Oct 8, 2008 | gold, platinum, RCM, silver, US Mint

Showing that the management of the US Mint does not understand how to manage a specialized manufacturing facility, it was reported that the Mint is not going to try to maintain the supply to meet the demand for precious metals. In a letter to authorized dealers, the Mint blames the fluctuating market and high demand for this decision.

For the rest of the year, the Mint will continue to strike gold and platinum coins until supplies of blanks are depleted. The supply of 24-karat Gold Buffaloes have been depleted. Silver and one-ounce gold American Eagles will continue to be available as they can be struck.

Those wanting to purchase gold may want to consider previous years or Canada Gold Maple Leafs. It is being reported that the Royal Canadian Mint continues to strike gold but has been having problems keeping up with the demand. Alex Reeves, a spokesperson with the Royal Canadian Mint, said, “[Distributors] would like more gold than we can produce but we’re supplying the best we can. Look at that as good news. We’re able to keep producing gold while the U.S. Mint has to throw up their hands and say, ‘we’re out.’ ”

Fasten your seat belts, it’s going to be a bumpy ride!

Sep 18, 2008 | Eagles, gold, silver, US Mint

When I started writing this blog in 2005, gold was around $470 per ounce and silver was around $7.75 per ounce. The economy was going strong and the numismatic market starting to really move lead by the strong housing market. For collectors, we wondered how high gold and silver would climb and how much more our collections would be worth.

As the economy is collapsing under the pressures caused by the failures of large financial institutions, gold opened the year at $846.75 per ounce, climbed to a high of $1,006.75 on March 18, and closed at $813.00 as I write this on September 18. After the some predictions of gold closing the year over $1,000.00, gold is now down for the year by over $30.

Additional pressure on the market will be the sale of $40 billion in 35-day bonds that will help the Federal Reserve fund the AIG bailout. While some see this as good for the government, there are others who think investors will run away from the market and look to gold as a safe haven.

Overnight, it is being reported that Morgan Stanley is talking with China about cash investments and mergers.

This has made all markets a bit skittish and looking for “safer” investments. Those looking to buy American Eagle bullion coins has been having a difficult time finding coins since the Mint admitted that they have a shortage of gold and silver.

While researching a future post, I visited the Kitco website and found the following note on their front page:

In order to reflect the current strong demand for Silver Maples and Silver Eagles, Kitco is temporarily increasing its current bid (buyback) price for these particular products. Please visit our Selling to Kitco page for more details.

The good news for those buying bullion, the prices are probably the best in a year. For example, the current price for American Eagles at Kitco are selling with a 6½-percent premium for gold and 11.2-percent premium for silver. These are better prices than purchasing from the US Mint.

Given the current environment, it is difficult to say where the financial markets are going and how it will affect the market for coins. We do know that generic gold and silver (common date) coins and bullion will rise and fall with the market. But it makes it difficult to consider what will happen in the collectible market. I will have some thoughts in a few days.

Sep 15, 2008 | Eagles, gold, platinum, silver, US Mint

When I woke up this morning, I found that Lehman Brothers filed for Chapter 11 Bankruptcy protection on Sunday. Merrill Lynch, another venerable Wall Street institution, is being purchased by Bank of America. Insurance giant AIG is asking the Federal Reserve for a bridge loan to weather its own fiscal issues. As the Dow Jones Industrial Average index drops 300 points after the markets open, it is not surprising that there are worries about the fundamentals of the economy.

Those of us in numismatics, we watch the prices of precious metals for indication as to how our market is going. In recent weeks, gold, silver, and platinum have been falling to levels not seen since early 2007. As I write this, gold is up $11.80 to $775.50 per ounce (1.5-percent) while silver is up only 20-cents and platinum is down $38.00.

The general rule of thumb is that when there are problem in the capital markets, investors try to convert their cash to precious metals. While gold is the most popular investment, the relatively stable prices and average trading volumes suggest that investors are not running away.

For the collector, this means that collectibles tied to the prices of precious metals should not move much. Even though the U.S. Mint has not changed its prices during this declining market, those using American Eagle and 24-karat Gold Buffaloes as investments can find coins from previous years at lower prices.

If you are collecting rare coins, the PCGS3000 Index (a market basket price of 3,000 rare coins) shows that prices are up $4.65 for the day (0.01-percent). The PCGS3000 index has trended upward since November 2007.

As a collector and not an investor, I will take the advice of Dave Harper and wait to see what happens to the market. The currents are much to rough for a collector to jump in head first!

Aug 18, 2008 | Eagles, silver, US Mint

This morning, I was checking the prices of the various commodities market and noticed that metal prices rose a little in foreign markets. Gold is hovering just below $800 per ounce and silver is under $13. Both are significantly lower than their recent six-month highs. It made me curious as to whether the US Mint is still selling gold and silver at a significant premium.

