Aug 7, 2022 | news, personal

The text of this week’s post does not contain any numismatic content. The numismatic content is below the story.

When my wife and I left today, we came home with a new family member. We welcomed Abe to our family four months after Tessa crossed the Rainbow Bridge.

When my wife and I left today, we came home with a new family member. We welcomed Abe to our family four months after Tessa crossed the Rainbow Bridge.

Rescuers found Abe Pugoda as a stray. The rescue organization said he was well behaved with many of the typical medical problems strays experience, and it appears that someone might have abandoned him.

One look at that face made it difficult to understand why someone would abandon Abe. He has a good disposition, moderate energy, and a sniffer that doesn’t stop. Abe is a Puggle, half pug, and half beagle. Doctors that examined him believe that he is 10 years old.

Abe has had an eventful first day in his new home. We know it will take time for us to become accustomed to each other. For us, we have another four-legged baby in the house and looking forward to having fun over the next few years together.

And now the news…

August 1, 2022

A mysterious daguerreotype of a woman and a pair of jeans possibly made by Levi Strauss himself are among nearly 1,000 Gold Rush-era treasures recovered from the fabled "Ship of Gold" now on display in Reno, Nevada.

→ Read more at

cbsnews.com

August 2, 2022

The new 20 peso bill presented in September 2021 to commemorate the bicentennial of the Consummation of Independence, will stop circulating by 2025, as reported by the Bank of Mexico (Banxico).

→ Read more at

california18.com

August 2, 2022

Investigators as well as experts who have been fishing off the coast of Israel unearthed a bronze penny on arguably one of the Roman Civilization's finest tranquil periods.

→ Read more at

natureworldnews.com

August 6, 2022

The archeologist team in North Israel has found a bronze coin that depicts the zodiac symbol. It dates back about 2,000 years. The archeologists have discovered it near Haifa.

→ Read more at

art-insider.com

August 7, 2022

A St Edmund memorial penny worn by a Viking to "advertise his Christianity" has been found by a metal detectorist.

→ Read more at

bbc.com

Jul 31, 2022 | coins, news

Scammers continue to sell counterfeit American Silver Eagles on Facebook because users keep buying them.

One of the issues that prevented me from writing a more substantive post is that I am investigating an alleged California-based site that is scamming people via Facebook. When I warned Facebook users it was a scam, the site owner sent a private message telling me I was a bad boy before turning off all means to comment or return messages.

Whoever is behind this site is trying to sell American Silver Eagles for below spot. The prices for these fakes have dropped to $14 as the price is silver is falling.

Please don’t fall for these scams. Tell your friends and relatives not to buy from them. It will not end well for anyone.

And now the news…

July 25, 2022

A rare, 1,850-year-old bronze coin depicting the Roman Moon goddess Luna was recently found off the coast of Haifa, the Israel Antiques Authority said Monday. The coin shows Luna above a depiction of the zodiac sign Cancer.

→ Read more at

timesofisrael.com

July 26, 2022

Cash isn’t as popular as it used to be, but that hasn’t put counterfeiters out of business. A 2020 survey cited in a recent Federal Reserve report showed that showed U.S. consumers used cash for only 19% of their transactions.

→ Read more at

money.usnews.com

Jul 25, 2022 | news, shows

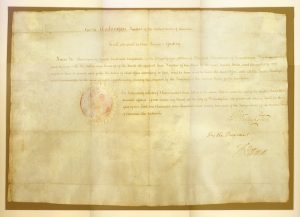

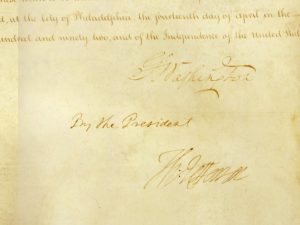

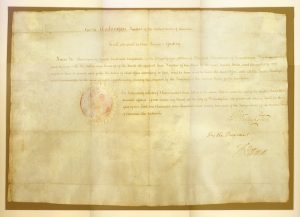

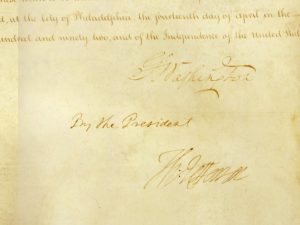

In the run-up to the World’s Fair of Money, several releases have announced the display of rarities and different collectibles relating to numismatics that will make an appearance. The announcement that excited me was the Brian Hendelson Collection of Presidential Appointment Documents.

