May 25, 2022 | currency, Federal Reserve, policy

Would ending the circulation of the $100 Federal Reserve Note force the Russian people to pressure Putin over his Ukraine attack?

Would ending the circulation of the $100 Federal Reserve Note force the Russian people to pressure Putin over his Ukraine attack?

According to an opinion piece published in the Wall Street Journal by Markos Kounalakis (sorry, it’s behind a paywall), the sanctions on Russia are not reaching their people. Kounalakis believes that the United States should stop circulating the $100 bill to reach the people.

The United States dollar is the world’s reserve currency, and it is used as a safe store of wealth by people and companies. The Euro may represent an easily transactional currency, but the dollar is where the world turns for a store of wealth. In Russia, where the banks are not trusted, average citizens keep their savings in dollars.

According to the Federal Reserve, more than 661,500 pounds of $100 bills are in Russia as of 2019. Russians are stuffing them in a mattress and not using them for commerce.

Removing large-denomination currency from circulation is not new. In 1969, the Treasury withdrew the $500 and $1000 notes from circulation to make it more challenging for drug traffickers to move large amounts of cash.

In 2016, some economists made a case to stop circulating the $100 bill and the €500 banknote, even claiming the €500 note was nicknamed the “Bin Laden.” Eventually, the European Central Bank (ECB) stopped circulating the €500 banknote in 2018. But that has not stopped their use by criminals since the ECB has not demonetized the notes.

Even if the United States wanted to stop the circulation of $100 notes in Russia, it would not be an easy process. First, who would have the authority to make this determination? According to the Federal Reserve Act of 1918, it is the Federal Reserve’s job to manage circulating currency independently. The law that created the Office of the Comptroller of the Currency (OCC) allows this Treasury bureau to oversee the mechanisms that go into currency movement.

The government has more latitude over managing currency than coins. The law requires the U.S. Mint to strike cents, 5-cents, dimes, quarter dollars, half-dollars, and dollar coins (31 U.S. Code § 5111). On the other hand, the law (12 U.S. Code § 418) sets the denomination types, but it does not require the Federal Reserve to circulate all denominations.

If the President decides that it is in the best interest of U.S. foreign policy to stop the circulation of $100 notes, the Federal Reserve must decide if it is in the best interest of the Federal Reserve System to do so. However, the law complicates the matter by having the OCC oversee the institutions managing the currency. The blurry line between the authority of the Treasury Department and the independence of the Federal Reserve could create tension.

Should the policy regarding issuing $100 Federal Reserve Notes change, currency collectors may find opportunities to collect $100 notes.

Oct 6, 2021 | coins, Federal Reserve, policy, US Mint

The $1 trillion coin concept turns up like a bad penny.

Also turning up are all pundits, politicos, reporters, and sycophants explaining why the U.S. Mint should or should not strike the coin. The problem is that EVERYONE IS WRONG!

Let’s look at the FACTS.

FACT: Before a coin leaves the U.S. Mint, the purchaser must pay for the coin.

The Federal Reserve purchases business strike coins at face value. The money is deposited in the U.S. Mint’s Public Enterprise Fund.

Collectors pay for collector coins through the U.S. Mint’s retail and e-commerce operations. When the money is collected, they deposit the funds in the U.S. Mint’s Public Enterprise Fund.

FACT: The United States Mint has successfully argued in court that a coin is not legal tender until it is paid for.

After the U.S. Mint discovered the existence of several 1933 Double Eagle coins that were supposedly melted, the Secret Service investigated and seized several coins. Through the 1950s, government lawyers argued that the coins were government property since the coin was never monetized.

During the case of the Farouk-Fenton double eagle coin, the government used the same argument. Even though there was an export license for the coin issued to King Farouk of Egypt, the government maintained that the lack of monetization made the coin illegal.

As part of the $7,590,020 paid for the 1933 Double Eagle in 2002, $20 of the purchase price was paid to the U.S. Government to monetize the coin. When Sotheby’s sold the coin in June for $18,872,250, the coin came with a certificate from the U.S. Mint declaring its Legal Tender status.

If the U.S. Mint does not monetize a coin until someone or entity buys it, then how will striking a $1 trillion coin help anything?

Even as crazy as government generally accepted accounting principles (GAAP) may appear to the commercial market, Government GAAP still requires double-entry bookkeeping. In double-entry bookkeeping, if an asset is added to one part of the ledger, there must be a debit on another.

Forget the political arguments about the debt. When the government needs money, it sells bonds to finance its obligation. The bond is the created asset, as the coin. The asset is purchased, adding cash to the general treasury. In bookkeeping terms, an asset entry and an associated debit entry.

Who is going to buy the coin?

The Federal Reserve is not going to buy the coin. Bonds, warrants, and other investments have tangible returns. The investments have value and can be traded on the equity markets keeping the books balanced. What happens if $1 trillion is tied up in a non-investing asset?

If the Federal Reserve buys the coin, the general treasury may see a $1 trillion windfall, but the Federal Reserve will have $1 trillion less economic power. It is $1 trillion less in short-term loans to large financial institutions and quantitative easing that is keeping the economy in control.

If the Federal Reserve buys the $1 trillion coin, it will create a $1 trillion hole in the economy.

