Nov 7, 2021 | news, technology

A news item popped up that announced a dealer is selling Non-Fungible Tokens (NFT) for 13 rare ancient coins. Following the news, collectors ask if NFTs should be part of numismatics.

A news item popped up that announced a dealer is selling Non-Fungible Tokens (NFT) for 13 rare ancient coins. Following the news, collectors ask if NFTs should be part of numismatics.

To answer the question, we must define the NFT. An NFT is a piece of data created using the complex math of cryptography to make it unique to tie it directly to the owner and the item. It is non-fungible because it represents a one-to-one relationship between the owner and the asset. An asset is fungible because it is interchangeable. A coin can be a fungible asset.

A token is an object that represents something else. In numismatics, a token represents money. The NFT is a piece of data that represents the owner and its tie to the asset.

Are you confused? So is most of the market that has run face-first into this new allegedly fantastical concept of owning a piece of something.

But is it an NFT or cryptocurrency numismatics?

According to Merriam-Webster, numismatics is “the study or collection of coins, tokens, and paper money and sometimes related objects (such as medals).”

First, NFTs are not numismatics. NFTs are a deed of ownership. Deeds are not numismatics.

Cryptocurrency may be considered a related object by definition, but does it represent money or currency in any form?

Cryptocurrency is an asset. The asset is assigned a value based on market forces. Are those assets numismatics? No! Cryptocurrency is an asset that does not represent anything. It is a set of bits and bytes created using complicated math.

The creators of cryptocurrency use names similar to physical assets to influence a market. For example, crypto-mining is a series of calculations to find large prime numbers. Searching for large prime numbers is something researchers have been calculating since the discovery of computers. In college, I worked on a project that calculated the largest prime number held at the time.

Today, someone decided to sell the idea of this complex math to calculate a series of prime numbers within constraints. Cryptocurrency is buying the number stored in something called a digital wallet. Owners of these numbers can trade them the same way you can trade stock or your car to a dealer.

Cryptocurrency is not legal tender. A governing authority does not authorize it. It is also not representative of anything except mathematics.

There is nothing in the definition of the trade of numbers to make it part of numismatics.

And now the news…

November 4, 2021

A group of the gold coins discovered in west Norfolk. Photograph: British Museum/PA

→ Read more at

artnews.com

November 5, 2021

Licinius I Aureus as NFT Art on OpenSea A Selection of 13 Rare ancient coins has been listed on OpenSea by DFGrotjohann.

→ Read more at

einnews.com

Sep 21, 2021 | coins, commentary, Eagles, scams, technology

Two counterfeit American Silver Eagles purchased from LIACOO, a company based in China who advertised on Facebook.

Over the last few weeks, I have been counseling several people about requesting a chargeback for receiving counterfeit merchandise. Requesting chargebacks have their problems, too. Some credit card issuers will use the chargeback as an excuse not to renew your credit card.

During this time, another group has been trying to work with Facebook to stop the scammers from reaching consumers.

On Monday, three numismatic groups sent a letter to Facebook Founder Mark Zuckerberg asking why he did not respond to a similar letter a month ago. The letter was signed by Doug Davis, Director of the Anti-Counterfeiting Educational Foundation, Mark Salzberger, Chairman of Numismatic Guaranty Company, and Bob Brueggeman, Executive Director of the Professional Numismatists Guild. You can read the press release and letter here.

It is not surprising that Facebook and Zuckerberg have not answered previous letters. If you watch other media reports about Facebook, the company is notorious for trying to sweep issues under the proverbial rug until something brings it to the forefront. While Facebook claims they are responsive to the communities, they respond solely when someone yells and causes an uproar.

Although some find Facebook useful, it is a cesspool of scammers and trolls playing on the gullible looking to prove P.T. Barnum correct: There’s a sucker born every minute.

News organizations worldwide have reported how criminals use Facebook advertising for crimes, including selling counterfeit merchandise, false activism (e.g., Fake News), and human trafficking.

Facebook’s response has been the same. They promise to try harder and look to add code to help protect their users. The result is that they try to implement a technical solution that works to the point of being able to placated the current activists. The problem is that while Facebook depends on artificial intelligence to protect its platform, company leadership has not shown any real intelligence to understand that there may not be a technical solution to every problem.

