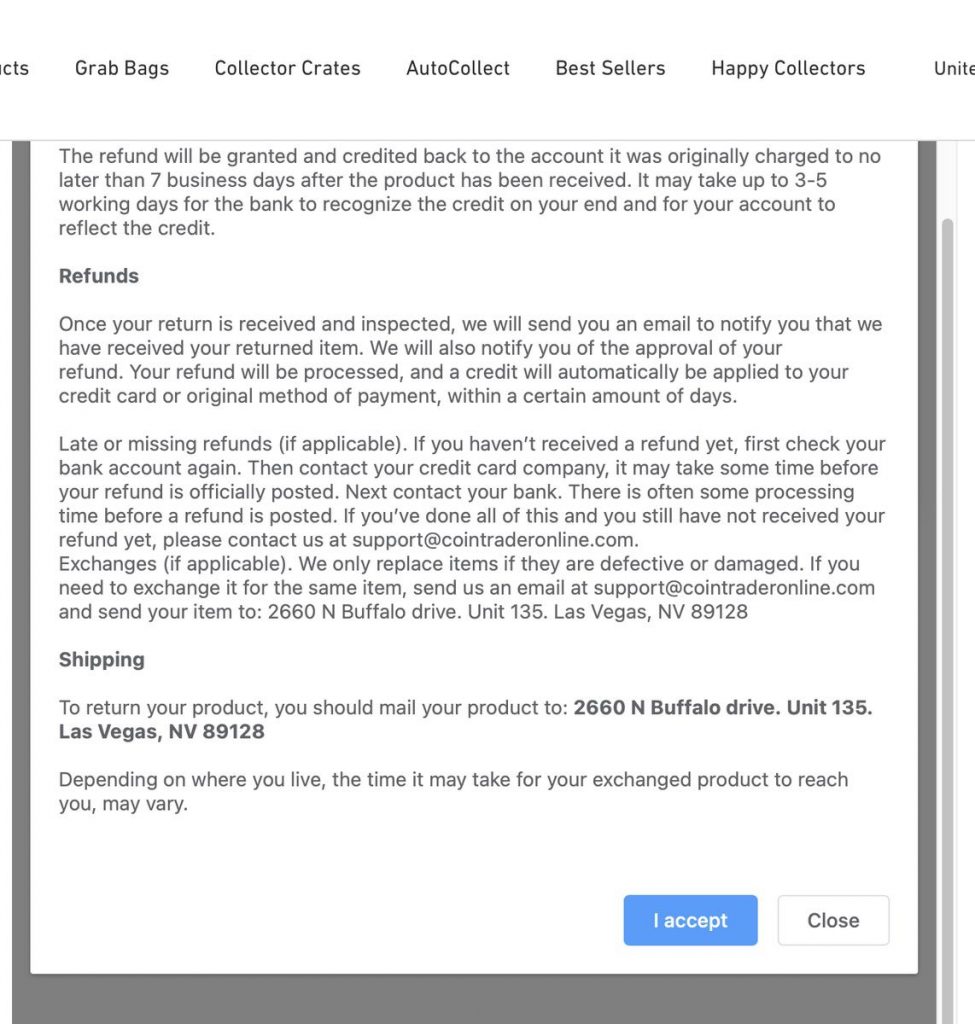

A site called cointraderonline.com (I purposely did not make it a link; please do not visit the site) began advertising heavily on Facebook. The ad, whose image appears here, says that the purchaser will buy a “US Vault Bag” that is “Packed With Unsearched US Coins.” The ad and the site say that there is a 60-Day Return policy.

I have been advising people not to purchase from this site. Unfortunately, some did not seek advice before purchasing. When they received their bag, the results were less than satisfying.

Buyers of the Vault Bags report that they received bags that contain at least 50-percent copper coins with the rest common silver coins. Buyers describe the coins as being heavily circulated, some with scratches and dings, along with very worn and dateless Buffalo Nickels. Although the owner of this site may not have searched the hoard they used to fill the bags, the product appears to lack key or semi-key dates and higher-grade material based on reports from several people.

One person tried to return the coins on their 60-day return policy. The buyer mailed the coins to a Las Vegas address with tracking from the US Postal Service. The package was delivered, but the person did not receive a refund.

Refund policy page containing the address to a Las Vegas-area apartment.

The Investigation

Finding information about the company from their website was difficult. The “About Us” page contains very little useful information about the company. Still, the page uses a few images from elsewhere on the Internet. A random sample of images found several duplicates on other sites using a Google Image search. Many are stock images that the web designer could have purchased from legitimate sources. However, the number of images used to make the website pretty without being functional is an area I find concerning.

