Dec 19, 2021 | Britain, coins, gold, silver

It is the time of year for retrospectives, looking back on the good and bad of the past year. But there is still time left in the year, and there is still news to cover.

It is the time of year for retrospectives, looking back on the good and bad of the past year. But there is still time left in the year, and there is still news to cover.

Breaking late in the week, a Royal Proclamation passed to create a 50 pence coin to celebrate the 100th Anniversary of the British Broadcasting Company. The BBC was founded and made its first broadcast in 1922 on the recommendation of the General Post Office, which had problems managing broadcast licenses.

Gold has been hovering between $1760 and $1810 for the last two months. Although the gold spot price is close to the $1900 that some have predicted for the year-end price of gold, the $28 prediction of silver will fall short.

Silver has been on a steady fall since hitting $30 in February. Earlier in the year, the pandemic caused the closing of mines and processing facilities. The advancement of COVID-19 vaccines allows facilities to ramp up processing, and the increased supply allows prices to fall.

There are two weeks left in 2021 and time for more news.

And now the news…

December 16, 2021

If you like seeing ancient coins and understanding history through the coins, then Aloyseum, a museum at St Aloysius College in Mangaluru, is the place for you. Nearly 1,328 coins from 82 countries are on display.

→ Read more at

deccanherald.com

December 16, 2021

MANILA, Philippines – The decision of the Bangko Sentral ng Pilipinas (BSP) to exclude World War II heroes from the new P1,000 polymer banknotes met outrage from Filipinos. Descendants of Josefa Llanes Escoda, Vicente Lim, and Jose Abad Santos urged the BSP to keep the martyrs’ portraits and place the Philippine eagle – or other plants and animals the central bank wants to feature – on the other side of the bill.

→ Read more at

rappler.com

No news this week.

Jun 8, 2021 | auction, coins, gold

On June 8, 2021, Sotheby’s auctioned the Stuart Weitzman Collection. The auction consisted of three of the rarest items in the world, including the Farouk-Fenton 1933 Saint Gaudens Double Eagle. It is the only 1933 Double Eagle coin that anyone who can afford it can legally own.

The coin sold for $18,872,250!

Although not confirmed by Sotheby’s, the price realized suggests that it includes the buyer’s premium. Sotheby’s has not disclosed the buyer’s name.

Farouk-Fenton 1933 Saint-Gaudens $20 Double Eagle was sold by Sotheby’s for $18,872,250 in a June 2021 auction.

(Picture Credit: PCGS)

Arguably, the most famous coin in the world, the price was over the auction estimate of $10-15 million but under what the numismatic industry expected. The price is significantly more than the $7,590,020 paid in 2002 for the coin, including $20 to monetize the coin officially. The auction included the U.S. Mint’s monetization certificate.

U.S. Mint’s Certificate of Monetization for the Farouk-Fenton Double Eagle (Picture Credit: Sotheby’s)

Also included in the auction was The Inverted Jenny Plate Block sold for $4,860,000 (estimated at $5-7 million), and The British Guiana One-Cent Black on Magenta stamp that sold for $8,307,000 (estimated at $10-15 million).

Numismatists may want to save the catalog link for the sale of this coin. Sotheby’s catalog listing includes the coin’s history with an updated history of the other 1933 Double Eagle coins. The update includes the ten coins “discovered” by Joan Langbord, daughter of Israel Switt, and her family’s fight to retain ownership. Documentation from court filings adds to the story.

David Tripp wrote the original catalog description for the first Sotheby’s/Stack’s auction. In 2004, Tripp published his research in Illegal Tender. Given the new information, would it be worth updating the book?

Apr 12, 2021 | coins, gold, news

Some can make an argument to call the Farouk-Fenton 1933 Saint-Gaudens Gold $20 Double Eagle coin the most famous coin in the world. Although other coins have surpassed it in price since Stuart Weitzman purchased it in 2002, its legend lives beyond any other coin.

The story of the coin spans families, generations, continents, court cases, and was almost destroyed in the World Trade Center on September 11, 2001. Its story was told in two excellent books and the revealing of the coin’s current owner made international headlines.

