James Earle Fraser and A Controversial Statue

Equestrian Statue of Theodore Roosevelt at the American Museum of Natural History in New York City. (Wikipedia)

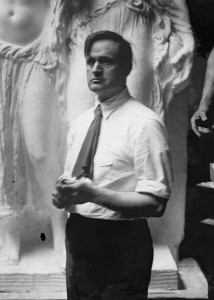

Since Roosevelt’s death, Fraser was asked to design three different statues honoring the 26th President with themes picked by the sponsors. The theme was chosen for this statue by the Roosevelt Memorial Association. The statue would honor Roosevelt and the indigenous people in the Badlands of South Dakota and the Africans he met during his post-presidency safari. They were meant to be allegorical figures, not real people.

Theodore Roosevelt was a fascinating personality. TR was fond of the Badlands area, the area of the Dakota territory around the Little Missouri River. In his autobiography, Roosevelt admitted that he used his trips to the Badlands as an escape. The trips started after the death of his first wife, Alice, who died within days of giving birth to their only child.

Roosevelt stopped talking about Alice after her death. Until he wrote his autobiography, the last statement Roosevelt made about Alice was in his diary, where he wrote, “The light has gone out of my life.” Some scholars believe that Roosevelt’s trips to the Badlands were his attempt to combat depression or post-traumatic stress following Alice’s death.

Following his presidency, Roosevelt went on a safari in Africa and a trip through Europe. In Africa, Roosevelt’s safari was a research project sponsored by Andrew Carnegie that would bring back specimens for the Smithsonian Institue and the American Museum of Natural History.

His guide through Africa was a British national RJ Cunninghame. Aside from his knowledge of the region, Cunninghame knew many natives who can lead them around the land. In each of the countries, the local guides were natives.

In his autobiography, Roosevelt would credit the native people for helping on his trips. It was clear that Theodore Roosevelt would not have been associated with these people in other areas of his life. Still, his writing demonstrated a lot of respect for their guidance.

Fraser was consulted many times by the Roosevelt Memorial Association. It was due to his being an accomplice to Roosevelt’s “pet crime,” the redesign of the nation’s coinage. Fraser, who was an assistant to Augustus Saint-Gaudens, understood the imagery the President wanted that became the inspiration for the Buffalo Nickel.Frasier’s style was called Beaux-Arts, which relied on neoclassical-like images. Frasier was the designer of the Buffalo Nickel and other commemorative coins. Frasier’s style was called Beaux-Arts, which relied on neoclassical-like images. Frasier took Beaux-Arts to a new level by studying his subjects’ history and incorporating them into the imagery.

All of Frasier’s work has many elements that have to be studied to be appreciated. Numismatists can see his attention to detail by studying a Type 1 Buffalo Nickel with a loupe. The detail gives the coin a lot of character that makes it an appealing collectible. When the U.S. Mint tried to recreate the design for the 2001 commemorative coin, collectors were not satisfied with the flatter image.

The 24-karat Gold Buffalo coin is a good representation of Frasier’s Type 1 Buffalo Nickel design. John Mercanti’s execution of Fraser’s design is phenomenal.

- 1913 Buffalo Nickel Type 1 Reverse

- Reverse of the 2013-W American Buffalo gold reverse proof

Many of the statues in tribute to the 26th President show Roosevelt on a horse. Fraser was consulted about two other Roosevelt memorial statues. The statue Fraser proposed that is now on Roosevelt Island in New York’s East River was similar in design to the Equestrian Statue at the Museum of Natural History. The other was a statue to be part of the Theodore Roosevelt Island in the Potomac River near Georgetown. It depicted Roosevelt on a horse without the guides. Fraser died before funding for the statue was realized.

Fraser’s image for the statue was clear. It was the two indigenous people working to support Roosevelt’s adventures. These are not racist images, even when it has been badly misinterpreted by some media who call the person to Roosevelt’s left an African-American.

Unfortunately, the current society has lost the ability to reason beyond the surface at allegorical symbols that are supposed to honor rather than demean. It takes a higher sense of forethought to understand what is being depicted. A value that is lacking today. Understanding the history of the man and the imagery offered by Fraser something to be admired. It is a work of art that needs to be preserved and not run over by a politically correct freight train.

