Jan 20, 2020 | ancient, coins, legal, news

Abbasid coins of the late ninth century

(via Egypt Today)

The Ottoman Empire was the last of the significant conquering empires of Europe. By the late 19th century, modernization and uprisings forced the Empire to consolidate around the area of modern-day Turkey and the Middle East. Even though the Empire was declining, that did not stop the government from trying to exert influence.

After Great Britain left Egypt in 1914, the Ottomans stepped in and demanded Egypt pay tribute in the form of gold coin to the Empire. After the fall of the Empire and the formation of modern-day Turkey, they continued to demand tribute. Egypt stopped paying the tribute on the establishment of the Republic in 1953.

The lawsuit claims that the Ottomans and Turkey illegally removed the coins from Egypt and demands their return.

In one report, the brief cites the provisions of the UNESCO convention as authority for demanding their return by declaring the coins as cultural property.

If allowed through their courts and if the suit is successful, it becomes precedent for Egypt to claim any item as cultural property and demand their return. Aside from coins, exhibits at museums around the world would have to prepare for similar requests. In the United States, the Brooklyn Museum has one of the most extensive Egyptology collection in North America. Their holding is second to the British Museum, who will also face the same questions.

Ancient Egypt did not have a monetary system as we know it today. Since they did not have silver mines and gold was scarce, they traded goods and services. Taxes were paid by people providing products or working for the government.

There are known bronze coins from early periods, but several references noted that they were used for a limited amount of trade.

The first known coins of Egypt came during the Ptolemaic Empire of ancient Greece. By that time, the Egyptian Empire moved up the Nile River from the area near modern Cairo to modern-day Alexandria. As a weakened Empire, Ptolemy I was able to conquer these areas of the Middle East following the death of Alexander the Great.

It was a time of great fortune that included education, the arts, and modernization of the old Egyptian Empire. Silver and gold were brought as the economy soared. Ptolemaic coins are considered Greek coins for many collectors of ancient coinage.

Those who enjoy collection ancient coins should carefully watch this case as it winds through the Egyptian courts. The wrong outcome will affect collectors and be another attack on the hobby.

And now the news…

January 13, 2020

…My Proustian moment came when I read Maurer’s comment: “People working on new technologies of money tend to assume that money is just money…

→ Read more at

frbatlanta.org

January 15, 2020

14 January 2020 Almost 1,000 coins dating back to the years 1500 – 1600 have been discovered in the locality of Săbieşti, in Dâmboviţa county, some 50 km north of Bucharest.

→ Read more at

romania-insider.com

January 15, 2020

It looked, on first examination, like an antique charm bracelet loaded with gold trinkets: a tiny Eiffel Tower and a little bowling pin and iconic images of provincial Italy. The owner thought the family heirloom might fetch $8,000 on the open market.

→ Read more at

ottawacitizen.com

January 16, 2020

While first responders in Windsor-Essex save other peoples' lives every day, they're now equipped with a new 'All In Coin' taking aim at their own mental health. Essex-Windsor EMS and Essex Fire are giving out coins to their workers to make it easier for them to talk when needing mental help.

→ Read more at

cbc.ca

January 18, 2020

A rare coin featuring Britain's King Edward VIII, who abdicated to marry American divorcee Wallis Simpson, has sold for a record £1 million

→ Read more at

cnn.com

January 18, 2020

CAIRO – 18 January 2020: Egypt’s Administrative Court has set February 15, 2020 to consider a lawsuit demanding Turkey to repay Egypt more than 23.1 million gold coins that were taken from Egypt in tribute by Ottoman Empire “illegally.”

→ Read more at

egypttoday.com

January 19, 2020

If you’re keen to own a piece of British history, The Royal Mint January sale may have just what you’re looking for.

→ Read more at

dailyrecord.co.uk

Nov 28, 2018 | ancient, coins, commentary, foreign, legal, policy

I said that if we do not act that we would become victims!

A man came into my shop the other day. Like all new visitors, my assistant greeted him with her usual charm while he looked at the eclectic inventory in the showroom.

The man was different than others. On a slow morning, he lingered around the set of auction catalogs I have for sale while saying little to my assistant who felt uncomfortable with this man in the shop. Another customer came into the shop and my assistant took care of them while I watched this gentleman.

After a while, he came to me and, in a heavy accent I could not identify, asked if I was the store’s owner. He pulled out a few folded pieces of paper and showed me a sheet with the article “Coin jewelry is not legal everywhere” I wrote on this blog in April 2016.

He pointed to one of the pictures and asked if I knew anything about the coin. I asked why and he said he was interested in purchasing one. For some reason, I had a feeling that he might have had other interests in mind.

-

-

Resin ear rings made by InspiringFlowers using Roosevelt dimes

-

-

Hummingbird cut from a Trinidad and Tobago penny by SawArtist

-

-

1996 Half Dollar Ring by LuckyLiberty

Examples of the coin jewelry from the orignal post

I explained to that I do not carry a lot of jewelry since it is not a specialty of my business. When I do have jewelry in stock it does not sell well. He opened the paper and asked if I knew anything about the jewelry on the page.

I explained that the article he is holding is from a blog post I made explaining how some countries have restrictions regarding the usage of their coins for jewelry. When he pressed for more information I said that it was noted in the posting that the images came from Etsy and I do not know any of the sellers. Their goods were used as an example for the posting.

