Jul 31, 2011 | iPad, review, technology

Back in March I asked, “Where’s my e-Numismatist?” A few months later, the American Numismatic Association released two apps for iPhone and iPad users to read The Numismatist electronically. Since I had to travel recently, I felt it was time to use and review these apps.

Back in March I asked, “Where’s my e-Numismatist?” A few months later, the American Numismatic Association released two apps for iPhone and iPad users to read The Numismatist electronically. Since I had to travel recently, I felt it was time to use and review these apps.

During the last week, I had to travel for family business and brought both my iPhone and iPad with me to have content to keep me occupied between business. One of the apps that I was interested in exercising was ti read The Numismatist on the iPhone and The Numismatist HD version for the iPad.

First thing that you notice is that although the programmers tried to make the experience similar on both devices, the additional screen space on the iPad makes it a better experience. But the iPod version is very serviceable using options available in the application.

After the obligatory splash screen, the reader is presented with a screen showing the covers of The Numismatist to read. If you started reading an issue, the corner of the cover is folded down and the page number of the last page you viewed is displayed. If you have not read or downloaded an issue, there will be a down arrow button embossed over the image. Press the cover of the issue you want to read to begin.

After the obligatory splash screen, the reader is presented with a screen showing the covers of The Numismatist to read. If you started reading an issue, the corner of the cover is folded down and the page number of the last page you viewed is displayed. If you have not read or downloaded an issue, there will be a down arrow button embossed over the image. Press the cover of the issue you want to read to begin.

If you open a new issue, you are shown a table of contents with an option to download or read online. If you are going to be connected to Internet, you can read it online. Reading online means that as you turn the virtual pages, they will be downloaded on demand. By clicking download you will download the entire issue. In either case, this is where you find an initial problem with the app: downloading is slow.

When I first tried to use the app, I was reading the May 2011 Numismatist using an iPhone connected via 3G over AT&T. Trying to go from section to section was so slow that it was painful. After switching to a WiFi connection that was routed directly to a broadband connection, it was faster and almost as painful. I switched phones from my iPhone 3G to an iPhone 4 and the pain continued. After continued frustration, I used some online tools to figure out that the images of The Numismatist pages are very big. The amount of data being downloaded seems excessive.

Since my iPad is WiFi only and I wanted to read the June 2011 edition on the plane, I chose to download the entire issue because I will not be connected. Watching the progress of the download is almost like watching grass grow. With each issue over 100 pages, it took a long time to download. Also, I am not sure if it is a system issue or the way the app is written, but the download slows if I used another app during the download. Anecdotally, I have run a streaming music app while downloading an app from the App Store and reading email with more success than downloading an electronic issue of The Numismatist.

Since my iPad is WiFi only and I wanted to read the June 2011 edition on the plane, I chose to download the entire issue because I will not be connected. Watching the progress of the download is almost like watching grass grow. With each issue over 100 pages, it took a long time to download. Also, I am not sure if it is a system issue or the way the app is written, but the download slows if I used another app during the download. Anecdotally, I have run a streaming music app while downloading an app from the App Store and reading email with more success than downloading an electronic issue of The Numismatist.

I started the download of the July 2011 edition before going to sleep on my last night using my hotel’s WiFi service. When I awoke the next morning, the edition was downloaded allowing me to start reading on the plane trip home.

Once the issue is downloaded, the app is nearly wonderful. For iPhone users, most of the articles could be read using the text-only option. This will show the entire article text without any images. Since many of the images are embellishments from iStockphoto, you would not miss much. However, articles that show numismatic items should be viewed with images. Reading the image pages on the iPhone shows the downside of the small screen, but you can double-tap the screen then use the open pinch motion to expand the text to be readable.

Once the issue is downloaded, the app is nearly wonderful. For iPhone users, most of the articles could be read using the text-only option. This will show the entire article text without any images. Since many of the images are embellishments from iStockphoto, you would not miss much. However, articles that show numismatic items should be viewed with images. Reading the image pages on the iPhone shows the downside of the small screen, but you can double-tap the screen then use the open pinch motion to expand the text to be readable.

Reading imaged pages is more comfortable on the iPad. The screen size of the iPad makes it suitable for reading in portrait mode. In landscape mode, the iPad will show two facing pages. Like the iPhone, the page can be resized after double-tapping to zoom in. Regardless of whether you use the app in portrait (preferred) or landscape mode, you get the full experience of dead-tree version but in electronic form and with links.

In keeping with it being an electronic version is that links are embedded into the pages. Some links help in the navigation of the issue. For example, the table of contents contains links to each of the stories. If you find something you like, tap the name and the app will advance to that page. If you read an advertisement that you want more information, you can tap on the link in the ad you will be directed to the vendor’s website. Same for links embedded into stories. Email links will open a blank message with the email address in the “To:” line for you to send a message.

In keeping with it being an electronic version is that links are embedded into the pages. Some links help in the navigation of the issue. For example, the table of contents contains links to each of the stories. If you find something you like, tap the name and the app will advance to that page. If you read an advertisement that you want more information, you can tap on the link in the ad you will be directed to the vendor’s website. Same for links embedded into stories. Email links will open a blank message with the email address in the “To:” line for you to send a message.

My one complaint about links is that links to webpages are limited to the embedded browser in the app. After tapping a link, the screen will “raise” a browser insert and show the webpage. With the webpage open, you can expand it to show in the full screen or close the browser pane. The problem is that I may want to open the page in Safari so that I can bookmark the page. However, the app does not have an “Open in Safari” or “Bookmark Page” option. Many other apps can do this and should be added to The Numismatist app.

One annoying “feature” of both versions of the app is that you cannot advance pages when zoomed in. Once you double-tap to activate the zoom, you have to double-tap again to return to “page mode” in order to turn the virtual page. It was annoying that while being engrossed in a longer article, I could not turn the page until I remembered to double-tap again. After advancing to the next page, I then had to double-tap to zoom in again. After a while, I put my glasses back on so I could read the text without relying on the zoom feature.

One annoying “feature” of both versions of the app is that you cannot advance pages when zoomed in. Once you double-tap to activate the zoom, you have to double-tap again to return to “page mode” in order to turn the virtual page. It was annoying that while being engrossed in a longer article, I could not turn the page until I remembered to double-tap again. After advancing to the next page, I then had to double-tap to zoom in again. After a while, I put my glasses back on so I could read the text without relying on the zoom feature.

