Earlier today, the Federal Reserve issued a press release announcing that the redesigned $100 Federal Reserve Note will be issued on October 8, 2013.

Earlier today, the Federal Reserve issued a press release announcing that the redesigned $100 Federal Reserve Note will be issued on October 8, 2013.

The redesign of the $100 note was announced with a press release that was to be held on April 21, 2010 at the Department of the Treasury Cash Room with all of the usual suspects: then Secretary of the Treasury Timothy Geithner, Chairman of the Board of Governors of the Federal Reserve System Ben Bernanke, Treasurer of the United States Rosie Rios, and the since retired Director of the United States Secret Service Mark Sullivan.

The date of the announcement, the Bureau of Engraving and Printing and Federal Reserve announced that Chairman of the Federal Reserve Board Ben S. Bernanke said, “When the new design $100 note is issued on February 10, 2011, the approximately 6.5 billion older design $100s already in circulation will remain legal tender.”

Throughout the summer of 2010, the BEP and Federal Reserve released a lot of training and education materials in anticipation of the release of the new notes.

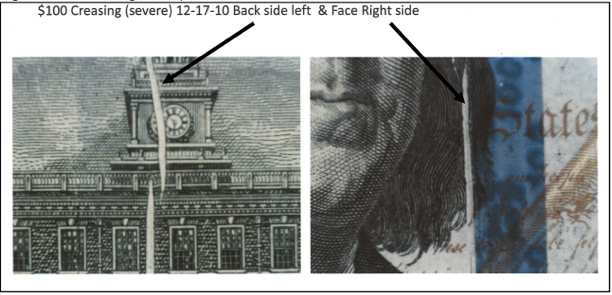

Everything seemed to be going well until October 1, 2010 when the Federal Reserve “announced a delay in the issue date of the redesigned $100 note.” The Federal Reserve and BEP said that there was a problem with creasing of the paper during the printing process. That was the last we heard from the Federal Reserve until today’s announcement.

Magnified images of the creasing showing up on the new $100 notes.

In the mean time, the Treasury Office of the Inspector General issued a report (OIG-12-038 [PDF]) that said the BEP did not handle this process properly. The report said:

We consider the delayed introduction of the NexGen $100 note to be a production failure that potentially could have been avoided and has already resulted in increased costs. We found that BEP did not (1) perform necessary and required testing to resolve technical problems before starting full production of the NexGen $100 note, (2) implement comprehensive project management for the NexGen $100 note program, and (3) adequately complete a comprehensive cost-benefit analysis for the disposition of the approximately 1.4 billion finished NexGen $100 notes already printed but not accepted by FRB. [Federal Reserve Board]

After the report noted that the BEP basic responded by saying that they were sorry and are looking into it, the OIG caved and said that even though the BEP was bad, the corrective actions “are responsive to our recommendations.”

Then nothing. No follow up by the OIG or the Government Accountability Office. In fact, we have not heard from the GAO since their 2005 report suggesting whether a second supplier of currency paper is needed (see GAO-05-368).

Of course it is easy for the BEP to say that Crane & Co., the Dalton, Massachusetts company that has been the exclusive currency paper supplier since 1879, because it would be easy to justify. Some of the arguments against finding a second supplier includes the cost of entering the market and the established relationship with Crane who the BEP allows to “own” the innovations paid with taxpayer money. There was also the case of having two of the most powerful senators, Ted Kennedy and John Kerry, there to protect Crane. Neither are the senators from Massachusetts today.

While the BEP has been struggling with rag-bond paper, countries have been moving to using polymer “paper.”. The polymer “paper” was developed by the Reserve Bank of Australia to enhance the durability of the notes and to incorporate security features not possible with paper or rag-based paper. RBA has been distributing polymer notes since 1992. While the polymer substrate costs little more and the production is only marginally more expensive, the benefit will come from the reduction in counterfeiting and the durability of the note. Polymer will last three-to-six times longer than rag-based paper.

The Bank of Canada has reissued its C$100, C$50, and C$20 notes using the polymer paper and will issue the new C$5 and C$10 notes later this year.

Switching to polymer notes, especially for higher denominations, would be a better decision. It will reduce counterfeiting and reduce the costs over the lifetime of the note. And there is no law that would prevent the Federal Reserve from using the polymer paper.

Considering the Bureau of Engraving and Printing’s previous performance with the $100 notes, this should not be consider the time to celebrate. Especially since a pre-solicitation notice asking for information about purchasing a Single Note Inspection System is still open at FedBizOpps.gov and the BEP has not issued a request for proposal (RFP) to purchase such a system. Let’s wait for the BEP to deliver the notes to the Federal Reserve for distribution before considering this a success.

While waiting, enjoy this video announcement narrated by Federal Reserve Deputy Associate Director Michael Lambert about the new release date.

Images courtesy of the Bureau of Engraving and Printing.

Video courtesy of the Federal Reserve.