It felt like I was being interrogated. I asked if he was a member of law enforcement or any other government investigative agency, he mumbled something I did not like. I asked him to leave. My assistant had called the police.

The police arrived and escorted the man out of the shop and questioned him before letting him drive away in his own vehicle. I noted the license plate. The officer came inside and said that this will be handled elsewhere and that I was not to report it any further.

About a week later, I was visited by someone representing a federal agency and a member of federal law enforcement who wanted to question me about the incident. After they produced proper identification, we went into my office to discuss the matter.

I was told that the man who came into my shop was an agent for an unnamed foreign government. This government has been visiting collectible stores and shows to intimidate people into “returning cultural items” from that country. The country that this person represents considers this legal even though it violates my Fifth Amendment right of due process.

Apparently, the person that visited my shop is responsible for the “confiscation” of items from more than a dozen antiques and collectibles shops in the mid-Atlantic region.

It is not the first time we have heard the foreign governments have tried to go around the United States’ right of due process by trying to confiscate coins under the guise that they are “national treasures.” In 2013, I wrote “Why you should care about restrictions on collecting ancient coins” sounding an alarm for people to act.

People did not act or act strongly enough. It has allowed a foreign government to pervert the 1970 UNESCO Convention’s intent to steal legally obtained inventory from United States businesses they claim are national treasures.

In the next few weeks, I will be writing a short position paper to present to the American Numismatic Association in order to get them to work to protect collectors. It is time that the ANA and other numismatic organizations work together to protect the hobby and stop kowtowing to every country who wants to retroactively make a claim against United States business because a foreign government said so.

Jul 8, 2018 | coins, legal, news

This past week the Bangko Sentral ng Pilipinas (BSP; the Philippines Central Bank) announced that commemorative coins are legal tender and can be used to purchase good or services.

The problem began as people were using coins that were meant as a commemorative and collectible issue for commerce. Since they were minted with permission of BSP and have a denomination, they are recognized as legal tender coins.

Sometime in the future, BSP will demonetize the coins as they have done with all past issues.

Unlike the United States, not every coin or currency note produced by the world mints and central banks are legal tender. However, it is a story that keeps occurring as the world mints use commemorative and bullion coins to boost sales.

Recently, there was an issue in Canada with the Royal Canadian Mint’s $20 for $20 program. Beginning in 2011, the Royal Canadian Mint began to sell silver coins with the face value of $20 for $20 tax-free. When the price of silver dropped not only did Canadians return the coins but they tried to spend them.

Aside from the falling revenues caused by the return of the coins, Canada does not require merchants to accept all legal tender coins. When some Canadians tried to spend the $20 coins, the Bank of Canada had to issue a statement to stop the practice and threaten to demonetize the coin. Demonetization would have hurt the secondary market on top of the falling price of silver.

Nearly every country in the world, except the United States, demonetizes previous issues of coins and currency. A recent example was this past year when the Bank of England demonetized the old “round pound” when the Royal Mint issued the new 12-sided pound coin.

The only United States coin to ever have its legal tender status revoked was the Trade Dollar. The Trade Dollar was minted to compete with other silver coins for trade with East Asia beginning in 1873. Although not intended for the United States trade market, it began to find use, especially in the west. To control its use, the Trade Dollar was demonetized in 1876. The coin regained its legal tender status as part of the Coinage Act of 1965, the law that introduced clad coinage and ushered in the “modern era” of United States coins.

Every coin produced by the U.S. Mint can be used as legal tender at their face value, although it would be foolish to spend an American Gold Eagle one-ounce coin for its $50 face value since its gold content would be worth more!

And now the news…

July 3, 2018

Calling all coin collectors — you could have a coin in your stash right now worth thousands of dollars and not even know it. Don't miss out on possible cash. There are three things to look for in your half dollars, quarters, and dimes.  → Read more at abc13.com

→ Read more at abc13.com

July 3, 2018

(ANSAmed) – ROME, JULY 3 – An exceptional discovery was made at the Vulci archaeological site, where a treasure of coins from the 3rd century B.C. was found intact, according to a statement from the site's scientific department.  → Read more at ansa.it

→ Read more at ansa.it

July 4, 2018

Commemorative coins issued by the Bangko Sentral ng Pilipinas (BSP) can be used purchase goods or services as these are deemed legal tender, the central bank said on Wednesday. “Together with BSP-issued banknotes and coins, commemorative coins … may be used … unless these coins have been demoneti  → Read more at manilatimes.net

→ Read more at manilatimes.net

July 7, 2018

Iranian state TV says police have arrested a man who was hoarding two tonnes of gold coins in order to mani…  → Read more at finance.nine.com.au

→ Read more at finance.nine.com.au

July 7, 2018

The new series of banknotes and R5 coin designed to celebrate milestones of former president Nelson Mandela’s life will go into circulation next week Friday.  → Read more at timeslive.co.za

→ Read more at timeslive.co.za

July 7, 2018

Police believe a rare 470-year-old coin may prove the key to the Sutton Coldfield murder  → Read more at birminghammail.co.uk

→ Read more at birminghammail.co.uk

July 8, 2018

Ancient remnants including stamps and currency offer a trip down history lane  → Read more at thehindu.com

→ Read more at thehindu.com

Jul 1, 2018 | advice, legal, news

Image of fake ATF badge Jonathan A. Kirschner used to lure his victims. On June 25 Kirchner pleaded guilty to impersonating an ATF agent and selling and importing counterfeit coins and precious metals bars.