As I looked through their online catalog, I noticed that Proof American Silver Eagles are no longer for sale!

Legally, there are no limits on the number of proof American Silver Eagles that may be sold. But the Mint has placed limits on the sale of these coins. In 2003, there was a published limit of 750,000 coins. However, since 2005, the Mint does not report there being any limit on the sales of American Silver Eagle proof coins.

Last week, the Mint halted gold bullion sales to dealers. A move that has been speculated to be tied to the downward trend in the price of gold. But American Eagle gold collectible coins remain for sale at their previous prices.

Are the American Silver Eagle proofs sold out or is there a production issue that the Mint has yet to announce? Inquiries to the Mint have not been unanswer at this time. Stay tuned.

Aug 15, 2008 | Eagles, gold, silver, US Mint

Several sources are reporting that the US Mint has suspended sales of American Gold Eagle bullion coins to dealers. There has been no announcement but the Mint has refused to take orders.

American Eagle Gold Proof and collector uncirculated coins are still for sale at the Mint’s online catalog. All coins appear to be available with no backorder messages.

Gold has fallen below $800 during today’s trading. In this week’s trading, gold dropped 8.4-percent for the week. Silver also fell 16.4-percent. The fall is attributed to the strengthening of the US dollar.

Since gold reached $1,004.30 on March 17, the price has dropped more than 20-percent over the five months.

Silver has not been immune to the a change in value. From the high of $21.24 and a close of $20.64 on March 17, the current price of silver is $12.75, a 38-percent drop in value.

Currently, the US Mint has not indicated that they would revalue collectibles in the light of the market downturn. One reason could be that the Mint bought the metals at the higher prices and need to recoup their investment in these metals as part of their real cost of doing business. However, if the price of metals drop and sales of Eagles decline, then the Mint will have to adjust its prices.

Last year, we speculated about what it would take for the Mint to raise prices. What will it take for the Mint to lower prices?

Apr 23, 2008 | Eagles, gold, silver

In the volatile commodities and money markets, the spot price of gold dropped under $900 per ounce briefly as the dollar rose against the Euro. Pressure is being placed on the Euro as analysts think it may not be able to maintain its current value against the weakening dollar and the high price of crude oil.

Bloomberg is reporting that analysts believe that the price of crude oil is unsustainable and will weaken other non-dollar currencies as the price falls. Speculators are selling gold futures looking to make more money with oil and currency futures. This has lead some analysts to believe that gold will fall below $900 by the end of the year citing lows in the range of $860 to $880.

Silver is also trading lower but above the $17 mark. Analysts speculated that silver will slip below $17. Nobody expects the prices to reach the levels seen in 1980.

For numismatics, the lower spot price of precious metals should lower the cost of bullion coins, such as the American Eagles. However, with the popularity of collecting earlier common date gold coins, those prices may not fall as much since their numismatic value may help them maintain their prices.

Jan 17, 2008 | coins, fun, pocket change, quarter, silver

Many collectors are cherrypickers. We search change, dealer junk boxes, and other places for bargains. Then there are those hardcore cherrypickers who look for slight errors, die varieties, and other subtle features missed by the casual onlooker. I am not a hardcore cherrypicker. But I do search pocket change to see what I find.

After returning home from dealing with family business, my wife left a sandwich bag full of change and later told me she needed soda money. That means pick out the quarters, see if there is anything interesting, and fill up the quarter tube so she can buy her daily Coca-Cola. I started picking out the quarters and one caught my eye. It was worn but it had a distinct color. I dropped the coins on the desk and heard a distinct “ting.” It was the sound of days gone by. It was the sound of a silver quarter!

Somewhere, my wife received a 1964 Washington Quarter in change. If I was to have it grade, it would probably be slabbed in Extra Fine condition. There is some slight luster and it shows the signs of once being in someone’s collection. According to coinflation.com, the coin is worth about $2.85 in metals (as I type this), which is probably more than its numismatic value. But that does not matter… it was fun to find!!

Somewhere, my wife received a 1964 Washington Quarter in change. If I was to have it grade, it would probably be slabbed in Extra Fine condition. There is some slight luster and it shows the signs of once being in someone’s collection. According to coinflation.com, the coin is worth about $2.85 in metals (as I type this), which is probably more than its numismatic value. But that does not matter… it was fun to find!!

Jan 12, 2008 | gold, silver

An old Chinese proverb (or curse) says “May you live in interesting times.” When looking at the various conditions that make up the numismatic world, these times are certainly interesting.

The big news of the week, the price of gold hit the $900 per ounce level before backing off and closing at just under $895. Quietly, the price of silver has hit historical highs, closing at $16.23. Regardless of a coin’s numismatic value, the metal values drives up the price of coins. So if you had a roll of circulated Jefferson War Nickels, those coins contain $36.53 of silver and a total of $37.39 in its total melt value. Your old hoards may now be worth something!