-

-

Signed by George Washington as President and Thomas Jefferson as Secretary of State, this 1792 document appointed David Rittenhouse as the first Director of the United States Mint. (Photo courtesy of Brian Hendelson.)

-

One of the appeals of numismatics is the history coins and documents represent. The documents range from the document of George Washington’s appointing David Rittenhouse as the first Mint Director to President U.S. Grant’s appointment of Chauncy Noteware as Carson City Mint Director.

Historical documents can be as important as the coins because they represent the journey that led to the issuing of the coin. Although collectors would like to collect the 1907 Saint-Gaudens Double Eagle, I find the letters between Augustus Saint-Gaudens and Theodore Roosevelt more fascinating.

Most people will not geek out over historical documents, but I would love to see more original documents relating to numismatics. It would be an exhibition I would find fascinating and keep me off the bourse floor.

And now the news…

July 19, 2022

Croatia started the production of Croatia euro coins as it gets ready to enter the European Union as a state of the bloc by January 2023.

→ Read more at

european-views.com

July 21, 2022

Known as the "Coin Cabinet of Dresden," this museum houses over 300,000 currency-related artifacts.

→ Read more at

atlasobscura.com

July 22, 2022

Curator, National Numismatic Collection Before the February 2022 Russian invasion of Ukraine, few outside of the country took note of the trident symbol at the center of Ukraine’s national emblem. But in the days following the invasion, the trident was beamed around the world, appearing in the backdrops at press conferences and embossed on the clothing worn by the nation’s leaders and soldiers.

→ Read more at

smithsonianmag.com

Jul 18, 2022 | books, Canada, coins, news

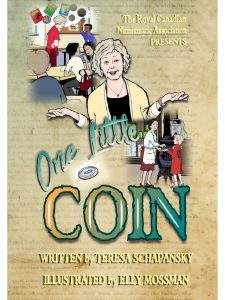

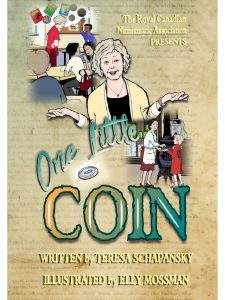

As the times change, traditional hobbies have to find new ways to reach a new audience. The Royal Canadian Numismatic Association (RCNA) tried something different and published a new children’s book.

As the times change, traditional hobbies have to find new ways to reach a new audience. The Royal Canadian Numismatic Association (RCNA) tried something different and published a new children’s book.

The RCNA teamed up with best-selling Canadian author Teresa Schapansky and award-winning artist Elly Mossman to produce a children’s book, One Little Coin. The book is about a child’s adventures in joining a coin club and what happens.

Here’s the publisher’s blurb:

Dear Journal, I signed up for the coin club, because to be honest, I really like money. Wasn’t that what a coin club was about? Money? That, and how to get it, how much to keep and how much to spend? I glanced around the room, and easily saw that the class was made up of quite an assortment of kids – polar opposites, in my opinion. In the end, who could have guessed that seven totally different kinds of people would form such an unlikely bond in a coin club? Maybe one day, I’ll find one little coin that will change my life, forever. Maybe I’ll find it with Jacques’s metal detector, or maybe it’ll be stuck in some couch cushion. The possibilities are endless.

The book includes “Miss Cassidy’s Guidebook,” a guide to coin collecting for young readers.

One Little Coin is written in English and in French as Une Petite Monnaie.

One Little Coin is written in English and in French as Une Petite Monnaie.

Book publishing is always a risk. A publisher once told me that less than 10-percent of the books they publish make a significant profit. The RCNA is taking a risk by publishing a children’s book in a society where parents opt for electronic entertainment.

I hope it works. If it does, I hope it inspires others to find new ways to reach collectors.

And now the news…

July 9, 2022

There are some $200 bills that were put into circulation in October 2016 by the Central Bank of the Argentine Republic (BCRA) that have a particular production error for which numismatic specialists and collectors in the field paid attention to them.