Jonathan A. Kirschner, 34, of Moorestown, NJ, pleaded guilty to impersonating an ATF agent and unlawfully importing counterfeit coins and bullion into the United States.

Kirschner, who used the alias “Jonathan Kratcher,” sold fake gold bars to a collector for $11,000 in cash. When the collector brought them to a dealer it was determined they were fakes. The dealer reported the incident to Industry Council for Tangible Assets Anti-Counterfeiting Task Force (ICTA ACTF) who reported it to federal law enforcement.

After being caught, Kirschner admitted to also selling 59 fake Morgan dollars and importing the bogus coins and bullion from other countries, including China.

Even though Kirschner had a badge that looked real, it is likely that he did not have a Personal Identity Verification (PIV) card that every employee and contractor to the United States federal government is supposed to carry. Those in the military may also know this as a Common Access Card (CAC). Regardless of the name, the format is the same and should be included with the badge to properly identify the law enforcement officer.

Anatomy of a United States federal PIV card

If you have any question as to the identity of any federal government official, you are allowed to ask for further identification. They must show their PIV card to confirm their identity. When you look at the PIV card, make sure the name and picture match the person in front of you. Also, ensure the agency on the card matches the agency the person claims to be from. It is not enough for the PIV card to say the person works for the Department of Homeland Security (DHS). DHS does not do direct law enforcement. It should say that the PIV card was issued by the ATF, U.S. Secret Service, or any other appropriate law enforcement agency including the Federal Bureau of Investigation (FBI).

Before you buy expensive coins and bullion from a stranger you may want to take a lesson from foreign policy: trust but verify.

And now the news…

June 25, 2018

He wore an ATF badge when meeting with his victims to put them at ease, authorities said.  → Read more at patch.com

→ Read more at patch.com

June 26, 2018

Vancouverite Alexandra Lefort’s passions for painting and planetary science came together when the opportunity presented itself to design the Royal Canadian Mint’s latest silver coin.Gr…  → Read more at vancouversun.com

→ Read more at vancouversun.com

June 26, 2018

Fake currency was used in elaborate satanic hoax in Scandinavia in 1970s  → Read more at theguardian.com

→ Read more at theguardian.com

June 27, 2018

Jonathan A. Kirschner sold fake gold bars and Morgan dollars.  → Read more at philly.com

→ Read more at philly.com

June 30, 2018

If a colonial U.S. coin is jangling in your pocket, consider a visit to Paul Padget’s corner booth this weekend.  → Read more at cincinnati.com

→ Read more at cincinnati.com

June 30, 2018

Since 2006, the metals used to make nickels have exceeded the value of the coin itself.  → Read more at qz.com

→ Read more at qz.com

May 22, 2018 | coins, commentary, gold, legal, US Mint

The ten 1933 Saint-Gaudens Double Eagles confiscated by the government from Joan Lanbord, daughter of Israel Switt.

For those who have not read Illegal Tender by David Tripp or Double Eagle by Allison Frankel, aside from both being worth reading, they claim that 25 of these coins were illegally removed from the Philadelphia Mint. Of those 25 coins, nine were confiscated during the 1940s and 1950s by the Secret Service, ten are from the Langbord Hoard stored at the Bullion Depository at Fort Knox, and one is the Farouk-Fenton example which is the subject of the books.

That leaves five left.

During the Pennsylvania Association of Numismatics (PAN) spring show, U.S. Mint Senior Legal Counsel Greg Weinman said that he knows where one is located in the United States, one is in Europe, and a third is somewhere else. The location of the last two is not known.

It can be speculated that the “somewhere else” may be in Egypt. On February 8, 2008, the Moscow News Weekly reported that a version of the coin was found in Egypt in an old box that was owned by the discoverer’s father (web archive link). Although there had been a lot of speculation that coin might not be genuine, there has been no further reports as to the disposition of this coin.

Weinman said that there are no plans to go after the three coins where the U.S. Mint knows their location.

Why?

Following the trial in 2011 with a jury verdict against the Langbords. After the ruling, Assistant U.S. Attorney Jacqueline Romero, the government’s lead attorney in the case, came out with a courthouse statement, “People of the United States of America have been vindicated.”

If the country is to be vindicated and the government has consistency in its argument that the coins are “chattel,” according to Weinman, then it is their legal obligation to have the U.S. Secret Service pursue the three known examples.

Otherwise, it could be said that the government has undergone selective prosecution and has given up its right to the ten in its possession or the five that are still in public hands.

It is these inconsistencies of policies with regard to these coins that could drive collectors away. While most people may never find or own one of these rare coins, what happens to those who might get lucky.

While the 1913 Liberty Head Nickels were not considered chattel because they were never struck for circulation, the government fought the finding of the 1974-D Aluminum cent forcing its return. The circumstances for the striking of both coins are similar but the government has treated each issue differently.

This is not a matter of integrity of the hobby. It is the integrity of the U.S. Mint and their bogus argument of what is or is not something they produced for whatever the reason. The integrity of the U.S. Mint can be questioned when they applied 21st century operating standards to the U.S. Mint of the 1930s in order to convince a “jury of peers,” none of which probably had a numismatic background questioning their ability to be peers, that these coins belonged to the government for it to hold like some almighty savior of us from the depths of fraudulence.