The U.S. Gross Domestic Product (GDP), the monetary value of all goods and services, is estimated at $22.675 trillion. Taking $1 trillion out of the economy will reduce the economy by 4.4-percent.

As the Great Recession of 2008 raged, the GDP lost 1-percent of its value by 2009. If a one percent drop caused the most significant economic calamity since the Great Depression, what will happen if the GDP contracts by more than 4-percent?

Of course, Congress can pass a law that changes how the U.S. Mint determines the legal tender status of coinage they manufacture. But the likelihood of that happening is about the same as the U.S. Mint striking a $1 trillion coin.

Jul 25, 2020 | cash, coins, Federal Reserve, US Mint

The U.S. Mint succinctly stated in its press release about the shortage of circulating coins is that there are enough coins in the economy. There is no shortage.

The U.S. Mint succinctly stated in its press release about the shortage of circulating coins is that there are enough coins in the economy. There is no shortage.

What is happening is that, like everything else during the COVID-19 crisis, the supply chain broke. Coins stopped circulating because people were not going out and spending the coins or currency. Since cash sales dropped, there was no need for stores to stock up on coins. They had the supply to conduct business.

Since the stores did not need the coins, the banks stopped ordering coins for its inventories. Larger stores that rely on logistics carriers were not ordering coins or sending coins into the supply chain. Finally, the logistics carriers saw their inventories rise and become stagnant, giving them no reason to buy more coins from the Federal Reserve.

Now that areas are opening and the demand for change has increased, the supply chain has to restart. According to Federal Reserve Chairman Jerome Powell, the cash rooms operated by each Federal Reserve District has a sufficient supply of coins. But the coins have to be circulated through the system.

The government is doing its job. The U.S. Mint is striking a sufficient volume of coins for circulation, and the Federal Reserve has the supply to support commerce. It is the private sector that manages the supply chain that has failed.

The logistics companies, the coin processors that move the money between the Federal Reserve, the banks, and the retailers, have caused the backup. Since many banks have limited access to their drive-thru operations, there is an opportunity for the supply chain to adjust. They cannot adjust fast enough.

If you want to help fix the supply chain, spend your coins. Use exact change when possible. When it is not possible, use a credit or debit card.

If you are the type that keeps coins in jars, now is the time to do your search and send the rest back into circulation. Some banks are offering bonus payments for bringing in coins. Others that were charging fees if you did not roll the coins are waiving those fees. If you regularly buy from Amazon, consider using a Coinstar machine to turn your coins into an Amazon credit. Coinstar does not charge a fee when you trade your coins for Amazon credit.

Relax! It is not a conspiracy to get coins out of circulation. The government is not replacing U.S. dollars with Bitcoin. The government is not participating in creating a global currency, especially when you see how that has worked with mixed results in Europe. And this is not how the government is going to take your money away from you. That is what the tax code does.

Take your coin jar, search for collectible circulating coins, and spend the rest. Get the coins back into circulation.

If you like what you read, share, and show your support

Jul 20, 2020 | coins, Federal Reserve, news

There is a coin shortage.

There is a coin shortage.

There is also a currency shortage, but it is not as severe as the coin shortage.

The shortage is not because the government has stopped the manufacturing process. There was a production slowdown in April and May, but that does not account for the lack of circulating coins. The West Point Mint briefly closed because the circumstances were different. West Point does not strike circulating coinage.

Although the Bureau of Engraving and Printing slowed down production in Washington, D.C., Fort Worth did not miss a beat.

The Federal Reserve, an independent organization, did not stop the circulation of money. There is money in the various cash rooms around the country. While some of the supply is lower than usual, Federal Reserve Chairman Jerome Powell testified to Congress that their supplies are adequate to meet the demand.

If the government is not causing the coin shortage, then where are the coins?

For nearly eight weeks beginning in mid-March, the amount of money circulating diminished to its lowest levels since the Great Depression. You have not been spending cash. The result is that the stores and banks were not circulating coins forcing the logistics companies to store what they can and deposit the rest with the Federal Reserve.

The Federal Reserve believes there are enough coins to satisfy commerce. The problem is that the supply chain has to restart. There is a limit to how fast the supply chain can move the coins around.

The warehouses where the coins are stored is like a gallon jug or your favorite beverage. To server your guests, you need to pour that gallon jug into glasses. But the only way to pour the jug is into a funnel to guide the liquid into each glass. How much is pouring slowed down by the bottleneck of the smaller opening at the bottom of the funnel?

In the case of coins, the smaller opening is the armored cars that deliver the money from the warehouses to the banks and other large institutions. The limited capacity of the opening will slow down the pouring of the beverage and the pouring of the coins back into the economy.

One Federal Reserve research group suggested that it could take 3-6 weeks for the supply chain to get back to normal. Compared to the lack of Clorox and Lysol cleaners in the supermarkets, that is lightning fast!

And now the news…

July 14, 2020

A recent social media post falsely said a coin shortage in the U.S. was a sign of an impending one-world government. The false claim included a photo of a sign in a grocery store asking customers to use exact change or noncash payments due to a "national coin shortage," according to PolitiFact.com.

→ Read more at

dailyherald.com

July 14, 2020

Editor's note: This is an excerpt of Planet Money's newsletter. You can sign up here.

