Mar 8, 2021 | bullion, coins, gold, investment, markets, news, silver

Prices are rising.

Whether you talk about the price of groceries, gas, or collectibles, prices are rising. So are the price of the collectibles markets, including numismatics.

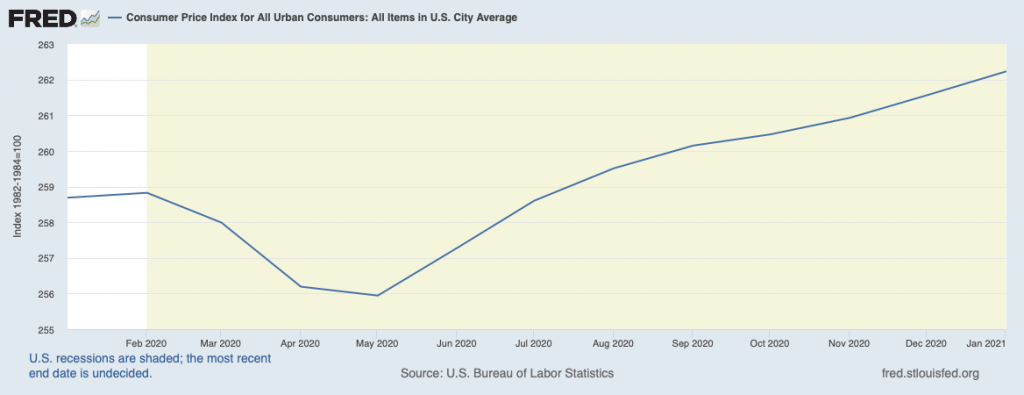

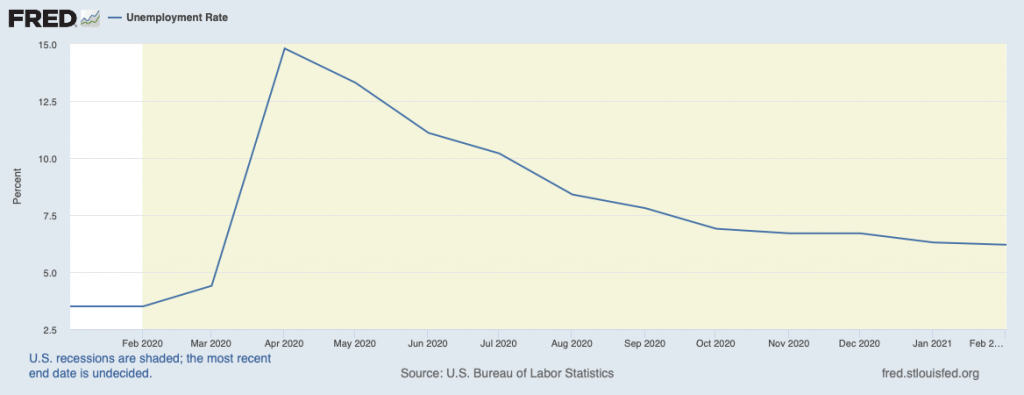

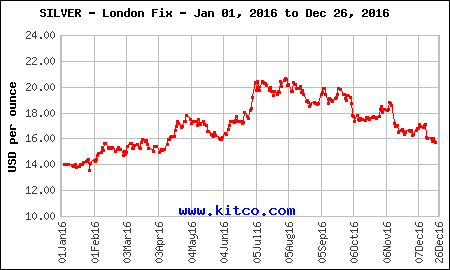

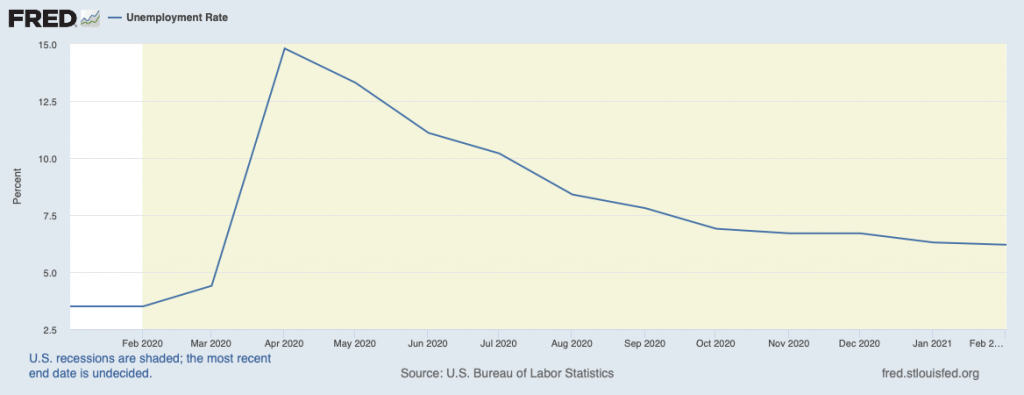

According to the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) has been steadily rising for six months. While the prices are rising, unemployment has dropped from the beginning of the pandemic high of 14-percent to the 6.2-percent rate, BLS recently announced.

-

-

Charting the Consumer Price Index during the pandemic

(Chart courtesy of the St. Louis Fed)

-

-

Charting the Unemployment rate during the pandemic

(Courtesy of the St. Louis Fed)

With all of this economic stress, why are collectibles, especially numismatics, are seeing rising prices?

An auction industry source said that there is a pent-up demand for something resembling normal. Instead of the everyday routine, those with means are buying. In the last six months, the industry reports that prices realized for all sectors have risen at rates higher than seen in many years. Estate auctions are attracting new customers looking for unique items.

Numismatics is in the middle of the trend, with collectors and investors looking for something to do. Collectors are spending more time with their collections and looking to expand. Investors see the rise in values because of the rise in precious metal prices and have driven the market higher.

-

-

One year gold spot price

(Graph courtesy of PCGS)

-

-

One year silver spot price

(Graph courtesy of PCGS)

One of the areas where the price changes are noticeable is in the markets for precious metals. While the spot price for gold and silver has been relatively steady, the numismatic spread for coins has climbed. Dealers are reporting that generic gold and silver for numismatic items increased over the last six months.

