Apr 10, 2011 | gold, investment, silver

On January 28, 2011, the spot price for silver closed at $26.68 per troy ounce. That was almost $4 lower than it opened on January 4, the first trading day of the year. Since then, silver has climbed steadily to close at $40.22 on April 8. A rise that has seen the price of silver gain a bit more than 50-percent in value.

Some are wondering if the price of silver could hit the $48.70 it did in 1980 when the Hunt Brothers, Nelson and Herbert, tried to corner the silver market. Although the comparisons are interesting, it would only be a numeric record. Accounting for inflation, the actual value would be $130.80 in terms of 2011 dollar. For a true record, silver has a long way to go!

Since the economic downturn, there have been significant investment in gold pushing prices higher with it reaching a record of $1,469.50 per troy ounce as of Friday’s close. However, silver has remained relatively flat until this year. The one explanation that makes sense is that silver remains a good investment because it is undervalued as compared to gold—called the spread or ratio of silver to gold.

Historically, prior to the deregulation of markets, governments have fixed the spread around 15-to-1, meaning that the price would be set to where 15 ounces of silver would buy one ounce of gold. This changed during following deregulation of the markets. One analyst found that gold was over 100 times more expensive than silver but the price ratio never went below 41.51.

At the beginning of the year, a few analysts commented that silver was prime to rise because of the gold-to-silver ratio was very wide. Some suggested that the ratio should be closer to 25-to-1 even though it has never been lower than 41-to-1. However, as of Friday’s close, the ratio is now 36.29!

Some analysts believe that as the dollar falls in value, the prices of both gold and silver will rise. Projections see gold rising to anywhere from $1,500 to $1,600 per ounce. But because this price is high for some investors, silver looks like a better value and is expected to hit the $50 mark before the end of the year. Given its trend and the nature of the markets, it could reach $50 by the summer.

If you are not an investor but a collector of United States coins from prior to 1965, the value of your collection has been going up. Do you have American Gold Eagles? You might have noticed that some of your coins have more than doubled their original price, even for the one-tenth ounce. Remember when the first Gold Buffalo sold for $650? Now add a $200 premium to the gold spot price to find the current value.

Are you collecting dimes? Just the silver value of the dime is $2.96. Those Kennedy Half-Dollars that your father or grandfather saved from 1964 have $14.80 worth of silver. And those common date Peace Dollars (1922-23) that sold for $20-25 a year ago is now worth $31.65 in silver.

By the way, those 1965-1970 Kennedy Halves that are 40-percent silver contains $6.05 worth of silver.

The analysts who determine and publish the values of coins have been very busy!

I am not suggesting that anyone buy gold or silver as an investment—speak to your investment advisor before doing anything. I am looking at the situation from a collector’s point of view. The rise of prices makes my collection worth more when considering the bullion value and the numismatic premium. Maybe now is a good time to consider selling some of my collection—the parts I am less emotionally attached to—and start over again when metals prices drop. In any case, we certainly live in interesting times!

Jan 2, 2011 | coins, economy, gold, investment, policy, silver

Many things can be said about 2010, but for numismatics and precious metals it was quite a ride. What could this ride tell us about 2011?

Looking at the economy, the real gross domestic product—the output of goods and services produced by labor and property located in the United States—increased at an annual rate of 2.6 percent in the third quarter of 2010. A rate greater than in 2009. Although real disposable personal income increased 0.2 percent through November, the consumer price index rose at a faster rate of 1.1-percent while unemployment reached a one-year high of 9.8 percent in November.

If the slow improving economy and expanding unemployment has you confused, the simple explanation is that if the economy was a bus, it just pulled away from the curb and the driver started to shift into second gear while employment has yet to be allowed aboard. Although economists agree that employment and Consumer Confidence Index are lagging indicators, neither have seen improvement in 2010. Although the politicians are hoping their lame duck legislative efforts will help the unemployed to board the employment bus, it is possible that the bus will be too far down the road to make a difference in 2011. Let’s hope it is not too late!

In an attempt to provide its version of stimulus in 2010, the Federal Reserve’s lowered its discount rates and its ability to manipulate the money supply to try to provide relief. Although the Fed has increased the money supply, the United States dollar has not been significantly weakened against most of the world currencies—although some would say that it was seriously weakened in 2009. While the dollar has fluctuated against other major currencies throughout the year, the dollar has shown marginal only weakness against the British Pound, Euro, and Yen year-over-year while there were no weaknesses against the Reniminbi (or Yuan) because of institutionalized currency manipulation in China. Many economists believe that the avoidance of a dollar free-fall was because of the failure and pending failure of some Eurozone economies and China’s desire to reduce its own inflation concerns. The rumblings to remove the dollar as the standard and benchmark currency that we heard in 2009 subsided in 2010.

To measure the effect of the economy on the numismatic markets, I use the PCGS3000® Index as an indicator. The PCGS3000 Index is a market basket of 3,000 coins that PCGS their analysts believe represents the broad market. The variety of coins makes for a good indicator but as a broad market basket, movement indicates trends rather than a real-time indicator (similar to the Russell 2000).

The PCGS3000 Index opened 2010 with at 68,476.87. After dropping to a 12-month low of 66,886.27 (↓2.3-percent) in August, the index closed at 67,323.11, down ↓1.68-percent for the year. For a market basket that consists of 3,000 non-volatile items made from a variety of metals an in different grades, a downward trend of one-to-two percentage points indicates a weakness in the numismatic market. While some think the markets are strong—and there has been no slow down in the high-end coin market—collectors and some investors are either pushing prices downward or waiting for prices to drop before buying. Like in retail sales, many purchasers are standing on the sidelines waiting for the bargains or the market to settle.

But if the economic indicators do not show weaknesses except in employment, then why should the numismatic market show a weakness? The answer can be summed up in two words: gold and silver.

Some dealers and auction houses have found that the buyers for the high-end coins have continued their strong buying but the rest of the market has not joined them. One of the factors can be that the price of gold has scared many people away. When the markets opened on January 4, 2010, the price was $1,087.50 for one troy ounce of gold. During the year, the price never dipped below $1,050 climbing to $1,420 on December 7 before closing at $1,405.50 on December 30. As a result, investors who bought gold prior to 2010 saw their investment to rise 29.2 during the year. One would think it makes sense that the generic gold coin market would rise with the gold market. But a look at the PCGS Generic Gold Coin Index found that even with gold’s rise through the year, the generic gold coin market also saw a 17.76-percent drop in prices. However, Proof Gold rose only four-tenths of one-percent (0.41%) showing that there continued to be a little activity in the high-end market.

