Jul 22, 2022 | ANA, commentary

Earlier this month, the ANA emailed members to join the “Crowdfunding Drive to Improve Our Online Technology.” The email admitted the “pandemic taught us a lot about the importance of online learning and communication.” Thus, money is needed to “make much-needed website improvements to allow the ANA to take advantage of current technologies, resulting in a better online experience for ANA members and the collecting community.”

Earlier this month, the ANA emailed members to join the “Crowdfunding Drive to Improve Our Online Technology.” The email admitted the “pandemic taught us a lot about the importance of online learning and communication.” Thus, money is needed to “make much-needed website improvements to allow the ANA to take advantage of current technologies, resulting in a better online experience for ANA members and the collecting community.”

The email says that an anonymous donor will match all gifts.

I support this effort to raise funds to improve the ANA’s technology. I urge all members to

donate. Please go to

info.money.org/techfund and donate!

I also thank the anonymous donor. I raise my coffee cup to you, and that’s a high honor from a coffee addict!

The ANA should not be in this situation. While there were failures before the pandemic put the ANA on the path to this failure, President Steve Ellsworth cemented the ANA’s fate because his bravado and ego got in the way of effectively running this organization.

Ellsworth dismissed the Technology Committee Chairperson in October 2019, and he did not replace the chair before the pandemic precautions caused the world to shut down. Ellsworth assigned Ron Oberth to work on ANA technology, who had no background in technology, and came up with unimaginative solutions and put the ANA behind other organizations who learned from the pandemic.

Although Ellsworth is out of office, he continues to be an ex-officio member of the Board of Governors. President Ron Ross has not demonstrated an understanding of the issue. Sources say that the loudest voice in the room is influencing Ross and that loudest voice belongs to Governor Ron Oberth. Oberth runs a successful numismatic company, but he does not know or understand technology, nor is he experienced in education that should guide the technology.

Ross and Oberth have not asked the ANA community to help. While they have listened to the ANA Headquarters staff, they have not listened to any other advisors with the experience necessary to lead the ANA into the future.

In other words, Ross and Oberth turned the Board of Governors into an insular club, and the rest of the membership was not welcome.

Both will deny their responsibility for the failures and ignore calls for their resignation. What you can do as a member is donate to the fund and add a note that the donation is conditional on the ANA assigning an independent committee to oversee the future of the technology policy. It was the model used by Presidents Walt Ostromecki, Jeff Garrett, and Gary Adkins to modernize the ANA technology infrastructure, and it should be the model in the future.

Jun 20, 2022 | administrative, commentary, news

Now is the time for all exhausted people to take a necessary vacation. If you are tired of the pandemic, need a breather, worked your behind off, and have not taken a break, it is time you take a break.

Disconnect from the world and go away. Rent a boat and go out into the middle of the ocean and enjoy the view. The sound of the boat’s engine and the wake it leaves behind is symbolic of washing away the cares and worries of the day.

Yes, I am on holiday and relaxing. It is time to get away and enjoy myself after starting a business and ensuring it survives through the pandemic. Change is coming but not before I recharge the batteries. Even after driving over 10 hours and spending two days away, I recommend going away to just relax. I know the price of gas is up along with everything else. Then go for one week instead of two. Leave for an extended weekend. Find a bed and breakfast of a lovely Airbnb somewhere and just go. Having a break is good for your mental health. And what good is collecting if your mind is scattered in the doldrums?

In the meantime, if I find anything fun in numismatics, I will let you know.

And now the news…

June 10, 2022

The American Women Quarters Program aims to celebrate and honor women who have made history in the US. This week, Wilma Mankiller was honored, and she will be featured on a limited quantity of US quarters. Mankiller was the first women to serve as principal chief of a major American Indian tribe.

→ Read more at

thehill.com

June 14, 2022

It is increasingly common to see various options on the Internet for collectible products, such as coins, action figures, artistic pieces and even banknotes that are currently in circulation in Mexico.

→ Read more at

california18.com

June 14, 2022

The new Bela Lyon Pratt Gallery of Numismatics at the Yale University Art Gallery showcases objects from the museum’s numismatics collections — rare and unique coins, medals, and paper money. The Circus Maximus, the stadium where Romans gathered by the tens of thousands to watch chariot races and other spectacles, had lap counters shaped like dolphins.

