Jun 14, 2022 | Carson City, coins, dollar, errors, grading, GSA, Morgan

Life can be confusing. One of those confusions is when people do something for reasons that are not obvious. Then when the people were asked why they did not offer any answers.

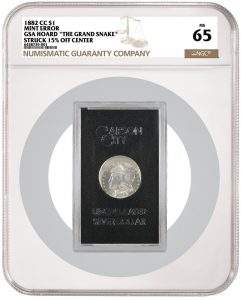

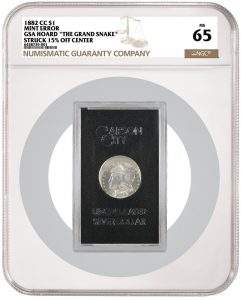

1882-CC GSA “Grand Snake Morgan Dollar Struck 15% Off Center graded NGC MS 65 (Image courtesy of NGC)

The coin is fascinating in that it looks stunning, survived for so long to be part of the GSA Hoard, and the original owner purchased the coin for $30 in 1972. But that is not what makes this coin a curiosity.

Rather than NGC applying the tamper-evident label that NGC wraps around the GSA holder, NGC placed the entire GSA holder in one of their Mega Holders.

According to NGC’s website, the Mega Holder can hold a coin as large as 180 mm (about 7-inches) in diameter and 28 mm (about 1.1-inches) thick. The NGC holder appears to be three times the size of the GSA holder.

Understandably, a collector would send a coin of this significance to NGC for authentication and grading. But why did NGC have to slab the entire GSA holder? The coin is 38.1 mm in diameter (less than 1-inch) and is in a holder for a coin seven times its size. The coin, which should be the central focus, appears lost.

I tried to ask NGC about their decision to slab the entire GSA holder, and the response I received referred me back to the article that does not discuss the decision. There must be a reason other than “this is what the client wanted.” Even if NGC does not want to answer the question, I want to see the coin in person.

Jun 7, 2022 | auction, coins, grading

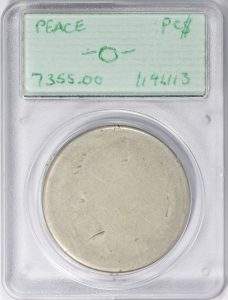

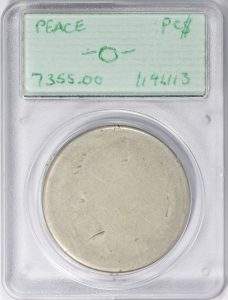

Peace Dollar with PCGS Prototype Handwritten Label

(Image courtesy of Great Collections)

That curiosity in history had me searching for the auction of a significant piece of numismatic history. An article appeared at Coin Week reporting that a sample PCGS Type 1 holder with a handwritten label was up for auction at Great Collections.

According to the auction description, it is a prototype holder for a very worn Peace dollar to show how a coin with a worn date could be certified by PCGS. The handwritten label was produced in 1989 or 1990, with PCGS confirming the label’s authenticity.

The label is a demonstration of the growing pains experienced by PCGS. By 1989, PCGS was three years old and experienced an exception to its established procedures. Long before low-ball collecting, what does a company do with a low-grade coin?

The prototype holder with a coin that would likely grade PO-1 today is an artifact of numismatic history. Aside from its historical significance, it is just a cool item. The price as this is being written is $5,050. The auction ends Sunday, June 19, 2022, at 06:38 PM Pacific Time. Get your bids in!

EDITED: I am not the owner/seller of this slab and I am not a bidder in this auction. I was accused of shilling this auction by a reader via an email. It is featured here because I thought it was something interesting and, quite frankly, cool. I have no association with Great Collections except as a satisfied customer.

