Jan 2, 2022 | bullion, news

We like to speculate on many things that will happen in the future. Sports bettors have been watching the bowl games to see how their prognostications will make money, and market prognosticators bet the winners and losers of companies.

Prognostication is not something that is pulled out of a hat. Past performance and the environment are some of the information used to make the decisions.

At the end of August, the Accredited Precious Metals Dealers (APMD) predicted that at year-end, gold would close at $1,897, silver $28, and platinum $1,153. The APMD is a professional organization of precious metals dealers with a mission to educate and promote market integrity. These are the people within the market and have the background to understand the nuances.

On the other end of the weekend’s prognostication were the oddsmakers who earn their living predicting the outcome of football games. For the Alabama vs. Cincinnatti Cotton Bowl game, the oddsmakers made Alabama a -13.5 point favorite. For those not aware of sports betting, that means the oddsmakers believe that Alabama would win by 13.5 or more points. If Alabama loses or wins by 13-points or less, you lose the bet.

The Cotton Bowl’s over-under was 57.5 points. If the gambler believes that the game’s combined score would be more than 57.5 points, you will bet the over.

For the Orange Bowl, Georgia was a -7.5 favorite over Michigan with an over-under of 46 points.

Who did better?

In the Cotton Bowl, Alabama beat Cincinnatti 27-6. Although Alabama beat the spread, only those who bet the under won money. The story was similar in the Orange Bowl where Georgia blasted Michigan 34-11, beating the spread and going under the predicted 46 point total.

How did the APMD do? As we check their results, the comparison also includes the London Bullion Market Association (LBMA) consensus prediction is included to compare results. The LBMA is the operator of the London markets that set the worldwide price of precious metals. Using the prices at the close in the New York Metals Market on Friday as reported by Kitco:

2021 Precious Metal Predictions vs. Reality

| Medal |

August 31 Prediction |

December 31 Close |

Difference (Pct) |

LBMA Consensus |

| Gold |

$1,897.00 |

$1,815.20 |

-81.80 (-4.31%) |

$2,072.00 |

| Silver |

$28.00 |

$23.20 |

-4.80 (-17.14%) |

$32.00 |

| Platinum |

$1,153.00 |

$963.00 |

-190.00 (-16.47%) |

$1,205.00 |

The difference between the markets is that the gambling bookmakers make their living on being right about the odds, and precious metals dealers make money on their premiums on selling coins and bullion.

Bookmakers have to make the correct predictions daily. An incorrect prediction on a big game will cost the bookmakers millions of dollars, and too many bad odds predictions could bankrupt a sportsbook.

Bullion dealers can adjust the premiums as the metals rise and fall, and they have to promote their product and let the buyers come. Bullion inventory usually turns over faster than the changes in the market, limiting the price risks. As long as the dealer is selling within the spread of the spot price and the premium, their incentive to be correct in their metals predictions is reduced.

All investments are a gamble, and the difference amongst the markets is what stake the prognosticators have on the outcome. You would have made more money by betting on Alabama and Georgia to win their games than most precious metals predictions.

Georgia opens as a -2.5 favorite over Alabama for the National Championship in Indianapolis on January 10, 2022. The over/under is 51.5, according to Draftkings, and Sports Illustrated published a trends analysis for the betting line.

It’s your money. Bet wisely.

GO DAWGS!

And now the news…

December 26, 2021

The 'Le Catillon II' hoard was discovered in 2012 by two amateur metal detectorists who had spent decades combing a single field on the island of Jersey.

→ Read more at

dailymail.co.uk

December 29, 2021

European researchers determined which locations may have been mined for silver to produce Roman coinage.

→ Read more at

mining.com

December 30, 2021

COIN collectors can make a mint if they spot a piece with a double die error, with Lincoln cents selling for eye-watering price tags online. The US Mint has struck cents that feature 16th US President Abraham Lincoln since 1909.

→ Read more at

the-sun.com

December 31, 2021

The rare gold leopard coin, which was minted in 1344.

→ Read more at

livescience.com

December 31, 2021

A rare 17th century gold coin from the reign of King Sigismund III is set to fetch a whopping 1 million US dollars when it goes up for auction in New York next month.

→ Read more at

thefirstnews.com

Sep 6, 2021 | bullion, news

Welcome to the Labor Day Edition of the Weekly World Numismatic News!

The story that caught my eye is that the members of Accredited Precious Metals Dealers (APMD) of the Professional Numismatists Guild (PMG) predicted their end-of-year prices for precious metals.

The story that caught my eye is that the members of Accredited Precious Metals Dealers (APMD) of the Professional Numismatists Guild (PMG) predicted their end-of-year prices for precious metals.

According to the APMD members, the year-end predictions are as follows:

- Gold: $1,897

- Silver: $28

- Platinum: $1,153

Their estimates are the “mean averages of price predictions made by 25 accredited dealers” of the APMD. Members of the APMD “based their forecasts on years of being on the front lines of the bullion markets.” In other words, their predictions are as reliable as those that predict the pro football and basketball drafts.

With all due respect to the APMD and their members, every forecast I have heard while carefully watching the markets as a buyer has been bullish. It is very rare to hear anyone that is involved with this market make a bearish prediction.