It is easier for Facebook to scan for words that someone believes are hurtful than to look at an advertisement selling a one-ounce silver coin for less than its silver value. Besides, the alleged bully is not paying for to have their content distributed to a target audience that includes you.

Facebook really doesn’t care because they are getting paid. They were being paid as late as 2018 by a Russian troll bot for placing activist ads after being admonished for accepting campaign ads paid in Russian rubles in 2016.

Zuckerberg and company do not care. He is getting paid and so is their management. They lie just enough to get past alleged watchdogs in a way to keep confidence in their market price. After all, Facebook stock (NASDAQ: FB) is up 32.25% for the year as of Sep 20, 2021. Why should they care what you think about their advertisers? In the meantime, consumers are getting defrauded by scammers allowed to roam freely by a company that advertises on television as being a place to build a community.

Do not expect help from the government. In between their partisan fighting, members of Congress do not have the knowledge or competence to figure out how to fix the issue. Most members of Congress are lawyers with no technical background nor did any study the technical issues enough to make competent decisions.

Although Congress is to blame, the voters must accept their part of the responsibility. Instead of voting in competent people, they send these old folks with no technical background back to Washington. Many have held their seats for over 20 years without any incentive for advancement. So they grow old without learning new ways and blame everyone else for what they are not doing. Think of the problem like this: 26 of the 100 Senators are 70 years of age or older. None of these people had any experience with computers as students or early in their careers. Most can barely use a smartphone (Steve King actually asked Google CEO Sundar Pichai why his daughter’s iPhone behaved strangely). Even if they did, when was the last time you saw an elderly member of congress with a computer or even a smartphone?

Davis, Salzberg, and Brueggeman will have an uphill battle with Facebook. Everyone does. But the ACEF and PNG need to think beyond talking reason to Zuckerberg. They need to work with Congress to help them understand the technologies and what regulations will be effective without putting undue limits on the technology companies.

NOTE TO THE DAVIS, SALZBERG, AND BRUEGGEMAN:

I know of one person in the numismatic industry that has a background in technology and public policy. This person worked as a contractor to the federal government for 25 years as an information security analyst. This person worked for a PAC concerned with numismatic issues and has a Masters’ with a concentration in information security and technology public policy from Carnegie Mellon University. You can contact this person at

coinsblog.ws/contact.

Nov 14, 2020 | commentary, technology, US Mint

Following the debacle that became of the online ordering process for the End of World War II 75th Anniversary American Eagle Coins, the U.S. Mint issued a statement on social media. On Twitter, the U.S. Mint posted in a series of tweets that read:

Following the debacle that became of the online ordering process for the End of World War II 75th Anniversary American Eagle Coins, the U.S. Mint issued a statement on social media. On Twitter, the U.S. Mint posted in a series of tweets that read:

When people complained, whoever is posting on their social media platforms commented:

The problem is that there have been problems for many years. Every time the U.S. Mint offers a limited edition coin, their website has problems meeting the demand, leading to an apology and a promise that they will resolve the system issues.

Searching this blog, you can find problems with the ordering process for:

What you will not find is a story where the ordering process went smoothly. You will not find a story where the U.S. Mint claims that they have fixed their ordering problems. And you will be able to find a story where the U.S. Mint explains how they plan to fix the problems.

From 2016 through 2019, the U.S. Mint has held a collecting forum in Philadelphia. Each year, the U.S. Mint has invited people from all areas of the industry to meet with them and discuss the future of the U.S. Mint’s products. The coronavirus pandemic prevented them from holding this year’s forum. After every forum, the U.S. Mint thanks the participants and promises to do better.

David J. Ryder at the hearing regarding his nomination to be the 39th Director of the U.S. Mint

Ryder is not a stranger to the U.S. Mint or the federal government. Besides working at the Commerce Department, he served in the Office of the Vice President for George H.W. Bush. Bush appointed Ryder as the 34th Mint Director during a Senate recess in 1992.

Before joining the U.S. Mint, Ryder worked for the Secure Products division of the Sarnoff Corporation. After purchased by Honeywell in 2007, he was Director of Currency for Honeywell Authentication Technologies. Ryder can lead an organization looking in the critical security of currency handling with worldwide influence, but he cannot manage the U.S. Mint out a technological paper bag.