Now, the world’s most famous coin has been certified, graded, but not entombed in plastic. Sotheby’s requested the grading and certification for the coin and asked that the coin not be slabbed. PCGS graded the coin and provided an image certification. They also announced that the new owner could submit the coin for holdering after the auction.

Although certification is necessary for some coins in this day of counterfeits, there are some coins whose importance goes beyond the need to entomb them in plastic away from the world. The last legal tender gold coin from the time Franklin D. Roosevelt withdrew gold from the market is one of those coins.

There have been other famous coins displayed in slabs that give them a lonely feel. Looking at any of the five 1913 Liberty Head Nickels makes it seem like it’s trapped instead of proudly standing, showing off its fascinating story. The same fate awaits the 1933 Double Eagle should its next owner decide the plastic is more important than the coin.

For the sake of allowing the legend to live, I hope the next owner decides not to hide this coin in plastic and allows the world to celebrate its story and beauty.

And now the news…

April 5, 2021

A magnified view of corrosion on one of the medieval Islamic coins being examined and restored by the Louvre Abu Dhabi.Department of Culture and Tourism – Abu Dhabi In a newly acquired cache of more than 2,800 coins dating to Islam’s medieval era, the Louvre Abu Dhabi not only has a bounty for its permanent collection, but also signposts on the road map of early Islam, all coated in tarnish, corrosion and the mystery of history.

→ Read more at

nytimes.com

April 6, 2021

A 17th-century Arabian coin discovered by Jim Bailey. Courtesy of the American Numismatic Society via Flickr.

→ Read more at

news.artnet.com

April 7, 2021

This gold "Memento Mori" ring, dating to the Tudor period, sports an enamel skull.

→ Read more at

livescience.com

April 9, 2021

If the infamous rum-soaked Jack Sparrow of Pirates of the Caribbean dropped some of his pocket change while drunkenly dancing around when he was supposed to be pillaging and plundering, what would you expect to find 325 years later?

→ Read more at

syfy.com

If you like what you read, share, and show your support

Mar 12, 2021 | auction, coins, gold

1933 Saint Gaudens Double Eagle (obverse).

Last sold for $7,590,020 in 2002.

Weitzman continued to design shoes with unique designs and materials not used before. He was creating one-of-a-kind designs for stars to wear on the red carpet. Top stars and models consider Stuard Weitzman shoes the must-have accessory to any designer outfit.

Weitzman collected stamps as a child. As he collected, Weitzman became fascinated with very rare stamps. Although his collection is modest in size, it consists of two rarest stamps, the only surviving British Guiana One-Cent Magenta stamp and the 1918 24-Cent Inverted Jenny Plate Block stamps. Sotheby’s will be selling both stamps in an auction on June 8, 2021.

As part of the auction announcement, Sotheby’s revealed that Weitzman was also selling the only 1933 Saint Gaudens Double Eagle gold coin that is legal to own. It is the first time the identity of the coin’s owner is publicly known.

Stuart Weitzman was the winning bidder of the Sotheby/Stack’s auction held on July 30, 2002, held at the Sotheby’s headquarters in New York City. When the hammer fell, Weitzman anonymously purchased the coin for $6.6 million plus a 15-percent buyer’s premium. Sotheby’s famously paid the $20 face value to the U.S. Mint to monetize the coin. The final sale price was $7,590,020. At the time, it was almost twice the previous record paid for a coin.

Although there are other one-of-a-kind coins, none have the same story as the 1933 Farouk-Fenton Double Eagle. It is a unique story that could only be born out of the circumstances of the Great Depression and the documented corruption at the Philadelphia Mint.

The coin and stamps will be on public view by appointment at Sotheby’s in New York until March 17 and June 5-7.

The Double Eagle and British Guiana stamp carries a pre-auction estimate of $10-15 million. The Inverted Jenny is estimated to be worth $5-7 million.

I expect the sale of the coin will break the record for the price of a single coin. The coin is likely to sell for more than $12 million, including the buyer’s premium.

Auction preview video courtesy of Sotheby’s

If you like what you read, share, and show your support

Mar 9, 2021 | gold, history

Sometimes, finding a link to a page that describes what things were like the year you were born can lead to educational and fun reading.

