Aug 6, 2022 | coins, commemorative, legislative

World War II Memorial from the Washington Monument

The Greatest Generation Commemorative Coin Act (H.R. 1057) was introduced last year by Rep. Marcy Kaptur (D-OH) to create a 2024 commemorative coin to raise money to care for the World War II memorial in Washington, D.C.

The commemorative program will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits to 50,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars. The bill sets surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar.

If the program sells out, the Friends of the National World War II Memorial will receive $9.5 million for maintenance and educational purposes.

H.R. 1057: Greatest Generation Commemorative Coin Act

Summary: National World War II Memorial Commemorative Coin Act This bill directs the Department of the Treasury to mint and issue up to 50,000 $5 coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins in commemoration of the National World War II Memorial in the District of Columbia. The design of the coins shall be emblematic of the memorial and the service and sacrifice of American soldiers and civilians during World War II. All surcharges received from the sale of such coins shall be paid to the Friends of the National World War II Memorial to support the National Park Service in maintaining and repairing the memorial, and for educational and commemorative programs.

Introduced in House — Feb 15, 2021

Referred to the House Committee on Financial Services. — Feb 15, 2021

Sponsor introductory remarks on measure. (CR E134) — Feb 15, 2021

Ms. Waters moved to suspend the rules and pass the bill, as amended. — Jul 26, 2022

Considered under suspension of the rules. — Jul 26, 2022

DEBATE – The House proceeded with forty minutes of debate on H.R. 1057. — Jul 26, 2022

On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. — Jul 26, 2022

Passed/agreed to in House: On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. — Jul 26, 2022

Motion to reconsider laid on the table Agreed to without objection. — Jul 26, 2022

Received in the Senate, read twice, considered, read the third time, and passed without amendment by Voice Vote. — Jul 27, 2022

Passed/agreed to in Senate: Received in the Senate, read twice, considered, read the third time, and passed without amendment by Voice Vote. — Jul 27, 2022

Message on Senate action sent to the House. — Jul 28, 2022

Presented to President. — Aug 2, 2022

Signed by President. — Aug 3, 2022

Became Public Law No: 117-162. — Aug 3, 2022

Harriet Tubman Bicentennial Commemorative Coin Act (H.R. 1842) was introduced last year by Rep. Gregory Meeks (D-NY) to create a commemorative coin program to raise money to support museums remembering the legacy of Harriet Tubman.

The commemorative program will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits tp\o 50,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars. The bill sets surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar.

If the program sells out, the National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York, will receive $9.5 million ($4.625 million each) for maintenance and educational purposes.

H.R. 1842: Harriet Tubman Bicentennial Commemorative Coin Act

Summary: This bill directs the Department of the Treasury to mint and issue 50,000 $5 gold coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins emblematic of the legacy of Harriet Tubman as an abolitionist. The Secretary may issue coins under this bill only during the period of January 1, 2024, through December 31, 2024. All surcharges received by Treasury from the sale of such coins must be paid equally to the National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York, for the purpose of accomplishing and advancing their missions.

Introduced in House — Mar 11, 2021

Referred to the House Committee on Financial Services. — Mar 11, 2021

Ms. Waters moved to suspend the rules and pass the bill. — Jul 26, 2022

Considered under suspension of the rules. — Jul 26, 2022

DEBATE – The House proceeded with forty minutes of debate on H.R. 1842. — Jul 26, 2022

On motion to suspend the rules and pass the bill Agreed to by voice vote. — Jul 26, 2022

Passed/agreed to in House: On motion to suspend the rules and pass the bill Agreed to by voice vote. — Jul 26, 2022

Motion to reconsider laid on the table Agreed to without objection. — Jul 26, 2022

Received in the Senate, read twice, considered, read the third time, and passed without amendment by Voice Vote. — Jul 27, 2022

Passed/agreed to in Senate: Received in the Senate, read twice, considered, read the third time, and passed without amendment by Voice Vote. — Jul 27, 2022

Message on Senate action sent to the House. — Jul 28, 2022

Presented to President. — Aug 2, 2022

Signed by President. — Aug 3, 2022

Became Public Law No: 117-163. — Aug 3, 2022

These are the only two numismatic-related bills passed by the 117th Congress.