Price trends of coinage over the last year

(graphs courtesy of PCGS)

-

-

One year trend of generic gold coin prices

-

-

One year trend of Morgan and Peace Dollar prices

-

-

One year trend of 20th Century coin prices

Several industry reports note a higher demand for physical ownership of precious metals, putting pressure on the markets. But rather than buying bullion, investors are purchasing coins. Demand for American Eagle products has outpaced many dealer’s abilities to purchase supplies. When bullion coins were not available, investors purchase coins produced for the collector market, including proof and special issues coins.

Recently, the U.S. Mint set a 99 coin limit when they released the 2021-W American Silver Eagle Proof coin with the original reverse. The coin sold quickly. When asked, the U.S. Mint claimed they did not have the statistics about the number of 99 coin purchases they fulfilled. Collectors report that they were shut out of coin purchases while dealers have been slabbing and selling the coins mostly to investors.

If the predictions are true, economists believe that there will be a roaring 2020s similar to the roaring 1920s following the Spanish Flu Pandemic. Considering the current trends, the secondary market for numismatics may make it too expensive for the average collector to participate in the market.

And now the news…

March 1, 2021

Some artists struggle to figure out ways to make money from their art. Not Christina Hess, a Philadelphia-based artist and chair of the illustration department at Pennsylvania College of Art & Design.

→ Read more at

lancasteronline.com

March 2, 2021

Most people have some coins lying around in their house somewhere, some people decide to keep them in a jar, and some may have quite a lot of them.

→ Read more at

tweaktown.com

March 2, 2021

At least 110 ancient gold coins were seized and a suspect was arrested in an anti-smuggling operation in southeastern Turkey, a security source said on March 1. Gendarmerie teams fighting organized crime in Şanlıurfa province raided the address of the suspect, who was learned to be smuggling historical artifacts, in Viranşehir district, said the source on condition of anonymity due to restrictions on speaking to the media.

→ Read more at

hurriyetdailynews.com

March 5, 2021

There has been strong interest in the international numismatic auction planned for Friday March 12 in Central Wellington. From a midday start, there will be more than 600 lots to auction, with participants bidding both in the room and online.

→ Read more at

scoop.co.nz

March 6, 2021

Artist Gary Cooper of Belfast used a 3D sculpting computer program to create the winning design for the commemorative coin that will mark the 50th anniversary of the 1969 Apollo 11 mission. Credit: Abigail Curtis / BDN

→ Read more at

bangordailynews.com

If you like what you read, share, and show your support

Jan 10, 2021 | bullion, Eagles, gold, investment, markets, news, silver

The Weekly World Numismatic News return finds that although 2020 was a stressful year and 2021 has not started with a promise for improvement, the rare coin and paper money market appears healthy.

The Weekly World Numismatic News return finds that although 2020 was a stressful year and 2021 has not started with a promise for improvement, the rare coin and paper money market appears healthy.

Based on a survey of auction houses conducted by the Professional Numismatists Guild, they reported the total sales at auction to be over $419 million. With COVID-19 causing the cancellation of every major show, the auction moved online with success.

A consistent comment is that the auctions provided a means for collectors to liquidate all or parts of their collections to raise money during the pandemic. But for this type of sale to be effective, there have to be bidders to buy the coins. The buyers came.

HiBid, an online auction platform that supports many auction houses, has consistently reported weekly sales on the tens-of-millions of dollars. This year, HiBid reports that traffic to coins.hibid.com was their fastest growing platform.

Finally, with the stock markets soaring with the economic uncertainty growing because of the COVID-19 pandemic, the U.S. Mint saw the sale of American Eagle gold and silver coins increase dramatically. In 2020, the U.S. Mint sold 884,000 ounces of American Gold Eagle coins, increasing 455% from the 152,000 ounces sold in 2019.

The sale of American Silver Eagle coins doubled from last year by selling 30.01 million ounces of silver.

Since the U.S. Mint reports bullion coins more regularly than collector coin sales, those coins’ impact is not reflected in these numbers.

There are collectors out there. Unfortunately, they are not members of the American Numismatic Association or other numismatic organizations. Maybe the numismatic community should use this as a lesson to try to grow the hobby.

And now the news…

December 29, 2020

One face of the coin features a typical Cyberpunk 2077 scene with towering skyscrapers and hulking mega-structures looming over a souped-up motor vehicle. The coin’s flip side depicts a bust of Queen Elizabeth II, Press materials

→ Read more at

thefirstnews.com

January 4, 2021

Queen Elizabeth is just months away from a milestone birthday — and the U.K.'s Royal Mint is already celebrating. The Royal Mint unveiled five new commemorative coins for 2021, including a £5 coin to mark the monarch's 95th birthday in April.

→ Read more at

people.com

January 4, 2021

Kitco News has launched its 2021 Outlook, which offers the most comprehensive coverage of precious metals markets in the new year. Trillions of dollars were pumped into financial markets in 2020 and that won't come without consequences.

→ Read more at

kitco.com

January 4, 2021

A coin collection in a backroom of the Graveyard of the Atlantic Museum could one day reveal Outer Banks history

→ Read more at

pilotonline.com

January 8, 2021

With an alarming level of uncertainties across-the-board courtesy of the COVID-19 pandemic, coupled with a return to high market volatility and unprecedented global economic stimulus, investors are increasingly seeking alternative investment strategies.

→ Read more at

thearmchairtrader.com

If you like what you read, share, and show your support

May 1, 2020 | gold, investment, markets

In last Sunday’s Weekly World Numismatic News, it opened with a discussion about how gold and silver were doing in the current market. While researching the data, the indication was that physical bullion and electronic purchases were driving the markets. Bullion coins were not a factor.

In last Sunday’s Weekly World Numismatic News, it opened with a discussion about how gold and silver were doing in the current market. While researching the data, the indication was that physical bullion and electronic purchases were driving the markets. Bullion coins were not a factor.

On Monday, Bloomberg News published an article that suggested otherwise. The article notes that retail buyers of gold are paying up to $135 per ounce above spot prices. An analyst interview for the article said, “There has never been a time for American Gold Eagles at this premium level.”

A call to a trusted source explained the differences in the reporting.