Sometimes, finding a link to a page that describes what things were like the year you were born can lead to educational and fun reading.

A friend sent a link to an October 2020 article on Stacker titled “Cost of gold the year you were born.” Aside from finding out that gold broke the $35 barrier the year I was born, the article outlines economic history from 1920 to 2020.

Some of the descriptions also will help explain some of the numismatic decisions that affect collectors. Understanding the economic history behind money can help understand where collectibles are today.

While reading through the list, I picked out ten significant highlights of the last 100 years:

- 1932: The last year the U.S. Mint struck gold coins that were circulated

- 1949: Switzerland stops minting the 20 Franc gold coin, the last gold coin struck for circulation

- 1955: San Francisco Mint stopped coining operations (it would return 13 years later)

- 1967: South Africa introduces the Krugerrand

- 1975: Gold ownership made legal again

- 1979: Canada introduces the gold Maple Leaf

- 1982: China introduces the gold Panda

- 1985: Reagan signs the Gold Bullion Coin Act

- 1998: The euro is introduced

- 2000: The Denver Mint produced 15.4 billion coins, the most of any mint

Understanding history is another way to get more out of your collection.

Read! Educate! And collect!

Mar 8, 2021 | bullion, coins, gold, investment, markets, news, silver

Prices are rising.

Whether you talk about the price of groceries, gas, or collectibles, prices are rising. So are the price of the collectibles markets, including numismatics.