If there was a bull market in 2010 they were running for silver. After opening the year at $16.99 per troy ounce, silver closed at $30.63—a whopping 80.4-percent increase! Although less than the $54 ($143 adjusted for inflation in 2010 dollars) that it reached when the Hunt Brothers tried to corner the silver market in 1980, the 2010 rise is significant because few believe that the markets are being manipulated. In fact, one analyst believes that the silver market is undervalued as compared to the gold market. He said, “The gold rush of the 2000s is going to be nothing [compared] to the silver rush of the 2010s.”

When looking at the numismatics market, silver is the key metal. Up until 1964, every dime, quarter, half-dollar, and non-gold dollars were made of silver. Silver has been a key coining metal since the creation of the United States Mint in 1792. Many of the most collectible coin ever created by the U.S. Mint were struck in silver. Nothing represents silver coins like Morgan and Peace Dollars. Arguably one of the most popular numismatic collectibles, Morgan and Peace dollars are 26.73 grams made of 90-percent silver and 10-percent copper making its melt value $23.03 at the end of 2010.

But the value of Morgan and Peace dollars extend beyond their melt value. Morgan and Peace dollars are tied to the late 19th and early 20th century history of silver manipulation in the United States with designs popular with collectors. Morgan dollars struct at the Carson City mint are amongst the most desired. Since the GSA sales in the 1970s, the prices of these coins have gone up—in some cases beyond the reach of the average collector. Of the Peace dollar series, the high-relief 1921-D dollar is very desirable as is the low mintage 1928 dollar, and the 1935 last year of issue dollars. And the rumor that not all of the 1964-D Peace dollars were melted makes finding out the absolute truth a great interest to the numismatic world. However, with the rest of the market trending downward and silver skyrocketing, the PCGS3000 Morgan and Peace Dollar Index found the market rise-then-fall-then-rise again to end the year up eight-tenths of one-percent (0.825-percent) for 2010. Not a great showing, but demonstrating that Morgan and Peace dollars are still popular amongst collectors.

What is clear is that the coin market was down in 2010 while investors and even some collectors might have been concentrating on gold and silver bullion.

In speaking with some dealers, many have said that they have survived the last two years buying and selling bullion including American Eagle coins. One said that the numismatic market has been very slow that the bullion market has allowed him to stay in business during this era being dubbed “The Great Recession.”

Just because the calendar turns does not mean the market will turn along with it. Even though the lame duck congress passed significant stimulus legislation, it will take some time for those measures to settle into the markets. Some experts think that the eventual hiring may not occur for at least six monist and that there will not be a significant drop in unemployment until the fall. Others point to the infrastructure project the new laws are supposed to support forgetting that even shovel-ready projects have legal requirements, such as contract and environmental restrictions, that have to be address before a shovel can be used. In short, we may be in for more of the same through the first and even second quarters of 2011.

The new congress will help keep the economic uncertainty alive. Although the Republicans will control the House of Representatives, the Senate will be controlled by the Democrats with an active Republican minority who has shown that they will use the body’s rules to try to force their will. In other words, prepare for gridlock. None of this takes into consideration that Rep. Ron Paul (R-TX) will be the chairman of the House Finance Committee, thus allowing him to have control over economic policy in the House!

Neither the lame duck stimulus or the new congress will do anything to settle the markets in the short term. With the uncertainty, investors will continue hedge their bets using precious metals. Gold will continue to rise but at a rate less than in 2010. It is fair to say that with the current valuation being so high, it is likely that 2011 will end with gold only rising by 20-percent. However, the argument that the gold-to-silver ratio is out of balance being very compelling, we may see silver continue to climb. Silver may not climb at the 80-percent rate we saw in 2010, but a 40-percent rate may be reasonable. If this holds true, this time next year we could be talking about gold being $1,680 per troy ounce and silver closing at $42.

During the Fall of 2010, the PCGS3000 Index rose a bit from its low for the year and the low since the index’s all-time high in 2008. But with other factors not changing in the short term, could this be the coin market’s version of a “dead cat bounce?” A dead cat bounce is a small yet brief market recovery derived from the idea that “even a dead cat will bounce if it falls from a great height.” It is more likely that the numismatic market will flatten a bit while the rest of the markets figure out which direction they will go.

The first indication of how the numismatic market starts the year will be at the F.U.N. Show held January 4-9 in Tampa, Florida. With F.U.N. being one of the largest non-ANA shows of the year, sales and dealer impressions will set the tone for at least the next few months. Under the premise that markets do not turnaround quickly and that the last major show, Whitman Baltimore Expo in November, saw only nominal sales, one can assume a similar atmosphere for F.U.N. It will be more reasonable to wait until the National Money Show March 17-19 in Sacramento and the Whitman Baltimore Expo held March 31-April 3 to determine if the numismatic market will be better in 2011. At the end of the year, it is reasonable to expect that the PCGS3000 Index will be up 2.5-percent by the end of 2011 given the other market forces.

Of course predicting any market is a total crap shoot. While my roll of the dice may be no better than others, I would caution against thinking that my crystal ball is clearer than anyone else’s. All I have done is read the proverbial tea leaves and drank the tea while throwing darts at the wall trying to guess what the future will bring. Or as one comedian used to say, “That’s my opinion, I could be wrong.”

Metals charts courtesy of Kitco.

The PCGS300® Index courtesy of the Professional Coin Grading Service.

Dec 29, 2010 | Britain, foreign, silver

Silver can bring out the best in nearly every design. Another silver coin worth collecting is the Britannia. After joining the United States and other countries to offer gold bullion coins in 1987, the Royal Mint celebrated the tenth anniversary of their program by introducing a £2 silver coin. Silver Britannias are struck in what is called Britannia silver, an alloy consisting of 958 parts per thousand silver. As a comparison, sterling silver consists of 925 parts per thousand silver. Comparatively, the American Silver Eagle contains 999 parts per thousand silver and the Canadian Maple Leaf consists of 999.9 parts per thousand silver. The balance of the alloy is usually copper.