With two flights of over an hour, I was able to read the entire June issue and half of the July issue on the iPad. Even with the annoyances, I found it easier to carry along with other electronic publications than dead tress. Even without the app being fixed, I am seriously considering converting my membership to electronic delivery only on my next renewal. I grade The Numismatist app and its HD counterpart for the iPad MS63. Although I recommend the iPad version over the iPhone version, the iPhone version is very usable—but consider using it on an iPhone 4. Using the app on an iPhone 3G or 3Gs shows the limitations of that hardware.

If you want to consider the e-subscription only, make sure you have an iPad. In addition to the iPad’s other advantages, this app makes it worth owning one.

Here are screen images from The Numismatist app from the iPhone:

Jul 24, 2011 | commentary, dollar, legislative

Not to be outdone, Rep. Jackie Speier (D-CA12) with co-sponsor Rep. Jared Polis (D-CO2) introduced their own bill in the House of Representatives to end the Presidential $1 Coin Program. On the same day Sens. Vitter and DeMint introduced their bill, Speier and Polis introduced H.R. 2593, Wasteful Presidential Coin Act of 2011.

Don’t you love the way congress can editorialize in what is supposed to be serious laws?

But wait, there’s more!

The bill is essentially the same as the Senate version. However, in an attempt to become managers of the Federal Reserve coin rooms, Reps. Speier and Polis has added a new section to their version of the bill:

SEC. 3. RESTRICTION ON OVERPRODUCTION OF $1 COINS.

Section 5112 of title 31, United States Code, is amended by adding at the end the following new subsection:

`(w) Restriction on Overproduction of $1 Coins- Notwithstanding any other provision of this section, no $1 coin may be minted or issued under this section during any period in which the number of $1 coins issued, but not in circulation, is more than 10 percent of the number of $1 coins in circulation.’.

What Speier and Polis is saying is that they know better than the Federal Reserve on how to manage the coins in their possession. Should the Federal Reserve find that in the future they want to add stock to their coin rooms, like when congress actually does the right thing and end the printing of the $1 federal reserve note, the Federal Reserve could find itself in a shortage situation in trying to comply with the law.

This is the type of legal provision that has the potential to create unintended consequences. Further, I do not think that congress should manage the cash operations of the Federal Reserve. They can barely manage the nation’s budget, I do not want these people trying to manage the Fed.

Jul 21, 2011 | coins, commentary, dollar, legislative

On July 19, 2011, Sen. David Vitter (R-LA) and Sen. Jim DeMint (R-SC) introduced S. 1385, To terminate the $1 presidential coin program. Simply, the bill removes subsection n of Section 5112 of title 31 United States Code (31 U.S.C. § 5112), which is the law authorizing for the Presidential $1 Coin Program.

The bill reads as follows:

S 1385 IS

112th CONGRESS

1st Session

S. 1385

To terminate the $1 presidential coin program.

IN THE SENATE OF THE UNITED STATES

July 19, 2011

Mr. VITTER (for himself and Mr. DEMINT) introduced the following bill; which was read twice and referred to the Committee on Banking, Housing, and Urban Affairs

A BILL

To terminate the $1 presidential coin program.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,

SECTION 1. TERMINATION OF PRESIDENTIAL $1 COIN PROGRAM.

Section 5112 of title 31 United States Code, is amended by striking subsection (n) and inserting the following:

`(n) [Reserved.]’.

This is clearly an over reaction to the slanted report by NPR that suggests this is a taxpayer issue and not an issue of the broken monetary system in the United States. Rather than figure if this bill will properly achieve their purpose, Messrs. Vitter and DeMint wrote the most expedient bill regardless of its ramifications.

First, if this bill is passed, it will not do anything to relieve the oversupply of dollars being held by the Federal Reserve. All it will do is not increase the current supply leaving about $1 billion of coins in the Fed’s coin vaults and not circulating in the economy.

Another problem with the bill is that it leaves the First Spouse Gold Coin program in place. A closer look at the law shows that the First Spouse Program is codified in 31 U.S.C. § 5112(p). In order to stop the entire program, the bill would have to remove both subsections “n” and “p.”

Further, 31 U.S.C. § 5112(q) (subsection “q”) requires the U.S. Mint to promote the Presidential Dollar program and includes the requirements about the government and commercial acceptance of the coins. If the bill passes by removing subsection “n,” both the U.S. Mint and Federal Reserve will have difficulty complying with this law.

For numismatists who have been collecting Presidential Dollars, this bill’s passage will end the program early leaving us with a partial series. Teachers who use the coins and the good materials produced by the U.S. Mint to help teach history will have to find different tangible aids than coins. Coins would be a better teaching aid since it is tangible and money gets everyone’s attention.

The ONLY way to reduce the oversupply of dollars being held in the Federal Reserve coin vaults is to eliminate the $1 Federal Reserve Note. With out the paper, coins become the currency of the realm and will start to circulate.

I am sure that within a day someone will send a comment saying that Americans like paper and do not like coins. While there are segments of the population that will complain, Americans are resilient and will adapt. We can adapt to anything that the government can do and be successful. We can adapt to anything that market forces place on us and bees successful. We went from an all cash society to adding credit cards; cell phones are now everywhere as compared to 10 years ago; we have survived many changes in the economy; we went from leaded gas to unleaded; transit tokens to electronic metro passes; and now many cities are moving to paying for parking electronically rather than feeding quarters into meters. Americans adapt to change all of the time. Now it is time for all Americans to dig into their souls and change their currency habits for the good of the country.

Jul 21, 2011 | coins, commentary, legal, US Mint

“People of the United States of America have been vindicated.”

This utterance came from Assistant U.S. Attorney Jacqueline Romero, the government’s lead attorney in the case Langbord v. United States after the jury deliberation said that the ten 1933 Saint-Gaudens Double Eagle coins found by Joan Langbord is government property.

For years, the government has wasted taxpayer dollars on attorneys, staff, investigators, and expert witnesses (the government paid David Tripp $300 per hour) to deny the numismatic world the coins of legend. For what purpose? As a result, the jury set a precedence by saying that these coins “left the Mint illegally and were concealed.” It is an argument that can be used to confiscate any coin or pattern that has left the U.S. Mint.

What does this verdict say about the five 1913 Liberty Head Nickels? While the 1933 Saint-Gaudens Double Eagles were legally struck before the order to cease their distribution and melt the coins, the five 1913 Liberty Head Nickels were not supposed to exist. The U.S. Mint was supposed to start striking Buffalo Nickels for circulation, yet someone at the Mint struck five coins using Charles Barber’s Liberty Head design and they left the Mint without any record of their existence.

What does this verdict say about the pattern coins that are in collector hands. None of these patters were supposed to leave the U.S. Mint. Yet there are records of patterns being given out as favors to “important people” to curry favor. Aside from being Secretary of the Treasury at the beginning of the first Franklin D. Roosevelt administration, William H. Woodin was a collector of coins and patterns he collected mostly while director of the New York Federal Reserve Bank. Are those pattern now illegal since they left the Mint illegally and were concealed?