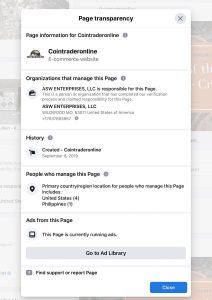

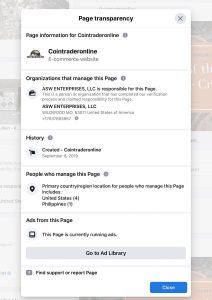

Facebook’s Page Transparency section

(click image to see a larger version)

One tool Facebook provides is a “Page Transparency” section. You must go to the company’s main page to find the information. According to the information on the page, Facebook reports that “ASW ENTERPRISES, LLC” was verified as responsible for the page. ASW Enterprises is in Wildwood, Missouri, with a telephone number that has a 703 area code. The 703 area code maps the Northern Virginia suburbs of Washington, DC.

Hotfrog, a collector of business information, has the phone number listed on Facebook on record but also a St. Louis-area telephone number.

The information found at Hotfrog

Using the St. Louis-area telephone number, a reverse search found a listing at hub.biz for an address in Baldwin, Missouri. The address is for a 4 bedroom, 4 bathroom, 2880 square foot home that Zillow says is worth $576,300 with what looks like it has a three-car garage. I wish I had a three-car garage!

