Sep 20, 2021 | cash, cents, coins, news

Yes, I’m a day late. At least I’m not a dollar short!

It is not a surprise to economic and market watchers that there is a perceived coin shortage. The problem is not just in the United States, but worldwide central banks are trying to fix their circulation issues.

It is not a surprise to economic and market watchers that there is a perceived coin shortage. The problem is not just in the United States, but worldwide central banks are trying to fix their circulation issues.

Over the last three months, the Reserve Bank of India (RBI) has been trying different tactics to get money to circulate. In addition to striking more coins, they promote new designs and a program for citizens to redeem old coins for the newly issued coins. It has a moderating effect on the COVID crisis at high levels in the country.

India has also been dealing with rumors one type of circulating coin has been counterfeited or been withdrawn and not legal tender. However, the RBI has insisted that the coins are legal tender but continue to promote them with the redesign.

The Royal Mint has stepped up the production of 1 penny coin for circulation. Physical money is used more in the UK than electronic transactions, especially outside of the cities. Although some feel the penny has been overproduced and would rather see the 2 pence coin used, the increase in the number of transactions since the lifting of COVID restrictions created the demand.

The United States continues to see shortages. Most of the reports are coming from outside of the major metropolitan areas. Most are looking for one-cent coins. Experts are blaming accelerated consumer spending in areas where cash payments are more prevalent. More populated urban regions are seeing more electronic transactions than cash.

Let’s keep the economy moving. Spend those coins! (not the ones you collect)

And now the news…

September 14, 2021

Bankers thought the nationwide coin shortage was over, as the U.S. economy reopened and previously housebound consumers were able to unload more of their change. But a combination of factors — including government stimulus payments, accelerated consumer spending and the threat of the COVID-19 delta variant — has stymied progress and forced retailers to resort again to asking shoppers for exact change.

→ Read more at

americanbanker.com

September 14, 2021

Croatian National Bank (HNB) Governor Boris Vujčić said on Monday after meeting with European Commission Vice President Valdis Dombrovskis that a test production of euro coins with Croatian national motifs should begin by the end of this year, with possibly about two million coins being minted.

→ Read more at

croatiaweek.com

September 15, 2021

LAS CRUCES – The Las Cruces Police Department received two reports of movie prop money that was passed as legal tender over the weekend, a news release on Monday stated. In the news release police stated movie prop money can look like actual currency but, in most instances, does not have the same texture.

→ Read more at

lcsun-news.com

September 15, 2021

A very rare large gold coin from the reign of Charles I is expected to fetch £50,000 when it is sold at auction.

→ Read more at

newschainonline.com

September 15, 2021

A huge hoard of Iron Age gold artifacts has been uncovered by an amateur metal detectorist in Denmark. The "enormous" find consists of almost one kilogram (2.2 pounds) of gold buried 1,500 years ago, according to a press release from the Vejlemuseerne museum, which will exhibit the hoard.

→ Read more at

cnn.com

September 16, 2021

One penny coins were back in production last year after none were minted for general circulation in the previous two years, Royal Mint figures show.

→ Read more at

bbc.com

Jul 25, 2020 | cash, coins, Federal Reserve, US Mint

The U.S. Mint succinctly stated in its press release about the shortage of circulating coins is that there are enough coins in the economy. There is no shortage.

The U.S. Mint succinctly stated in its press release about the shortage of circulating coins is that there are enough coins in the economy. There is no shortage.

What is happening is that, like everything else during the COVID-19 crisis, the supply chain broke. Coins stopped circulating because people were not going out and spending the coins or currency. Since cash sales dropped, there was no need for stores to stock up on coins. They had the supply to conduct business.

Since the stores did not need the coins, the banks stopped ordering coins for its inventories. Larger stores that rely on logistics carriers were not ordering coins or sending coins into the supply chain. Finally, the logistics carriers saw their inventories rise and become stagnant, giving them no reason to buy more coins from the Federal Reserve.

