Still Trying to Figure Out the Pandemic Gold Market

In last Sunday’s Weekly World Numismatic News, it opened with a discussion about how gold and silver were doing in the current market. While researching the data, the indication was that physical bullion and electronic purchases were driving the markets. Bullion coins were not a factor.

In last Sunday’s Weekly World Numismatic News, it opened with a discussion about how gold and silver were doing in the current market. While researching the data, the indication was that physical bullion and electronic purchases were driving the markets. Bullion coins were not a factor.

On Monday, Bloomberg News published an article that suggested otherwise. The article notes that retail buyers of gold are paying up to $135 per ounce above spot prices. An analyst interview for the article said, “There has never been a time for American Gold Eagles at this premium level.”

A call to a trusted source explained the differences in the reporting.

Last year, gold hit a low of $1,269 per troy ounce. With good economic indicators, investors thought that the prices would continue to fall. The market did not see value in buying a declining asset. Sellers were hoarding their stock until prices became more favorable.

The lack of buying, especially by retail investors, left dealers with a lot of inventory. With inventory building, dealers did not buy additional coins from the U.S. Mint’s dealers. As the prices rose, sellers started to sell their gold coins adding to the inventory.

Then came the coronavirus pandemic.

Markets hate uncertainty. The coronavirus pandemic has made uncertainty the only certainty. Not knowing where to turn, many sources are reporting significant gold sales. Where the reports differ is the source of the gold.

Although sources confirm that physical bullion and warrants are producing the highest volumes, they say it is because the investors cannot find enough bullion coins to satisfy market demands. The markets adjusted.

The demand increased when the U.S. Mint temporarily closed the West Point Mint. While the reaction did not rise to panic-like levels, retail gold buyers sought bullion coins, primarily American Gold Eagles, with greater urgency.

Professional investors are buying bullion and other gold products, including classic United States gold coins. The retail demand for American Gold Eagle coins has driven up the price. As the price for Eagles rises, it has driven up the cost of other bullion coins, including the Canadian Maple Leaf and Krugerrand.

When considering the purchase of gold coins, keep the spread in mind. If you purchase gold coins with a $150 premium over spot, to ensure that your investment generates a return, the bid price has to raise $150 plus whatever premiums dealers place on the coins. It might require the price of gold to rise $200-255 per troy ounce to break even.

Investors thought that the supply would ease with the Royal Canadian Mint resuming processing of bullion. However, in the beginning, the Royal Canadian Mint will produce large gold bars to satisfy orders from central banks so they can settle on accounts. They will also be striking silver Maple Leaf bullion coins.

Some reports suggest that most of the early production of silver coins will stay in Canada.

After discussing the markets with three different analysts, the only certainty is uncertainty. Each had an opinion that differed from each other but agreed that someone is going to make money.

1099 Filing Requirement for Large Sales REPEALED

The White House announced that President Obama signed H.R. 4, Comprehensive 1099 Taxpayer Protection and Repayment of Exchange Subsidy Overpayments Act of 2011. This law eliminates the requirement to file Form 1099 for sales more than $600.

The Form 1099 filing requirement was seen as a serious burden for small businesses. Since the vast majority of numismatic dealers are small businesses, it would have create a serious problem for the entire industry. Now that it is law, the reduction in paperwork and the reduced burden on numismatic dealers and other small businesses should be a relief.

Attend An Online Beginners Seminar Next Tuesday

As part of my posts earlier this year about creating more electronic access for numismatic publications and resources, I wrote how the ANA could do more. This post was the reprinted in Numismatic News (with my permission). Apparently, someone decided that one of my suggestions was a good idea.

This past weekend, I received an email from Numismatic News inviting me to a free live, web-based seminar Beginning Coin Collecting presented by Numismatic News editor Dave Harper. When I clicked the link in the email, I was sent to a registration page at GoToMeeting.com. The seminar will be on Tuesday, April 19, 2011 starting at 4:00 PM until 5:00 PM EDT.

Harper has an easy style and tremendous knowledge that should make the seminar worth attending. Although I would like to attend, I may have a conflict that will prevent me. However, I urge those working on the conventions and in the education department at the American Numismatic Association to login and see how Dave handles the seminar. I hope it gives the ANA ideas as to how they can transform their education program into something that can be presented online.