As a former federal contractor, I understand that the contracting process is slow. The federal government acquisition process is fraught with checks, rechecks, oversight, and investigations that drive up a hammer’s price to thousands of dollars. But it is the same process to purchase a tool as it is to make a change to a fighter jet costing tens of millions of dollars.

The U.S. Mint has done some work on the website. Aside from changing the look, they replaced the content management system which manages the site. For the technologically savvy, they migrated from the original Drupal implementation to WordPress. The Coin Collectors Blog uses WordPress.

Although the transition to WordPress may provide the flexibility the U.S. Mint needs to manage the website, they have not met the critical need for customer engagement. Fixing customer engagement in a government agency requires the head of the agency to initiate that change. What has Ryder been doing?

Although the pandemic caused significant interruptions in everything, developers do not have to be on-site to develop software. A program can write programs from just about anywhere. Why were these processes not managed in the subsequent months?

I am asking Ryder to step up to his role and better manage the situation. I am not calling for the removal of Ryder. (POLITICAL ANALYSIS ALERT: Don’t read the rest of the paragraph if you do not like a frank discussion of politics as it affects the U.S. Mint). If Ryder leaves his position, President-elect Biden will likely never have an appointment voted on by the Republican-controlled Senate. We will be back to the nearly eight years of Acting Directors who do not have the authority to make necessary changes as the appointed director could.

Please, Director Ryder, fix the problem. Maybe you can listen to the collecting community. We have good ideas, and we are willing to help.

If you like what you read, share, and show your support

Mar 28, 2020 | review, technology

(yes, I borrowed their logo!)

Currently, there are three numismatic-related podcasts. Today’s review will only look at the newest entry, the Coin World Podcast.

The Coin World Podcast is one-year old. It started on March 28, 2019, and features hosts Jeff Starck and Chris Bulfinch, both writers for Coin World. After one-year, Jeff and Chris have hit on a rhythm that makes it worth listening.

If you binge listen from the beginning, you will find that it takes Jeff and Chris a while to fix a number of their technical issues. As a listener of those early shows, I can tell you that the sound quality was not right and sometimes was grating. It took almost two months for them to work out those issues.

Even with the lousy sound quality, it is worth going back and listening, especially for the interviews. After the banter at the beginning, each episode features a conversation with someone in the numismatic industry.

Doing a “live” interview, as opposed to an interview for print, is that a broadcast interview has to flow in a way that makes sense. Aside from being able to flow, the interviewer has to anticipate what the listener wants to hear. They ask compelling questions and add logical followup. It makes for a great listen.

As with a lot of podcasts, Jeff and Chris open with the news. While they do report the news, they do let some of their opinions show through. The way they add their opinion is not overt but enough to get their point across in a way that does not alienate a listener who might disagree.

A recent feature is a discussion of this period in numismatic history. Jeff and Chris would reference something that happened and read a contemporary account. They will also read letters that appeared in Coin World from years ago to prove the axiom, “the more things change, the more they stay the same.”

Combining history with contemporary accounts gives the feature a more exciting feel than just reciting facts. They should do this more with other discussions, especially with the library they have access to at Coin World.

After a year together, Jeff and Chris have developed a pleasant on-air rapport and a rhythm that makes the podcast worth the time to listen. However, whenever listening to the podcast, it feels as if something is missing before the interview. I know the P.T. Barnum once said, “Always leave them wanting more.” But there should be something else to add that one extra punch.

Having been a listener since Episode 1, the improvements have made a difference, and the interviews are enough to keep listeners coming back for more. I grade the podcast and MS-65, noting that there is a little room to add that one thing that can give it a grade boost.

Congratulations to Jeff Stark and Chris Bullfinch for making it to the first anniversary of the Coin World Podcast!

Mar 26, 2020 | advice, other, technology

With most of the country in some a state of quarantine, there may be time to expand our numismatic knowledge. Collecting can be fun, but learning about your collection will give it more meaning.

With most of the country in some a state of quarantine, there may be time to expand our numismatic knowledge. Collecting can be fun, but learning about your collection will give it more meaning.