Now that areas are opening and the demand for change has increased, the supply chain has to restart. According to Federal Reserve Chairman Jerome Powell, the cash rooms operated by each Federal Reserve District has a sufficient supply of coins. But the coins have to be circulated through the system.

The government is doing its job. The U.S. Mint is striking a sufficient volume of coins for circulation, and the Federal Reserve has the supply to support commerce. It is the private sector that manages the supply chain that has failed.

The logistics companies, the coin processors that move the money between the Federal Reserve, the banks, and the retailers, have caused the backup. Since many banks have limited access to their drive-thru operations, there is an opportunity for the supply chain to adjust. They cannot adjust fast enough.

If you want to help fix the supply chain, spend your coins. Use exact change when possible. When it is not possible, use a credit or debit card.

If you are the type that keeps coins in jars, now is the time to do your search and send the rest back into circulation. Some banks are offering bonus payments for bringing in coins. Others that were charging fees if you did not roll the coins are waiving those fees. If you regularly buy from Amazon, consider using a Coinstar machine to turn your coins into an Amazon credit. Coinstar does not charge a fee when you trade your coins for Amazon credit.

Relax! It is not a conspiracy to get coins out of circulation. The government is not replacing U.S. dollars with Bitcoin. The government is not participating in creating a global currency, especially when you see how that has worked with mixed results in Europe. And this is not how the government is going to take your money away from you. That is what the tax code does.

Take your coin jar, search for collectible circulating coins, and spend the rest. Get the coins back into circulation.

If you like what you read, share, and show your support

Sep 25, 2019 | Canada, cash, coins, commentary

The Canadian Broadcast Company reported that a bank in Montreal refused the deposit of $800 in rolled coins.

The Canadian Broadcast Company reported that a bank in Montreal refused the deposit of $800 in rolled coins.

Julien Perrotte saves the coins he receives in change. Every year he will sort and roll the coins so that he can deposit them into his account at Laurentian Bank. This year, the bank told Perrotte that it was a new policy not to accept coins.

Canadian laws do not require banks to accept all legal tender coins or currencies. They can refuse to take any form of specie and only operate using electronic funds.

Laurentian Bank has taken advantage of these laws and no longer employ human tellers to accept cash. Customers can deposit currency and checks in their automated banking machines. The machines do not accept coins.

Before people begin to criticize Laurentian, this is starting to occur in the United States. Banks and other financial institutions are beginning to offer checking and other consumer banking services accessible online. They do not have branch offices.

The largest and most successful of the online banks is Ally. Anyone can open an Ally account and have access to the full line of banking services except you cannot deposit cash.

Then there are banks with physical presences that are transitioning to a model like Laurentian. Capital One Bank entered the consumer banking business when it started buying smaller banks in 2005. Today, Capital One is closing branches and consolidating teller operations in Capital One Cafes. Customers that do not live near Capital One Cafes can deposit currency and checks via an ATM but cannot deposit coins.

Does this mean we are heading toward a cashless society?

No! It means that the United States has an economy diverse enough to support new ideas in banking services while maintaining traditional banking operation. It is because the United States has a diverse economy that includes a cash-based transaction (see here and here) that will prevent our society from going cashless.

Rather than try to deal with Laurentian Bank’s new policy, Perrotte said he will be taking his business elsewhere.

May 26, 2019 | cash, coins, currency, news

In the argument as to whether to get rid of cash in favor of credit cards and electronic payments just took an interesting twist this week. According to a study by LendEDU.com, a website that specializes in loan comparison and education, credit and debit cards are dirtier and carry more germs than currency and coins.

LendEDU reported that they “used a scientific device that tests for bacteria on a given surface.” Their publication did not disclose the device that they used. And based on the results, the tests were performed in New York City.

On average, NYC CitiBike (a bicycle sharing service), McDonald’s door handles, a park bench, and a parking meter had more bacteria than the average credit card. But they did find that the credit card was dirtier than a Penn Station bathroom, cash, coins, and a subway pole.

With all due respect to LendEDU, did they find the most remote bathroom in Penn Station and test it after someone did their quick wipe down? And did they test the pole on the subway car after someone used that bathroom and washed their hands if the sink worked?