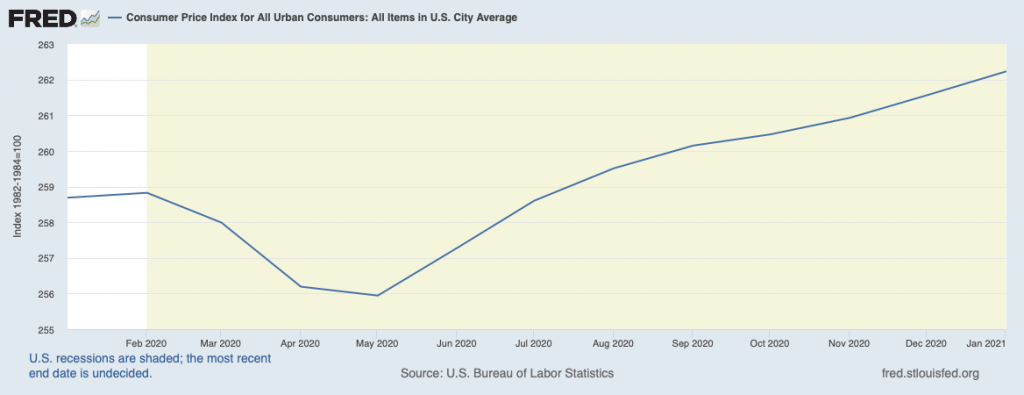

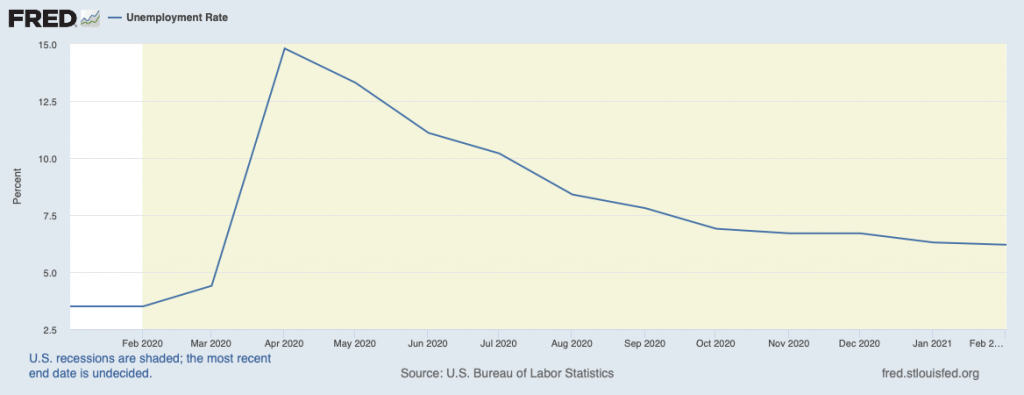

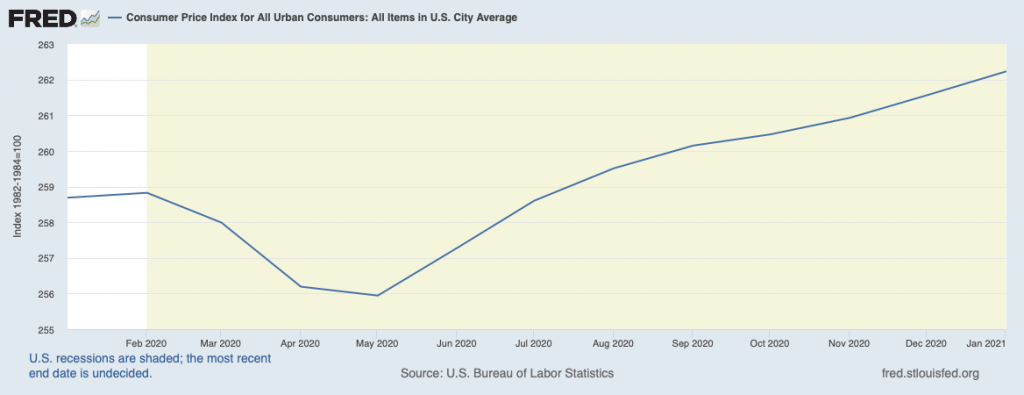

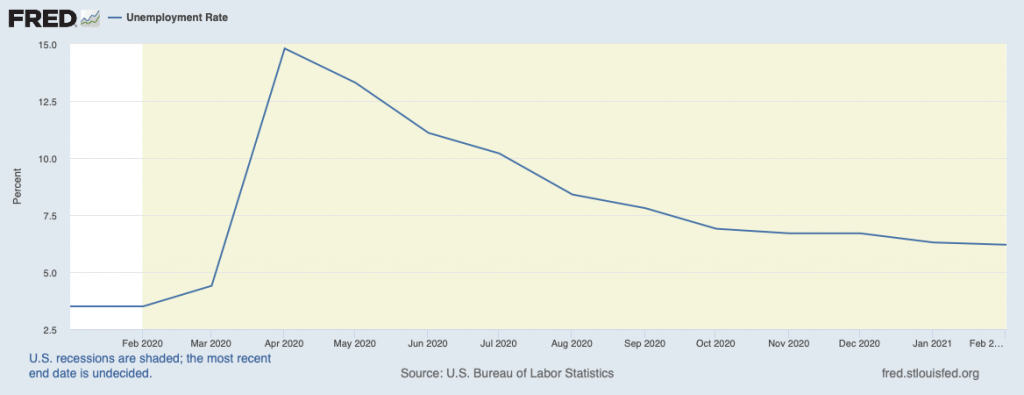

According to the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) has been steadily rising for six months. While the prices are rising, unemployment has dropped from the beginning of the pandemic high of 14-percent to the 6.2-percent rate, BLS recently announced.

-

-

Charting the Consumer Price Index during the pandemic

(Chart courtesy of the St. Louis Fed)

-

-

Charting the Unemployment rate during the pandemic

(Courtesy of the St. Louis Fed)

With all of this economic stress, why are collectibles, especially numismatics, are seeing rising prices?

An auction industry source said that there is a pent-up demand for something resembling normal. Instead of the everyday routine, those with means are buying. In the last six months, the industry reports that prices realized for all sectors have risen at rates higher than seen in many years. Estate auctions are attracting new customers looking for unique items.

Numismatics is in the middle of the trend, with collectors and investors looking for something to do. Collectors are spending more time with their collections and looking to expand. Investors see the rise in values because of the rise in precious metal prices and have driven the market higher.

-

-

One year gold spot price

(Graph courtesy of PCGS)

-

-

One year silver spot price

(Graph courtesy of PCGS)

One of the areas where the price changes are noticeable is in the markets for precious metals. While the spot price for gold and silver has been relatively steady, the numismatic spread for coins has climbed. Dealers are reporting that generic gold and silver for numismatic items increased over the last six months.