Let’s have some fun with this. In the next few days, I will make my predictions along with the logic behind my prediction. Then I will create a graph to monitor the markets compared to our predictions. Let’s see how we do after the market closes on December 31!

And now the news…

August 26, 2021

While excavating the ancient city of Phangoria, located north of the Black Sea, in the Taman peninsula of southern Russia, archaeologists made an odd discovery: A single copper coin, minted in the year 1570, far far away in the Cypriot city of Famagusta.

→ Read more at

haaretz.com

August 27, 2021

Dealing with a recently passed away parent’s belongings is always a tough subject. It’s never just about the stuff – it’s about the memories and the emotions it all brings up, not to mention disagreements with siblings and partners about what to do with it all.

→ Read more at

goodmenproject.com

September 2, 2021

Money, money, money, money, ah so not just the song. But, the real thing. During the height of the pandemic, remember the shortages of toilet paper, paper products, disinfectant, hand sanitizer and yes, money, coins to be exact.

→ Read more at

poconorecord.com

September 3, 2021

By K Rajan Chennai: A finely made thin silver punch-marked coin weighing 2.2g unearthed at Keeladi in the seventh season of excavation this year holds key to the history of trading routes spanning the subcontinent and beyond — till Sri Lanka in the south and Afghanistan in the northwest

→ Read more at

timesofindia.indiatimes.com

September 4, 2021

Cree artist Sheila Orr designed a collectors coin for the Royal Canadian Mint, depicting the fur trade from a Cree perspective. It was released earlier this summer.

→ Read more at

cbc.ca

Sep 2, 2021 | bullion, coins, US Mint

Coining machines striking one-cent coins at the U.S. Branch Mint in Philadelphia.

During the recent media availability, U.S. Mint Director David Ryder said that the U.S. Mint is the only sovereign mint in the world to produce its bullion products since the start of the pandemic without interruption.

When COVID-19 affected the entire population, nobody understood the virus. In a panic, the entire world shut down. We did not understand the effects, but people were getting sick, requiring ventilators and scarce resources, and filling hospitals. For the U.S. Mint, there was an outbreak at the West Point Mint that affected production. They moved production to Philadelphia while those in West Point went into quarantine.

Like many critical businesses, the U.S. Mint reworked its schedule, added health precautions to keep workers safe, and continued production. While the numismatic world was worried about grading bullion coins from Philadelphia as an attempt to make a buck, the U.S. Mint was dealing with the health and safety of their workers.

It puts the industry’s selfishness in perspective.

Analysts give us many reasons why precious metals have risen, and the demand for bullion coins defies the usual analysis. Still, the U.S. Mint has been operating to supply a clamoring market.

Bullion production did slow down. The temporary closing of the West Point Mint reduced the resources they could use to produce bullion coins. There were also production problems by the U.S. Mint’s suppliers in producing the blanks they use. Those businesses were also facing COVID-19 issues that limited their capacity. And do not forget about the mines that could not operate or operated with limited capacity so they can protect their workers.

Ryder said that the procurement staff was diligent in using their resources to ensure the U.S. Mint had the materials to manufacture bullion.

Further limiting the U.S. Mint’s ability to manufacture bullion was the requirement to satisfy the orders for circulating coinage from the Federal Reserve.

As retailers were opening with new precautions, they reported that it was not easy to change because there were not enough coins. Headlines of a “coin shortage” became a topic. When the Federal Reserve investigated the issue, they found there were enough coins in the economy. Because the economy was not moving, circulating coinage was not circulating.

The problem was that the supply chain was interrupted and not moving as expected.

Coin Pusher in a penny arcade. Cambridge Midsummer Fair 2005 (Photograph © Andrew Dunn, cc-by-sa-2.0)

In the pandemic version of the game, the U.S. Mint manufactured coins so the Federal Reserve could dump billions into the economic hopper, hoping that some would fall out into the circulating economy.

In 2020, the U.S. Mint struck 14.774 BILLION coins, 23.7-percent more than they struck in 2019. Nearly every industry reported a reduction in demand and the ability to produce products. And the supply chain continues to affect production in some industries, including tech, where there is a shortage of computer chips. But the U.S. Mint was able to add over 14 BILLION coins to the economy.

The U.S. federal government continues to operate under mandatory pandemic-related protocols. As a federal bureau, the U.S. Mint continues to do its part to maintain social distancing and keeping its workers safe. No company, industry, or government has continued or boosted its production in this manner in the last 18 months.

Remember, the U.S. Mint does this without using any money from the general treasury. Their operating budget comes from the seignorage (profit) from the coin manufacturing process. When the profit exceeds their needs, a portion of the money is deposited in the general treasury. The more money the U.S. Mint makes, the more money they deposit in the general treasury. Talk about a money-making operation.

The U.S. Mint continues to have problems dealing with the collector market. Given the circumstances they have faced over the last 18 months, you have to admire their accomplishments.

Jul 21, 2021 | bullion, coins, silver, US Mint

This is the first article of three regarding the recent problems at the U.S. Mint.

Economic analysts believe there is a silver shortage but that it is not critical. According to the supply chain reports, a sufficient supply of industrial silver for manufacturers to keep up with production. The reduction in computer chip production because of COVID-based plant shutdowns is the greatest threat to manufacturing.