What does this verdict say about the 1974 Aluminum Cent? The U.S. Mint struck these patterns to show to try to convince congress to change the composition of the cent to save money. After they were distributed to congress as “demonstrations,” the U.S. Mint asked for their return. Not all of the congress members returned the coins and some ended up in collectors hands. Are these aluminum coins illegal since they were not legally issued coins?

With all due respect to Assistant U.S. Attorney Romero, I do not feel vindicated. I feel cheated!

Jul 19, 2011 | commentary, dollar, Federal Reserve, US Mint

According to the website at National Public Radio, “The mission of NPR is to work in partnership with member stations to create a more informed public – one challenged and invigorated by a deeper understanding and appreciation of events, ideas and cultures.” Unfortunately, it looks like NPR drowned in the shallow end when it published its story “$1 Billion That Nobody Wants.”

While the Federal Reserve is holding about $1 billion in dollar coins in its coin vaults, its assertion that, “Some 2.4 billion dollar coins have been minted since the start of the program in 2007, costing taxpayers about $720 million,” is false. To quote myself:

NO TAX DOLLARS ARE USED IN THE MANUFACTURE OF COINS AND FEDERAL RESERVE NOTES IN THE UNITED STATES!

The U.S. Mint can strike trillions of coins that will sit in the Federal Reserve’s vaults, but none of the money used to strike the coins comes from taxpayer dollars. For our friends at NPR, money used by the U.S. Mint is withdrawn from the United States Mint Public Enterprise Fund (PEF). The PEF is the account where the seigniorage, the profit from selling the coins, is deposited. As sales are deposited in the PEF, the law requires that the U.S. Mint use the money in the PEF for budgetary reasons like to manufacture coins, maintain facilities, pay employees, etc. No tax money is deposited in the Public Enterprise Fund.

While the NPR story says, “The government has made about $680 million in profit by selling some 1.4 billion dollar coins to the public since the program began,” they failed to mention that this profit comes from the money paid by the Federal Reserve to buy the coins. Excess profit over and above the U.S. Mint’s operations funds are returned to the Treasury general fund.

Wait! Did you say that the program actually made a profit?

Yes, I did and so did the NPR story. And it did not cost the taxpayer anything to make that profit. Not one red cent!

But what about the $1 billion in the Federal Reserve’s vaults?

Those coins were not purchased from the U.S. Mint using taxpayer money. Each and every dollar coin in those vaults were paid for by the Federal Reserve at face value. Since it costs the U.S. Mint about 30-cents to strike one dollar coin, the U.S. Mint made a profit (seigniorage) of 70-cents per coin. The money was paid by the Federal Reserve and NOT taxpayer money.

Think about it: the U.S. Mint is generating 70-percent profit for striking $1 coins with most of that money will eventually make its way to the Treasury general fund.

If it is not taxpayer money, then whose money is it?

It is the money earned by the Federal Reserve through its banking operations as the United States central banking infrastructure. Deposits made to the Federal Reserve are made by member banks. Fees are paid by those banks for cash services, check clearing, and transfer services. The Federal Reserve also earns its money from making loans made to member banks. Some Federal Reserve branches make money on other services. For example, the New York Fed stores gold for foreign countries and sells currency overseas.

But it’s our money, right?

Yes, it is the money that is the heart of the economy of the United States. It is not classified as taxpayer money because no tax dollars were collected in order to fill its coffers.

You don’t make it sound like a problem. Why did the story go viral?

Actually, the $1 billion in coins sitting in the Federal Reserve’s vaults is a problem. It represents $1 billion of working capital that is not circulating in the economy. It is money that cannot be invested by loaning it to other banks or be used in other banking operations. In a tight economy, it is not a good idea to have $1 billion sitting idle. Unfortunately, the NPR story and subsequent follow-ups by various news outlets made it sound like it was $1 billion of taxpayer money being wasted by the government. On the contrary, the federal government earned $680 million!

If those dollar coins sitting in the Fed’s vaults is a problem, what can be done about it?

Stop printing $1 paper notes! The United States is the only “first world” country still producing its unit currency in paper. Two currencies whose value has stood up against the dollar during the current economic crisis, the British Pound and Euro, use coins for their unit currency and not paper. In fact, European Union use coins for the 1 Euro and 5 Euro denominations.

I know that “public sentiment” says to keep the $1 note. But when is governing about bowing to public sentiment. I thought government was supposed to do what is in the nation’s best interest. If it will save money in the long term, then let’s drop the paper for coins. American’s are resilient, they will get used to it.

Jul 17, 2011 | coins, commemorative, legislative, US Mint

In a very rare show of bipartisan ship in the House of Representatives, Rep. Richard Hanna (R-NY24) introduced H.R. 2527, National Baseball Hall of Fame Commemorative Coin Act. Hanna, whose district includes Cooperstown, submitted the bill with 293 sponsors, including the entire New York delegation from both parties. This might be the first coin-related legislation to see action in the 112th congress.

In a very rare show of bipartisan ship in the House of Representatives, Rep. Richard Hanna (R-NY24) introduced H.R. 2527, National Baseball Hall of Fame Commemorative Coin Act. Hanna, whose district includes Cooperstown, submitted the bill with 293 sponsors, including the entire New York delegation from both parties. This might be the first coin-related legislation to see action in the 112th congress.

The National Baseball Hall of Fame and Museum opened in Cooperstown, New York on June 12, 1939. Its first inductees class include five payers who many consider amongst the greatest who have ever played professional baseball. These inductees were (in alphabetical order):

Tyrus Raymond “Ty” Cobb, also known as “The Georgia Peach,” set 90 Major League Baseball Records including highest career batting average (.367) and most career batting titles (12) which he still holds today. His 24-year career was also memorable for his surly temperament and aggressive playing style. When he was voted in to National Baseball Hall of Fame on its inaugural ballot in 1936, he received 222 out of a possible 226 votes, the most of this entry class. The other four votes were probably from sportswriters Cobb made upset during the course of his career.

