Dec 2, 2018 | bullion, coins, foreign, markets, news, platinum

While watching the numismatic news that appears in non-numismatic sources, I noticed that regardless of the predictions of cashless societies taking over, there are a few countries with interest in coins for both commerce and collecting.

While watching the numismatic news that appears in non-numismatic sources, I noticed that regardless of the predictions of cashless societies taking over, there are a few countries with interest in coins for both commerce and collecting.

By far, the one country that seems to have an affinity for coins is India. The news consistently highlights collectors who have coin collections of all sizes and varieties. Whether it is someone who has collected old Indian coins dating back to the Britsh control of the country to someone that collects foreign coins from visitors, there seems to be a story about coin collectors in one of the many Indian news publications.

The other country I can count on for consistent numismatic-related stories is China. Aside from stories about coin shortages and how the poorer areas of the country are hoarding coins, Chinese collectors seem to gravitate toward precious metal coins. Interestingly, Chinese collectors seem to like silver coins even though investors are chasing gold. This is understandable since silver coins can be bigger and cost less.

Recently, it was reported that Chinese collectors are chasing platinum as an investment option. Reports are being circulated that Chinese markets are investing heavily in South African platinum mines allowing the production to increase. With the spot price of platinum ($802.00) lower than the spot prices of gold ($1,222.10) and palladium ($1,170.00), the growth of platinum investment options has grown. The Hang Seng ETF (exchange-traded funds) Index has noted a significant increase in the trading of platinum futures.

Several publications have asked if this means that China is attempting to corner the platinum market. Since I am not a financial analyst, I am not sure. As a numismatist, it is interesting to see that platinum has a growing interest in China.

And now the news…

November 15, 2018

Grab your metal detectors! We are seeking some of the most valuable treasures ever discovered. From buried treasures to sunken treasures, lying beneath villages, towns, cities, farms, riverbeds, and in…  → Read more at invest.usgoldbureau.com

→ Read more at invest.usgoldbureau.com

November 25, 2018

The National Bank of Romania (BNR) has issued several coins to mark the 100-year anniversary of Romania’s 1918 Union. They are a gold coin, a silver coin, and a brass collector coin for numismatic purposes, along with a brass commemorative circulation coin.  → Read more at romania-insider.com

→ Read more at romania-insider.com

November 26, 2018

Limited edition gold and silver coins commemorating the 70th anniversary of the first issuance of the renminbi (RMB) currency and establishment of China's central bank went on sale in China last Friday.  → Read more at gbtimes.com

→ Read more at gbtimes.com

November 26, 2018

The World Platinum Investment Council is pushing for new platinum products to lure Chinese investors into the metal, providing another source of demand for SA’s second-largest mineral export. Weibin Deng, China’s head at the council, which is financially backed by SA’s platinum producers to stimulate investment, outlined plans for coins, metal-backed exchange-traded funds (ETFs) and other products, targeting the country’s burgeoning middle class.  → Read more at businesslive.co.za

→ Read more at businesslive.co.za

November 26, 2018

The Celtic coins discovered in Slovakia were tetradrachms, which were the most precious coins available at the time. In the heart of Slovakia in Mošovce, archaeologists have unearthed 40 …  → Read more at inquisitr.com

→ Read more at inquisitr.com

November 27, 2018

Welcome back for Part II of our Most Valuable Treasure Discoveries series. Below is a continuation of some of the most remarkable treasures unearthed in recent history. The Staffordshire Hoard…  → Read more at invest.usgoldbureau.com

→ Read more at invest.usgoldbureau.com

November 28, 2018

THE CENTRAL Bank of Ireland has unveiled a special commemorative coin created to mark 100 years since Irish women won the right to vote.  → Read more at irishpost.com

→ Read more at irishpost.com

Sep 20, 2018 | bullion, coins, Eagles, platinum, US Mint

Want more information about American Eagle Coins?

The Coin Collectors Handbook: American Eagle Coins has more information and is fully illustrated. Read more →

here;

This is third article of a 4 part series:

The Platinum American Eagle coins were an addition to the American Eagle bullion program to satisfy the needs of the domestic platinum mining industry. Work to create the program began in 1995 with Platinum Guild International Executive Director Jacques Luben working with Director of the United States Mint Philip N. Diehl and American Numismatic Association President David L. Ganz to pursue the appropriate legislation.

As with a lot of legislation, it was added to an omnibus appropriations bill (Public Law 104-208 in Title V) passed on September 30, 1996. Since the bill was necessary to keep the government functioning, it was signed by President Bill Clinton that same day.

The first platinum coins were issued in 1997.

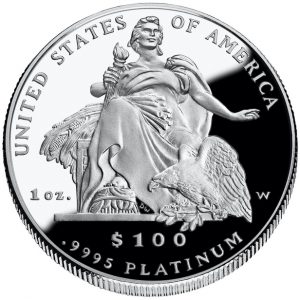

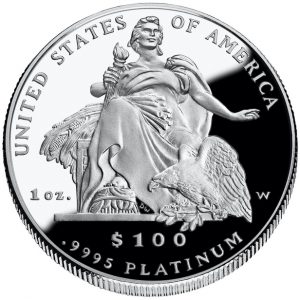

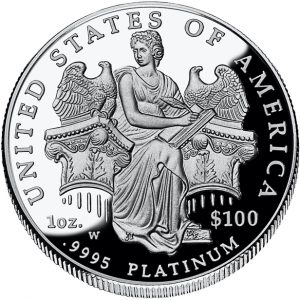

Platinum American Eagle coins are the only bullion coins struck by the U.S. Mint that use a different reverse design for the proof coins than the uncirculated bullion coins. The reverse of the proof coins featured different themes that have largely gone unnoticed by collectors. Beginning in 2018, the Preamble to the Declaration of Independence series will introduce all new designs for both the obverse and reverse of the proof coin.

American Platinum Eagle Design

The obverse design of the American Platinum Eagle features a front-facing view of the Statue of Liberty from the shoulders designed by John Mercanti. Mercanti also designed the obverse of the 1986 Statue of Liberty Commemorative Silver Dollar.

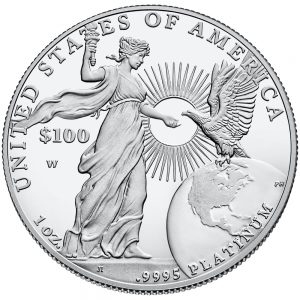

The reverse features a bald eagle soaring above the earth with a rising sun in the background. It was designed by Thomas D. Rodgers Sr. The reverse also includes the weight of the coin and its denomination.

-

-

Obverse of the American Platinum Eagle coin was designed by John Mercanti

-

-

Reverse of the original American Platinum Eagle and still used on the bullion coins was designed by Thomas D. Rodgers Sr.

The reverse designs of the proof coins were by different artists and discussed below.

American Platinum Eagle Coins are offered in four different sizes with each size being of different legal tender face value. The different coins are as follows:

- One-ounce American Platinum Eagle: $100 face value, is 32.7 mm in diameter, contains one troy ounce of platinum and weighs 1.0005 troy ounces,

- One-half ounce American Platinum Eagle: $50 face value, is 27 mm in diameter, contains 0.5000 troy ounce of platinum and weighs 0.5003 troy ounce,

- One-quarter ounce American Platinum Eagle: $25 face value, is 22 mm in diameter, contains 0.2500 troy ounce of platinum and weighs 0.2501 troy ounce,

- One-tenth ounce American Platinum Eagle: $10 face value, is 16.5 mm in diameter, contains 0.1000 troy ounce of platinum and weighs 0.1001 troy ounce.

All coins are struck with reeded edges.

Each coin is made from .9995 platinum. The composition is comprised of 99.95% platinum and 0.05% of an unspecified metal, likely copper. American Platinum Eagle coins are produced so that each size contains its stated weight in pure platinum. This means that the coins are heavier than their pure platinum weight to account for the other metals in the alloy.

Bullion American Platinum Eagle Coins

The American Platinum Eagle program produces bullion and collectible coins. The bullion coins can be stuck at any branch mint but does not have a mintmark. Bullion coins are sold in bulk to special dealers who then sell it to retailers. They are struck for the investment market.

Although some people do collect bullion coins there are not produced for the collector market. As with other investments, American Platinum Eagle bullion coins are subject to taxes when sold and may be held in Individual Retirement accounts. Please consult your financial advisor or tax professional for the tax implications for your situation.

Bullion coins of all four weights were struck from 1997-2008. Beginning in 2014, the U.S. Mint has only struck the one-ounce $100 American Platinum Eagle for the bullion market.

Collector American Platinum Eagle Coins

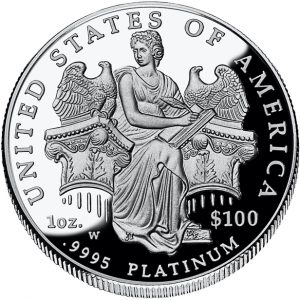

Collector coins are produced and sold by the U.S. Mint in specialty packaging directly to the public. Collectors can purchase new coins directly from the U.S. Mint and find these coins online. Collector American Platinum Eagle are different from other coins in the American Eagle series in that every year they are produced the U.S. Mint struck them in different designs and are only available as proof strikes.

In addition to the changing designs, the U.S. Mint sold uncirculated coins with a burnished (satin) finish using the design of the business (bullion) coins were struck 2006-2008 at West Point in all four weights.

The collector American Platinum Eagle may be one of the most under-appreciated series of coins produced by the U.S. Mint. Since its introduction in 1997, the U.S. Mint has produced four series of proof coins with the reverse honoring different aspects of the nation with plans for two more beginning in 2018 and 2021.

What distinguishes these coins are the well-executed reverse designs that few get to see or pay attention. It may be difficult for the average collector to consider collecting these coins because of the price of platinum has been either on par or higher than the price of gold. Also, platinum is not as well regarded as gold or silver as a precious metal causing it to be overlooked.

Following the proof coins issued in 1997 with the design used on the bullion coin, the reverse design has featured the following themes:

- Vistas of Liberty Reverse Designs (1998-2003):