→ Read more at

npr.org

July 15, 2020

People have been collecting coins since they became useful for bartering around 700BC. The hobby of collecting currency today is now one of the best activities that kids of all ages can become involved with. There isn’t a video game in existence that packs the same reward as collecting coins.

→ Read more at

williamsondailynews.com

July 15, 2020

Interest in gold is rising across the globe as confidence in paper currencies declines. Image: Chris Ratcliffe, Bloomberg Demand for Kruggerands, the top-selling gold coin in the world, is surging as buyers across the globe scramble for one of the few safe havens in times of economic distress.

→ Read more at

moneyweb.co.za

July 16, 2020

Maybe you’ve seen signs in retail stores about a coin shortage, which led to a widely shared conspiracy theory on Facebook. "National Coin Shortage Just Beginning. The national coin shortage was done intentionally, the mint is no longer releasing coins into circulation aka this is the beginning of the end of paper money," the July 2 post says in part, arguing it’s part of a decades-old plan toward enabling a "soon coming one world government" to track every private transaction.

→ Read more at

politifact.com

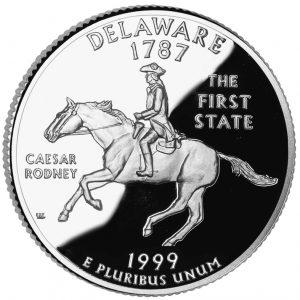

Nov 27, 2018 | cash, coins, Federal Reserve, markets, state quarters, US Mint

It never ceases to amaze me that even the most seasoned and esteemed numismatists do not understand how United States coinage goes from manufacturing to circulation.

It never ceases to amaze me that even the most seasoned and esteemed numismatists do not understand how United States coinage goes from manufacturing to circulation.

Recently, Harvey Stack wrote a column that appeared as a Viewpoint in Numismatic News (November 18, 2018). In the column, he blamed the U.S. Mint for problems with the distribution of the 50 State Quarters program. In the article Stack wrote that “the distribution of the new designs did not get full nationwide distribution. The Mint sent to most banks nationwide whatever they had available, with some districts getting large quantities of the new issue and other districts getting relatively few, if any.”

The U.S. Mint does not distribute circulating coins to any United States bank except the Federal Reserve. At the end of every production line is a two-ton bag made of ballistic materials that collect every coin produced on the line. When the bag is full it is sealed and later transported to a processing center designated by the Federal Reserve.

The U.S. Mint is a manufacturer. When they complete making the product, it is packaged in bulk and the customer, the Federal Reserve, picks up the product. Once the product is delivered to the client, that product’s distribution is no longer in the U.S. Mint’s control.

During the time of the 50 States Quarters program, the U.S. Mint had an agreement with the Federal Reserve to distribute the new coins first in order to get them into circulation. When the new coins were transferred to the various Federal Reserve cash rooms in the 12 districts, the Federal Reserve did circulate the new coins first.

What gets left out of the discussion is the logistics of transferring the coins from the cash rooms to the banks. The Federal Reserve does not deliver. Like many government agencies, the Federal Reserve relies on contractors to carry out that job. The Federal Reserve “sells” the coins to the logistics companies that bag and roll the coins and eventually deliver the coins to in armored vehicles to the banks.

In order to save money, these logistics companies keep their own supply of coins. This supply comes from the Federal Reserve cash room operations or excess they are given by the banks. Sine the logistics companies were not part of the deal that the U.S. Mint made with the Federal Reserve, a bank that asked for a delivery of quarters may have received quarters from the logistic company’s stock rather than new issues from the Federal Reserve.

Logistics is the coordination of complex operations and it is the job of these logistics companies to fulfill the inventory needs of the bank in the most efficient manner possible. It was more efficient to supply the banks in less densely populated areas with coins from current stock than transporting large amounts of coins from one of the Federal Reserve cash room operations that may be hundreds of miles away.

The U.S. Mint may do many things that collectors might take exception to, but the distribution of circulating coins is not their responsibility.

Coin image courtesy of the U.S. Mint.

Aug 8, 2018 | BEP, coins, commentary, currency, Federal Reserve, US Mint

Following the introduction of the Presidential $1 Coin program and the discussion about replacing the Federal Reserve Note with a coin,

I wrote an article explaining how the situation will not change. Not much has changed in 10 years!

Whenever a proposal or law that creates a new dollar coin, there is always a discussion as to how to make the program more successful. In the past, the Gallup organization has polled the public on a few occasions asking about the potential acceptance of dollar coins.

Whenever a proposal or law that creates a new dollar coin, there is always a discussion as to how to make the program more successful. In the past, the Gallup organization has polled the public on a few occasions asking about the potential acceptance of dollar coins.

Regardless of the questions asked, the only way to increase the circulation of the dollar coin is to stop printing the one-dollar Federal Reserve Note and begin to withhold it from circulation. It is a move that will force the people to use the coin as the population of the paper currency is reduced.

There are many emotional arguments on both sides of the issue. Whether one is for or against the printing of the one-dollar note, the US is one of the extreme few first-world countries issue its unit currency on paper. Looking beyond the emotional arguments, each side has dominant arguments to support their positions.