Britannia was originally the Latin name that the Roman Empire gave to the island of Great Britain and its possessions. After the fall of the Roman Empire it had lost most symbolic meaning until the rise of British influence and being renewed during the time of Queen Victoria. Still depicted as a young woman with brown or golden hair, she kept her Corinthian helmet and her white robes, but now she held Poseidon’s three-pronged trident and often stood in the ocean, representing British naval power. She also usually held or stood beside a Greek hoplon shield which sports the British Union Jack. At her feet was often the British Lion, the national animal of England. Britannia first appeared on the farthing in 1672, followed by the halfpenny later the same year under Charles II.

When introduced in 1997, the Silver Britannia was minted with the official “hid Portrait” of HM Queen Elizabeth II on the obverse. This portrait was designed by Raphael Maklouf FRSA and shows the Queen with the Royal Diadem which she wears on her way to and from the State Opening of Parliament. The fourth official portrait of Her Majesty the Queen was introduced for all Commonwealth coinage in 1998. It is the work of sculptor Ian Rank-Broadley FRBS, FSNAD. Her Majesty is wearing the tiara which was used in an earlier coinage portrait by Arnold Machin. The Queen is shown facing right, in accordance with a tradition dating back to the seventeenth century, where successive monarchs face in alternative directions on the coinage.

From their introduction in 1987, the gold Britannia coins used the standing Britannia design on the reverse. On the tenth anniversary of the program and the introduction of the silver Britannia, a new deisign was created. The design was a figure of Britannia driving a chariot in the manner of Boudica was designed by Philip Nathan. Boudica, also know as Boadicea, was ruler of the Iceni tribe in eastern England and Queen of the Britons. She led her forces in revolt against the Romans and sacked Colchester, St. Albans, and London before being defeated by the Roman governor, Suetonius Paulinus. She died in the year 62 CE. This design was used in 1997, 1999, and 2006.

Following the successful launch of the silver Britannia coins, the Royal Mint returned to the standing Britannia design. Created by Philip Nathan, Britannia is depicted adorned in flowing robes standing proud in defense of Britain’s shores. The design recalls the design used on florins of Edward VII. this design also appeared in 2000, 2002, 2004, and 2006.

With a few other designs mixed in, the 2010 is also a single year design designed by Suzie Amit who said that she wanted to portray Britannia as a strong and courageous looking but not overly warlike woman—more peaceful and protective. The coin is struck with shiny surfaces without contrast from frosted designs. Unfortunately, it made it difficult to image. Although this image does not capture its beauty, it is a very nice design and worthy of completing my one ounce Silver Britannia collection.

With a few other designs mixed in, the 2010 is also a single year design designed by Suzie Amit who said that she wanted to portray Britannia as a strong and courageous looking but not overly warlike woman—more peaceful and protective. The coin is struck with shiny surfaces without contrast from frosted designs. Unfortunately, it made it difficult to image. Although this image does not capture its beauty, it is a very nice design and worthy of completing my one ounce Silver Britannia collection.

American Silver Eagles, Chinese Pandas, and Great Britain Britannias are not only beautiful silver coins, but make a nice set to collect. Even with silver prices on the rise, they do make nice sets.

Dec 28, 2010 | bullion, foreign, silver

Some have called silver the investment vehicle for the masses. Even with the price rises, silver remains more affordable than gold and is more accessible than gold. Looking at the U.S. Mint product line, the consumer has more silver options than gold. At some point, the U.S. Mint will actually sell the American the Beautiful silver bullion coins that seems to have garnered a lot of attention.

Silver has a long history as being the most popular metals for coins. From Ancient Rome to the Spanish Pillar Dollars that became the basis of United States currency, silver has been the plentiful and desirable metal used for coinage. Once silver became the base metal of choice, the United States spent over 100 years manipulating the composition of coins and silver prices in an effort to support silver mining concerns of favored members of congress.

I like silver coins. Silver has a silky color that allows for striking designs to be very visible. Because silver is less dense than gold, a one ounce coin made from silver are larger than gold. For example, most gold bullion coins are around 28 mm while silver coins average 38-40 mm (the Canadian Maple Leaf is 38 mm). It translates to more surface area for beautiful designs.

I collect a few silver bullion coins. Aside from the American Silver Eagle in proof and bullion versions, I also collect Canadian Maple Leafs, British Britannias, and China Silver Pandas. Silver Pandas are very interesting. China has been minting the Panda Bullion coin since 1983. The obverse features a panda in various images in its environment. Every year (except 2002) features a different panda image depicted in its natural environment. The reverse is The Hall of Prayer for Abundant Harvests in the Temple of Heaven. There have been four versions of this design (1983-1991, 1992-1999, 2000, 2001-present).

There have been three generations of Pandas and a single “different” issue. Generations are based on content and changes in design. The claim is that 2010 is the last year of the current generation since there may be a slight change in the works along with a significant increase in production. The People’s Bank, which governs the creation of coins in China, is planning for a 10-fold increase in production. It is conjectured that since the price of silver is so high that the premium they charge because of the popular designs can bring in more revenue. It is uncertain whether this will be a successful strategy because those who studied microeconomics will tell you that an increased supply without an increased demand will push the prices downward. The U.S. Mint discovered this a few years ago and reduced the number of products offered.

There have been three generations of Pandas and a single “different” issue. Generations are based on content and changes in design. The claim is that 2010 is the last year of the current generation since there may be a slight change in the works along with a significant increase in production. The People’s Bank, which governs the creation of coins in China, is planning for a 10-fold increase in production. It is conjectured that since the price of silver is so high that the premium they charge because of the popular designs can bring in more revenue. It is uncertain whether this will be a successful strategy because those who studied microeconomics will tell you that an increased supply without an increased demand will push the prices downward. The U.S. Mint discovered this a few years ago and reduced the number of products offered.

With the new information, one source, the generations have been described as:

| Generation |

Weight |

Content |

Size |

| First Silver Panda Coins (1983-1985) |

27g |

.900 fine |

38.6 mm |

Sterling Silver Panda (1987)

one year issue |

1 troy oz |

.925 fine |

40 mm |

| Second Generation (1988-1999) |

1 troy oz |

.999 fine |

40 mm |

Third Generation (2000-2010)

Change in artists |

1 troy oz |

.999 fine |

40 mm |

| Fourth Generation |

Projected for 2011: 10x increased production |

Recently, I picked up the 2010 Panda to keep my Third Generation collection complete. The Third Generation Panda designs are distinctive in being more realistic than previous designs with fine details as part of the design. Gone are the cartoon-like panda figures allowing this generation of panda designs to appeal to a wider audience. These are wonderful designs and something that shows off very well on the 40 mm silver planchet.