Do you still feel vindicated?

Jul 28, 2017 | bullion, coins, commemorative, commentary, legal, legislative, policy, US Mint

A while ago, I received the following question from a reader:

Why do coins that were made NOT for circulation, like Silver Eagles, Commemoratives Productions, etc have any value other than their face value? I do not see the value of collecting something that was never meant for circulation.

2013 American Eagle West Point Two-Coin Silver Set with reverse proof and enhanced uncirculated coins.

The American Silver Eagle Program was the result of the Reagan Administration wanting to sell the silver that was part of the Defense National Stockpile to balance the budget. Originally, the plan was to auction the bullion. After intense lobbying by the mining industry warning that such an auction would damage their industry, the concept was changed to selling the silver as coinage.

Changing the sales to coinage allowed for market diversification. Rather than a few people attempting to corner the market at an auction, selling coins on the open market allows more people to have access to the silver as an investment vehicle.

As codified in Title II of the Statue of Liberty-Ellis Island Commemorative Coin Act (Public Law 99-61, 99 Stat. 113), the “Liberty Coin Act” defines the program as we know it today including the phrase “The coins issued under this title shall be legal tender as provided in section 5103 of title 31, United States Code.”

As a legal tender item, the coin’s basic value has the backing of the full faith and credit of the United States government. Regardless of what happens in politics and world events, the coin will be worth at least its face value. Being minted by the U.S. Mint is a guarantee of quality that is recognized around the world making worth its weight in silver plus a numismatic premium.

Coins are perceived by the market as being more desirable than medals. Medals have no monetary value except as an art object. When it comes to investments, they do not hold a value similar to that of a legal tender coin. This is because medals are not guaranteed by the United States government, a key factor in determining its aftermarket value.

Once the coin has been sold by the U.S. Mint, its value is determined by various market forces. For more on how coins are priced, see my two-part explanation: Part I and Part II.

Why do American Silver Eagles have a One Dollar face value? Because the law (31 U.S.C. Sect. 5112(e)(4)) sets this as a requirement.

Why are the coins worth more than their face value? Because the law (31 U.S.C. Sect. 5112(f)(1)) says that “The Secretary shall sell the coins minted under subsection (e) to the public at a price equal to the market value of the bullion at the time of sale, plus the cost of minting, marketing, and distributing such coins (including labor, materials, dies, use of machinery, and promotional and overhead expenses).”

Can you spend the American Silver Eagle as any other legal tender coin? In the United States, you can use any legal tender coin in commerce at its face value. This means that if you can find someone to accept an American Silver Eagle, it is worth one dollar in commerce. However, it would be foolish to trade one-ounce of silver for one dollar of goods and services.

Commemorative Coins

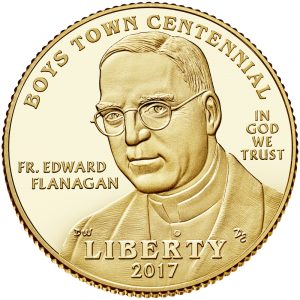

Commemorative programs are different in that the authorizing laws add a surcharge to the price of the coin to raise money for some organization. Using the 2017 Boys Town Centennial Commemorative Coin Program (Public Law 114-30) as an example, Rep. Jeff Fortenberry (R-NE) introduced a bill (H.R. 893 in the 114th Congress) to celebrate the centennial anniversary of Boys Town. As with all other commemorative bills, the bill specified the number, type, composition, and denomination of each coin.

The Boys Town Centennial Commemorative coin features Fr. Edward Flanagan, founder of Boys Town

As with other commemorative, the coins will include a surcharge. Each gold coin will include a $35 surcharge, $10 for a silver dollar, and $5 for each clad half-dollar coin. When the program is over, the surcharges “shall be paid to Boys Town to carry out Boys Town’s cause of caring for and assisting children and families in underserved communities across America.”

The 2017 Boys Town Centennial Uncirculated $5 Gold Commemorative Coin is selling for $400.45 and the proof coin is selling for $405.45 suggesting that the process of producing a proof coin costs the U.S. Mint $5 more than the uncirculated coin.

What goes into the price of the coin? After the face value of $5, there is a $35 surcharge added that will be paid to Boys Town, there is the cost of the metals used. Here is a workup of the cost of the gold planchet using current melt values:

| Metal |

Percentage |

Weight (g) |

Metals Base Rate |

Price (g) |

Metal Value |

| Gold |

90% |

7.523 |

1259.00/toz |

40.48 |

$ 304.52 |

| Silver |

6% |

5.015 |

16.57/toz |

0.53 |

0.27 |

| Copper |

4% |

3.344 |

2.83/pound |

0.006 |

0.00 |

| Total metal value |

$ 304.79 |

Even though the melt value of the coin is $304.79, there is a service charge the U.S. Mint has to pay the company that creates the planchets. Thus, before the labor, dies, use of machinery, overhead expenses, and marketing is calculated into the price, the coin will cost $344.79 even though the legal tender face value of the coin is $5.

Taking it a step further, the average profit the U.S. Mint makes from gold commemorative coins is 8-percent (based on the 2015 Annual Report). If they are charging $400.45 for the uncirculated gold coin, the coin costs $368.41 to manufacture, $373.41 for the proof version.

Why collect these coins?

Why not?!