Tyrus Raymond “Ty” Cobb, also known as “The Georgia Peach,” set 90 Major League Baseball Records including highest career batting average (.367) and most career batting titles (12) which he still holds today. His 24-year career was also memorable for his surly temperament and aggressive playing style. When he was voted in to National Baseball Hall of Fame on its inaugural ballot in 1936, he received 222 out of a possible 226 votes, the most of this entry class. The other four votes were probably from sportswriters Cobb made upset during the course of his career. Walter “Big Train” Johnson played 21 years for the original Washington Senators, 1907-1927. Johnson is second in all time wins with 417 (Cy Young won 511) and is still the all-time career leader in shutouts with 110. Using scientific tests available at the time, Johnson’s fastball was clocked at over 91 miles per hour which was phenomenal for the time. His motion and fastball fooled many hitters, especially right handers. Many of his strikeout records lasted more than 50 years before being broken by future Hall of Famers Bob Gibson, Nolan Ryan, Steve Carlton, and Gaylord Perry.

Walter “Big Train” Johnson played 21 years for the original Washington Senators, 1907-1927. Johnson is second in all time wins with 417 (Cy Young won 511) and is still the all-time career leader in shutouts with 110. Using scientific tests available at the time, Johnson’s fastball was clocked at over 91 miles per hour which was phenomenal for the time. His motion and fastball fooled many hitters, especially right handers. Many of his strikeout records lasted more than 50 years before being broken by future Hall of Famers Bob Gibson, Nolan Ryan, Steve Carlton, and Gaylord Perry. Christy Mathewson holds the National League record for wins with 373. In 17 years, he won all but one of those games with the New York Giants. In 1916, Mathewson was traded to the Cincinnati Reds and became their manager. During his career, Mathewson was famous for his duels with Mordecai “Three Finger” Brown, mostly against the Chicago Cubs. Brown got the best of Mathewson 13-11 with one no-decision. Johnson’s career was cut short when he was accidentally gassed during World War I.

Christy Mathewson holds the National League record for wins with 373. In 17 years, he won all but one of those games with the New York Giants. In 1916, Mathewson was traded to the Cincinnati Reds and became their manager. During his career, Mathewson was famous for his duels with Mordecai “Three Finger” Brown, mostly against the Chicago Cubs. Brown got the best of Mathewson 13-11 with one no-decision. Johnson’s career was cut short when he was accidentally gassed during World War I. George Herman “Babe” Ruth, “the Bambino,” “the Sultan of Swat,” the former pitcher turned outfielder is largely credited for saving baseball after the Chicago Black Sox Scandal during the 1919 World Series. Baseball needed a new hero and Babe Ruth was there with a mighty bat. The sale of his contract from the Red Sox to the Yankees in December 1919 had been part of Red Sox lore and hung like an albatross until the BoSox won the World Series in 2004—which they beat the Yankees to get into the World Series after being down three games to one in the ALCS!

Babe Ruth was baseball’s first home run king. In 1921, Ruth hit 59 home runs while the Yankees shared the Polo Grounds with the Giants. That record stood until Ruth belted 60 for the “Murderer’s Row” team of 1927. It was a record that stood until Roger Maris hit 61 in 1961. His 714 career home runs served as a record until broken by Hank Aaron in 1974. Ruth’s .690 slugging percentage remains a record.

George Herman “Babe” Ruth, “the Bambino,” “the Sultan of Swat,” the former pitcher turned outfielder is largely credited for saving baseball after the Chicago Black Sox Scandal during the 1919 World Series. Baseball needed a new hero and Babe Ruth was there with a mighty bat. The sale of his contract from the Red Sox to the Yankees in December 1919 had been part of Red Sox lore and hung like an albatross until the BoSox won the World Series in 2004—which they beat the Yankees to get into the World Series after being down three games to one in the ALCS!

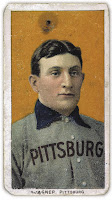

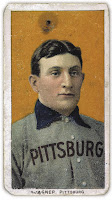

Babe Ruth was baseball’s first home run king. In 1921, Ruth hit 59 home runs while the Yankees shared the Polo Grounds with the Giants. That record stood until Ruth belted 60 for the “Murderer’s Row” team of 1927. It was a record that stood until Roger Maris hit 61 in 1961. His 714 career home runs served as a record until broken by Hank Aaron in 1974. Ruth’s .690 slugging percentage remains a record. Johannes Peter “Honus” Wagner was probably baseball’s first superstar. Playing most of his career with the Pittsburgh Pirates, Wagner won eight batting titles which is tied for the most in the National League with Tony Gwynn. One of the highlights of Wagner’s career was when the Pirates faced the Detroit Tigers in the 1909 World Series. The Tigers were lead by the 22-year old Ty Cobb. Vowing not to have the same poor showing as he did during the 1903 World Series, Wagner out hit Cobb .333 to .231 and stole six bases, setting a World Series record. At 35 years old, Wagner lead his Pirates to victory over the Tigers, 4-3. Wanger’s T206 Baseball card made by the American Tobacco Company is the most expensive baseball card in the world—only 57 are known to exist.

Johannes Peter “Honus” Wagner was probably baseball’s first superstar. Playing most of his career with the Pittsburgh Pirates, Wagner won eight batting titles which is tied for the most in the National League with Tony Gwynn. One of the highlights of Wagner’s career was when the Pirates faced the Detroit Tigers in the 1909 World Series. The Tigers were lead by the 22-year old Ty Cobb. Vowing not to have the same poor showing as he did during the 1903 World Series, Wagner out hit Cobb .333 to .231 and stole six bases, setting a World Series record. At 35 years old, Wagner lead his Pirates to victory over the Tigers, 4-3. Wanger’s T206 Baseball card made by the American Tobacco Company is the most expensive baseball card in the world—only 57 are known to exist.

There have been 205 former major leaguers, 27 executives, 35 Negro League players, 19 managers, and 9 umpires elected to the Hall of Fame. There are currently 63 living members. Exhibits include Women in Baseball, ¡Viva Baseball! celebrating baseball in Latin America and the Caribbean, and The Records Room that shows off the real equipment used to set Major League records.

Should the bill pass, it calls for the minting of 750,000 half-dollar clad coins, 400,000 $1 silver coins, and 50,000 $5 dollar gold coins in 2015. The sale of these coins will include a $35 surcharge for the gold coin, $10 for the silver dollar, and $5 for the clad half-dollar. The potential income of $9.5 million will be paid to the National Baseball Hall of Fame to help finance its operations.

According to the bill, the obverse design of the coin will require an open competition. “The competition shall be judged by an expert jury chaired by the Secretary and consisting of 3 members from the Citizens Coinage Advisory Committee who shall be elected by such Committee and 3 members from the Commission of Fine Arts who shall be elected by such Commission.” The bill said that the “Secretary shall determine compensation for the winning design, which shall be not less than $5,000.” Of course there is a catch. The bill says that the “Secretary may not accept a design for the competition unless a plaster model accompanies the design.”

For the reverse, the bill says the coins “shall depict a baseball similar to those used by Major League Baseball.”