While rising metal values are exciting as a story, I have written about what it could mean in other areas of investments and in the economy. For numismatics, that means all prices will go up at least proportional to the rise in the price of metals. Even those early gold coins that are considered “common” whose price is tied to the value of the metals will now see a rise in price. I wish I had started watching the pricing trends with Saint Gaudens Double Eagles as the market was rising. In addition to their numismatic value, the common price of lower grade coins are over $1,000.

As I write this, the Florida United Numismatics (FUN) Show is underway in Orlando, Florida. FUN is always the first show of the year. With the current state of the economy, the rising prices, and the weakening of the US dollar, it will be interesting to hear the stories from the bourse floor—the guys and gals in the trenches. I hope they report that it is still a good market!

Nov 4, 2007 | foreign, silver

An old axiom in show business says to never follow children or animals on stage. But with the world wide acceptance of other animals on silver coinage, who can fault the Perth Mint for trying. In the spirit of the updated designs of the Chinese Panda since 2001, the Perth Mint has entered the bullion collectible market in 2007 with the Australian Koala Silver Coin.

Minted in .999 pure silver with a legal tender face value of one dollar, the Koala features Ian Rank-Broadley effigy of Her Majesty Queen Elizabeth II on the obverse and an image “depicting Australia’s most endearing marsupial” on the reverse. The Perth Mint describes the reverse design featuring “a cuddly koala clinging tenaciously to the branch of a gum tree. The image appears on a ‘shimmer’ background, a remarkable new effect developed exclusively by The Perth Mint.”

Minted in .999 pure silver with a legal tender face value of one dollar, the Koala features Ian Rank-Broadley effigy of Her Majesty Queen Elizabeth II on the obverse and an image “depicting Australia’s most endearing marsupial” on the reverse. The Perth Mint describes the reverse design featuring “a cuddly koala clinging tenaciously to the branch of a gum tree. The image appears on a ‘shimmer’ background, a remarkable new effect developed exclusively by The Perth Mint.”

In hand, it is a beautiful coin mounted on a collectible card. The design is very reminiscent of the style used to depict the Pandas but with an interesting background. The field is a series of a geometric shape that is shallow that gives the koala depth on the background. It is very difficult to image without over emphasizing the background.

This is the first issue and the Perth Mint has announced a new design for 2008. I think this fits into my “oh, neat” catagory for being part of my collection.

Mar 12, 2006 | coins, currency, history, medals, silver

In this time of uncertainty, I feel that we Americans need to remember those who have given their lives in defense of this country. This is not a political statement on the current Middle East situation, but an appreciate of those with their boots on the ground who risk their lives daily. As part of that, my wife and I visited the U.S.S. Arizona (BB-39) Memorial at Pearl Harbor during our trip to Hawaii. Unfortunately, rain prevented us from visiting the U.S.S. Missouri (BB-63) Memorial.

In this time of uncertainty, I feel that we Americans need to remember those who have given their lives in defense of this country. This is not a political statement on the current Middle East situation, but an appreciate of those with their boots on the ground who risk their lives daily. As part of that, my wife and I visited the U.S.S. Arizona (BB-39) Memorial at Pearl Harbor during our trip to Hawaii. Unfortunately, rain prevented us from visiting the U.S.S. Missouri (BB-63) Memorial.

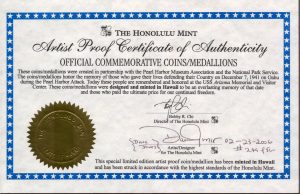

In front of the gift shop that is inside the Visitors Center was a table with gentleman selling Pearl Harbor commemorative medals and sets produced by the Honolulu Mint. I was very intrigued by the items and gravitated to the commemorative set that contains two .999 Silver, 1 Troy Ounce medals, an uncirculated 1943 Steel Lincoln Cent, and a Series 1935A Hawaii issue Silver Certificate. Even though I am not a commemorative collector, I do tend to buy numismatic items from my personal experiences. While standing in the Memorial, and with my wife’s urging, I could not pass up buying this set.