Those who want to eliminate the one-dollar note use at the cost of is production and the savings to the government as the dominant reasons. According to the Bureau of Engraving and Printing, 95-percent of all Federal Reserve Note printed for circulation are used to replace damaged and worn notes that are being taken out of circulation. Using BEP’s 2017 production report, 2,425,600,000 one-dollar notes were printed. With 95-percent being replacement notes, 2,304,320,000 notes were printed just to maintain circulation levels. With it costing 4.385-cents to produce one note of any denomination, the cost to just replace notes removed from circulation was $100,422,265.60 in 2017.

Rather than printing paper dollars, if the US Mint strikes coins the cost to replace those 2.4 billion notes would cost 21-cents per coin (according to the U.S. Mint’s 2014 Annual Report, the last documenting seigniorage for the dollar coin). The total production cost would be $483,907,200.

But do not let the 381-percent increase in cost fool you. For the real picture, the costs have to be predicted over time. According to the BEP and the Federal Reserve, the lifespan of a one-dollar Federal Reserve Note is 5.8 years. When the U.S. Mint makes plans for circulating coinage, they accept that the lifespan of a coin is 30-years. To help with the calculation, it will be assumed that the price of manufacturing coins and currency s will stay constant. In order to keep the $2.4 billion of one dollar notes in circulation for 30 years, it will cost the BEP $522.6 million dollars.

By comparison, since the U.S. Mint will be striking new coins for circulation and (theoretically) not replacement coins (not including the coins already in storage), the U.S. government would save about $117 million over 30 years. The following table illustrates these costs:

| Denomination |

Production Total |

Number of Replacement Notes |

Cost of Production for Replacements |

Cost of Replacements over 30 years |

| Paper Dollar (2008) |

4,147,200,000 |

3,939,840,000 |

$177,292,800 |

$1,772,928,000 |

| Paper Dollar (2018) |

2,425,600,000 |

2,304,320,000 |

$101,044,432 |

$522,643,614 |

| Coin Dollar (2008) |

N/A |

3,939,840,000 |

$626,434,560 |

$626,434,560 |

| Coin Dollar (2018) |

N/A |

2,425,600,000 |

$509,376,000 |

$509,376,000 |

While this might be a compelling argument to stop printing one dollar notes, such a move has political ramifications for some powerful members of Congress. With over 1500 people working in the Eastern Currency Facility in downtown Washington, DC, they are represented by several leaders of both parties. When it comes to jobs in their districts, members of Congress will not allow anything that will reduce the production capacity of the Bureau of Engraving and Printing and where constituents could lose jobs.

Before Congress changes the law to stop the printing of the one-dollar note (31 U.S.C. §5115(a)(2)), the BEP will have to supplement production in order to protect jobs. The way this could be done would be to print foreign currency. However, it seems that the BEP is having problems selling their services to foreign governments.

Although the Bureau of Engraving and Printing has experimented with polymer notes and other printing substrates, the Federal Reserve has said that it does not consider these alternatives viable for United States currency. However, the Federal Reserve and Bureau of Engraving and Printing has been testing rag-based paper from companies that can produce new anti-counterfeiting features.

If there was a change to the supplier of currency paper, that would raise concern by the Massachusetts congressional delegation whose constituents include Crane Currency, the subsidiary of Crane & Company. Crane has been the exclusive supplier of currency paper to BEP since 1879. Although BEP has tried to open the competition for purchasing currency paper (see GAO Report GAO-05-368 [PDF]), the cost of entry into the market has prevented other manufacturers from competing for the business. If BEP would stop printing over 2 million one dollar notes without replacing it with similar paper production, the Massachusetts-based company could lose significant business.

Regardless of the measures taken by the US Mint to increase the circulation of the one-dollar coin, public perception is that the one-dollar paper note is easier to use than the coin. Unless key congressional leaders agree that ending the printing of the one-dollar note is in the best interests of everyone, including their political careers, the political reality is that printing of the one-dollar note is here to stay until a significant event causes a change in policy.

The original post can be read

here.

Oct 18, 2017 | cents, coins, currency, dollar, Federal Reserve, US Mint

Could the recent cyber attacks and growing severity of cybersecurity issues become the motivation for Congress to vote to reform United States currency?

According to Philip Diehl and Edmund Moy, former Directors of the U.S. Mint, the discussion as to remove the cent and paper dollar from circulation should be part of the current budget and tax overhaul debates.

-

-

Philip N. Diehl

35th Director of the U.S. Mint

June 1994 — March 2000

-

-

Edmund C. Moy

38th Director of the U.S. Mint

September 2006 — January 2011

The discussion is the same as it has been. The cost of zinc has risen causing the manufacturing costs of the Lincoln cent to climb above its face value. Even with operating efficiencies that have brought down the cost of manufacturing to its lowest levels in many years, the price of zinc keeps makes the materials cost more than the coin is worth.

As for the paper dollar, the Government Accountability Office has published several reports over the years that demonstrate the cost savings between using the paper dollar versus a coin dollar. The last GAO report (GAO-13-164T) concluded that using a dollar coin instead of the paper note “could potentially provide $4.4 billion in net benefits to the federal government over 30 years.”

This is not a new discussion. The only change is that this is being suggested by former Directors of the U.S. Mint from both sides of the aisle. Diehl was appointed by Bill Clinton and served from June 1994 through March 2000. Moy was appointed by George W. Bush and served from September 2006 through January 2011.