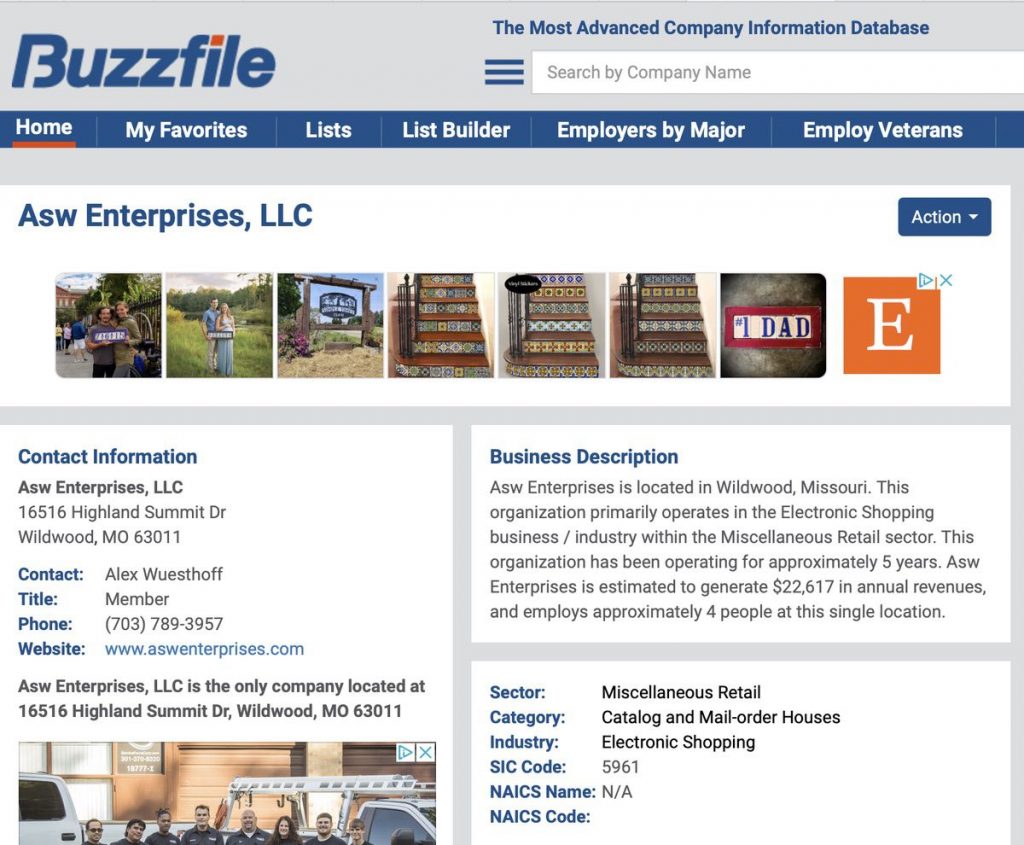

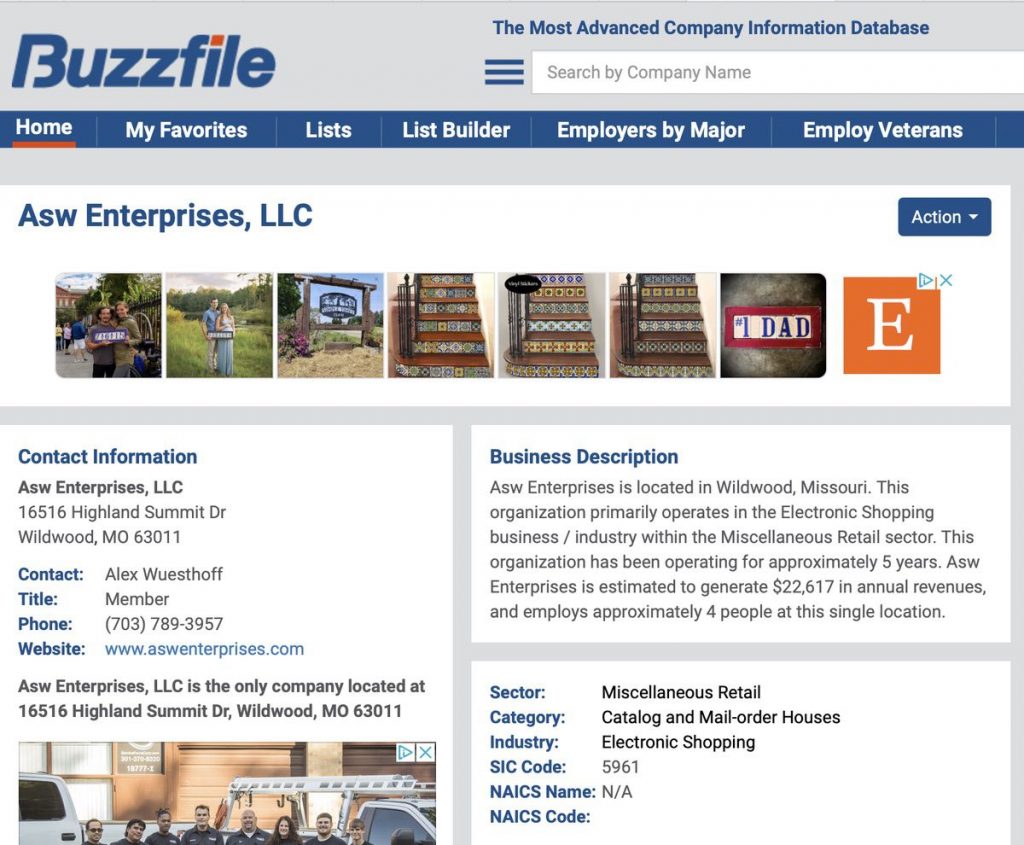

A reverse lookup of the address and telephone number finds information about ASW Enterprises on Buzzfile. This information provides a person’s name that, when plugged into the ANA Dealers” directory, does not find a record. Although the site says that this person/business is a member of the ANA, he is not listed as a registered dealer in the ANA database they use for the Find a Dealer page.

Buzzfile provides addresses and telephone number.

The website on the Buzzfile page is for a company selling preparation materials for a Texas-based spelling competition. There is every indication that the website has nothing to do with the cointraderonline.com business.

The About page also says they are a National Silver Dollar Round Table member. Neither the company name nor the name of the person listed as the principal of ASW Enterprises is listed on the NSDRT membership page. I did not consult with the Certified Collectors Group (NCG/PCGS) to verify the membership claim.