If you continue to watch cable news, you are going to think the world will end tomorrow. While the situation is serious and deserves attention, you need to find time to think about something else.

Keeping Up With The News of Numismatics

When you turn off the television, here is where you can read about the latest in numismatics:

- news.coinsblog.ws – full press releases and pictures from news sources without commentary.

- coinworld.com – Coin World magazine online

- numismaticnews.net – Numismatic News online; look on the right side of the page for the links to their other (former Krause Publication) magazines.

- CoinNews.net – One of the oldest online news sites that does a good job in covering numismatic-related news.

- CoinUpdate.com – A news site that is more of an aggregator of numismatic-related news.

- CoinWeek.com – A good, comprehensive site on numismatic-related news.

- CoinsWeekly.com – Germany-based website (in English) with more international news. You should subscribe to their newsletter. You will receive an email summary of the world’s numismatic news every Thursday.

Precious Metals Market News

If you want to read about the markets, there are many news sites to read. However, if you are only looking for news from a source that concentrates on the metals market, then Kitco (kitco.com) is the proverbial 800-pound gorilla in this space. Kitco employs analysts and writers to look at the market from different angles.

Amazingly, the wealth of information Kitco provides is free. The free data, including the free charts and graphs that many websites use, is supported by advertisements, selling bullion, and a premium news service for the serious investor.

Podcasts

Podcasts have been around for many years dating back to the release of Apple’s iPod. In the beginning, podcasts were simple audio files passed around the Internet by maverick content creators to share knowledge, entertain, educate, or have fun. There are also video podcasts for on-demand viewing.

Today, podcasting is a big business. Many media outlets are producing podcasts. There are also companies whose business model is to create podcasts. There is at least one podcast for every taste. There are also many ways to listen to podcasts. Rather than discuss it here, search for “how to listen to a podcast” to learn more.

Here are three numismatic-related podcasts for your listening pleasure:

- Coin Show Radio – The oldest of the numismatic-related podcasts. The Hosts, Mike & Matt, have a little fun bringing the news and talking coins.

- CoinWeek Podcast – Although it has been around a while, I keep forgetting to subscribe when I pick up my phone, so I did it now. I will let you know what I think at some point.

- Coin World Podcast – The newest entry in the numismatic-related podcast world has become one of my favorite podcasts. One of the reasons to listen to this podcast is for the interviews. Jeff Stark and Chris Bullfinch are good interviewers and deserve a listen.

That should keep you busy for a while. Next time, I will look at other resources.

BOOKMARKS

Do you want to add these links to your browser’s bookmarks? Right-click (or Mac users can CTRL-Click) on the button to the right and select whatever option your browser requires to save the file to hard drive. Import the file as an “HTML Bookmark” file to add these links to your browser’s bookmarks.

Dec 30, 2019 | news, technology

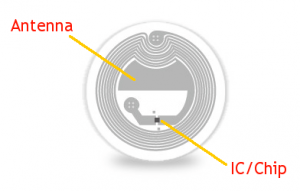

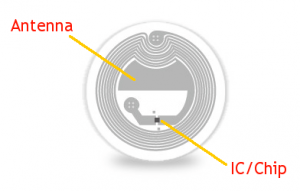

PCGS plans to place an NFC chip under their labels. (PCGS Image)

Coin World wants to join the sticker craze and add one to your NGC or PCGS slabbed coin. PCGS is offering a similar technology under the label.

Both services will use something called Near Field Communication (NFC). NFC is a technology based on low-frequency communications where a transmitter emits a signal when activated by a reader.

Although NFC is not a new technology, it had gained interest when Apple announced that the latest iPhones had programmable NFC hardware. The NFC capabilities built into prior versions of the iPhone were not accessible outside of Apple’s applications running on the phone.

You may have used NFC without your knowledge. All contactless payments like Apple Pay, Google Pay, and the tap-to-pay credit cards require NFC. Many department stores are using they call smart tags, which are tags with an NFC chip embedded in them. Aside from electronic payment, contactless keycards, sometimes called proximity cards, are used to access restricted areas are NFC-based technologies.

One Example of an NFC Tag

Like every technology, NFC is not perfect. Its most significant risks come from the use of NFC tags. These low-power devices have limitations that have allowed hackers to defeat whatever features they are supposed to protect.

