Weekly World Numismatic News for December 29, 2019

Coin World wants to join the sticker craze and add one to your NGC or PCGS slabbed coin. PCGS is offering a similar technology under the label.

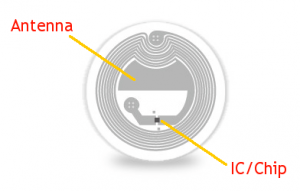

Both services will use something called Near Field Communication (NFC). NFC is a technology based on low-frequency communications where a transmitter emits a signal when activated by a reader.

Although NFC is not a new technology, it had gained interest when Apple announced that the latest iPhones had programmable NFC hardware. The NFC capabilities built into prior versions of the iPhone were not accessible outside of Apple’s applications running on the phone.

You may have used NFC without your knowledge. All contactless payments like Apple Pay, Google Pay, and the tap-to-pay credit cards require NFC. Many department stores are using they call smart tags, which are tags with an NFC chip embedded in them. Aside from electronic payment, contactless keycards, sometimes called proximity cards, are used to access restricted areas are NFC-based technologies.

Now Coin World and PCGS want to bring it to numismatics.Like every technology, NFC is not perfect. Its most significant risks come from the use of NFC tags. These low-power devices have limitations that have allowed hackers to defeat whatever features they are supposed to protect.

The security concerns do not consider privacy issues. Do you trust PCGS or Coin World with the data they claim to be keeping? Do you trust that this data will not be for sale under any circumstances? Do you trust that there are sufficient protections in place to prevent others from hacking the NFC antenna that will allow you to be tracked?

In my past life in information security, I had the opportunity to test the security of these wireless communications. As part of the test, I was able to walk out into the parking lot and open car doors without access to the keys. Unfortunately, the principles I used in that demonstration are the same that others have used to hack NFC.

As we head into 2020, I plan to discuss the impact of NFC from the perspective of someone who used to look at this stuff for a living and had to explain it to non-technical people.

And now the news…

→ Read more at ottawacitizen.com

→ Read more at ottawacitizen.com

→ Read more at taiwannews.com.tw

→ Read more at taiwannews.com.tw

→ Read more at krqe.com

→ Read more at krqe.com

→ Read more at myjoyonline.com

→ Read more at myjoyonline.com

→ Read more at newsmax.com

→ Read more at newsmax.com

→ Read more at anash.org

→ Read more at anash.org

→ Read more at djournal.com

→ Read more at djournal.com

Cash Is Still King

We are going to take time off from restructuring the US Mint to look at coin news from the United Kingdom. While reading other news from the British Broadcasting Company, I found two interesting articles.

In the first article, Are coin fairs the new investment clubs? BBC reporter Carolyn Rice attends a “coin fair” (coin show) last February following attendees who are more interested with coin investments than collecting.

One interesting aspect of the article is noting that British collectors and investors are interested in older gold sovereigns and ancient coins. It was interesting to read about a 10 year old collector from Birmingham who is “looking for a Julius Caesar coin, it has got an elephant on the back.”

The end of the story talks about the future of money and the lure of collecting. While one dealer thinks “[coins] will become more of a novelty and more collectable but [he] can’t see cash dying out completely.”

Is it possible to go through your day without cash? In a video report, BBC reporter Kevin Peachey tries to live a day without cash. Peachy, who begins his day from his London flat with breakfast, empties his pockets of money and tries to go through his day paying with credit and other payment cards.

While watching the video, I was struck by how many different cards had to be used to go through his day and looked at the cards in my wallet. Aside from the usual set of bank, store, and gas credit cards there are also cards for my morning coffee, a card if I need to ride the Metro, two gift cards, and various retail loyalty cards. The common denominator is that each card is backed with cash that is either paid directly or electronically transferred. In thinking about it, until a universal card can be developed to be as universal as coins and currency it will be difficult to create a cashless society.

Peachey and Rice team up to report that the usage of cheques is decreasing. While their report describes how the use of cash is decreasing to non-cash options, the authors predict that by 2015 there will be more usage of debit cards than other non-cash payments.

However, in the end, cash is still king and the various world mints do not have much to worry about.

Reforming America’s Currency: Part 4-Commemorative Coin Programs

As part of the restructuring of the US Mint, the area of commemorative coins have to be a significant concern. With both the classic and modern commemoratives, congress could not help itself by using commemorative coins as a form of fundraising for pet causes. While some of the beneficiaries of the funds are worthy, others have caused significant controversy. Additionally, there were commemorative programs that have lost money for the US Mint causing more losses than what has been seen in the cent and nickel.