Do We Really Need New Silver Eagles?

You might have read that the U.S. Mint surveyed purchasers of their 25th Anniversary American Silver Eagle sets to ask whether they would buy different options of the coins. Amongst the options surveyed include coins minted in Denver, reverse proofs, and a high relief coin.

Mint Director of public affairs Tom Jurkowsky was quoted by Numismatic New as saying, “Just because a question is presented doesn’t mean that a product would be offered.”

I was one of those asked by the U.S. Mint to participate in the survey. As I was answering the question I was excited because the American Silver Eagle is my favorite modern coin. Aside of being 40mm with one troy ounce of beautiful silver, Adolph A. Weinman’s Walking Liberty design is one of the best designs to be featured on a United States coin. With the John Mercanti designed heraldic eagle on the reverse, the coin screams of being an American coin.

Later in the day, I received a product notice from the Royal Canadian Mint for yet another non-circulating legal tender (NCLT) collectible. That is when I realized that the Royal Canadian Mint produces a lot of NCLT coins including ones that celebrate Canada with the use of the maple leaf. Don’t get me wrong, I love Canada. I collect Canadian circulated coins and I am a member of the Royal Canadian Numismatic Society. But the Royal Canadian Mint just produces too many products.

While I sometimes look at some of the RCM’s products and think that the U.S. Mint could produce coins of the same themes if congress would release their shackles, I also know that the overload of products from the RCM appears to cheapen their product offerings.

Additional American Silver Eagles would be nice, but I question whether adding additional options would push the U.S. Mint into overload? Even though the reverse proof American Silver Eagle is a beautiful coin, does it really have to be produced every year? What is wrong with producing the coin for special anniversary sets?

After seeing the reverse proof and the U.S. Mint’s previous high relief coin, I think they would produce a phenomenal coin. But why waste the design on an ordinary release. Why not wait until 2016 and produce a high relief American Silver Eagle to commemorate the 100 year anniversary of the first release of the design on the Walking Liberty Half Dollar? That would make the high relief coin special. In fact, since it is beyond the 25th year of the design, why not produce the reverse of the 2016 high relief American Silver Eagle using the same reverse as the Walking Liberty Half Dollar?

I hope the excitement over the survey calms down and that cooler heads will prevail.

How Are Coins Priced (Part II)

Understanding how coins or any numismatic item is priced cannot be complete without the final transaction between the current owner of a coin to a new owner. The current owner could be a dealer, auction house, or another collector that is looking to sell a coin. Each seller has different motivations for selling and different factors goes into the final price that you might pay when buying that coin.

In Part I, I mentioned that there was a difference between the “price” of the coin and it’s “value.” The price of the coin is what you pay when you buy the coin—sometimes called the retail price. The value of the coin is what a dealer will pay you for the coin—also called the wholesale price. Another designation you might are the “bid/ask” price spread, a term that comes from auction-based transactions. The bid price is what the dealer is willing to pay for inventory and ask is what they will ask to be paid for that item.

Regardless of what its called, there is one price that a dealer or other reseller will buy the item and the other is the price they will sell the item. As in any business where there is a product being sold, the seller buys low and sells high. However, that markup can be different based on various factors.

Setting these prices require more thought than guessing. The primary references are the price guides published by many companies. Price guides come in various forms from catalogs, auction catalogs, publishers whose market is producing works for the collectors market, or specialized publishers who watch the market on a continual basis and publish their findings.

Although there are a few references, for most dealers, the basis of their pricing begins with a publication entitled The Coin Dealer Newsletter, called the “Grey Sheet” for its grey color. The Grey Sheet surveys the market provides to provide weekly bid and ask wholesale prices for the dealers to use as guidelines. In addition to the Grey Sheet, the same company publishes the Certified Coin Dealer Newsletter, called the Blue Sheet for its use of blue ink, and The Currency Dealer Newsletter, the Green Sheet, for currency. These publications can be purchased by anyone to gauge the market.