→ Read more at

california18.com

July 12, 2022

<em>One Little Coin</em>, the latest book by Duncan, B.C.’s Teresa Schapansky, topped the Amazon Hot New Releases list for coins and medals this June. The Royal Canadian Numismatic Association (RCNA) published the digital version of the book in both English and French on June 22.

→ Read more at

canadiancoinnews.com

July 14, 2022

The new P1,000 polymer banknotes, another legacy left to President Bongbong Marcos by his predecessor, came as a surprise parachute drop on a market that appears to be not adequately prepared.

→ Read more at

philstar.com

July 15, 2022

It’s possible you might be able to find coins worth in the thousands around your home or anywhere you store change. The value of your coins could depend on a few factors including mintage, grade and condition, as well as errors.

→ Read more at

the-sun.com

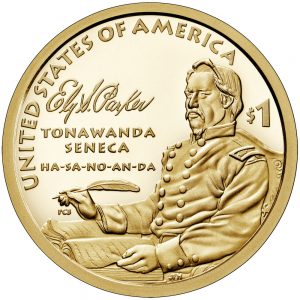

Jul 11, 2022 | coins, dollar, news

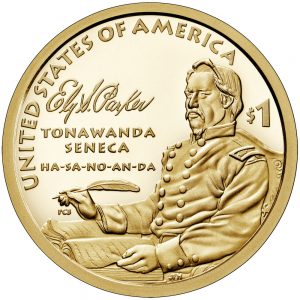

This past week, I had an email conversation with a reader and collector from the United Kingdom that started with a conversation about the Women on Quarters and Innovative Dollar programs. In one of the emails, I was asked why the dollar coin was not generating interest.

This past week, I had an email conversation with a reader and collector from the United Kingdom that started with a conversation about the Women on Quarters and Innovative Dollar programs. In one of the emails, I was asked why the dollar coin was not generating interest.

The simple answer is that the dollar coin does not circulate.

My correspondent asked why the United States strikes a circulating coin that does not circulate? My response, “because it is the law, ” did not satisfy my correspondent because the U.S. also prints a paper dollar. Why do both?

Good question. Why does the United States do both?

There are several reasons, but the main driver is politics. For many years, Ted Kennedy, the powerful senator from Massachusetts, protected the interest of Crane and Company, the manufacturer of U.S. currency paper. On the other side, politicians interested in manipulating people against the government convinced them taking the paper dollar away would weigh them down.

In response, my friend from across the pond said it did not make sense while pointing out that many countries successfully dropped paper for coinage.

The arguments become a religious war whenever the paper versus coin discussion surfaces. I had no answers as to why. Some day, we may resolve this debate, but it is not going to happen today.

And now the news…

July 4, 2022

Secretary Janet Yellen reiterated the promise of ensuring an inclusive currency in an internal department Black History Month message. In contrast with the several speculations spreading over the internet, the Harriet Tubman $20 bill is on its way to rolling out in 2030.

→ Read more at

venturejolt.com

July 7, 2022

The historic rocket that launched the first astronauts to the moon will blast off from the back of a new dollar coin in 2024.

→ Read more at

collectspace.com

Jul 3, 2022 | counterfeit, news

As I returned from two weeks off, I noticed that the Anti-Counterfeiting Educational Foundation (ACEF) warned about Chinese counterfeits using the example of a gentleman in Texas who was scammed by buying counterfeits.

According to the report, “Oliver” paid $1,000 for counterfeit coins. As part of the order, Oliver paid $499 for an American Gold Eagle that the U.S. Mint sold for $1,950. He paid $499 for 50 alleged American Silver Eagles that would have been worth $40 each and received fakes.

Some of the counterfeit coins were received by a Texas investor.

If Oliver had done a little due diligence, he would not have been scammed out of $1,000. Sure, he will work with his credit card company to recover his money, but that may be $1,000 that the credit card company has to absorb. The credit card company will try to recover the money from the scammer, but the process will cost money.

Remember, credit card companies do not absorb these losses. They will raise service charges and interest rates to compensate for the losses. Oliver might be made whole, but we will all pay for his lapse of judgment.

Before you purchase these alleged “good deals,” please remember my rules:

- NO LEGITIMATE DEALER IS SELLING BULLION COINS FOR BELOW THE SPOT PRICE!