→ Read more at

news.yale.edu

June 19, 2022

It would undoubtedly be strange that among the coins most sought after by collectors, and therefore most appreciated, is the paltry 1 cent coin. Rare one-cent coin – Nanopress.it

→ Read more at

hardwoodparoxysm.com

May 26, 2022 | commentary, currency, policy

Changes to the Series 2013 $1 Note

For most of the 21st century, many groups have advocated for eliminating the $1 bill, while others provide a counterpoint to maintain the status quo. While the discussion of eliminating the note has economic and policy concerns that lawmakers must address, how would the U.S. government implement the policy?

The Federal Reserve Act of 1918 gives the Federal Reserve the authority to procure, distribute, and manage the nation’s currency supply. They must procure the paper money from the Treasury Department, but the Federal Reserve is required to tell Treasury how much money they need to print. But does the Fed determine which notes to print?

The law (12 U.S. Code § 418) says that the Treasury Department prints notes in “the denominations of $1, $2, $5, $10, $20, $50, $100, $500, $1,000, $5,000, $10,000 as may be required to supply the Federal Reserve banks.” The statement suggests that the Federal Reserve banks set the printing requirements. Does this mean that the Federal Reserve banks can tell Treasury that it no longer requires them to print the $1 note?

Series 1934 $1000 Federal Reserve Note

Although the denominations remain part of the law, the Federal Reserve Act gives the Federal Reserve latitude to manage the currency supply as it deems necessary. It was a policy enacted by the Treasury and Federal Reserve in tandem.

The agreement was not as easy as the history books want us to believe. In 1969, William McChesney “Bill” Martin was the Federal Reserve Chair. Martin was appointed by Harry S. Truman in 1951, fiercely guarded the Federal Reserve’s independence, and was known to push back against presidential policies with a minimalist approach to managing market factors. In the 1960s, Martin ran afoul of Lyndon Johnson and Richard Nixon for not doing more to help prevent a recession.

Following a meeting with Nixon in October 1969 about what his administration saw as an impending recession, Nixon announced that he would replace Martin when the Federal Reserve chair’s term expired on January 31, 1970.

It was not the first time the Federal Reserve changed United State currency without legislation. Since the formation of the Federal Reserve, the Federal Reserve authorized the printing of gold certificates, silver certificates, Legal Tender notes, Federal Reserve Banknotes, and the ongoing Federal Reserve Notes.

Before the formation of the Federal Reserve, the Treasury Department determined what currency to print and its design. Treasury Secretary Franklin MacVeagh proposed reducing the size of the currency paper in 1909. After years of study and discussion, Secretary Andrew Mellon approved new smaller designs issued in 1929. The change did not require new legislation.

Based on history, Treasury Secretary Janet Yellen and Chairman of the Federal Reserve Jerome Powell can decide to withdraw the $1 Federal Reserve Note from circulation. Powell can instruct the Federal Reserve Banks to stop issuing $1 bills and use the $1 coin instead. When the notes return to the Federal Reserve System, they can withdraw the notes and destroy them as they do with old currency.

Yellen can refuse by saying that she is following her boss’s policies, the President of the United States. But the Federal Reserve is an independent agency and does not have to ask for permission. By law, if the Federal Reserve does not order the printing of new $1 bills, the Bureau of Engraving and Printing will not print new currency.

Politics may prevent Yellen and Powell from making this decision, but they can do it and allow the United States to join the rest of the civilized world that no longer carries its unit currency in paper form.

May 8, 2022 | coins, commentary, news

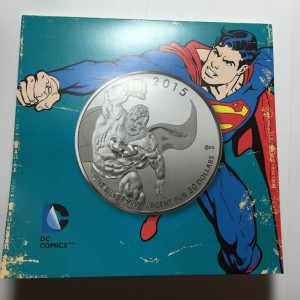

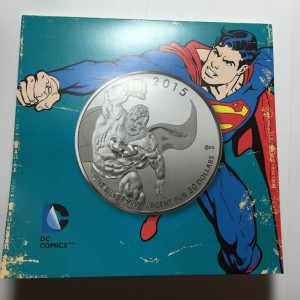

Reverse of the Royal Canadian Mint 2015 Superman $20 for $20 coin featuring “The Man of Steel”

After reading yesterday’s blog post, the comics dealer asked me how to become a coin dealer to sell comics-themed coins.