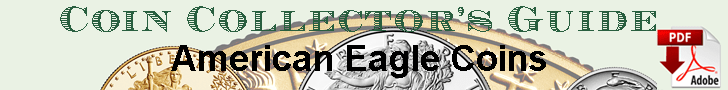

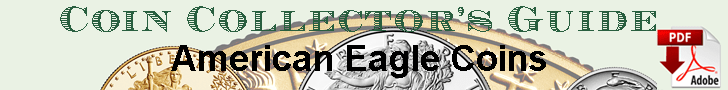

- 1998 Eagle Over New England

- 1999 Eagle Above Southeastern Wetlands

- 2000 Eagle Above America’s Heartland

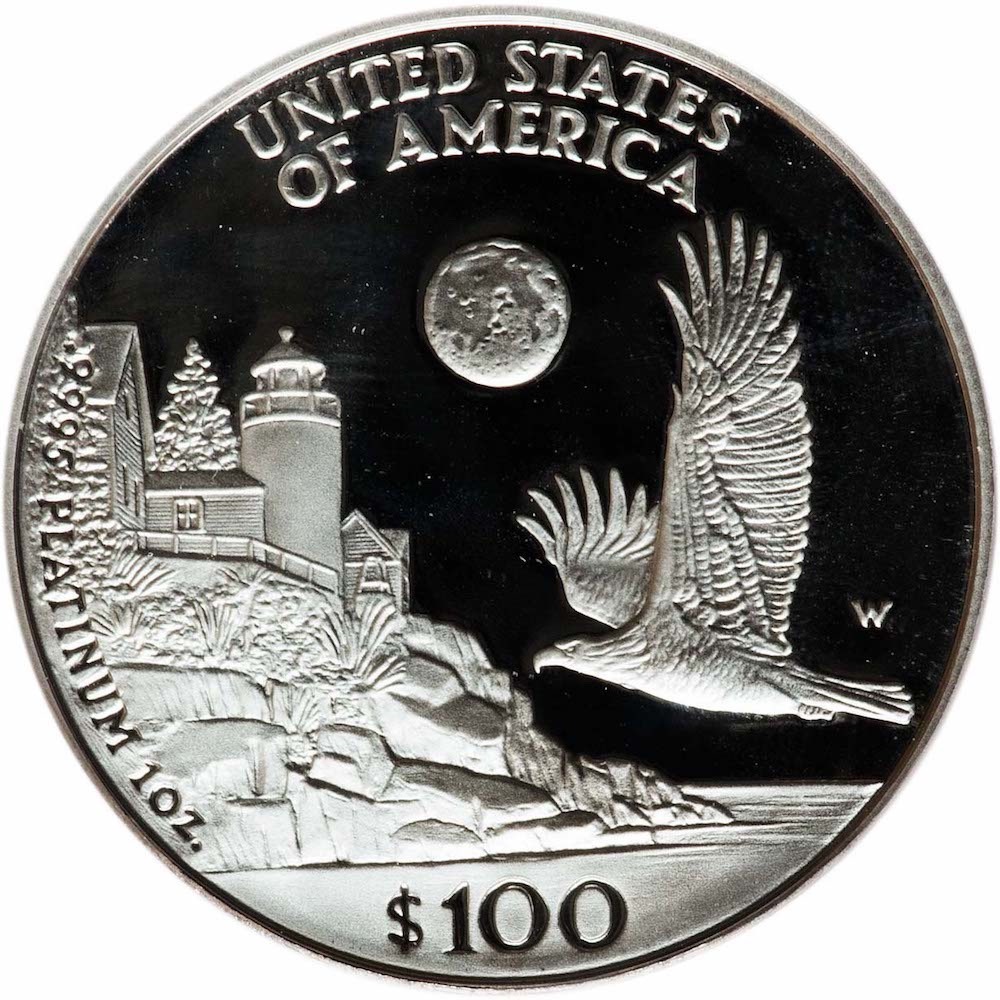

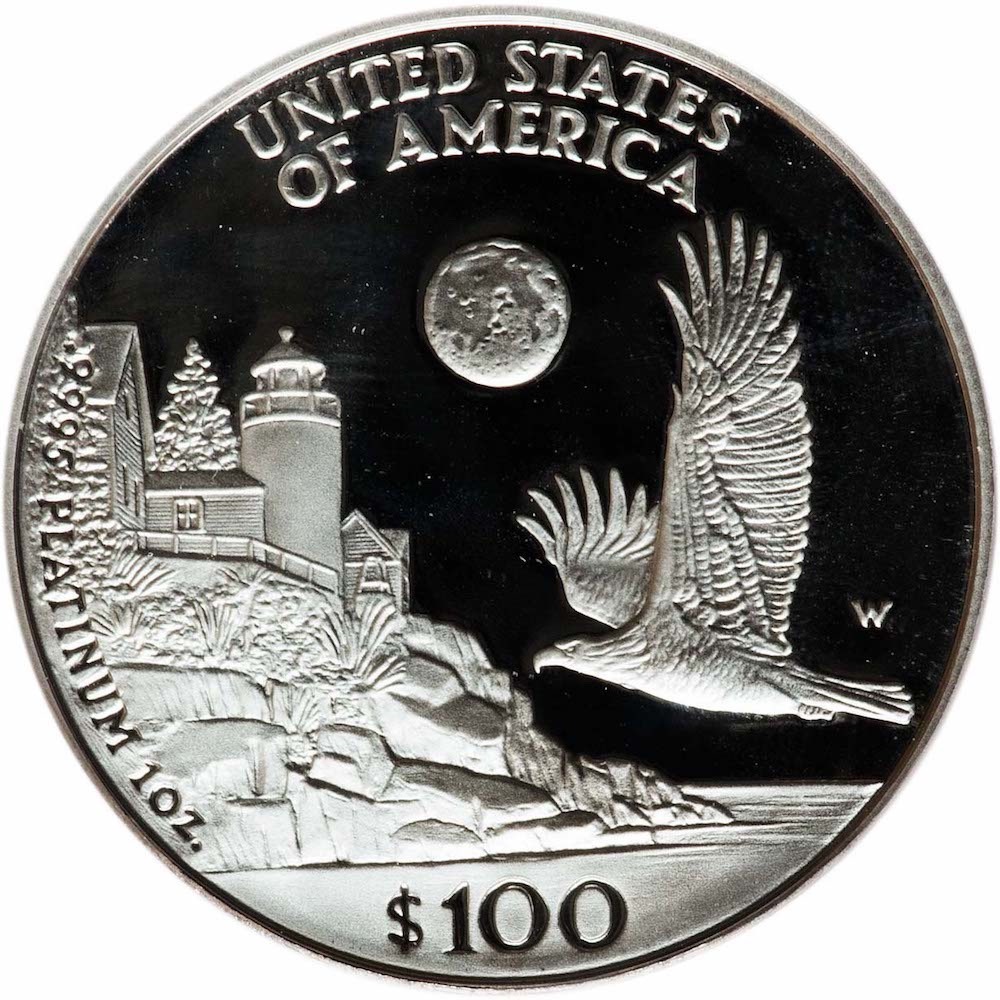

- 2001 Eagle Above America’s Southwest

- 2002 Eagle Fishing in America’s Northwest

- 2003 Eagle Perched on Rocky Mountain Pine Branch

-

-

1998 Eagle Over New England

-

-

1999 Eagle Above Southeastern Wetlands

-

-

2000 Eagle Above America’s Heartland

-

-

2001 Eagle Above America’s Southwest

-

-

2002 Eagle Fishing in America’s Northwest

-

-

2003 Eagle Perched on Rocky Mountain Pine Branch

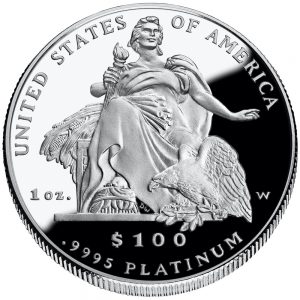

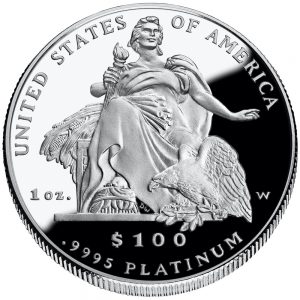

- 2004 Proof reverse design: Daniel Chester French’s “America” that sits before the U.S. Customs House in New York City.

- 2005 Proof reverse Design: Heraldic Eagle

-

-

2004 Daniel Chester French’s “America” that sits before the U.S. Customs House in New York City

-

-

2005 Heraldic Eagle

- Branches of Government Series:

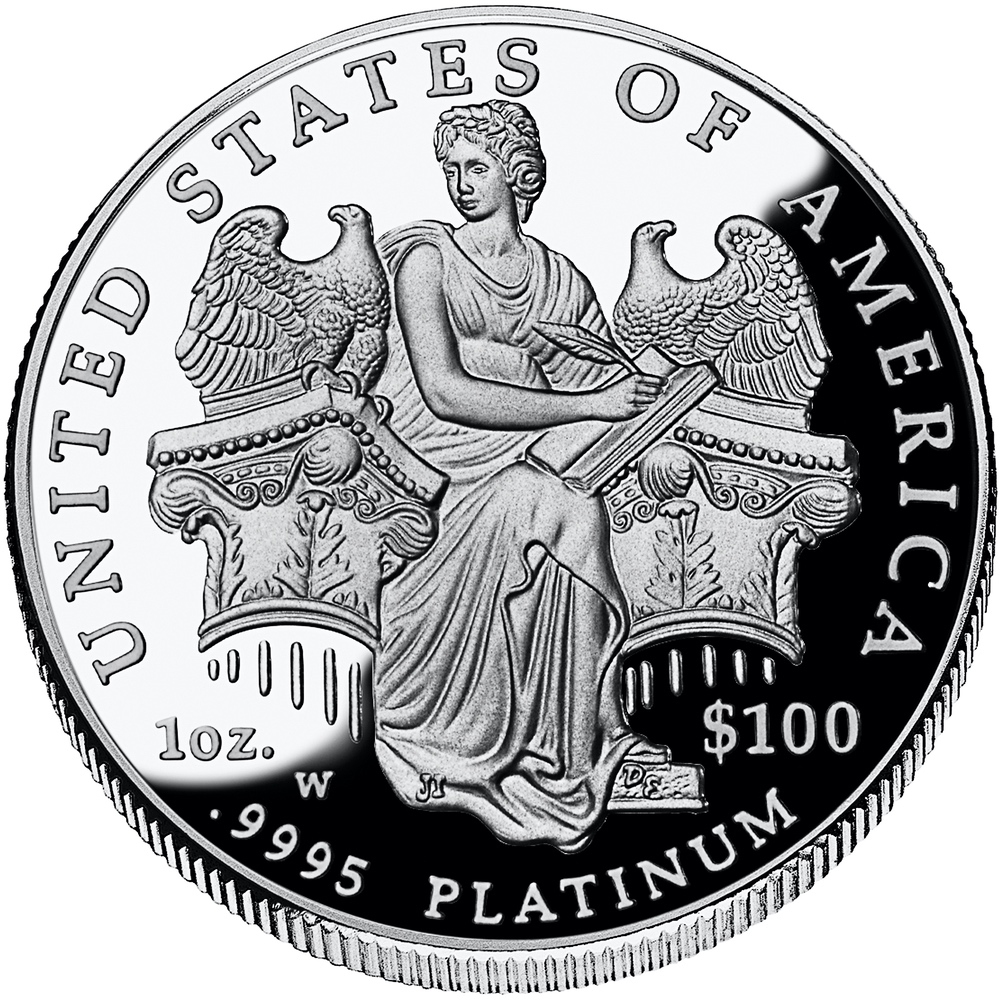

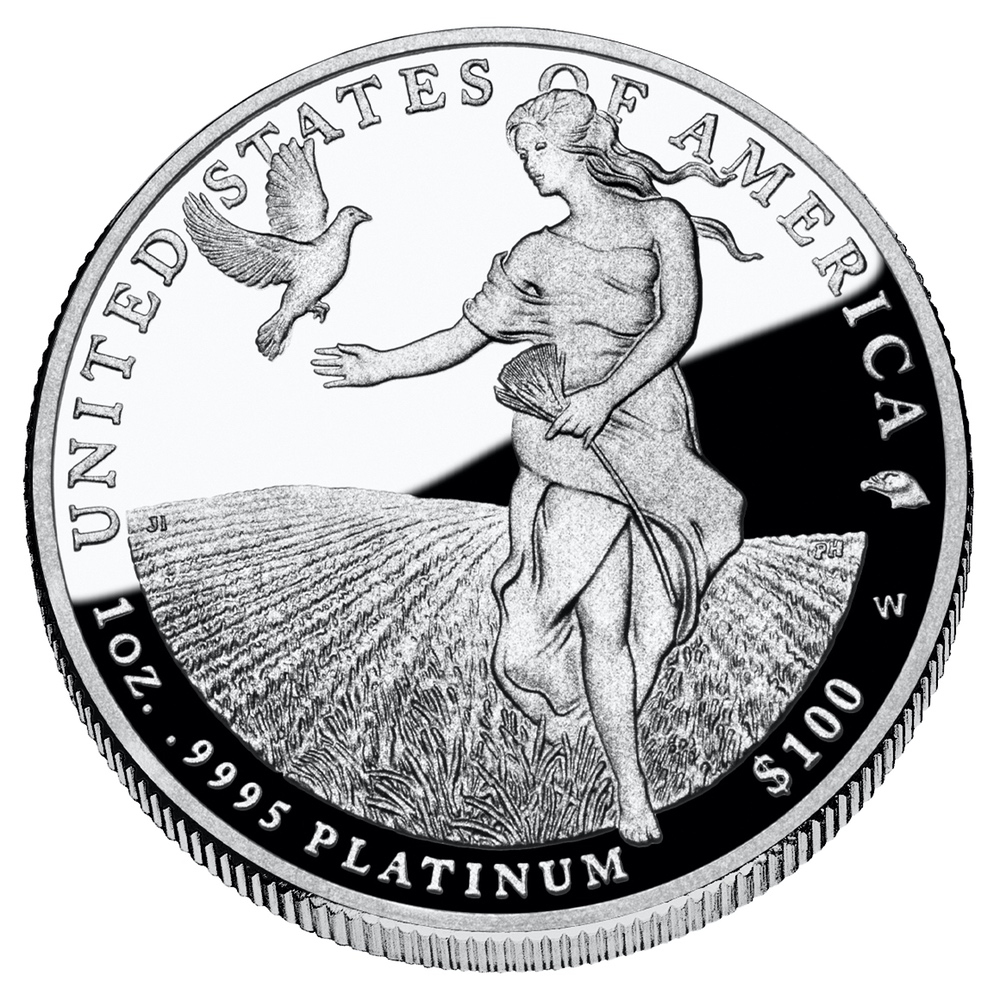

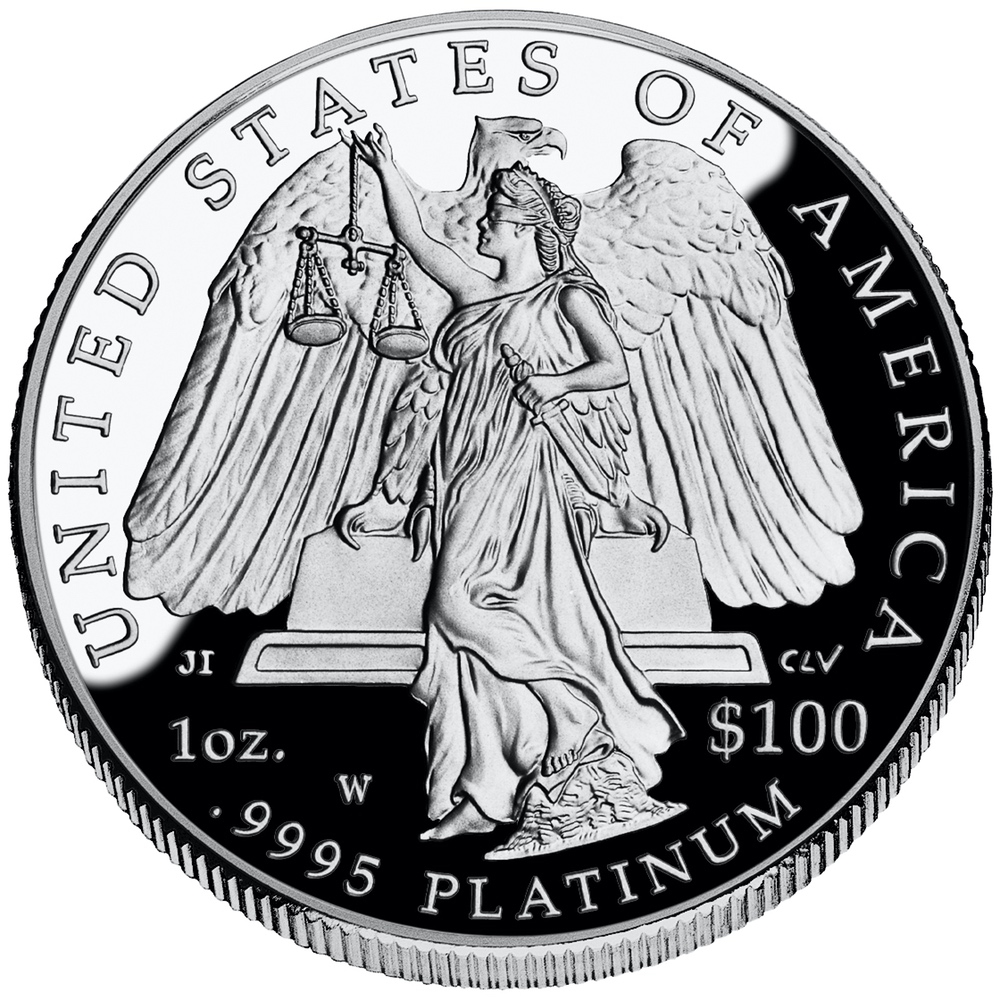

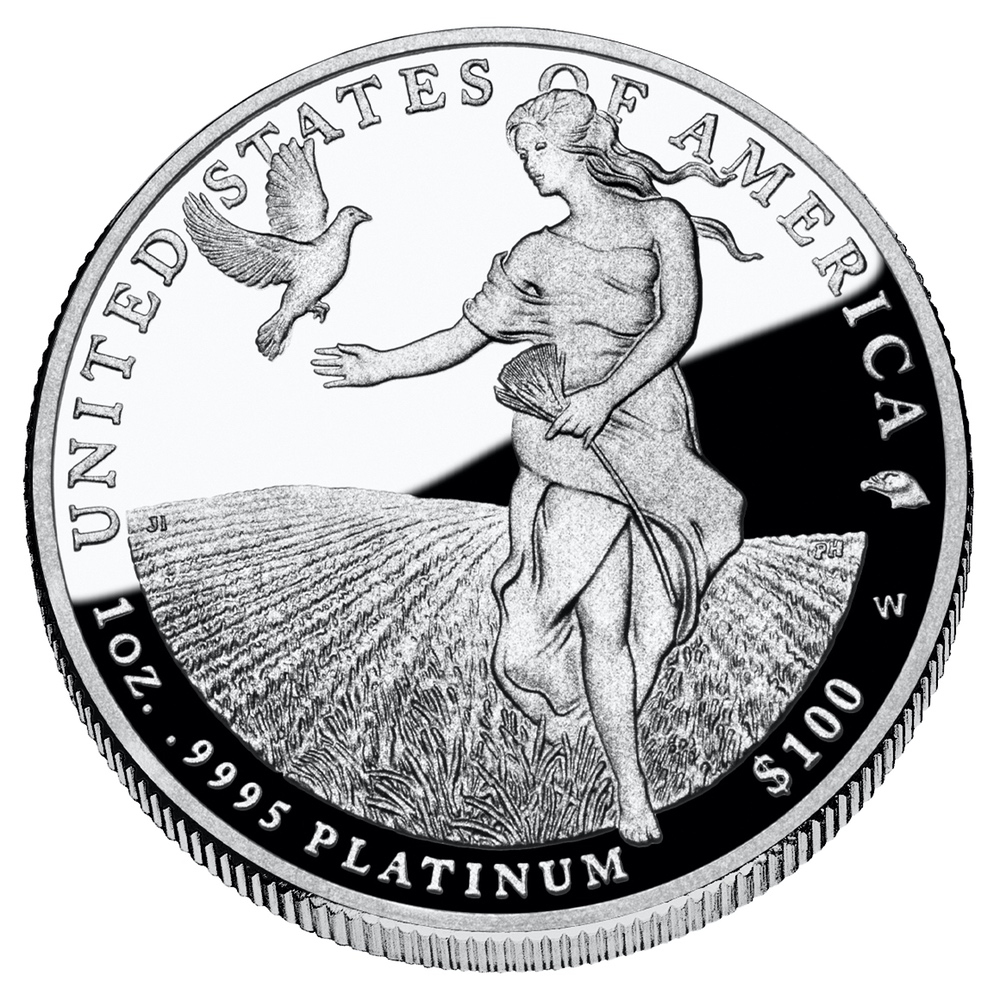

- 2006 “Legislative Muse” representing Legislative Branch

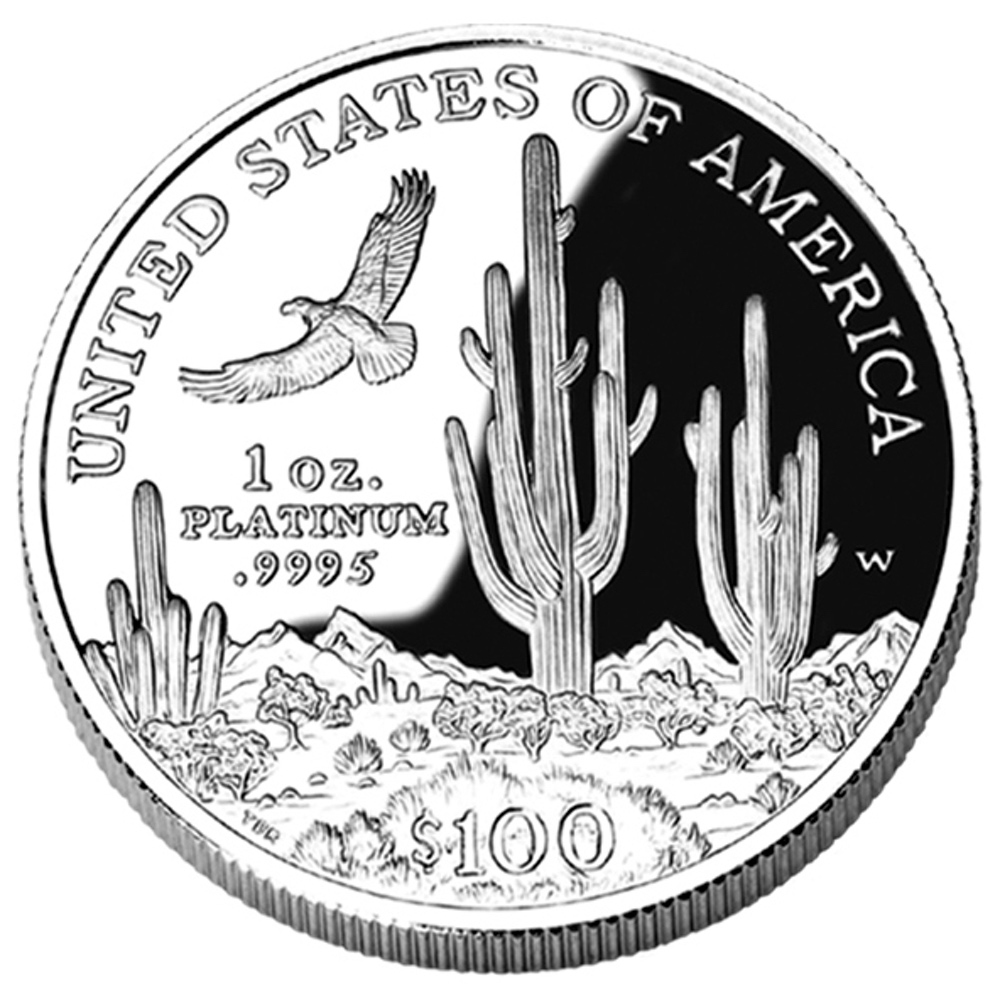

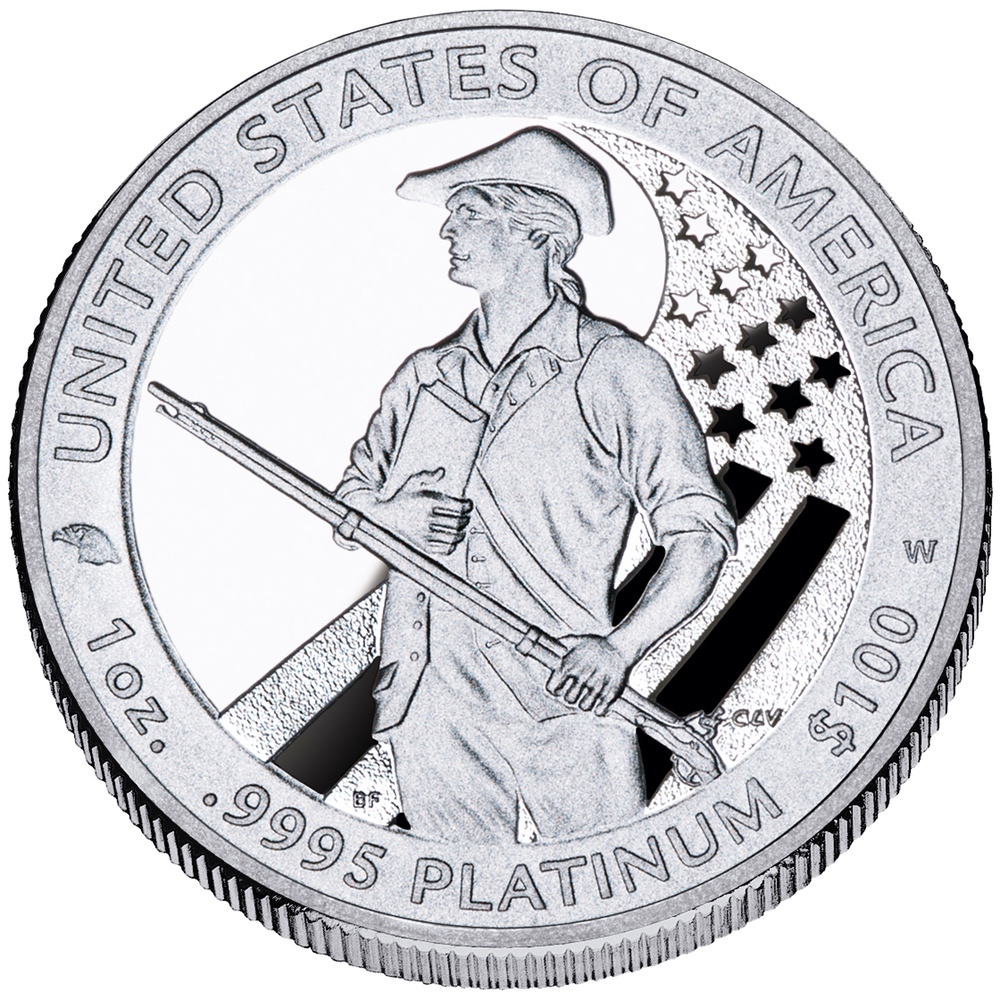