Earlier this year, Sen. John McCain (R-AZ) introduced the Currency Optimization, Innovation, and National Savings Act of 2017 (COINS Act) (S. 759). McCain’s bill would require:

- Suspending the production of the one-cent coin for 10 years except for collectibles. After three years, the GAO would doe a study to determine whether production should remain suspended or should be reinstated. This would not demonetize the cent.

- Change the composition of the nickel to 80-percent copper and 20-percent nickel. This should bring down the cost of materials used in striking the five-cent coin to be on par with its value. Efficiencies in manufacturing could lower costs further.

- If the bill becomes law, two years after it is enacted, the Federal Reserve will begin removing $1 Federal Reserve Notes from circulation. This will probably be done by the banks who will take the notes on deposit and send them back to the Federal Reserve where they will be destroyed. Coins would take their place. The $1 FRN could still be produced for the collector market.

Sources report that the chances of McCain’s bill getting a hearing are minuscule. While having lunch with on congressional staffer, I was given three reasons why Congress will not address this issue:

- States with a large rural population primarily west of the Mississippi River represented by Republicans are unlikely to support the removal of the one-cent coin. Removal of the coin is viewed as a hidden tax against the people with fear mongering that suggest the government is keeping the extra money that would become on the rounding of prices.

- States with large poor populations, primarily in the south, and their advocates who believe that taking away the pennies are a way to separate more money from poor people who can least afford to lose the ability to pay in cents.

- Surveys show that most of the people older than Millenials are against removing the paper dollar. Since this population constitutes the majority of the voters and donors, the politicians are not about to make those people upset.

Another issue is that McCain is not popular amongst his fellow Republicans. If the issue is addressed, it is likely to be discussed as part of a bill that does not bear McCain’s sponsorship.

Given the partisan nature of politics and the perceptions of the members of Congress, there is a very little chance of the Coins Act or any similar legislation being enacted during this session of Congress.

Jan 20, 2017 | BEP, Federal Reserve, news, US Mint

January 20, 2017, marks the end of the Presidency of Barack Obama, the 44th President of the United States. At noon the 45th president will be inaugurated.

January 20, 2017, marks the end of the Presidency of Barack Obama, the 44th President of the United States. At noon the 45th president will be inaugurated.

Also, as of noon, Obama’s appointments to Executive Branch positions will resign from their position to be filled by the new president’s appointment. Of the people resigning are Secretary of the Treasury Jacob “Jack” Lew and Principal Deputy Director of the U.S. Mint Matthew Rhett Jeppson. Jeppson was nominated to be the 39th Director but the nomination died with the end of the 114th congress.

Attempts to contact the U.S. Mint to ask them about the bureau’s leadership starting Friday has gone unanswered.

The position of Treasurer of the United States would have also resigned but is currently vacant after the July 2016 resignation of Rosie Rios. Treasurer of the United States is a presidential appointment that does not require Senate confirmation.

The Bureau of Engraving and Printing is not affected by a change in administrations because the position of the director is a career appointment. Len Olijar will remain Director of the BEP as long as he is a government employee in good standing.

Members of the Federal Reserve Board are appointed but they are not considered part of the Executive Branch. The Fed is independent and the Fed Chair, the Federal Reserve Board, and the president of the regional Federal Reserve Banks are appointed to four-year terms irrespective of political timelines. Janet Yellen, Chair of the Federal Reserve, has announced she will serve her full her full four-year term that will expire on February 3, 2018.

The Plum Book, which documents more than 9,000 Federal civil service leadership and support positions in the executive and legislative branches, lists quite a number of positions that supports numismatic production. Of course, significant changes will be reported here!