- IF THE DEAL IS TOO GOOD TO BE TRUE, IT LIKELY IS NOT A GOOD DEAL!

- IF THE DEALER DOES NOT IDENTIFY THEMSELVES ON THEIR WEBSITE, THEY ARE LIKELY HIDING SOMETHING!

Check the “About” or “Contact” page. If there is no address, then they are hiding. If the address is in China or the Middle East, they will sell you counterfeit merchandise. If there is an address, go to Google Maps and see what is really at the address.

- IF THERE ARE ANY QUESTIONS, THEN DO NOT PURCHASE THE COINS!

There is no harm in asking for help. Talk to a dealer. If you do not know a dealer, reach out to an expert affiliated with the Accredited Precious Metals Dealer program (www.APMDdealers.org) or the Professional Numismatists Guild (www.PNGdealers.org). Or ask me! Using my background as a (now retired) information security specialist, I can tell you if I think a scammer created the website.

Please! Please! Please! Do not give these scammers your credit card information. You will be ripped off, and they will likely steal your credit card information, leading to other problems.

And now the news…

June 29, 2022

WATERLOO REGION — Waterloo Region’s club for coin enthusiasts has been recognized for using the internet to keep members connected during the pandemic. The Waterloo Coin Society was named club of the year by the Royal Canadian Numismatic Association, the national organization for coin collectors.

→ Read more at

therecord.com

June 30, 2022

A hoard of Roman gold coins hidden in the decades before the Roman invasion of Britain has been discovered.

→ Read more at

bbc.com

July 1, 2022

"What looks and feels like a real paper money, but doesn't work?" Well, obviously, that is Russian paper money. Russian Central Bank officially introduced the updated 100 rouble bill today.

→ Read more at

afterdawn.com

Jun 26, 2022 | news

Even though I spent the week relaxing, the news continues. Here are three significant stories from this past week.

New Mint Director

Ventris C. Gibson, 41st Director of the U.S. Mint

Compared to previous appointments, the Senate acted with lightning speed to fill the vacancy left by David J. Ryder. Ryder’s resignation. The position was vacant for 264 days.

New Treasurer

Chief Marilynn “Lynn” Malerba, 18th Chief of the Mohegan Tribe and the 45th Treasurer of the U.S.

Chief Marilynn “Lynn” Malerba became the 18th Chief of the Mohegan Tribe in 2010 and is the first woman to serve in this position in the Tribe’s modern history. Chief Malerba earned a Doctor of Nursing Practice and Masters in Public Administration degrees, and she has advocated for tribal health and management throughout her career.

Since the Federal Reserve Note includes the signatures of the Treasury Secretary and the Treasurer, it will be the first time in United States history that both signatures on the currency will be women.

New Numismatic Auction Record

2021 Nobel Peace Prize Medal sold for $103.5 million with proceeds going to charity (Image courtesy of Heritage Auctions)

Muratov, the editor-in-chief at Novaya Gazeta, decided to sell his Nobel Peace Prize medal to raise money for Ukrainian relief. Heritage Auctions hammered closed the auction for a record $103.5 million. All proceeds were paid to UNICEF’s aid efforts for Ukrainian children and their families displaced by war. It is a record sale for any Nobel medal and any numismatic item.

And now the news…

June 19, 2022

The mighty gold often overshadows its cousin silver, but did you know that its price jumped 70% the last year? From $15.5 per ounce, silver is now traded at $27 an ounce worldwide.

→ Read more at

newsweekme.com

June 21, 2022

Amateur metal detectors have found a Viking-era cache of silver coins and jewellery in a field in Mynämäki in southwest Finland, the Finnish Heritage Agency has reported in a press release.

→ Read more at

yle.fi

June 24, 2022

TBritain’s Central Bank will remove bank notes worth 14.5 billion pounds, or nearly $18 billion, from circulation by Sept. 30, as it seeks to retire its remaining paper currency in favor of polymer bills. The transition will make Britain the world’s largest economy that uses only plastic-like bank notes.

→ Read more at

washingtonpost.com

June 24, 2022

SN 1054 was almost wholly absent from the Western record—except, potentially, for a subtle hint at it in the most unlikely of place: some Byzantine coins.