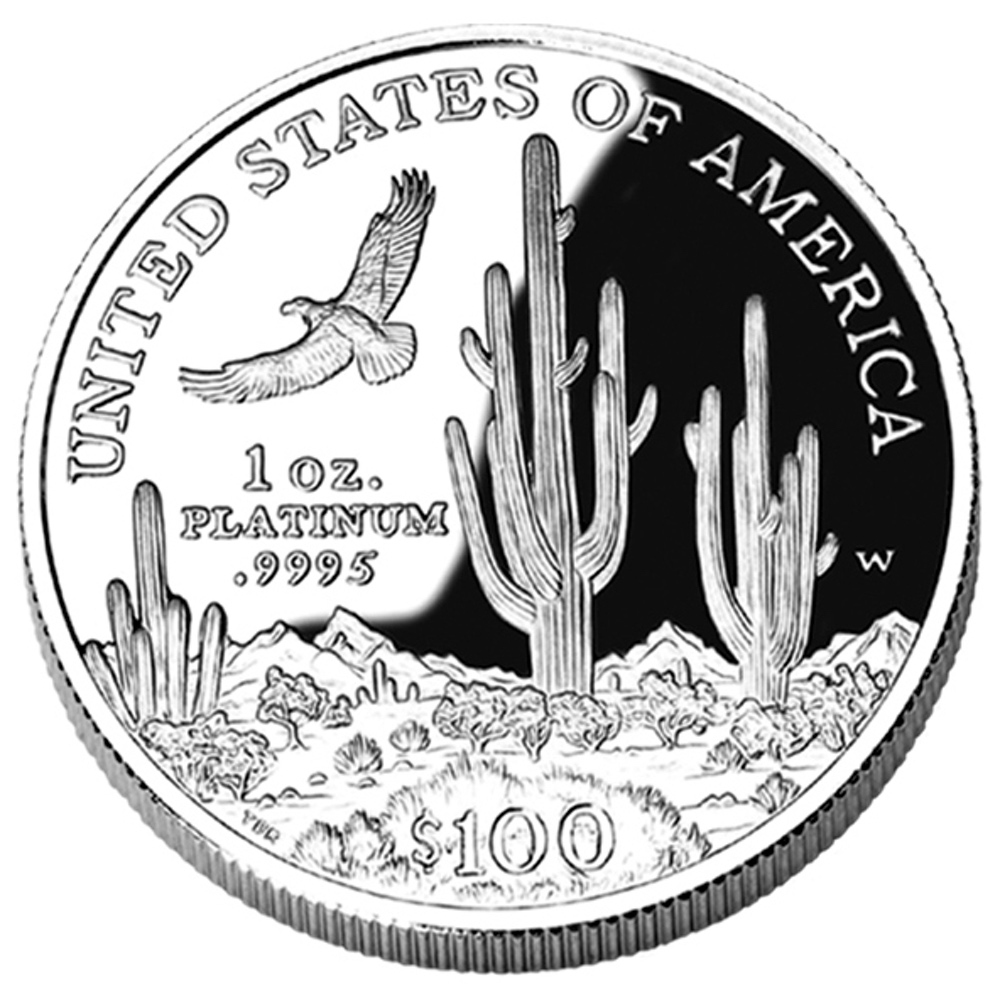

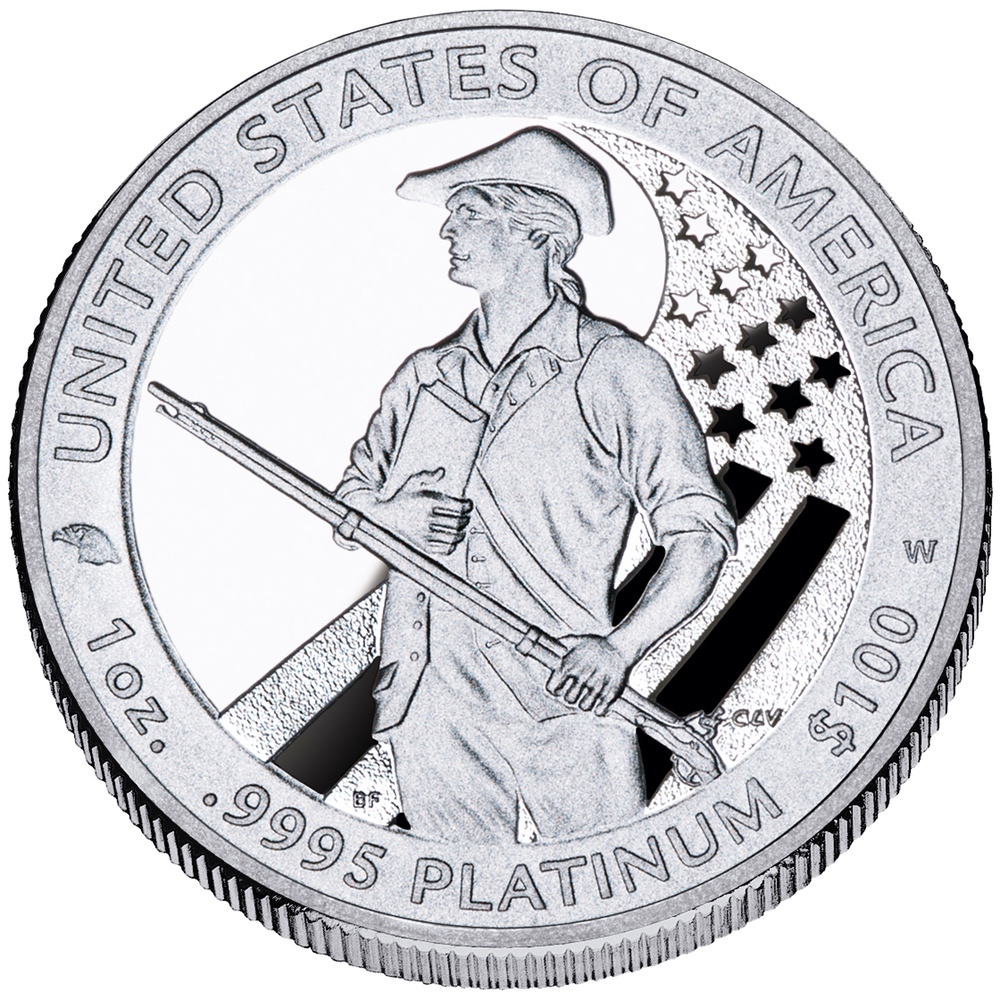

- 2007 “American Bald Eagle” representing Executive Branch

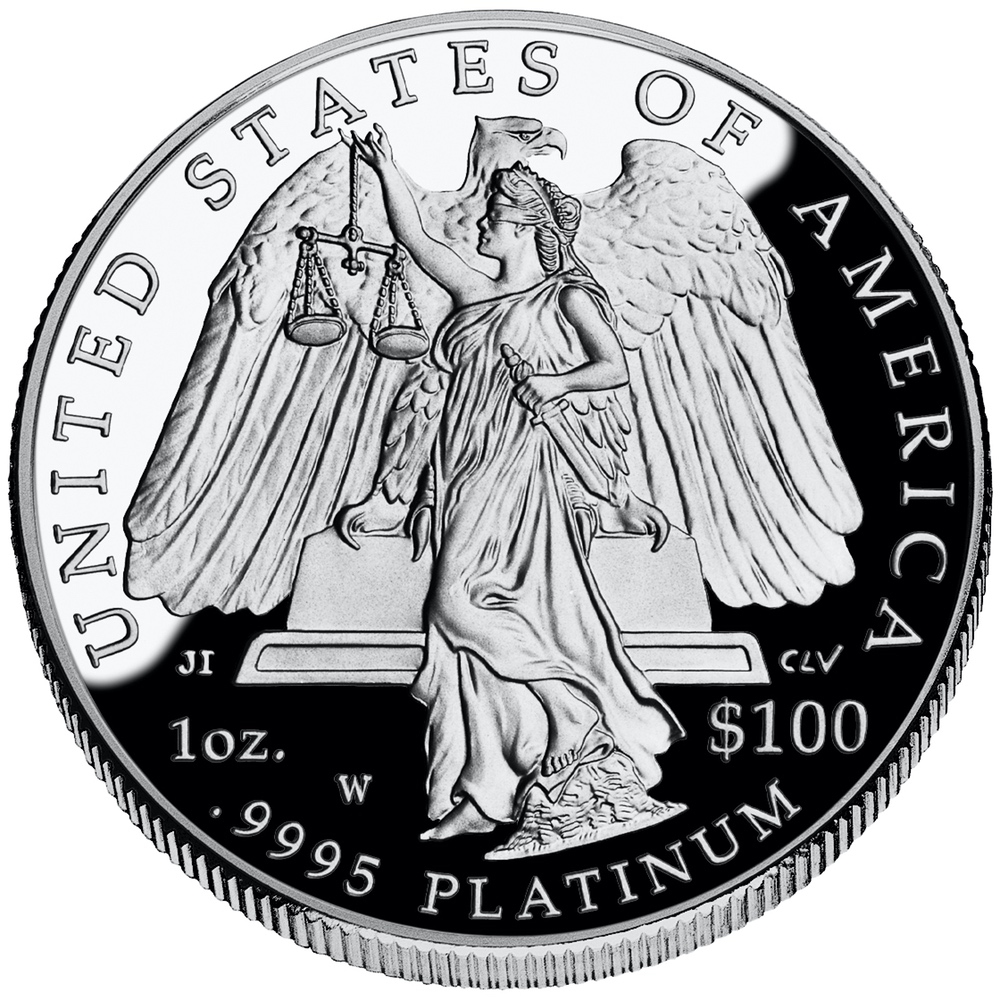

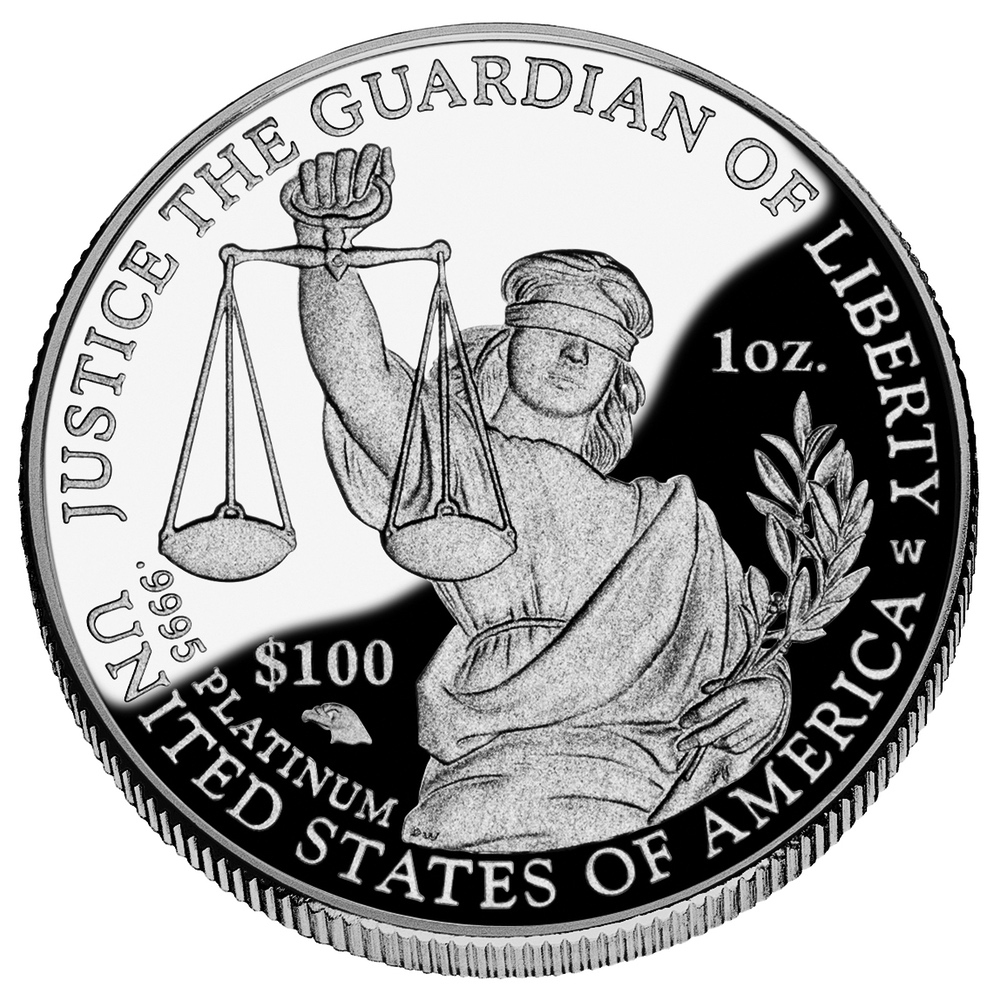

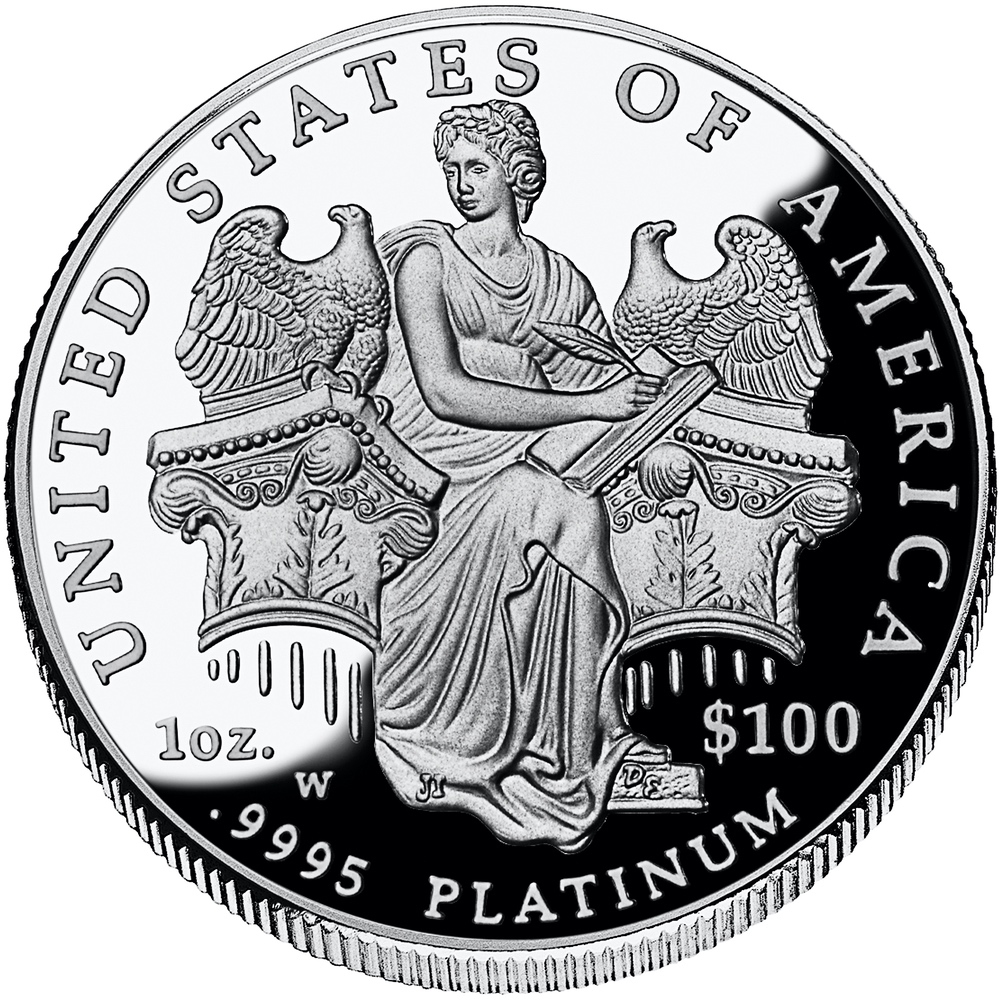