-

-

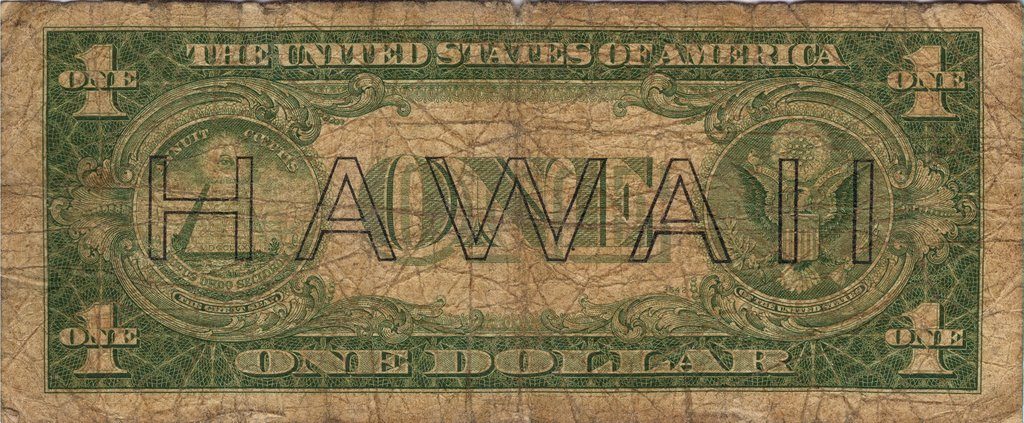

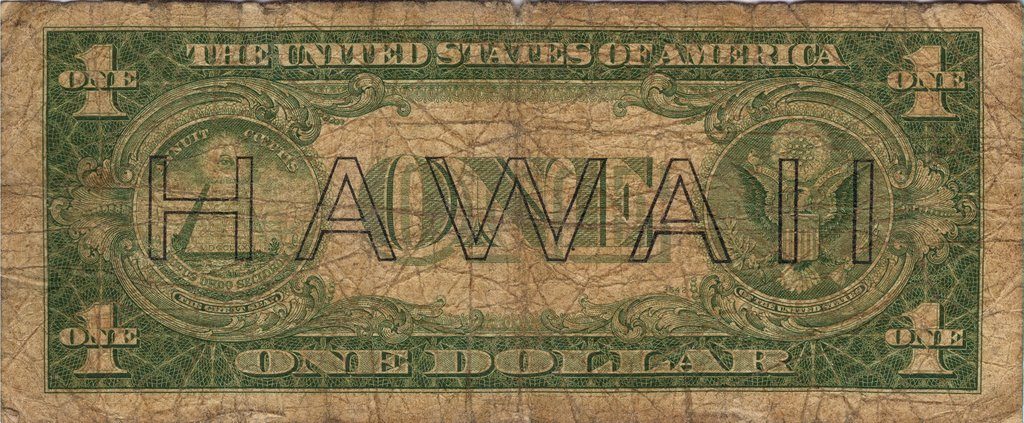

Series 1935A Silver Certificate with “HAWAII” Overprint Reverse

The set includes a medal commemorating the 65th Anniversary of the Japanese bombing of Pearl Harbor. The obverse shows the U.S.S. Arizona and the anniversary date. The reverse shows an arial view of the memorial with the outline of the sunken ship in the water. On the image are the words “Honoring all those who made the ultimate sacrifice on Dec. 7, 1941.”

-

-

Obverse of the Pearl Harbor 65th Anniversary silver medal

-

-

Reverse of the Pearl Harbor 65th Anniversary silver medal

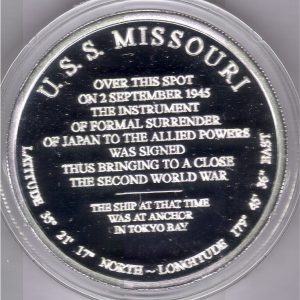

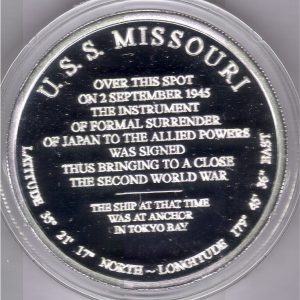

The other medal commemorates the Japanese surrender aboard the U.S.S. Missouri. It was prophetic that the articles of surrender were signed on her deck. The obverse of this medal recreates the signing of the document by General Yoshijiro Umezu, Chief of the Army General Staff, with Lieutenant General Richard K. Sutherland standing across the table. The reverse has the inscription on the deck of the Missouri where the articles were signed.

-

-

Obverse of the Japanese Surrender Silver Medal

-

-

Reverse of the Japanese Surrender Silver Medal

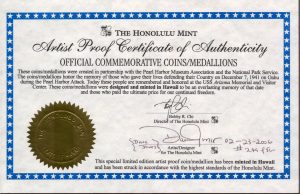

Personally autographed COA from the Honolulu Mint

Although everyone should visit the U.S.S. Arizona Memorial and the rest of Pearl Harbor, I know it is not a trip that every can take. So if you are interested in this collectible and other medals honoring those who served and gave the ultimate sacrifice, you can visit the Honolulu Mint’s website or the U.S.S. Arizona Memorial Bookstore. Portions of the proceeds benefit the Memorial.