Aug 1, 2021 | coins, markets, news

2021-W American Silver Eagle Type 1 Proof

The answer was not a response to the weather but the market. According to his partner, they had a difficult time stocking inventory. The number of buyers is outpacing the sellers a lot. The limited inventory is also impacting dealer-to-dealer transactions. The low supply and high demand are causing prices to rise.

Aside from the typical demand for collector coins, modern silver is in high demand. Anything made of silver is in high demand, that many dealers cannot find enough inventory.

One observation was that after silver, collectors are looking for something different. International coins are seeing increased interest. New collectors are discovering their past and are looking for coins that their grandparents may have used. One dealer said there is an increase in people looking for 20th-century coins from Eastern Europe.

Another area that is becoming popular is hometown collecting. A currency dealer said that collectors are asking about obsolete and national banknotes based on their location. After suggesting to speak with an exonumia dealer, I learned that new collectors are discovering transportation and other tokens from their hometowns or the hometown of their parents. The dealer told me that two young collectors almost cleaned out their inventory of Iowa tokens.

The lesson is that the market is hot, prices are rising, and new collectors are entering the market looking to have fun. It makes for a healthy

And now the news…

July 26, 2021

A collection of 80 copper staters discoverd by archeologists at the site of the ancient city of Phanagoria. Courtesy of the Russian Academy of Science’s Institute of Archaeology.

→ Read more at

news.artnet.com

July 27, 2021

Nikola Tesla, pioneer of alternating current electricity, might have been shocked to know how his legacy would cause a row between European states.

→ Read more at

bbc.com

July 28, 2021

Loose change was scarce last year. Retail and restaurant industries collected less cash from customers, so had fewer coins to deposit with their banks, while limited hours and new safety protocols at mints around the country slowed coin production.

→ Read more at

newyorker.com

July 29, 2021

SALT LAKE CITY — In February 1848, Isaac Chase stalled the vigorous swing of his pick at the sound of something metallic in a hole by a creek in what is now Liberty Park.

→ Read more at

ksl.com

July 30, 2021

The claim: Microwaving a penny for one minute will shrink the coin Most everyone knows some things are not meant to be microwaved, like metal for example. But some social media users are contradicting that, claiming microwaving a coin will shrink it.

→ Read more at

usatoday.com

July 31, 2021

Numismatics – more commonly known as coin collecting – is a time-honoured pastime that has grown in popularity over the years. Often dubbed ‘the hobby of kings’ due to only the very wealthy being able to enjoy the activity – the good news is coin collecting is now something that pretty much anyone can take a shine to, regardless of status.

→ Read more at

eadt.co.uk

If you like what you read, share, and show your support

Jul 4, 2021 | grading, markets, news

The week’s surprise news is that the Certified Collectibles Group (CCG), Numismatic Guarantee Corporation’s (NGC) parent company, sold a majority stake in its company to a private equity firm.

The week’s surprise news is that the Certified Collectibles Group (CCG), Numismatic Guarantee Corporation’s (NGC) parent company, sold a majority stake in its company to a private equity firm.

The report notes that the deal with The Blackstone Group was for more than $100 million and places CCG’s valuation at more than $500 million.

In November 2020, a group led by D1 Capital Partners purchased Collectors Universe, the parent company of Professional Coin Grading Service, for $700 million. D1 then took the company private in December.

Private equity firms (PEF) like The Blackstone Group and D1 Captial Partners work to bring together clients use the power of their capital and influence to invest in companies. They take over the companies with the intent of growing them and increasing their profits.

Although private equity firms will infuse the businesses with money, they are not known to do what is best for the industry they enter. They are strictly bottom-line focused. Companies purchased by a PEF have deteriorated because they paid too much for the company and have to pay off that debt and assume the liabilities of the company they purchases.

Another big problem with a PEF is the turnover of staff. The PEF will look to have its people run the businesses in a manner that may not sit well with current employees. When key executives start to leave, it is an indication that the shift in the business culture has begun.

Brett Charville is stepping down as president of PCGS.

The top two grading services owned by private equity firms question what will happen to the collecting hobbies? Will NGC continue its relationship with the ANA? Will the push for these companies to make more money cause a loosening of grading standards? Or will these firms now have the money to increase the use of technology to enhance the authentication process? Whatever is going to happen, the transition begins this summer and likely will not be felt until the end of the year.