Last year, gold hit a low of $1,269 per troy ounce. With good economic indicators, investors thought that the prices would continue to fall. The market did not see value in buying a declining asset. Sellers were hoarding their stock until prices became more favorable.

The lack of buying, especially by retail investors, left dealers with a lot of inventory. With inventory building, dealers did not buy additional coins from the U.S. Mint’s dealers. As the prices rose, sellers started to sell their gold coins adding to the inventory.

Then came the coronavirus pandemic.

Markets hate uncertainty. The coronavirus pandemic has made uncertainty the only certainty. Not knowing where to turn, many sources are reporting significant gold sales. Where the reports differ is the source of the gold.

Although sources confirm that physical bullion and warrants are producing the highest volumes, they say it is because the investors cannot find enough bullion coins to satisfy market demands. The markets adjusted.

The demand increased when the U.S. Mint temporarily closed the West Point Mint. While the reaction did not rise to panic-like levels, retail gold buyers sought bullion coins, primarily American Gold Eagles, with greater urgency.

Professional investors are buying bullion and other gold products, including classic United States gold coins. The retail demand for American Gold Eagle coins has driven up the price. As the price for Eagles rises, it has driven up the cost of other bullion coins, including the Canadian Maple Leaf and Krugerrand.

When considering the purchase of gold coins, keep the spread in mind. If you purchase gold coins with a $150 premium over spot, to ensure that your investment generates a return, the bid price has to raise $150 plus whatever premiums dealers place on the coins. It might require the price of gold to rise $200-255 per troy ounce to break even.

Investors thought that the supply would ease with the Royal Canadian Mint resuming processing of bullion. However, in the beginning, the Royal Canadian Mint will produce large gold bars to satisfy orders from central banks so they can settle on accounts. They will also be striking silver Maple Leaf bullion coins.

Some reports suggest that most of the early production of silver coins will stay in Canada.

After discussing the markets with three different analysts, the only certainty is uncertainty. Each had an opinion that differed from each other but agreed that someone is going to make money.

Apr 27, 2020 | gold, investment, markets, news, silver

As the stay or safe at home orders continue, news in the investing world around coins and bullion is whether there will be a recovery and what will happen.

As the stay or safe at home orders continue, news in the investing world around coins and bullion is whether there will be a recovery and what will happen.

While investors are turning to gold as the equity markets are less than stable, reports that bullion and bullion-related warrants are outselling all coin offerings. Even though the West Point Mint briefly paused coin production, the markets have not felt the impact.

Silver prices are faring as well as gold. The area that silver is gaining strength is in the industrial markets. Driving the price is the demand for electronics. The primary use of silver is in the braising that ensures the connections between the chips are secure and with the production of LEDs.

Industrial silver is in more demand than industrial gold. As Asian electronics production begins to ramp up, some investors feel that there may be a temporary shortage of silver. One analyst suggested that silver prices could climb to $18 per ounce. Silver is currently $15.26 per troy ounce.

On the other hand, the reports of economic contraction have suggested that bullion prices will collapse. If this is the case, then there will be more to worry about than the market price of bullion.

And now the news…

April 22, 2020

People have been collecting coins for about as long as coins have been made. That’s a passion that has endured for centuries, since roughly 600 to 800 BC. Coin collecting is a worthwhile hobby and can sometimes be a financially savvy investment.

→ Read more at

washtimesherald.com

April 23, 2020

Gold coin demand makes up a small part of total demand, and thus doesn’t have much impact on the gold price. Demand for gold coins must be seen as a retail sentiment indicator.

→ Read more at

seekingalpha.com

April 25, 2020

Copper is well documented for its impressive antibacterial properties. Even Ancient Egyptians used bronze filings (an alloy of copper and tin) from their freshly sharpened swords to treat their wounds.

→ Read more at

iflscience.com

April 25, 2020

What's True The reverse of a U.S. quarter issued in 2020 honoring the National Park of American Samoa features a pair of fruit bats.

→ Read more at

snopes.com

Jun 30, 2019 | bullion, economy, gold, investment, markets, news

Price of Gold for the 2nd Quarter of 2019

(Chart courtesy of GoldSeek.com)

With the price of gold opening at $1,279.00 on January 2, 2019, it saw some bumps in its price but has largely averaged a modest gain until the price closed at $1,271.15 on May 21. Then it started to climb and climb rapidly by market standards. On Friday, June 28, the end of the second fiscal quarter, gold closed at $1,409.00. The rise is a 10.8-percent gain since May 21.

Gold is considered a safe bet for investors. It is a way of investing in cash or cash equivalence. Investors buying gold will purchase bullion, gold bullion coins like the American Eagle, or shares in a fund that maintains large stores of gold. There are many types of funds and ways to purchase shares in these funds, but it is not the same as owning the physical gold. Most reports are claiming that investors are interested in purchasing physical gold with bullion coins being the preference.

Investors make money by investing with what they consider a manageable amount of risk. If the risk pays off, they can make a lot of money. The risks that fail must be made up elsewhere. Investors diversify their portfolios to mitigate these risks. However, if the institutional and large investors are moving their monies to safe harbors, like gold, they sense a problem.

This relatively sharp jump in the price of gold is being driven by the major investors who are worried about the future of the U.S. economy. They see the various trade wars being detrimental to the economy. One economist said that the recent hike in soybean tariffs to China is going to have long term effects long after this president leaves office.

Although the United States is no longer an agrarian economy, agriculture plays a significant role in the country’s economic health. Upsetting that role that agriculture plays will cause long-term damage to the economy. The soybean tariffs are believed to be the driver that is scaring investors.

You may ask how are soybeans causing gold to rise?

As part of foreign policy in Africa, the government has been supplying countries with the proper climate the means to grow soybeans. It was a way to make the countries self-sufficient by helping create an economy. In many cases, the United States did not follow through on commitments to help with the infrastructure that is needed to create access to the markets. Countries needed irrigation and road improvements. Rather than helping with the upgrades, the United States government concentrated on the military aspects of these country’s problems. A policy of one-problem-at-a-time.

For at least 15 years, China has ignored the military issues and began to supply the money, supplies, and labor to fix the infrastructure. The Chinese government helped build irrigation systems, roads, and provided transportation to build these economies with the promise that China would buy their products.