Economic analysts believe there is a silver shortage but that it is not critical. According to the supply chain reports, a sufficient supply of industrial silver for manufacturers to keep up with production. The reduction in computer chip production because of COVID-based plant shutdowns is the greatest threat to manufacturing.

Jewelry and other businesses that use silver for their beauty are experiencing a slowdown but not to the extent of the computer chip industry. The industry has been able to use recycled silver fueled by people cashing in their scrap silver. One silver refiner reports that they have more work than they can process.

Although manufacturers have silver to maintain production, the U.S. Mint announced on May 28, 2021, that “The global silver shortage has driven demand for many of our bullion and numismatic products to record heights.”

On June 2, the U.S. Mint clarified their statement by saying, “In a message released Friday, May 28, we made reference to a global shortage of silver. In more precise terms, the silver shortage being experienced by the United States Mint pertains only to the supply of silver blanks among suppliers to the U.S. Mint.”

Why is the U.S. Mint different from the other industries?

The short answer is that the U.S. Mint is just another government agency subject to federal law.

The U.S. Mint is required to buy silver mined in the United States within one year of its mining (31 U.S. Code §5132(a)(2)(D)). Under this law, the U.S. Mint cannot use recycled silver or silver that the government has not purchased from the mines.

The U.S. Mint discontinued assay operations shortly after the passage of the Coinage Act of 1964. Since then, the bureau has bought the metals from other manufacturers, either sheets or already formed planchets. When the American Eagle Program started, the law required the U.S. Mint to use the silver in the Strategic and Critical Materials Stockpile. The U.S. Mint manufactured the planchets in West Point.

When the program depleted the Strategic Stockpile, Congress updated the law to require the U.S. Mint to use freshly mined silver. They found that it was more cost-effective to have a commercial vendor manufacture the planchets.

Hiring a commercial vendor to do work for the federal government is different from a business-to-business transaction. The government requires all contracts and contractors to follow the Federal Acquisition Regulations (FAR) to purchase goods and services.

For the government to contract with any company, a bidding and vetting process can last from weeks to years. The agency has to produce requirements, selection criteria and evaluate the proposals, called source selection.

Congress purposely made the process challenging to promote fairness in the bidding process and ensure the government pays a fair price. Unfortunately, the process is expensive and fraught with problems.

For the U.S. Mint, the problem is that FAR does not allow the latitude to find alternate vendors when there are supply issues.

The U.S. Mint has contracts with four vendors to make silver planchets. They have vetted the contractors, their processes and have contractual quality control measures to ensure the planchets comply with the Treasury’s legal and quality requirements. If the vendors cannot fulfill the U.S. Mint’s order, the law prevents them from looking for immediate alternatives.

According to the U.S. Mint, the suppliers of silver planchets had production slowdowns because of COVID-19 operating precautions. In addition to manufacturing issues, the mining operators also experienced slowdowns because of the same operating precautions. Every industry is experiencing supply chain interruptions.

Where the U.S. Mint could have done better was to order the planchets sooner. The U.S. Mint reported that agency attorneys refused to allow their purchasers to order planchets before the law was signed. The bill, H.R. 6192, was sent to the president on December 24, 2020. The president signed the bill into law on January 5, 2021 (Public Law No. 116-286).

When a law is signed, the White House will tell the appropriate Departments. If that does not happen, the agencies receive notice from the Government Printing Office (GPO) who publishes the laws. Like everything else, the GPO has experienced interruptions because of pandemic protocols.

According to a government attorney that works for the Inspector General’s office in a non-Treasury department, agencies have the latitude to work on anticipated laws. An example cited is that the IRS works on drafting forms and regulations based on the bills in progress to be ready for the filing season.

Although Congress did not do the U.S. Mint a favor by passing the bill on Christmas Eve, the White House did not do the U.S. Mint a favor by not letting the Treasury know they signed the bill. However, the leadership of the U.S. Mint allowed the lawyers to dictate operations. The lawyers are supposed to be advisors, not the last word.

If you like what you read, share, and show your support

Jun 20, 2021 | bullion, coins, news

Farouk-Fenton 1933 Saint-Gaudens $20 Double Eagle was sold by Sotheby’s for $18,872,250 in a June 2021 auction. (Picture Credit: PCGS)

The gold market is very active, and the prices are rising, but not because of the sale of the Double Eagle. The demand for physical metals caused by economic uncertainty has driven up the prices for gold and silver coins.

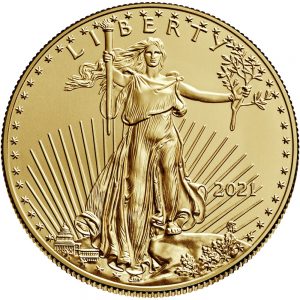

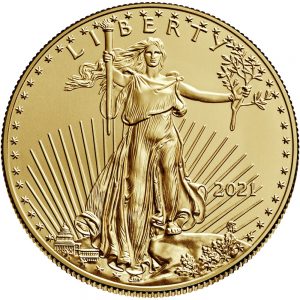

While discussing the demands for precious metals with dealers, they say that the demand is for coins. Their customers are buying American Eagle coins causing the supply of coins to decrease. When customers cannot buy American Eagles, they look to purchase silver coins from other state mints. Canada’s Maple Leaf and Mexico’s Libertad are popular alternatives to the American Eagle.