Aside from being a proponent for using the products produced by the Bureau of Engraving and Printing and the U.S. Mint, I am a native New Yorker and one-time commuter from Long Island. These findings are difficult to believe, especially the low score for the subway pole. I have taken the A Train. I would not have a sandwich without washing my hands after getting off the train!

It is a fun story but hardly a credible test.

If you would excuse me, I have to check the level of the big bottle of hand sanitizer next to the cash register!

And now the news…

May 22, 2019

That credit or debit card in your wallet is apparently dirtier than you might have suspected.  → Read more at foxbusiness.com

→ Read more at foxbusiness.com

May 23, 2019

MONTREAL, May 23, 2019 /PRNewswire/ – In 1969, Plastic Ono Band (John Lennon and Yoko Ono) recorded Give Peace A Chance, an anti-war anthem for generations of pacifists and music fans around the world. The song was recorded live from Lennon and Ono’s Queen Elizabeth Hotel suite in downtown Montreal  → Read more at finance.yahoo.com

→ Read more at finance.yahoo.com

May 24, 2019

The recent discovery of two ancient Spanish coins near Halls Crossing excited archaeologists at Glen Canyon National Recreation Area, who wondered whether they offered evidence that Spanish explorers, possibly in search of mythical cities of gold, passed through Utah centuries ago.  → Read more at sltrib.com

→ Read more at sltrib.com

May 25, 2019

A US-made collectable coin lists Britain and France among the honored US allies in WWII, but, strangely, the Soviet Union, whose Red Army delivered a crushing blow to the Nazis in Europe and fought Japan, is omitted.  → Read more at rt.com

→ Read more at rt.com

May 25, 2019

Apparently, the Soviet Union, whose soldiers hoisted a red flag over the Reichstag marking the liberation of most of Europe from the Nazis during World War II, is not a country that contributed to securing the "liberties" the Western states "enjoy today", per a US company which issued a souvenir commemorating the victory's upcoming anniversary.  → Read more at sputniknews.com

→ Read more at sputniknews.com

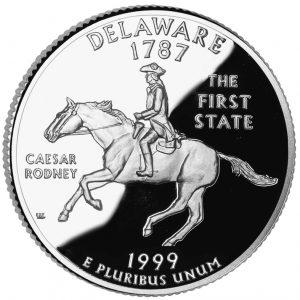

Nov 27, 2018 | cash, coins, Federal Reserve, markets, state quarters, US Mint

It never ceases to amaze me that even the most seasoned and esteemed numismatists do not understand how United States coinage goes from manufacturing to circulation.

It never ceases to amaze me that even the most seasoned and esteemed numismatists do not understand how United States coinage goes from manufacturing to circulation.

Recently, Harvey Stack wrote a column that appeared as a Viewpoint in Numismatic News (November 18, 2018). In the column, he blamed the U.S. Mint for problems with the distribution of the 50 State Quarters program. In the article Stack wrote that “the distribution of the new designs did not get full nationwide distribution. The Mint sent to most banks nationwide whatever they had available, with some districts getting large quantities of the new issue and other districts getting relatively few, if any.”

The U.S. Mint does not distribute circulating coins to any United States bank except the Federal Reserve. At the end of every production line is a two-ton bag made of ballistic materials that collect every coin produced on the line. When the bag is full it is sealed and later transported to a processing center designated by the Federal Reserve.

The U.S. Mint is a manufacturer. When they complete making the product, it is packaged in bulk and the customer, the Federal Reserve, picks up the product. Once the product is delivered to the client, that product’s distribution is no longer in the U.S. Mint’s control.

During the time of the 50 States Quarters program, the U.S. Mint had an agreement with the Federal Reserve to distribute the new coins first in order to get them into circulation. When the new coins were transferred to the various Federal Reserve cash rooms in the 12 districts, the Federal Reserve did circulate the new coins first.