My reader knows that the comics industry is exploding and that the publishers are dabbling in non-fungible tokens (NFT) to see if they can extend the market. Those skeptical of the NFT market are looking for alternatives. A comics dealer that expanded to other publications, toys, and other collectibles understands that extending his market with coins will be profitable.

Walk into any hobby shop and see how every hobby has evolved. Comics, sports, and antiques have seen a rise in collecting, and all have seen the benefit of cross-collecting. A sports dealer is also selling comics and other collectibles with sports themes. Comics dealers are collectible cards and souvenirs from the ComicCons, the same as the sports dealers are selling game tickets.

Coin dealers extend their business into metals and jewelry, and their stores look the same as they did 10 years ago. The dealers may be making a living, but it is not expanding the hobby. But is it their job to expand the hobby or make a living? Unfortunately, this attitude is typical with the dealers trying to set ANA policy and is not helping the hobby’s growth.

And now the news…

May 4, 2022

The most successful artistic design of the Croatian national side of the €1 coin has been selected, the Croatian National Bank (HNB) said in a press release.

→ Read more at

croatiaweek.com

May 5, 2022

Found in Switzerland, some of the buried Roman coins were minted during a time of relative political stability, between 332 and 335 C.E.

→ Read more at

smithsonianmag.com

May 7, 2022 | coins, commentary

Cover with the 2015 $20 Canada Superman coin

Free Comic Book Day is more than an effort to get people into the stores to buy comics. The publisher will take the opportunity to tweak a story, start a new story arc, or introduce new characters. They spend a few pages in the free comic book to enhance their stories or introduce new characters. The free comic book may also have an existing story that can summarize the story to convince readers to start reading the series.

Free Comic Book Day is more than a giveaway day. It is a marketing tool for the story writers to interact with the readers and get them attracted to the stories. The publishers and store owners use the giveaway to keep current customers interested and lure in new customers.

Although the publishers will introduce many new stories and characters, almost 90-percent will not last more than a few issues. The publishers know this and are willing to try whatever it takes to ensure that the readers come back for more. Once the readers are hooked, the publishers extend the brand into movies and other collectibles where collectors can purchase the merchandise anywhere.

The comic book industry accomplishes more in one day than the numismatic industry accomplishes in one week. Considering how ubiquitous money is in society, It is any wonder that we can raise new collectors.

2016 Canada Batman v Superman: Dawn of Justice $20 silver coin

There is nothing wrong with comics and the comics culture. Comics readers love their characters, especially the superheroes, that they extend their buying beyond the comic book. Why not invite them into your shop to add comic book character coins to their collection.

You may not find coins with Superman, Batman, Captain America, or Spider-man exciting coins, but they are legal tender coins made of silver or gold that excite this crowd. Contact the publishers and see if you can source material to supplement the coins. It could create a partnership that could benefit both collectibles.

It might not be selling rare proof-like Morgans, but it will get people in your shop to look at your other inventory. Maybe they will see the Buffalo nickels and think those Type 1 coins are so cool that they might start a collection.

I have an idea… on Free Comic Book Day, the numismatic community can work with Marvel and DC to create a brass token that would be available to the collecting public. Some to the coin store, get the token for free. Let the publishers work on tokens and medals associated with their comics and sell them through coin stores. Then the coin stores can contact the New Zealand Mint or the Royal Canadian Mint to purchase a supply of comic book character coins and join the fun.