The security concerns do not consider privacy issues. Do you trust PCGS or Coin World with the data they claim to be keeping? Do you trust that this data will not be for sale under any circumstances? Do you trust that there are sufficient protections in place to prevent others from hacking the NFC antenna that will allow you to be tracked?

In my past life in information security, I had the opportunity to test the security of these wireless communications. As part of the test, I was able to walk out into the parking lot and open car doors without access to the keys. Unfortunately, the principles I used in that demonstration are the same that others have used to hack NFC.

As we head into 2020, I plan to discuss the impact of NFC from the perspective of someone who used to look at this stuff for a living and had to explain it to non-technical people.

And now the news…

December 23, 2019

Most years, at least, a nickel produced that same year would show up in pocket change somewhere between late winter and mid-summer.Not in 2019. I even purchased two rolls of nickels from a bank in …

→ Read more at

ottawacitizen.com

December 25, 2019

TAIPEI (Taiwan News) — Tainan City police have arrested a woman suspected of smuggling in fake Taiwanese currency from China with the intention of disturbing the economic system on the island. According to Liberty Times, the police received a report from an owner of a claw machine who claimed that someone had been inserting fake NT$50 coins into the drop-and-grab machine.

→ Read more at

taiwannews.com.tw

December 26, 2019

Local News Posted: Dec 26, 2019 / 11:10 AM MST / Updated:

→ Read more at

krqe.com

December 26, 2019

The recent introduction of GHC 100 and GHC 200 new currency denominations has left many thinking about the nation’s one pesewa coin, which has gone into oblivion. Background It is common knowledge that, when currencies are introduced, they are well received by the people who are keen to hold them sometimes in admiration of the mere design amidst criticism of the colours and the features used.

→ Read more at

myjoyonline.com

December 28, 2019

The United States Mint has announced that new reverse designs will be coming to the popular American Silver Eagle (ASE) and American Gold Eagle (AGE) coins in 2021, marking the end of the popular “family of eagles” reverse design by renowned sculptor Miley Tucker-Frost from the original 1986 gold coin series.

→ Read more at

newsmax.com

December 28, 2019

Following heated debates in Crown Heights over a recently minted coin, we bring you a halachic exploration of the topic from the Ami Magazine. The beis din column appears weekly in the Ami Magazine.

→ Read more at

anash.org

December 28, 2019

When a handy, capable soldier truly loves a woman, he can fashion something beautiful out of practically anything.

→ Read more at

djournal.com

Sep 3, 2019 | ANA, coin design, coins, commentary, education, technology, US Mint

Although it has been a while since I have posted something outside of the Weekly World Numismatic News, it does not mean that I have been idle. Here are some random thoughts:

2019 Glenn B Smedley Medal

ANA President Steve Ellsworth asked me to continue as Chair of the Technology Committee. I accepted his appointment. Steve has a different vision for how to move forward. Change is a good thing and will work with him and the Board to do what is best for the ANA.

There continues to be work to do for the ANA to add technology to the numismatic experience. One of the areas I would like to include more technology are the exhibits. After speaking with one person familiar with the exhibiting process, I think there are ways to add technology without technology overshadowing the numismatic content. I will have a proposal shortly. Stay tuned.

2007 Somalia Motorcycle Coins

I love these coins but is this the direction the U.S. Mint should go?

There are many collectibles whose values have declined over the last year, including some collector coins. One area that remains low are those collector sets produced by the television hucksters or the private mints. These firms overhype the value of their wares to convince buyers that they should purchase them as an investment. Recently, I handled an estate with several items purchased from QVC and the Franklin Mint. All of the coins were overpriced. The family was upset when I provided my valuation. I will talk about this more in a future post.

Another article idea that is inspired by my business is the difference between collecting and investing. Although some people like to try to mix the two, most of the time, the result is that the investor does not create a compelling collection while most of the collectors create value without trying.

I sold my silver Pandas. I lost interest after the composition was changed but the hype has kept the prices up. Hype is not a long-term strategy.

Finally, I am still waiting to find a “W” quarter in change. I have yet to see one. Most of the people I know that are looking for these quarters are roll hunting. If I were into conspiracies, I would suggest that the Mint did this on purpose to increase the demand for quarters. People would demand rolls of quarters, forcing the Federal Reserve to order more.