The first reform in commemorative coinage would be that no commemorative would be struck for the sole purpose of raising money for any organization. Regardless of how worthy the organization may be, the association of the commemorative with fundraising taints the process. Thus, this proposed reform recommends that no commemorative coin may be proposed with the purpose of fundraising.

Once the commemorative coin has been approved, related groups may petition congress to attach their organization to the commemorative for fundraising purposes. If congress approves, the organization will be paid for the profits beyond the cost of manufacturing, packing, and distribution of the coin. The US Mint must be able to recover their costs before any money is distributed to the approved organization. Payments will be made quarterly after the US Mint has broken-even. As part of this plan, the US Mint holds back 5-percent of the dispersal in order cover future expenses. When the sales of the commemorative coins are complete, the US Mint’s costs will be recalculated and the remainder will be paid to the approved organization.

Before choosing an organization for fundraising, the commemorative coin must be selected. Since congress has bungled this over the years, congress should no longer select topics or how the program is to run. As part of the reformed commemorative coin laws, the congress sets parameters for how commemorative programs and leaves the decisions to the Citizens Coinage Advisory Committee. When the CCAC makes their selection, the process will be limited to something of national interest. It may be something relating to history (e.g., War of 1812), the anniversary of a government institution or program, someone of national historical significance, or a building of national importance (e.g., the Capital Building, White House). The commemorative must be something representative of the national interest.

All commemoratives will be proof strikes. There seems to be no purpose to uncirculated commemorative coins nor is there a purpose for clad commemorative. Commemorative programs may contain up to four coins with the priority being $1 silver, $10 gold, half-dollar silver, and $5 gold. In this scenario, if the commemorative program is to only have three coins, then the $5 gold coins would not be used. If the commemorative is used for a fundraiser, the US Mint will add a $5 premium for the half-dollar, $10 premium for the dollar, $25 premium for the $5 gold coin, and the $35 premium for the $10 coin.

Because it may be impossible for the egos in congress to remove themselves from the commemorative process, the law should allow that they be given the ability to vote in one commemorative program per year. As opposed to their current practice, a congressional commemorative program may specify everything except the design and where the coins will be struck. The design will be created by the CCAC and the US Mint engravers to match the theme of the program and the branch mint used to strike the coins will be selected by the US Mint in a manner to make efficient use of the facilities.

As part of the transition, any commemorative program passed by congress prior to the restructuring will be issued as required by the enacted law. However, those commemoratives will count against the one program that congress is allocated per year.

Fixing the commemorative coin program is a combination of making it relevant and removing the fundraising aspect of the programs. With the compromise of allowing congress one commemorative program a year and giving them the ability to add a controlled fundraising aspect after the fact, this should prevent commemorative coins from becoming irrelevant.

The restructuring continues next with the bullion programs.

Reforming America’s Currency: Part 3-Circulating Coins

Now that the US Mint has been reorganized, it is time to strengthen the product line. The US Mint’s primary product are the circulating coins that are sold to the Federal Reserve. At this moment, there should be no changes to the required denominations and composition. Although there have been recent issues with the rise in the costs of zinc and nickel that affected the seignorage of the one and five cent coins, the US Mint produces enough coins in other denominations to mitigate those losses. Business calls selling a product at or below it manufacture price is called a loss leader. As long as the US Mint is meeting its obligations to the Federal Reserve, it is not a problem for the US Mint to downgrade the cent and nickel to loss leader status.

Numismatists are most vocal over the design of the coinage and the number of rotating series that drives up the costs to collectors. In order to add sanity to the process, there must be some rules. Thus, under this reorganization, no coin design is to last more than 25 years. The coin design can refer either to the obverse, reverse, or both, but something must be changed. This means the end of the 50 year design pattern given to the Lincoln Cent. Once the new design is settled in 2010, it must be changed by 2035. At that point, the CCAC and the US Mint will decide to redesign the entire coin or, once again, replace the reverse only.

Under this rule, the dime and half-dollar are due for design updates.

This proposal does not change the elements that are required on the coin. As described in 31 U.S.C. §5112(d)(1), “United States coins shall have the inscription ‘In God We Trust’. The obverse side of each coin shall have the inscription ‘Liberty’. The reverse side of each coin shall have the inscriptions ‘United States of America’ and ‘E Pluribus Unum’ and a designation of the value of the coin.” All other rules about design in that paragraph would be eliminated under this plan.

If the US Mint creates circulating commemoratives, there should be no more than two programs in place. One program can be a multi-coin commemorative, like the Presidential $1 Coins, and the other an annual series, such as the Native American $1 Coins. Any more than that becomes too much where the US Mint apparently cannot maintain the levels of manufacturing necessary to satisfy demands for their products. Once the circulating commemorative series is completed, the coin will undergo a final design change for the year after the program’s conclusion and remain that way for 25 years. An exemption to this rule will be to maintain the America the Beautiful Quarters Program as part of the transition.