And now the news…

July 1, 2021

Jocelyn Trent says reunited WW1 medals ‘ray of sunshine’ Peter Thorpe came across the medal when he was trying to build a greenhouse in his garden and needed to move soil to do so. He is now hoping that the relatives of the soldier will come forward, so that the heirloom can be in the hands of those who knew the man.

→ Read more at

express.co.uk

July 2, 2021

In another bellwether of the red-hot grading industry for coins, comics and sports cards, Sarasota’s Certified Collectibles Group is selling a majority stake in its company to private equity firm Blackstone in a deal that puts the company’s value at more than $500 million.

→ Read more at

news.yahoo.com

July 3, 2021

An Iraq War hero is selling his £140,000 gallantry medal so he can get on the property ladder.

→ Read more at

mirror.co.uk

July 3, 2021

Dupondius of Emperor Trajan showing a selection of military scenes. You can see Emperor Trajan in military uniform between two trophies.

→ Read more at

phys.org

If you like what you read, share, and show your support

Jun 29, 2021 | markets, news

It’s hot out there!

Yes, I know I’m late. But business has been so good that it has kept me very busy. I channel what I am seeing about the market into this article.

And I am not talking only about the weather.

And I am not talking only about the weather.

The collectors’ market is hot.

Buyers are buying all types of collectibles. Items that have not been selling well in the last 10 years are now selling for more than a few dollars. And there is no sign that it will stop soon.

If the collectible market is hot, then the numismatic market is like the weather in Pacific Northwest and Western Canada. The numismatic market appeared to hit a high on June 8, 2021, and it has not stopped. It seems that every few weeks, the numismatic press tells us about another rarity that sold for over $1 million.

Prices are also rising in the regular collectors’ market. Silver coins are selling for significant premiums over what the price guides publish. The premiums have become so big that the price guides are almost irrelevant.

The sensation extends to the entire numismatic market. People buying common coins of popular series are paying significant premiums for the coins like Lincoln Wheat Cents and Buffalo Nickels. Some are complaining that the market is becoming too expensive for the average collector.

It is a mixed feeling for sellers. While their profits are increasing and they can unload items sitting in their shops for years, they cannot find the inventory to sell. Dealers that know I work in the liquidation business have called to ask whether I can find coins. Of course, economists will remind me that when there is a high demand and low supply, the prices rise so that the Supply and Demand curves reach equilibrium. Then they will ask snarkily where I went to school!

As a seller, I love this market. It will help my company’s recovery from the pandemic. As a collector, I think I will concentrate on the less expensive series of interests. Although there’s a National Banknote worth about $1,500 that I have been looking at… (as he stares wistfully off into the distance).

And now the news…

June 23, 2021

TEHRAN – Iranian police forces have arrested a person suspected of smuggling ancient artifacts and recovered seven ancient coins. The lawbreaker was traced and finally arrested at his place in the city of Kashan after the authorities received reports from cultural heritage aficionados, Kashan tourism chief Mehran Sarmadian said, IRIB reported.

→ Read more at

tehrantimes.com

June 24, 2021

One of the most popular hobbies of children is collecting rare items such as coins, stamps, banknotes, and autographs. For some, coin collection may seem a boring and pointless activity, but for many, it is fascinating.

→ Read more at

theworldbeast.com

June 24, 2021

Canadian Muslims are getting used to Canada Post regularly issuing commemorative stamps for Eid. However, as yet, there has not been commemorative coins that reflect the presence of Muslims in Canada, despite commemorative coins being issued annually for other religious and cultural holidays of other diverse communities.

→ Read more at

muslimlink.ca

June 24, 2021

• The coronavirus pandemic has disrupted the availability of quarters, nickels, dimes, and pennies. • Unlike supply issues that have affected computer chips and lumber, there's no actual shortage of coins.

→ Read more at

businessinsider.com

June 26, 2021

Two rare coins which date from around the time of the Black Death have been declared treasure. An inquest was held at Norfolk Coroner's Court on Wednesday, July 23 into the 2019 discovery of a leopard coin and a noble coin in the Reepham area.

→ Read more at

northnorfolknews.co.uk

June 26, 2021

A collection of antique coins which date back almost 600 years has been donated to a County Armagh library due to their unusual link to the area.