Oct 4, 2010 | Eagles, silver, US Mint

November 19, 2010!

Circle the date. Add a reminder on your electronic calendar. Program your toaster to remind you. November 19 is the date that the U.S. Mint will begin to sell American Silver Eagle PROOF coins!

Reported by Dave Harper of Numismatic News on his blog, the coins will cost $45.95 per coin with a limit of 100 coins per household. That is a significant increase in the price because of the price of silver ($22.03 per troy ounce as I type this). Delivery is planned for December 1.

UPDATE: You can read the U.S. Mint’s press release here.

For fans of the American Silver Eagle proof who mourned the lack of 2009 coins, this is great news. It has been a while since I was happy about the announcement of a coin release.

I commend the U.S. Mint for this move to make collectors happy.

Oct 3, 2010 | Eagles, gold, palladium, platinum, silver, US Mint

In a rare swift move by the House of Representatives, H.R. 6166, American Eagle Palladium Bullion Coin Act of 2010, was introduced, discharged from the House Committee on Financial Services, considered on the floor, and passed without objection. With its passage in the House, the bill was Engrossed and sent to the Senate for consideration.

In the Senate, the bill was read twice and referred to the Committee on Banking, Housing, and Urban Affairs. Congress has adjourned for the election season.

H.R. 6166 was introduced by Rep. Denny Rehberg (R-MT), the representative at-large from Montana. Montana is home of the Stillwater Mining Company, (NYSE: SWC) the only producer of palladium in the United States. Stillwater also owns platinum mines that supplies the U.S. Mint with platinum for American Eagle Bullion coins. With this bill, Rehberg adds his name to a long line of congressmen who have introduced bills to protect their state’s mining interests by using the U.S. Mint as a primary purchaser.

In the world of metal investing, palladium is behind gold, silver, and platinum in demand. Palladium is not as popular in the United States as it is in other countries. Palladium sells better than silver in Canada and Europe. It is rarer than gold, but a little more abundant than platinum but has the silky look of platinum while being almost as ductile as silver. Artists in Europe and Asia are beginning to use palladium instead of platinum for their higher-end designs.

Since the price of palladium is less than the price of gold and platinum, it is possible that investors could consider palladium as part of a diverse portfolio. Those who believe in “end of the world” scenarios will not be interested because the secondary market is not as strong as it is for gold.

The bill requires that “the obverse shall bear a high-relief likeness of the ‘Winged Liberty’ design used on the obverse of the so-called ‘Mercury dime’” making it yet another bullion coins using a design from the early 20th century. For the reverse, the law says that it “shall bear a high-relief version of the reverse design of the 1907 American Institute of Architects medal.” Both the Mercury Dime and 1907 AIA medal were design by Adolph A. Weinman, whose Walking Liberty design is used on the American Silver Eagle coin.

The bill requires that “the obverse shall bear a high-relief likeness of the ‘Winged Liberty’ design used on the obverse of the so-called ‘Mercury dime’” making it yet another bullion coins using a design from the early 20th century. For the reverse, the law says that it “shall bear a high-relief version of the reverse design of the 1907 American Institute of Architects medal.” Both the Mercury Dime and 1907 AIA medal were design by Adolph A. Weinman, whose Walking Liberty design is used on the American Silver Eagle coin.

In other words, congress saying that it does not trust the U.S. Mint to create a design suitable for this coin. While some might have an issue with the design of recent coins, it would be nice to unleash the creativity of the U.S. Mint’s artists and allow them to make a design to represent Liberty. Maybe if the artists were less constrained, they can use their talents.

Another provision of the bill is that aside from using palladium from U.S. sources, it allows the U.S. Mint to purchase palladium from other sources. The bill also makes a distinction between proof and bullion coins allowing the U.S. Mint consider minting proofs to meet collector demand… or not depending on whether there is a demand and a supply to meet the demand. In other words, it will be up to the government lawyers to figure out what is meant by the wording in the bill!

If the bill passes the Senate and signed by the President, palladium bullion coins will not be issued until 2012 because it is too late in the year for the U.S. Mint to plan to issue this coin.

1938 Mercury Dime image is owned by the author.

Image of the 1907 AIA Medal copied from Architecture: celebrating the past, designing the future by Nancy B. Solomon.

Nov 9, 2009 | bullion, foreign, gold, silver, US Mint

My motivation for recommending the restructuring of the US Mint was when they announced that proof silver and gold American Eagle coins will not be produced in 2009. The logic of the decision in the context of what we know of the US Mint’s operations was unpalatable.

Restructuring the bullion program is to first acknowledge that it is a profit center for the US Mint. Its sole purpose is the buy precious metals and create bullion coins for sale at a significant profit. In the 2008 Annual Report, the profit on bullion issues was 22-percent over all costs, more than circulating currency or commemorative coins.

The anchor of the bullion program are the American Eagles, which has been the most successful bullion program since its inception in 1986. The program started with silver and gold American Eagles. Platinum bullion Eagles were first struck in 1997. American Silver Eagle coins are one troy ounce of 99.9-percent pure silver. American Gold Eagles contain 22-karat (91.67-percet) of gold balanced with silver and copper struck in 1/10 ($5), ¼ ($10), ½ ($25), and one ($50) troy ounces. American Platinum Eagles are struck using 99.95-percent platinum in 1/10 ($10), ¼ ($25), ½ ($50), and one ($100) troy ounces. This program will not change and the US Mint will continue striking coins to meet the demand.

Under the current law, it is not required that the US Mint strike proof versions of these bullion coins. This restructuring will change this to require a minimum mintage of these coins. For the future, the US Mint will strike proof coins to meet the demand with a maximum number in ounces of metals used. For this policy, it is proposed that 1 million troy ounces of silver be used for proof coins meaning the production will be limited to 1 million coins. Gold will be limited to 500,000 troy ounces of gold across all sizes. Finally, platinum will be limited to 100,000 troy ounces in proof coins.

I am not proposing changes to the 24-karat (.999 fine) Gold Buffalo program.

To complete the transformation, the First Spouse program will be transfered to bullion issues and continue using the same rules as it does today.

This year, the US Mint introduced the 2009 Ultra High Relief Coin. This coin brings to life the Augustus Saint-Gaudens proposed high relief design for his $20 Double Eagle design that 1909 technology could not create. The coin has been praised for its beauty and should be a future Coin of the Year candidate.