Investors are looking to purchase physical assets that have some backing. They are not buying bullion or contracts. As a result, the price of bars and other bullion products is reasonable compared to higher-priced coins. Contracts are paper-based trading of bullion. Many smaller investors traditionally do not like to trade based on paper. They are looking for something physical, like coins.

Bullion investing increases when investors perceive there are uncertainties in the markets. The current market run started last year during the beginning of the pandemic and has not stopped.

The markets are not responding to the sale of the 1933 Double Eagle. It is the only 1933 Double Eagle coin that is legal to own and has a story that inspired two books. Using this coin as an example of a reason to invest in gold coins is not representative of the reality of the bullion coin market. Beware of those who will try to sell you bullion based on the sale of this coin.

And now the news…

June 14, 2021

BOSTON — The wife and brother-in-law of a Cranston coin dealer convicted of laundering millions for a Mexican drug cartel struck out again in challenging $136-million forfeiture rulings against them.

→ Read more at

providencejournal.com

June 15, 2021

Beginning tomorrow, the Federal Reserve will begin its FOMC meeting for June, which will conclude on Wednesday. Following the conclusion, the Federal Reserve will release a statement, which a press conference will follow by Chairman Jerome Powell.

→ Read more at

kitco.com

June 17, 2021

Ultra rare stamps and a unique coin have sold at auction for a total of $32 million. Sotheby’s in New York played host to the record-breaking event. What were the lots?

→ Read more at

thevintagenews.com

June 18, 2021

In the article “Watermarked Paper First Series”, published in Pattaya Mail on Friday February 12, 2021, I wrote about problems with the watermarked paper.

→ Read more at

pattayamail.com

June 19, 2021

The 2021 platinum bullion American Eagle 1 oz coin has achieved the second highest sales on record, with sales of 75 000 oz for the five months to May 31, industry organisation the World Platinum Investment Council (WPIC) reports.

→ Read more at

miningweekly.com

If you like what you read, share, and show your support

Mar 8, 2021 | bullion, coins, gold, investment, markets, news, silver

Prices are rising.

Whether you talk about the price of groceries, gas, or collectibles, prices are rising. So are the price of the collectibles markets, including numismatics.