Although there was significant Chinese investment in Africa, it was still cheaper to buy soybeans from the United States. That situation changed with the 25-percent tariffs placed on soybean exports. The tariffs raised the price of U.S. soybeans beyond what the Chinese would pay to the African exporters. Now China is importing soybeans from Africa while U.S. farmers are provided allegedly short-term subsidies from the federal government.

Now that the infrastructure is in place for China to import soybeans from Africa, the costs have reduced and is projected to have the long-term effect of lowering the U.S. market for soybeans in China. One economist said privately that even if the tariffs were reduced to pre-trade war levels, it might not make it economically viable for China to buy as much from the United States as it did in the past.

Institutional investors see the loss in revenue from China, the increased deficit in providing welfare to soybean farmers, and the danger of the business not returning to the United States. They also see the reduction of tariffs to Russia for wheat and that Russia is also looking to African and South American countries for wheat sources. The competition is making trade prices drop and is making it look like agriculture trade is in trouble.

If exports of United States agriculture are in trouble, then it will hurt the economy. With the uncertainty added to the risk profile investors and fund managers have to manage, they have turned to gold as the natural, safe harbor.

The rise in gold prices always helps numismatics. It helps boost the prices of gold and, by association, other rare coins. However, if the gold prices go up because of economic stress, it will not matter what happens to numismatic prices. Fewer people will be in the market to buy coins.

And now the news…

June 26, 2019

Gold is a hedge against financial risk, and coins offer convenience.  → Read more at marketwatch.com

→ Read more at marketwatch.com

June 26, 2019

COIN collectors can now get their hands on a Toy Story 4 50p piece – but you can’t use it in shops. The commemorative coin features popular character Woody in colour with the cowboyR…  → Read more at thesun.co.uk

→ Read more at thesun.co.uk

Mar 2, 2019 | coins, commemorative, investment, legislative

While the mainstream media has mostly been distracted by other activities in Congress, those of us who watch numismatic-related legislation have had our own action.

While the mainstream media has mostly been distracted by other activities in Congress, those of us who watch numismatic-related legislation have had our own action.

First, the House of Representatives passed Route 66 Centennial Commission Act (H.R. 66) to create a commission to celebrate the centennial of the famous Route 66 in 2026. Although this is not a numismatic-related bill per se, if passed, the bill says that the centennial commission will recommend commemorative coins for this event. The bill has been referred to the Senate Environment and Public Works Committee waiting further action.

The other legislation of note is the Monetary Metals Tax Neutrality Act of 2019 (H.R. 1089) that removes all tax considerations for the sale of “gold, silver, platinum, or palladium coins minted and issued by the Secretary at any time.” It also exempts “refined gold or silver bullion, coins, bars, rounds, or ingots which are valued primarily based on their metal content and not their form.” This means that no capital gains on the sale of these items will be taxed and no losses can be written off by the taxpayer.

An interesting side effect of this bill would be that the gains realized when rare coins auctioned for millions of dollars will not be taxed. This means if an 1804 Silver Dollar sells for more than the $3.8 million it sold for in 2013, the seller will not pay capital gains tax on the sale. However, if it sells for less, the seller will not be able to write-off the loss.

For those keeping score at home, this law will not help the sale of a 1913 Liberty Head Nickel since its composition is copper and nickel.

Of course, this will only be an issue if H.R. 1089 passes and the president signs it into law.

H.R. 66: Route 66 Centennial Commission Act

Summary: This bill establishes the Route 66 Centennial Commission to honor Route 66 on the occasion of its centennial anniversary.The Department of Transportation shall prepare a plan on the preservation needs of Route 66.

Received in the Senate and Read twice and referred to the Committee on Environment and Public Works. — Feb 7, 2019

Motion to reconsider laid on the table Agreed to without objection. — Feb 6, 2019

On motion to suspend the rules and pass the bill Agreed to by the Yeas and Nays: (2/3 required): 399 – 22 (Roll no. 67). — Feb 6, 2019

Considered as unfinished business. — Feb 6, 2019

At the conclusion of debate, the Yeas and Nays were demanded and ordered. Pursuant to the provisions of clause 8, rule XX, the Chair announced that further proceedings on the motion would be postponed. — Feb 6, 2019

DEBATE – The House proceeded with forty minutes of debate on H.R. 66. — Feb 6, 2019

Considered under suspension of the rules. — Feb 6, 2019

Ms. Norton moved to suspend the rules and pass the bill. — Feb 6, 2019

Referred to the House Committee on Transportation and Infrastructure. — Jan 3, 2019

H.R. 1089: Monetary Metals Tax Neutrality Act of 2019

Summary: Monetary Metals Tax Neutrality Act of 2019This bill exempts gains or losses from the sale or exchange of certain coins or bullion from recognition for income tax purposes. The exemption applies to gains or losses from the sale or exchange of (1) gold, silver, platinum, or palladium coins minted and issued by the Department of the Treasury; or (2) refined gold or silver bullion, coins, bars, rounds, or ingots which are valued primarily based on their metal content and not their form.

Referred to the House Committee on Ways and Means. — Feb 7, 2019

S. 457: President George H.W. Bush and Barbara Bush Coin Act

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Feb 12, 2019

H.R. 1173: President George H.W. Bush and Barbara Bush Dollar Coin Act

Referred to the House Committee on Financial Services. — Feb 13, 2019

H.R. 1257: To require the Secretary of the Treasury to mint coins in commemoration of the United States Coast Guard.