Jul 28, 2021 | coins, commentary, grading

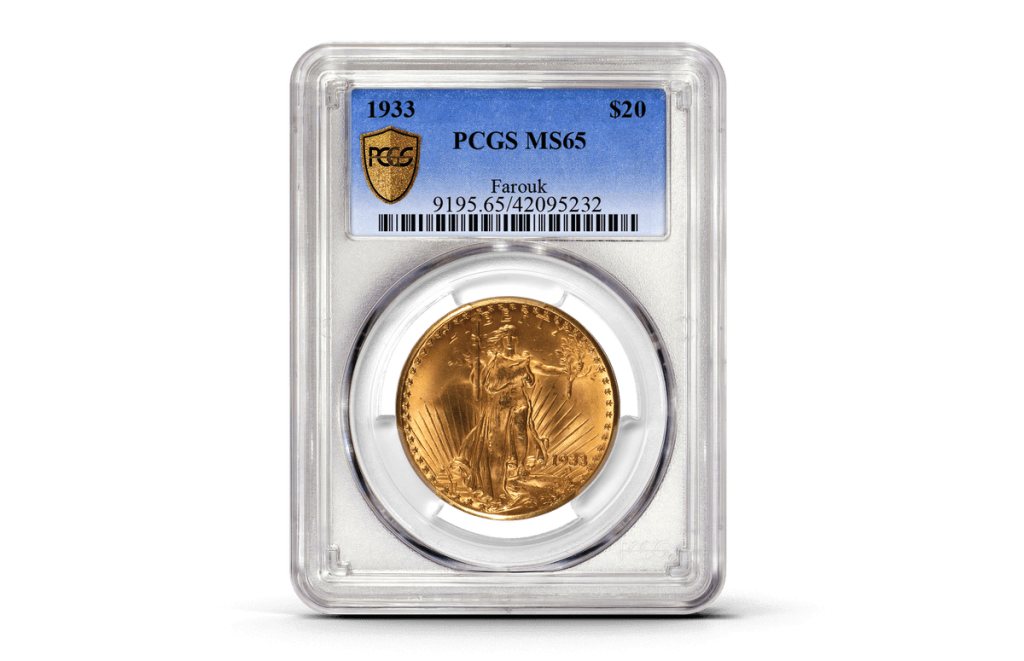

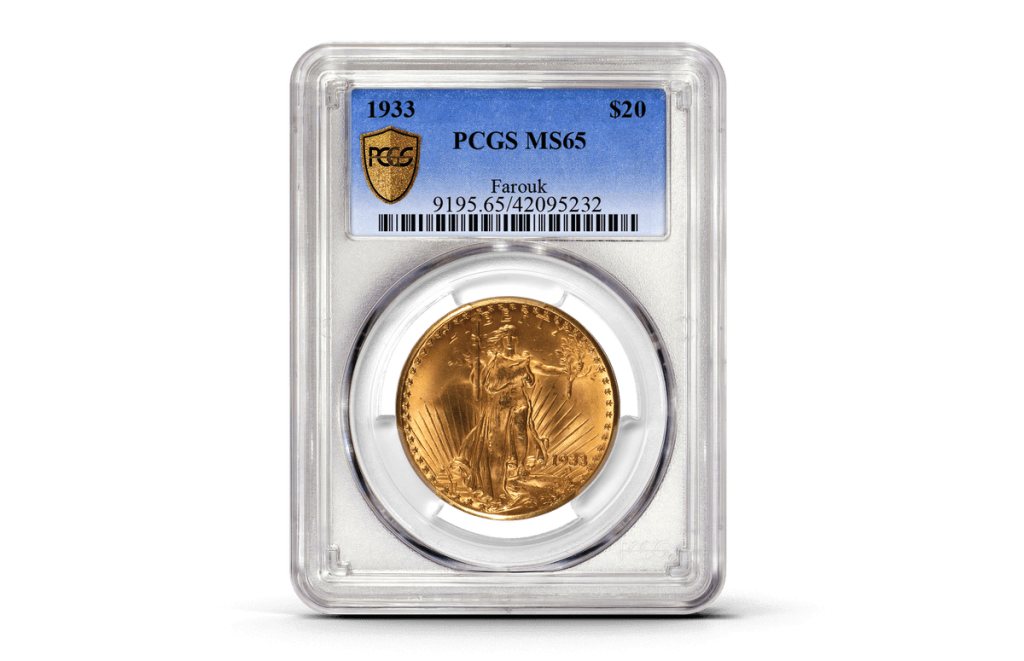

Last April, PCGS announced that they had certified the 1933 Saint-Gaudens Double Eagle Gold Coin that Stuart Weitzman recently sold at auction. The coin sold for $18.9 million to an undisclosed buyer on June 8, 2021, by Sotheby’s

On July 27, 2021, PCGS announced that they entombed the most expensive coin in the world in their plastic.

-

-

1933 $20 Obv – The 1933 Saint-Gaudens Double Eagle is a gold coin with a $20 face value that sold for nearly $19 million in June 2021 and was graded MS65 by Professional Coin Grading Service. The obverse, seen here, depicts a striding Miss Liberty before a sunrise over the U.S. Capitol in Washington, D.C. Courtesy of Professional Coin Grading Service.