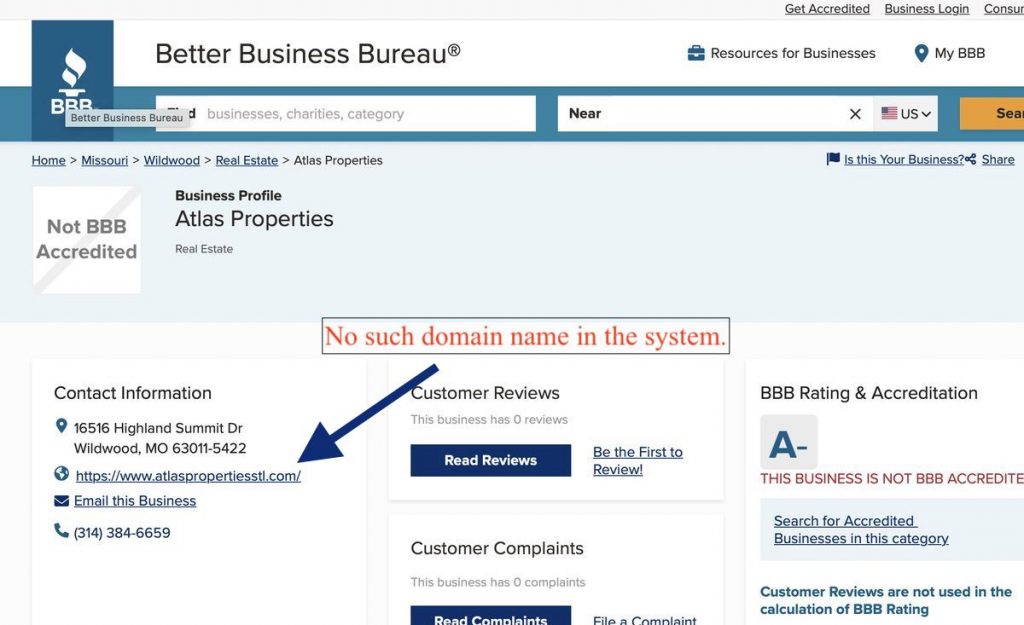

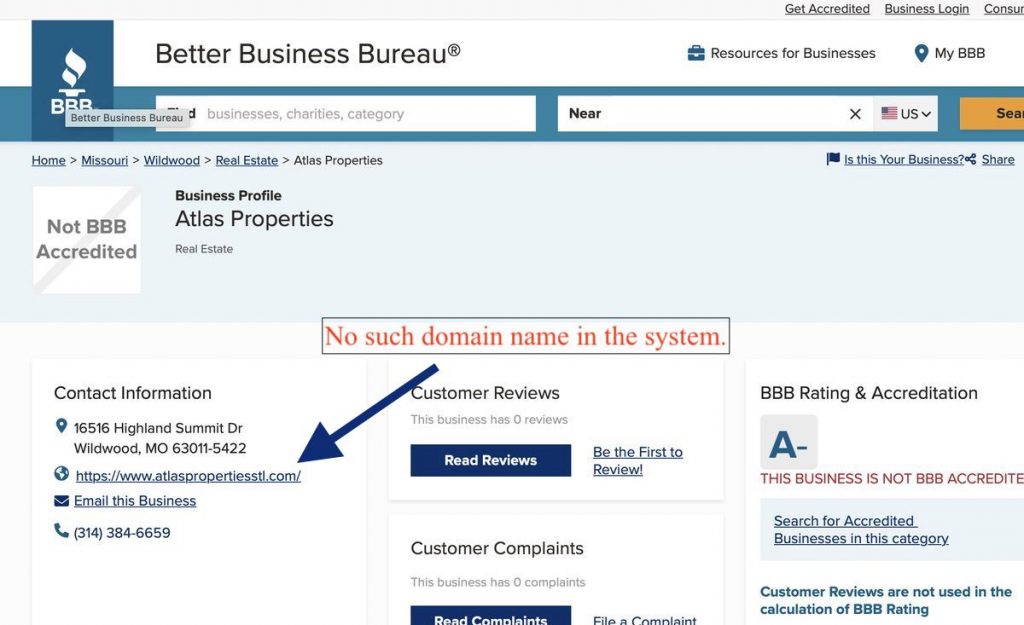

Finally, a reverse search of the person’s name suggests that this is not his only business venture. A Better Business Bureau entry suggests he is also involved with real estate. The finding was supported by a posting to a public message board looking for fellow investors in the St. Louis area.

The Better Business Bureau has a listing that includes a bogus website name.,

There appears to be no connection between the owner listed on the Facebook Page Transparency page and the operation in Las Vegas.