→ Read more at

phys.org

June 25, 2022

Back in 1951, shortly before I was born, my father had a very challenging job. He worked at a tavern in a very rough Chicago neighborhood on East 51st Street. One very special day for me, anyway, a customer came into the tavern, ordered a drink, and paid for it with a half dollar.

→ Read more at

americanthinker.com

Jun 20, 2022 | administrative, commentary, news

Now is the time for all exhausted people to take a necessary vacation. If you are tired of the pandemic, need a breather, worked your behind off, and have not taken a break, it is time you take a break.

Disconnect from the world and go away. Rent a boat and go out into the middle of the ocean and enjoy the view. The sound of the boat’s engine and the wake it leaves behind is symbolic of washing away the cares and worries of the day.

Yes, I am on holiday and relaxing. It is time to get away and enjoy myself after starting a business and ensuring it survives through the pandemic. Change is coming but not before I recharge the batteries. Even after driving over 10 hours and spending two days away, I recommend going away to just relax. I know the price of gas is up along with everything else. Then go for one week instead of two. Leave for an extended weekend. Find a bed and breakfast of a lovely Airbnb somewhere and just go. Having a break is good for your mental health. And what good is collecting if your mind is scattered in the doldrums?

In the meantime, if I find anything fun in numismatics, I will let you know.

And now the news…

June 10, 2022

The American Women Quarters Program aims to celebrate and honor women who have made history in the US. This week, Wilma Mankiller was honored, and she will be featured on a limited quantity of US quarters. Mankiller was the first women to serve as principal chief of a major American Indian tribe.

→ Read more at

thehill.com

June 14, 2022

It is increasingly common to see various options on the Internet for collectible products, such as coins, action figures, artistic pieces and even banknotes that are currently in circulation in Mexico.

→ Read more at

california18.com

June 14, 2022

The new Bela Lyon Pratt Gallery of Numismatics at the Yale University Art Gallery showcases objects from the museum’s numismatics collections — rare and unique coins, medals, and paper money. The Circus Maximus, the stadium where Romans gathered by the tens of thousands to watch chariot races and other spectacles, had lap counters shaped like dolphins.

→ Read more at

news.yale.edu

June 19, 2022

It would undoubtedly be strange that among the coins most sought after by collectors, and therefore most appreciated, is the paltry 1 cent coin. Rare one-cent coin – Nanopress.it

→ Read more at

hardwoodparoxysm.com

Jun 12, 2022 | cents, coins, news

1943-S Steel Cent

Copper was a crucial element in making bullets for the war efforts. With the production of war materials increasing, congress and the U.S. Mint thought that striking the cent using another metal would help. After testing different materials in 1942, the U.S. Mint selected a zinc-coated steel planchet. In 1943, the U.S. Mint produced 1,093,838,670 steel cents between the three mints.

The coins were not well received by the public. Their size and lighter weight caused many people to confuse the steel cent with the dime. The zinc coating would wear as the coin circulated, allowing rust to form on the steel.

With over 1 billion coins struck, there are plenty of opportunities to collect steel cents. At the time, some people saved rolls, and others put the coins aside because they did not like to use them. They can be purchased online or from many dealers.

When looking for steel cents for a collection, look for a coin that continues to show its zinc color. The zinc will be a semi-bright silvery color that does not have a very shiny look. Grey-looking and dark grey coins have been handled and should be less expensive.

Nice examples of Steel Cents are not expensive. With over 680 million struck in Philadelphia, uncirculated examples of those coins cost $2.50 – $3.00. There were over 210 million struck in Denver, uncirculated 1943-D steel cents will sell for $3.25 – $4.00. There were fewer steel cents struck in San Francisco. Over 190 million struck, uncirculated 1943-S coins cost $5.00 – 6.50.

When buying coins for your collection, be careful with coins that look shinier than others. These coins may be reprocessed Steel Cents. Reprocessed steel cents are real coins but have a new coating of polished zinc. While they are pretty coins, numismatists consider these coins damaged and advise not collecting them if you are looking for value.

Rather than continuing to use the steel planchet, the U.S. Mint used copper recovered from the spent shell casing used for ammunition. The shell casing came from the training fields in the United States and not from the battlefields.

In 1944 and 1945, spent ammunition provided the copper used to strike Lincoln Cents. These coins are known as shotgun case cents and are darker than other copper coins because the smelting process could not remove all of the impurities from the ammunition.