Price trends of coinage over the last year

(graphs courtesy of PCGS)

-

-

One year trend of generic gold coin prices

-

-

One year trend of Morgan and Peace Dollar prices

-

-

One year trend of 20th Century coin prices

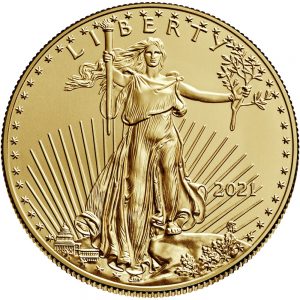

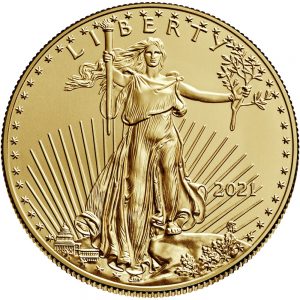

Several industry reports note a higher demand for physical ownership of precious metals, putting pressure on the markets. But rather than buying bullion, investors are purchasing coins. Demand for American Eagle products has outpaced many dealer’s abilities to purchase supplies. When bullion coins were not available, investors purchase coins produced for the collector market, including proof and special issues coins.

Recently, the U.S. Mint set a 99 coin limit when they released the 2021-W American Silver Eagle Proof coin with the original reverse. The coin sold quickly. When asked, the U.S. Mint claimed they did not have the statistics about the number of 99 coin purchases they fulfilled. Collectors report that they were shut out of coin purchases while dealers have been slabbing and selling the coins mostly to investors.

If the predictions are true, economists believe that there will be a roaring 2020s similar to the roaring 1920s following the Spanish Flu Pandemic. Considering the current trends, the secondary market for numismatics may make it too expensive for the average collector to participate in the market.

And now the news…

March 1, 2021

Some artists struggle to figure out ways to make money from their art. Not Christina Hess, a Philadelphia-based artist and chair of the illustration department at Pennsylvania College of Art & Design.

→ Read more at

lancasteronline.com

March 2, 2021

Most people have some coins lying around in their house somewhere, some people decide to keep them in a jar, and some may have quite a lot of them.

→ Read more at

tweaktown.com

March 2, 2021

At least 110 ancient gold coins were seized and a suspect was arrested in an anti-smuggling operation in southeastern Turkey, a security source said on March 1. Gendarmerie teams fighting organized crime in Şanlıurfa province raided the address of the suspect, who was learned to be smuggling historical artifacts, in Viranşehir district, said the source on condition of anonymity due to restrictions on speaking to the media.

→ Read more at

hurriyetdailynews.com

March 5, 2021

There has been strong interest in the international numismatic auction planned for Friday March 12 in Central Wellington. From a midday start, there will be more than 600 lots to auction, with participants bidding both in the room and online.

→ Read more at

scoop.co.nz

March 6, 2021

Artist Gary Cooper of Belfast used a 3D sculpting computer program to create the winning design for the commemorative coin that will mark the 50th anniversary of the 1969 Apollo 11 mission. Credit: Abigail Curtis / BDN

→ Read more at

bangordailynews.com

If you like what you read, share, and show your support

Feb 8, 2021 | bullion, gold, silver

If you missed the five-second commercial from Reddit after the halftime show, you missed their touting their service as a place to discuss things. Lately, Reddit has been famous for a sub-Reddit that helped promote the stocks of GameStop, AMC movie theaters, and BlackBerry. All companies whose business models have not kept up with technology or are suffering because of the pandemic.

If you missed the five-second commercial from Reddit after the halftime show, you missed their touting their service as a place to discuss things. Lately, Reddit has been famous for a sub-Reddit that helped promote the stocks of GameStop, AMC movie theaters, and BlackBerry. All companies whose business models have not kept up with technology or are suffering because of the pandemic.

An interesting aspect of this story is the Robinhood trading platform’s use to buy and sell these stocks. Robinhood is a no-commission trading service that many of the people participating in the sub-Reddit use to trade. Not only are they gaining free access to the markets, but they were able to cause significant losses amongst the large hedge funds. The hedge funds did not like losing money to what they considered non-professionals. The Reddit users called it the democratization of the markets.