Once again, I urge the ANA to look into broadcasting open meetings, board meetings, and Numismatic Theater presentations for anyone who wants to log in at the time of the event. It will be a great promotion for the organization.

I am still willing to volunteer my services as an ANA member and a computing professional to help bring the ANA into the 21st century!

Silver On The Rise

On January 28, 2011, the spot price for silver closed at $26.68 per troy ounce. That was almost $4 lower than it opened on January 4, the first trading day of the year. Since then, silver has climbed steadily to close at $40.22 on April 8. A rise that has seen the price of silver gain a bit more than 50-percent in value.

Some are wondering if the price of silver could hit the $48.70 it did in 1980 when the Hunt Brothers, Nelson and Herbert, tried to corner the silver market. Although the comparisons are interesting, it would only be a numeric record. Accounting for inflation, the actual value would be $130.80 in terms of 2011 dollar. For a true record, silver has a long way to go!

Since the economic downturn, there have been significant investment in gold pushing prices higher with it reaching a record of $1,469.50 per troy ounce as of Friday’s close. However, silver has remained relatively flat until this year. The one explanation that makes sense is that silver remains a good investment because it is undervalued as compared to gold—called the spread or ratio of silver to gold.

Historically, prior to the deregulation of markets, governments have fixed the spread around 15-to-1, meaning that the price would be set to where 15 ounces of silver would buy one ounce of gold. This changed during following deregulation of the markets. One analyst found that gold was over 100 times more expensive than silver but the price ratio never went below 41.51.

At the beginning of the year, a few analysts commented that silver was prime to rise because of the gold-to-silver ratio was very wide. Some suggested that the ratio should be closer to 25-to-1 even though it has never been lower than 41-to-1. However, as of Friday’s close, the ratio is now 36.29!

Some analysts believe that as the dollar falls in value, the prices of both gold and silver will rise. Projections see gold rising to anywhere from $1,500 to $1,600 per ounce. But because this price is high for some investors, silver looks like a better value and is expected to hit the $50 mark before the end of the year. Given its trend and the nature of the markets, it could reach $50 by the summer.

If you are not an investor but a collector of United States coins from prior to 1965, the value of your collection has been going up. Do you have American Gold Eagles? You might have noticed that some of your coins have more than doubled their original price, even for the one-tenth ounce. Remember when the first Gold Buffalo sold for $650? Now add a $200 premium to the gold spot price to find the current value.

Are you collecting dimes? Just the silver value of the dime is $2.96. Those Kennedy Half-Dollars that your father or grandfather saved from 1964 have $14.80 worth of silver. And those common date Peace Dollars (1922-23) that sold for $20-25 a year ago is now worth $31.65 in silver.

By the way, those 1965-1970 Kennedy Halves that are 40-percent silver contains $6.05 worth of silver.

The analysts who determine and publish the values of coins have been very busy!

I am not suggesting that anyone buy gold or silver as an investment—speak to your investment advisor before doing anything. I am looking at the situation from a collector’s point of view. The rise of prices makes my collection worth more when considering the bullion value and the numismatic premium. Maybe now is a good time to consider selling some of my collection—the parts I am less emotionally attached to—and start over again when metals prices drop. In any case, we certainly live in interesting times!

Money Manufacturing and the Looming Shutdown

If congress cannot settle on a budget to keep the federal government operating past midnight on Friday, April 8, the U.S. Mint and the Bureau of Engraving and Printing will continue to operate. Even though both agencies are bureaus under the Department of the Treasury, both are funded through their respective Public Enterprise Funds. The Public Enterprise Funds contains the seignorage (profits) made from the manufacture of the money.

Although Treasury Department has not made any official announcements, the U.S. Mint did send a note to their employees in February. U.S. Mint employees were told that “unless specifically instructed otherwise, United States Mint employees are required to report to work as usual even if there is a government-wide shutdown.”

