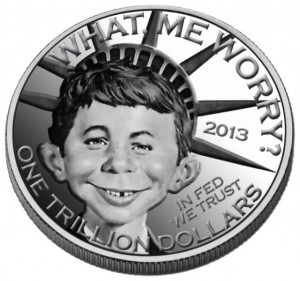

In 2013, Heritage Auctions asked the public to suggest names and and designs for the mythical $1 trillion coin. This was one of the proposals.

This time, the scheme was cooked up by Rep. Rashida Tlaib (D-MI), a freshman member of Congress. Apparently, Tlaib read that the Federal Reserve has more than a $2 trillion surplus. Rather than allow the Fed to use it to sure up financial systems in a crisis, she wants to transfer the money out of the semi-autonomous agency and put it in the general treasury to fund her version of a stimulus.

It is not the first time in the last ten years this idea came up. Back in late 2012, conservative pundits pushed Congress to do the same thing. The drumbeat for this idea became so loud that cooler heads finally prevailed, and the jokes about how to design such a coin quickly faded into history.

Tlaib is trying to learn from history by proposing that not only should the coins be struck but transferred to the Federal Reserve. By removing the $2 trillion liability from the Treasury Department’s books, it places the debt on the Federal Reserve.

If we were to ignore the law (31 U.S.C. §5136) will require the U.S. Mint to deposit the money int into the United States Mint Public Enterprise Fund, the costs of striking these coins including the design and administration is required to be deducted from the $2 trillion. It is a small percentage of the total, but it counts.

Then there is the question of operating capital. What will the Federal Reserve do if it needs the money to keep banks open during this crisis? By taking its operating capital, the Federal Reserve will have to raise money on a market that will become more restrictive when the United States central bank cannot perform. One analyst said it would be like tying the Fed’s arms and throwing them into the deep end of the pool. Everyone will panic, jump in to save them, and will drown.

To make the ensuing chaos even worse, to prevent the bank failures and to prop up the bank-related insurance programs, like the Federal Deposit Insurance Corporation (FDIC), Treasury will have to get very creative to fund the insurance program. Like they did in the late 1980s during the Savings and Loan fiasco, the Treasury had to sell bonds and bills to make the depositors whole. Back then, the economy was better, and there were willing buyers. Today, if the coronavirus crisis continues and worldwide investors become spooked because the Fed failed to help, the costs of that paper (interest rate) will skyrocket.

When the government borrows money on the open market at high interest rates, the payment for just the interest (servicing the debt) becomes part of the national debt.

Take two platinum coins and give them a face value of $1 trillion each. Make the Federal Reserve buy these coins. The result will be a ripple of actions disrupting everything, like when a stone is thrown in the middle of a calm lake.

There was a time when freshman members of Congress were pushed to the background and told to shut up and learn. It was to allow them to learn from more senior members and to prevent them from saying and doing stupid things. Maybe Congress should go back to that practice.

And now the news…

→ Read more at bloomberg.com

→ Read more at bloomberg.com

→ Read more at news.justcollecting.com

→ Read more at news.justcollecting.com

→ Read more at stockinvestor.com

→ Read more at stockinvestor.com

→ Read more at collectspace.com

→ Read more at collectspace.com

→ Read more at bloomberg.com

→ Read more at bloomberg.com

→ Read more at finews.com

→ Read more at finews.com

Scott

Rep. Tlaib is part of The Squad. All we get from The Squad is wacky ideas. This is the latest. There will be more.

If anyone dislikes my use of the phrase The Squad, I have no apologies.