The concept of creating special bullion coins like the Ultra High Relief coin is something that a new bullion program can do. The US Mint, with direction from the CCAC acting as the US Mint’s Board of Directors can authorize new bullion coins that will allow the US Mint to create new collectibles that could be marketed to a wider audience. In addition to special strikes, the new bullion program can include coins with privy marks, special reverses, enameled coins, even coins made from multiple materials.

Examples of what could be accomplished can be seen in the 2007 Coin of the Year and 2008 Coin of the Year candidates. Although there are wonderful single metal coins, there are some wonderful coins using other design elements. In fact, the the 2009 Coin of the Year award was given to the 2007 Mongolia Wolverine coin with diamonds for eyes that is very intriguing when seen in hand!

It is not my intent to tun the US Mint into the non-circulating legal tender (NCLT) producer like the Royal Canadian Mint who is known to produce a large number of bullion-related issues. The CCAC should limit the introduction of bullion issues to a few a year and limit the number of coins that could be produced for each type. But if the US Mint can find influence in more areas than classic US coinage to produce beautiful collectibles using bullion metals.

Before I forget, these coins are bullion collectibles sold as a profit for the US Mint. They are not commemorative coins and not subject to the fundraising considerations proposed for commemorative coins.

Although the US Mint has been the focus of this series, we cannot reform America’s currency without considering paper money. Next, I will look at the Bureau of Engraving and Printing and what to do with Federal Reserve Notes.

Oct 19, 2009 | bullion, Eagles, gold, silver, US Mint

I am sure you heard that the US Mint has announced that they will not produce American Eagle gold and silver proof coins “[because] of unprecedented demand for American Eagle Gold and Silver Bullion Coins.” Is there really an unprecedented demand?

What We Should Have Learned

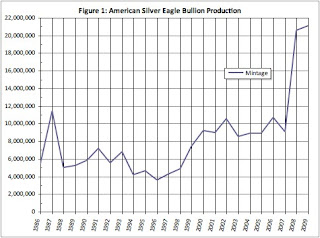

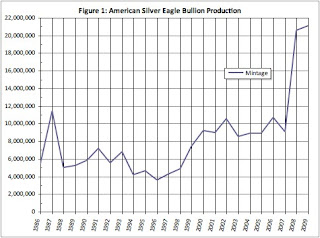

In an analysis posted here last April, production totals for 2008 showed that the US Mint experienced an extraordinary increase in demand for American Silver Eagle bullion coins striking over 20 million ounces of silver for the first time. This was a 128-percent increase over the 2007 production and almost twice as large as 2006, the second highest production total.

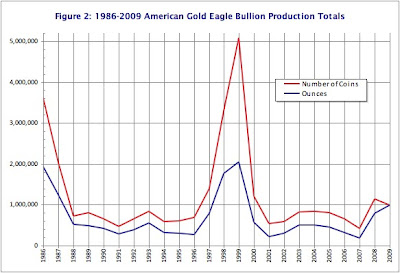

Gold production totals revealed a different story. There was an unprecedented demand in 1998-1999 where the number of American Gold Eagle coins and the ounces of gold used has not been matched by the US Mint. In addition to striking over 5 million coins using over 2 million ounces of gold, the US Mint also struck over 4.4 million 50 State Quarters in the program’s first year of issue. The production of 1.1 million coins using 788,500 ounces of gold was only a bit above average but the most in the 21st century.

Since the start of the current economic crisis that experts say began in December 2007, it was clear that the US Mint was unprepared when investors turned to purchasing American Eagle coins looking for safe investments. In fact, the US Mint admitted that the US Mint knew they were experiencing shortages as early as June 2008. By October, the US Mint had to announce that there is a shortage of bullion because the US Mint could not purchase enough material at market prices to meet the demand. After a year, the US Mint announced that “the United States is lifting the allocation process,” ending the rationing of bullion issues.

Whoever said no news is good news has never met the politicians running the US Mint.

Where We Stand Today

With the announcement by the US Mint, I downloaded the 2009 bullion production totals and added it to the previous analysis to see if there has been an unprecedented demand.

If the demand for silver in 2008 was any indication, it would be matched or exceeded by the demand in 2009. Through the first week in October, the US Mint has struck over 21 million one-ounce American Silver Eagle bullion coins. That is more coins than the 20.5 million struck in 2008. Figure 1 shows that if the trend continues, 2009 will exceed all silver production totals for American Silver Eagle coins.

Click image to enlarge

Click image to enlargeAlthough there was a dip in the monthly production for September (see Figure 2), trends show that American Silver Eagle coins struck in the fourth quarter (the first quarter of the fiscal year) can outpace production in earlier in the year. It is possible that the US Mint could produce another 10 million silver coins by the end of the year, especially if collectors plan to buy bullion coins to fill in the whole made by the 2009 discontinuance of the proof coin.

Click image to enlarge

Click image to enlargeGold Glitters, But…

Although production for the 2009 American Gold Eagle is outpacing production for 2008, this cannot be said about gold. While gold will surpass last year’s production totals, the US Mint will not produce the amount of coins or strike the amount of gold that they did in 1998 and 1999 (see Figure 3). And while the US Mint may strike more than the 1.3 million coins that marked 1997, they will do so by striking only one-ounce coins.

Click image to enlarge

Click image to enlargeEven with the production increases in 2009, the combined unit production of the gold and silver American Eagle coins will be less than it was a decade ago.

So What Is The Mint Doing?

At the end of April, it was reported that US Mint ceased production of nickels and dimes that would last for six months because of the reduced demand from the Federal Reserve. They continued the production of other coins with changing designs, such as the Bicentennial Lincoln Cent, DC & Territories Quarters, and Presidential Dollars. Recent reports show that the US Mint has not continued striking nickels and dimes while producing fewer quarters than any series since the start of the 50 States Quarter program began in 1999.

The Philadelphia Mint has also ceased production of Kennedy Half Dollars. In fact, Denver has out produced Philadelphia by 26.5 million coins.

As part of the announcement of the temporary cessation of production, the US Mint said that workers will participate in a six-month productivity maintenance program and capital maintenance in order to keep the rank-and-file workers employed.

According to the US Mint’s Annual Reports, American Eagle coins are struck at both Philadelphia and West Point. Bullion issues do not include mint marks making it difficult for collectors to determine where the coins were struck.