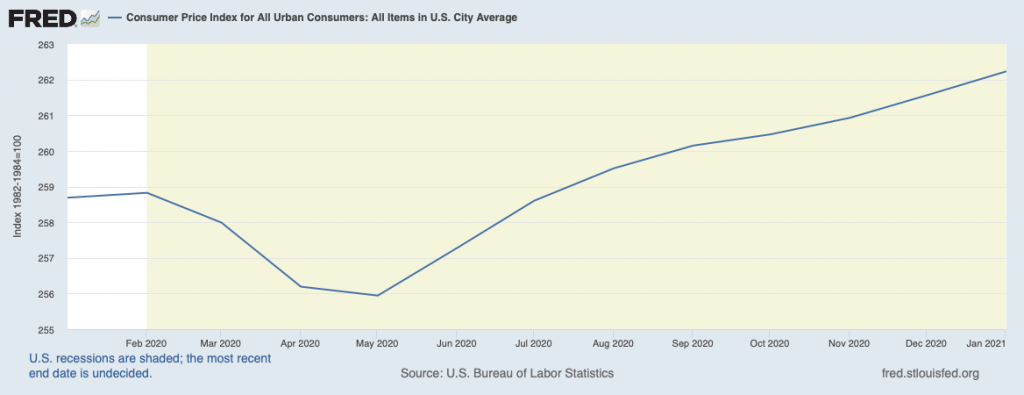

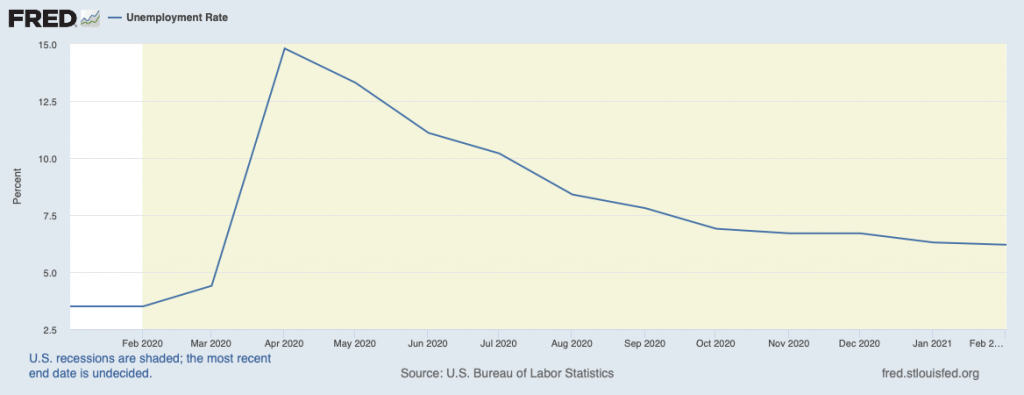

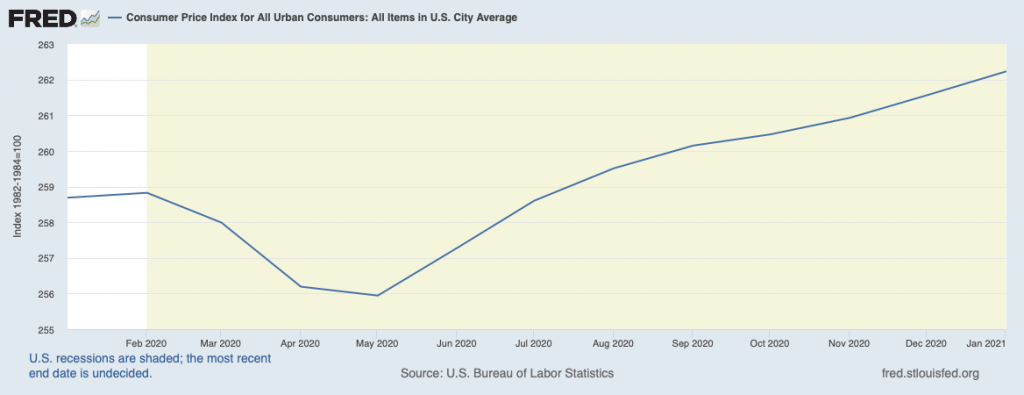

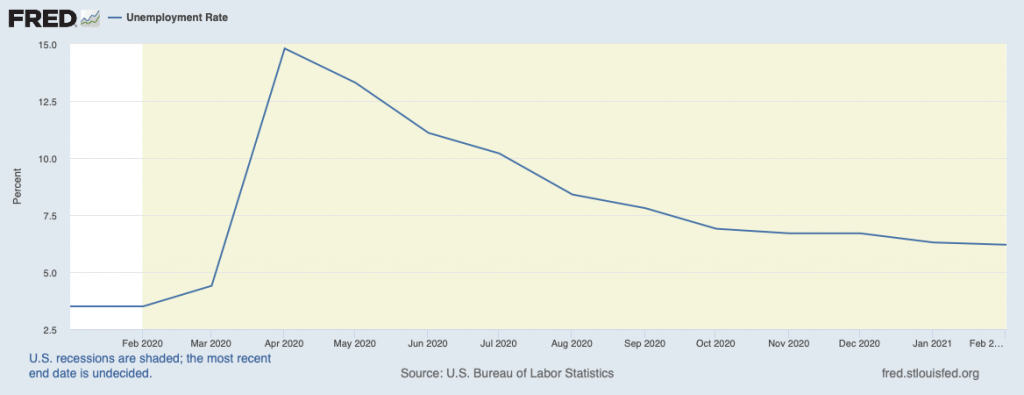

According to the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) has been steadily rising for six months. While the prices are rising, unemployment has dropped from the beginning of the pandemic high of 14-percent to the 6.2-percent rate, BLS recently announced.

-

-

Charting the Consumer Price Index during the pandemic

(Chart courtesy of the St. Louis Fed)

-

-

Charting the Unemployment rate during the pandemic

(Courtesy of the St. Louis Fed)

With all of this economic stress, why are collectibles, especially numismatics, are seeing rising prices?

An auction industry source said that there is a pent-up demand for something resembling normal. Instead of the everyday routine, those with means are buying. In the last six months, the industry reports that prices realized for all sectors have risen at rates higher than seen in many years. Estate auctions are attracting new customers looking for unique items.

Numismatics is in the middle of the trend, with collectors and investors looking for something to do. Collectors are spending more time with their collections and looking to expand. Investors see the rise in values because of the rise in precious metal prices and have driven the market higher.

-

-

One year gold spot price

(Graph courtesy of PCGS)

-

-

One year silver spot price

(Graph courtesy of PCGS)

One of the areas where the price changes are noticeable is in the markets for precious metals. While the spot price for gold and silver has been relatively steady, the numismatic spread for coins has climbed. Dealers are reporting that generic gold and silver for numismatic items increased over the last six months.

Price trends of coinage over the last year

(graphs courtesy of PCGS)

-

-

One year trend of generic gold coin prices

-

-

One year trend of Morgan and Peace Dollar prices

-

-

One year trend of 20th Century coin prices

Several industry reports note a higher demand for physical ownership of precious metals, putting pressure on the markets. But rather than buying bullion, investors are purchasing coins. Demand for American Eagle products has outpaced many dealer’s abilities to purchase supplies. When bullion coins were not available, investors purchase coins produced for the collector market, including proof and special issues coins.

Recently, the U.S. Mint set a 99 coin limit when they released the 2021-W American Silver Eagle Proof coin with the original reverse. The coin sold quickly. When asked, the U.S. Mint claimed they did not have the statistics about the number of 99 coin purchases they fulfilled. Collectors report that they were shut out of coin purchases while dealers have been slabbing and selling the coins mostly to investors.

If the predictions are true, economists believe that there will be a roaring 2020s similar to the roaring 1920s following the Spanish Flu Pandemic. Considering the current trends, the secondary market for numismatics may make it too expensive for the average collector to participate in the market.