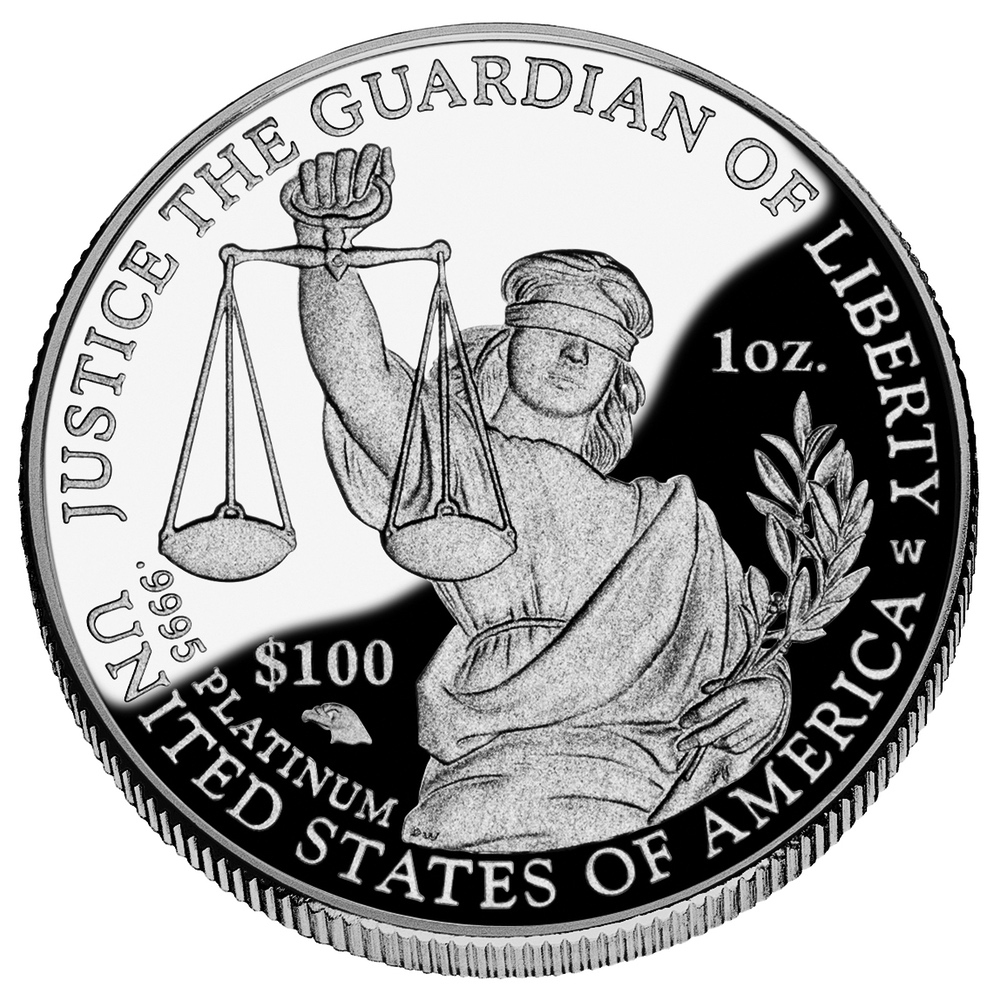

- 2008 “Lady Justice” representing Judicial Branch

-

-

2006 “Legislative Muse” representing Legislative Branch

-

-

2007 “American Bald Eagle” representing Executive Branch

-

-

2008 “Lady Justice” representing Judicial Branch

- Preamble Series (2009–2014):