Aug 1, 2022 | coins, commemorative, legislative

A quick update:

A quick update:

The National World War II Memorial Commemorative Coin Act (H.R. 1057) and Harriet Tubman Bicentennial Commemorative Coin Act (H.R. 1842) passed the Senate on a voice vote. The next stop is the president’s desk.

- H.R. 1057: Greatest Generation Commemorative Coin Act

Sponsor: Rep. Marcy Kaptur (D-OH)

Summary: National World War II Memorial Commemorative Coin Act This bill directs the Department of the Treasury to mint and issue up to 50,000 $5 coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins in commemoration of the National World War II Memorial in the District of Columbia. The design of the coins shall be emblematic of the memorial and the service and sacrifice of American soldiers and civilians during World War II. All surcharges received from the sale of such coins shall be paid to the Friends of the National World War II Memorial to support the National Park Service in maintaining and repairing the memorial, and for educational and commemorative programs.

Passed the House of Representatives with amendments — Jul 26, 2022

Passed the Senate with amendments — Jul 27, 2022

LAST ACTION: Message on Senate action sent to the House. — Jul 28, 2022

- H.R. 1842: Harriet Tubman Bicentennial Commemorative Coin Act

Sponsor: Rep. Gregory W. Meeks (D-NY)

Summary: This bill directs the Department of the Treasury to mint and issue 50,000 $5 gold coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins emblematic of the legacy of Harriet Tubman as an abolitionist. The Secretary may issue coins under this bill only during the period of January 1, 2024, through December 31, 2024. All surcharges received by Treasury from the sale of such coins must be paid equally to the National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York, for the purpose of accomplishing and advancing their missions.

Passed the House of Representatives — Jul 26, 2022

Passed the Senate with amendments — Jul 27, 2022

LAST ACTION: Message on Senate action sent to the House. — Jul 28, 2022

Jul 29, 2022 | coins, commemorative, legislative

As part of the congressional charade of staying in session to prevent the appearance of adjournment, the House of Representatives cycled through some non-controversial legislation that included two that would authorize two 2024 commemorative coin programs.

As part of the congressional charade of staying in session to prevent the appearance of adjournment, the House of Representatives cycled through some non-controversial legislation that included two that would authorize two 2024 commemorative coin programs.

National World War II Memorial Commemorative Coin Act (H.R. 1057) was introduced last year by Rep. Marcy Kaptur (D-OH) to create a 2024 commemorative coin to raise money to care for the memorial.

If passed, the commemorative set will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits are 50,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars. The bill sets surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar.

If the program sells out, the Friends of the National World War II Memorial will receive $9.5 million for maintenance and educational purposes.

H.R. 1057: National World War II Memorial Commemorative Coin Act

Summary: This bill directs the Department of the Treasury to mint and issue up to 50,000 $5 coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins in commemoration of the National World War II Memorial in the District of Columbia. The design of the coins shall be emblematic of the memorial and the service and sacrifice of American soldiers and civilians during World War II. All surcharges received from the sale of such coins shall be paid to the Friends of the National World War II Memorial to support the National Park Service in maintaining and repairing the memorial, and for educational and commemorative programs.

Introduced in House — Feb 15, 2021

Referred to the House Committee on Financial Services. — Feb 15, 2021

Sponsor introductory remarks on measure. (CR E134) — Feb 15, 2021

Ms. Waters moved to suspend the rules and pass the bill, as amended. — Jul 26, 2022

Considered under suspension of the rules. — Jul 26, 2022

DEBATE – The House proceeded with forty minutes of debate on H.R. 1057. — Jul 26, 2022

On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. — Jul 26, 2022

Passed/agreed to in House: On motion to suspend the rules and pass the bill, as amended Agreed to by voice vote. — Jul 26, 2022

Motion to reconsider laid on the table Agreed to without objection. — Jul 26, 2022

Harriet Tubman Bicentennial Commemorative Coin Act (H.R. 1842) was introduced last year by Rep. Gregory Meeks (D-NY) to create a 2024 commemorative coin to raise money to support museums remembering the legacy of Harriet Tubman.

The National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York.