→ Read more at

bbc.com

If you like what you read, share, and show your support

May 16, 2021 | coins, markets, news, silver

It has been a long 16-months. During that time, a virus caused a worldwide pandemic still being felt in much of the world. Thanks to science and the government removing barriers that slow the development process, the pharmaceutical industry found vaccines to reduce infection rates.

It has been a long 16-months. During that time, a virus caused a worldwide pandemic still being felt in much of the world. Thanks to science and the government removing barriers that slow the development process, the pharmaceutical industry found vaccines to reduce infection rates.

The increase in vaccinations and the reduction of infections has government easing restrictions that shut down the country for three months in 2020. As the restrictions ease, coin shows are appearing. Small shows have been running for a few months, but last week, the ANA announced the World’s Fair of Money would go on.

Over the last six months, hobby and other spending have dramatically increased. The demand for goods has outpaced the supply. Big-ticket items like housing and vehicles are experiencing low inventories as people leave their homes and spend money. I regularly pass a few used car lots on my way to work, and their inventory is the lowest I have seen.

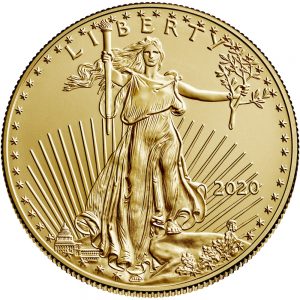

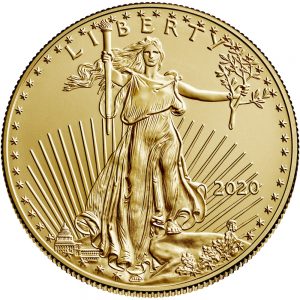

Numismatics is also seeing a surge. Even though analysts note that lower sales of bullion coins from last year, the demand for collector coins has caused prices to skyrocket. Services that monitor online markets say that the 2021-W American Silver Eagle Proof coin price is averaging $140-160 or 100-percent over their issue price.

Because silver is in high demand, dealers are charging high premiums over the spot price and sellout out of their inventory. When I recently looked at buying circulated coins whose value is tied to the silver spot price, the premiums were the highest that I have seen.

It has been a long time since silver coins were this popular. There is no telling how high this market will go with the expanding market for non-circulated legal tender (NCLT) and bullion coins drawing people into collecting.

And now the news…

May 10, 2021

What do ancient coins tell us about the Omer period and the time of the Bar-Kochba revolt, when the 49 days between Passover and Shavuot became associated with death and mourning? According to the Bible, the seven weeks between the two holidays referred to as ‘omer’ – a unit of measure which was used to quantify the amount of produce to offer as a sacrifice to God – was not meant to carry any specific connotation other than its agricultural meaning.

→ Read more at

jpost.com

May 11, 2021

An early pandemic problem that plagued businesses is back: not enough change to go around. Why it matters: The pandemic broke America's coin flow. It has repercussions for millions that rely on it for daily transactions.

→ Read more at

axios.com

May 13, 2021

If you like what you read, share, and show your support

Mar 8, 2021 | bullion, coins, gold, investment, markets, news, silver

Prices are rising.

Whether you talk about the price of groceries, gas, or collectibles, prices are rising. So are the price of the collectibles markets, including numismatics.