Referred to the House Committee on Financial Services. — Feb 14, 2019

S. 509: A bill to require the Secretary of the Treasury to mint coins in commemoration of the United States Coast Guard.

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Feb 14, 2019

Jun 9, 2018 | coins, copper, investment, medals

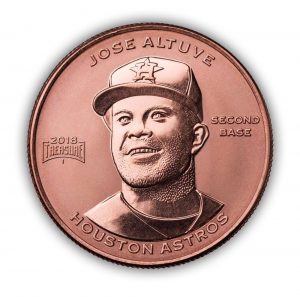

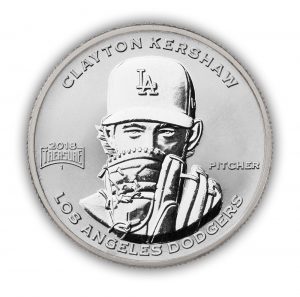

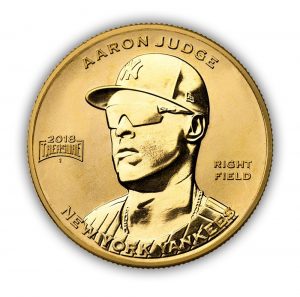

Keeping with this week’s theme of sports on coins, a company named Baseball Treasure (at baseballtreasure.com) created baseball “coins,” technically medals, representative of all 30 teams. Each team is represented by one player whose likeness will appear on the medals.

These medals are licensed by Major League Baseball and the Major League Baseball Players Association.

Most of the medals are made from one ounce of copper. The medals are mounted on a baseball-card-sized cardboard card with player highlights, similar to what you would see on a baseball card.

The medals are sold in packs of three, six, and nine—or you will receive multiple packs of three medals. You can buy a box containing 36-packs. Assuming a pack contains three medals, their “Treasure Chest” contains 108 medals. For $3,000 you can buy a 12 box package with 432 packs containing 15,552 medals.

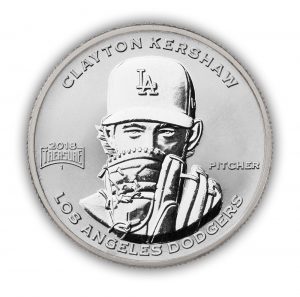

According to their website, one in every 432 packs will have a version of the medal made in .999 silver. Silver medals have been struck for each of the 30 players.

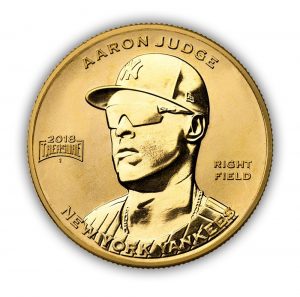

If you want to go for the gold, one in every 21,600 packs contains a specially marked medal redeemable for a gold medal featuring Aaron Judge of the New York Yankees. This was created to commemorate his rookie record of 52 home in the 2017 season.

-

-

José Altuve of the Houston Astros Copper Medal

-

-

Clayton Kershaw of the Los Angeles Dodgers Silver Medal

-

-

Aaron Judge of the New York Yankees Gold Medal

For those who are into trivia and would like to win a silver medal, they will post a clue on social media with the answer being a major league team. If you want more information, visit their #JoinTheHunt webpage for more information.

Previously, Upper Deck created hockey coins that they sold for $100 per coin on a virtual basis. While you could request the physical coin, they created a system to buy and trade these medals. There was also the chase to find the gold versions in this series.

The hockey coins are legal tender coins in the Cook Islands.

I had interviewed the Vice President involved in the program and just could not bring myself to write about the interview because I was very skeptical about how the program worked. Initially, they were sold in what they called e-Packs, virtual packages that would be held by Upper Deck. From the e-pack website, collectors can trade with each other.

One of my issues with this program is that they are sold blind packaged like baseball cards. You do not know what is in the package until it is opened. At $100 you can receive either a one-ounce silver coin, one-ounce high relief coin, one-ounce silver frosted coin, or a quarter-ounce gold coins. It would be a real bargain if you received a gold. It would be a worse deal than many Royal Canadian Mint silver coins otherwise.

Visiting their website recently, there is an option to purchase the coins at Canadian Imperial Bank of Commerce (CIBC) throughout Canada. There is no option to physically purchase coins in the United States except through the e-pack website.

These coins must be selling well enough for Upper Deck to continue the program.

In both cases, I am just not impressed with either program.

Both programs are over-priced.

The Baseball Treasure program is selling one-ounce of copper medals at $6.65 each. With the current copper price of $3.2858 per pound, each coin contains 20.5-cents of metals. The rest is packaging, licensing, and distribution. Even so, that is a 3,123,9-percent markup that you may never make up on the secondary market if you were to lose interest, especially since this is a medal and not a legal tender coin.

Of course, it is a better deal if you found a silver or gold medal. Then again, part of the markup to the copper medal is subsidizing the silver and gold medals. Without knowing how many medals or packages are being produced, it is difficult to determine how much of the $6.65 price is subsidizing the gold and silver.

Baseball Treasure’s program is certainly a more interesting idea than the Upper Deck Hockey Coin Program. It is more affordable and carries less risk. The Treasure Hunt also looks like fun and maybe something I will look into. But for now, it is not something I will collect. But if you do be aware that the copper medals may not return much more than $1-2 on the secondary market, depending on the price of copper.

Jun 3, 2018 | commentary, dollar, economy, investment, markets, policy

Zimbabwe’s 2009 $100 trillion hyperinflation note

In the news this week was a story about the Reserve Bank of Zimbabwe touting the adoption of Chinese currency for general use in the country as circulating currency.

Zimbabwe’s economy has seen wild swings between massive inflation and significant economic stagnation that has caused currency fluctuations so bad that the country has given up managing its own currency. The economic problems have created a hyperinflation currency with notes printed with denominations as high as 100 Trillion Zimbabwean Dollars. So many of these notes were printed that any collector can buy them for $5-10 each.

Because of trade restrictions, Zimbabweans turned to United States currency smuggled from outside of the country. The supply of United States currency was so limited that some had begun the practice of cleaning the paper because people were carrying their currency in their underwear and new notes were difficult to come by.

Following negotiations with the United States, the RBZ was able to obtain new currency notes and offered an exchange to its residents. But that is where the negotiations ended. Upon the change of administrations, the current Department of the Treasury stopped negotiating with Zimbabwe and other African nations to introduce additional trade in United States dollars.

As the United States began to abandon these countries, the Chinese stepped in. The Chinese government has been negotiating with these countries and have made several inroads, especially in Africa. Zimbabwe is just the latest to announce that they could adopt the Yuan as their currency.

Although Zimbabwe is not an influential economy, it expands the Chinese economic base in Africa. By chipping away at the United States economic influence, it reduces the impact of the dollar on the continent that could have an effect on numismatics.