Up until the last few years, price guides for collectors have have been limited to the long running A Guide Book of United States Coins, known as the Red Book for its red color, from Whitman Publishing and later joined by the U.S. Coin Digest from Krause Publications and price guides published by CoinWorld (sometimes referred to as “Trends”), the guidelines have opened a bit with the help of technology. Whether you get your guide price from Numismedia, Numismaster whose prices are driven by the Krause database, PCGS whose own market drives their price guide, or by checking prices amongst online dealers, the resources provide more options for collectors not to be surprised when they go to purchase coins or currency.

Another good are to investigate coin prices are auction results. Most auction houses use their websites to advertise their sales online, but also maintain the price realized from their auctions with some having online archives dating back many years. Accessing the prices realized is as simple as registering on the site and searching previous auctions. Like anything on the Internet, some sites are better than others so your experience will differ from site to site. However, the advantage is that rather than guessing based on surveys, you will know exactly what has been paid in the past and can adjust your expectations according. There will be more on the auction process later.

Two agencies within the Department of the Treasury are responsible for the manufacture of money in the United States: the U.S. Mint and Bureau of Engraving and Printing. Both agencies are responsible for supplying the Federal Reserve with the physical currency necessary for the economy. In fact, both the U.S. Mint and BEP sells their products to other governments for use where the U.S. dollar is the standard currency.

Both agencies have collector products they sell to the general public (see the BEP Store and U.S. Mint online Catalog) that are sold at a fixed price. The difference between the two is that the BEP does not produce commemorative or something similar to proof coins, the U.S. Mint does produce coins specifically marketed to collectors and investors. Both agencies will package their regular products in a way to entice collectors to buy them at a premium whether these are Federal Reserve Notes with special numbers, uncut currency, or packaging of uncirculated coins. When these items sell out or withdrawn from their respective catalogs, the collector can buy them from the secondary market.

Meet the seller to the secondary market, the dealer. A dealer is someone who will buy coins from collectors, estates, auctions, or other dealers and resell them for a profit to an interested collector. Some dealers sell at wholesale rates (bid or value) to other dealers to move stagnant inventory or to trade inventory in order that both are able to meet their customer’s demands.

Dealers work in different areas of expertise. Some will only deal in raw coins while others will only sell coins in slabs. They will specialize in coin types while others will sell currency, ancient coins, or foreign coins. There are dealers who sell numismatic books, supplies, tokens, bullion, and exonumia. Dealers may also sell jewelry as part of their inventory. If you had to classify most dealers, they are usually small businesses, many with a few employees, whose livelihoods depends on acquiring and turning over inventory.

Although there are suggested prices, as described above, dealers set their own prices on their inventory. They do take into consideration what the price guides say, but they also have to consider what they paid for the coin and what it costs for them to sell that coin. Costs include everything it takes to run the shop from the lease to utilities plus security and employees. The dealer also has to make a profit—after all, they are in business to make money.

Coin shows present a different buying experience from dealers in that you have a lot of people to potentially buy from. Even the smallest coin show offers a variety of products that many shops could not replicate and while there is a camaraderie amongst the dealers, they are also in competition with each other. As a buyer or someone who is selling their coins, this is the variety provides many opportunities to get the best price.

The best experience you can have in numismatics is going to a coin show regardless of whether it is a large or small show. As you walk around the bourse floor, look around, talk with the dealers, and talk with other collectors. It is a way to learn more about the hobby and the people in the hobby. Use the opportunity to build a rapport with the dealers. Not only are many the most knowledgable in the industry, but they may offer you discounts if you buy from them based on the recommendations. You can also take the opportunity to shop around to find that perfect coin.

There are all types of dealers who attend shows with a varying type of inventory. At the largest shows, you can meet dealers with a brick-and-mortar presence back home, dealers who just travel to shows to buy and sell, part time dealers who have a regular job during the week and sell at shows on the weekend, and vest pocket dealers who may not have a table but walks the floor and tries to sell their wares. Remember, dealers who travel to these shows have inventory that they bought, travel expenses, and fees for setting up at the show that will factor into their prices.

Mail order dealers may be as old as the Post Office itself. They grew out of the need to be able to sell to collectors that may not have a coin shop nearby or cannot travel to shows. Lately, a few of the very large mail order dealers have received criticism for their higher pricing structure without considering their business model.