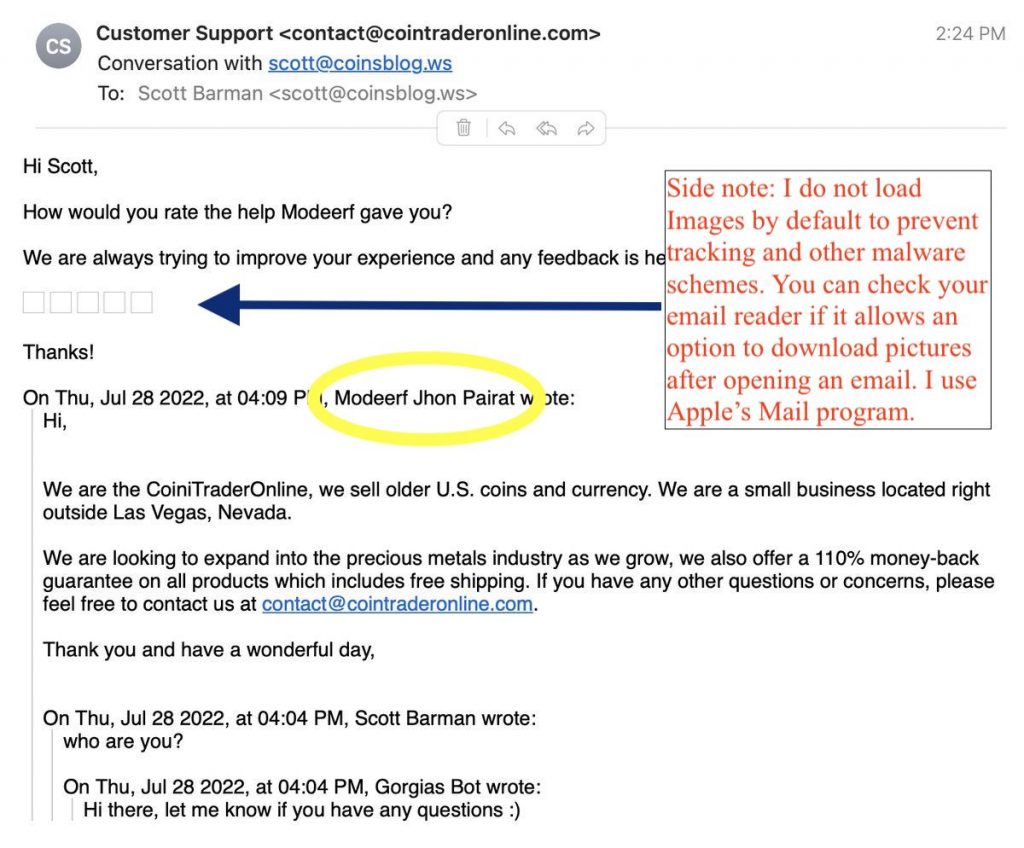

I tried to send a message to the site owner via the chat option on the website. After receiving a response via email, I asked several follow-up questions that have been unanswered at this point. If they answer my questions, I will add the information here and in a new post.

I received an automated message from their system. It was formatted as a reply and included the name of the person that replied to my chat request. When I looked up the name in the email, I found public interactions of someone from the Philippines.

The email telling me who my correspondence is with.

Having a support contract with someone offshore should not raise a concern. Still, when the return address is Las Vegas, and the company’s background information leads to the St. Louis area, it creates concern.

Should You Buy From this Site

My investigation suggests that the person behind the site may be an inexperienced young adult. The diverse information indicates that he is trying to find a way to earn a living. However, he must understand that online sellers have cheated too many coin collectors and that he should opt for transparency rather than pretty pictures on a website.

If you want to support someone trying to start a business, you may want to buy from this company. However, reports suggest that you will not receive value for your money.

Why Publish The Investigation Detail

An old proverb says, “Give a Man a Fish, and You Feed Him for a Day. Teach a Man To Fish, and You Feed Him for a Lifetime.” Rather than providing my opinion, showing you how to investigate sites you are unsure about will help you fight online fraud.

Scams with online shopping are a problem beyond numismatics. Although legitimate small businesses are selling online, there are many scammers. The above processes can help you investigate someone before spending your money.

Suggestions for Small E-Commerce Businesses

For small businesses, I would highly recommend that you be as transparent as possible. You should publish contact information and respond as quickly as possible. Let your buyers know a little about you. Who are you, and why are you in the business? Do you have a passion for what you are selling? Do you have a compelling story about why you are in business? I understand you are communicating with customers, but customers also want to have a connection with the people they do business with.

You have to generate a sense of trust with the customer, which gives you an advantage over a large online retailer. Give me a reason to trust you over the next-day shipping behemoth, and I could become a regular customer. Let the customers know they will deal with another person, not a big corporation riding down a South American river.

Finally, pretty websites are nice but if you are going to use stock photographs, use them sparingly. Stock photographs of coins, people supposedly looking the part they playing on your page might look good, but they come off as fake and as valuable as a cleaned coin. Do not fill up a page with images. Clear, concise, and accurate information is better than pictures.

“Let’s be careful out there.”

Jul 29, 2022 | coins, commemorative, legislative

As part of the congressional charade of staying in session to prevent the appearance of adjournment, the House of Representatives cycled through some non-controversial legislation that included two that would authorize two 2024 commemorative coin programs.

As part of the congressional charade of staying in session to prevent the appearance of adjournment, the House of Representatives cycled through some non-controversial legislation that included two that would authorize two 2024 commemorative coin programs.

National World War II Memorial Commemorative Coin Act (H.R. 1057) was introduced last year by Rep. Marcy Kaptur (D-OH) to create a 2024 commemorative coin to raise money to care for the memorial.

If passed, the commemorative set will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits are 50,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars. The bill sets surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar.