-

-

1933 $20 Rev – A flying eagle graces the reverse of the 1933 Saint-Gaudens Double Eagle, a gold coin with the face value of $20 that was originally designed by namesake sculptor Augustus Saint-Gaudens in 1907. Courtesy of Professional Coin Grading Service.

While I acknowledge there is a place for third-party grading services in the collecting market, certifying and encasing the most valuable coin in the world does not qualify.

Although forgeries and fakes are infesting the market, a coin like this one-of-a-kind wonder with a story that reads like a best-selling whodunit the coin is so unique that encasing it away from the world has no equivalent in other collectibles.

Art collectors spend more money for the rarest of paintings only to display them without encapsulation. For example, Salvator Mundi attributed Leonardo da Vinci sold in 2017 for a world record of $450.3 million to Prince Badr bin Abdullah of Saudi Arabia. The prince intends to display it at the Louvre Abu Dhabi. Although the display will have security, the painting will be on display for all to see, not entombed in plastic.

Slabs give coins a homogenous feeling. All slabs look the same. There is little to distinguish the coins other than the information on the label. But the label is not the coin. It hides the differences away from the admirer. A row of slabbed coins does little to enhance the fact that each is different.

Coin collectors have given up eye appeal and the emotion of seeing a beautiful coin to the third-party grading services. Collectors have become mesmerized by labels, numbers, and even stickers without truly understanding what they mean.

Recently, a friend purchased a Carson City minted Morgan Dollar that we thought should grade DMPL (deep-mirrored proof-like). The coin was beautiful but had some slight inclusions. There were bag and handling marks on the coin, but we were confident that the coin would earn the DMPL designation.

When he sent the coin to a third-party grading service for encapsulation (not my coin, so it was not my decision), we played “guess the grade.” My guess was lower than my friend’s. He was more optimistic and overlooked some of the issues I saw. Even though the coin was graded MS-62 DMPL, it did not take anything away from the coin’s beauty.

Except my friend was upset, and the coin is in plastic.

He was conditioned by the phenomenon of grading every coin that the higher the grade, the better the coin. Forget that the coin was beautiful to look at, and he paid less for the coin than if it was graded. He really wanted the coin to grade MS-64. After all, MS-64 is better than MS-62, right?

Now that the coin is encased in plastic, it has lost its luster. I am sure the coin is fine, and the third-party grading service did not damage the coin, but the plastic mutes the impressive DMPL fields. I do not have the same emotional response to the coin in the plastic.

As a result, he wants to crack out the coin and send it to the other third-party grading service to see if he can get a higher grade. I shook my head and wished him good luck.

I am worried that by encasing the only 1933 Saint-Gaudens Double Eagle Gold Coin that is legal to own in a plastic case, the coin will lose its impressive look and make it like any other coin.

If you like what you read, share, and show your support

Jul 4, 2021 | grading, markets, news

The week’s surprise news is that the Certified Collectibles Group (CCG), Numismatic Guarantee Corporation’s (NGC) parent company, sold a majority stake in its company to a private equity firm.

The week’s surprise news is that the Certified Collectibles Group (CCG), Numismatic Guarantee Corporation’s (NGC) parent company, sold a majority stake in its company to a private equity firm.

The report notes that the deal with The Blackstone Group was for more than $100 million and places CCG’s valuation at more than $500 million.

In November 2020, a group led by D1 Capital Partners purchased Collectors Universe, the parent company of Professional Coin Grading Service, for $700 million. D1 then took the company private in December.

Private equity firms (PEF) like The Blackstone Group and D1 Captial Partners work to bring together clients use the power of their capital and influence to invest in companies. They take over the companies with the intent of growing them and increasing their profits.

Although private equity firms will infuse the businesses with money, they are not known to do what is best for the industry they enter. They are strictly bottom-line focused. Companies purchased by a PEF have deteriorated because they paid too much for the company and have to pay off that debt and assume the liabilities of the company they purchases.

Another big problem with a PEF is the turnover of staff. The PEF will look to have its people run the businesses in a manner that may not sit well with current employees. When key executives start to leave, it is an indication that the shift in the business culture has begun.

Brett Charville is stepping down as president of PCGS.