But there is an interesting catch to the design specified in the bill. The bill wants the coin design “fashion[ed] similar to the 2009 International Year of Astronomy coins issued by Monnaie de Paris, the French (sic) Mint, so that the reverse of the coin is convex to more closely resemble a baseball and the obverse concave, providing a more dramatic display of the obverse design chosen.” This should give the U.S. Mint some use for the machinery they used to strike the 2009 Ultra High Relief Double Eagle Gold Coin.

With 293 co-sponsors from both sides of the aisle, there should be no reason for this this bill not to pass—but stranger things have happened with this congress already. The bill has been referred to the House Financial Services Committee where it will likely to be assigned to the Subcommittee on Domestic Monetary Policy and Technology chaired by Rep. Ron Paul (R-TX). In the “what could go wrong” category, Rep. Paul is not considered a friend to the U.S. Mint or its practices.

The bill has also been referred to the House Budget Committee who has its hands full with other matters. Budget Committee Chairman Rep. Paul Ryan (R-WI) is also known not to be a fan of the government.

Neither Paul or Ryan are co-sponsors of this bill. Maybe they can put aside their partisan differences like others who have co-sponsored the bill since baseball is something we can all agree on. As a long time baseball fan, I would buy these commemoratives. I hope congress gives me the chance!

Baseball Hall of Fame image courtesy of the National Baseball Hall of Fame and Museum.

All other pictures courtesy of Wikimedia.

Jul 16, 2011 | coins, fun, US Mint

Looking around for something interesting I was thinking about putting together a type collection. I was looking for an interesting type collection. Rather than a type collection by coin types, how about by a theme. How about a Buffalo Type Collection.

The American Buffalo, or more accurately called the American Bison, was once king of the American Plains. Until the 19th century, it roamed freely until they were almost hunted and slaughtered to extinction. Still, the buffalo represents the United State’s expansion to the west and the growth of the nation. It is just an All-American symbol.

Putting together a Buffalo Type set could be easy, depending on the coins you choose, but it can get expensive. If you choose all proof coins, it could get very expensive. In any case, you can put together a nice collection of coins with buffaloes on them.

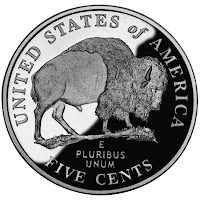

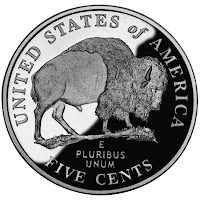

Looking at a buffalo type collection, we have to start with the Buffalo Nickel. Designed by James Earle Fraser, the Buffalo Nickel was struck by the U.S. Mint from 1913 to 1987. The obverse of the coin features a Native American that Fraser said was a composite design of three chiefs and the reverse is a buffalo that Fraser was modeled after Black Diamond, an American bison he found at the Bronx Zoo. Both claims by Fraser has been controversial since several American Indian Chiefs claimed to have been Fraser’s model and Black Diamond was housed at the Central Park Zoo. In either case, it is a wonderful coin and a great start to a collection.

Looking at a buffalo type collection, we have to start with the Buffalo Nickel. Designed by James Earle Fraser, the Buffalo Nickel was struck by the U.S. Mint from 1913 to 1987. The obverse of the coin features a Native American that Fraser said was a composite design of three chiefs and the reverse is a buffalo that Fraser was modeled after Black Diamond, an American bison he found at the Bronx Zoo. Both claims by Fraser has been controversial since several American Indian Chiefs claimed to have been Fraser’s model and Black Diamond was housed at the Central Park Zoo. In either case, it is a wonderful coin and a great start to a collection.

For the type collection, there are two varieties of Buffalo Nickels. Variety 1 is the original where the buffalo is standing on a mound that was only issued in 1913. After finding that the lettering that said “Five Cents” and the mint mark wore off easily, the U.S. Mint hollowed out the mound making it look like a line that the buffalo stood on. The second variety was used until the last Buffalo Nickel was struck in 1938.

To start this set, I can purchase a nice 1913 (P) Type 1 Buffalo Nickel for $35-50 and a 1938-D for $25-40. These would be attractive uncirculated coins but not top of the grading scale.

Keeping with nickels, the first issue of the 2005 Westward Journey Nickels had a bison on the reverse. Not only did it have a bison, but it featured an attractive portrait of Thomas Jefferson by artist Joe Fitzgerald. That portrait of Jefferson has the most character of any presidential portrait that has appeared on a coin. Too bad they U.S. Mint issued it only in 2005. Since this is an easy and inexpensive purchase, I think I would add both the P and D business strikes along with an S mint proof coin.

Keeping with nickels, the first issue of the 2005 Westward Journey Nickels had a bison on the reverse. Not only did it have a bison, but it featured an attractive portrait of Thomas Jefferson by artist Joe Fitzgerald. That portrait of Jefferson has the most character of any presidential portrait that has appeared on a coin. Too bad they U.S. Mint issued it only in 2005. Since this is an easy and inexpensive purchase, I think I would add both the P and D business strikes along with an S mint proof coin.

Two more easy coins are the 2005 Kansas State Quarter and the 2006 North Dakota State Quarter. Both quarters are highly available in uncirculated grades making it easy to collect P and D mint coins. The question then is whether to collect one proof or the clad and silver proof. Since both are readily available, I am going to add both to the collection.

<UPDATE>

Originally, I forgot about looking at the National Park Quarters for buffaloes. One of the reasons is that I have yet to see one in pocket change. But the 2010 Yellowstone National Park Quarter does feature a buffalo standing in front of Old Faithful erupting. Like the state quarters, circulating coins were struck in Philadelphia and Denver. There were also clad proof and silver proof. It is probably costs the same to collect these sets as with the State Quarters, so we will add all four coins to this collection.

</UPDATE>

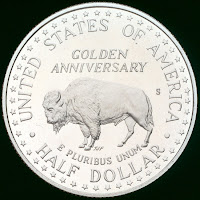

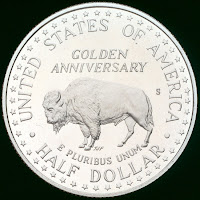

Moving from circulating coins to commemoratives, the first coin is the 1991 Mount Rushmore Golden Anniversary Half Dollar. While the the obverse has a nice image of the Gutzon Borglum masterpiece carved into the Black Hills of North Dakota, the reverse uses a classic design of a buffalo. Since there were so many of these coins struck, both the 1991-D (uncirculated) and 1991-S (proof) are available as inexpensive additions. So let’s get both for our type collection!