Although these stocks have returned to more reasonable levels as compared to their earnings, people in the sub-Reddits are looking to make statements in other markets. One of the markets they are trying to work on is silver.

Precious metals continue to be a safe haven for uncertain markets. With the uncertainty of the markets and the Exchange Traded Funds (ETF) in the metals market and changes in some rules, investors demand access to physical metals.

Rather than buying bullion, investors are buying legal tender coins. Even with the high numismatic premiums on precious metals coins, they are reporting limited supply. The highest demand is for the American Silver Eagle and the Canadian Silver Maple Leaf. Both mints are reporting record production of these coins.

When an ETF creates its market basket of stocks, the exchanges require that each of the stocks have specific minimum holdings of physical metals to back the prices. ETFs are finding they have to rebalance their portfolios since the funds holding the metals are not increasing their holdings as much as the general public. Their lack of buying is keeping the price of metals stable.

Dealers are reporting that individual and smaller institutional investors are buying silver. Although these buyers do not impact the broader market, they are impacting the numismatic premium. People are paying upwards of 35 percent over the spot price.

The rules will prevent the Reddit mob from manipulating the metals markets. However, until there is more certainty in the market, there will continue to be a high numismatic premium for bullion coins.

And now the news…

February 4, 2021

• Silver keeps corrective pullback from $25.90 trapped in a $0.10 range off-late. • Premiums on American Eagle silver coins jump on Thursday, Apmex urges customers to expect delay in order processing.

→ Read more at

fxstreet.com

February 4, 2021

The Edge of the Cedars State Park Museum needs help identifying some BLM collections and a mystery coin.

→ Read more at

abc4.com

February 4, 2021

* More than 1.1 million troy ounces of silver sold in Jan * Selling everything that can be currently made in silver- Mint * Short-squeeze story boosted demand for physical silver-analyst

→ Read more at

kitco.com

February 5, 2021

A COIN collection has gone under the hammer for £2.3m with the latest sale bringing a world record price for one 450 year old Oliver Cromwell gold coin.

→ Read more at

gazetteherald.co.uk

If you like what you read, share, and show your support

Jan 10, 2021 | bullion, Eagles, gold, investment, markets, news, silver

The Weekly World Numismatic News return finds that although 2020 was a stressful year and 2021 has not started with a promise for improvement, the rare coin and paper money market appears healthy.

The Weekly World Numismatic News return finds that although 2020 was a stressful year and 2021 has not started with a promise for improvement, the rare coin and paper money market appears healthy.

Based on a survey of auction houses conducted by the Professional Numismatists Guild, they reported the total sales at auction to be over $419 million. With COVID-19 causing the cancellation of every major show, the auction moved online with success.

A consistent comment is that the auctions provided a means for collectors to liquidate all or parts of their collections to raise money during the pandemic. But for this type of sale to be effective, there have to be bidders to buy the coins. The buyers came.

HiBid, an online auction platform that supports many auction houses, has consistently reported weekly sales on the tens-of-millions of dollars. This year, HiBid reports that traffic to coins.hibid.com was their fastest growing platform.

Finally, with the stock markets soaring with the economic uncertainty growing because of the COVID-19 pandemic, the U.S. Mint saw the sale of American Eagle gold and silver coins increase dramatically. In 2020, the U.S. Mint sold 884,000 ounces of American Gold Eagle coins, increasing 455% from the 152,000 ounces sold in 2019.

The sale of American Silver Eagle coins doubled from last year by selling 30.01 million ounces of silver.

Since the U.S. Mint reports bullion coins more regularly than collector coin sales, those coins’ impact is not reflected in these numbers.

There are collectors out there. Unfortunately, they are not members of the American Numismatic Association or other numismatic organizations. Maybe the numismatic community should use this as a lesson to try to grow the hobby.