There are famous 1943 Lincoln Cents struck on copper planchets, and 1944 cents struck on steel. These are rare coins and not as readily available.

The 1943 Steel Cent is the only circulating coin ever produced by the United States Mint that does not contain copper. Collecting a complete three-coin set adds a historic coin to your collection at an affordable price.

And now the news…

June 6, 2022

Prague, Czech Republic – A rare ten-ducat coin dating from the 17th century sold for more than 10 million Czech crowns (about €4 million) at an auction held in Prague on Saturday. The ten-ducat coin was minted in Prague during the reign of Frederick the Great in the early 17th century.

→ Read more at

kafkadesk.org

June 7, 2022

Hyderabad: Security Printing and Minting Corporation of India Limited (SPMCIL) is organising Azadi Ka Amrit Mahotsav celebrations from June 6 to 13 in all its units. As a part of the celebrations, India Government Mint, Hyderabad, is inaugurating the coin museum at Saifabad Mint on June 7.

→ Read more at

thehansindia.com

June 7, 2022

Centuries-old shipwrecks complete with gold coin treasure have been discovered off Colombia. According to officials, Colombian naval officials conducting underwater monitoring of the long-sunken San Jose galleon discovered two other historical shipwrecks nearby.

→ Read more at

presstv.ir

June 8, 2022

A SELLER on eBay recently had some luck with his coin collection – selling it for nearly $3,500. The collection featured Lincoln steel pennies that mostly bared the 1943 dates, according to the seller.

→ Read more at

the-sun.com

June 10, 2022

The U.S. Mint released the first quarters featuring Wilma Mankiller, who was the first woman named Chief of the Cherokee Nation.

→ Read more at

poncacitynow.com

Jun 5, 2022 | Britain, news

The college-age child of a friend accepted a summer job in London and went early to witness the Queen’s Platinum Jubilee. Earlier today, I joined my friend on a video talk with the group of U.S. students staying in a London hotel.

The college-age child of a friend accepted a summer job in London and went early to witness the Queen’s Platinum Jubilee. Earlier today, I joined my friend on a video talk with the group of U.S. students staying in a London hotel.

During the discussion about the atmosphere around the streets of London, I asked about coins and medals that they encountered. All of the students found a 50 pence coin issued by the Royal Mint, and almost every shop and street vendor carried the coin they included in making change.

Other souvenirs the group collected are aluminum tokens with images commemorating the jubilee. The tokens were reminiscent of Mardi Gras tokens. Some found tokens that were the size of the old large penny with images of the Queen at various ages.

A few found currency-looking commemoratives, and they were designed as £70 notes with images of the Queen. The reverse has the name and address of a London business using the notes as an advertising opportunity.

The jubilee celebration is over, but the collectibles will live on.

And now the news…

May 31, 2022

JEDDAH: For artist Hisham Al-Najjar, painting on canvas or papers is conventional. Instead, the Jeddah-based artist uses pennies and other international coins as the backdrop for his impressive paintings.

→ Read more at

arabnews.com

June 1, 2022

There is a coin worth up to 40.000 Euro! It sounds crazy, but coin collecting also has these little rarities. Coins that, due to their unobtainability and value, are likely to be worthy of becoming part of the museum’s collection.

→ Read more at

hardwoodparoxysm.com

June 2, 2022

There's a new trend that has been sweeping YouTube with hundreds of videos — one that claims you can earn hundreds, or even thousands, of dollars with this hobby. It's called “coin roll hunting.” And it's pretty much exactly what you imagine it is: searching through rolls of coins to hunt for collectible and valuable coinage.

→ Read more at

outsiderclub.com

When my wife and I left today, we came home with a new family member. We welcomed Abe to our family four months after Tessa crossed the Rainbow Bridge.

When my wife and I left today, we came home with a new family member. We welcomed Abe to our family four months after Tessa crossed the Rainbow Bridge. → Read more at cbsnews.com

→ Read more at cbsnews.com

→ Read more at california18.com

→ Read more at california18.com

→ Read more at natureworldnews.com

→ Read more at natureworldnews.com

→ Read more at art-insider.com

→ Read more at art-insider.com

→ Read more at bbc.com

→ Read more at bbc.com