Regardless of what the non-federal political leaders say, the Washington, D.C. area is a essentially a company town. In addition to the agencies based in the District, there is a significant federal presence in Maryand and Virginia that will impact the communities where they are located. A shutdown will affect the area as far north as Baltimore, Fredericksburg to the south, and many border towns in West Virginia that host “remote” federal facilities. This does not include the commercial contractors that provide support and services to many federal agencies. I saw one estimate that said 80-percent of the DC Metro Area would be affected by a government shutdown.

I know I am not objective on this subject because it is personal. Not only will a government shutdown hurt the economy of everyone in the region, but it can affect me personally. Since my current project is essential in the long term it is not essential for the short term operations of the government. This means I could be furloughed with my colleagues a lot of other people in a similar situation.

Television news shows us stories about the small towns that lost its mill, plant, or factory and its economy crashes. The stories are all the same, the facility closes and the small town of a few thousand is devastated—almost to the point of turning it into a ghost town. If that happened to an area with over 5.5 million people, what will be the economic impact to the entire nation?

While I agree that we need to fix the budget, get rid of government waste, and figure out how to get out of debt for the overall economic health of the nation, drastic measures are not the way to do it. Very few people can kick any habit “cold turkey” and neither can the government. It will just bring pain and suffering to the people who will not have the money manufactured by the U.S. Mint and BEP to circulate in the economy necessary to promote growth.

It Wasn’t Broke But The US Mint Fixed It Anyway

In May 1977, Bert Lance was the Director of the Office of Management and Budget under President Jimmy Carter. He was interviewed for Nation’s Business, the news letter for the U.S. Chamber of Commerce. Lance was quoted in the article saying:

Bert Lance believes he can save Uncle Sam billions if he can get the government to adopt a simple motto: “If it ain’t broke, don’t fix it.” He explains: “That’s the trouble with government: Fixing things that aren’t broken and not fixing things that are broken.”

Someone forgot to remind the U.S. Mint of Lance’s axiom.

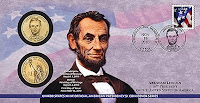

Last month, the U.S. Mint announced the availability of the availability of 2011 Andrew Johnson $1. I am a fan of the coin covers. I have the covers from the 50 State Quarters, D.C. & Territories, Westward Journey Nickels, and the 2000 Sacagawea Dollar covers. I also own the four covers produced by the U.S. Mint produced in the years leading to the American Revolution Bicentennial. However, I was reminded of Bert Lance when I saw the new cover.

Starting in 2007, the covers had a large image of the president being honored with the president’s name, term, and a postmarked current stamp. On the reverse is a short blurb about the president. Embedded in the cover are two uncirculated coins, one from Philadelphia and the other from Denver, from the first day the coins were struck. It is the only way to know on which date the coins were struck. The entire cover was beautiful in its simplicity.

Starting in 2007, the covers had a large image of the president being honored with the president’s name, term, and a postmarked current stamp. On the reverse is a short blurb about the president. Embedded in the cover are two uncirculated coins, one from Philadelphia and the other from Denver, from the first day the coins were struck. It is the only way to know on which date the coins were struck. The entire cover was beautiful in its simplicity.

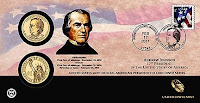

In trying to deal with its new branding, the U.S. Mint altered the cover that reduced the cover and added a black bar across the bottom of the cover. The black bar is empty except for a small version of the official U.S. Mint logo on the left and the new branding logo on the right. As a result, the portrait of the president is made smaller. The space taken up by that garish black bar causes the rest of the cover to look cluttered.

In trying to deal with its new branding, the U.S. Mint altered the cover that reduced the cover and added a black bar across the bottom of the cover. The black bar is empty except for a small version of the official U.S. Mint logo on the left and the new branding logo on the right. As a result, the portrait of the president is made smaller. The space taken up by that garish black bar causes the rest of the cover to look cluttered.

Rather than trying to find a more subtle way to add their branding to the cover, like on the reverse without the tacky black bar, the U.S. Mint broke one of their better presentations.

After this debacle, maybe the CCAC Blueprint Report should have added packaging design to the list of functions that should be reviewed!

Images courtesy of the U.S. Mint