Considering the U.S. Mint is a government agency, I bet they are storing most of the quarters in Area 51! After all, if we are going into conspiracy theories, we might as well go all of the way!

Aug 19, 2019 | ANA, coins, commentary, technology

This past week the World’s Fair of Money was held in Rosemont, just outside of Chicago. I wish I knew more of what happened, but the coverage of the show was its usual light to non-existent.

This past week the World’s Fair of Money was held in Rosemont, just outside of Chicago. I wish I knew more of what happened, but the coverage of the show was its usual light to non-existent.

For years, I have been calling for the ANA to broadcast from the convention. For many years, I have been saying that when the collector cannot go to the show, the show must go to the collector. Nearly every other industry that holds a significant show finds ways of broadcasting part of the show to people who cannot attend.

One of the reasons I could not be at the World’s Fair of Money was because I was attending two seminars from another show. These were classes that are required so that I can become a licensed appraiser. Rather then travel to the show, I was able to view these seminars as they occurred. The conferencing software also allowed me to ask questions.

For next year’s show, I would like to see the ANA start to broadcast the Money Talks programs. All business-related items like the meeting of the Board of Governors session could appear on a live stream. Let’s start with that before I go into the rest of my wishlist.

And now the news…

August 10, 2019

The Royal Mint has revealed no new 1p or 2p coins were struck over the last year. Is the future of copper coins under threat again?  → Read more at which.co.uk

→ Read more at which.co.uk

August 12, 2019

The government’s latest wheeze to convince us that Brexit means Brexit was announced this weekend. Sajid Javid is drawing up plans for millions of 50p coins to be issued when the UK leaves the EU later this year.  → Read more at independent.co.uk

→ Read more at independent.co.uk

August 14, 2019

To ensure you the best experience, we use cookies on our website for technical, analytical and marketing purposes. By continuing to browse our site, you are agreeing to our use of cookies.  → Read more at antiquestradegazette.com

→ Read more at antiquestradegazette.com

August 15, 2019

Sen. Roy Blunt wants a commemorative coin to honor Negro League Baseball when it celebrates its 100 year anniversary in 2020. The Missouri Republican talked about his coin push during a tour of the Negro Leagues Baseball Museum in Kansas City, Missouri, this week.  → Read more at rollcall.com

→ Read more at rollcall.com

August 15, 2019

A woman from Asten found a very peculiar coin when she emptied out her purse after her vacation on Wednesday. A 2-euro coin, with the image of Princess Beatrix on it, that had also been minted with an image of an eagle with a swastika under it, De Gelderlander reports.  → Read more at nltimes.nl

→ Read more at nltimes.nl

Apr 2, 2019 | commentary, review, technology

Did you hear? Coin World started a podcast.

Did you hear? Coin World started a podcast.

I found out in one of their multiple daily email blasts that Coin World is producing a podcast starring Chris Bulfinch and Jeff Starck.

A professionally produced podcast that is regularly published for the hobby is a good idea. I would become a listener but it is not possible. The podcast is not in the Apple Podcast directory and only available on directories other than Apple including Spotify, Stitcher, or TuneIn.

Aside from not having enough room on my iPhone for another app, I have a lot of time invested in my chosen podcast app that is configured to work with my weird listening schedule.

Why did Coin World make this decision? Shouldn’t they want to reach as many people as possible? After all, there are approximately 97.2 million iPhone users in the United States. That is approximately 47-percent of the smartphone market. And some research suggests that approximately two-thirds of podcast listeners use an Apple device. That is a lot of people to exclude!

Time and again it seems that when numismatics does something to try to reach beyond its borders using technology, the attempt reminds me of the 1971 kitschy movie The Gang that Couldn’t Shoot Straight. In this case, Coin World shot itself in the foot.

ADDENDUM: After I wrote this and queued it for posting, I went back to the announcement page on Coin World’s website and looked at the HTML source behind the page. I found the URL of the RSS feed that my podcast app could use to subscribe.

Even though I found the URL, I deconstructed the page to find where the link was hiding. Yes, it is hidden.