Moving from circulating coins to commemoratives, the first coin is the 1991 Mount Rushmore Golden Anniversary Half Dollar. While the the obverse has a nice image of the Gutzon Borglum masterpiece carved into the Black Hills of North Dakota, the reverse uses a classic design of a buffalo. Since there were so many of these coins struck, both the 1991-D (uncirculated) and 1991-S (proof) are available as inexpensive additions. So let’s get both for our type collection!

A little more expensive addition is the 2001 American Buffalo Dollar. Struck as uncirculated in Denver and proof in Philadelphia, this coin has been in high demand, which shows in its price. Although the coin was criticized for not being as faithful to James Earle Frasier’s original design, the buffalo on the reverse is well done while being proportionally smaller than it should have been. Even though both the uncirculated and proof coins can cost between $150-200, I think I will stick with the proof. I think proof coins are better looking.

A little more expensive addition is the 2001 American Buffalo Dollar. Struck as uncirculated in Denver and proof in Philadelphia, this coin has been in high demand, which shows in its price. Although the coin was criticized for not being as faithful to James Earle Frasier’s original design, the buffalo on the reverse is well done while being proportionally smaller than it should have been. Even though both the uncirculated and proof coins can cost between $150-200, I think I will stick with the proof. I think proof coins are better looking.

<UPDATE>

Another commemorative that includes a buffalo is the 1999 Yellowstone National Park Commemorative Silver Dollar. Struck to commemorate the 125th anniversary of the park’s establishment by Ulysses S. Grant in 1872, the proceeds given to the Yellowstone National Park and the National Park Foundation to help maintain the U.S. national park system. The obverse is shows Old Faithful, one of the park’s main attractions, erupting. The reverse is an adaptation of the National Park Service’s official agency logo. Since there is little difference in the price between the uncirculated and the proof, I will add both for somewhere in the $35-40 range, each.

Another commemorative that includes a buffalo is the 1999 Yellowstone National Park Commemorative Silver Dollar. Struck to commemorate the 125th anniversary of the park’s establishment by Ulysses S. Grant in 1872, the proceeds given to the Yellowstone National Park and the National Park Foundation to help maintain the U.S. national park system. The obverse is shows Old Faithful, one of the park’s main attractions, erupting. The reverse is an adaptation of the National Park Service’s official agency logo. Since there is little difference in the price between the uncirculated and the proof, I will add both for somewhere in the $35-40 range, each.

</UPDATE>

Now for the higher end is the American Buffalo 24-Karat Bullion Gold Coin. Since the program started in 2006, the U.S. Mint has been producing a one-ounce 24-karat gold coin with a very faithful image of James Earle Frasier’s Type 1 design. The textured fields on the obverse of the coin adds character to the large gold disk and makes it a very attractive coin. Fortunately for me, I own a 2006 proof American Buffalo coin from when the spot price of gold is almost half of what it is today. But if I was starting this collection today, I would only purchase the proof coin since it looks much nicer than its uncirculated cousin.

Now for the higher end is the American Buffalo 24-Karat Bullion Gold Coin. Since the program started in 2006, the U.S. Mint has been producing a one-ounce 24-karat gold coin with a very faithful image of James Earle Frasier’s Type 1 design. The textured fields on the obverse of the coin adds character to the large gold disk and makes it a very attractive coin. Fortunately for me, I own a 2006 proof American Buffalo coin from when the spot price of gold is almost half of what it is today. But if I was starting this collection today, I would only purchase the proof coin since it looks much nicer than its uncirculated cousin.

In 2008 and 2009, the U.S. Mint struck fractional gold American Buffalo coins in ½-, ¼-, and 1⁄10-ounce coins. If you can afford the one-ounce coin, I would suggest buying one. But if you cannot, the 1⁄10-ounce proof coin is worth the spot price of its gold content ($159.41 as I type this) plus 10-15 percent. Having the option to purchase the fractional gold coins makes this set more affordable.

For extra credit, how about adding one currency item to the collection? In 1901, the Bureau of Engraving and Printing printed the $10 Legal Tender Note (Fr.#114-122) with an image of a buffalo surrounded by portraits of Meriwether Lewis and William Clark. Aside from being my favorite note, it is ranked sixth in the book 100 Greatest American Currency Notes, by Q.David Bowers and David M. Sundman. It is possible for find a nice specimen in Fine and Very Fine condition for $500-800 depending which issue you purchase and where you buy one. Higher grades can push the price over $2,000! Adding one to this type collection would be wonderful.

This would make an attractive type set consisting of:

- 1913 (P) Buffalo Nickel

- 1938-D Buffalo Nickel

- 2005-P Westward Journey Nickel, Bison Reverse, uncirculated

- 2005-D Westward Journey Nickel, Bison Reverse, uncirculated

- 2005-S Westward Journey Nickel, Bison Reverse, proof

- 2005-P Kansas Quarter, uncirculated

- 2005-D Kansas Quarter, uncirculated

- 2005-S Kansas Quarter, clad proof

- 2005-S Kansas Quarter, silver proof

- 2005-P North Dakota Quarter, uncirculated

- 2005-D North Dakota Quarter, uncirculated

- 2005-S North Dakota Quarter, clad proof

- 2005-S North Dakota Quarter, silver proof

- 2010-P Yellowstone National Park Quarter, uncirculated

- 2010-D Yellowstone National Park Quarter, uncirculated

- 2010-S Yellowstone National Park Quarter, clad proof

- 2010-S Yellowstone National Park Quarter, silver proof

- 1991-D Mount Rushmore Golden Anniversary Half Dollar, uncirculated

- 1991-P Mount Rushmore Golden Anniversary Half Dollar, proof

- 1999 Yellowstone National Park Commemorative Dollar, uncirculated

- 1999 Yellowstone National Park Commemorative Dollar, proof

- American Buffalo Bullion Coin, one-ounce proof

- 1901 $10 Legal Tender Note (Fr.#114-122)

It is such a good idea, I might just put together a set!

Buffalo Nickel, Buffalo Dollar, and Mount Rushmore Commemorative images are courtesy of The Coin Page.

Westward Journey Nickel, Yellowstone National Park Dollar, and American Buffalo Gold images are courtesy of the U.S. Mint.

$10 Legal Tender Note image is courtesy of Wikimedia.

Prices confirmed with NumisMedia.

Jul 11, 2011 | coins, commemorative, foreign

Long before the invention of electricity, before steam powered everything, and even before the perfection in the forging of iron and steel to make manual machines, coins were hammered by strong men in order to impress the image on the coinage metals.