What gets left out of the discussion is the logistics of transferring the coins from the cash rooms to the banks. The Federal Reserve does not deliver. Like many government agencies, the Federal Reserve relies on contractors to carry out that job. The Federal Reserve “sells” the coins to the logistics companies that bag and roll the coins and eventually deliver the coins to in armored vehicles to the banks.

In order to save money, these logistics companies keep their own supply of coins. This supply comes from the Federal Reserve cash room operations or excess they are given by the banks. Sine the logistics companies were not part of the deal that the U.S. Mint made with the Federal Reserve, a bank that asked for a delivery of quarters may have received quarters from the logistic company’s stock rather than new issues from the Federal Reserve.

Logistics is the coordination of complex operations and it is the job of these logistics companies to fulfill the inventory needs of the bank in the most efficient manner possible. It was more efficient to supply the banks in less densely populated areas with coins from current stock than transporting large amounts of coins from one of the Federal Reserve cash room operations that may be hundreds of miles away.

The U.S. Mint may do many things that collectors might take exception to, but the distribution of circulating coins is not their responsibility.

Coin image courtesy of the U.S. Mint.

Sep 16, 2018 | cash, coins, news

Before E-ZPass, I used to buy discount rolls of tokens to cross the bridges in New York City.

Rather than the coin machines, the lanes will be converted to “E-ZPass Only” lanes.

Although I am a proponent of cash, E-ZPass has been a blessing when traveling in the northeast. When I started a somewhat regular drive between the D.C. area and northern New Jersey, where my first wife is resting, I applied for the New Jersey E-ZPass. It made driving to the New York area easier by not having to stop for tolls.

Then there were the advances that allowed the New Jersey Turnpike to allow the use of E-ZPass before Maryland finally joined the party. Soon I was able to drive from Maryland to Maine without having to stop and pay a toll.

Long gone were the days where I planned a trip with a pocket full of quarters. Or when I was commuting to New Jersey from New York, buying a $20 roll of ten Triborough Bridge and Tunnel Authority tokens to cross the Verrazano-Narrows Bridge from Brooklyn to Staten Island. The one-way toll on the Verrazano Bridge was $5.00 or two tokens.

For the return home, there was a discount coupon book I bought every two weeks from the Port Authority to pay for crossing either the Goethals Bridge or the Outerbridge Crossing.

Both bridges provide a toll discount for using E-ZPass. Given the nature of traffic, it is easier to get through the toll plaza with the E-ZPass.

I will continue to use cash more than my credit card but I will not give up my E-ZPass.

And now the news…

September 8, 2018

Hundreds of ancient Roman gold coins have been discovered on the site of an old theatre in Como in northern Italy, the Ministry of Culture said.  → Read more at thelocal.it

→ Read more at thelocal.it

September 10, 2018

Ultimately a judge did not have to decide which mint was in the right. The case was dismissed after they agreed to a ‘collaborative’ cross-licensing agreement  → Read more at nationalpost.com

→ Read more at nationalpost.com

September 12, 2018

Plans to sell them as ‘sacred coins’ to non-resident Telugu society  → Read more at thehindubusinessline.com

→ Read more at thehindubusinessline.com

September 14, 2018

Mike Alessia chuckled when he thought about the days before E-Z Pass and paying your way down the Garden State Parkway doubled as a skill sport.  → Read more at pressofatlanticcity.com

→ Read more at pressofatlanticcity.com

September 15, 2018

Madurai: An ancient coin, dating back to the 14th century was discovered near Palani recently.  → Read more at timesofindia.indiatimes.com

→ Read more at timesofindia.indiatimes.com

September 15, 2018

A drop in silver prices this year has attracted investors seeking a bargain, prompting a temporary sellout of the 2018 American Silver Eagle bullion coins at the U.S. Mint this month.  → Read more at marketwatch.com

→ Read more at marketwatch.com

September 15, 2018

The battle to end taxation of constitutional money has reached the federal level as U.S. Representative Alex Mooney (R-WV) today introduced sound money legislation to remove all federal income taxation from gold and silver coins and bullion.  → Read more at moneymetals.com

→ Read more at moneymetals.com

Jul 21, 2018 | cash, coins, commentary, currency, markets, technology

With the discovery of every new technology, there are the inevitable predictions that it will make the old ways obsolete. Although the automobile reduced the reliance on horses, the basics of the internal combustion engine have not changed in over 100 years. Take away the electronics around the engine, the technology increasing the air intake, and cleaning up the exhaust, and you still have an engine block with pistons that go up and down in the classic suck-bang-blow rhythm that was used in the Model T.