The top two grading services owned by private equity firms question what will happen to the collecting hobbies? Will NGC continue its relationship with the ANA? Will the push for these companies to make more money cause a loosening of grading standards? Or will these firms now have the money to increase the use of technology to enhance the authentication process? Whatever is going to happen, the transition begins this summer and likely will not be felt until the end of the year.

And now the news…

July 1, 2021

Jocelyn Trent says reunited WW1 medals ‘ray of sunshine’ Peter Thorpe came across the medal when he was trying to build a greenhouse in his garden and needed to move soil to do so. He is now hoping that the relatives of the soldier will come forward, so that the heirloom can be in the hands of those who knew the man.

→ Read more at

express.co.uk

July 2, 2021

In another bellwether of the red-hot grading industry for coins, comics and sports cards, Sarasota’s Certified Collectibles Group is selling a majority stake in its company to private equity firm Blackstone in a deal that puts the company’s value at more than $500 million.

→ Read more at

news.yahoo.com

July 3, 2021

An Iraq War hero is selling his £140,000 gallantry medal so he can get on the property ladder.

→ Read more at

mirror.co.uk

July 3, 2021

Dupondius of Emperor Trajan showing a selection of military scenes. You can see Emperor Trajan in military uniform between two trophies.

→ Read more at

phys.org

If you like what you read, share, and show your support

May 10, 2020 | bullion, coins, Eagles, grading, markets, news, silver

Is it Sunday already?

Is it Sunday already?

This past week, the numismatic world was greeted with the news that the Philidelphia Mint struck a limited number of American Silver Eagle bullion coins to help fill the demand.

Most of the production of the American Silver Eagle bullion coins are in the West Point Mint. Sometimes, the San Francisco and Philadelphia Mints add capacity when necessary, with San Francisco being the priority. Since the West Point and San Francisco Mints temporarily closed because of the effects of COVID-19, Philadelphia picked up the slack.

The U.S. Mint produces all bullion coins without mintmarks. In most cases, it is impossible to tell which mint struck the coins. An exception is the 2015 (P) American Silver Eagles. Collectors and the grading services have been trying to figure out where the green monster boxes came from by examining the serial number and other clues. In 2015, Philadelphia struck just under 80,000 bullion coins. Those handling monster boxes noticed a difference in the packaging and quality.

According to the U.S. Mint, “Monster boxes of 2020 American Eagle Silver Bullion Coins minted in Philadelphia were affixed with a typed label containing the box tracking number; additionally, box tracking numbers were handwritten directly on the boxes. Box tracking numbers 400,000 through and including 400,479 were used on boxes of coins minted in Philadelphia.”

The 480 monster boxes translate into about 240,000 coins.

With that knowledge, the third-party grading services will add a special label noting that the coins were struck at Philidelphia only if the monster box sent for grading has the proper label and seal.

Of course, the price gougers are out in force. Most reputable companies are selling MS-70 graded “emergency” coins at around $250. That is about $200 over a “First Strike” or “Early Release” graded coins. One online seller is offering a pre-sale of the “emergency release” coins in MS-70 PCGS slabs with John Mercanti autographs for $595.

Coins graded MS-69 are selling for $75-80, which is $40-45 over other MS-69 graded coins.

Remember, if the listing says “pre-sale” it means that the seller does not have the coins in inventory.

And now the news…

May 6, 2020

With central banks spraying unprecedented amounts of printed money at the global economic system, it’s little wonder the gold price soared by 18% in the six weeks following the stockmarket meltdown. All the extra money sloshing around means the chances that consumer price inflation will take off and erode the value of your cash have risen sharply.

→ Read more at

theweek.co.uk

May 6, 2020

(Kitco News) – The last time the U.S. Mint sold this many platinum coins, President Bill Clinton was being tried by the U.S. Senate and Spongebob SquarePants was premiering on Nickelodeon. As of last month, the U.S. Mint said sales of the 1 oz platinum Eagle in 2020 reached 56,500 oz.

→ Read more at

kitco.com

May 8, 2020

A veritable gold mine of silver coins which had been hastily stashed inside a church in a ceramic jug hidden by a blind Polish priest over 300 years ago has been unearthed by workers removing rotting floorboards in the blind priest’s former church.

→ Read more at

thevintagenews.com

Feb 25, 2020 | advice, commentary, grading, registry sets

Last month, the American Numismatic Association announced that they have partnered with Numismatic Guarantee Corporation (NGC) to launch the ANA Coin Registry.

Last month, the American Numismatic Association announced that they have partnered with Numismatic Guarantee Corporation (NGC) to launch the ANA Coin Registry.