If the program sells out, the Friends of the National World War II Memorial will receive $9.5 million for maintenance and educational purposes.

H.R. 1057: National World War II Memorial Commemorative Coin Act

Summary: This bill directs the Department of the Treasury to mint and issue up to 50,000 $5 coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins in commemoration of the National World War II Memorial in the District of Columbia. The design of the coins shall be emblematic of the memorial and the service and sacrifice of American soldiers and civilians during World War II. All surcharges received from the sale of such coins shall be paid to the Friends of the National World War II Memorial to support the National Park Service in maintaining and repairing the memorial, and for educational and commemorative programs.

Introduced in House — Feb 15, 2021

Referred to the House Committee on Financial Services. — Feb 15, 2021

Sponsor introductory remarks on measure. (CR E134) — Feb 15, 2021

Ms. Waters moved to suspend the rules and pass the bill, as amended. — Jul 26, 2022

Considered under suspension of the rules. — Jul 26, 2022

DEBATE – The House proceeded with forty minutes of debate on H.R. 1057. — Jul 26, 2022

On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. — Jul 26, 2022

Passed/agreed to in House: On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. — Jul 26, 2022

Motion to reconsider laid on the table Agreed to without objection. — Jul 26, 2022

Harriet Tubman Bicentennial Commemorative Coin Act (H.R. 1842) was introduced last year by Rep. Gregory Meeks (D-NY) to create a 2024 commemorative coin to raise money to support museums remembering the legacy of Harriet Tubman.

The National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York.

If passed, the commemorative set will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits are 50,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars. The bill sets surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar.

If the program sells out, the National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York, will receive $9.5 million ($4.625 million each) for maintenance and educational purposes.

H.R. 1842: Harriet Tubman Bicentennial Commemorative Coin Act

Summary: This bill directs the Department of the Treasury to mint and issue 50,000 $5 gold coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins emblematic of the legacy of Harriet Tubman as an abolitionist. The Secretary may issue coins under this bill only during the period of January 1, 2024, through December 31, 2024. All surcharges received by Treasury from the sale of such coins must be paid equally to the National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York, for the purpose of accomplishing and advancing their missions.

Introduced in House — Mar 11, 2021

Referred to the House Committee on Financial Services. — Mar 11, 2021

Ms. Waters moved to suspend the rules and pass the bill. — Jul 26, 2022

Considered under suspension of the rules. — Jul 26, 2022

DEBATE – The House proceeded with forty minutes of debate on H.R. 1842. — Jul 26, 2022

On motion to suspend the rules and pass the bill Agreed to by voice vote. — Jul 26, 2022

Passed/agreed to in House: On motion to suspend the rules and pass the bill Agreed to by voice vote. — Jul 26, 2022

Motion to reconsider laid on the table Agreed to without objection. — Jul 26, 2022

Jul 26, 2022 | coins, commemorative, legislative

Last month, Rep. Paul Gosar (R-AZ) introduced a bill (H.R. 8244) to create a 2023 commemorative coin program to honor the Granite Mountain Hotshots.

Last month, Rep. Paul Gosar (R-AZ) introduced a bill (H.R. 8244) to create a 2023 commemorative coin program to honor the Granite Mountain Hotshots.

“Hotshots” are elite firefighters that specialize in the containment of wildfires. On June 28, 2013, lighting ignited the Yarnell Hill Fire on a ridge west of Yarnell, Arizona, and the fire spread rapidly. Firefighters from the Granite Mountain Interagency Hotshot Crew were deployed to assist with the containment of the fire. On June 30, 2013, 19 members of the Granite Mountain Hotshots died while attempting to contain the fire. Only one survived.

If passed, the commemorative set will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits are 100,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars.

The bill sets the surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar. Proceeds will be paid to the Yarnell Fire District to help with wildfire prevention and wildfire education.

If the program sells out, the Yarnell Fire District will receive $11.25 million from the sale of the commemoratives.

H.R. 8244: Granite Mountain Hotshots Commemorative Coin Act

Introduced in House — Jun 28, 2022

Referred to the House Committee on Financial Services. — Jun 28, 2022

Jul 18, 2022 | books, Canada, coins, news

As the times change, traditional hobbies have to find new ways to reach a new audience. The Royal Canadian Numismatic Association (RCNA) tried something different and published a new children’s book.

As the times change, traditional hobbies have to find new ways to reach a new audience. The Royal Canadian Numismatic Association (RCNA) tried something different and published a new children’s book.

The RCNA teamed up with best-selling Canadian author Teresa Schapansky and award-winning artist Elly Mossman to produce a children’s book, One Little Coin. The book is about a child’s adventures in joining a coin club and what happens.