Africa continues to have the largest deposits of precious metals. Southern African regions have the world’s most active gold, silver, and platinum mines that if the United States loses influence in the region could have a negative effect on worldwide precious metals prices.

It is not a matter of the golden rule, “He who has the gold rules,” it is a matter of who controls the flow of gold from those mines. If the Chinese control the economic engine that runs those mines, they can use that influence to make or break the markets as they see fit. The ripple effect could not only bring higher precious metals prices but worldwide economic instability.

History has taught us that market manipulating does not work except if the manipulators have a backup plan. In this case, the Chinese are using their treasury as the backup plan. They are amassing economic power that could manipulate markets to the point that would cause prices to rise.

Currently, precious metals prices are set by arrangement with the London Bullion Market Association (LBMA) based on the daily auction prices in London. This is known as the London Fix Price. The market uses United States dollars for its pricing. However, if the dollar loses its economic power because the Chinese are controlling the markets where the metals are mined, it will affect the cost of everything.

In the short term, economic factors will affect the price of bullion being produced by the U.S. Mint since those prices are based on LBMA price averages. Collectors and investors will be hit first. After that, it would be a short time before economic instability hits everyone else.

And now the news…

May 27, 2018

If you visit Stones River National Battlefield and Cemetery, you'll likely see coins on the top of many tombstones. According to park workers, the small mementos are a way some choose to pay their respects to the fallen soldier, and each kind of coin has a different meaning.  → Read more at newschannel5.com

→ Read more at newschannel5.com

May 27, 2018

In this edition of East Idaho Newsmakers, Nate Eaton speaks with Randy’L Teton. Teton is a Fort Hall native and is featured on the US Sacagawea dollar gold coin. She is the only living person to currently appear on a United States coin. During their conversation, Teton shares the fascinating story of how she ended …  → Read more at eastidahonews.com

→ Read more at eastidahonews.com

May 28, 2018

TOKYO (Jiji Press) — The Finance Ministry said Friday that it will issue a silver coin to commemorate the 150th anniversary of the 1868 start of the country’s Meiji period, which ended in 1912.  → Read more at the-japan-news.com

→ Read more at the-japan-news.com

May 29, 2018

Ahmed Mohamed Fahmy Yousef has spent the last academic year at the University of Colorado conducting research on learning technologies and instructional design in computer science education.  → Read more at dailycamera.com

→ Read more at dailycamera.com

May 29, 2018

Tawanda Musarurwa, Harare Bureau The adoption of Renmimbi/Yuan as a reserve currency, will help the country repay loans and grants from China, the Reserve Bank of Zimbabwe has said.  → Read more at chronicle.co.zw

→ Read more at chronicle.co.zw

June 1, 2018

Archaeologists in Egypt have unearthed a 2,200-year-old gold coin depicting the ancient King Ptolemy III, an ancestor of the famed Cleopatra.  → Read more at foxnews.com

→ Read more at foxnews.com

June 1, 2018

An ancient Egyptian coin discovered in far north Queensland has researchers questioning how it got there.  → Read more at abc.net.au

→ Read more at abc.net.au

June 3, 2018

The Royal Canadian Mint unveiled their first-ever panda-themed coin at the Calgary Zoo.  → Read more at thestar.com

→ Read more at thestar.com

Jan 9, 2017 | bullion, coins, commentary, Federal Reserve, investment, markets, news