According to the ANA press release, the ANA Registry will accept coins graded by NGC and Professional Coin Grading Service (PCGS). The ANA Registry will be the only service that will allow both NGC and PCGS graded coins.

NGC has been a partner with the ANA for 25-years making it a natural choice to implement this program. Since NGC once allowed PCGS graded coins to count in their registry program, the facilities continue to exist for them to create a similar program for the ANA.

Participation is open to any collector. ANA members will receive a special icon of recognition next to their sets.

What is missing from the registry is the ability to include ANACS and ICG graded coins. Regardless of the opinion of these companies, they are competitive services to NGC and PCGS with a legitimate niche in the market.

By excluding ANACS and ICG, the ANA is telling the public that they decided who the best third-party grading services are. It is not the job of the ANA to pick market winners. Let the collecting public decide.

One advantage that ANACS and ICG has is that there are no memberships required to submit coins for grading. Anyone can directly submit coins to either company. Although ANA members can directly submit coins to NGC without an additional membership, only PCGS members can submit coins for grading.

Allowing open submission policies will allow for more people to participate. They can collect what they like and send it to ANACS and ICG without having to spend extra money or rely on a member. It will create greater access to casual collectors who might become more series if they can participate.

Could there be other reasons for not including ANACS and ICG? Since anyone can submit coins to ANACS and ICG, how will the dealers make money? If a collector buys a coin online or from another collector and sends their coins to ANACS or ICG for grading, how will the dealers make money?

Further, dealers have their own biases. They decided which grading service they like the best based on many factors, including perception and financial reasons. Whatever these reasons are should not be the policy of the ANA.

If the ANA is to fulfill its mission to encourage people to study and collect money and related items, then they cannot be picking market winners and losers. The ANA must revisit this policy and include the entire market without bias.

Feb 3, 2019 | coins, commentary, grading, news

Sorry for being late, but there was this boring football game on. And the commercials stunk, too!

A story that resonated with me was from the American Physical Society that discussed research being done in Germany that could digitally examine coins.

Currently, the research is using ancient coins stored by their local heritage society. The purpose is to aid in the identification of the coins and to maintain an accurate description of these coins.

Although there have been similar attempts including smaller programs, this appears the first attempt to use computer imaging on a large scale to analyze the characteristics of coins. If it is successful, the imaging can also be used to determine the grade of coins.

-

-

The coin as it appears without digital enhancement

-

-

When the coin is imaged, the imaging software analyzes the surface to highlight its features

-

-

A computer representation of the coin as it might have looked when it was originally struck.

Yes, I am saying that computers can do the grading of coins and probably do a better job than humans.

Computer imaging has come such a long way that it is an enhancement to almost everything that requires visual work. Nothing is more impressive than the system that uses medical imaging to virtually recreate a surgery scene so that a doctor and team can practice the most delicate surgery before cutting open the patient. Imaging can see beyond blood, organs, and even ordinary body fat to guide instruments through the body allowing for minimally invasive surgery.

Those of us with a smart telephone in our pocket that was purchased within the last three years has a device with the imaging capabilities and computing power that is equivalent to those used in those medical situations.

We can perform medical miracles, detect people from satellites thousands of miles in space, and even capture clear images of someone committing a crime with a phone from your pocket but the numismatic industry pedantically resists the use of computer imaging to grade coins.

The problem is that computer imaging will disrupt the status quo and make the grading services nearly obsolete if it was an acceptable way of analyzing coins. Dealers would lose their advantage of being the experienced eye looking at coins.

The result will be a consistency in coin grading that is not available today.

Think about it. There would be no need for crossovers, crack-outs, or a fourth-party sticker service that is nothing more than an arbitrage system to drive prices up. Collectors would be in control. Take out your phone and scan the coin. It will tell you the grade. And it will be the same grade whether I do the scan or if you do.

Computers do not like. Computers do not have emotions. Computers do not have an agenda. Take the picture, analyze, and provide a result. It puts the power in the hands of the collectors.

Of course, putting the power in the hands of the collectors is not what the dealers want. It is not what the grading services want. Computer imaging will disrupt their business.

