Weekly World Numismatic News for May 15, 2022

It has been an interesting week. I tried to keep up with the news and the collecting world, but a health issue sidelined me. Unfortunately, I was diagnosed with COVID. I am feeling better, but it does affect my breathing. I am glad I am fully vaccinated.

It has been an interesting week. I tried to keep up with the news and the collecting world, but a health issue sidelined me. Unfortunately, I was diagnosed with COVID. I am feeling better, but it does affect my breathing. I am glad I am fully vaccinated.

I was not completely sidelined. While trying to breathe, I was able to go online and find some interesting items online. The purchase taught me something about an area of numismatics that I did not know existed. It will be something I write about when I receive the new purchase.

During the week, the U.S. Mint mailed a package that arrived in my mailbox containing the Negro Leagues Baseball Commemorative Proof Set. The coins look better in hand than the U.S. Mint’s website images.

As the Paxlovid works to get me back in the game, it will take a few days to get everything back together, and I will be ready to get back to collecting.

Life is short. Have fun collecting.

And now the news…

→ Read more at cottagelife.com

→ Read more at cottagelife.com

→ Read more at worldakkam.com

→ Read more at worldakkam.com

Weekly World Numismatic News for Independence Day 2021

The week’s surprise news is that the Certified Collectibles Group (CCG), Numismatic Guarantee Corporation’s (NGC) parent company, sold a majority stake in its company to a private equity firm.

The week’s surprise news is that the Certified Collectibles Group (CCG), Numismatic Guarantee Corporation’s (NGC) parent company, sold a majority stake in its company to a private equity firm.

The report notes that the deal with The Blackstone Group was for more than $100 million and places CCG’s valuation at more than $500 million.

In November 2020, a group led by D1 Capital Partners purchased Collectors Universe, the parent company of Professional Coin Grading Service, for $700 million. D1 then took the company private in December.

Private equity firms (PEF) like The Blackstone Group and D1 Captial Partners work to bring together clients use the power of their capital and influence to invest in companies. They take over the companies with the intent of growing them and increasing their profits.

Although private equity firms will infuse the businesses with money, they are not known to do what is best for the industry they enter. They are strictly bottom-line focused. Companies purchased by a PEF have deteriorated because they paid too much for the company and have to pay off that debt and assume the liabilities of the company they purchases.

Another big problem with a PEF is the turnover of staff. The PEF will look to have its people run the businesses in a manner that may not sit well with current employees. When key executives start to leave, it is an indication that the shift in the business culture has begun.

The previous week, PCGS announced that President Brett Charville has announced he will be leaving the company. Charville became PCGS president in January 2019, succeeding Don Willis. The press release did not mention Charville’s future, nor was there any announcement from another numismatic-related organization announcing his hiring. Based on the history of executive interactions with private equity firms, it is likely that Charville is the first key executive of Collectors Universe to experience the impact of being purchased by a PFE.The top two grading services owned by private equity firms question what will happen to the collecting hobbies? Will NGC continue its relationship with the ANA? Will the push for these companies to make more money cause a loosening of grading standards? Or will these firms now have the money to increase the use of technology to enhance the authentication process? Whatever is going to happen, the transition begins this summer and likely will not be felt until the end of the year.

And now the news…

→ Read more at express.co.uk

→ Read more at express.co.uk → Read more at news.yahoo.com

→ Read more at news.yahoo.com → Read more at mirror.co.uk

→ Read more at mirror.co.uk → Read more at phys.org

→ Read more at phys.org

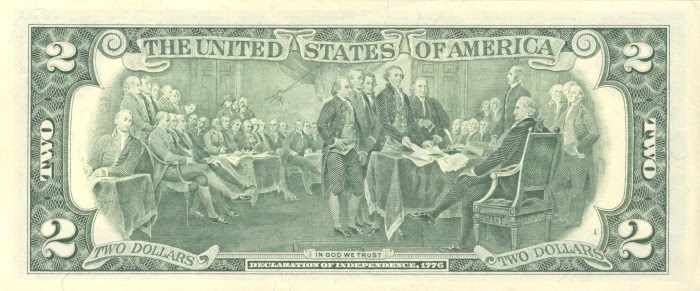

245 Years and Counting

U.S. Mint Promotes Circulation of Circulating Coins

As more people come out of their pandemic bubble, some areas continue to report a coin shortage. Although it appears to be a shortage in circulating coinage, there is a reduction of coin available for merchants to give change. Although the situation has improved, the problem is that coins are still not circulating.

In a video by U.S. Mint Director David Ryder, he reports that the Mint has increased production during the last year. Typically, the U.S. Mint supplies less than 20-percent of the coin in circulation. Last year, the U.S. Mint increased production to add 30-percent of the coins in circulation.

Given the situation with the pandemic that caused the West Point Mint to shut down and pause Philadelphia, the fact that the U.S. Mint was able to produce more coins than ever is a significant accomplishment. Regardless of your opinion as to how the U.S. Mint has handled the sale of collector coins, no other mint in the world could accomplish this feat.

In 2020, the U.S. Mint struck 14.774 BILLION coins. But in 2019, a year where the economy was doing very well, the U.S. Mint produced 11.942 BILLION coins. They produced 23.7 more coins while taking precautions during a pandemic.