And now the news…

December 29, 2020

One face of the coin features a typical Cyberpunk 2077 scene with towering skyscrapers and hulking mega-structures looming over a souped-up motor vehicle. The coin’s flip side depicts a bust of Queen Elizabeth II, Press materials

→ Read more at

thefirstnews.com

January 4, 2021

Queen Elizabeth is just months away from a milestone birthday — and the U.K.'s Royal Mint is already celebrating. The Royal Mint unveiled five new commemorative coins for 2021, including a £5 coin to mark the monarch's 95th birthday in April.

→ Read more at

people.com

January 4, 2021

Kitco News has launched its 2021 Outlook, which offers the most comprehensive coverage of precious metals markets in the new year. Trillions of dollars were pumped into financial markets in 2020 and that won't come without consequences.

→ Read more at

kitco.com

January 4, 2021

A coin collection in a backroom of the Graveyard of the Atlantic Museum could one day reveal Outer Banks history

→ Read more at

pilotonline.com

January 8, 2021

With an alarming level of uncertainties across-the-board courtesy of the COVID-19 pandemic, coupled with a return to high market volatility and unprecedented global economic stimulus, investors are increasingly seeking alternative investment strategies.

→ Read more at

thearmchairtrader.com

If you like what you read, share, and show your support

Nov 2, 2020 | bullion, gold, news, silver

Here we are with the election on Tuesday. The numismatic-related news has some stories but nothing of significance. For bullion buyers, the metals market has been active. One analyst called the market schizophrenic while trying to figure out what economic conditions will be.

Another analyst that follows the silver market noted the decline of silver prices since September. Among the reasons is that early buyers of silver are looking to cash in on their holdings. Those who bought last year when the average price was around $18 per ozt have been looking to profit from the spot being over $22. When asked if the price of silver will decline, the response was to ask after the election.

-

-

60 Day Gold Chart ending 01-Nov-2020 — courtesy of Kitco

-

-

60 Day Silver Chart ending 01-Nov-2020 — courtesy of Kitco

Gold prices have been steadier but have shown a gradual decline since August. A gold analyst reminded me that gold is a safe haven for investors when markets are uncertain. This analyst did not think the markets will see certainty after the election. Their firm is telling clients that regardless of the outcome of the election, the lame-duck Congress will create a lot of infighting that will spill over into the markets.

The value of many modern collector coins is dependent on the value of the metals. Those coins will see their values fluctuate with the market. Unfortunately, none of the analysts consulted predicted stability in the market. They suggested that unless you had to sell that you might wait. One recommended setting a high and low price for buying and selling but would not recommend the spread.

Regardless of what you choose to do with your investment coin, be prepared for a bumpy ride because none of the analysts would predict any stability for the next six months.

And now the news…

October 24, 2020

For almost three thousand years, humans have been using coins as payment. As that winds down in an increasingly cashless world, let’s take a look at how the Vikings dealt with money.

→ Read more at

lifeinnorway.net

October 25, 2020

A man with a metal detector has found a long-hidden, 222-year-old coin under a few inches of soil outside a church in Maine. Shane Houston, of Charlotte, North Carolina, was on a metal-detecting trip with a friend from New Hampshire when he found the coin earlier this month, the Bangor Daily News reported.

→ Read more at

wbtv.com

October 27, 2020

A rare King Harold II coin dating from 1066 that was found by a metal detecting teenager has made £4,000 at auction.

→ Read more at

bbc.com

October 27, 2020

The Bank of Lithuania minted the first euro piece of currency containing Hebrew letters. The 10-euro coin was minted on Tuesday and is a limited-edition commemorative collector’s item celebrating the 300th anniversary of the birth of the Vilna Gaon, the 18th-century rabbinical luminary Elijah ben Solomon Zalman, who lived and died in the Lithuanian capital of Vilnius.

→ Read more at

jpost.com

October 29, 2020

Heartbreaking message behind new $2 Aussie coin. Source: Royal Australian Mint

→ Read more at

au.finance.yahoo.com

If you like what you read, share, and show your support

Jul 5, 2020 | gold, news

An article on Yahoo Finance asked the same question many have asked me: are the high premiums for physical gold a scam or a supply crisis?

An article on Yahoo Finance asked the same question many have asked me: are the high premiums for physical gold a scam or a supply crisis?