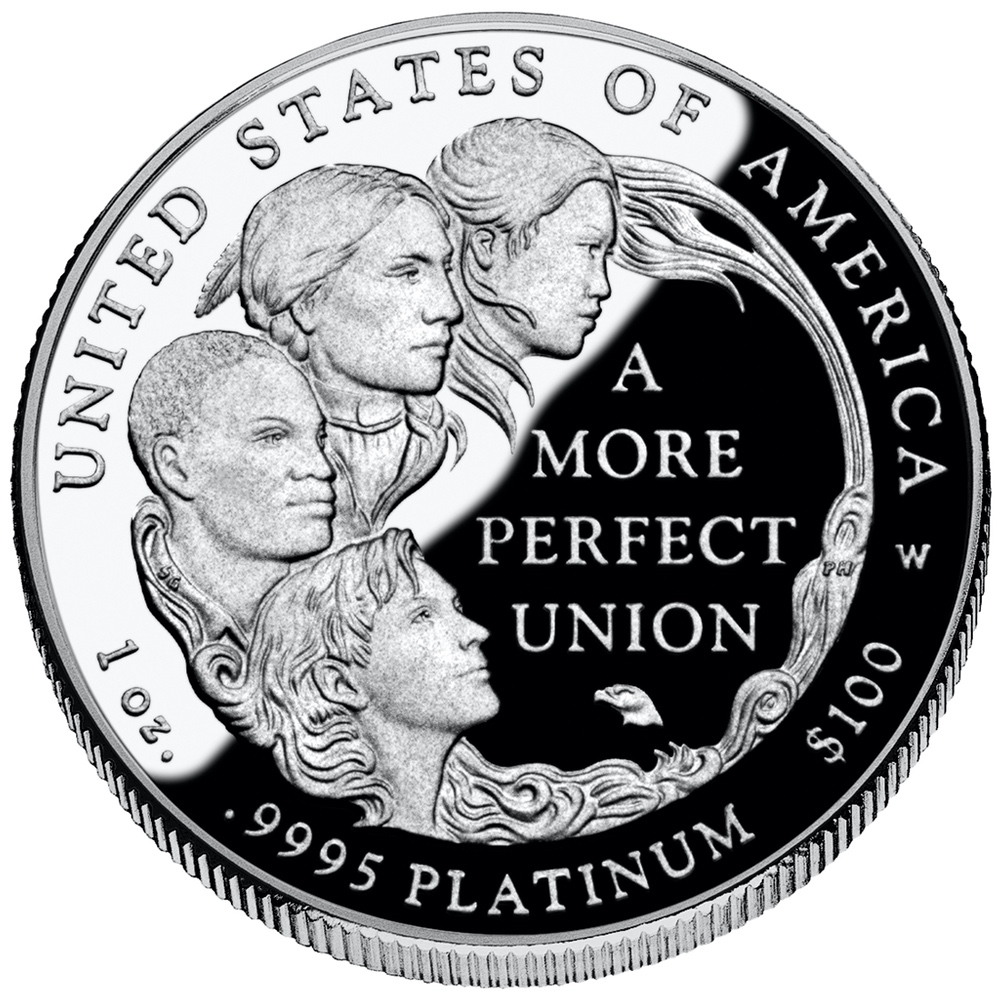

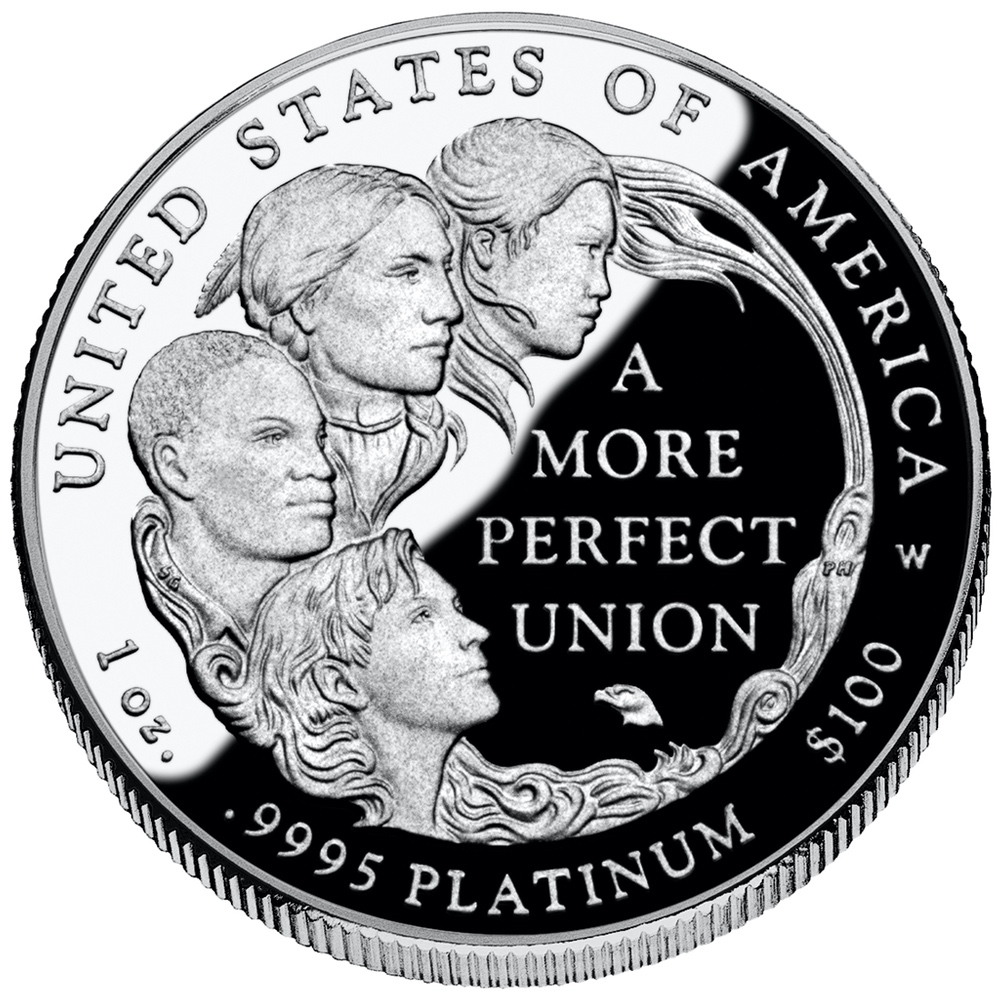

- 2009 “To Form a More Perfect Union”

- 2010 “To Establish Justice”

- 2011 “To Insure Domestic Tranquility”

- 2012 “To Provide for the Common Defence”

- 2013 “To Promote the General Welfare”

- 2014 “To Secure the Blessings of Liberty to Ourselves and our Posterity”

-

-

2009 “To Form a More Perfect Union”

-

-

2010 “To Establish Justice”

-

-

2011 “To Insure Domestic Tranquility”

-

-

2012 “To Provide for the Common Defence”

-

-

2013 “To Promote the General Welfare”

-

-

2014 “To Secure the Blessings of Liberty to Ourselves and our Posterity”

- Nations Core Values (2015-2016):

- 2015 “Liberty Nurtures Freedom”

- 2016 “Liberty and Freedom”

-

-

2015 “Liberty Nurtures Freedom”

-

-

2016 “Liberty and Freedom”

- 2017 depicted the original reverse designed by Thomas D. Rodgers Sr.

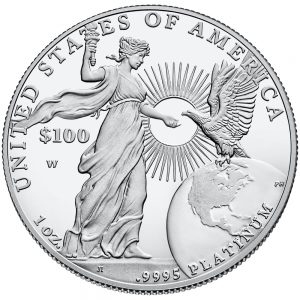

Beginning in 2018, the U.S. Mint will introduce two themes that will feature new obverse designs with a new common reverse with the following themes:

- 2018-2020 Preamble to the Declaration of Independence Series

- 2018 “Life”

- 2019 “Liberty”

- 2020 “Pursuit of Happiness”

-

-

Obverse of the 2018-W American Platinum Eagle Proof coin “Life.”

-

-

For the Declaration of Independence Series beginning in 2018, the common reverse designed by Patricia Lucas-Morris of the Artistic Infusion Program.

- 2021-2025 Five Freedoms Guaranteed Under the First Amendment Series

- 2021 “Freedom of Religion,”

- 2022 “Freedom of Speech,”

- 2023 “Freedom of the Press,”

- 2024 “Freedom to assemble peaceably,”

- 2025 “Freedom to Petition the Government for a Redress of Grievances.”

Tenth Anniversary American Platinum Eagle Set

As part of the Tenth Anniversary of the American Platinum Eagle, the U.S. Mint issued a special set to celebrate this milestone. The set featured two one-half ounce platinum proof coins using the American Bald Eagle design representing Executive Branch by Thomas Cleveland and was struck at the West Point Mint. One was struck as a standard proof with mirrored fields and frosted designs. The other was struck as a reverse proof with mirrored designs and frosted fields.

The set was announced November 2007 and scheduled to go on sale in mid-December. and remain on sale until December 31, 2008, with several interruptions.

During the sale, the price of platinum greatly fluctuated. At one point the price of platinum was greater than the price of the set. The U.S. Mint had suspended the sale of the coins in February 2008. They were priced higher when they were offered for sale again a month later. Sales were suspended again when the price of platinum fell dramatically. When the coins were brought back for sale, their final price was less than the set’s initial offer price.

Although the U.S. Mint set a maximum mintage of 30,000 sets, the final sales figure showed they sold 19,583 sets.

2007 “Frosted Freedom” Variety

For a very low production series that is handled differently than other coins, it is unusual for there to be a variety or error. In 2011, the Numismatic Guarantee Corporation announced that they certified a variety that was given the name “Frosted Freedom.”

On the proof strike of the 2007 American Platinum Eagle coin with the bald eagle design to celebrate the executive branch of the government, there is a shield in front of the eagle’s breast. Draped across the shield is a ribbon with the word “FREEDOM”. On the coins issued in 2007, the incuse word “FREEDOM” has the same mirrored finish as found on the coin’s fields. On the variety found by NGC, the word appears frosted with the same finish found on the coin’s raised devices.

In a statement by the U.S. Mint, these coins were pre-production strikes that had been inadvertently released into the production stream. They were struck to verify the look of the coin.

According to the U.S, Mint, the total number of “Frosted Freedom” coins potentially distributed to collectors includes 12 one-ounce coins, 21 half-ounce coins, and 21 quarter-ounce coins. As this is being written, only two one-ounce, one half-ounce, and one quarter-ounce coin have been certified by the major grading services.

In our next installment, we look at the American Palladium Eagles.

Feb 5, 2018 | coins, gold, palladium, platinum, US Mint

2018 American Eagle Platinum Proof obverse, Preamble to the Declaration of Independence Series — Life (U.S. Mint image)

Price for the American Gold Eagle proof coin was raised by $17.50 while the one-tenth ounce coin was raised by $2.50 across all price points (averages per troy ounce). The price for the 4-coin proof set was raised by $37.50.

The one-ounce American Gold Eagle uncirculated, American Gold Buffalo 24-karat Proof, and American Eagle Platinum proof coins were raised by $20.00 also across all price points.

The price will not change for the American Liberty Gold Proof, which will use the same design as the 2017 American Liberty 225th Anniversary Gold Proof. There will be a one-tenth ounce option that will go on sale February 8 now included in the table. If the price of gold remains steady, the opening price is expected to be $215.00.

The price for the Breast Cancer Awareness Commemorative “Pink” Gold $5 proof coin will be $6.35 more than the 2017 commemorative gold coin while the uncirculated version will be 25-cents less expensive.

You can find the U.S. Mint pricing table here (PDF).

Remember, precious metals pricing is not a matter of a table lookup. They use average prices based on the prices set by the London Bullion Market Association (also known as the London Fix Price). You can find the Pricing Criteria here (PDF).

Oct 30, 2017 | coin design, coins, Eagles, platinum, US Mint

Over a week ago, the U.S. Mint announced that they will begin a three-year series of the American Platinum Eagles proof coins featuring designs inspired by the Declaration of Independence. After looking at the designs and the designs of past platinum proof coins, they may be one of the most under-appreciated series of coins produced by the U.S. Mint.

-

-

American Platinum Eagle bullion reverse design

-

-

1999 American Platinum Eagle Proof reverse – Vistas of Liberty Reverse Designs – Eagle Above Southeastern Wetlands

-

-

2004 American Platinum Eagle proof reverse – Daniel Chester French’s “America” that sits before the U.S. Customs House in New York City.

Since its introduction in 1997, the U.S. Mint has produced four series of proof coins with the reverse honoring different aspects of the nation. To see the list, see the “U.S. Coins by Type” page.