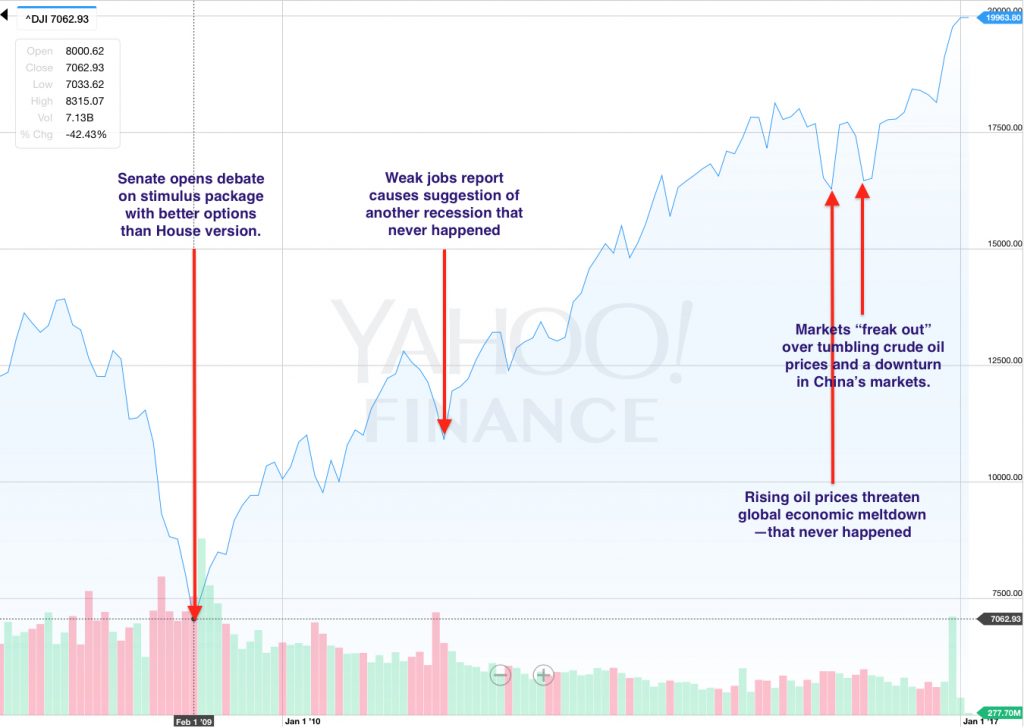

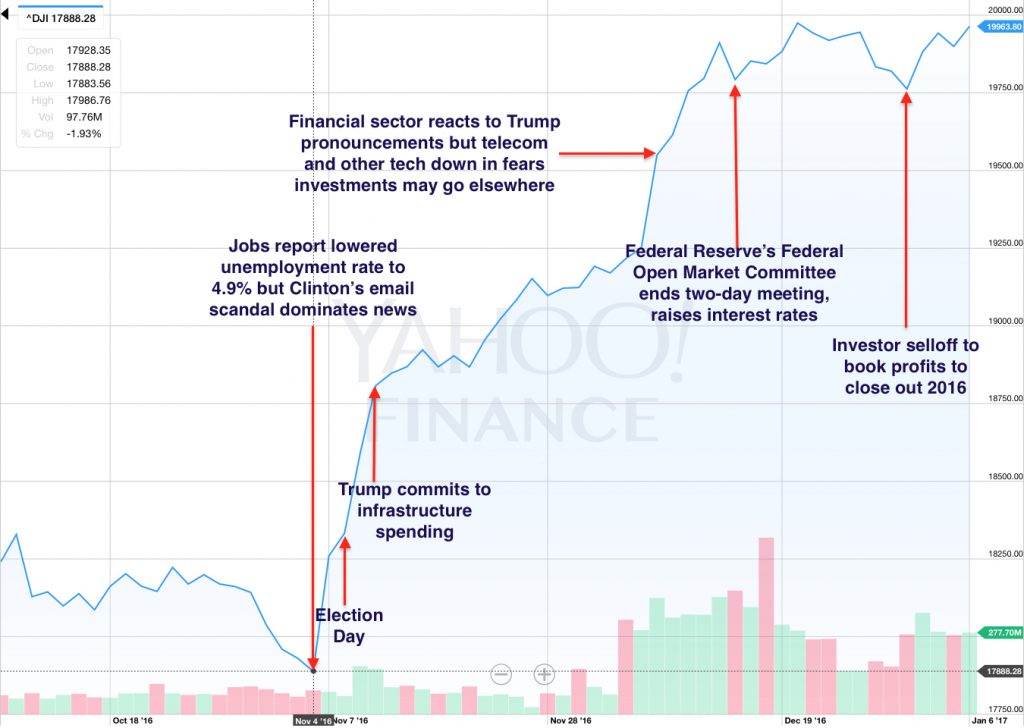

Jan 9, 2017 | bullion, coins, commentary, Federal Reserve, investment, markets, news

Since the election, there have been a number of stories about the “Trump Effect” on the markets. The narrative is that the economic bounce is tied specifically to the election of Trump.

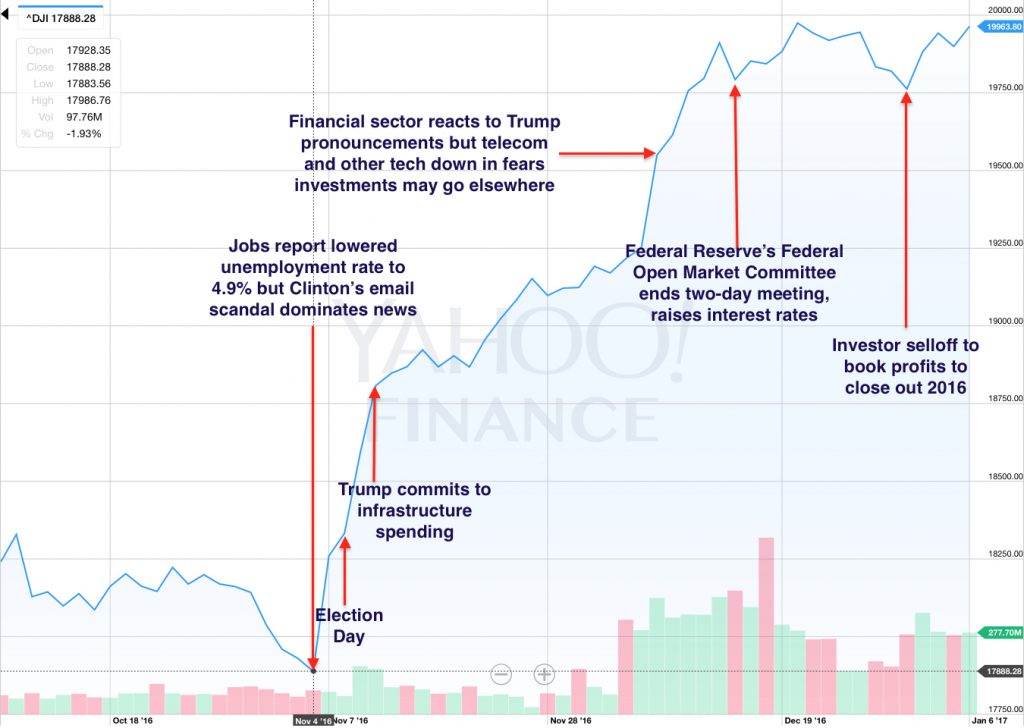

The premise is that the market is reacting to the election of Donald Trump and is the direct cause for the change in the economic factors in the markets. Unfortunately, the narratives being promoted is shortsighted. Markets are not reacting to the election of Trump. The markets are reacting to the certainty that the election is settled.