To find the link, you have to hover your mouse over the embedded podcast player on their webpage so that the controls appear. Click on the share button to the far right to bring up a share panel. There is a button that says “Get the RSS Feed.” Clicking on that will bring you to the feed.

Or you can just use https://feeds.buzzsprout.com/273189.rss.

Click on the share button? Really? Now that’s really intuitive!

Coin World is using Buzzsprout as their hosting service. There is nothing wrong with Buzzsprout although its embedded podcast player’s UX (user experience) leaves much to be desired. However, Buzzsprout is a well-rated service for podcast hosting.

Then again, Coin World should have read Buzzsprout’s “How to Make a Podcast” guide. Step 6 on their list is “Get listed in Apple Podcasts, Google Podcasts, and Spotify.” After all, it says “Listing your podcast in these directories will ensure that people can find your podcast when they search for it. Getting into these directories is the most important step in marketing your podcast.”

Coin World should have considered their overall UX when doing this. It’s an amateur’s mistake!

There once was a time that Coin World’s parent company, Amos, had a good technical group that was there to help the Amos properties but was also doing consulting. These were the people who were brought in to help get the improved money.org off the ground. The people we worked with were very intelligent.

Unfortunately, Amos did not retain this group following the issuing of the money.org request for proposal (RFP). These smart people went their separate ways. I hope they all have had a lot of success after leaving Amos. But for Coin World, it is too bad because this is a time when it seems that this they could have used expert assistance.

Jul 21, 2018 | cash, coins, commentary, currency, markets, technology

With the discovery of every new technology, there are the inevitable predictions that it will make the old ways obsolete. Although the automobile reduced the reliance on horses, the basics of the internal combustion engine have not changed in over 100 years. Take away the electronics around the engine, the technology increasing the air intake, and cleaning up the exhaust, and you still have an engine block with pistons that go up and down in the classic suck-bang-blow rhythm that was used in the Model T.

With the discovery of every new technology, there are the inevitable predictions that it will make the old ways obsolete. Although the automobile reduced the reliance on horses, the basics of the internal combustion engine have not changed in over 100 years. Take away the electronics around the engine, the technology increasing the air intake, and cleaning up the exhaust, and you still have an engine block with pistons that go up and down in the classic suck-bang-blow rhythm that was used in the Model T.

The latest technology that is being touted as being the doom for physical money, which can also be the end of numismatics, is cryptocurrency.

There are two aspects of cryptocurrency that its fans say are its biggest strength. First, it is not bound by the traditional means of generating wealth. You can think of cryptocurrency as digital gold. It is mined using computers and a lot of complex arithmetic to generate one unit of the currency, sometimes referred to as a bitcoin. Like physical gold, there is some work required to mine for these bitcoins. It lies in the ability to create a computing environment capable of performing these intensive mathematical operations. You may not be panning for gold but you might spend as much on equipment and travel.

The other aspect about cryptocurrency is that the blockchain technology allows for both anonymous and secure transactions. Think of the blockchain as a giant ledger that is copied wherever bitcoin is accepted with regular updates. There is no single source that could control the ledger nor is there a single point of failure.

However, both its strengths are its greatest weaknesses.

While the value of money is regulated by their respective government there are no blockchain regulations. There is no regulation on the number of generated bitcoins but is arbitrarily set by the creator of the cryptocurrency. There is no guarantee of value as a state-sponsored currency. Bitcoin investors are betting on the value of electronics and math, something many of these investors does not fully understand.

The blockchain also provides its own problems. In order to use the cryptocurrency, you have to have your own copy of the ledger and be able to pass the information to the party you want to pay. Think about having a checkbook with everyone’s information. You cannot read the information because it is encrypted but you have to have a copy. Then you need to pay someone. You hand over the checkbook in order to complete the transaction.

Think about the amount of data that would be if the blockchain supported 1,000 people. What would it take to support 1 million people? What if the government decided that everyone would do their business in bitcoin and everyone would have to have a way to deal with the blockchain in order to facilitate payments. How cumbersome will that ledger be if all 325.7 million people in the United States had to carry that around?

Each blockchain is its own entity. While you can trade in bitcoins on the same blockchain, you may have to participate in more than one blockchain if you want to accept bitcoins from several different people. It is like different currencies today. I can go anywhere in the United States and use dollars. But if I wanted to go to Canada, I can either arrange an exchange or find someone who will trade.