And now the news…

March 1, 2021

Some artists struggle to figure out ways to make money from their art. Not Christina Hess, a Philadelphia-based artist and chair of the illustration department at Pennsylvania College of Art & Design.

→ Read more at

lancasteronline.com

March 2, 2021

Most people have some coins lying around in their house somewhere, some people decide to keep them in a jar, and some may have quite a lot of them.

→ Read more at

tweaktown.com

March 2, 2021

At least 110 ancient gold coins were seized and a suspect was arrested in an anti-smuggling operation in southeastern Turkey, a security source said on March 1. Gendarmerie teams fighting organized crime in Şanlıurfa province raided the address of the suspect, who was learned to be smuggling historical artifacts, in Viranşehir district, said the source on condition of anonymity due to restrictions on speaking to the media.

→ Read more at

hurriyetdailynews.com

March 5, 2021

There has been strong interest in the international numismatic auction planned for Friday March 12 in Central Wellington. From a midday start, there will be more than 600 lots to auction, with participants bidding both in the room and online.

→ Read more at

scoop.co.nz

March 6, 2021

Artist Gary Cooper of Belfast used a 3D sculpting computer program to create the winning design for the commemorative coin that will mark the 50th anniversary of the 1969 Apollo 11 mission. Credit: Abigail Curtis / BDN

→ Read more at

bangordailynews.com

If you like what you read, share, and show your support

Feb 8, 2021 | bullion, gold, silver

If you missed the five-second commercial from Reddit after the halftime show, you missed their touting their service as a place to discuss things. Lately, Reddit has been famous for a sub-Reddit that helped promote the stocks of GameStop, AMC movie theaters, and BlackBerry. All companies whose business models have not kept up with technology or are suffering because of the pandemic.

If you missed the five-second commercial from Reddit after the halftime show, you missed their touting their service as a place to discuss things. Lately, Reddit has been famous for a sub-Reddit that helped promote the stocks of GameStop, AMC movie theaters, and BlackBerry. All companies whose business models have not kept up with technology or are suffering because of the pandemic.

An interesting aspect of this story is the Robinhood trading platform’s use to buy and sell these stocks. Robinhood is a no-commission trading service that many of the people participating in the sub-Reddit use to trade. Not only are they gaining free access to the markets, but they were able to cause significant losses amongst the large hedge funds. The hedge funds did not like losing money to what they considered non-professionals. The Reddit users called it the democratization of the markets.

Although these stocks have returned to more reasonable levels as compared to their earnings, people in the sub-Reddits are looking to make statements in other markets. One of the markets they are trying to work on is silver.

Precious metals continue to be a safe haven for uncertain markets. With the uncertainty of the markets and the Exchange Traded Funds (ETF) in the metals market and changes in some rules, investors demand access to physical metals.

Rather than buying bullion, investors are buying legal tender coins. Even with the high numismatic premiums on precious metals coins, they are reporting limited supply. The highest demand is for the American Silver Eagle and the Canadian Silver Maple Leaf. Both mints are reporting record production of these coins.

When an ETF creates its market basket of stocks, the exchanges require that each of the stocks have specific minimum holdings of physical metals to back the prices. ETFs are finding they have to rebalance their portfolios since the funds holding the metals are not increasing their holdings as much as the general public. Their lack of buying is keeping the price of metals stable.

Dealers are reporting that individual and smaller institutional investors are buying silver. Although these buyers do not impact the broader market, they are impacting the numismatic premium. People are paying upwards of 35 percent over the spot price.

The rules will prevent the Reddit mob from manipulating the metals markets. However, until there is more certainty in the market, there will continue to be a high numismatic premium for bullion coins.

And now the news…

February 4, 2021

• Silver keeps corrective pullback from $25.90 trapped in a $0.10 range off-late. • Premiums on American Eagle silver coins jump on Thursday, Apmex urges customers to expect delay in order processing.

→ Read more at

fxstreet.com

February 4, 2021

The Edge of the Cedars State Park Museum needs help identifying some BLM collections and a mystery coin.

→ Read more at

abc4.com

February 4, 2021

* More than 1.1 million troy ounces of silver sold in Jan * Selling everything that can be currently made in silver- Mint * Short-squeeze story boosted demand for physical silver-analyst

→ Read more at

kitco.com

February 5, 2021

A COIN collection has gone under the hammer for £2.3m with the latest sale bringing a world record price for one 450 year old Oliver Cromwell gold coin.

→ Read more at

gazetteherald.co.uk

If you like what you read, share, and show your support

Jan 10, 2021 | bullion, Eagles, gold, investment, markets, news, silver

The Weekly World Numismatic News return finds that although 2020 was a stressful year and 2021 has not started with a promise for improvement, the rare coin and paper money market appears healthy.

The Weekly World Numismatic News return finds that although 2020 was a stressful year and 2021 has not started with a promise for improvement, the rare coin and paper money market appears healthy.

Based on a survey of auction houses conducted by the Professional Numismatists Guild, they reported the total sales at auction to be over $419 million. With COVID-19 causing the cancellation of every major show, the auction moved online with success.

A consistent comment is that the auctions provided a means for collectors to liquidate all or parts of their collections to raise money during the pandemic. But for this type of sale to be effective, there have to be bidders to buy the coins. The buyers came.