And now the news…

January 29, 2019

During school field trip, student finds coin bearing the inscription "King Agrippa."  → Read more at israelnationalnews.com

→ Read more at israelnationalnews.com

January 30, 2019

At the same time, the number of fake banknotes has dropped.  → Read more at spectator.sme.sk

→ Read more at spectator.sme.sk

January 30, 2019

The County  → Read more at thecounty.me

→ Read more at thecounty.me

January 31, 2019

The massive medallion, made of the purest gold bullion ever refined and worth $5.8 million, was stolen from the Bode Museum in Berlin—and has never been found  → Read more at macleans.ca

→ Read more at macleans.ca

February 1, 2019

A new exhibit at a landmark Vermont museum showcases the work of a renowned artist who calls New England Home. In his Windham County workspace, Johnny Swing transforms quarters, half dollars, and other…  → Read more at nbcboston.com

→ Read more at nbcboston.com

February 1, 2019

Countless historical coins that differ from each other only in details are in storage at German state museums. Unlike paintings, these archaeological artifacts may not be labeled, marked or barcoded. Researchers at the Fraunhofer Institute for Factory Operation and Automation IFF developed a scanner and analysis software in collaboration with the Saxony-Anhalt State Office for Heritage Management and Archaeology, which digitally capture the visual features of coins and describe them exactly in a matter of seconds. The scanning system can be used to identify and recognize coin finds.  → Read more at phys.org

→ Read more at phys.org

Dec 22, 2018 | coins, grading, news

1996 Olympic Tennis Commemorative silver dollar “X” cancelled die encapsulated by NGC (Image courtesy of NGC)

Fees for this service range from $20 for a defaced die to $50 for a die that was canceled with an “X” to $100 for a die that was not canceled.

The holder appears to be similar to those used to encapsulate rolled coins. It will hold a die up to 40.6mm wide and 59.6mm tall, likely the largest die that the U.S. Mint would use to strike coins. The holder will be too small for the dies that would have struck 3-inch medals.

NGC does not say how the holders would keep smaller dies in place.

NGC will accept coin dies from any country.

Since I found coin dies interesting, I bought a few. Two Lincoln cent dies were ground down except still have a small part of the design visible. The other is a 1994 half-dollar obverse die. The one cent dies are on my desk at home and the half-dollar dollar dies is in my office.

-

-

Lincoln Cent Dies from the Denver Mint

-

-

Canceled obverse die from a 1994-D Kennedy Half Dollar

Having the die sitting on my desk is a great conversation starter. Visitors will ask what it is and when I explain they have the same reaction that I had when I bought it at the 2018 World’s Fair of Money: “ooo, neat!”

I am not sure how I feel about this news for the industry but I will not be submitting my dies for encapsulation. I do not think the die’s industrial look would look good entombed in plastic.

Sep 23, 2018 | coins, grading, news

David Hall

(PCGS Image downloaded from the Internet Archive)

In a surprise announcement, Collector’s Universe, Inc. (NASDAQ: CLCT) announced the termination of David Hall as president and CEO as of September 18. No reason was given for his termination.

Hall remains on the Collector’s Universe board of directors.

Hall was one of seven co-founders of Professional Coin Grading Service in 1985. In 1999, PCGS expanded to Collector’s Universe to provide grading and authentication services to other collectibles. Professional Sports Authentication and PSA/DNA are considered the gold standard in the sports collectible industry. He has held several leadership roles in PCGS and Collector’s Universe over the years.

When contacted by Coin World, Hall did not provide additional details.

In the article, it said that Hall plans to remain prominent in the industry and will be more active with David Hall Rare Coins, a firm he founded in the 1970s.

We here at the Coin Collectors Blog wish Hall well as he begins the next phase of his professional life.

And now the news…

September 17, 2018

Rock musician Rory Gallagher represented the “very best aspirations of our republic”, President Michael D Higgins has said. Mr Higgins was presented with a €15 commemorative coin featuring an image of the late guitarist who died in 1995, aged just 47.  → Read more at irishtimes.com

→ Read more at irishtimes.com

September 17, 2018

THE Royal Mint is selling a GOLD Kew Gardens 50p coin which could be worth up to £800. Only 1,000 of these rare coins were made and only 629 of them were actually bought by the public, making them even more valuable to collectors.  → Read more at thesun.co.uk

→ Read more at thesun.co.uk

September 17, 2018

Law enforcement officers are urging the public to be on the lookout for scam artists trying to sell fake coins in the Cameron, Missouri, area. The DeKalb County Sheriff's Office issued an alert showing plastic sleeves of old coins that were passed off as valuable silver to one business.  → Read more at newspressnow.com

→ Read more at newspressnow.com

September 22, 2018

The Royal Mint has increased its production of collectible coins in an attempt to appeal to a wider market as the use of cash declines across the country.  → Read more at telegraph.co.uk

→ Read more at telegraph.co.uk

Oct 27, 2017 | coins, commentary, grading, technology

SinoTech Stereo Microscope with USB interface

However, the area where they are lacking is the science of numismatics. The part where technology has been able to automate to perform mundane work and do the finest details that many factories have increased output while reducing the workforce. It is their inability to grasp new technologies that have been holding back the growth of numismatics.