Nearly every industry reported a reduction in demand and the ability to produce products. And the supply chain continues to affect production in some industries, including tech, where there is a shortage of computer chips. But the U.S. Mint was able to add over 14 BILLION coins to the economy. Amazing!

Weekly World Numismatic News for June 27, 2021

It’s hot out there!

And I am not talking only about the weather.

And I am not talking only about the weather.

The collectors’ market is hot.

Buyers are buying all types of collectibles. Items that have not been selling well in the last 10 years are now selling for more than a few dollars. And there is no sign that it will stop soon.

If the collectible market is hot, then the numismatic market is like the weather in Pacific Northwest and Western Canada. The numismatic market appeared to hit a high on June 8, 2021, and it has not stopped. It seems that every few weeks, the numismatic press tells us about another rarity that sold for over $1 million.

Prices are also rising in the regular collectors’ market. Silver coins are selling for significant premiums over what the price guides publish. The premiums have become so big that the price guides are almost irrelevant.

The sensation extends to the entire numismatic market. People buying common coins of popular series are paying significant premiums for the coins like Lincoln Wheat Cents and Buffalo Nickels. Some are complaining that the market is becoming too expensive for the average collector.

It is a mixed feeling for sellers. While their profits are increasing and they can unload items sitting in their shops for years, they cannot find the inventory to sell. Dealers that know I work in the liquidation business have called to ask whether I can find coins. Of course, economists will remind me that when there is a high demand and low supply, the prices rise so that the Supply and Demand curves reach equilibrium. Then they will ask snarkily where I went to school!

As a seller, I love this market. It will help my company’s recovery from the pandemic. As a collector, I think I will concentrate on the less expensive series of interests. Although there’s a National Banknote worth about $1,500 that I have been looking at… (as he stares wistfully off into the distance).

And now the news…

→ Read more at tehrantimes.com

→ Read more at tehrantimes.com

→ Read more at theworldbeast.com

→ Read more at theworldbeast.com

→ Read more at muslimlink.ca

→ Read more at muslimlink.ca

→ Read more at businessinsider.com

→ Read more at businessinsider.com

→ Read more at northnorfolknews.co.uk

→ Read more at northnorfolknews.co.uk

→ Read more at bbc.com

→ Read more at bbc.com

ANA Elections Are Here

Welcome to the election season for the American Numismatic Association. It is the first election after the pandemic. As the ANA recovers from the pandemic with the rest of the United States, the ANA must elect the right people to rebuild the association.

Welcome to the election season for the American Numismatic Association. It is the first election after the pandemic. As the ANA recovers from the pandemic with the rest of the United States, the ANA must elect the right people to rebuild the association.

The ANA leads leadership to revive the association so that it matches the interest in the market. The current Board appears to lack vision and is led by someone incapable of getting out of his ideological way. It is easy to maintain an ideology when times are good, but an effective leader knows when to adjust when difficulties arise.

The definition of insanity is doing the same things over and over again, expecting different results.

Unfortunately, there are members of the current ANA Board of Governors that need to learn this lesson.

Primary to the election is the vote for president. For this election, I am endorsing Don Kagin. With no offense intended to Ron Ross, the ANA needs a president that has the experience to navigate the association through the post-pandemic environment. Ron Ross has the right idea for expanding numismatic education. It is that the ANA is in a place that it needs more. The ANA needs a president with a strong business background to lead the ANA forward.

If Ross is not elected, I hope that Kagin will find a way to keep Ross involved with the ANA’s education initiatives.

Joe Boling is the only candidate for Vice President. If Boling ran for the Board of Governors, I would endorse his candidacy. Boling has to be a member of the Board if for nothing else to restore the exhibit committee. Many people vehemently disagree with Steve Ellsworth’s mishandling of the exhibit committee and his alleged plans. As the former chair of the Exhibits Committee, Boling is the right person to fix this situation.

As for the Board of Governors, I am endorsing the following candidates:

- Muriel Eymery

- Mark Lighterman

- Clifford Mishler

- Charles Morgan

- Rob Oberth

- Shanna Schmidt

First, I am endorsing everyone running for the Board of Governors who is younger than me. It is time for the ANA to transform, and I believe that those younger have the ideas. I added Cliff Mishler to the list because he favors change with the intelligence to be a moderating voice.

I will not endorse anyone who wants to repeat the past mistakes to move the ANA forward, which is why I am not endorsing Mike Ellis and Mary Lynn Garrett.

I discussed the issues I have with Ellis in the past. I will never endorse someone who was forced to resign from the Board because of his actions.

Garrett lost my endorsement during the candidate’s forum when she did not embrace the new environment for improving ANA. Garrett wants to turn to traditional fundraising methods to grow revenues and did not indicate that she was in favor of expanding the ANA’s reach using new technologies during the forum. Garrett may have a different view after reflecting on her answers, but in a critical moment the Board needs people who can think beyond whatever they perceive as what worked in the past.

Although I only voted for four of the above list, the ANA Board of Governors will consist of seven members. If you want to vote for seven, I would recommend Garrett over Ellis.

Now it is your turn. Remember, the independent auditing firm has to receive the election ballots no later than July 1. VOTE!