With the discovery of every new technology, there are the inevitable predictions that it will make the old ways obsolete. Although the automobile reduced the reliance on horses, the basics of the internal combustion engine have not changed in over 100 years. Take away the electronics around the engine, the technology increasing the air intake, and cleaning up the exhaust, and you still have an engine block with pistons that go up and down in the classic suck-bang-blow rhythm that was used in the Model T.

The latest technology that is being touted as being the doom for physical money, which can also be the end of numismatics, is cryptocurrency.

There are two aspects of cryptocurrency that its fans say are its biggest strength. First, it is not bound by the traditional means of generating wealth. You can think of cryptocurrency as digital gold. It is mined using computers and a lot of complex arithmetic to generate one unit of the currency, sometimes referred to as a bitcoin. Like physical gold, there is some work required to mine for these bitcoins. It lies in the ability to create a computing environment capable of performing these intensive mathematical operations. You may not be panning for gold but you might spend as much on equipment and travel.

The other aspect about cryptocurrency is that the blockchain technology allows for both anonymous and secure transactions. Think of the blockchain as a giant ledger that is copied wherever bitcoin is accepted with regular updates. There is no single source that could control the ledger nor is there a single point of failure.

However, both its strengths are its greatest weaknesses.

While the value of money is regulated by their respective government there are no blockchain regulations. There is no regulation on the number of generated bitcoins but is arbitrarily set by the creator of the cryptocurrency. There is no guarantee of value as a state-sponsored currency. Bitcoin investors are betting on the value of electronics and math, something many of these investors does not fully understand.

The blockchain also provides its own problems. In order to use the cryptocurrency, you have to have your own copy of the ledger and be able to pass the information to the party you want to pay. Think about having a checkbook with everyone’s information. You cannot read the information because it is encrypted but you have to have a copy. Then you need to pay someone. You hand over the checkbook in order to complete the transaction.

Think about the amount of data that would be if the blockchain supported 1,000 people. What would it take to support 1 million people? What if the government decided that everyone would do their business in bitcoin and everyone would have to have a way to deal with the blockchain in order to facilitate payments. How cumbersome will that ledger be if all 325.7 million people in the United States had to carry that around?

Each blockchain is its own entity. While you can trade in bitcoins on the same blockchain, you may have to participate in more than one blockchain if you want to accept bitcoins from several different people. It is like different currencies today. I can go anywhere in the United States and use dollars. But if I wanted to go to Canada, I can either arrange an exchange or find someone who will trade.

Cryptocurrency that has to operate across different blockchains is just like going to Europe and having to change your dollars for euros.

As with anything that is computer-based and managed, there is always the security issues. Blockchains have been hacked. Although most of the hacks are based on compromised passwords, each hack yields millions of dollars in stolen cryptocurrency to the hackers and everyone who then does business with them on the same blockchain.

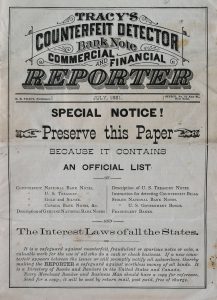

Eventually, this will lead to a cryptocurrency version of a Bank Note Reporter and Counterfeit Detector as was popular during the broken banknote period. Then it will be followed by a Cryptocurrency Act similar to the Currency Act that ended the broken banknote period proving George Santayana right as we repeat history.

Cryptocurrency is the darling of the technology industry and those in the financial industry that trade in high-risk investments. Even traditional financial services companies are spending a limited amount of risk capital on cryptocurrency investments. However, by all statistics, the number of consumers using cryptocurrency for transactions is less than 1-percent.