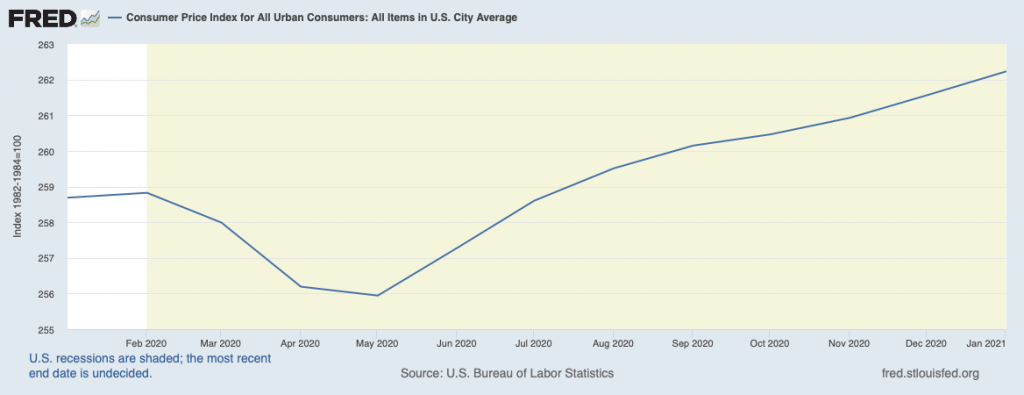

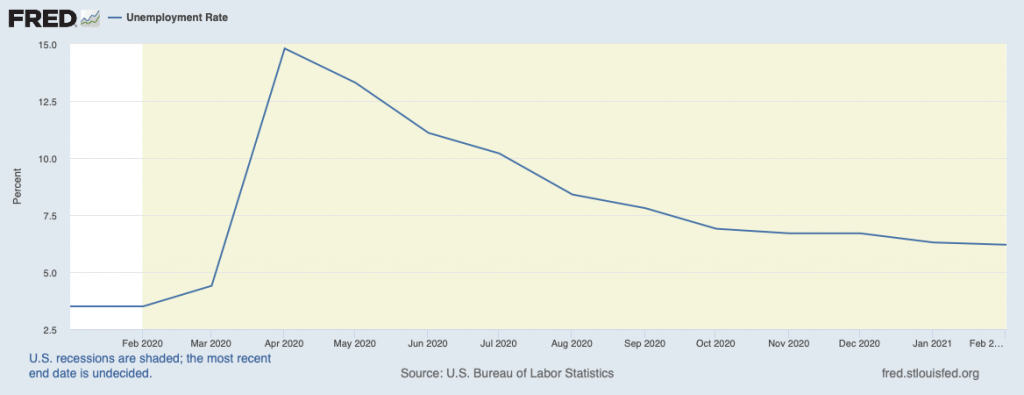

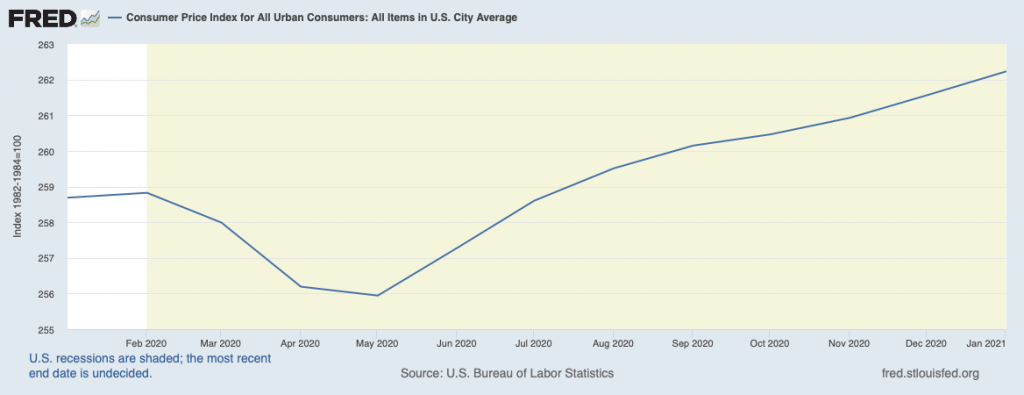

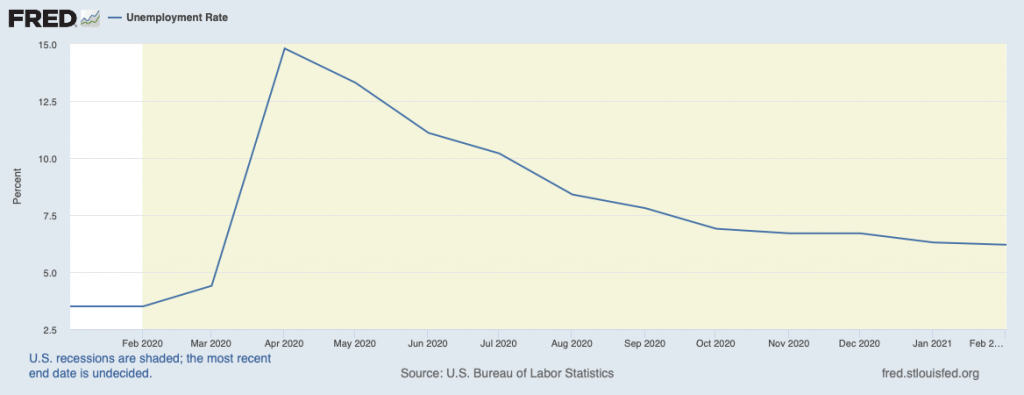

According to the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) has been steadily rising for six months. While the prices are rising, unemployment has dropped from the beginning of the pandemic high of 14-percent to the 6.2-percent rate, BLS recently announced.