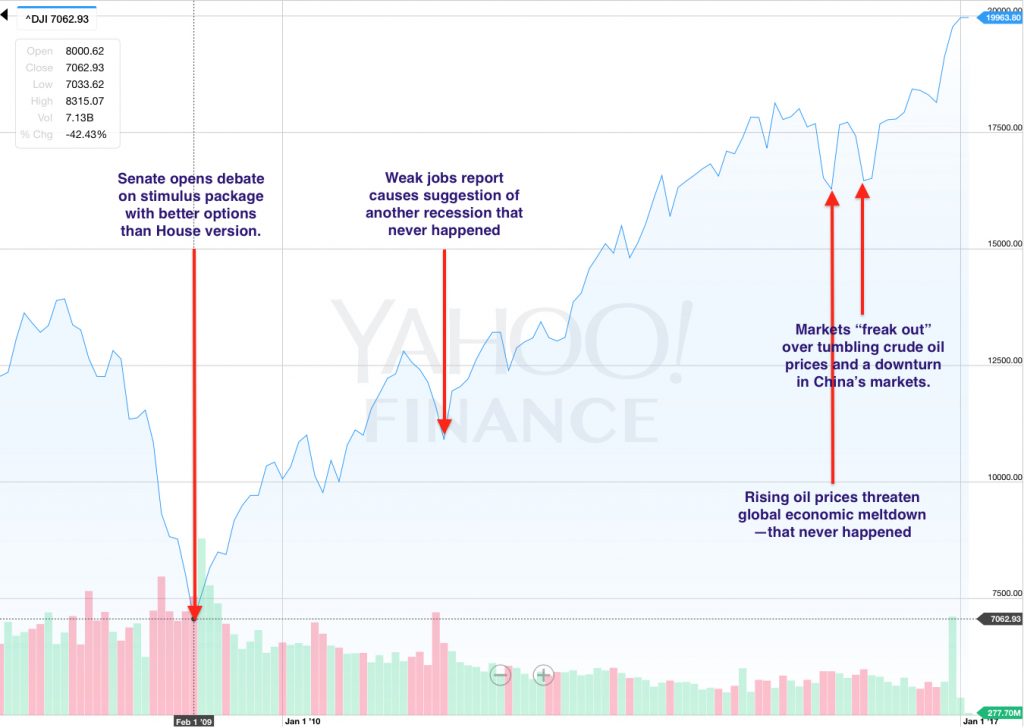

Markets hate uncertainty. When there is uncertainty, the markets tend to react to everything and sometimes in an exaggerated manner. Fortunately, the economic indicators have been good and the markets have reacted accordingly with exaggeration.

How the markets have reacted to uncertainty in economic news

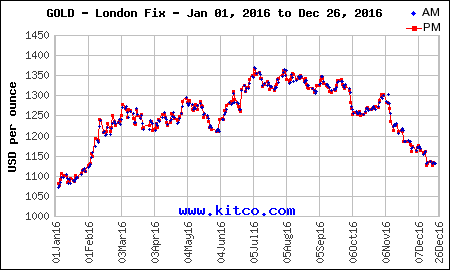

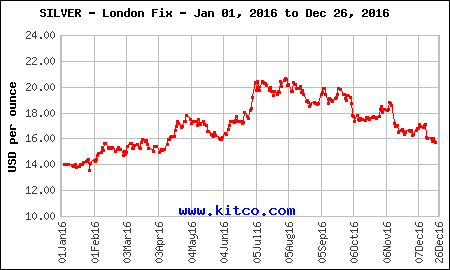

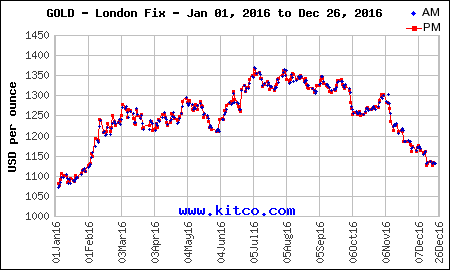

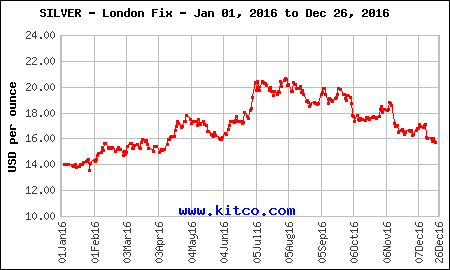

When looking at the collecting markets, whether it is numismatics or antiques, you can look at the precious metals markets as a key indicator. In basic terms, the price of precious metals is indirectly proportional to the strength of the markets and economy. It translates to if the economy is strong making investing less of a risk, then the precious metals markets will be weaker. it means there is more cash circulating creating discretionary income that buyers use to spend on non-essentials, like hobbies.