If there are idle coin presses at the Philadelphia Mint and employees not working on the production of business strikes, why has management not allocated the appropriate resources to meet the demand for bullion as well as the demand for collector American Eagle coins?

Between 1998 and 2001, the US Mint was running at full production including the new 50 State Quarters and was able to meet the bullion and collector demand for American Eagle coins. In fact, between the two years, the US Mint was producing half-dollars for regular circulation and changed the production of dollars from the Susan B. Anthony dollars to the Sacagawea design. Even with the economic slowdown, the US Mint produced a record number of coins in 2001.

With coin presses silent and the lack of sell outs for this year’s commemorative coins, why can’t the US Mint keep up with the investor and collector demand for American Eagles?

It Does Not Make Sense

Even though there was a coin shortage in the mid-1960s, production at the US Mint exceeds what it is today. In order to find production totals as low as they are this year, we would have to look over 50 years ago when the Philadelphia Mint was in its third building and only producing five types of coins with no commemoratives.

Today, the Philadelphia Mint is in a larger building with more state of the art equipment. The same facility that helped produce record numbers of coins less than ten years ago while striking bullion that included platinum American Eagle coins.

The only answer is the incompetence of the US Mint’s management.

It is very clear that the leadership of Director Edmund Moy and Deputy Director Andrew Brunhart must be questioned. Moy was a patronage appointee who has no experience managing a manufacturing operation or in any other type of position where workflow and resource management is critical. Brunhart, who was hired for his “expertise in organizational change,” appears to be changing the US Mint the same way he changed the Washington Suburban Sanitary Commission (WSSC), for the worse.

I know that the country has issues that may be more important than who is running the US Mint. But the US Mint is a profit center for the federal government and those profits (seignorage) are being hurt by its leadership’s inability to manage its resources properly. Therefore, it is time that President Obama set aside a few moments to replace these political hacks before they destroy one of America’s oldest bureau.

Will You Help?

If you are a collector, investor, or have an interest in seeing the US Mint successfully carry out its mission, I ask that you write a letter (addressed to 1600 Pennsylvania Ave NW, Washington, DC 20500-0001), send an email, or go to the White House website contact form and tell President Obama that Director Moy and Deputy Director Brunhart are damaging this venerable institution.

Hopefully, we can convince the President to act now before US Mint management tries something insipid, like blame collectors for their problems as they tried to do in the mid-1960s.

Jun 27, 2009 | bullion, coins, foreign, gold, silver

Fans of the Chinese Panda can look forward to a special edition bullion coin to commemorate 30 years of producing bullion coins. Although the Panda began its production in 1982, The People’s Bank of China has been producing bullion coins since 1979.

The basic design of the coin will be the same as the regular 2009 issue. The obverse of the coin features the Hall of Praying for Good Harvest of the Temple of Heaven in Beijing, the title for the Peoples’ Republic of China in Chinese, and the year. Added to the lower half of the edge will be “30th Anniversary of the Issuance of the Chinese Modern Precious Metal Commemorative Coins” in Chinese.

The basic design of the coin will be the same as the regular 2009 issue. The obverse of the coin features the Hall of Praying for Good Harvest of the Temple of Heaven in Beijing, the title for the Peoples’ Republic of China in Chinese, and the year. Added to the lower half of the edge will be “30th Anniversary of the Issuance of the Chinese Modern Precious Metal Commemorative Coins” in Chinese.

The reverse will feature the panda design for 2009 with a border that will include “30th Anniversary of the Issuance of the Chinese Modern Precious Metal Commemorative Coins” in English. The weight and fineness of the metal will be placed at the bottom of the design just above the border.

This commemorative series will consist of a one-quarter ounce gold coin and a one-ounce silver coin. The gold coin will be made of one-quarter troy ounces of .999 gold, 22 millimeters in diameter, and have a face value of 100 Yuan. The silver coin will be made of one troy ounce of .999 fine silver, 40 millimeters in diameter, and have a face value of 10 Yuan. Mintage is limited to 10,000 gold and 300,000 silver coins.

Coins will be struck at the Shenzhen Guobao Mint and officially distributed by China Gold Coin, Inc., a corporation of the People’s Bank of China.

It looks like I will have to add the silver coin to my want list in order to keep up with the series.

Image courtesy of China Gold Coin, Inc.

Apr 27, 2009 | coins, gold, silver, US Mint

Last year, the US Mint has been under a lot of scrutiny for how they handled gold bullion sales. I tried to find any positive story for the US Mint’s handling of bullion coins. Regardless of the search string I fed into several search websites, I did not find any positive article. Even though the US Mint continues to have problems supplying bullion to the market, I began to wonder if there was a deeper reason that may explain the situation.

Starting with the hypothesis that the shortage of American Gold Eagle bullion coins was because of record high mintage demands, I started by collecting the mintage totals for all American Eagle bullion coins from the US Mint’s website. I am limiting my study to bullion coins because of the difference in striking, handling, and selling collectible versions. I am also not including Gold Buffaloes since they make up less than one-percent of the total number of gold coins produced by the US Mint.

The US Mint does not make downloading mintage data easy. While the numbers are nicely displayed on their website, they do not provide a way to easily import that number into a database or spreadsheet. Using my programming skills, I was able to download the HTML files and extract the numbers. It would be nice if the US Mint would provide a way to download the raw numbers.

Counting Gold Coins

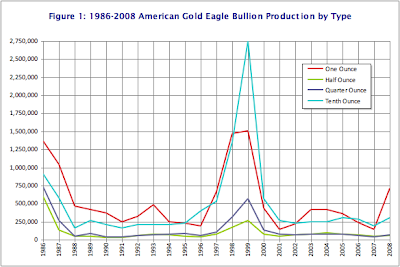

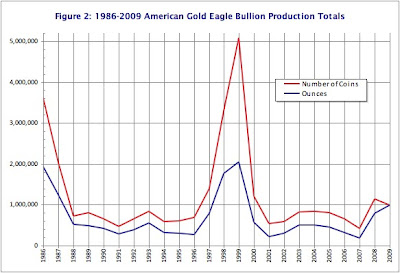

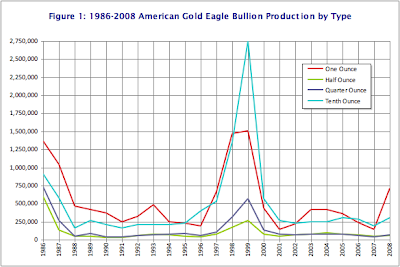

In 27 years of production the US Mint produced over 28.4 million American Gold Eagle bullion coins using over 15.1 million ounces of gold. Over 12 million, or 42.5-percent of the production has been one-ounce coins while more than 10.8 million, or 38-percent are in tenth-ounce coins. Half and quarter-ounce coins combined make up less than 20-percent of the total production of American Gold Eagles. Figure 1 graphs the sales of American Gold Eagle coins.