If passed, the commemorative set will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits are 50,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars. The bill sets surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar.

If the program sells out, the National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York, will receive $9.5 million ($4.625 million each) for maintenance and educational purposes.

H.R. 1842: Harriet Tubman Bicentennial Commemorative Coin Act

Summary: This bill directs the Department of the Treasury to mint and issue 50,000 $5 gold coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins emblematic of the legacy of Harriet Tubman as an abolitionist. The Secretary may issue coins under this bill only during the period of January 1, 2024, through December 31, 2024. All surcharges received by Treasury from the sale of such coins must be paid equally to the National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York, for the purpose of accomplishing and advancing their missions.

Introduced in House — Mar 11, 2021

Referred to the House Committee on Financial Services. — Mar 11, 2021

Ms. Waters moved to suspend the rules and pass the bill. — Jul 26, 2022

Considered under suspension of the rules. — Jul 26, 2022

DEBATE – The House proceeded with forty minutes of debate on H.R. 1842. — Jul 26, 2022

On motion to suspend the rules and pass the bill Agreed to by voice vote. — Jul 26, 2022

Passed/agreed to in House: On motion to suspend the rules and pass the bill Agreed to by voice vote. — Jul 26, 2022

Motion to reconsider laid on the table Agreed to without objection. — Jul 26, 2022

Jul 26, 2022 | coins, commemorative, legislative

Last month, Rep. Paul Gosar (R-AZ) introduced a bill (H.R. 8244) to create a 2023 commemorative coin program to honor the Granite Mountain Hotshots.

Last month, Rep. Paul Gosar (R-AZ) introduced a bill (H.R. 8244) to create a 2023 commemorative coin program to honor the Granite Mountain Hotshots.

“Hotshots” are elite firefighters that specialize in the containment of wildfires. On June 28, 2013, lighting ignited the Yarnell Hill Fire on a ridge west of Yarnell, Arizona, and the fire spread rapidly. Firefighters from the Granite Mountain Interagency Hotshot Crew were deployed to assist with the containment of the fire. On June 30, 2013, 19 members of the Granite Mountain Hotshots died while attempting to contain the fire. Only one survived.

If passed, the commemorative set will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits are 100,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars.

The bill sets the surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar. Proceeds will be paid to the Yarnell Fire District to help with wildfire prevention and wildfire education.

If the program sells out, the Yarnell Fire District will receive $11.25 million from the sale of the commemoratives.

H.R. 8244: Granite Mountain Hotshots Commemorative Coin Act

Introduced in House — Jun 28, 2022

Referred to the House Committee on Financial Services. — Jun 28, 2022

Jun 23, 2022 | coins, commemorative, legislative

One of several emblems as part of a changing logo to be used by LA28 Committee

If passed, the commemorative set will include a $5 gold coin, silver dollar, clad half-dollar, and a five-ounce silver proof coin that collectors call the “hockey puck.” The bill sets mintage limits are 100,000 gold coins, 500,000 silver dollars, 300,000 clad half-dollars, and 100,000 proof hockey pucks.

The 300,000 limits for the clad half-dollars are likely to be increased when the bill goes through markup.

The bill sets the surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, $5 for each clad half-dollar, and $50 for each hockey puck. Proceeds will be paid to the U.S. Olympic Committee.

If the program sells out, the U.S. Olympic and Paralympic Committee will receive $15 million from the sale of the commemoratives.

Of course, all this will be moot if the bill does not pass Congress and is not signed by the President.

H.R. 8047: LA28 Olympic and Paralympic Games Commemorative Coin Act

Referred to the House Committee on Financial Services. — Jun 13, 2022

Introduced in House — Jun 13, 2022

S. 4382: LA28 Olympic and Paralympic Games Commemorative Coin Act

Introduced in Senate — Jun 13, 2022

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Jun 13, 2022

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. (Sponsor Introductory Remarks on measure: CR S2912) — Jun 13, 2022

May 24, 2022 | coins, commemorative, legislative

World War II Memorial from the Washington Monument

Without noticeable prompting or any other reason, the Senate Banking Committee discharged the Greatest Generation Memorial Act (S. 1596) and was passed by unanimous consent by the Senate.