If Not Cryptocurrency The What About Credit Cards

Credit and debit cards remain the primary target that proponents of a cashless society use to promote their agenda. However, when faced with the realities of life in the United States, there are three statistics that work against their arguments:

- The Bureau of Engraving and Printing, the printer of United States currency, reports a year-over-year increase in production of just over 4-percent.

- The U.S. Mint, the manufacturer of United States coinage, is reporting a year-over-year increase of 6-percent striking circulating coinage.

- According to CreditCards.com, “In 2013, 20 percent of whites did not have access to a credit card compared with 47 percent of African-Americans and 30 percent of Latinos.”

The primary customer for the Bureau of Engraving and Printing and U.S. Mint is the Federal Reserve. If the Federal Reserve needs the money for its operations, they buy it from these government bureaus. The Federal Reserve only orders what it needs. If it does not need the money, then it is not produced.

Aside from the over 50-percent of the population without access to credit cards, there continues to be a demand for physical currency. Whether the currency is used in a vending machine or to buy other items, cash is still king and shows no sign of slowing.

While there continues to be a demand for the products from the U.S. Mint and Bureau of Engraving and Printing, these bureaus will continue to produce coins and currency giving us more opportunity to collect their products.

Feb 25, 2018 | cash, coins, commentary, currency

Here we go again. Another story about how one country is starting to go cashless and the pundits crawl out of the woodwork saying that the United States should do the same.

Here we go again. Another story about how one country is starting to go cashless and the pundits crawl out of the woodwork saying that the United States should do the same.

There are a lot of reasons why this will not happen in the United States. One of the biggest reason is the overall economic impact that can affect the actual strength of the U.S. dollar as the world’s reserve currency.

The strength of the U.S. dollar is based on the (relative) security of our government and that the Gross Domestic Product (GDP), the measure of all goods and services produced within a country. According to The World Bank 2016 data (the latest available), the United States has the largest economy with a GDP of over $18.6 trillion. Sweden, the world’s 22nd largest economy, has a GDP of over $514 billion. Their economy is 2.76-percent the size of the United States’s economy.

It is the difference between dumping a bucket of water versus draining an Olympic-sized pool.

But wait, you exclaim, the United States already has an economy that is already electronic and should be able to follow suit. According to the Federal Reserve Bank of San Francisco, based on 2016 data, 31-percent of all transactions are made in cash. Most of the cash usage, 60-percent, are for transactions of $10 or less with lower income people preferring cash over middle and higher income consumers.

“Since 2009, the compound annual growth rate (CAGR) for the number of notes in circulation has been 5.6 percent, with the value of currency in circulation growing at a 7.4 percent annual growth rate,” reports the San Francisco Fed.

When we are not using cash, we are using cash equivalences such as debit cards and pre-paid debit and credit cards. Credit-related purchases account for approximately 20-percent of all transaction.

Cash is not going away anytime in the near future which means that the U.S. Mint and Bureau of Engraving and Printing will continue to produce collectible numismatics for quite some time.

And now the news…

February 18, 2018

At a public toilet in a shopping centre in Gothenburg, a struggle is taking place between old and new Sweden. Last year, the the shopping centre installed cash-free toilets, forcing customers to pay with their mobile phones – a process new to most.  → Read more at theguardian.com

→ Read more at theguardian.com

February 18, 2018

South African Reserve Bank subsidiary, the South African Mint, has announced new collectables product ranges that will appear in the global coin market this year, including the ‘Celebrating South Africa’ series, which will commemorate the life of former President, distinguished Statesman and global icon Nelson Mandela.  → Read more at m.engineeringnews.co.za

→ Read more at m.engineeringnews.co.za

February 19, 2018

The coin, dubbed the Jewelled Phoenix, was crafted from 99.9 per cent pure gold and inset with 1.22 carats of rare, natural fancy pink diamonds from Rio Tinto’s Argyle diamond mine in Western Australia.  → Read more at jewellermagazine.com