What distinguishes these coins are the well-executed reverse designs that few get to see or pay attention. It may be difficult for the average collector to consider collecting these coins because of the price of platinum has been either on par or higher than the price of gold. Also, platinum is not as well regarded as gold or silver as a precious metal causing it to be overlooked.

-

-

2006 American Platinum Eagle proof reverse – Branches of Government Series – “Legislative Muse” representing Legislative Branch

-

-

2013 American Platinum Eagle proof reverse – Preamble Series – “To Promote the General Welfare”

-

-

2016 American Platinum Eagle proof reverse – Nations Core Values – “Liberty and Freedom”

Since many of these coins did not sell in large quantities, many could be classified as modern rarities. But do not let the lack of supply dissuade you. Prices could be in the range of their bullion value plus a modest numismatic premium because the demand is also lower.

It is too bad these designs are confined to platinum coins. Unfortunately, the authorizing laws allow the U.S. Mint to do this with the platinum coins but not with silver. Since silver is more affordable for the average collector, maybe it is worth trying to ask Congress to change the law to allow these types of series for the American Silver Eagle proof coins.

Coin images courtesy of the U.S. Mint.

Aug 5, 2015 | coins, commemorative, gold, legislative, news, platinum, policy, US Mint

The term Dog Days goes back to ancient Roman times when calendars were measured by the stars. While trying to measure time, the hottest part of the summer would coincide with the brightest star, Sirius, being dominant in the sky. Sirius is part of the constellation Canis Major (big dog).

The term Dog Days goes back to ancient Roman times when calendars were measured by the stars. While trying to measure time, the hottest part of the summer would coincide with the brightest star, Sirius, being dominant in the sky. Sirius is part of the constellation Canis Major (big dog).

During the period from about 20 days prior to the height of Sirius to 20 days following, Canis Major would only appear with the sunrise and sunset. Because ancient Romans thought Sirius contributed to the heat and humidity, this period would be called the Dog Days.

Today’s society has attached many meanings to the Dog Days of Summer. In baseball, it is the jockeying for position to get ready for the pennant races. Football begins training camps, politicians warm up to run for office (sometimes a year early), and the temperatures are rising with the east getting too wet and the west not getting wet enough.

These contrasts illustrate a congress that sometimes looks like they are really trying to do something and then really trying to put the “fun” in dysfunctional!

In July, it looks like congress really tried to do some work. Here are the coin-related legislative actions from our from our representatives on Capitol Hill:

It’s the law!

H.R. 893: Boys Town Centennial Commemorative Coin Act

Sponsor: Rep. Jeff Fortenberry (R-NE)

• Introduced: February 11, 2015

• Signed by the President: July 6, 2015

• Public Law 114-30

• Summary:

- 2017 Commemorative program

- 50,000 $5 gold coins with $35 surcharge

- 350,000 silver $1 coins with $10 surcharge

- 300,000 clad half-dollars with $5 surcharge

- Surcharge paid to Boys Town

Read the details of this law at https://www.govtrack.us/congress/bills/114/hr893

Passed the House

H.R. 2722: Breast Cancer Awareness Commemorative Coin Act

Sponsor: Rep. Carolyn Maloney (D-NY)

• Introduced: June 10, 2015

• Passed the House: July 15, 2015

• Received by the Senate: July 16, 2015

• Referred to the Senate Banking, Housing, and Urban Affairs Committee

• Summary:

- 2018 Commemorative program

- 50,000 $5 gold coins with $35 surcharge

- 400,000 silver $1 coins with $10 surcharge

- 750,000 clad half-dollars with $5 surcharge

- Surcharge paid to Breast Cancer Research Foundation for the purpose of furthering breast cancer research

Track this bill at https://www.govtrack.us/congress/bills/114/hr2722

Commemorative Coin Legislation Introduced

H.R. 2980: Mayflower Commemorative Coin Act

Sponsor: Rep. Bill Foster (D-IL)

• Introduced: July 8, 2015

• Referred to the House Committee on Financial Services

• Summary:

- 2020 Commemorative program

- 50,000 $5 gold coins with $35 surcharge

- 100,000 silver $1 coins with $10 surcharge

- Surcharge paid to General Society of Mayflower Descendants for educational purposes.

Track this bill at https://www.govtrack.us/congress/bills/114/hr2980

S. 1715: Mayflower Commemorative Coin Act

Sponsor: Sen. John Hoeven (R-ND)

• Introduced: July 8, 2015

• Referred to the Senate Banking, Housing, and Urban Affairs Committee

• Summary: see H.R. 2980, above

Track this bill at https://www.govtrack.us/congress/bills/114/s1715

H.R. 2978: Thirteenth Amendment Commemorative Coin Act

Sponsor: Rep. Danny Davis (D-IL)

• Introduced: Jul 8, 2015

• Referred to the House Committee on Financial Services

• Summary:

- 2015 Commemorative program

- 250,000 $50 bi-metallic (gold & platinum) with $10 surcharge

- 250,000 $20 gold coins with $10 surcharge

- 500,000 silver $1 coins with $10 surcharge

- Surcharge paid to Smithsonian National Museum of African American History and Culture.

Track this bill at https://www.govtrack.us/congress/bills/114/hr2978

Other coin-related legislation

H.R. 3097: Commemorative Coins Reform Act of 2015

Sponsor: Rep. Justin Amash (R-MI)

• Introduced: Jul 16, 2015

• Referred to the House Committee on Financial Services

• Summary: If passed, this bill will prohibit payment of surcharges from commemorative coins to organizations outside of the federal government.

Track this bill at https://www.govtrack.us/congress/bills/114/hr3097

H.R. 3300: To reduce waste and implement cost savings and revenue enhancement for the Federal Government.

Sponsor: Rep. Robert Pittenger (R-NC)

• Introduced: Jul 29, 2015

• Referred to many committees including the House Committee on Financial Services

Track this bill at https://www.govtrack.us/congress/bills/114/hr3300

Mar 21, 2015 | bullion, gold, markets, news, palladium, platinum, US Mint

Last day at the London Fix market

The move to an electronic system followed the revelation that in June 2012 an employee of Barclays Bank manipulated the gold fixing process. Unfortunately, it was not an isolated incident. When Barclays was investigated, it was revealed that there were such system and control failures that members of the bank had been manipulating gold prices since they started hosting the market. In May 2014, the Financial Control Authority, the British equivalent Commodity Futures Trading Commission, fined Barclays £26 million for not properly managing the market.

What made the old system susceptible to manipulation was that it was still widely a human controlled process with bidding arbitrarily controlled behind then scenes. Even as the market moved toward a more technological approach, it was as if the technology was being used as the proxy with a human still doing the arbitration. Think of it as if the computers would provide the bidding but there was still an human auctioneer managing the bids.

The new market is electronically run and monitored in cooperation with the LBMA. Rather than a single source being responsible for all of the benchmark prices, the LBMA Gold price auctions are held twice daily by the ICE Benchmark Administration (IBA) at 10:30 AM and 3:00 PM London time in U.S. dollars. IBA is an independent subsidiary of the Intercontinental Exchange (ICE) responsible for the end-to-end administration of benchmark prices. They do not buy or sell commodities but manage the transactions and setting rates based on market forces.

To further diversify the market, the LBMA Silver price auction is operated by the CME Group, a Chicago-based market maker, and administered by Thompson Reuters. The London Metals Exchange administers the platinum and palladium price market. Silver auctions are held once per day at noon London time.

Proponents of the new market system touts its stronger oversight and detailed audit trail capabilities to support the new regulations as making this market more trustworthy than the previous system. Detractors wonder if the new electronic system could create market inequities that was seen in U.S. markets with programmed trading.

News reports suggest that the new market operated without problems on its opening day. In fact, the market saw a rise in all metals by the afternoon auction.

Snapshot of the bullion market on March 20, 2015 (static image, will not update)

Since the U.S. Mint sets its price based on the London market, they sent the following note to Authorized Purchases of bullion products on March 18, 2015:

This is to inform you that on Friday, March 20, 2015 the U.S. Mint will start using the LBMA Gold Price (PM) to price and settle all of its gold bullion coin orders. The new gold price replaces the London Gold Fix and will be managed by the ICE Benchmark Administration (IBA). We do not anticipate any transition issues. Moving forward all gold bullion transactions with the United States Mint will utilize the new LBMA Gold Price (PM) in place of the (PM) London Gold Fix.

While the move will make the markets more transparent and possibly open it to more participants, it is uncertain how this will affect the price of metals in the long term. For that, my crystal ball does not compute!

London Metals Exchange market images courtesy of

Mining.comLondon gold price snapshot courtesy of

Kitco.

Dec 23, 2013 | celebration, coins, commentary, Federal Reserve, platinum, US Mint

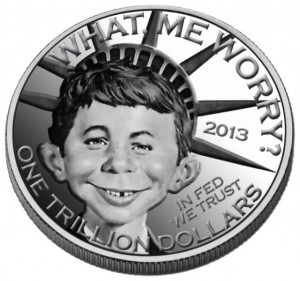

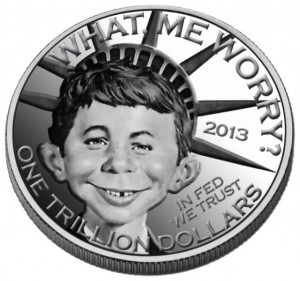

If there was a countdown of the idiocy of the punditocracy of this country, the discussion over the $1 Trillion platinum coin would be the number 1 story. As I previously explained, which it is feasible for the U.S. Mint to strike a $1 Trillion coin, the question remains, “Who will buy the coin?” In order for the U.S. Mint to gain from the seigniorage that would come from minting and selling this coin.

If the coin is has to be paid for by a depositor before it can become legal tender, who will buy a $1 Trillion coin?

How could the coin be used to reduce the debt? If the coin is just deposited with the Federal Reserve, there will be a $1 Trillion liability on the government’s balance sheet. In order to make the books balance, the Department of Treasury would have to sell debt bonds to make up the difference and that would add $1 Trillion to the national debt.

If the coin is bought by the Federal Reserve, then the Fed will have to pay $1 Trillion to the U.S. Mint for the coin reducing its overall working capital by $1 Trillion. Paying for a $1 Trillion that could not be used will just transfer the debt from the general treasury to the Federal Reserve. Since the Federal Reserve is in charge of managing the country’s money supply, the net effect will be to reduce the money supply by $1 Trillion that will cause the economy to shrink—any time you artificially remove money from the economy it will shrink which will also weaken the buying power of the U.S. dollar.

Transferring the debt away from the general fund might look good on paper but the effect will shrink the economy and cause more problems than even considering the constitutionality of doing this.

The bottom line is that regardless of what the U.S. Mint sells, there has to be a buyer. If there is no buyer then all the government would do is transfer balances from one balance sheet to another without any net gain.

Dallas-based Heritage Auctions, held a mock contest on Facebook for the public to design a potential $1 trillion coin. The concept of a coin was even a joke to the folks at Heritage whose mockup included famed Mad Magazine “pitchman” Alfred E. Newman.

Oct 30, 2013 | CCAC, coin design, coins, commentary, Eagles, platinum

The buzz around the numismatics industry is the article that appeared on the front page of Coin World saying that the Citizens Coinage Advisory Committee rejected the U.S. Mint proposal to use classic coin designs as the basis for a new series of American Eagle Platinum Proof coins.

According to the article, CCAC Chairman Gary Marks commented, “My message is, ‘Let’s do something modern, something new.’”