May 4, 2022 | ANA, commentary

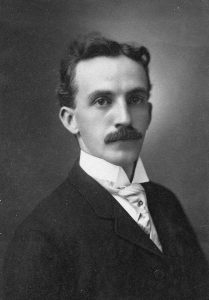

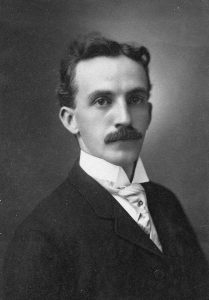

Faran Zerbe ca. 1908

In early 2021, the Board voted to remove Faran Zerbe’s name from the award based on unproven accusations. Based on the Board’s statement, they accused Zerbe of “hucksterism and fraud” for a collectible created in 1904 for the Louisiana Purchase Expo. However, contemporary accounts do not support this accusation, and Zerbe went on to serve as head numismatist for the expositions in 1905 (Portland) and 1915 (San Francisco).

The Board also accused Zerbe of “unscrupulously obtained personal ownership of The Numismatist in 1908 from relatives of the ANA’s late founder, Dr. George F. Heath.” Their statement even said it was an “allegation” and has never provided documentation to confirm their allegations.

It is difficult to argue against creating an award for Chet Krause, and his work and dedication to the ANA and the hobby deserve an honor. But honoring Krause should NOT diminish the contribution of Zerbe, and the ANA should have created a separate award or renamed the award the Zerbe-Krause Distinguished Service Award.

Instead of joining the politically correct “woke” crowd, the ANA Board of Governors should be working on ways to expand the association’s reach and impact. There is so much the Board can do to better the ANA than play these games.

Mar 11, 2022 | ANA, commentary, shows, video

ANA President Dr. Ralph Ross opening the 2022 National Money Show (video screen capture)

Colorado Springs is the home of the ANA’s headquarters, and it is about 75 miles south of Denver. Colorado Springs is also the home of the United States Air Force Academy. It is a nice place, and planning a visit should be on anyone’s destination list.

While it is nice that the National Money Show is in Colorado Springs, other cities could hold the show. The ANA refuses to consider holding any show in Washington, DC.

Regulations by the city’s government and the city council’s unresponsiveness to address the issues prevented the ANA from considering Washington for one of their shows.

Times have changed.

Since Larry Shepherd stuck the ANA with keeping the World’s Fair of Money in the Chicago area, Washington has new facilities to host the ANA shows.

Even though Washington is the home of the U.S. Mint, the Bureau of Engraving and Printing, and the Smithsonian National History Museum, where the National Numismatic Collection is located, the ANA cannot get past the memories of past problems to explore new opportunities.

The problem was driven home by Larry Shepherd, who said on an episode of the Coin World Podcast that Washington cannot hold an ANA show. Shepherd, who probably has not been to Washington since being dismissed as the ANA’s executive director, has no clue how his pronouncement is wrong.

The ANA can hold either show at the National Harbor, a development outside the Beltway in Oxon Hill, Maryland. Aside from being the location of an MGM Grand Hotel, the 2,000 room Gaylord National Resort & Convention Center can comfortably host the ANA.

But people like Larry Shepherd do not keep up with the present and do not know about National Harbor. Instead, they isolate themselves in their prejudices and ignorantly dismiss the ideas.

The Washington region can be a destination for collectors and their families. After all, Washington is the nation’s capital. Come for the show, stay for the history. Bring the kids. We can go to the Smithsonian American Art Museum to see the art of the artists who designed U.S. coins. Tour the city to see the statues by some of those same artists.

What if the ANA worked with the Smithsonian Institute to create exhibits around the coins and the history they represent. How fascinating will it be to take the Native American Dollar program and create a program to expand on their message at the National Museum of the American Indian?

Even though the Bureau of Engraving and Printing has brought interesting items to other shows, they can host special tours in their Washington printing center for ANA members.

When it is time to visit the bourse, it will be in the expansive convention center at the Gaylord Hotel. After the bourse closes, convention-goers can stay in National Harbor to have a good time, including a ride on the Capital Wheel overlooking the Potomac River.

Since National Harbor is in Maryland, the sales tax laws favor bringing all of the shows to the area.

Maybe Larry Shepherd is right. All Washington could do is add new educational opportunities and create family fun to increase the show’s attendance. It is not the direction it appears the ANA wants to go.

Opening Ceremony at the 2022 National Money Show in Colorado Springs

Feb 15, 2022 | ANA, coins, commentary, scams

There was once a time that the American Numismatic Association worked with stakeholders to protect numismatic buyers. The ANA worked with eBay to create marketplace protection rules. They were involved with helping raise awareness to gain the passage of the Collectible Coin Protection Act. But where has the ANA been over the last eight years?