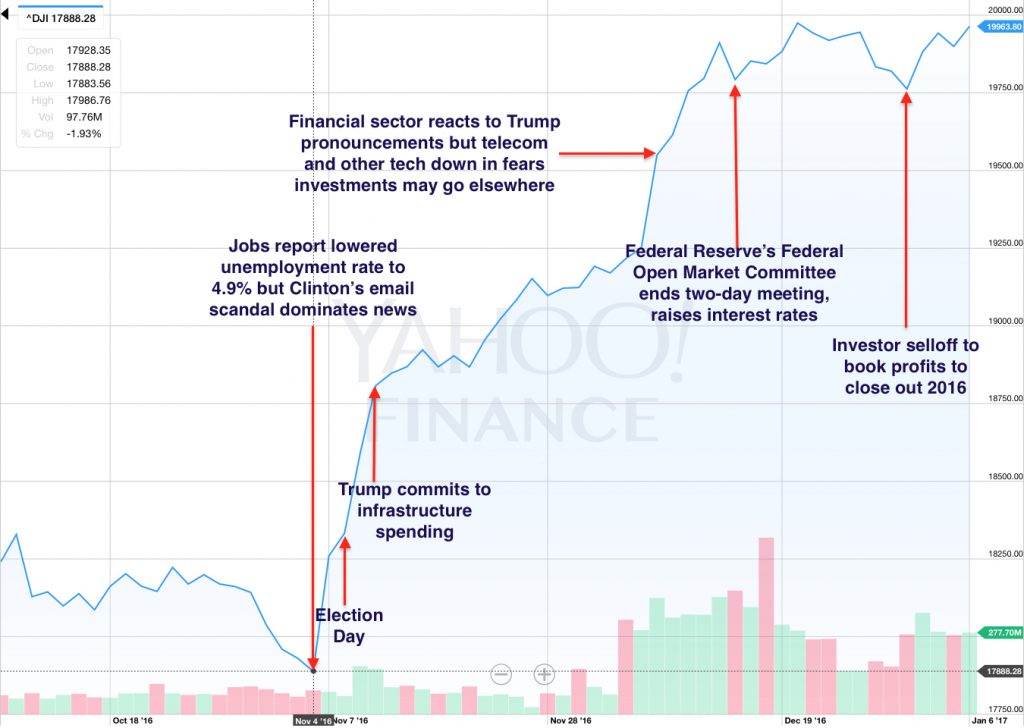

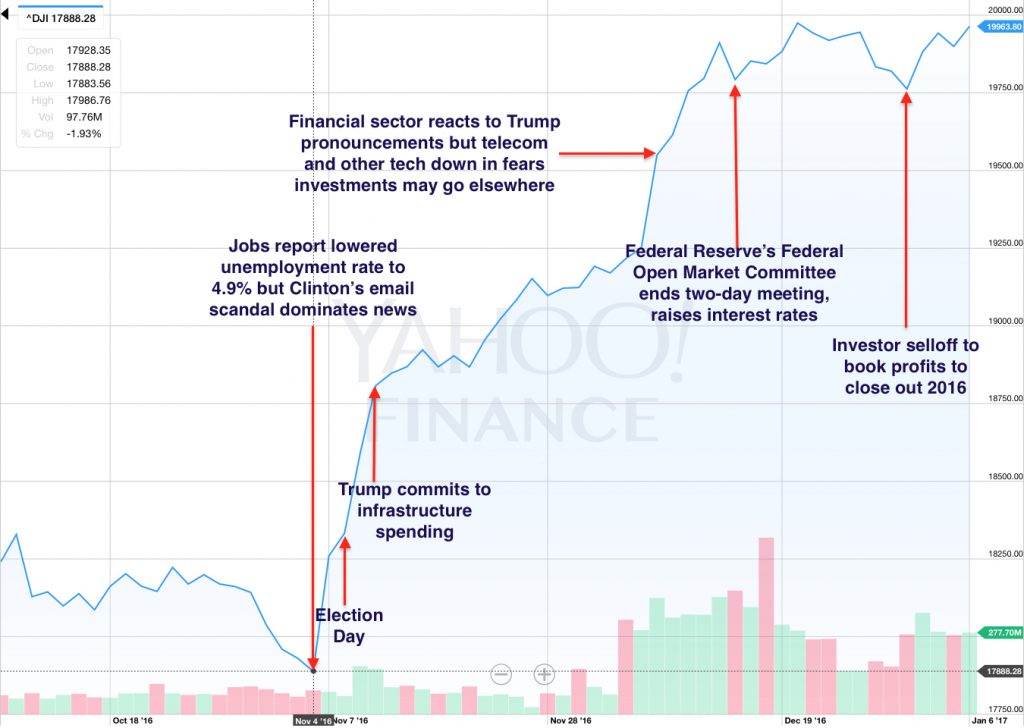

Since the election, there have been a number of stories about the “Trump Effect” on the markets. The narrative is that the economic bounce is tied specifically to the election of Trump.

The premise is that the market is reacting to the election of Donald Trump and is the direct cause for the change in the economic factors in the markets. Unfortunately, the narratives being promoted is shortsighted. Markets are not reacting to the election of Trump. The markets are reacting to the certainty that the election is settled.

Markets hate uncertainty. When there is uncertainty, the markets tend to react to everything and sometimes in an exaggerated manner. Fortunately, the economic indicators have been good and the markets have reacted accordingly with exaggeration.

How the markets have reacted to uncertainty in economic news

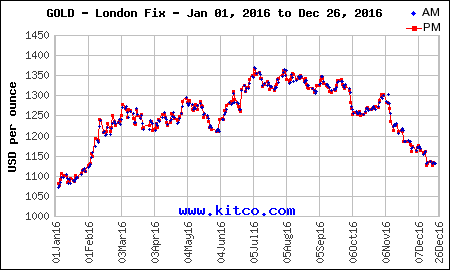

When looking at the collecting markets, whether it is numismatics or antiques, you can look at the precious metals markets as a key indicator. In basic terms, the price of precious metals is indirectly proportional to the strength of the markets and economy. It translates to if the economy is strong making investing less of a risk, then the precious metals markets will be weaker. it means there is more cash circulating creating discretionary income that buyers use to spend on non-essentials, like hobbies.

A strong market and economy means that investments in businesses are a better bet. Strong employment numbers and the movement of goods and services mean that there is money to be made by investing in business. If there are good investment opportunities, it does not make sense for investors to tie money up in precious metals.

Investment in metals makes sense when investing in their value is better than the expected rate of return on business investments. Once investors turn to precious metals, the price is based purely on supply and demand. Since the supply stream is relatively constant, demand mostly influences the price of metals. If the demand is high and the supply cannot keep up with the demand, the price will rise. What helps regulate the price is that there continues to be a supply but the demand has been known to outpace the supply.

The fact of the matter is that economic indicators have improved. Prices of metals have been steadily dropping since August as the investment in stocks been going up. Even before the election, the markets were in growth mode but skittish with uncertainty.

All the election brought was a certainty. Markets know who the next president will be, who will be in congress, and who will control the state houses. If markets hate uncertainty then the currency that fueled the rally was the removal of uncertainty.

After the week following the election, the markets leveled off with the next goal to figure out what the Federal Reserve would do. With the uncertainty surrounding the December Federal Open Market Committee (FOMC) meeting, the drive to record levels stalled. When the FOMC announced the increase in interest rates, rather than reacting negatively, the reactions was as if the markets were saying, “It’s about time.” with the uncertainty of what the FOMC would do, the markets reacted by climbing to record levels.

Market reactions to various news and economic events

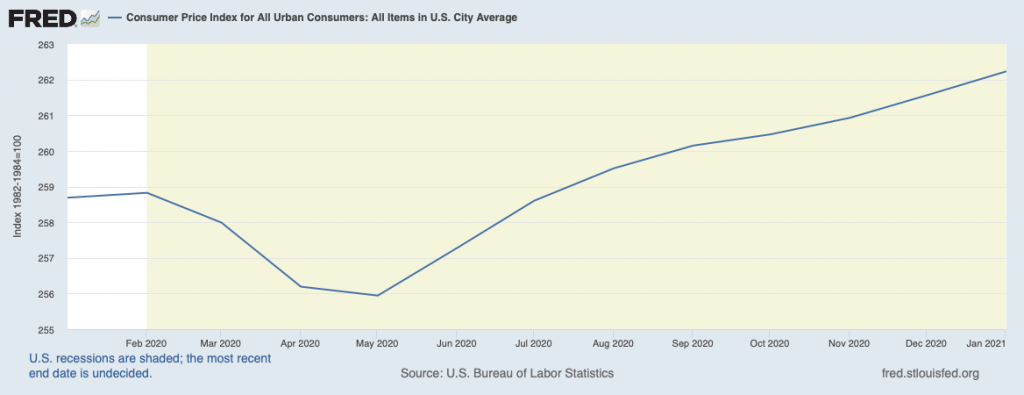

In the meantime, the metals markets have been on a steady decline. Since the capital markets are providing a good return on investments, there is no incentive to invest in metals. Although people are buying, the fewer buyers are beating the prices down making bullion-based collectibles cheaper.