2012 American Eagle Platinum Proof reverse — “To Provide for the Common Defence”

Unlike other coin programs, the law governing the platinum bullion coins (31 U.S.C. §5112(k)) allows “The Secretary [to] mint and issue platinum bullion coins and proof platinum coins in accordance with such specifications, designs, varieties, quantities, denominations, and inscriptions as the Secretary, in the Secretary’s discretion, may prescribe from time to time.”

Now, The Secretary’s proxy, the management at the U.S. Mint, is proposing a series based on classical coins designs. Using charts showing declining coin sales, they claim that a study shows that “classic Eagle” and “classic coin” designs are popular amongst their customer.

The U.S. Mint may be reading too much into their studies.

First, any sales studies over the last four years have to be taken with a heavy dash of salt. As much as the economy affects their circulating coin programs it also affects the collector coin programs. Since coin collecting is not a necessity, expecting sales to do anything but decline during an economic downturn is naive.

The other problem with coin sales are the coins programs themselves. Rather than give the quarters programs a rest and come up with something different, congress, who decides what the U.S. Mint can do, passed the America’s Beautiful National Parks Quarter Dollar Coin Act of 2008 (Public Law 110-456) to overload our senses with yet another 10-year program. It was justified by noting the seigniorage of the 50 States Quarters program.

This leads to the crux of the problem: the tail wagging this dog are marketeers and bureaucrats rather than collectors and those concerned with how American coinage represents this country.

1928 Peace Dollar is a classic and under-appreciated design

A lot of people love the classic designs but on the classic coins. There comes a time to move forward and come up with something different and fresh. Although I have not agreed with some of the CCAC’s decisions, I agree with this decision.

When asked if there should be a theme to the design, CCAC member and medal sculptor Wendy Wastweet said, “No. The artists would be delighted to be free.”

Why not let the U.S. Mint artists have free reign to come up with new designs? They have proven that when allowed to use their talents they can create some of the best designs in the world.

The CCAC has been consistent in tell the U.S. Mint to get out of the way of the artists. In fact, the CCAC Blueprint Report released in February 2011 recommended better working conditions for the U.S. Mint’s artists and engravers while giving them a freer hand in using their talents for new coin designs.

In more than two years, the U.S. Mint has not changed allowing their marketing bureaucracy misread statistics in an attempt to fix a problem they continually demonstrate they have no understanding or insight. The CCAC is right to tell the U.S. Mint to come up with something better. In the process, if the marketing department would stand aside and let the artists be creative, I am reasonably certain these talented individuals will create something far more interesting than any marketeer, bureaucrat, or any member of congress.

American Eagle Platinum proof reverse courtesy of the U.S. Mint.

Mar 6, 2013 | bullion, coins, gold, platinum, policy, US Mint

It was reported in the numismatic press but not formally announced by the U.S. Mint that they filed a notice that appeared in the Federal Register (78 FR 11954) raising precious metal prices. The new prices, which are as much as 30-percent higher than the previous became effective as of noon (ET) on Wednesday, February 27, 2013.

It was reported in the numismatic press but not formally announced by the U.S. Mint that they filed a notice that appeared in the Federal Register (78 FR 11954) raising precious metal prices. The new prices, which are as much as 30-percent higher than the previous became effective as of noon (ET) on Wednesday, February 27, 2013.

It was noted in the U.S. Mint’s annual report that seigniorage on precious metal products were lower in 2012 than in years past. This move appears that the U.S. Mint is trying to make up for that lost revenue.

The announcement can be found at the Government Printing Office website ![[PDF]](http://coinsblog.ws/library/images/pdf.png) or you can find a printable version at on the U.S. Mint’s website.

or you can find a printable version at on the U.S. Mint’s website. ![[PDF]](http://coinsblog.ws/library/images/pdf.png)

Coin image courtesy of the U.S. Mint.

Jan 6, 2013 | bullion, coins, commentary, Eagles, gold, legal, platinum, policy

Obverse of the 2012 American Eagle Platinum Proof

Regardless of the side of the political spectrum you are in this topic, it will not work.

The United States Code (U.S.C.) is the codification of the laws of the United States. It is divided into 51 titles each covering one general topic. References to the law are made by providing the title number, followed by “U.S.C.,” then the section of the law. Subsections are added using parentheses after the section. All of the laws governing the U.S. Mint are under Title 31. When talking about what coins the U.S. Mint may be allowed to strike, you would find those laws in Title 31 Section 5112 (

31 U.S.C. §5112).

First question is whether it is legal for the U.S. Mint to strike the $1 Trillion coin. Although there are as many answers as there are pundits, everyone points Title 31, Section 5112, paragraph “k” (31 U.S.C. § 5112(k)) that reads as follows:

The Secretary may mint and issue platinum bullion coins and proof platinum coins in accordance with such specifications, designs, varieties, quantities, denominations, and inscriptions as the Secretary, in the Secretary’s discretion, may prescribe from time to time.

This law was passed by congress under their authority in Article 1, Section 8 of the U.S. Constitution that says “The Congress shall have Power… To coin Money, regulate the Value thereof, ….” The law’s intent was to give the U.S. Mint the authority to issue the American Eagle Platinum Bullion and Platinum Proof coins. American Eagle Platinum coins have a $100 face value and sell for a premium over the market price of platinum and taking into consideration coin’s production cost. However, the law does not restrict the issuance of the platinum coin to the American Eagle program.

But is it constitutional? The argument from John Carney of CNBC says it is not by twisting a ruling by the Supreme Court. Carney cites the case Whitman v. American Trucking Assns., Inc. (531 U.S. 457 (2001)) in saying that “the Environmental Protection Agency rule making authority was too broad because Congress had failed to provide ‘intelligible principle’ to guide the agency.” Unfortunately, like a lot of people, Carney reads the headlines and not the majority opinion. In the majority opinion, Justice Antonin Scalia wrote the law “does not permit the Administrator [of the EPA] to consider implementation costs” which is against previous precedent because the Clean Air Act, which was under question, “often expressly grants the EPA the authority to consider implementation costs, a provision for costs will not be inferred from its ambiguous provision.”

In other words, the Supreme Court said that because there are conflicts in the law. The “intelligible principle” is that Congress cannot delegate partial authority over one part of a law where other parts have a requirement to consider other circumstances. In other words, the Supreme Court is saying that Congress has to be consistent in delegating its authority.

Could 31 U.S.C. § 5112(k) be interpreted in the same manner? It is possible for the Supreme Court to declare the law unconstitutional, but if they do so they would also have to rule that the law that allowed the U.S. Mint to create the 2009 Ultra High Relief Gold Coin unconstitutional. According to 31 U.S.C. § 5112(i)(4)(C):

… at the same time the Secretary in minting and issuing other bullion and proof gold coins under this subsection in accordance with such program procedures and coin specifications, designs, varieties, quantities, denominations, and inscriptions as the Secretary, in the Secretary’s discretion, may prescribe from time to time.

Under both 31 U.S.C. § 5112(k) and 31 U.S.C. § 5112(i)(4)(C), the Secretary can authorize the U.S. Mint to strike any denomination platinum or gold coin with the value of $1 Trillion. Since there is no ambiguity or contradictions that would be able to use Whitman v. American Trucking Assns. as a precedence, the constitutionality should not be in question.

If the Secretary could mint and issue a $1 Trillion coin, then the Secretary could mint 17 such coins that could theoretically be used to pay off the country’s debt and give the country a positive balance for the first (and only) time since 1835 under President Andrew Jackson.

For discussion sake, let us say that the Secretary authorized the U.S. Mint to produce a $1 Trillion coin. Who is going to buy the coin?

If the concept is to use the profit (seigniorage) from the sale of the coin, whether it is made of gold or platinum, the coin has to be sold in order for there to be a profit. If the government would just deposit a $1 Trillion coin in the Federal Reserve, then where is the profit for the government? In order for a coin to become legal tender, it has to be bought from the government for at least its face value unless the law allows otherwise (see the American Eagle Bullion program and any of the commemorative programs). The U.S. Mint does not consider a coin to be legal tender until it receives an appropriate deposit of bullion or other forms of legal tender.

It this concept of legal tender that has been behind the government’s position that because the 1933 Saint-Gaudens Double Eagle coin was not paid for by a depositor (part of which is required in 31 U.S.C. § 5122), they are government owned coins (31 U.S.C. § 5121) and not legal tender. This concept has been upheld in the history of the 1933 Saint-Gaudens Double Eagles including the settlement over the Fenton-Farouk coin that sold for $7,590,020 with $20 going to “monetize” the coin.

Most recently, Judge Legrome D. Davis (U.S. District Court for Eastern Pennsylvania) confirmed the legal tender status of the 10 Double Eagles that Joan Langbord allegedly found in a box once owned by her father, infamous Philadelphia jeweler Israel Switt who is considered one of the central figures in the coins removal from the U.S. Mint. In Lanbord et al v. U.S. Treasury (Civil Action No. 06-5315), Judge Davis’s opinion cites past cases including the government’s own case against Israel Switt in 1934 for not forfeiting recalled gold and the previous return of 75 coins attributed to him. His opinion effectively confirms the U.S. Mint’s argument that once it creates a coin it is not legal tender and a liability on their balance sheet until the coins is bought.

If the coin is has to be paid for by a depositor before it can become legal tender, who will buy a $1 Trillion coin?

If the coin is just deposited with the Federal Reserve, there will be a $1 Trillion liability on the government’s balance sheet. In order to make the books balance, the Department of Treasury would have to sell debt bonds to make up the difference and that would add $1 Trillion to the national debt.

If the coin is bought by the Federal Reserve, then the Fed will have to pay $1 Trillion to the U.S. Mint for the coin reducing its overall working capital by $1 Trillion. Paying for a $1 Trillion that could not be used will just transfer the debt from the general treasury to the Federal Reserve. Since the Federal Reserve is in charge of managing the country’s money supply, the net effect will be to reduce the money supply by $1 Trillion that will cause the economy to shrink—any time you artificially remove money from the economy it will shrink which will also weaken the buying power of the U.S. dollar.

Transferring the debt away from the general fund might look good on paper but the effect will shrink the economy and cause more problems than even considering the constitutionality of doing this.

Unfortunately, this scheme was conjured by someone who did not think through the idea thoroughly.

Coin image courtesy of the U.S. Mint.

While watching the numismatic news that appears in non-numismatic sources, I noticed that regardless of the predictions of cashless societies taking over, there are a few countries with interest in coins for both commerce and collecting.

While watching the numismatic news that appears in non-numismatic sources, I noticed that regardless of the predictions of cashless societies taking over, there are a few countries with interest in coins for both commerce and collecting. → Read more at invest.usgoldbureau.com

→ Read more at invest.usgoldbureau.com → Read more at romania-insider.com

→ Read more at romania-insider.com → Read more at gbtimes.com

→ Read more at gbtimes.com → Read more at businesslive.co.za

→ Read more at businesslive.co.za → Read more at inquisitr.com

→ Read more at inquisitr.com → Read more at invest.usgoldbureau.com

→ Read more at invest.usgoldbureau.com → Read more at irishpost.com

→ Read more at irishpost.com

The term Dog Days goes back to ancient Roman times when calendars were measured by the stars. While trying to measure time, the hottest part of the summer would coincide with the brightest star, Sirius, being dominant in the sky. Sirius is part of the constellation Canis Major (big dog).

The term Dog Days goes back to ancient Roman times when calendars were measured by the stars. While trying to measure time, the hottest part of the summer would coincide with the brightest star, Sirius, being dominant in the sky. Sirius is part of the constellation Canis Major (big dog).

It was reported in the numismatic press but not formally announced by the

It was reported in the numismatic press but not formally announced by the ![[PDF]](http://coinsblog.ws/library/images/pdf.png) or you can find a printable version at on the

or you can find a printable version at on the