American Silver Eagle bullion coins were created for the investment market even though the authorizing law saw the benefit of allowing the U.S. Mint to sell a collector version. All of the Eagle coins are sold for investment or because people want to collect them for their own reasons. Some collect the collector version as an investment.

Commemorative coins are collected for their design or the buyer’s affinity for the subject and to support the cause which is being sponsored by the sale of the coin. Some collect commemorative coins like others collect series of coins.

Even though modern commemorative coins are sold for more than their face value, that does not mean they are not worth collecting. After all, can you buy a Morgan Dollar, Peace Dollar, Walking Liberty Half-Dollar, or a Buffalo Nickel for its face value?

Collecting bullion, commemorative, and other non-circulating legal tender (NCLT) coins is a matter of choice. If you choose to collect these coins, know that they will be worth more than their face value. And while they are legal tender coins, they are not meant for circulation. They are collectibles.

If you like these collectibles, enjoy your collection. Along with coins produced for circulation, I own American Silver Eagle coins, commemoratives, and other NCLT because I like them.

Some of the NCLT coins in my collection

-

-

2013 American Eagle West Point Two-Coin Silver Set with reverse proof and enhanced uncirculated coins.

-

-

2015 March of Dimes Commemorative Proof set

-

-

2014 National Baseball Hall of Fame commemorative proof dollar graded by PCGS PR70

-

-

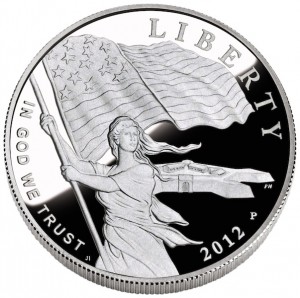

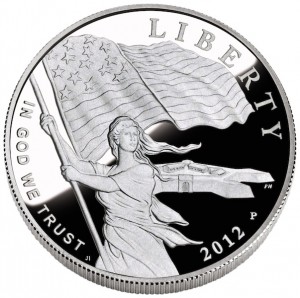

2012 Star-Spangled Banner Silver Commemorative Obverse depicts Lady Liberty waving the 15-star, 15-stripe Star-Spangled Banner flag with Fort McHenry in the background. Designed by Joel Iskowitz and engraved by Phebe Hemphill.

-

-

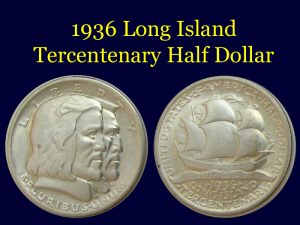

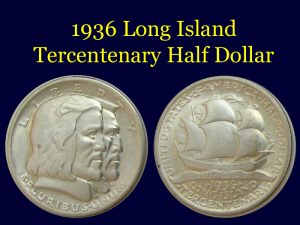

1936 Long Island Tercentenary Half Dollar

-

-

Reverse of the 2016 Chinese Silver Panda coin

-

-

2006 Canada silver $5 Breast Cancer Commemorative Coin

-

-

2007 Somalia Motorcycle Coins

-

-

2010 Somalia Sports Cars

Boys Town commemorative coin image courtesy of the U.S. Mint.

Apr 19, 2017 | coins, commentary, gold, legal, news, US Mint

The ten 1933 Saint-Gaudens Double Eagles confiscated by the government from Joan Lanbord, daughter of Israel Switt.

Shortly after the sale of the Farouk-Fenton 1933 Saint-Gaudens Double Eagle coin, currently the example that is legal to own, in 2002 for $7.59 million at auction ($10.23 million accounting for inflation), Joan Langbord, daughter of Israel Switt, was searching through her late father’s boxes and found ten of these coins. Langbord then sent the coins to the U.S. Mint to authenticate. After a period of time, the Langbords inquired about the coins. They were told the coins were genuine and would not return them, calling them stolen items.

Langbord and her son Roy Langbord hired Barry Berke to help retrieve the coins. Berke was the attorney for British coin dealer Stephen Fenton who was arrested by the U.S. Secret Service when trying to buy the coin at the famous Waldorf-Astoria Hotel in New York in 1996. Berke negotiated Fenton’s release from prison and the subsequent sale at the July 2002 auction.

After the U.S. Mint refused to return the coins, the Langbords sued the government in 2006. The case went to trial in 2011 with a jury verdict against the Langbords. After the ruling, Assistant U.S. Attorney Jacqueline Romero, the government’s lead attorney in the case, came out with a courthouse statement, “People of the United States of America have been vindicated.” Do you feel vindicated?

The case was appealed to the U.S. Court of Appeals for the Third Circuit in Philadelphia.

In a hearing in 2015, Judge Marjorie O. Rendell ruled that the government was too aggressive in its actions and that the lower court judge erred in evidence handling. A subsequent three-judge panel upheld Judge Rendell’s ruling and ordered the government to return the coins.

The government appealed the ruling and asked for a full-circuit hearing. Called a ruling en banc, in 2016, a full panel of 12 judges ruled 9-3 that they agreed the lower court made mistakes in the presentation of evidence but they did not feel that there was not enough evidence that could overturn the ruling. The Appellate Court overturned the appeals and reinstated the original verdict.

Berke, on behalf of the Langbords, asked the Supreme Court to review the ruling of the Third Circuit. Officially, it is called a petition for a writ of certiorari. The petition was filed on October 28, 2016.

On April 17, the petition was denied. Justice Neil Gorsuch did not take part in the decision since he was not on the bench at the time the petition was filed.