Here’s the publisher’s blurb:

Dear Journal, I signed up for the coin club, because to be honest, I really like money. Wasn’t that what a coin club was about? Money? That, and how to get it, how much to keep and how much to spend? I glanced around the room, and easily saw that the class was made up of quite an assortment of kids – polar opposites, in my opinion. In the end, who could have guessed that seven totally different kinds of people would form such an unlikely bond in a coin club? Maybe one day, I’ll find one little coin that will change my life, forever. Maybe I’ll find it with Jacques’s metal detector, or maybe it’ll be stuck in some couch cushion. The possibilities are endless.

The book includes “Miss Cassidy’s Guidebook,” a guide to coin collecting for young readers.

One Little Coin is written in English and in French as Une Petite Monnaie.

One Little Coin is written in English and in French as Une Petite Monnaie.

Book publishing is always a risk. A publisher once told me that less than 10-percent of the books they publish make a significant profit. The RCNA is taking a risk by publishing a children’s book in a society where parents opt for electronic entertainment.

I hope it works. If it does, I hope it inspires others to find new ways to reach collectors.

And now the news…

July 9, 2022

There are some $200 bills that were put into circulation in October 2016 by the Central Bank of the Argentine Republic (BCRA) that have a particular production error for which numismatic specialists and collectors in the field paid attention to them.

→ Read more at

california18.com

July 12, 2022

<em>One Little Coin</em>, the latest book by Duncan, B.C.’s Teresa Schapansky, topped the Amazon Hot New Releases list for coins and medals this June. The Royal Canadian Numismatic Association (RCNA) published the digital version of the book in both English and French on June 22.

→ Read more at

canadiancoinnews.com

July 14, 2022

The new P1,000 polymer banknotes, another legacy left to President Bongbong Marcos by his predecessor, came as a surprise parachute drop on a market that appears to be not adequately prepared.

→ Read more at

philstar.com

July 15, 2022

It’s possible you might be able to find coins worth in the thousands around your home or anywhere you store change. The value of your coins could depend on a few factors including mintage, grade and condition, as well as errors.

→ Read more at

the-sun.com

Jul 12, 2022 | coins

DO NOT BUY COINS FROM A FACEBOOK AD!

DO NOT BUY COINS FROM A FACEBOOK AD!

Two counterfeit American Silver Eagles purchased from LIACOO, a company based in China who advertised on Facebook.

Nearly every email I receive starts with the writer seeing an ad on Facebook and bought the coins advertised. The coins are always advertised below melt value and up to 75-percent off the published market guides.

A few weeks ago, the Anti-Counterfeiting Educational Foundation (ACEFonline.org) said they are helping an “investor” who bought counterfeit coins based on an ad he saw on Facebook. The investor paid $499 for what he thought would be 50 American Silver Eagles and $499 for an American Gold Eagle.

He is another scammed collector who bought coins from a Facebook ad.

Some legitimate dealers use Facebook to promote their stores. There are Facebook groups dedicated to buying and selling amongst members. These groups are self-policed and have no significant problems. However, we cannot say this about many of Facebook’s advertised content.

How to Identify Legitimate Sellers from the Scammers

Facebook provides clues on how to identify advertisers’ potential legitimacy. First, all advertised content is marked ”Sponsored.” Look below the company’s name; instead of the date, the post is ’Sponsored.’ If it is just a timeline post that the writer stuffed with keywords to game the system and get you to notice the content, it is likely not legitimate.

Look for the check next to the company’s name for Facebook’s verification. A company that has submitted to Facebook’s process for verification is likely safe. For example, the advertisement below for Moden Coin Mart shows a verified company with sponsored content. Modern Coin Mart is a good company with fair prices and will sell a quality product and should not be dismissed because they advertise on Facebook.

The following is an advertisement from BullionMax. BullionMax has not submitted its company information to Facebook’s verification process and does not show the blue check. But they are a company selling bullion. However, BullionMax is a company in that grey area between having a reputation that could pass a verification process and selling products at a premium price using advertising bordering on deceptive.

For a sanity check, I will search for the dealers in the Professional Numismatic Guild (png.memberclicks.net/find-a-png-dealer) and the Accredited Precious Metals Dealers (apmddealers.org/apmd-dealers) databases of members. If the dealer is not in either of those directories, I will avoid purchasing from them based on an online advertisement. Modern Coin Mart has employees that are PNG Members, and BullionMax does not.

For the record, I am not affiliated with Modern Coin Mart except as a satisfied customer.