→ Read more at jewellermagazine.com

February 21, 2018

FOR 60 years, generations of children have grown up with the lovable, marmalade-eating bear, created by the late Michael Bond. But now, it has been announced the Queen has ordered a batch of specia…  → Read more at thesun.co.uk

→ Read more at thesun.co.uk

February 23, 2018

CHAMBERSBURG, Pa. — The Franklin County (Pa.) Veterans and 9/11 Memorial Park now has a commemorative coin for guest speakers, dignitaries and donors.  → Read more at heraldmailmedia.com

→ Read more at heraldmailmedia.com

February 23, 2018

Japan’s government has unveiled designs for 5 commemorative coins for the 2020 Tokyo Olympics and Paralympics.  → Read more at www3.nhk.or.jp

→ Read more at www3.nhk.or.jp

February 23, 2018

CHANDIGARH: When the collection of original Sikh coins is available at half the price in the open market, the Punjab Government has paid lakhs of rupees to a private firm just for minting duplicate coins.  → Read more at tribuneindia.com

→ Read more at tribuneindia.com

February 23, 2018

JIM THORPE — Jim Thorpe Neighborhood Bank on Broadway was very busy with customers looking to get the latest Native American $1 coin. Take a closer look and you’ll see why. The coin has the face of the borough’s namesake etched into it — Jim Thorpe. "We actually heard about it at another store that they were getting coins issued for Jim Thorpe. It was very enjoyable to find out so we decided to walk down and come over here to the bank," said David Knarr, Hellertown.  → Read more at wnep.com

→ Read more at wnep.com

February 23, 2018

Kitco News' Weekly Gold Outlook recaps how the week's events affected the gold market, and where expert analysts think the metal is headed next. Every Friday, get an in-depth look into the metals space and see how experts see the fundamentals set up gold in the week ahead.  → Read more at kitco.com

→ Read more at kitco.com

February 24, 2018

THERE’s a new 50p coin causing a stir with collectors.  → Read more at dailystar.co.uk

→ Read more at dailystar.co.uk

Oct 11, 2016 | cash, coins, commentary, currency, markets

Cash seems to be the new 4-lettered word.

In February, former Treasury Secretary Lawrence Summers authored an opinion article that appeared in The Washington Post calling for the end of high-denomination banknotes. Summers cites a paper that claims to make a compelling case to stop issuing high denomination notes and possibly withdraw them from circulation because of its use in crime and corruption because large denominations are easier to carry. The paper claims that criminals have nicknamed the €500 note the “Bin Laden.”

In February, former Treasury Secretary Lawrence Summers authored an opinion article that appeared in The Washington Post calling for the end of high-denomination banknotes. Summers cites a paper that claims to make a compelling case to stop issuing high denomination notes and possibly withdraw them from circulation because of its use in crime and corruption because large denominations are easier to carry. The paper claims that criminals have nicknamed the €500 note the “Bin Laden.”

Last May, the European Central Bank announced will stop printing the €500 banknote by the end of 2018 when the €100 and €200 banknotes of the Europa series are planned to be introduced. Although the announcement did not quote the Summers article, the announcement had addressed some of the issues he addressed.

In June, Sweden became the first nation to announce a formal policy to become a cashless society within five years. According to reports, Riksbank, the Swedish central bank, claims that just under 2-percent of all transactions are made by cash. They expect that number to drop to one-half of one-percent by 2020. Most shops report that 20-percent of sales are made using cash.

Sweden may be an outlier. Globally about 75-percent of all sales are made using cash.

In the United States, it is being reported that some higher-end retailers have stopped taking cash.

Retailers have been looking to the convenience industries as an example of the future. There are parking lots that no longer take coins in their parking meters. Pay stations now only accept credit cards. Some toll roads now require a special transponder to be mounted in your car because there are no booths to collect tolls. Those transponders must be linked to a credit card. Airlines no longer take cash when you buy beverages or snacks on the plane because handling the change is too difficult.