Attempts to contact Burke have not been successful.

The inconsistency of how the government has handled the many different cases of coins that were not supposed to be in public hands is infuriating. Although the government has a history of confiscating the 1933 Double Eagles, the 1913 Liberty Head Nickels remain out of government control while the 1974-D Aluminum Cent was confiscated, while the 1974 Aluminum Cent pattern that was allegedly given to janitor by a member of congress was allowed to be sold at auction.

Patterns were never supposed to leave the U.S. Mint yet after the William Woodin served as Franklin Roosevelt’s first Secretary of the Treasury, the government has not tried to confiscate patterns. Woodin was a collector of patterns and trial coins who also had Roosevelt exempt “rare and unusual coin types” when writing the order to withdraw gold from private hands.

Even if the Third Circuit agreed that the evidence was not handled properly by the lower-court judge under the terms of the law, how can they tell whether a retrial would yield a different outcome? Why not return the case and retry the case?

While I love reading a good conspiracy theory, I find many difficult to understand how all of the moving parts can work in unison for or against anything. However, there are aspects of this story where a good conspiracy theorist could spin quite a tale.

Saying, “there ought to be a law” is usually not the real answer to many problems. However, maybe it is time to reconsider that feeling to force the government to act consistently. Considering how congress has turned dysfunction into fine art, I do not see this ever happening.

Do you still feel vindicated?

Nov 5, 2016 | coins, counterfeit, legal, news

The Federal Trade Commission (FTC) published the “Final Rule of its Rules and Guidelines” for enforcing the Hobby Protection Act (16 CFR Part 304) to include the provisions of the Collectible Coin Protection Act (Pub. L. 113-288) that was signed into law by President Obama on December 19, 2014.

The Federal Trade Commission (FTC) published the “Final Rule of its Rules and Guidelines” for enforcing the Hobby Protection Act (16 CFR Part 304) to include the provisions of the Collectible Coin Protection Act (Pub. L. 113-288) that was signed into law by President Obama on December 19, 2014.

It is the job of the FTC to provide support to enforce the Hobby Protection Act. When updates are made to the law, such as the Collectible Coin Protection Act, the FTC is required to figure out how they will implement the law. Executive agencies, like the FTC, is required to write regulations that conform with the law and legal precedent, announce them to the public, allow for public comment, and then publish the file rule.

On October 14, 2016, the final rules that the FTC will use to enforce the Hobby Protection Act was published in the Federal Register (81 FR 70935). Since this is the final rule, the section begins with explanations and commentary about the information received from the public comments.

What appears to be troubling is that the FTC rejected comments from noted numismatists that there should be a rule to cover the manufacturing of fantasy coins. Fantasy coins are those that were not manufactured by the U.S. Mint. An example cited was the manufacturing of a 1964-D Peace Dollar “FANTASY” since the coins were never officially manufactured. Although the coins were struck, they were considered trial strikes and subsequently destroyed.

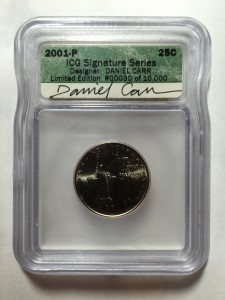

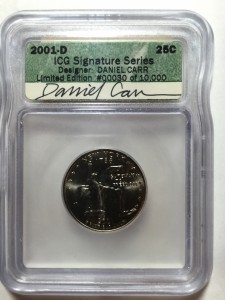

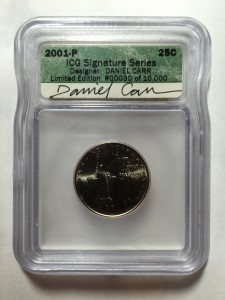

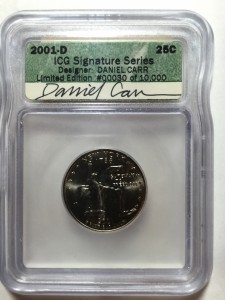

Daniel Carr is a mechanical engineer who also studied computer graphics and later turned it into an art career. He had entered U.S. Mint sponsored competitions for coin designs that have been used on commemorative coins. Carr is the designer of the New York and Rhode Island state quarters and his design was used as the basis of the Maine state quarter.

-

-

2000-P New York quarter with Daniel Carr’s autograph on ICG label

-

-

2000-D New York quarter with Daniel Carr’s autograph on ICG label

Carr had bought surplus coining machines from the Denver Mint, repaired them, and had been using them to strike fantasy coins. One of his fantasy coins was the 1964-D Peace Dollar. Over 300,000 coins were struck in 1965 at the Denver Mint anticipating its circulation only to be destroyed after congress disapproved of the way the Mint was allegedly handing the program. Some believe that some coins have survived, much like the 1933 Saint-Gaudens Double Eagle. But like that famed double eagle, it would spark a legal battle if a coin would surface.

Capitalizing on the story, Carr struck his own versions with varieties, errors, and finishes. He sold them as fantasy coins but were not marked in any way. Advertising and writings from Carr explicitly call them fantasy coins, but what about future sellers?

FTC claims it is not necessary to amend the rules “because it can address specific items as the need arises” The FTC further states they have “addressed whether coins resembling government-issued coins with date variations are subject to the Rules.” Using past precedent, the FTC concludes “such coins should be marked as a ‘COPY’ because otherwise they could be mistaken for an original numismatic item.”