In the last few years, mail order dealers have marketed themselves to new and inexperienced collectors offering various clubs and other promotional items to convince people to collect then retain them as casual collectors. Their business model is similar to any mail order business with catalog production costs, a telephone sales force, and a full shipping staff. Mail order dealers usually do not attend many coin shows but may attend some to set up a table for buying only. Their pricing reflects their business model.

Another service of mail order dealers is that once they get you on their mailing list, they will send coins on approval. This service not only helps the casual collector put together sets of their favorite coins, but it helps those who cannot go to shows or to a coin shop regularly. There is also a cost for this service including postage and the possibility of loss that has to be accounted for in their business model. They still have a market niche and are a way to add to your collection.

Auctions are the oldest type of marketplace with the earliest recorded auction occurring in 500 BCE. Numismatic auctions sell goods by offering them for bid, accepting bids, and then selling the item to the highest bidder. Auctions begin with a minimum price and go until a bidding ends with no further bids where the highest bidder is obligated to pay for the item at that price. Some auctions have a reserve price, the minimum price the seller would accept for the item. If the reserve price is not met, the seller can withdraw the item without selling it.

Internet auctions have changed the process by adding a time limit on the sale of a single lot. Rather than wait for the last bidder as with a live auction, the highest bidder at the time of the end of the Internet-based auction purchases the item at their highest bid.

When auctions started, participants had to be present or send an agent in order to bid on the item. As technologies have changed, the nature of bidding has change. The first change was the introduction of the Postal Service that introduced bidding by mail. Bids could be sent by mail or some firms offer auction exclusively by mail called mail bid sales. Telephones added the ability for people to attend an auction from far away by communicating their bid through a representative of the auction company. Some could even contact an auction company and leave a proxy bid for specific auctions. The invention of facsimile technologies added the ability to quickly send proxy bids along with other verification information for those who are not or infrequent customers of the auction company.

Buying and selling via an auction requires payment to the auction company for selling the item. Seller fees are either a fixed price or percentage of the final price of the item sold, also called the price realized. If the item sells, the seller is paid the final price less the seller fees. The buyer pays a buyer’s fee as a percentage of the price realized with an advertised minimum. Seller fees range from 10-15 percent and buyer fees range from 15-20 percent. Sellers can negotiate the seller fees. Buyers are told what the buyer fees as part of the terms of sale and are not negotiable. Buyers may also be required to pay for shipping of items when they are not present at the live auction.

Online auctions are a bit different in that the sellers pay a listing fee and a final value fee based on the price realized. In these venues, sellers bear all of the fees while the buyers pay the price realized plus shipping. Some sellers will add “handling” charges to offset the fees paid as part of the auction.

Negotiating is difficult for some for many reasons. For others, not only can it be fun but there is an additional thrill of being able to negotiate a price. There is no rule that you have to negotiate. You can accept a dealer’s price and either buy or not. However, in my world, everything is negotiable and it is part of the thrill of buying that perfect collectible.

There are no set rules for negotiating and how you negotiate will change with the situation. When purchasing a coin, I will ask the dealer for a price. Depending on the price and situation, I will either pay the price if I think it is a fair price or ask if the dealer could do better. Sometimes I ask if I can offer a lower price. The dealer may come down in price or say that the price is firm. The negotiation continues until either a price is agreed upon or we cannot settle on a price. For those times I am unwilling to pay the dealer’s price, I will always thank the dealer for the time before turning them down.

When negotiating, I follow three guidelines that you might want to consider adopting:

- Be nice. The dealer is a human being and should be treated with the respect shown to anyone else. As you are talking, if you get the feel that you can be a little more aggressive, then do so only if the dealer seems receptive. Do not insult the dealer and do not turn the negotiation into an attack. Do not make it personal, it’s business.

- Do your homework. Before trying to negotiate, you should know the price and value of the coin and be prepared to use those as guidelines. Also, know what the bullion value of the coin is and never offer less than that value for the coin. Trying to buy coins below melt value may be insulting to the dealer and your attempt at negotiating will not be taken seriously. In some cases, it would help to know what is selling in the overall market. At shows I would ask dealers how their sales were doing and what was selling. If a dealer is having a slow show, they may be willing to accept a lower price to make a sale. Once you have the information and talk with a dealer, you have to remember and respect that this is the dealer’s livelihood. Trying to shave pennies off the price may be fun for you but you may make the dealer upset and will refuse to sell the coin.