There was once a time that the American Numismatic Association worked with stakeholders to protect numismatic buyers. The ANA worked with eBay to create marketplace protection rules. They were involved with helping raise awareness to gain the passage of the Collectible Coin Protection Act. But where has the ANA been over the last eight years?

Since the passage of the Collectible Coin Protection Act 2014, the ANA has been silent on all aspects of counterfeit coins entering the United States, primarily from China. In the past, the ANA has partnered with China Gold Coin to manufacture Panda silver coins with the ANA logo for the World’s Fair of Money. China Gold Coin is a People’s Bank of China subsidiary that manufactures the Panda bullion coins.

According to the ANA’s website, its mission statement begins:

The American Numismatic Association is a nonprofit educational organization dedicated to educating and encouraging people to study and collect money and related items.

The education process has been lacking in the area of consumer awareness. While some of the topics are covered in their introductory collecting course, are no courses, statements, or seminars about the scams collectors face daily.

Previously, the ANA has used its position as a national organization to work with eBay to make the online marketplace safer for buyers. It is impossible to eliminate all problems, but the result has been a safer marketplace for eBay buyers. It is a program that the ANA can proudly take credit.

But when it comes to Chinese counterfeits, the ANA has been silent.

The ANA must develop a plan to educate the public to help the collecting and investing public how to protect themselves against the scammers.

-

-

Two counterfeit American Silver Eagles purchased from LIACOO, a company based in China who advertised on Facebook.

-

-

The font for LIBERTY is too thin. Also, the stars in her flag draped over the shoulder are too small.

-

-

Aside from the rims being to thin, look at the U in United and the dash between SILVER and ONE. These are not correct for the 2020 ASE.

While the ANA devises a plan, they can produce videos that teach collectors to avoid scams. The videos can feature the ANA President, prominent dealers, collectors, and anyone who can help deliver a message. Find someone who was scammed to talk about their experience. Two videos can include a guide to examining an American Silver Eagle to determine if it is a counterfeit coin.

The ANA must advertise the release of the videos nationally. While the numismatic press will promote these videos, the promotion must appear in the non-numismatic media. The promotion must go beyond the press release, and Spokespeople must be made available to media outlets catering to a broader audience.

The ANA can craft a plan to educate the collecting and investing public during the video production to protect against counterfeit coins. The plan must continue to educate the collecting public and educate law enforcement and politicians who can become involved with a scammed collector. The ANA can partner with the U.S. Mint, Bureau of Engraving and Printing, and the U.S. Secret Service to add depth to the public education program.

A plan must include working with Facebook to eliminate advertisements for counterfeit coins.

If the ANA Board of Governors does not know where to begin, consider the Ad Council’s campaign criteria to develop a plan. Even if the ANA cannot convince the Ad Council to work with the ANA, they are successful guidelines to publicize this issue.

Jan 16, 2022 | coins, commentary, news

The deaths of Harvey G. Stack and Muriel Eymery and other events in my life have me thinking about our legacy on the hobby. All of us will leave a legacy, and whether it is with our family or the hobby in general, sometimes we need to take stock in what that legacy will be.

Although they were of different ages, Stack and Eymery had similar philosophies. Both wanted to bring advancement to the hobby by expanding what people collected. Stack was one of the people who advocated for the 50 State Quarters program, and Eymery was an advocate for international collecting for collectors from all over the world.

It was not enough for both to look beyond their primary interests. Stack could have made a good living from his New York City store selling rare coins, holding auctions, and serving a high-end community without being involved in areas that would help the average collector. Eymery took her passion and made a career in several countries, including the United States and Hong Kong. She became an ANA Governor overcoming xenophobia because she spoke with an accent even though she was a U.S. citizen.

Both stepped beyond their comfort zone to help the hobby and should be role models for all of us. Stack and Eymery went beyond their self-interests to grow the hobby. They had their business interests, but they could think beyond an alleged correct way to collect for the sake of the hobby.