HiBid, an online auction platform that supports many auction houses, has consistently reported weekly sales on the tens-of-millions of dollars. This year, HiBid reports that traffic to coins.hibid.com was their fastest growing platform.

Finally, with the stock markets soaring with the economic uncertainty growing because of the COVID-19 pandemic, the U.S. Mint saw the sale of American Eagle gold and silver coins increase dramatically. In 2020, the U.S. Mint sold 884,000 ounces of American Gold Eagle coins, increasing 455% from the 152,000 ounces sold in 2019.

The sale of American Silver Eagle coins doubled from last year by selling 30.01 million ounces of silver.

Since the U.S. Mint reports bullion coins more regularly than collector coin sales, those coins’ impact is not reflected in these numbers.

There are collectors out there. Unfortunately, they are not members of the American Numismatic Association or other numismatic organizations. Maybe the numismatic community should use this as a lesson to try to grow the hobby.

And now the news…

December 29, 2020

One face of the coin features a typical Cyberpunk 2077 scene with towering skyscrapers and hulking mega-structures looming over a souped-up motor vehicle. The coin’s flip side depicts a bust of Queen Elizabeth II, Press materials

→ Read more at

thefirstnews.com

January 4, 2021

Queen Elizabeth is just months away from a milestone birthday — and the U.K.'s Royal Mint is already celebrating. The Royal Mint unveiled five new commemorative coins for 2021, including a £5 coin to mark the monarch's 95th birthday in April.

→ Read more at

people.com

January 4, 2021

Kitco News has launched its 2021 Outlook, which offers the most comprehensive coverage of precious metals markets in the new year. Trillions of dollars were pumped into financial markets in 2020 and that won't come without consequences.

→ Read more at

kitco.com

January 4, 2021

A coin collection in a backroom of the Graveyard of the Atlantic Museum could one day reveal Outer Banks history

→ Read more at

pilotonline.com

January 8, 2021

With an alarming level of uncertainties across-the-board courtesy of the COVID-19 pandemic, coupled with a return to high market volatility and unprecedented global economic stimulus, investors are increasingly seeking alternative investment strategies.

→ Read more at

thearmchairtrader.com

If you like what you read, share, and show your support

Nov 2, 2020 | bullion, gold, news, silver

Here we are with the election on Tuesday. The numismatic-related news has some stories but nothing of significance. For bullion buyers, the metals market has been active. One analyst called the market schizophrenic while trying to figure out what economic conditions will be.

Another analyst that follows the silver market noted the decline of silver prices since September. Among the reasons is that early buyers of silver are looking to cash in on their holdings. Those who bought last year when the average price was around $18 per ozt have been looking to profit from the spot being over $22. When asked if the price of silver will decline, the response was to ask after the election.

-

-

60 Day Gold Chart ending 01-Nov-2020 — courtesy of Kitco

-

-

60 Day Silver Chart ending 01-Nov-2020 — courtesy of Kitco

Gold prices have been steadier but have shown a gradual decline since August. A gold analyst reminded me that gold is a safe haven for investors when markets are uncertain. This analyst did not think the markets will see certainty after the election. Their firm is telling clients that regardless of the outcome of the election, the lame-duck Congress will create a lot of infighting that will spill over into the markets.

The value of many modern collector coins is dependent on the value of the metals. Those coins will see their values fluctuate with the market. Unfortunately, none of the analysts consulted predicted stability in the market. They suggested that unless you had to sell that you might wait. One recommended setting a high and low price for buying and selling but would not recommend the spread.

Regardless of what you choose to do with your investment coin, be prepared for a bumpy ride because none of the analysts would predict any stability for the next six months.

And now the news…

October 24, 2020

For almost three thousand years, humans have been using coins as payment. As that winds down in an increasingly cashless world, let’s take a look at how the Vikings dealt with money.

→ Read more at

lifeinnorway.net

October 25, 2020

A man with a metal detector has found a long-hidden, 222-year-old coin under a few inches of soil outside a church in Maine. Shane Houston, of Charlotte, North Carolina, was on a metal-detecting trip with a friend from New Hampshire when he found the coin earlier this month, the Bangor Daily News reported.

→ Read more at

wbtv.com

October 27, 2020

A rare King Harold II coin dating from 1066 that was found by a metal detecting teenager has made £4,000 at auction.

→ Read more at

bbc.com

October 27, 2020

The Bank of Lithuania minted the first euro piece of currency containing Hebrew letters. The 10-euro coin was minted on Tuesday and is a limited-edition commemorative collector’s item celebrating the 300th anniversary of the birth of the Vilna Gaon, the 18th-century rabbinical luminary Elijah ben Solomon Zalman, who lived and died in the Lithuanian capital of Vilnius.

→ Read more at

jpost.com

October 29, 2020

Heartbreaking message behind new $2 Aussie coin. Source: Royal Australian Mint

→ Read more at

au.finance.yahoo.com

If you like what you read, share, and show your support

Oct 11, 2020 | bullion, coins, silver, US Mint

If you do not follow the U.S. Mint on Facebook or Twitter, they announced that there would be a price increase for silver coins as of October 13, 2020. Their statement read:

The United States Mint recently adopted a new strategy for pricing products in its silver numismatic products portfolio. As a result, prices for products containing silver will change EFFECTIVE October 13, 2020, with release of the 2020 American Eagle Silver Proof Coin with “S” mint mark (20EM). The new pricing will affect prices for silver products already on sale (including prior year) and those remaining to be released in 2020.