- Know when to stop. At some point in the negotiation the dealer may decide that they are offering you the best deal and will stop the negotiation. If you are far apart on what you wanted to spend for the item, you may want increase your last offer, but doing that more than once could cause hard feelings. Sometimes, if you are nice (see the first rule), you can turn this last part into a game: “Gee, I am having a hard time deciding.” “I really want the coin but I didn’t want to pay more than x,” where x is a realistic number. If you try this method, do not try more than once. You will either have to buy the coin or walk way.

If you buy the coin, be gracious. You might have paid more than you expected, but you did get that special coin for your collection. It is appropriate to thank the dealer, shake their hand, smile, and be appreciative. Good will is always appreciated and will be remembered the next time you encounter this dealer again.

If you do not buy the coin, be gracious. Thank the dealer for speaking with you and say, “maybe next time.” Do not waste the dealer’s time especially if there are other customers around. While you may be disappointed do not walk away like the dealer just kicked your dog. Who knows, next time may be in a few hours after the coin is still on the dealer’s table at closing time. The dealer may be willing to “work the price further” if they perceive that you are a serious and courteous buyer.

Finally, have fun! Unless you are an investor, this is a hobby. Hobbies are supposed to be fun and you can have fun with numismatics. Whether it is the thrill of the chase, finding that special coin, or putting together a great set of coins, you can have even more fun when you are smart about what you buy. To borrow a phrase, Live, Learn, and Collect!

eBay to Ban All Replica Coins

This past week, the online auction company eBay announced that effective Febrary 20 listings for replica coins will no longer be allowed on the site. “eBay defines replica coins as a copy or reproduction of an actual coin, including U.S., foreign and other historic coins.” The announcement said that eBay is working with the Professional Numismatists Guild “to help ensure the coin experience on eBay meets industry standards and is an effective destination for customers selling or shopping for coins.”

First, the wording of the press release was confusing. After mentioning that eBay will ban all replica coin listings, the press releases from eBay and PNG said that the “This policy decision will help ensure compliance with applicable laws (the Hobby Protection Act) that require replica coins to be permanently marked with the word ‘COPY.’” It suggests that coins marked as “COPY” would be allowed. However, an in an email from Johnna Hoff, Media Relations from eBay, all replica coins are being banned. “Because of the nature of our

marketplace – specifically that we don’t control the inventory – we’re not able to confirm before purchase that a coin is truly stamped. Customer feedback told us that often coins shown in pictures as stamped werenrsquo;t delivered that way.”

When asked specifically about replica currency, Ms. Hoff responded that the new policy just “applies to coins at this time.” A follow up question as to whether silver rounds, specifically the Buffalo Silver Rounds, and replica medals, including ones produced by the U.S. Mint, will be included in the ban.

Another question that would have to be answered is what about restored coins, legitimate coins that have been restored by artificial means. These are not copies but could be passed as original coins to the unsuspecting buyer. Buffalo Nickels fall into this category. There are many “acid coins,” Buffalo Nickels whose dates are raised by using a liquid date enhancer, and coins that have undergone tooling to restore the features. Another similar collectible are “reprocessed” steel cents that are recoated with zinc to make them look better than when they left the U.S. Mint and are not marked in any way. These deceptions may cause more of a threat to the hobby than replica or downright counterfeit attempts.

While it is good that eBay and PNG are working together to make eBay a safer marketplace for collectors, this is a heavy handed act suggesting that eBay protect the consumer from themselves. Rather than eBay and PNG working together to work with law enforcement against the people who break the law, both groups are turning their back on a legitimate market for replica coins.

The Hobby Protection Act of 1973 (15 U.S.C. § 2101 et seq.) allows for both private enforcement, such as a civil action (15 U.S.C. § 2102) and reporting violations to the Federal Trade Commission (15 U.S.C. § 2103 and 16 CFR 304).

Further, eBay has extensive policies regarding prohibited and restricted items as well remedies for violating these policies. Rather than ban these items, PNG should work with eBay to find a way to enforce their existing policies alienate a market segment.