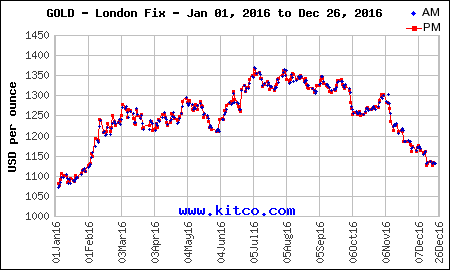

Gold free fall began on Election Day 2016

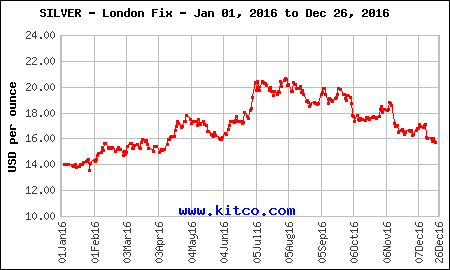

Silver downward trend started on Election Day

What does that have to do with higher end collectibles such as rare coins?

When capital markets are adding to the general wealth of the investor community, they will look for different places to invest their winnings. The new money will start to buy high-end items to supplement their other investments. This is why the collector market thrives during good economic times. Prices of fine art, prime real estate, collector cars, and even rare coins rise.

Rare coins have been resilient since the decline in markets. Rare coins became a safer bet and have attracted new investors which has bucked the trends of the past. This was not lost on the broader investing community who may be looking for diversity in their portfolios.

In review, the markets have been on a six-year rise as the economy has recovered from the Great Recession. Economic indicators are on an extended positive run. The election created certainty in the future of the government and the Federal Reserve created certainty when it raised interest rates. Since markets like certainty, the reaction is not because of the result of the election it is that the election is over.

Certainty is driving the markets, not the details of the results.

Credits

- Dow Jones Industrial Average charts courtesy of Yahoo! Finance.

- Gold and silver charts courtesy of Kitco.

Aug 26, 2015 | bullion, coins, commentary, gold, investment, silver, US Mint

Reference price of metals for this post (does not update)

Watching the price of gold has been interesting. Since the release of the 2014 50th Anniversary Kennedy 2014 Half-Dollar Gold Proof Coin when the price of gold was set based on the $1,290.50 spot price, the trend of gold prices has been to go lower. Gold spot hit a low almost one year to the day of the release of the Kennedy gold coin on August 5, 2015 at $1,085.10. It has taken three weeks to bounce back a little.

Gold Chart for August to date (does not update)

I call silver the precious metal for the masses. Aside from being less expensive it is still considered a valuable commodity. Aside from the aesthetics of the color (I love the look of chrome on cars) you can really see a great design on a larger silver coin than a gold coin for a lower cost. For example, I like the look of the larger Silver Panda over the yellow gold Panda—and it is cheaper!

While my interest is more of aesthetics and the costs between purchasing the different types of coins, you can get into a situation where the composition determines the price of a coin. After all, the most expensive coin to sell at auction was a 1794 Flowing Hair silver dollar with a rare die variety. For a non-precious metal coin, you can always look at the 1913 Liberty Head Nickels whose composition is 75-percent copper and 25-percent nickel. Sales of these coins have averaged around $3-5 million in the last few auctions.

Rare and key date coins notwithstanding, more people can afford silver than gold. As a result, we have seen a rise in the collecting of silver non-circulated legal tender (NCLT) coins. Although I am not a fan of many of these designs, the various mints creating them would stop if there was not a market for them. Since this is what people are buying, the mints are striking.

To some degree, the price of silver may be inconsequential to the cost of some of these NCLT sets. Coins like the Looney Tunes and DC Comics sets from the Royal Canadian Mint; Star Wars, Disney, and Dr. Who sets from the New Zealand Mint are priced to include royalties that will have to be paid to their respective copyright holders.

-

-

Royal Canadian Mint’s $100 Looney Tunes 14-karat Reverse

-

-

Could this Looney Tunes Silver Kilo coin be on your list?

Then there are the countries of Somalia, Niue, Tuvalu, and the Marshall Islands that do have their own mints but license their names or contract other mints to strike coins for them. Even though these coins may not require licensing fees, many are made with popular themes to entice collectors to purchase them. Seigniorage then goes to both the mint striking the coins and the general treasuries of country whose name is on the coin.

-

-

2007 Somalia Motorcycle Coins

-

-

2010 Somalia Sports Cars

Most mints will float the price of their bullion coins to reflect market forces but not the price of NCLT coins. Even the U.S. Mint does not adjust the price of commemorative coins if the price of the metals drops.

While there are collectors that view their collection in terms of its value and others collecting as an investment of those of us who collect for the sake of collecting, the dropping of metals prices can be seen as an opportunity to buy some nice collectibles cheaper than otherwise. However, never underestimate the greed of some of these mints and the companies that sign agreements with them that will keep your prices high.

I wonder how these coins will fare on the aftermarket in the future?

Image Credits

- Charts courtesy of Kitco.

- Looney Tunes coin images courtesy of the Royal Canadian Mint.

- Somalia motorcycle and sports car coins from author’s personal collection.

→ Read more at lancasteronline.com

→ Read more at lancasteronline.com

→ Read more at tweaktown.com

→ Read more at tweaktown.com

→ Read more at hurriyetdailynews.com

→ Read more at hurriyetdailynews.com

→ Read more at scoop.co.nz

→ Read more at scoop.co.nz

→ Read more at bangordailynews.com

→ Read more at bangordailynews.com

As the stay or safe at home orders continue, news in the investing world around coins and bullion is whether there will be a recovery and what will happen.

As the stay or safe at home orders continue, news in the investing world around coins and bullion is whether there will be a recovery and what will happen.

While the mainstream media has mostly been distracted by other activities in Congress, those of us who watch numismatic-related legislation have had our own action.

While the mainstream media has mostly been distracted by other activities in Congress, those of us who watch numismatic-related legislation have had our own action.