If passed, the bill will require the minting of up to 50,000 $5 gold coins, 400,000 $1 silver coins, and 750,000 clad half-dollar coins in commemoration of the National World War II Memorial in Washington.

At the end of the sale, the Treasury will pay all surcharges ($35 per gold coin, $10 per silver dollar, and $5 per clad half-dollar) to the Friends of the National World War II Memorial to help maintain the memorial.

The Senate sent the bill to the House of Representatives, where it is being held at the desk because it was a bill not introduced by the majority party.

S. 1596: Greatest Generation Memorial Act

Summary: This bill directs the Department of the Treasury to mint and issue up to 50,000 $5 coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins in commemoration of the National World War II Memorial in the District of Columbia. The design of the coins shall be emblematic of the memorial and the service and sacrifice of American soldiers and civilians during World War II. All surcharges received from the sale of such coins shall be paid to the Friends of the National World War II Memorial to support the National Park Service in maintaining and repairing the memorial, and for educational and commemorative programs.

Introduced in Senate — May 12, 2021

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — May 12, 2021

Senate Committee on Banking, Housing, and Urban Affairs discharged by Unanimous Consent. — May 16, 2022

Passed Senate with an amendment by Unanimous Consent. (text of amendment in the nature of a substitute: CR S2515-2516) — May 16, 2022

Measure laid before Senate by unanimous consent. — May 16, 2022

Message on Senate action sent to the House. — May 17, 2022

May 5, 2022 | commemorative, legislative

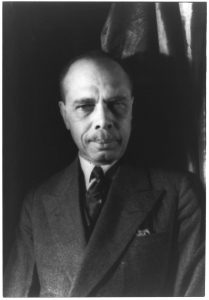

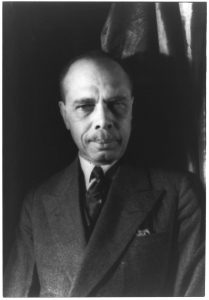

James Weldon Johnson (Photographed by Carl Van Vechten, 1932)

James Weldon Johnson was a writer and civil rights activist who was a leader of the NAACP. In 1920, Johnson was chosen as the first African-American executive secretary of the NAACP, effectively becoming its chief operating officer.

Johnson was known for his writing about black culture during the Harlem Renaissance. His work includes the lyrics for “Lift Every Voice and Sing,” which later became known as the Negro National Anthem. The music was written by his younger brother, J. Rosamond Johnson.

Johnson’s other accomplishments include his appointment as the U.S. consul in Venezuela and Nicaragua by Theodore Roosevelt, the first African-American professor hired by New York University, and later became a professor at Fisk University.

If this bill becomes law, 85-percent of the surcharges will be divided equally between the Marshall-Motley Scholars Program, the Stanton College Preparatory School, and the National Association for the Advancement of Colored People (NAACP). The rest of the money will be given to the James Weldon Johnson Foundation.

H.R. 7469: James Weldon Johnson Commemorative Coin Act

Introduced in House — Apr 7, 2022

Referred to the House Committee on Financial Services. — Apr 7, 2022

Mar 8, 2022 | coins, commemorative, legislative

I have to admit that I stopped watching what they are doing on Capitol Hill. As long as the government is functioning, my neighbors continue to work as federal workers or government contractors, my days of watching Congress has passed. Although my program continues to download the status of bills in Congress daily, the overall frustration with Congress does not have me running to the computer to check the status.

I have to admit that I stopped watching what they are doing on Capitol Hill. As long as the government is functioning, my neighbors continue to work as federal workers or government contractors, my days of watching Congress has passed. Although my program continues to download the status of bills in Congress daily, the overall frustration with Congress does not have me running to the computer to check the status.

While reading other news sources, I discovered that the Senate did something. Of course, the House has to be passed to have any impact, but the fact that the Senate actually did work is astounding!

S. 697: Harriet Tubman Bicentennial Commemorative Coin Act

Summary: This bill directs the Department of the Treasury to mint and issue 50,000 $5 gold coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins emblematic of the legacy of Harriet Tubman as an abolitionist. The Secretary may issue coins under this bill only during the period of January 1, 2024, through December 31, 2024. All surcharges received by Treasury from the sale of such coins must be paid equally to the National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York, for the purpose of accomplishing and advancing their missions.