In order for the United States Mint to cover rising costs, meet its fiduciary responsibility to operate at no net cost to taxpayers, and return money to the Treasury General Fund, re-setting silver prices is necessary.

The Mint’s goal, as a fiscally responsible self-funded Federal agency, is to always provide the best quality numismatic products while maintaining fair prices. The first objective is to ensure that the numismatic portfolio (all product lines together) be self-sufficient and cover all associated costs. The new silver prices reflect a sound business decision aimed at meeting these obligations. (No tax dollars are used to fund numismatic operations.)

The United States Mint will continue to look for operations optimization and cost reduction efforts to deliver superior quality numismatic products at a fair price.

Kitco YTD Silver Price as of 10/9/2020 (does not update, trendline added)

From the $17.925 at the close of the markets on January 2 through August 6, silver rose 58-percent. If the U.S. Mint had to purchase silver in August to meet market demands, it was the most expensive silver they purchased.

U.S. Mint Price Update

| Product |

Old Retail Price |

New Retail price |

Percent Increase |

| Presidential Silver Medals |

$46.00 |

$65.00 |

41.304% |

| America the Beautiful Quarters Silver Proof Set |

$42.50 |

$60.00 |

29.167% |

| American Eagle One Ounce Silver Proof Coin |

$64.50 |

$73.00 |

13.178% |

| American Eagle One Ounce Silver Uncirculated Coin |

$54.00 |

$67.00 |

24.074% |

| American Eagle One Ounce Silver Proof Coins—Bulk Pack |

† |

$2,920.00 |

— |

| American Eagle One Ounce Silver Uncirculated Coin—Bulk Pack |

† |

$2,680.00 |

— |

| Limited Edition Silver Proof Set |

$120.00‡ |

$201.00 |

67.500% |

| Silver Proof Set |

$63.25 |

$105.00 |

66.008% |

| America the Beautiful Five Ounce Silver Uncirculated Coin |

$178.25 |

$229.00 |

30.670% |

| End of World War II 75th Anniversary American Eagle Silver Proof Coin |

* |

$83.00 |

— |

| End of World War II 75th Anniversary One Ounce Silver Medal |

* |

$75.00 |

— |

| 2019 America the Beautiful Quarters Silver Proof Set |

$36.95 |

$60.00 |

62.514% |

| 2019 American Liberty High Relief Silver Medal |

$99.95¶ |

$175.00 |

75.088% |

| 2019 Congratulations Set |

$56.95 |

$75.00 |

31.694% |

| 2019 Silver Proof Set |

$54.95¶ |

$105.00 |

91.083% |

† These products are sold directly to distributors who sell them to dealers. Prices are not on the U.S. Mint’s website.

‡ The only items for sale at the U.S. Mint that comes close to this is the Women’s Suffrage Centennial 2020 Proof Silver Dollar and Medal Set

* Item was not for sale prior to the price hike

¶ Listed as “Currently Unavailable” on the U.S. Mint’s website.

You cannot blame the U.S. Mint’s metals buyers. First, they are mandated to buy precious metals from U.S. sources at the market value. If they need additional inventory, then they buy it on the market like everyone else. Like any investor, the U.S. Mint can try to predict the market, but the results are variable like any investor.

Since August 6, the price of silver dropped to $24.315, a 14.17-percent decrease. However, the price of silver is up 35.65-percent for the year. If the price of materials rise, how long could the U.S. Mint maintain their prices?

Aside from the rising cost of silver, the U.S. Mint did not report how much other costs have risen. Aside from the dies and facilities costs, they must account for labor, design, and production costs. The U.S. Mint has not reported what additional costs they have incurred because of the pandemic.

The U.S. Mint is unlikely to report about these issues until the release of the annual report.

And now the news…

October 6, 2020

The Ministry of Culture and Sports on Monday announced that five rare silver coins dating to the 5th and 4th centuries BC were returned to Greece, before being auctioned off in Munich and Zurich.

→ Read more at

greekcitytimes.com

October 5, 2020

The executive officer said construction workers found the coins and rings in a brass box.

→ Read more at

newindianexpress.com

October 9, 2020

Surprising as it may sound, there once was a time that our coinage system, backed by gold and silver, was mostly supplied by Spain and countries under Spanish rule, such as Mexico, Chile, Bolivia, Peru and Guatemala.

→ Read more at

yarmouth.wickedlocal.com

October 10, 2020

An extremely rare Roman coin commemorating the assassination of Julius Caesar has surfaced and may be worth millions of dollars, according to coin experts.

→ Read more at

foxnews.com

If you like what you read, share, and show your support

→ Read more at dailymail.co.uk

→ Read more at dailymail.co.uk

→ Read more at mining.com

→ Read more at mining.com

→ Read more at the-sun.com

→ Read more at the-sun.com

→ Read more at livescience.com

→ Read more at livescience.com

→ Read more at thefirstnews.com

→ Read more at thefirstnews.com