As with most new coin series, the first year of issue started strong then trailed off the next few years. Our graph in Figure 1 shows that significant changes started in 1998 and continued until 2000. This was the time of the Internet boom when companies were spending money on technology related projects when budgets swelled in fear of the dreaded Y2K Bug. Technology company sprung up like weeds with no business plan, went public with initial public offerings whose prices prompted then Federal Reserve Chairman Alan Greespan to call the run up irrational exuberance, only to crash by 2001.

The economy began to slow after Y2K fizzled but not that slow as the technology industry focused on the potential Leap Day Bug. Usually, every 100 years there will be no leap day on the last year of a century except every 400 years and the last year of a millennium. The threat of the Leap Day Bug continued technology spending but at a slower pace. The economy showed tentative strength through the end of the quarter before showing a slowdown as technology spending slowed.

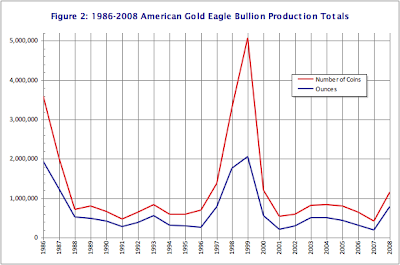

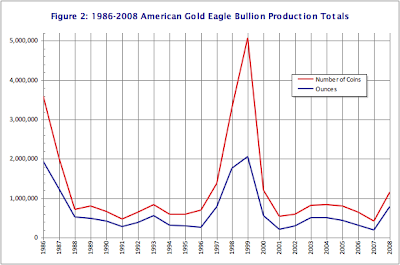

With all of the money entering the market, people were looking for areas for investment. Aside from the irrational exuberance, there were a significant number of investors looking to buy assets to hedge against potential tragedy. Since gold has always been a safe haven from potential disaster, the US Mint increased their production to meet the demand. From 1997 through 2000, the US Mint struck 10.9 million gold coins representing 5.16 million ounces of gold. Considering gold bullion coins are a generic investment, I thought it would be a good baseline to use the number of coins struck and the amount of gold used as a generic comparison from year to year. Figure 2 shows this comparative bullion production.

Graphs in Figures 1 and 2 illustrate that the US Mint produced a significant number of American Gold Eagle Bullion coins during the 1997-2000 economic run. At the time, the US Mint was under the leadership of Philip N. Diehl (1994-2000) and Jay Johnson (2000). Diehl and Johnson guided the US Mint in the production of 48-percent of all gold coins struck between 1986 and 2000. Although this does not take into consideration the total coin production at the US Mint, the time included the introduction of the 50 State Quarters program which caused a significant increase in the number of quarters produced.

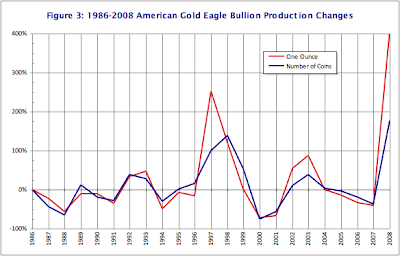

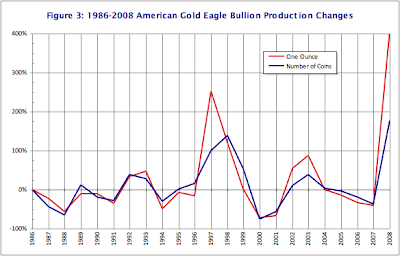

Both graphs show an uptick in production for 2008 where the US Mint reports that they struck over 1.14 million gold coins using 788,500 ounces of gold. This is comparable to the 2000 American Gold Eagle bullion production. But the increase may tell another story. I wanted to figure out what was the difference in production from year to year to see what that says. Figure 3 shows the percent change from year to year.

In 2008, the US Mint produced over 400-percent more gold coins than in 2007 using 178-percent more gold. Since the start of the American Gold Eagle bullion program, there has never been this significant of a change from year to year. But this change was for the year. Was this a steady increase or was there a immediate demand?

Assessing the Demand

Market watchers were greeted on September 8, 2007 with an editorial from the Wall Street Journal saying that 2008 would bring a recession. Citing the credit crunch that began that past July, the editorial said that “tighter credit conditions mean that the drag on the U.S. economy will soon spread beyond the housing sector to affect consumption and investment decisions.” By January 2008, it was reported that Goldman Sachs said that they “[believe] the housing slump and recent credit market turmoil will spill over into the broader economy this year.”

As a result, the spot price of gold rose to over $830 in December 2007, and almost to $930 by the end of January 2008.

According to the US Mint, their best sales month in 2007 was January with sales of 1,650 coins representing 1,208 ounces of gold. As the economy began to turn, the US Mint saw sales increase from 100 coins in September to 1,000 coins in October, and 1,350 in November. There was only a modest increase in sales to 1,400 coins in December 2007 as the US Mint was gearing up for 2008 production.

In January 2008, they reported selling 26,000 coins representing 23,650 ounces of gold. In one month, the US Mint exceeded the sales of gold bullion for all of 2007! Figure 4 graphs the gold bullion production for both 2007 and 2008.

But was this a steady increase or was the growth really a surprise?

Although there were reports we were in a recession, the Dow Jones Industrial Average was still over 12,000 points and gold had a once-per-month spike around $940 per ounce before dropping to $840 with an over $1,000 per ounce spike in March. Sales of American Gold Eagles averaged around 33,000 coins leading up to the summer. Compared to other years, these statistics are unremarkable for the US Mint.

By August, gold dropped to $780 for a brief period and the DJIA dropped to 11,000 points while the financial industry was starting to show significant weakness. Investors started to run for cover in July causing an increase in sales of American Gold Eagles by over 200-percent and an additional 72-percent in August. The rush to buy bullion was too much for the US Mint to handle causing the Mint to suspend bullion sales in mid-August. In September, the markets began to decline, banks and investment houses began to fail, the term “bailout” became prominent in our vocabularies, and the rush for gold strengthened.