Hammered coins were struck from ancient times until the screw coin press was invented by German silversmith Max Schwab around 1550. Hammered coins were struck by frost placing a coin blank on a stationary die (anvil die) that was attached or sunk into a log or another hard surface. The anvil die produced the reverse image. Then, holding the obverse die (trussel) in one hand, the coiner swung the hammer and forced the dies into the coin blank. The pressure from the hammering pushed the metal into the crevices of the dies including the stationary lower die to create the impression. It would take multiple hammer strikes in order to impress the image into the coin.

Hammered coins were rarely perfectly round. Aside from there being no collar surrounding the blank to keep it in place, Depending on the strength and skill of the coiner, the image may not transfer perfectly, the thickness may vary, the coin could exhibit flat edges, and striking errors. Collectors of these coins, mostly pre-17th century, find beauty in the character of each strike.

Monnaie de Paris (The Paris Mint) announced that it will create coins with the theme “From Clovis to the Republic” commemorating 1500 years of the history of France. The theme and design concepts were created by famed designer Christian Lacroix, Artistic Advisor of the Monnaie de Paris. The series will celebrate 15 kings, emperors, and presidents over five years that represents French history from Clovis I through Fraçois Metterand.

The first coin commemorate Clovis I. Clovis was the first King of the Franks. Clovis was the first Catholic king who united all of the Frankish tribes under one ruler. The second coin in the series features Charlemagne, the first Holy Roman Emperor and King of the Franks who created the first European-based empire. Both France and Germany traces their history back to Charlemagne.

The first coin commemorate Clovis I. Clovis was the first King of the Franks. Clovis was the first Catholic king who united all of the Frankish tribes under one ruler. The second coin in the series features Charlemagne, the first Holy Roman Emperor and King of the Franks who created the first European-based empire. Both France and Germany traces their history back to Charlemagne.

To give the coin a similar character to what might have existed during the time of Clovis and Charlemagne, Monnaie de Paris developed a method to make the coin appear to be hammer struck using modern minting equipment. The obverse of both coins has a portrait as it might have appeared at the time.

The reverse of the Clovis coin has a dove flying over a baptismal font representing his Catholic heritage.

The reverse of the Charlemagne coin features a cross-bearing orb (globus cruciger in Latin), Charlemagne’s symbol of his sovereignty and power as the first emperor of the Holy Roman Empire.

The reverse of the Charlemagne coin features a cross-bearing orb (globus cruciger in Latin), Charlemagne’s symbol of his sovereignty and power as the first emperor of the Holy Roman Empire.

To the left of the reverse image are the years of their reign. To the right is the denomination. Below the image are the letters “RF” for République Français for “The French Republic.”

For each commemorative. Monnaie de Paris will be producing two coins. The 10 Euro coin is made from 22.2 grams of .900 fine silver and has a production limit of 20,000 coins at a cost of 65 € (54.35 € without VAT for outside of Europe). The 50 Euro coin is made from 8.45 grams (quarter-ounce) of .920 fine gold (22-Karat) and has a production limit of 1,500 coins and will cost 427 €. Those of us who live outside of Europe can find regional authorized distributors using a web search.

I like the idea to make commemoratives honoring historic figures designed and struck to look close to period pieces. It will be interesting to see how the people who vote for Coin of the Year reacts to these coins.

Coin images courtesy of Monnaie de Paris.

Jul 9, 2011 | commentary, US Mint

Since the founding of the U.S. Mint in 1792, all of its 38 directors, from David Rittenhouse to Edmund Moy, have been a political appointment. Every so often there has been a gap between the service of directors, but eventually, a director is appointed.

Currently, the U.S. Mint has not had a director since the departure of Ed Moy in January 2011. Four days later, it was announced that Deputy Director Andy Brunhart also left the U.S. Mint to take a position with the Bureau of Engraving and Printing.

Treasurer Rosie Rios became acting director and served until Richard Peterson was hired as Deputy Director on January 25. Peterson is not an appointee but a member of the government’s Senior Executive Service. According to his biography at the U.S. Mint website, Mr. Peterson was an executive at General Electric and has a manufacturing and supply chain background. Prior to becoming the Deputy Director, Mr. Peterson was Associate Director for Manufacturing. He is a retired U.S. Naval officer, a graduate of the U.S. Naval Academy, and holds an MBA from Harvard.

In other words, Richard Peterson is well qualified to be the chief executive of the largest manufacturer of coins and medals in the world.

Since Peterson’s promotion, there has not been controversies from the U.S. Mint. Granted, there has not been many opportunities for problems, but it seems the U.S. Mint has weathered released of the five-ounce silver National Parks coins without too many controversy. Neither has the sales of the 2011 commemorative coins. Sales of the 2011 September 11 National Medal seems to be going well.

The U.S. Mint does not have a politically appointed director and it appears to be running without issue. In fact, it might be running better under a professional executive.

With the exception of the recent problems with the production of the new $100 notes that has delayed their release, the Bureau of Engraving and printing has run very well over the last few years. It is an efficient organization that maximizes its seigniorage and is able to supply the Federal Reserve with the currency it needs. Larry Felix, Director of the Bureau of Engraving and Printing, is a government professional and not a political appointee.

Pendleton Civil Service Reform Act (22 Stat. 403) of 1883 eliminated the patronage system within the federal government. For the first time in United States history, government employment was determined by merit and not because of who you know. It has resulted in a more professional workforce and one that did not have to curry political favor.

Although the law allows the president to convert appointed positions to be civil service jobs, the Director of the U.S. Mint has remained an appointed position.

Considering the recent history of the U.S. Mint and in the best interest of the bureau, it is time for President Obama to exercise his privilege under the law and convert the job of Director of the U.S. Mint to be a civil service position.

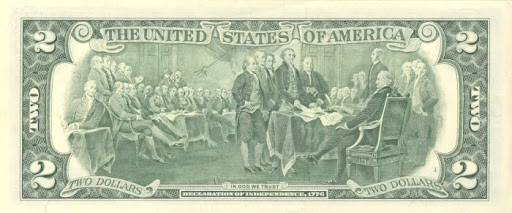

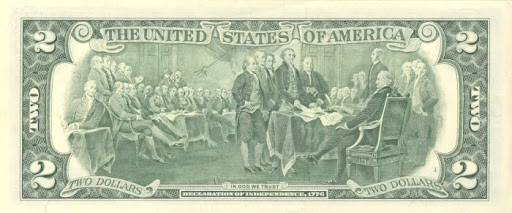

Jul 4, 2011 | history

In CONGRESS, July 4, 1776

The unanimous Declaration of the thirteen united States of America

When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature’s God entitle them, a decent respect to the opinions of mankind requires that they should declare the causes which impel them to the separation.

When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature’s God entitle them, a decent respect to the opinions of mankind requires that they should declare the causes which impel them to the separation.

