In last Sunday’s Weekly World Numismatic News, it opened with a discussion about how gold and silver were doing in the current market. While researching the data, the indication was that physical bullion and electronic purchases were driving the markets. Bullion coins were not a factor.

In last Sunday’s Weekly World Numismatic News, it opened with a discussion about how gold and silver were doing in the current market. While researching the data, the indication was that physical bullion and electronic purchases were driving the markets. Bullion coins were not a factor.

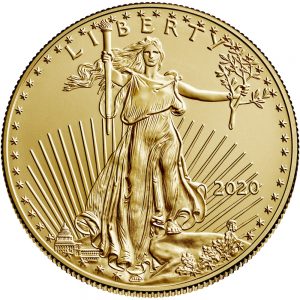

On Monday, Bloomberg News published an article that suggested otherwise. The article notes that retail buyers of gold are paying up to $135 per ounce above spot prices. An analyst interview for the article said, “There has never been a time for American Gold Eagles at this premium level.”

A call to a trusted source explained the differences in the reporting.

Last year, gold hit a low of $1,269 per troy ounce. With good economic indicators, investors thought that the prices would continue to fall. The market did not see value in buying a declining asset. Sellers were hoarding their stock until prices became more favorable.

The lack of buying, especially by retail investors, left dealers with a lot of inventory. With inventory building, dealers did not buy additional coins from the U.S. Mint’s dealers. As the prices rose, sellers started to sell their gold coins adding to the inventory.

Then came the coronavirus pandemic.

Markets hate uncertainty. The coronavirus pandemic has made uncertainty the only certainty. Not knowing where to turn, many sources are reporting significant gold sales. Where the reports differ is the source of the gold.

Although sources confirm that physical bullion and warrants are producing the highest volumes, they say it is because the investors cannot find enough bullion coins to satisfy market demands. The markets adjusted.

The demand increased when the U.S. Mint temporarily closed the West Point Mint. While the reaction did not rise to panic-like levels, retail gold buyers sought bullion coins, primarily American Gold Eagles, with greater urgency.

Professional investors are buying bullion and other gold products, including classic United States gold coins. The retail demand for American Gold Eagle coins has driven up the price. As the price for Eagles rises, it has driven up the cost of other bullion coins, including the Canadian Maple Leaf and Krugerrand.

When considering the purchase of gold coins, keep the spread in mind. If you purchase gold coins with a $150 premium over spot, to ensure that your investment generates a return, the bid price has to raise $150 plus whatever premiums dealers place on the coins. It might require the price of gold to rise $200-255 per troy ounce to break even.

Investors thought that the supply would ease with the Royal Canadian Mint resuming processing of bullion. However, in the beginning, the Royal Canadian Mint will produce large gold bars to satisfy orders from central banks so they can settle on accounts. They will also be striking silver Maple Leaf bullion coins.

Some reports suggest that most of the early production of silver coins will stay in Canada.

After discussing the markets with three different analysts, the only certainty is uncertainty. Each had an opinion that differed from each other but agreed that someone is going to make money.

One man’s “large premiums for physical coins” (gold bugs and silver stackers) is another man’s “failure of the coin market to capitulate to the new reality” (me and other economists). People who hold physical coins in inventory want to wait until markets normalize before selling. What if there is a new normal? This happens every time bullion products take a downward tumble.