-

-

Charting the Consumer Price Index during the pandemic

(Chart courtesy of the St. Louis Fed)

-

-

Charting the Unemployment rate during the pandemic

(Courtesy of the St. Louis Fed)

With all of this economic stress, why are collectibles, especially numismatics, are seeing rising prices?

An auction industry source said that there is a pent-up demand for something resembling normal. Instead of the everyday routine, those with means are buying. In the last six months, the industry reports that prices realized for all sectors have risen at rates higher than seen in many years. Estate auctions are attracting new customers looking for unique items.

Numismatics is in the middle of the trend, with collectors and investors looking for something to do. Collectors are spending more time with their collections and looking to expand. Investors see the rise in values because of the rise in precious metal prices and have driven the market higher.

-

-

One year gold spot price

(Graph courtesy of PCGS)

-

-

One year silver spot price

(Graph courtesy of PCGS)

One of the areas where the price changes are noticeable is in the markets for precious metals. While the spot price for gold and silver has been relatively steady, the numismatic spread for coins has climbed. Dealers are reporting that generic gold and silver for numismatic items increased over the last six months.

Price trends of coinage over the last year

(graphs courtesy of PCGS)

-

-

One year trend of generic gold coin prices

-

-

One year trend of Morgan and Peace Dollar prices

-

-

One year trend of 20th Century coin prices

Several industry reports note a higher demand for physical ownership of precious metals, putting pressure on the markets. But rather than buying bullion, investors are purchasing coins. Demand for American Eagle products has outpaced many dealer’s abilities to purchase supplies. When bullion coins were not available, investors purchase coins produced for the collector market, including proof and special issues coins.

Recently, the U.S. Mint set a 99 coin limit when they released the 2021-W American Silver Eagle Proof coin with the original reverse. The coin sold quickly. When asked, the U.S. Mint claimed they did not have the statistics about the number of 99 coin purchases they fulfilled. Collectors report that they were shut out of coin purchases while dealers have been slabbing and selling the coins mostly to investors.

If the predictions are true, economists believe that there will be a roaring 2020s similar to the roaring 1920s following the Spanish Flu Pandemic. Considering the current trends, the secondary market for numismatics may make it too expensive for the average collector to participate in the market.

And now the news…

March 1, 2021

Some artists struggle to figure out ways to make money from their art. Not Christina Hess, a Philadelphia-based artist and chair of the illustration department at Pennsylvania College of Art & Design.

→ Read more at

lancasteronline.com

March 2, 2021

Most people have some coins lying around in their house somewhere, some people decide to keep them in a jar, and some may have quite a lot of them.

→ Read more at

tweaktown.com

March 2, 2021

At least 110 ancient gold coins were seized and a suspect was arrested in an anti-smuggling operation in southeastern Turkey, a security source said on March 1. Gendarmerie teams fighting organized crime in Şanlıurfa province raided the address of the suspect, who was learned to be smuggling historical artifacts, in Viranşehir district, said the source on condition of anonymity due to restrictions on speaking to the media.

→ Read more at

hurriyetdailynews.com

March 5, 2021

There has been strong interest in the international numismatic auction planned for Friday March 12 in Central Wellington. From a midday start, there will be more than 600 lots to auction, with participants bidding both in the room and online.

→ Read more at

scoop.co.nz

March 6, 2021

Artist Gary Cooper of Belfast used a 3D sculpting computer program to create the winning design for the commemorative coin that will mark the 50th anniversary of the 1969 Apollo 11 mission. Credit: Abigail Curtis / BDN

→ Read more at

bangordailynews.com

If you like what you read, share, and show your support

Jan 10, 2021 | bullion, Eagles, gold, investment, markets, news, silver

The Weekly World Numismatic News return finds that although 2020 was a stressful year and 2021 has not started with a promise for improvement, the rare coin and paper money market appears healthy.

The Weekly World Numismatic News return finds that although 2020 was a stressful year and 2021 has not started with a promise for improvement, the rare coin and paper money market appears healthy.

Based on a survey of auction houses conducted by the Professional Numismatists Guild, they reported the total sales at auction to be over $419 million. With COVID-19 causing the cancellation of every major show, the auction moved online with success.

