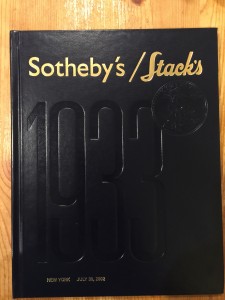

One of the ten 1933 Saint-Gaudens $20 Double Eagle gold coins from the Longbord Hoard confiscated by the U.S. Mint

This is a case that has been ongoing for ten years following the “discovery” of ten 1933 Saint-Gaudens $20 gold Double Eagle coins by Joan Langbord, the daughter of Philadelphia jeweler Israel Switt. Following the auction in 2002 of the only legal Double Eagle for a single coin record of $7,590,020 (since broken), Langbord claims that she found ten 1933 Double Eagles in a safe deposit box where Switt stored the coins.

Langbord reported the find to the Mint to “attempt to reach an amicable resolution of any issues that might be raised.” When Langbord gave the coins to the Mint to be authenticated, the Mint confiscated the coins. Langbord retained Barry H. Berke, the attorney who represented the plaintiffs in the case that resulted in the sale of the King Farouk coin.

-

Reverse of the iconic 1933 Saint Gaudens

$20 Double Eagle gold coin

After adding her sons Roy and David as plaintiffs to protect the property since Joan is elderly, the case is finally heard in July 2011. The court handed down an unanimous decision against the Langbords. The coins are moved to the United States Bullion Depository at Fort Knox, Kentucky.

Langbords appeal the trail to the Third Circuit where a three-judge panel vacated the forfeiture and order the government to return the coins.

The government appeals and asks that the return order be vacated in order to appeal the decision. Rather, the Chief Judge of the Third Circuit will stay the order and ruled that the appeal will be en banc, meaning that the appeal will be heard before the entire bench of judges.

In this round the government did not file in the proper time-frame and the Longboards appealed all rulings. The Third Circuit order the return of the coins but the government appealed the ruling again.

On August 1, 2016, in a 9-3 vote, a full Third Circuit panel of judges ruled that they agreed with the government who argued that forfeiture laws were not applicable because the coins were already U.S. property and could only be surrendered. The majority also ruled against granting a new trial noting that the errors of the 2011 trial were harmless even though a previous three-judge panel ruled differently.

In writing the dissenting opinion, Judge Majorie Rendell said that the majority based its opinion “mainly on its buy-in to the Government’s audacity—the Government’s say—so that it owned the 1933 Double Eagles and had no intention of forfeiting them.” She noted that the Civil Asset Forfeiture Reform Act was designed to prevent the government from forcefully seizing civilian property and that the ruling sets an “incorrect and dangerous precedent.”

A part of the government’s argument that is disturbing is that the they claim the Langbords are “the family of a thief” and should not benefit. Switt was never charged or convicted of a crime. While there is significant circumstantial evidence that Switt was the private seller of the coins and probably worked with the Mint’s cashier, his role has not been legally proven in any of the cases regarding any of the Double Eagle coins. Although this sounds like a legal arm-twist, it is important not only for this case but for any possible case the government can levy against any citizen. It is not right, fair, or legal and a violation of rights.

Berk told Reuters, “The Langbord family fully intends to seek review by the Supreme Court of the important issue of the unbridled power of the government to take and keep a citizen’s property.”

It is likely that the case will be filed to the U.S. Supreme Court for hearing in its next session beginning in October. Hopefully by then a ninth justice will be seated before hearing this case.

No, no, no! There is very little likelihood the SCOTUS will EVER take up this case. Yes, the Langbord family will certainly petition the high Court, but it is highly unlikely a Writ of Certiorari will be issued by the Court, and the case will likely die precisely where it rests today.