Then you find ads that use the images of shiny coins to get you to click on their site. Sites like this pretend to be search engines but lead you to scam sites, and they get a kickback from the scammers for every click they generate.

If you see these ads or any other, click on the three-dot menu at the top of the post and select “Report ad” from the pulldown menu. It will send a message to a human at Facebook to inform them that the ad is attempting to scam people.

DO NOT BUY COINS FROM A FACEBOOK AD!

DO NOT BUY COINS FROM A FACEBOOK AD!

DO NOT BUY COINS FROM A FACEBOOK AD!

Caveat emptor.

Jul 11, 2022 | coins, dollar, news

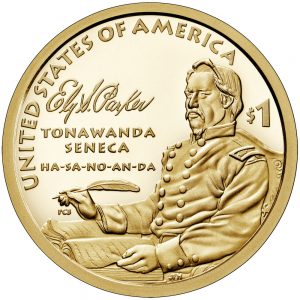

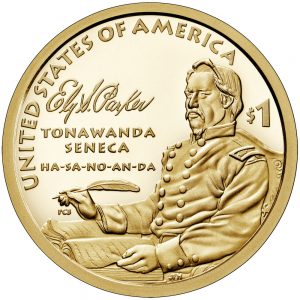

This past week, I had an email conversation with a reader and collector from the United Kingdom that started with a conversation about the Women on Quarters and Innovative Dollar programs. In one of the emails, I was asked why the dollar coin was not generating interest.

This past week, I had an email conversation with a reader and collector from the United Kingdom that started with a conversation about the Women on Quarters and Innovative Dollar programs. In one of the emails, I was asked why the dollar coin was not generating interest.

The simple answer is that the dollar coin does not circulate.

My correspondent asked why the United States strikes a circulating coin that does not circulate? My response, “because it is the law, ” did not satisfy my correspondent because the U.S. also prints a paper dollar. Why do both?

Good question. Why does the United States do both?

There are several reasons, but the main driver is politics. For many years, Ted Kennedy, the powerful senator from Massachusetts, protected the interest of Crane and Company, the manufacturer of U.S. currency paper. On the other side, politicians interested in manipulating people against the government convinced them taking the paper dollar away would weigh them down.

In response, my friend from across the pond said it did not make sense while pointing out that many countries successfully dropped paper for coinage.

The arguments become a religious war whenever the paper versus coin discussion surfaces. I had no answers as to why. Some day, we may resolve this debate, but it is not going to happen today.

And now the news…

July 4, 2022

Secretary Janet Yellen reiterated the promise of ensuring an inclusive currency in an internal department Black History Month message. In contrast with the several speculations spreading over the internet, the Harriet Tubman $20 bill is on its way to rolling out in 2030.

→ Read more at

venturejolt.com

July 7, 2022

The historic rocket that launched the first astronauts to the moon will blast off from the back of a new dollar coin in 2024.

→ Read more at

collectspace.com

Jun 23, 2022 | coins, commemorative, legislative

One of several emblems as part of a changing logo to be used by LA28 Committee

If passed, the commemorative set will include a $5 gold coin, silver dollar, clad half-dollar, and a five-ounce silver proof coin that collectors call the “hockey puck.” The bill sets mintage limits are 100,000 gold coins, 500,000 silver dollars, 300,000 clad half-dollars, and 100,000 proof hockey pucks.

The 300,000 limits for the clad half-dollars are likely to be increased when the bill goes through markup.

The bill sets the surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, $5 for each clad half-dollar, and $50 for each hockey puck. Proceeds will be paid to the U.S. Olympic Committee.

If the program sells out, the U.S. Olympic and Paralympic Committee will receive $15 million from the sale of the commemoratives.

Of course, all this will be moot if the bill does not pass Congress and is not signed by the President.

H.R. 8047: LA28 Olympic and Paralympic Games Commemorative Coin Act

Referred to the House Committee on Financial Services. — Jun 13, 2022

Introduced in House — Jun 13, 2022

S. 4382: LA28 Olympic and Paralympic Games Commemorative Coin Act

Introduced in Senate — Jun 13, 2022

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Jun 13, 2022

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. (Sponsor Introductory Remarks on measure: CR S2912) — Jun 13, 2022

A quick update:

A quick update:

→ Read more at

→ Read more at

As part of the congressional charade of staying in session to prevent the appearance of adjournment, the House of Representatives cycled through some non-controversial legislation that included two that would authorize two 2024 commemorative coin programs.

As part of the congressional charade of staying in session to prevent the appearance of adjournment, the House of Representatives cycled through some non-controversial legislation that included two that would authorize two 2024 commemorative coin programs.