A consistent comment is that the auctions provided a means for collectors to liquidate all or parts of their collections to raise money during the pandemic. But for this type of sale to be effective, there have to be bidders to buy the coins. The buyers came.

HiBid, an online auction platform that supports many auction houses, has consistently reported weekly sales on the tens-of-millions of dollars. This year, HiBid reports that traffic to coins.hibid.com was their fastest growing platform.

Finally, with the stock markets soaring with the economic uncertainty growing because of the COVID-19 pandemic, the U.S. Mint saw the sale of American Eagle gold and silver coins increase dramatically. In 2020, the U.S. Mint sold 884,000 ounces of American Gold Eagle coins, increasing 455% from the 152,000 ounces sold in 2019.

The sale of American Silver Eagle coins doubled from last year by selling 30.01 million ounces of silver.

Since the U.S. Mint reports bullion coins more regularly than collector coin sales, those coins’ impact is not reflected in these numbers.

There are collectors out there. Unfortunately, they are not members of the American Numismatic Association or other numismatic organizations. Maybe the numismatic community should use this as a lesson to try to grow the hobby.

And now the news…

December 29, 2020

One face of the coin features a typical Cyberpunk 2077 scene with towering skyscrapers and hulking mega-structures looming over a souped-up motor vehicle. The coin’s flip side depicts a bust of Queen Elizabeth II, Press materials

→ Read more at

thefirstnews.com

January 4, 2021

Queen Elizabeth is just months away from a milestone birthday — and the U.K.'s Royal Mint is already celebrating. The Royal Mint unveiled five new commemorative coins for 2021, including a £5 coin to mark the monarch's 95th birthday in April.

→ Read more at

people.com

January 4, 2021

Kitco News has launched its 2021 Outlook, which offers the most comprehensive coverage of precious metals markets in the new year. Trillions of dollars were pumped into financial markets in 2020 and that won't come without consequences.

→ Read more at

kitco.com

January 4, 2021

A coin collection in a backroom of the Graveyard of the Atlantic Museum could one day reveal Outer Banks history

→ Read more at

pilotonline.com

January 8, 2021

With an alarming level of uncertainties across-the-board courtesy of the COVID-19 pandemic, coupled with a return to high market volatility and unprecedented global economic stimulus, investors are increasingly seeking alternative investment strategies.

→ Read more at

thearmchairtrader.com

If you like what you read, share, and show your support

Dec 20, 2020 | markets, news, shows

As 2020 rages to a close, the damage on the numismatic world will carry over in 2021. This week, the American Numismatic Association announced the National Money Show’s cancellation scheduled for March in Phoenix. Earlier in the week, the February Long Beach Expo was canceled.

As 2020 rages to a close, the damage on the numismatic world will carry over in 2021. This week, the American Numismatic Association announced the National Money Show’s cancellation scheduled for March in Phoenix. Earlier in the week, the February Long Beach Expo was canceled.

Previously, the January Florida United Numismatists (FUN) Show and the New York International Numismatic Convention. The Berlin Money Fair has canceled in-person events and will offer a virtual convention.

The U.S. Mint canceled coin launch ceremonies for the 2020 and 2021 America the Beautiful Quarters and American Innovation Dollars. Most are now virtual events.

The numismatic market appears strong based on the prices realized by the auction companies. With every auction company moving their auction online, many report better than expected returns from their auctions. Online auction services like eBay and HiBid report strong sales of numismatics across their platforms. Finally, the U.S. Mint is also boasting of enthusiastic demand, even with its online ordering system’s failures.

Other areas that are showing significant interest are where numismatics are including as part of other hobbies. The most significant growth is with the mints that are producing coins supporting the comic book industry. Some overseas observers report that sales of comic-themed coins produced by the New Zealand and Royal Australian Mints have shown increased sales as part of the holiday shopping season.

The numismatic industry appears to be doing very well. Too bad the numismatic organizations have not figured out a way to reinvent themselves to adapt to the current environment.

And now the news…

December 11, 2020

December 11, 2020

A design by student Ymen Riahi, who attends St Nicholas Middle School in Rabat, was chosen for the last of a series of five €2 coins from the ‘From Children in Solidarity’ programme. The €2 commemorative coin will be issued on 14 December 2020 by the Central Bank of Malta.