What will your legacy be? Are you going to leave the hobby static or grow it by creating a legacy that collecting is fun and does not have to be limited by plastic-encased coins or printed albums? Or will you embrace everything that the hobby offers, including areas you do not collect?

For the memory of Harvey Stack and Muriel Eymery, we should commit to leaving a legacy of progress and inclusion in the hobby that all of us want to grow and thrive.

And now the news…

January 11, 2022

Famous author and noted civil rights leader Maya Angelou became the first African American woman featured on the 25-cent coin. The U.S. Mint began shipping the quarters on January 10. Reportedly, the Angelou coin is the first in a series designed to celebrate the accomplishments of American women.

→ Read more at

spokesman-recorder.com

January 13, 2022

A coin collector shows the commemorative coin, released by the Colombian Central Bank, to celebrate the 200th anniversary of Colombian independence.

→ Read more at

marketwatch.com

January 14, 2022

Being called “two-faced” by someone today would most likely “breed a quarrel,” as the old saying goes. However, if one were to go back just two centuries to classical Rome, that same depiction might elicit a very different response.

→ Read more at

theday.com

January 14, 2022

A hoard of 337 silver Roman coins, discovered in a field, have been declared as treasure.

→ Read more at

bbc.com

January 14, 2022

A badger has led archaeologists to a hoard of more than 200 Roman coins that had been hidden in a cave in Spain for centuries. The animal had burrowed into a crack in the rock inside the La Cuesta cave in the Asturias region of northwest Spain, and dug out coins that were later discovered by a local man, Roberto García, according to a paper on the find published in December.

→ Read more at

cnn.com

Dec 28, 2021 | auction, coins, commentary, news, shows, US Mint

The last two years have been a wild ride. Anyone who predicted what would have happened should be picking lottery numbers. For the rest of us, the predictable (i.e., the U.S. Mint) became unpredictable. The positives had a lot of negatives and what used to be extraordinary is now ordinary.

Without further ado, here are the top five numismatic stories for 2021.

5. Return of the coins shows

It isn’t easy to have any retrospective of 2021 without acknowledging how COVID-19 has affected the industry. At the beginning of 2021, there were cancelations of shows and other events. As the vaccines became more available and the infection rates declined, the shows returned.

It isn’t easy to have any retrospective of 2021 without acknowledging how COVID-19 has affected the industry. At the beginning of 2021, there were cancelations of shows and other events. As the vaccines became more available and the infection rates declined, the shows returned.

Smaller shows found hotels willing to lease larger rooms to allow the setup of a socially distance bourse. Like the World’s Fair of Money, Larger shows changed to provide for social distancing and limiting contact. Collectors that attended these shows called them a success. Still, the reports may be more emotional satisfaction after a year off.

Coins shows are adapting to an alleged new normal, and collectors are happy to get what they can. While it makes collectors happy, the looming threat of new variants may slow down the shows at the start of 2022.

4. The Positives and Negatives of the U.S. Mint

Ventris Gibson, Acting Director of the U.S. Mint (LinkedIn photograph)

Even with the COVID issues, the U.S. Mint could produce the coins required by law, including the 2021 Morgan and Peace Dollars. Unfortunately, selling these coins revealed collectors’ frustrations with the U.S. Mint.

The U.S. Mint’s online order processing system may work without product release. Still, a major product release causes the system to fail. The product release was a perfect storm of a limited supply and a high collector demand. The result exposed how PFSWeb, the U.S. Mint’s contractor, created a system that could not handle the rush.

The U.S. Mint became more communicative with the numismatic press. During this communication, it was clear that Director David Ryder wanted to talk more about the successes. Unfortunately, the failures of the ordering system overshadowed any success. Ryder resigned as Director effective October 1, 2021.

The e-commerce system at the U.S. Mint is broken and needs to be replaced. Unfortunately, the open communications from the U.S. Mint indicate that they are planning to install a bandaid to cover up the system’s problems. Unless the U.S. Mint and PFSWeb make major changes to their online order system, the issues will continue into 2022.

3. 2021 Morgan and Peace Dollars

Numismatists know that 2021 marked the end of the Morgan Dollar series and the introduction of the Peace Dollar. Morgan Dollars may be the most collected coin in U.S. numismatics. The Peace Dollar was the coin promoted by former ANA President Faran Zerbe with support from the ANA. In 1921, the U.S. Mint produced both coins. What better way to celebrate the centennial is by creating tributes to both coins.