Introduced in Senate — Mar 11, 2021

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Mar 11, 2021

Senate Committee on Banking, Housing, and Urban Affairs discharged by Unanimous Consent. — Feb 17, 2022

Passed Senate without amendment by Voice Vote. — Feb 17, 2022

Passed/agreed to in Senate: Passed Senate without amendment by Voice Vote. — Feb 17, 2022

Message on Senate action sent to the House. — Feb 18, 2022

Received in the House. — Feb 18, 2022

Held at the desk. — Feb 18, 2022

On February 17, 2022, the Senate passed the Harriet Tubman Bicentennial Commemorative Coin Act (S. 697) by voice vote. There was no debate or commentary. Just a procedural voice vote to clean up non-controversial bills that are just hanging around.

If the House passes the bill, the U.S. Mint will issue gold, silver, and clad coins celebrating the legacy of Harriet Tubman. The sale proceeds will go to National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home in Auburn, New York.

H.R. 6663: Fleet Reserve Association 100th Anniversary Act

Introduced in House — Feb 9, 2022

Referred to the House Committee on Financial Services. — Feb 9, 2022

In other numismatic-related Congressional news, two bills were introduced in the House of Representatives. The Fleet Reserve Association 100th Anniversary Act (H.R. 6663) may not be more than a vanity bill introduction.

H.R. 6681: 100th anniversary of the Lincoln Memorial Commemorative Coin Act

Introduced in House — Feb 9, 2022

Referred to the House Committee on Financial Services. — Feb 9, 2022

The other bill is the 100th anniversary of the Lincoln Memorial Commemorative Coin Act (H.R. 6681) to celebrate the 100th anniversary of the dedication of the Lincoln Memorial. The Lincoln Memorial was dedicated on May 30, 1922. If the bill passes, the U.S. Mint can issue 500,000 silver dollars in 2023. The proceeds will be paid to the Trust of the National Mall and to restore and preserve the Lincoln Memorial.

Nov 13, 2021 | coins, commemorative, legislative

On Friday, the Government Printing Office updated S. 2384, the Semiquincentennial Commemorative Coin Act, to include a summary. If passed, the bill will create a commemorative coin program in 2026 to celebrate the 250th anniversary of declaring our independence from England.

On Friday, the Government Printing Office updated S. 2384, the Semiquincentennial Commemorative Coin Act, to include a summary. If passed, the bill will create a commemorative coin program in 2026 to celebrate the 250th anniversary of declaring our independence from England.

S. 2384: Semiquincentennial Commemorative Coin Act

Summary: This bill directs the Department of the Treasury to mint and issue $25.00 gold coins, $2.50 silver coins, 25 cent clad coins, and proof silver $2.50 coins in commemoration of the 250th anniversary of the establishment of the United States. The designs of the coins shall be emblematic of the semiquincentennial anniversary of the establishment of the United States of America and celebrate 250 years of our nation. On each coin there shall be

- a designation of the value of the coin;

- an inscription of the years 1776-2026; and

- inscriptions of the words Liberty, In God We Trust, United States of America, and E Pluribus Unum.

Treasury may issue coins under this bill only during the period beginning on January 1, 2026, and ending on December 31, 2026. All sales of coins issued shall include a surcharge as prescribed by this bill. All surcharges received by Treasury from the sale of such coins shall be paid to the America 250 Foundation to fund the restoration, rehabilitation, and interpretation of units of the U.S. National Park System and its related areas, as a legacy of the semiquincentennial commemoration.

Introduced in Senate — Jul 20, 2021

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Jul 20, 2021

An interesting addition to the bill is in Section 3, Paragraph d that reads:

(d) Mintage Limit Exception.—If the Secretary determines, based on independent, market based research conducted by the designated recipient organization identified in section 7(b) that the mintage levels described under this subsection are not adequate to meet public demand, the Secretary may increase the mintage levels as the Secretary determines is necessary to meet public demand.

If the America 250 Foundation finds that the mintage limits are too low, the U.S. Mint can strike more coins without asking permission. Given the current status of the U.S. Mint, it will be interesting to see how it is implemented.