→ Read more at

newsbook.com.mt

December 14, 2020

Life as we know it may have ground to a halt in 2020, but treasure hunters appear to be going about business as usual. Witness the UK, where amateur archeologists have turned up thousands of gold coins and other antiquities since the start of the pandemic.

→ Read more at

robbreport.com

December 14, 2020

Half of all consumers believe that cash should be withdrawn from circulation in the next 10 years.

→ Read more at

irishexaminer.com

December 15, 2020

COLUMBUS, Ohio (AP) — A former deep-sea treasure hunter is about to mark his fifth year in jail for refusing to disclose the whereabouts of 500 missing coins made from gold found in an historic shipwreck.

→ Read more at

timesleaderonline.com

December 16, 2020

Berlin police raided homes and jewelry shops Wednesday on suspicion they could be connected to efforts to fence a massive 100-kilogram Canadian gold coin — piece by piece — that was stolen from a museum in the German capital.

→ Read more at

ctvnews.ca

Jun 15, 2020 | coins, markets, news

We sold this 1984 Mexico Libertad at auction for a nice premium above spot!

According to their survey, most of their readers report that collector coins are outselling all other categories and bringing in the best premiums. The best-sellers are modern bullion coins and Morgan dollars.

Modern bullion coins are not limited to American Eagles. Auction bidders are driving up the prices of Maple Leafs, Britannias, and Libertads. Collector bullion coins, like the American Eagle proofs and Pandas, have realized premiums beyond typical liquidation auctions.

Other categories that are experiencing a spike in sales are mixed lots. Mixed lots of silver U.S. coins are doing the best followed by lots with foreign coins. One dealer sold a lot of 20 holed English pennies for $2.50 per coin. These were coins from the reign of George V and early into Elizabeth II.

Since the readers of the newsletter I receive are dealers in the second-hand and liquidation markets, this is excellent news. The bad news is that it is becoming challenging to find inventory to resell.

And now the news…

June 5, 2020

A RARE Roman coin discovered in Colchester more than 40 years ago has sold for £4,000 after going under the hammer. Kevin Scillitoe found the coin, minted by the Emperor Carausius, when he was ten-years-old.

→ Read more at

harwichandmanningtreestandard.co.uk

June 7, 2020

Arizona history is rife with tales of hidden mines and buried treasure. Even today, those hoping to strike it rich head out with maps and shovels, despite tremendous odds against them. Scott Craven/The Republic

→ Read more at

lcsun-news.com

June 7, 2020

As shoppers and retailers do away with cash transactions, we may be witnessing the end of a major source of social and historical information – the coin. In the modern age, coinage is increasingly seen as cumbersome, a vector for disease and costly to manufacture.

→ Read more at

theconversation.com

June 8, 2020

Multiculturalism (tolerance) and the ability to unify large different ethnic groups living within the state’s boundaries are those distinct features which serve as the fundamentum for economic, military and cultural achievements of the Western civilization.

→ Read more at

georgiatoday.ge

May 24, 2020 | advice, bullion, markets, news

When talking about markets, the central theme is that investors hate instability. Whether the conversation is with the professional market maker or the individual investor, there is much uncertainty in the current marketplace.

When talking about markets, the central theme is that investors hate instability. Whether the conversation is with the professional market maker or the individual investor, there is much uncertainty in the current marketplace.

When equity markets become unstable, investors run to cash or cash equivalents. Cash equivalents include investments like bonds, especially those issued by stable governments. The other investment they run to is precious metals.

Gold is the primary safe-haven for investors. As a society, we have given this mineral an intrinsic value and trade it for a premium. With the panic of the U.S. Mint closing the West Point Mint for a short time, investors started buying platinum. The most popular form to purchase these metals is in coins where we saw the South African Platinum Elephant coins sell out its 2,000 coin production.

With the markets scrambling, it has opened up the door to scammers trying to cash in on the panic buying. Scammers use tactics like selling overpriced and overhyped coins, counterfeits, and not delivering coins after purchasing.

These scams are not new. Last year, the Accredited Precious Metals Dealer (APMD) program warned against scammers as the prices jumped. Unfortunately, the problem has only become worse.

Please do not fall for these scams. If you have any questions, contact a reputable dealer from the APMD, Professional Numismatists Guild (PNG), Industry Council for Tangible Assets (ICTA), or the American Numismatic Association dealer directories. You will be glad you did!