Many numismatic industry experts who have seen how Chinese counterfeits have damaged the hobby, wanted the FTC the rule codified so that it would force someone like Daniel Carr to mark his fantasy pieces appropriately. Carr continues to manufacture fantasy pieces based on designs of actual coins changing the date. Recently, Carr has produced Clark Gruber fantasy products with modern dates without the word “COPY” imprinted on the coin.

While Clark Gruber gold pieces were never legal tender, there were allegedly pattern pieces of Presidential dollars that included the required inscriptions and included a denomination. There was no indication on the coins that they were not legal tender even though Carr marketed them as medallions.

The purpose of the CCPA was to prevent counterfeit coins from misleading the public. Carr has allegedly jumped over that line joining the Chinese counterfeiters in an effort that will mislead the public with the apparent blessing of the FTC.

Sources I contacted were not encouraged by the FTC action. It was noted that when Carr’s 1964-D Peace fantasy dollars were reported, the FTC did not take action.

The new rules go into effect on November 16, 2016.

NOTE: Normally, I will include links and other details to the items I write about so you can read more. However, because it is my opinion that what Carr has done violates every spirit that the Hobby Protection Act stands for, I will not provide links to dignify his efforts. I wholeheartedly believe that if similar coins were brought into the United States from abroad, especially from China, the FTC would act to protect our rights under the Hobby Protection Act. However, since Carr previously provided art to the U.S. Mint, it is likely the government may be trying to spare its own embarrassment.

Sep 19, 2016 | ancient, coins, legal, policy

Here we go again… the government want to take your ancient coins away from you.

Here we go again… the government want to take your ancient coins away from you.

This is different from other conspiracy theories because since there is no mechanism for them. Here, foreign governments are working in collusion with the United States Department of State Cultural Property Advisory Committee (CPAC). The problem with CPAC is that it is not a real committee. They are largely a rubber-stamp part of the State Department’s Bureau of Educational and Cultural Affairs kowtowing to any foreign government who feels that items found in their country have been stolen from regardless of the evidence. This includes common ancient coins or coins that were removed from circulation long before the existence of the 1970 UNESCO Convention that created this situation.

If you want to read a more extensive discussion on the problems facing collectors of ancient coins, read my post “An ancient dilemma” from 2014.

The information comes from the Ancient Coin Collectors Guild (ACCG). Even if you are not a collector of ancient coins you should appreciate that the problems with governments wanting to stop your hobby. If they go after the ancients, what is to prevent these countries from trying to recall obsolete money? We need to support the ACCG and the community to prevent overreach by foreign governments and a committee who does not care what the coin collectors think.

Here’s the current issue as outlined by ACCG Executive Director Peter Tompa

Dear Fellow ACCG Member:

The State Department’s Bureau of Educational and Cultural Affairs and its Cultural Heritage Center have announced a comment period for a proposed extension of a Memorandum of Understanding (MOU) with Cyprus. See https://www.federalregister.gov/articles/2016/08/10/2016-19018/notice-of-meeting-of-the-cultural-property-advisory-committee

The U.S. Cultural Property Advisory Committee will review these comments and make recommendations based upon them with regard to any extension of the current agreement with Cyprus.

According to U.S. Customs’ interpretation of the governing statute, import restrictions authorized by this MOU currently bar entry into the United States of the following coin types unless they are accompanied with documentation establishing that they were out of Cyprus as of the date of the restrictions, July 16, 2007:

1. Issues of the ancient kingdoms of Amathus, Kition, Kourion, Idalion, Lapethos, Marion, Paphos, Soli, and Salamis dating from the end of the 6th century B.C. to 332 B.C.

2. Issues of the Hellenistic period, such as those of Paphos, Salamis, and Kition from 332 B.C. to c. 30 B.C. (including coins of Alexander the Great, Ptolemy, and his Dynasty)

3. Provincial and local issues of the Roman period from c. 30 B.C. to 235 A.D.

You may ask, why bother to comment—when Jay Kislak, CPAC’s Chairman at the time, has stated that the State Department rejected CPAC’s recommendations against import restrictions on Cypriot coins back in 2007 and then misled both Congress and the public about its actions? And isn’t it also true that although the vast majority of public comments recorded have been squarely against import restrictions, the State Department and U.S. Customs have imposed import restrictions on coins anyway, most recently on ancient coins from Bulgaria?

Simply because, our silence allows the State Department bureaucrats and their allies in the archaeological establishment to claim that collectors have acquiesced to broad restrictions on their ability to import common ancient coins that are widely available worldwide. And, of course, acquiescence is all that may be needed to justify going back and imposing import restrictions on more recent coins that are still exempt from these regulations.

Under the circumstances, please take 5 minutes and tell CPAC, the State Department bureaucrats and the archaeologists what you think.

How do I comment? Go to https://www.federalregister.gov/articles/2016/08/10/2016-19018/notice-of-meeting-of-the-cultural-property-advisory-committee to submit short comment just click on the green box on the upper right hand side of the above notice that says “submit a formal comment” and follow their directions.