Nov 9, 2021 | coins, commemorative, legislative

I have been following politics for many years. I trace my awakening to the news and politics to the assassination of Dr. Martin Luther King, Jr. It was something in the news that we discussed in school, and I did not know or understand what my classmates were talking about. After school, I read the stories about MLK in the Daily News and Newsday that were delivered daily. When my father came home, he brought a copy of the New York Times.

I have been following politics for many years. I trace my awakening to the news and politics to the assassination of Dr. Martin Luther King, Jr. It was something in the news that we discussed in school, and I did not know or understand what my classmates were talking about. After school, I read the stories about MLK in the Daily News and Newsday that were delivered daily. When my father came home, he brought a copy of the New York Times.

I was so interested in public policy that I did a master’s in public policy late in life. Having the degree helped my career as a government contractor working with government executives and appointees. Unlike others who go into public policy, I was fascinated with policy compliance and implementation. It became helpful in trying to implement information security policies for the government.

After 40 years in computing and 25 years with the federal government, I burned out. Since then, I have followed numismatic-related policy because the U.S. Mint does not strike any legal tender coin without a law permitting them.

Since retiring in 2017, partisan politics has gone from bad to worse. Politicians and their constituents are no longer talking with each other but shouting at each other. It is no longer looking to accomplish something for the common good but who can score points.

Unfortunately, there is no such thing as the radical middle. Those of us in the center are willing to work together but are being shut out by the shouting coming from the extremes.

Numismatic-related bills are not immune to the policy divide. The bills get dumped into committees and are subject to the partisan scorecard review. These bills languish in committee until an end-of-session floor review.

Although following numismatic legislation is necessary to know what the U.S Mint strikes next, it is no longer fun. Therefore, this will be the last monthly report. In the future, I will post updates after the Government Printing Office reports them. The GPO is the official publisher of the U.S. government and they are responsible for publishing everything from congress.

For the last monthly report, Rep. Claudia Tenney (R-NY) introduced H.R. 5601, the Erie Canal Bicentennial Commemorative Coin Act. If passed, the bill will create a commemorative program to celebrate the 200th anniversary of the building of the Erie Canal.

In 2025, the bill would require the U.S. Mint to strike clad half-dollars, silver dollars, and gold $5 coins with the dual date 2017-2025. These dates would mark the 200th anniversary of the construction of the canal (1817-1825). The funds raised from the sale of these coins would be paid to the “Erie Canalway Heritage Fund, Inc., to support the historic preservation, conservation, recreation, interpretation, tourism, and community development of the Erie Canalway National Heritage Corridor and for educational and commemorative programs of the Erie Canal’s history and impact on our Nation’s history.”

H.R. 5601: Erie Canal Bicentennial Commemorative Coin Act

Summary: This bill directs the Department of the Treasury to mint and issue 50,000 $5 gold coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins in recognition of the bicentennial of the Erie Canal. The designs of the coins shall be emblematic of the Erie Canal and its impact on the development of the United States and New York. Treasury may issue coins minted under this bill only during the one-year period beginning on January 1, 2025. All sales of coins issued under this bill shall include a surcharge, which shall be paid to the Erie Canalway Heritage Fund, Inc., to support the historic preservation, conservation, recreation, interpretation, tourism, and community development of the Erie Canalway National Heritage Corridor in New York and for educational and commemorative programs of the Erie Canal’s history and impact on our nation’s history.

Introduced in House — Oct 15, 2021

Referred to the House Committee on Financial Services. — Oct 15, 2021

It would not be the first time the Erie Canal appears on a coin. The Erie Canal was the innovation celebrated on the 2021 New York American Innovation $1 Coin.

A quick update:

A quick update: As part of the congressional charade of staying in session to prevent the appearance of adjournment, the House of Representatives cycled through some non-controversial legislation that included two that would authorize two 2024 commemorative coin programs.

As part of the congressional charade of staying in session to prevent the appearance of adjournment, the House of Representatives cycled through some non-controversial legislation that included two that would authorize two 2024 commemorative coin programs.

On Friday, the Government Printing Office updated

On Friday, the Government Printing Office updated