Numismatists know that 2021 marked the end of the Morgan Dollar series and the introduction of the Peace Dollar. Morgan Dollars may be the most collected coin in U.S. numismatics. The Peace Dollar was the coin promoted by former ANA President Faran Zerbe with support from the ANA. In 1921, the U.S. Mint produced both coins. What better way to celebrate the centennial is by creating tributes to both coins.

The tribute idea was popular by collectors suggesting that it would be a high-demand product. But the U.S. Mint found a way to destroy the movement. In a series of missteps, the U.S. Mint allowed its lawyers to restrict their ability to do its job. As a result, the U.S. Mint could not purchase enough planchets to satisfy collector demand.

It is difficult to call the program a success given its problems. But the coins were a sellout, and they continue to do well on the secondary market. The U.S. Mint announced that the program will continue in 2022, and hopefully, it will go better than the 2021 releases.

2. Million Dollar Coins No Longer a Surprise

1804 Class I Original Draped Bust dollar, PCGS Proof-68 and the finest known of its kind, acquired for a client by GreatCollections for $7.68 million. (Photo credit: Professional Coin Grading Service.)

The numismatic market is very active, and the price increase of significant rarities results from the active market. Although the market favors United States coins, the collectors extend their collections to coins made elsewhere. Of the ten-million-dollar coins sold in 2021, four were not U.S. coins.

Here are the coins that sold for more than $1 million in 2021:

Million Dollar Coin Sales in 2021

| Sale Price |

Coin Sold |

Date Sold |

| $18,900,000 |

1933 Saint-Gaudens Double Eagle (King Farouk provenance) |

June 8, 2021 |

| $9,360,000 |

1787 Brasher Doubloon – EB on Wing (ex: Stickney-Ellsworth-Garrett-Partrick) |

January 21, 2021 |

| $8,400,000 |

1822 Half Eagle (ex: Pogue) |

March 25, 2021 |

| $7,680,000 |

1804 Bust Dollar – Class I (one of 15 known) |

August 18, 2021 |

| $5,280,000 |

1804 $10 Proof Eagle (Finest of Three known) |

January 20, 2021 |

| $4,750,000 |

1907 Saint-Gaudens Ultra High Relief Double Eagle |

April 6, 2021 |

| $2,640,000 |

1825 Russia Ruble Pattern with would-be Emperor Constantine |

April 6, 2021 |

| $2,280,000 |

1928 China Pattern Dollar featuring the warlord Zhang Zuolin |

April 6, 2021 |

| $2,280,000 |

1937 Edward VIII 5 Pounds Pattern (one of six known) |

March 26, 2021 |

| $2,160,000 |

1928 China Pattern “Mukden Tiger” Dollar (one of ten known) |

December 11, 2021 |

1. The Double Eagle That Flies Higher

Farouk-Fenton 1933 Saint-Gaudens $20 Double Eagle was sold by Sotheby’s for $18,872,250 in a June 2021 auction. (Picture Credit: PCGS)

Since that sale, several coins sold for more.

On June 8, 2021, Sotheby’s auctioned the Stuart Weitzman Collection, including rare Inverted Jenny Plate Block and the British Guiana One-Cent Black on Magenta stamps. The coin sold for a record $18,872,250.

It answers the question, “What is a coin worth?” What are you willing to pay for it?

Earlier this month, the ANA emailed members to join the “Crowdfunding Drive to Improve Our Online Technology.” The email admitted the “pandemic taught us a lot about the importance of online learning and communication.” Thus, money is needed to “make much-needed website improvements to allow the ANA to take advantage of current technologies, resulting in a better online experience for ANA members and the collecting community.”

Earlier this month, the ANA emailed members to join the “Crowdfunding Drive to Improve Our Online Technology.” The email admitted the “pandemic taught us a lot about the importance of online learning and communication.” Thus, money is needed to “make much-needed website improvements to allow the ANA to take advantage of current technologies, resulting in a better online experience for ANA members and the collecting community.” → Read more at

→ Read more at