Recently, someone with great numismatic credentials said that you cannot teach grading using computers.

When I was working in non-civilian agencies, we would call that BRAVO SIERRA (from the phonetic alphabet meaning “B.S.”).

It used to be that video technology prevented images from being shown in detail. This goes back to the day from the old television standards were the picture was 525 scan lines (the number of passes the across the screen it took to form the picture) drawn about 30 times per second (the frame rate). This was different from early computers that drew fine dots on the screen. At the point color monitors entered the market, most were 640 dots wide by 480 dots tall which was a little smaller than your standard television screen.

Technology has advanced beyond what we had with the old cathode ray tube (CRT) television and monitor. Now, you can buy a monitor that attaches to your computer that has the same resolution as your television. What we call “4K High Definition” is 4096 pixels wide by 2160 pixels tall or over six time the size of the old monitors.

The iMac I am using has a display that is 5120 pixels tall by 2880 pixels wide and the iPhone 6 Plus in my pocket has a display that has 401 pixels per inch resolution. Think about that for a moment… every square inch of an image will use 160,801 individual dots to display on a device that fits into my back pocket!

These monitors are not only larger but the pixels are denser, meaning they are smaller and closer together. When in the old days you can look into the television and see jagged edges, you closeup look now shows smooth lines.

Go look at the specification of the smartphones and tablets that are on the market. They make television that was being sold as little as 10 years ago look like something out of ancient history.

Cameras are also better. Most smartphones can shoot images of over 8 megapixels up to 20 megapixels with image sensors that surpass what was on the market as late as 5 years ago. The amount of image data these cameras can capture are remarkable!

Can you guess the grade?

There are a lot of industries that use this technology for critical image analysis. The growing telemedicine field uses the imaging to allow a doctor to examine patients from anywhere including some of the most rural parts of the world. A nurse in the middle of a jungle can draw blood, put the slide in a machine that will take images and perform other data analysis and send it back to a doctor thousands of miles away to help diagnose illnesses.

Manufacturers of parts for your automobile and the airplanes you fly us this image analysis to check for imperfections in metal parts including difficult to spot stress fractures to prevent breakdowns. That should be comforting driving down the road at 60 MPH or 30,000 feet in the air.

Even the food industry uses this imaging technology to prevent foreign substances from being packaged and landing on the grocery store shelf. Remember the opening theme from Laverne & Shirley where they are on the bottling line watching for bottles without caps? That job does not exist anymore. Computers with imaging technology not only watch for those bottles but can spot one that is not filled correctly and if something other than beer was placed in the bottle.

If we can trust the imaging technology for medicine, vehicle safety, and food integrity, why can’t we trust imaging technology to grade coins?

-

-

1965 Canadian Half Dollar

-

-

1965 Canadian Half Dollar reverse

Images taken with an iPhone 6 Plus

This is not to suggest that we can start grading coins by computer tomorrow but we can start soon. Programs have to be written to support the type of image analysis that would be required to determine an MS-69 coin from an MS-70. In fact, we may see fewer MS-70 coins using computer image analysis because the closer we look the more flaws we will find.

Professional Coin Grading Service provides the tip of this iceberg with the PCGS Photograde app. Whether you use the online service or one of the mobile apps, detailed imaging, and high definition displays can show you the details necessary. In fact, in a video PCGS produced about Photograde, they note how you can see the scratches on the imaged coin.

Images from PCGS Photograde App on the iPhone

If you can use the high definition images to see the details of coins, then the first step would be to use those images and the knowledge of grading to grade coins. Digital images can be transmitted anywhere there is a connection using the proper teaching platform.

With all due respect to the numismatic expert that said to me that you cannot teach grading using the computers, it is time to evolve from the early 2010s and see how technology has evolved to make it possible.

The week’s

The week’s

→ Read more at

→ Read more at

Last month, the

Last month, the