We were given our “no kidding” moment when the National Bureau of Economic Research issued a report in December declaring we were in a recession for all of 2008.

Reaching Capacity

In the US Mint’s 2008 Annual Report, they allege that “Production capacity and the volume of precious metal blanks our suppliers can timely provide limit the number of bullion products the United States Mint can produce and sell.” However, the US Mint also noted that there was a decline in the number of business strikes sold as well as a decline in numismatic sales, including the drop in sales of the First Spouse gold coins. There are reports noting even lower production of business strikes this year.

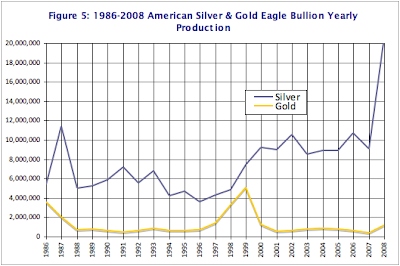

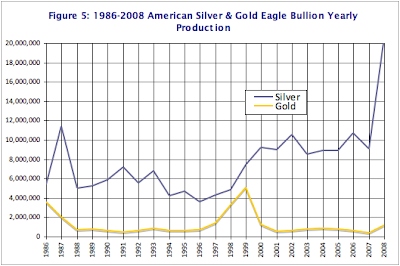

If the US Mint can be accused of modesty in any area it is their assessment of production capacity of bullion coins. According to reports, the US Mint knew that they were experiencing shortage of silver blanks as early as June. Apparently, the US Mint did not tell anyone that 2008 was their best sales year for American Silver Eagle bullion coins. In 2008, the US Mint struck over 20.5 million American Silver Eagle bullion coins. That is a 127-percent increase over 2007’s production and just under twice the previous record of 11.4 million coins in 1987. Figure 5 graphs the dramatic difference in silver production over that for gold.

With the exception of a brief dip in demand during February, production of American Silver Eagle bullion coins remained high as can be seen in Figure 6.

Although the US Mint does not advertise how many coins they can produce over any given period of time, it appears that a significant effort was placed into striking American Silver Eagles over their gold counterparts.

Why Silver Really is King

To understand why the US Mint prioritizes silver over gold is to dig into the how they operate, which is revealed in the 2008 Annual Report. Although the narrative in the report suggests that the net margin for gold is greater than silver, you have to dig deeper to understand the bigger picture.

According to 31 U.S.C. §5116 gold and silver purchased for coinage must be “mined from natural deposits in the United States, or in a territory or possession of the United States, within one year after the month in which the ore from which it is derived was mined.” Gold must be bought from the market at the “the average world price.” If the US Mint cannot purchase the necessary gold, “use gold from reserves held by the United States.” This means that in the event of a gold shortage, the US Mint can use the gold reserves held at Fort Knox to carry out the law.

Silver must also be purchase at the average costs on the world market. However, 31 U.S.C. §5111(b) allows the US Mint to maintain a Coinage Metal Fund to allow the Mint to “invest” in metals in order to maximize profits using dollar cost averaging.

In the FY2008 Annual Report, the US Mint discusses their “Hedging Fund” (Notes to Financial Statements Section 20. Hedging Program, p. 58) that it uses to trade silver shares with partners in order to raise additional capital. The report says that US Mint maintains custody of the silver while the trading occurs. This trading activity yielded $932,000 in profit for FY2008 and $1.3 million in FY2007.

There is no similar program for gold.

The silver trading program makes silver more profitable for the US Mint since they can make a profit by selling lease shares on their non-coinage inventory before making collecting the seigniorage when silver coins are sold.

But We Own A Lot of Gold

According the US Mint’s annual report, the United States is holding 245,262,897 ounces of gold at the United States Bullion Depository in Fort Knox, Kentucky. It has a statutory value of over $10.3 billion dollars (“42 and two-ninths dollars a fine troy ounce” according to 31 U.S.C. §5117(b)).

If there was a shortage of material and the law allows the US Mint to draw from deep storage to make up for the difference, then why did the Mint not withdraw gold to strike coins? Because 31 U.S.C. §5117(b) requires the transfer of gold to the Mint has to be approved by the Secretary of the Treasury, overseen by the Board of Governors of the Federal Reserve, and replaced at the statutory value of “42 and two-ninths dollars a fine troy ounce” when supplies become available. Given the current state of the market, the Mint would not be able to purchase gold for the statutory price $42.2222 fine troy ounce.

What Caused the Shortage

Evidence suggests that the higher demand for silver was a factor in the shortage. However, since the US Mint saw the demand for gold increase as the economy turned in December 2007, and since the US Mint does not keep a large working stock of gold, they were caught without the same safety net as they have with silver and was unable to catch up.

According to reports, the US Mint knew that they were experiencing shortages as early as June. By October, the US Mint announced a shortage of gold and platinum. With the prices rising and the worldwide demand increasing, the US Mint could not purchase enough material at market prices to meet the demand. In other words, the US Mint as unprepared for market demand.

Fixing the US Mint

In 1999, the US Mint announced that not only the Mint experienced increased demand for the American Gold Eagle but announced measures to ensure that the supply would keep up with the demand. In 2008, the US Mint did not adjust their business practices to keep up. Other than changing management at the US Mint, something must be done.

One idea is to change the law to allow the US Mint to have a Hedging Fund for gold. In this program, the US Mint would sell shares for gold in storage on the open market while holding on the physical metal. If the Mint could make an average of $1 million for silver, this would allow the US Mint to leverage stored gold in the same way they leverage stored silver.

In addition to creating a Hedging Fund for gold, the law should allow the US Mint to use the money earned in this program to purchase gold on the open market from any source in the event of a shortage, regardless of where mined. This will allow the US Mint to buy gold from any source to strike bullion coins and maintain their business.

I understand that there may be political implications for this proposal. But when the laws protecting US mining interests were first enacted in the 19th and early 20th centuries, the United States had an abundance of resources and congress passed laws to protect the mining companies, especially as consumer consumption saw a lot of metal leave our shores and not return. The market in the 21st century is more global and the amount of gold resources is not as it was in 1849. Precious metals are globally traded with markets centered in London or New York. It may be time to modernize the laws to allow the Mint to do its business without being held hostage to market forces.

Click on any graph to show larger versions.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)