And no more circulating commemoratives of the same coin. Either have the Presidential $1 Coin or the Native American $1 Coin, not both!

The US Mint will maintain the annual coin programs for all circulating coins. Mint Set will remain coins that have come from business strike production lines and proof coins will continue to use specially treated planchets as they do today. Additionally, the US Mint will continue to produce the Silver Proof Set except that the one-cent coins will be struck in an alloy of 95-percent copper.

Finally, it is time to make the one-dollar coin worth striking. The only way to do this is to stop producing the one-dollar Federal Reserve Note. The United States is the only “First World” country that continues to produce its unit currency in paper form. Even as the $1 FRN continues to be produced, some countries are eliminating more lower denominations to save on costs. It is time for the United States to do the same. In fact, the United States should also eliminate the $2 note.

At the end of the series, there will be an article about the paper currency and the Bureau of Engraving and Printing.

There are relatively few changes necessary for circulating coins. In the next article, we will look at the commemorative coin program.

Reforming America’s Currency: Part 2-Reorganizing the US Mint

Yesterday, I called for reform in the coinage laws to remove congress from the operations of the US Mint. Before talking about coinage, the first act of reformation is a reorganization of the system. When a business is failing, the first thing they do is to reorganize. This is the purpose behind Chapter 11 of the Bankruptcy laws.

The first step to reorganization is that congress must change the coinage laws (31 U.S.C. §5112) to divide the coinage types into the four relevant types: circulating coinage, bullion, commemorative coins, and medals. Making this distinction between coinage types will clean up the laws, reduce the confusion, and make it easier for the US Mint to understand the policies it is required to implement. A byproduct of making the laws easier to understand would help the public with understanding the responsibilities of the US Mint.

Next would be to change the organizational of the US Mint. It is unfortunate that the previous administration chose to appoint a political hack as the director. Rather than being a good manager to lead the US Mint through a slow period, the current director has shown that it needs more than a political appointee to run the US Mint. Thus, the US Mint needs a Board of Directors.

The Board of Directors would be responsible for ensuring that the US Mint would maintain policies, properly managed production issues, and assisted with the design of the coinage. The Board would be the first line of defense to ensure that the US Mint is living up to its responsibilities to both its commercial client, the Federal Reserve, and the collecting community. This Board would be responsible for contacting the Treasury Inspector General or the Government Accountability Office to investigate issues with the US Mint.

To create a Board of Directors, congress would have to look no further than the current Citizens Coinage Advisory Committee. Since its inception in 2003, the CCAC was supposed to be on the front-end of the design process. Instead, the lawyers at the US Mint defined the CCAC’s role as being virtually in competition with the US Commission of Fine Arts when it comes to coin design. It is time for that to end and give the CCAC a more significant role in the process.

Under this proposal, the CCAC would be the ultimate arbitrator of everything that goes into the coin design. While I will discuss this role in the context of coin types, this means that congress will cease deciding what is to be depicted on the coins. The CCAC will be the arbitrator of this process. While this concept is new in the United States, this is the role played by similar organizations that work with the Canadian Royal Mint, Great Britian’s Royal Mint, and other worldwide mint. It is time for the United States to catch up with the rest of the world in this regard.

With the expanded role of the CCAC, the role of the CFA to be the arbitrator of the final design will not end. However, rather than be in competition, the CCAC and CFA will work together on the final design.

As part of the CCAC’s role as the US Mint’s Board of Directors, the US Mint Director and the directors of each branch mint would have an ex-officio seat on the Board and be required to provide monthly production reports and quarterly operating reports (similar to SEC Form 10-Q) for review by the CCAC. All reports would then be published by the US Mint and made available electronically via the US Mint’s website. Similarly, notes from the CCAC, including design considerations, would be made available through the CCAC’s currently useless website.

If the CCAC is to take on a more significant role in operating the US Mint, it is reasonable that they should receive a stipend. The stipend would be paid out of the Public Enterprise Fund and counted as an operating expense of the US Mint.

Speaking of accounting, as part of this reorganization, the US Mint would be required to produce their quarterly and annual reports that is in full compliance with the Federal Accounting Standards Advisory Board. Annual reports must be audited by an accredited accounting firm while it would be optional for quarterly reports to be audited.

Funding for the US Mint and its operations will be proposed by the Director and approved by the CCAC. The approved budget will be provided to the Secretary of the Treasury and submitted to congress for their final approval. The budget for the US Mint must be withdrawn exclusively from the United States Mint Public Enterprise Fund (31 U.S.C. §5136). If the Public Enterprise Fund does not have enough money sufficient to fund US Mint operations, the Secretary of the Treasury must approve the transfer of money from the general fund to the Public Enterprise Fund.