In the press release from PNG, Executive Director Robert Brueggeman said, “Stay tuned for more exciting announcements over the coming year – this is only just the beginning. eBay is committed to working with PNG to grow the business of its member dealers.” I hope any follow up on this will be more thoughtful and consider the marketplace as a whole rather than sever a legitimate market.

Fun But Not That Challenging

While working on the second part to “How Are Coins Priced,” I wanted to let my readers know that not only am I still here, but still collecting. How can I stop? There are so many interesting things out there that even as I try to decide how to cut back, I am having a difficult time determining what to sell and keep!

But I found two keepers: challenge coins.

Officially, I am not a collector of challenge coins but have a few that were given to me as part of my work. The first one I received was from US-VISIT after giving a talk about privacy concerns to their employees. It was a great and unexpected gesture and the collector side of me appreciated receiving the challenge coin.

Last year, I participated in a company-internal conference on information security. My presentation discussed different aspect of web tracking technologies. It was based on research I performed for one of our clients trying to understand what was being said in the technical media so they could set policies to assure the public that the government was not tracking them. Although many of the technologies were known by my colleagues, it was one of the few times many of them have seen it discussed on one place. My talk was well received. Recently, the department that sponsored the conference sent certificates of appreciation and included a challenge coin in the envelope (pictured here). Because of my hobby, I was happier to receive the challenge coin than the certificate!

A few months ago I purchased the next challenge coin from the Naval Criminal Investigative Service (NCIS) European Field Office. I have not worked with NCIS nor have been investigated by them, but with the popularity of the show on CBS and the flags on the reverse, I thought it was an interesting coin. After trying to find out more information about the coin, I spoke with an NCIS investigator who worked in the Europe and Africa Field Office. I was told that the challenge coin was at least 15 years old since it has been that long since the NCIS reorganized offices and combined Europe and Africa into one office. My contact said that the reverse of the challenge coin was redesigned to remove the flags—which at the time represented where the support offices were located with the main field office in Italy. I learned a lot about NCIS from this person that does not make the television show that in their honor, I will add this challenge coin to my collection.

When I started working for this company 11 years ago, I did not think that one of the perks would be adding to my collection in this manner. Since I plan to continue to work there for a while, I hope to be honored to receive more challenge coins.

How Are Coins Priced (Part I)

Amongst the questions that are asked of me is what makes one coin worth more than another and why does one dealer charge more than others. The numismatic community was reminded that coin prices can vary based on a lot of conditions when a 1793 Chain Cent was auctioned for $1.38 Million at this year’s F.U.N. show in Orlando, Florida. In this article, I will discuss price and value of coins.

There is a difference between the “price” of a coin and its “value.” The “price” of the coin is what you pay when you buy the coin—sometimes called the retail price. The “value” of the coin is what a dealer will pay you for the coin—also called the wholesale price. Sometimes, the difference between the two concepts frustrates collectors who look at price guides as the price tag of a coin when it is a guideline. Dealers become frustrated because collectors fail to understand the business aspect of buying and selling coins. Hopefully, I can educate both sides.

Of all the factors that go into setting prices, the major consideration is supply and demand. While there are a lot of good definitions of the basic laws of supply and demand, in the numismatics industry the supply drives the price harder than the demand. This is because once a coin is minted, it is rare that they will be re-minted. There are exceptions to that rule, such as the 1804 silver dollar and 1942 Mexican Dos Pesos gold coin, but once the mintage period for those coins pass, no more will be struck.

Another factor that drives supply is how many of the coins survived the various melting and recalls that occurred over the years. While there have been many good educated guesses as to how many coins have survived, the only definitive answer are the population reports from the grading services. But those reports may not be accurate because of the number of people who crack the slabs and resubmit the coins hoping they receive a higher grade without reporting this to the grading services.

Supply factors do not apply to the bullion market. Coins minted strictly for their metal content, such as the American Eagles, are usually not affect by the supply. Of course there are exceptions that include the coins associated with American Eagle Anniversary Sets.