Gold is in high demand. As a safe haven for uncertain markets, the current markets have driven investors looking to have some stability in their portfolio. Some have suggested that the preppers, those who prepare themselves for a pending disaster, have been hoarding gold. A favorite among preppers is the small 1 gram through 10 gram gold bars because they will be more useful in daily transactions.

According to market analysts, the demand outpaced the available supply. The available supply is what is available to buy. The problem was that the pandemic caused many supply chains to break down with precious metals stuck somewhere and not being delivered to the buyers.

Another problem in the supply was the perception that the demand could not be satisfied after the West Point Mint’s temporary closing. Although the Philadelphia Mint stepped in to produce silver coins, the gold coin production stopped. Subsequently, there were conflicting reports on whether there was enough physical gold entering the supply chain or whether the gold was not getting to the sellers because of the pandemic.

During the shutdown, there were reports that gold mining slowed or stopped as travel became limited. It was also a problem when the major Swiss gold retailers had to shut down because of the quarantine since most as near the Italian border. While gold was available on the secondary market, perception became that if these retailers were closed, there would not be enough for the future. The uncertainty caused the gold buyers to increase their purchases.

One gold dealer reported that they had sufficient gold to satisfy the market but not in the form the customers wanted. The demand for American Gold Eagle exceeded their supply while the non-Swiss made bars were not selling. Customers that demanded Canadian Gold Maple Leaf coins were also disappointed but refused to buy gold coins from other European mints.

There is also no consistency between the premiums dealers charge. Some of the larger dealers use software to calculate the market price that examines other online sales to determine an average. Smaller dealers have said that they watch what the larger dealers are charging and adjust their premium below the average.

Nearly every analyst is bullish on the future of gold pricing. Being bullish on gold means that those watching the markets are not comfortable with the equities market’s stability. We can be in for a bumpy ride.

And now the news…

June 26, 2020

During the coronavirus crisis many people couldn’t find physical gold, as there was a bullion shortage at dealerships. And these lucky individuals who managed to obtain bullion had to pay high premiums.

→ Read more at

finance.yahoo.com

June 27, 2020

COLUMBUS — Letters to Gov. Mike DeWine urging him to grant clemency to Coingate central figure Tom Noe came with something that could help in any plan for the former Toledo area coin dealer to pay back the $12.7 million in taxpayer funding he still owes — job offers.

→ Read more at

toledoblade.com

June 27, 2020

In Vermont, the year 1927 is primarily remembered for the great flood in November – the most devastating event in the Green Mountain State’s modern history. But it was also the year of Vermont’s sesquicentennial, or 150th birthday. Although the event was marked with a pageant in Bennington on Aug. 16, there were other celebrations and remembrances of the founding of the Vermont Republic. There were also two commemorations that originated from the federal government in Washington, D.C.: the issue of a two-cent postage stamp and the minting of a silver coin.

→ Read more at

timesargus.com

June 29, 2020

EDMONTON — The Royal Canadian Mint released a special medal Monday meant to recognize the everyday heroes of the COVID-19 pandemic. The wearable recognition medal was designed as a symbol of gratitude for essential workers and others who have helped keep Canadians safe, healthy and connected through the COVID-19 crisis.

→ Read more at

edmonton.ctvnews.ca

June 30, 2020

A rare silver penny found in a field dating to 1150 and made out to a local Yorkshire baron rather than King John is due to be auctioned.

→ Read more at

yorkshirepost.co.uk

July 1, 2020

CHAMPLAIN — U.S. Customs and Border Protection officers assigned to the Champlain Port of Entry Cargo Facility recently discovered seven Sasanian coins being shipped into the United States. CBP officers assigned to the cargo facility encountered a shipment manifested as documents on June 2 and found nine unrecognizable foreign coins upon further inspection of the package, according to a press release.

→ Read more at

pressrepublican.com

It is the time of year for retrospectives, looking back on the good and bad of the past year. But there is still time left in the year, and there is still news to cover.

It is the time of year for retrospectives, looking back on the good and bad of the past year. But there is still time left in the year, and there is still news to cover. → Read more at deccanherald.com

→ Read more at deccanherald.com

→ Read more at rappler.com

→ Read more at rappler.com