And now the news…

May 18, 2020

Nervous investors have been pouring into the gold and silver markets over the past two months. Money Metals Exchange is proud to have helped almost 20,000 new customers with a precious metals purchase in recent weeks, many of whom came over from other dealers struggling with inventory shortages and ridiculous delivery delays.

→ Read more at

fxstreet.com

May 19, 2020

While the covid-19 pandemic has had a negative effect on the platinum market — including price, demand and supply — results for Q1 2020 show the net effect is less than feared, and the outlook for 2020 is better than expected, according the latest quarterly report by the World Platinum Investment Council (WPIC).

→ Read more at

mining.com

May 21, 2020

Investors seeking a haven from the economic turmoil created by the coronavirus pandemic are snapping up platinum coins engraved with African wildlife.

→ Read more at

ca.finance.yahoo.com

May 22, 2020

Kakinada: Cyclonic storm Amphan may have caused heavy damage in parts of Odisha and West Bengal, but the rains it brought in its wake helped unearth a treasure trove of silver coins of British India era in a village in north coastal Andhra.

→ Read more at

timesofindia.indiatimes.com

May 10, 2020 | bullion, coins, Eagles, grading, markets, news, silver

Is it Sunday already?

Is it Sunday already?

This past week, the numismatic world was greeted with the news that the Philidelphia Mint struck a limited number of American Silver Eagle bullion coins to help fill the demand.

Most of the production of the American Silver Eagle bullion coins are in the West Point Mint. Sometimes, the San Francisco and Philadelphia Mints add capacity when necessary, with San Francisco being the priority. Since the West Point and San Francisco Mints temporarily closed because of the effects of COVID-19, Philadelphia picked up the slack.

The U.S. Mint produces all bullion coins without mintmarks. In most cases, it is impossible to tell which mint struck the coins. An exception is the 2015 (P) American Silver Eagles. Collectors and the grading services have been trying to figure out where the green monster boxes came from by examining the serial number and other clues. In 2015, Philadelphia struck just under 80,000 bullion coins. Those handling monster boxes noticed a difference in the packaging and quality.

According to the U.S. Mint, “Monster boxes of 2020 American Eagle Silver Bullion Coins minted in Philadelphia were affixed with a typed label containing the box tracking number; additionally, box tracking numbers were handwritten directly on the boxes. Box tracking numbers 400,000 through and including 400,479 were used on boxes of coins minted in Philadelphia.”

The 480 monster boxes translate into about 240,000 coins.

With that knowledge, the third-party grading services will add a special label noting that the coins were struck at Philidelphia only if the monster box sent for grading has the proper label and seal.

Of course, the price gougers are out in force. Most reputable companies are selling MS-70 graded “emergency” coins at around $250. That is about $200 over a “First Strike” or “Early Release” graded coins. One online seller is offering a pre-sale of the “emergency release” coins in MS-70 PCGS slabs with John Mercanti autographs for $595.

Coins graded MS-69 are selling for $75-80, which is $40-45 over other MS-69 graded coins.

Remember, if the listing says “pre-sale” it means that the seller does not have the coins in inventory.

And now the news…

May 6, 2020

With central banks spraying unprecedented amounts of printed money at the global economic system, it’s little wonder the gold price soared by 18% in the six weeks following the stockmarket meltdown. All the extra money sloshing around means the chances that consumer price inflation will take off and erode the value of your cash have risen sharply.

→ Read more at

theweek.co.uk

May 6, 2020

(Kitco News) – The last time the U.S. Mint sold this many platinum coins, President Bill Clinton was being tried by the U.S. Senate and Spongebob SquarePants was premiering on Nickelodeon. As of last month, the U.S. Mint said sales of the 1 oz platinum Eagle in 2020 reached 56,500 oz.

→ Read more at

kitco.com

May 8, 2020

A veritable gold mine of silver coins which had been hastily stashed inside a church in a ceramic jug hidden by a blind Polish priest over 300 years ago has been unearthed by workers removing rotting floorboards in the blind priest’s former church.

→ Read more at

thevintagenews.com

→ Read more at news.artnet.com

→ Read more at news.artnet.com

→ Read more at bbc.com

→ Read more at bbc.com

→ Read more at newyorker.com

→ Read more at newyorker.com

→ Read more at ksl.com

→ Read more at ksl.com

→ Read more at usatoday.com

→ Read more at usatoday.com

→ Read more at eadt.co.uk

→ Read more at eadt.co.uk

The week’s

The week’s