Although supply is a significant issue, demand should not be underestimated. The demand is determined by how many of us collectors want to purchase a particular coin. The easiest way to envision how demand drives up the price is to take the classic 1909-S VDB Lincoln Cent. With 484,000 struck by the branch mint in San Francisco, it is the key to completing a Lincoln Cent collection making the demand higher than almost any other coin in the over 100 year old series. Since the supply remains unchanged but the demand increases with the number of new collectors entering the hobby or as collectors could afford a coin, it leads to a higher price.

Whenever supply and demand is explained to a new collector, they pull out their favorite reference book and point out that the 1914-D Lincoln Cent is worth more than the 1931-S Lincoln Cent even though more 1914-D cents were produced. That is when I bring up the third factor that determines price and value: state of preservation, or as many collectors call it, the coin’s grade.

Coin grading is one of those topics you do not want to bring up in polite company because the differences in opinions are akin to religious discussions—not only is everyone wrong, everyone is right. In other words, contrary to what many are lead to believe there are no right answers. After all, the two top grading services cannot agree amongst themselves. This is why the rest of this article will not discuss grading but use the concept as a relative term.

The higher grade of a coin, the better the state of preservation. The better the state of preservation, the more desirable the coin. Thus, it could be said that the state of preservation decreases the supply. Even if the demand remains the same, when the supply decreases the value increases. In the case of the 1914-D Lincoln Cent, the issue is that the coin did not feature a sharp strike as other coins and finding problem-free coins are difficult. Because the economy of 1914 was not strong, not only was the need to strike new coins were reduced, but citizens were more likely to spend their coins rather than save them. With the weak strike and heavy circulation, the actual supply of desirable collector coins is much lower than its mintage figures suggest.

Although there were fewer 1931-S cents struck (886,000 versus 1.193 million for the 1914-D cent), there are more 1931-S coins that were well struck resulting more desirable coins survived. Although 1931 was near the beginning of The Great Depression, enough coins were produced in the 1920s that the many 1931 coins were spared heavy circulation. In short, the supply of desirable collector coins is closer to its mintage than that of the 1914-S.

State of preservation also considers environmental factors of the coin. Using the copper cents as an example, a cent that still has its red luster as if it came right out of the Mint’s presses is worth more than a similar coin that has tarnished to a red-brown or even dark brown color. Because it is difficult to prevent copper from oxidizing, the number of copper coins (pre-1982) that still have their red color is far less than others lowering the supply for a high demand item. As the coin oxidizes, it joins a larger supply of others and lowers the value.

Similar to the red-to-brown oxidation of copper coins is toning on silver coins. Toning describes the result of the natural oxidation process of the silver-copper or gold-copper alloy used to strike older coins that create a tarnish or patina on the coins. The nature of the alloy can create very colorful toning on the surface of a coin making it more desirable to collectors. The condition that creates toned coins vary and not every coin becomes toned leaving a smaller supply. However, collecting toned coins is a matter of taste which reduces the demand for these coins and lower the expected price of a coin in a smaller supply.

Coins made of precious metals such as gold, silver, or platinum, at a minimum, will be worth the intrinsic value of the metals used in its manufacture. For example, a Morgan dollar was made with an alloy of 90-percent silver, 10-percent copper, and weighs 26.73 grams. Thus, a Morgan dollar contains 24.057 grams of silver and 2.673 grams of copper. Using the current price of silver and copper, known as the spot price, of the metals ($28.81 per troy ounce for silver and $3.3836 per pound of copper), the value of the metals in the Morgan dollar, called the melt value, is $22.30. You should never expect to pay less than the melt value for any coin even for the most common coins. If you find someone who will sell you coins for less than the melt value then please contact me—I am always in the market for a bargain!

Starting in 1965, the United States changed the composition of its coins because the spot price of silver was making the coin’s melt values worth more than their face value. Silver was replaced with a copper-nickel alloy that is still in use today. However, the Kennedy Half Dollars struck from 1965 through 1970 were struck using an alloy that contained 40-percent silver. Also, the U.S. Mint has continued to strike commemorative coins and special sets using silver and gold. These coins use the traditional alloy of 90-percent silver or gold along with 10-percent copper. They were not struck for circulation and are valued in much the same way as circulating coins.