If you are having trouble, go to the Federal eRulemaking Portal (http://www.regulations.gov), and enter Docket No. DOS-2016-0054 for Cyprus, and follow the prompts to submit comments. What should I say? The State Department bureaucracy has dictated that any public comments should relate solely to the following statutory criteria:

- Whether the cultural patrimony of Cyprus is in jeopardy from looting of its archaeological materials;

- Whether Cyprus has taken measures consistent with the 1970 UNESCO Convention to protect its cultural patrimony;

- Whether application of U.S. import restrictions, if applied in concert with similar restrictions by other art importing countries, would be of substantial benefit in deterring a serious situation of pillage and that less drastic remedies are not available;and,

- Whether the application of import restrictions is consistent with the general interest of the international community in the interchange of cultural property among nations for scientific, cultural, and educational purposes.

(See 19 U.S.C. § 2602 (a).) Yet, collectors can really only speak to what they know. So, tell them what you think within this broad framework. For instance, over time, import restrictions will certainly impact the American public’s ability to study and preserve historical coins and maintain people to people contacts with collectors abroad. (These particular restrictions have hurt the ability of Cypriot Americans to collect ancient coins of their own culture.) Yet, foreign collectors—including collectors in Cyprus—will be able to import coins as before. And, one can also remind CPAC that less drastic remedies, like regulating metal detectors or instituting reporting programs akin to the Treasure Act and Portable Antiquities Scheme, must be tried first. Finally, Cyprus is a member of the European Union, so why not allow legal exports of Cypriot coins from other EU countries?

Be forceful, but polite. We can and should disagree with what the State Department bureaucrats and their allies in the archaeological establishment are doing to our hobby, but we should endeavor to do so in an upstanding manner. Please submit comment just once, before the deadline on September 30, 2016.

Thank you for your help,

Peter,

Peter K. Tompa,

Executive Director

Ancient Coin Collectors Guild

Aug 23, 2016 | coins, gold, legal, news, US Mint

One of the ten 1933 Saint-Gaudens $20 Double Eagle gold coins from the Longbord Hoard confiscated by the U.S. Mint

This is a case that has been ongoing for ten years following the “discovery” of ten 1933 Saint-Gaudens $20 gold Double Eagle coins by Joan Langbord, the daughter of Philadelphia jeweler Israel Switt. Following the auction in 2002 of the only legal Double Eagle for a single coin record of $7,590,020 (since broken), Langbord claims that she found ten 1933 Double Eagles in a safe deposit box where Switt stored the coins.

Langbord reported the find to the Mint to “attempt to reach an amicable resolution of any issues that might be raised.” When Langbord gave the coins to the Mint to be authenticated, the Mint confiscated the coins. Langbord retained Barry H. Berke, the attorney who represented the plaintiffs in the case that resulted in the sale of the King Farouk coin.

-

-

-

-

Reverse of the iconic 1933 Saint Gaudens

$20 Double Eagle gold coin

After adding her sons Roy and David as plaintiffs to protect the property since Joan is elderly, the case is finally heard in July 2011. The court handed down an unanimous decision against the Langbords. The coins are moved to the United States Bullion Depository at Fort Knox, Kentucky.

Langbords appeal the trail to the Third Circuit where a three-judge panel vacated the forfeiture and order the government to return the coins.

The government appeals and asks that the return order be vacated in order to appeal the decision. Rather, the Chief Judge of the Third Circuit will stay the order and ruled that the appeal will be en banc, meaning that the appeal will be heard before the entire bench of judges.

In this round the government did not file in the proper time-frame and the Longboards appealed all rulings. The Third Circuit order the return of the coins but the government appealed the ruling again.

On August 1, 2016, in a 9-3 vote, a full Third Circuit panel of judges ruled that they agreed with the government who argued that forfeiture laws were not applicable because the coins were already U.S. property and could only be surrendered. The majority also ruled against granting a new trial noting that the errors of the 2011 trial were harmless even though a previous three-judge panel ruled differently.

In writing the dissenting opinion, Judge Majorie Rendell said that the majority based its opinion “mainly on its buy-in to the Government’s audacity—the Government’s say—so that it owned the 1933 Double Eagles and had no intention of forfeiting them.” She noted that the Civil Asset Forfeiture Reform Act was designed to prevent the government from forcefully seizing civilian property and that the ruling sets an “incorrect and dangerous precedent.”

A part of the government’s argument that is disturbing is that the they claim the Langbords are “the family of a thief” and should not benefit. Switt was never charged or convicted of a crime. While there is significant circumstantial evidence that Switt was the private seller of the coins and probably worked with the Mint’s cashier, his role has not been legally proven in any of the cases regarding any of the Double Eagle coins. Although this sounds like a legal arm-twist, it is important not only for this case but for any possible case the government can levy against any citizen. It is not right, fair, or legal and a violation of rights.

Berk told Reuters, “The Langbord family fully intends to seek review by the Supreme Court of the important issue of the unbridled power of the government to take and keep a citizen’s property.”

It is likely that the case will be filed to the U.S. Supreme Court for hearing in its next session beginning in October. Hopefully by then a ninth justice will be seated before hearing this case.

Image courtesy of U.S. Mint

→ Read more at frbatlanta.org

→ Read more at frbatlanta.org

→ Read more at romania-insider.com

→ Read more at romania-insider.com

→ Read more at ottawacitizen.com

→ Read more at ottawacitizen.com

→ Read more at cbc.ca

→ Read more at cbc.ca

→ Read more at cnn.com

→ Read more at cnn.com

→ Read more at egypttoday.com

→ Read more at egypttoday.com

→ Read more at dailyrecord.co.uk

→ Read more at dailyrecord.co.uk