A strong market and economy means that investments in businesses are a better bet. Strong employment numbers and the movement of goods and services mean that there is money to be made by investing in business. If there are good investment opportunities, it does not make sense for investors to tie money up in precious metals.

Investment in metals makes sense when investing in their value is better than the expected rate of return on business investments. Once investors turn to precious metals, the price is based purely on supply and demand. Since the supply stream is relatively constant, demand mostly influences the price of metals. If the demand is high and the supply cannot keep up with the demand, the price will rise. What helps regulate the price is that there continues to be a supply but the demand has been known to outpace the supply.

The fact of the matter is that economic indicators have improved. Prices of metals have been steadily dropping since August as the investment in stocks been going up. Even before the election, the markets were in growth mode but skittish with uncertainty.

All the election brought was a certainty. Markets know who the next president will be, who will be in congress, and who will control the state houses. If markets hate uncertainty then the currency that fueled the rally was the removal of uncertainty.

After the week following the election, the markets leveled off with the next goal to figure out what the Federal Reserve would do. With the uncertainty surrounding the December Federal Open Market Committee (FOMC) meeting, the drive to record levels stalled. When the FOMC announced the increase in interest rates, rather than reacting negatively, the reactions was as if the markets were saying, “It’s about time.” with the uncertainty of what the FOMC would do, the markets reacted by climbing to record levels.

Market reactions to various news and economic events

In the meantime, the metals markets have been on a steady decline. Since the capital markets are providing a good return on investments, there is no incentive to invest in metals. Although people are buying, the fewer buyers are beating the prices down making bullion-based collectibles cheaper.

Gold free fall began on Election Day 2016

Silver downward trend started on Election Day

What does that have to do with higher end collectibles such as rare coins?

When capital markets are adding to the general wealth of the investor community, they will look for different places to invest their winnings. The new money will start to buy high-end items to supplement their other investments. This is why the collector market thrives during good economic times. Prices of fine art, prime real estate, collector cars, and even rare coins rise.

Rare coins have been resilient since the decline in markets. Rare coins became a safer bet and have attracted new investors which has bucked the trends of the past. This was not lost on the broader investing community who may be looking for diversity in their portfolios.

In review, the markets have been on a six-year rise as the economy has recovered from the Great Recession. Economic indicators are on an extended positive run. The election created certainty in the future of the government and the Federal Reserve created certainty when it raised interest rates. Since markets like certainty, the reaction is not because of the result of the election it is that the election is over.

Certainty is driving the markets, not the details of the results.

Credits

- Dow Jones Industrial Average charts courtesy of Yahoo! Finance.

- Gold and silver charts courtesy of Kitco.

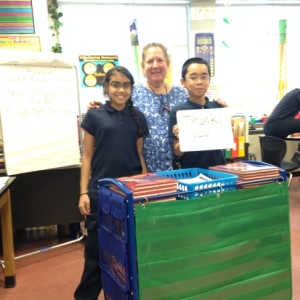

Sep 29, 2016 | charity, Federal Reserve, news, US Mint, YN

Mrs. Janas of Juniata Park Academy in

Philadelphia, PA (Grades 6-8)

The project can be funded for a paltry sum of $512.92. With the donations matched by the Dottie Lutz Foundation, we can send underprivileged students to visit the Mint and the Fed for $256.46!

As I said in my original post, maybe a few would become interested in numismatics. Seeing the exhibits and learning how money is made can inspire these children to become collectors. And as inner-city students in a minority community, adding this diversity to the hobby is one of the best gifts we can give the hobby.

There is ONE MONTH to go on this project.

Previously, I asked to see if nine readers of the Coin Collectors Blog would step in with a $25.00 donation. Thankfully, it appears that only one person did step up. This effort now needs $413.00 to be funded meaning it will take is $206.50 in donations for this to be funded!

I am asking for everyone to

give any amount to fund this project.

It would be wonderful if the numismatic community stepped up to help fund the visits to the Mint and Fed for these students. Let’s see if we can influence some students to become numismatists.

Will you please join me?

Would ending the circulation of the $100 Federal Reserve Note force the Russian people to pressure Putin over his Ukraine attack?

Would ending the circulation of the $100 Federal Reserve Note force the Russian people to pressure Putin over his Ukraine attack?

The

The

There is a coin shortage.

There is a coin shortage. → Read more at

→ Read more at

Whenever a proposal or law that creates a new dollar coin, there is always a discussion as to how to make the program more successful. In the past, the Gallup organization has polled the public on a few occasions asking about the potential acceptance of dollar coins.

Whenever a proposal or law that creates a new dollar coin, there is always a discussion as to how to make the program more successful. In the past, the Gallup organization has polled the public on a few occasions asking about the potential acceptance of dollar coins.

January 20, 2017, marks the end of the Presidency of Barack Obama, the 44th President of the United States. At noon the 45th president will be inaugurated.

January 20, 2017, marks the end of the Presidency of Barack Obama, the 44th President of the United States. At noon the 45th president will be inaugurated.