Up until 1982, the Lincoln Cent was struck using an alloy of 95-percent copper and 5-percent zinc weighing 3.11 grams. In 1982, the law was changed to allow the U.S. Mint to strike Lincoln Cents on a copper-coated zinc planchet. The coin is 99.2-percent zinc with .8-percent copper weighing in at 2.50 grams. Since the change occurred in the middle of the year, the U.S. Mint struck coins of both types. Specially packaged sets of these Lincoln Cents are in high supply with a low demand translating into an affordable collectible.

To learn more about the melt values of various U.S. and Canadian coins, you should read the information at coinflation.com.

Artificial factors are those that usually detract from a coin’s value. Coins that have been cleaned, doctored, tooled, dipped, whizzed, polished, or any other way that someone can use in an attempt to make the coins better will lessen the coin’s value. At one time, it was acceptable to clean and polish coins to make them look better. One method that was once acceptable to preserve the red color of copper cents was to use clear shellack to coat the coins. Do not clean, polish, scratch, or try to make your coin look better. If the coin has an issue that is not a permanent problem with a coin, you may want to consult a company like Numismatic Conservation Service to find out of professional conservation could save a coin that may have been damaged by accident.

Not only will altering a coin to make a common coin look like a rare coin lower the coin’s value, it is also illegal. Changing mint marks, dates, using a tool to make the coin look like another variety—usually with Morgan Dollars—will make the coin worthless and if you try to sell it as genuine will genuinely land you in jail.

Buffalo Nickels and the Standing Liberty Quarter Dollar were coins whose design did not wear well in circulation. On the Buffalo Nickel, the date was easily worn from the coin. Some people take dateless coin and use a special acid to determine what the date was on the coin. Acid can also be used on the reverse of the 1913 Type 1 Buffalo Nickels to show a mint mark that might have been on the mound the buffalo is standing on. These are known as “acid coins.” Both Buffalo Nickels and Standing Liberty Quarters can be enhanced using engraving tools. These altered coins are worth much less than their counterparts with original, non-altered, surfaces.

Tooling for altered surfaces can have value in certain circumstances. One of these collectibles are Hobo Nickels. The Hobo Nickel is an art for where the surface of a small denomination coin is carved to create a mini work of art. The nickel was the popular coin for its low cost and the softness of the metal. This art form became popular during The Great Depression when Hobos would carve designs in these coins and sell them in order to earn money. Hobo Nickels vary in value depending on the aesthetic value of the artwork and the artist. Two artists of the 1930s, Bertram Wiegand, known as Bert, was the first great Hobo Nickel artist. His student, George Washington Hughes, known as Bo, have both carved Hobo Nickels that have sold for prices equivalent to semi-key date coins.

Another type of tooled coin is a Love Token. The artist who creates a Love Token takes a coin, smooths one side and hand engraves a design. Many of the designs are an expression of love and given to a woman by her suitor. Love Tokens were more popular in the mid 19th century and mostly engraved on Seated Liberty Dimes, although other coins were used. After engraving, holes were punched in the coin or loops added to it in order to turn the new art work into jewelry. Prices vary with the type of material used and the quality of the artwork.

If you are not yet confused, then let’s take a new look at toning. When toning is natural or created accidentally over the years because of environmental factors, these coins are called “naturally toned” and desirable to some collectors. However, natural toning can have detrimental effects such as toning that occurs on coins because they were improperly stored. “Album toning” occurs when the coin is store in an old album that may be made of an acid-based paper that has leached chemicals on the coin. Verdigris is the green “toning” that appears on any coin containing copper that came from being stored in or near plastic that was made with chemical softeners such as polyvinyl chloride (PVC). Toning from improper storage can be ugly and not desirable which will lower the coin’s value.

Those who collect toned coins like the rainbow of colors. However, it is possible for coins to be artificially toned and made to look as if it was naturally toned. Determining the difference between naturally and artificially toned coins can cause an argument whose passion rivals that of a religious debate. Naturally toned coins are worth more to toned coin collectors than artificially toned coins, if you can tell the difference between the two.

If you dig further into pricing and exceptions of various numismatic items, determining price can be even more confusing. One area I did not discuss is paper currency, which is never worth less than face value. And this is only half the story. In the next installment, the discussion will look at how this information determines “price” and “value” when you visit a show or a coin dealer.