The only substantive change to the operations of the US Mint Public Enterprise Fund is how the excess money is handled. Although the wording is not clear, it appears that a reserve of “6.2415 percent of the nominal value of the coins minted” is required and that all excess is transferred to the general fund. For the reorganized US Mint, the reserve in the public enterprise fund would be 10-percent of the bureau’s total budget rounded up to the next million dollars. Also, to hedge against the problems congress creates with their annual budget battles, the budget approved by the Secretary will go into effect on October 1. During the budget process, the excess from the Public Enterprise Fund will remain in the fund until congress passes the budget.

While we are cleaning up the laws, congress needs to remove the Numismatic Public Enterprise Fund (31 U.S.C. §5134). The law that created the US Mint Public Enterprise Fund supersedes this law and is unnecessary to remain on the books.

The final aspect of the reorganization is to alter the laws that requires all metals to be purchased from United States mines and other sources. Through a labyrinth of laws, the copper, nickel, zinc, and manganese used for US circulating coinage and silver, gold, and platinum for bullion coins must be bought from US sources at the prevailing price. In other words, the US Mint cannot negotiate for discounts on the purpose of these metals as any large manufacturer would do. By doing this, congress is providing a subsidy (welfare) to the mining industries who have stemmed losses by selling to the US government. While politics will protect those mining interests, congress can authorize the US Mint to purchase coining metals from non-US sources when US sources cannot maintain sufficient supplies.

Now that the US Mint has been reorganized, the next installment will discuss improving circulating coinage.

Reforming America’s Currency: Part 1-Background

Since the ratification of the United States Constitution in 1788, congress has interpreted their Article I, Section 8 right to coin money beyond this sentence. Since the Coinage Act of 1792, congress has been heavily involved in the design of US coinage even to the point of providing exact design details.

In recent years, it appears that congress that too worried about their legacy in US coinage than their legislative legacy. The modern problem began with the success of the 50 State Quarters program. While this was a novel idea that was worth doing, congress has destroyed the novelty by making the start of the 21st century the decade of the rotating design. In this decade, congress approved the Westward Journey Nickels, Presidential Dollar, DC and US Territories Quarters, Native American $1 Coins, Lincoln Bicentennial One Cent, and the America the Beautiful Quarters programs that will begin next year. Making matters worse, the dollar coin programs have mintage requirements that the US Mint has confirmed that there is a surplus of dollars that have not been sold to collectors or the Federal Reserve.

Commemorative coins have had mixed results. What numismatists call classic commemoratives suffered from issue overload where congress authorized commemorative coins to raise money for any pet project. When congress reauthorized commemorative coins for 1982, it appeared that they learned the lessons from past mistakes by limiting the number of programs authorized. That was until congress authorized programs with multiple coin options, like the 1989 Congress Bicentennial, 1991 Mount Rushmore Golden Anniversary, and 1992 XXV Olympiad commemoratives, causing collector fatigue in the market.

After commemorative programs started showing losses, the General Accounting Office (now called the Government Accountability Office) investigated how to fix the commemorative coin program. In GAO report GGD-96-113 [PDF], U.S. Mint: Commemorative Coins Could Be More Profitable, they noted failures in the commemorative coin programs were because of over production, bad choices of subject, and the production of too many commemoratives. Subsequently, congress authorized the 32-coin Atlanta Olympic Commemorative Coin Program that lost money for the US Mint. As a result, congress codified the recommended limits on commemoratives which they have held to ever since.

With complaints coming from many directions, congress has regularly abused its constitutional powers to the point that collectors are threatening to turn away from future US Mint’s offerings. This will hurt the future commemorative market as well as the dollar coin market since collectors are the majority purchasers of these coins.

It is time to reform the coinage laws.

Even though the constitution says that congress has the authority to coin money it does not say that they have to the ability to design money or run the US Mint. Since the Coinage Act of 1792, congress has transferred the operation of the US Mint to the executive branch. But for over 200 years, congress continues to try to run the Mint from the halls of the capital so that whenever congress has asserted itself in the coining process the results have lead to failure. It is time to remove congress from the process. Congress continues to have a role in defining the denominations, metal types, and other specifications (see 31 U.S.C. §5112(a) through (c)), but what goes on the coins, how they are made, and where they are made should be removed from congressional tinkering.

Over the next week, I will look at how to improve the administration of the coining process by breaking the discussion up into four categories: circulating coinage, bullion, commemorative coins, and medals. But first, we must reorganize the US Mint to become a better operating entity. The next article will look at a reorganization proposal.