Cryptocurrency that has to operate across different blockchains is just like going to Europe and having to change your dollars for euros.

As with anything that is computer-based and managed, there is always the security issues. Blockchains have been hacked. Although most of the hacks are based on compromised passwords, each hack yields millions of dollars in stolen cryptocurrency to the hackers and everyone who then does business with them on the same blockchain.

Eventually, this will lead to a cryptocurrency version of a Bank Note Reporter and Counterfeit Detector as was popular during the broken banknote period. Then it will be followed by a Cryptocurrency Act similar to the Currency Act that ended the broken banknote period proving George Santayana right as we repeat history.

Cryptocurrency is the darling of the technology industry and those in the financial industry that trade in high-risk investments. Even traditional financial services companies are spending a limited amount of risk capital on cryptocurrency investments. However, by all statistics, the number of consumers using cryptocurrency for transactions is less than 1-percent.

If Not Cryptocurrency The What About Credit Cards

Credit and debit cards remain the primary target that proponents of a cashless society use to promote their agenda. However, when faced with the realities of life in the United States, there are three statistics that work against their arguments:

- The Bureau of Engraving and Printing, the printer of United States currency, reports a year-over-year increase in production of just over 4-percent.

- The U.S. Mint, the manufacturer of United States coinage, is reporting a year-over-year increase of 6-percent striking circulating coinage.

- According to CreditCards.com, “In 2013, 20 percent of whites did not have access to a credit card compared with 47 percent of African-Americans and 30 percent of Latinos.”

The primary customer for the Bureau of Engraving and Printing and U.S. Mint is the Federal Reserve. If the Federal Reserve needs the money for its operations, they buy it from these government bureaus. The Federal Reserve only orders what it needs. If it does not need the money, then it is not produced.

Aside from the over 50-percent of the population without access to credit cards, there continues to be a demand for physical currency. Whether the currency is used in a vending machine or to buy other items, cash is still king and shows no sign of slowing.

While there continues to be a demand for the products from the U.S. Mint and Bureau of Engraving and Printing, these bureaus will continue to produce coins and currency giving us more opportunity to collect their products.

A news item popped up that announced a dealer is selling Non-Fungible Tokens (NFT) for 13 rare ancient coins. Following the news, collectors ask if NFTs should be part of numismatics.

A news item popped up that announced a dealer is selling Non-Fungible Tokens (NFT) for 13 rare ancient coins. Following the news, collectors ask if NFTs should be part of numismatics. → Read more at artnews.com

→ Read more at artnews.com

→ Read more at einnews.com

→ Read more at einnews.com

Following the debacle that became of the online ordering process for the End of World War II 75th Anniversary American Eagle Coins, the U.S. Mint issued a statement on social media. On Twitter, the U.S. Mint posted in a series of tweets that read:

Following the debacle that became of the online ordering process for the End of World War II 75th Anniversary American Eagle Coins, the U.S. Mint issued a statement on social media. On Twitter, the U.S. Mint posted in a series of tweets that read:

With most of the country in some a state of quarantine, there may be time to expand our numismatic knowledge. Collecting can be fun, but learning about your collection will give it more meaning.

With most of the country in some a state of quarantine, there may be time to expand our numismatic knowledge. Collecting can be fun, but learning about your collection will give it more meaning.

This past week the

This past week the  Did you hear? Coin World started a

Did you hear? Coin World started a  With the discovery of every new technology, there are the inevitable predictions that it will make the old ways obsolete. Although the automobile reduced the reliance on horses, the basics of the internal combustion engine have not changed in over 100 years. Take away the electronics around the engine, the technology increasing the air intake, and cleaning up the exhaust, and you still have an engine block with pistons that go up and down in the classic suck-bang-blow rhythm that was used in the Model T.

With the discovery of every new technology, there are the inevitable predictions that it will make the old ways obsolete. Although the automobile reduced the reliance on horses, the basics of the internal combustion engine have not changed in over 100 years. Take away the electronics around the engine, the technology increasing the air intake, and cleaning up the exhaust, and you still have an engine block with pistons that go up and down in the classic suck-bang-blow rhythm that was used in the Model T.