We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness. — That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed, —  That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness. Prudence, indeed, will dictate that Governments long established should not be changed for light and transient causes; and accordingly all experience hath shewn that mankind are more disposed to suffer, while evils are sufferable than to right themselves by abolishing the forms to which they are accustomed. But when a long train of abuses and usurpations, pursuing invariably the same Object evinces a design to reduce them under absolute Despotism, it is their right, it is their duty, to throw off such Government, and to provide new Guards for their future security.

That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness. Prudence, indeed, will dictate that Governments long established should not be changed for light and transient causes; and accordingly all experience hath shewn that mankind are more disposed to suffer, while evils are sufferable than to right themselves by abolishing the forms to which they are accustomed. But when a long train of abuses and usurpations, pursuing invariably the same Object evinces a design to reduce them under absolute Despotism, it is their right, it is their duty, to throw off such Government, and to provide new Guards for their future security.

In every stage of these Oppressions We have Petitioned for Redress in the most humble terms: Our repeated Petitions have been answered only by repeated injury. A Prince whose character is thus marked by every act which may define a Tyrant, is unfit to be the ruler of a free people.

In every stage of these Oppressions We have Petitioned for Redress in the most humble terms: Our repeated Petitions have been answered only by repeated injury. A Prince whose character is thus marked by every act which may define a Tyrant, is unfit to be the ruler of a free people.

We, therefore, the Representatives of the united States of America, in General Congress, Assembled, appealing to the Supreme Judge of the world for the rectitude of our intentions, do, in the Name, and by Authority of the good People of these Colonies, solemnly publish and declare, That these United Colonies are, and of Right ought to be Free and Independent States; that they are Absolved from all Allegiance to the British Crown, and that all political connection between them and the State of Great Britain, is and ought to be totally dissolved; and that as Free and Independent States, they have full Power to levy War, conclude Peace, contract Alliances, establish Commerce, and to do all other Acts and Things which Independent States may of right do. And for the support of this Declaration, with a firm reliance on the protection of divine Providence, we mutually pledge to each other our Lives, our Fortunes and our sacred Honor.

Adams Dollar image courtesy of the U.S. Mint.

Franklin Half image courtesy of PCGS.

Two Dollar reverse and John Hancock signature images courtesy of WikiMedia.

NOTE: The section containing the declaration of charges against King George III was intentionally omitted.

Back in March I asked, “Where’s my e-Numismatist?” A few months later, the American Numismatic Association released two apps for iPhone and iPad users to read The Numismatist electronically. Since I had to travel recently, I felt it was time to use and review these apps.

Back in March I asked, “Where’s my e-Numismatist?” A few months later, the American Numismatic Association released two apps for iPhone and iPad users to read The Numismatist electronically. Since I had to travel recently, I felt it was time to use and review these apps. After the obligatory splash screen, the reader is presented with a screen showing the covers of The Numismatist to read. If you started reading an issue, the corner of the cover is folded down and the page number of the last page you viewed is displayed. If you have not read or downloaded an issue, there will be a down arrow button embossed over the image. Press the cover of the issue you want to read to begin.

After the obligatory splash screen, the reader is presented with a screen showing the covers of The Numismatist to read. If you started reading an issue, the corner of the cover is folded down and the page number of the last page you viewed is displayed. If you have not read or downloaded an issue, there will be a down arrow button embossed over the image. Press the cover of the issue you want to read to begin. Since my iPad is WiFi only and I wanted to read the June 2011 edition on the plane, I chose to download the entire issue because I will not be connected. Watching the progress of the download is almost like watching grass grow. With each issue over 100 pages, it took a long time to download. Also, I am not sure if it is a system issue or the way the app is written, but the download slows if I used another app during the download. Anecdotally, I have run a streaming music app while downloading an app from the App Store and reading email with more success than downloading an electronic issue of The Numismatist.

Since my iPad is WiFi only and I wanted to read the June 2011 edition on the plane, I chose to download the entire issue because I will not be connected. Watching the progress of the download is almost like watching grass grow. With each issue over 100 pages, it took a long time to download. Also, I am not sure if it is a system issue or the way the app is written, but the download slows if I used another app during the download. Anecdotally, I have run a streaming music app while downloading an app from the App Store and reading email with more success than downloading an electronic issue of The Numismatist. Once the issue is downloaded, the app is nearly wonderful. For iPhone users, most of the articles could be read using the text-only option. This will show the entire article text without any images. Since many of the images are embellishments from iStockphoto, you would not miss much. However, articles that show numismatic items should be viewed with images. Reading the image pages on the iPhone shows the downside of the small screen, but you can double-tap the screen then use the open pinch motion to expand the text to be readable.

Once the issue is downloaded, the app is nearly wonderful. For iPhone users, most of the articles could be read using the text-only option. This will show the entire article text without any images. Since many of the images are embellishments from iStockphoto, you would not miss much. However, articles that show numismatic items should be viewed with images. Reading the image pages on the iPhone shows the downside of the small screen, but you can double-tap the screen then use the open pinch motion to expand the text to be readable. In keeping with it being an electronic version is that links are embedded into the pages. Some links help in the navigation of the issue. For example, the table of contents contains links to each of the stories. If you find something you like, tap the name and the app will advance to that page. If you read an advertisement that you want more information, you can tap on the link in the ad you will be directed to the vendor’s website. Same for links embedded into stories. Email links will open a blank message with the email address in the “To:” line for you to send a message.

In keeping with it being an electronic version is that links are embedded into the pages. Some links help in the navigation of the issue. For example, the table of contents contains links to each of the stories. If you find something you like, tap the name and the app will advance to that page. If you read an advertisement that you want more information, you can tap on the link in the ad you will be directed to the vendor’s website. Same for links embedded into stories. Email links will open a blank message with the email address in the “To:” line for you to send a message. One annoying “feature” of both versions of the app is that you cannot advance pages when zoomed in. Once you double-tap to activate the zoom, you have to double-tap again to return to “page mode” in order to turn the virtual page. It was annoying that while being engrossed in a longer article, I could not turn the page until I remembered to double-tap again. After advancing to the next page, I then had to double-tap to zoom in again. After a while, I put my glasses back on so I could read the text without relying on the zoom feature.

One annoying “feature” of both versions of the app is that you cannot advance pages when zoomed in. Once you double-tap to activate the zoom, you have to double-tap again to return to “page mode” in order to turn the virtual page. It was annoying that while being engrossed in a longer article, I could not turn the page until I remembered to double-tap again. After advancing to the next page, I then had to double-tap to zoom in again. After a while, I put my glasses back on so I could read the text without relying on the zoom feature.