New payment options have entered the market. Smartphone-based Apple Pay, Samsung Pay, and MasterCard Master Pass have worked to make it easier to separate you from your money by allowing you to wave your phone at the reader and pay. For most retailers, there is little they have to do in order to accept these payment methods as long as they are accepting chip-based transactions. Since the transaction cost to the retailer does not change, it is an incentive for them to accept these types of electronic payments.

Although electronic payment options make up 13-percent of all cashless transactions you have to remember that this market barely existed a few years ago.

Even as banks and large retailers push to increase the number cashless transaction, there are problems that society faces when moving to a cashless retail system.

The biggest problem is one of scale. The United States makes more money, spends more money, trades more money, and has more economic impact than any other country in the world. It is the world’s single largest economy with a strong capitalistic culture where most of the commerce is done with small businesses. Amongst all business, 55-percent of retail merchants are cash-only enterprises. They are too small to consider paying the 3-to-5 percent fees for using a credit card, known as the “swipe fee.” Of those that do take credit cards, at least 36-percent require a minimum purchase.

Once you get past the problem of scale, then there are the issues of the poor who do not have bank accounts. Aside from not having the economic power to work with the banks, there are some communities that are culturally opposed to the banking system. Even if they can afford to have a bank account, many choose not to open one. The near failure of large financial institutions in 2008 did not help in the trust factor.

Of course, the one cultural issue that cannot be ignored is privacy. Cash transactions are private. Only the buyer and seller knows the details of the transaction (unless the buyer volunteers their loyalty or rewards account information). With the problems of hacking around the world, how do you know that your credit card transaction are safe? Should we ask the victims of the computer hacks on Target and Home Depot?

Aside from privacy, credit cards can be costly to the customer. High-interest rates, debilitating debt, and collection issues see the use of consumer credit dropping when there is an economic downturn. During the Great Recession that began in 2008, spending went down and, when the economy began to improve, savings went up. When wages began to rise in 2010, more money was being spent paying down debt than adding to the economy. Rather than stimulating the economy, this creates a stagnant effect since the economy thrives more on the selling of goods and not by the managing of cash.

It seems that every six months there is yet another “Chicken Little” story that either we are or should stop using cash. But when society seems to be set in using cash even when there is anecdotal evidence that makes it appear that we are on the brink of a cashless society, they become quiet as if they ended up in Foxey Loxey’s den!

Reports of cash’s eventual demise appear to be as amusing as it is greatly exaggerated. For numismatists, this means that our hobby will continue to grow with new, fresh material for years to come. Happy collecting!

Sep 8, 2016 | cash, counterfeit, currency, news

One of the strangest set of stories about the problem of counterfeiting was the several stories that came out at the end of August about people trying to make purchases with movie prop money. This has caused regional U.S. Secret Service across the south to issue warnings.

Prop movie money is designed to look close enough to real U.S. currency so that a moviegoer would not be able to tell the difference on screen. When these notes are examined closely, they are clearly marked with “THIS NOTE IS NOT LEGAL TENDER” and “FOR MOTION PICTURE USE ONLY.” Prop money is smaller than real U.S. currency and does not have the anti-counterfeiting features of a real Federal Reserve Note. But that has not stopped people from trying to pass these notes as real currency.

-

-

Prop Movie Money

-

-

Prop Movie Money

-

-

Prop Movie Money

Here is a sample of the reports about people trying to use prop money as real currency:

In Athens, Georgia, a 30 year-old man beat a customer with a baseball bat at a fast food restaurant when he alleged the customer bought marijuana using two prop $100 notes.

Police in the Gwinnett County, a suburb of Atlanta, are looking for two suspects who went on a spending spree by buying two cars and paying with prop money.

Prop money has shown up in Morristown, Tennessee, northwest of Knoxville.

U.S. Secret Service issued a warning in the Tampa Bay area when someone tried to buy a smartphone using prop money and noted that there has been an increase in the use of this currency.

Areas of East Texas have reported several cases in which prop money has been used. Texas Bank and Trust reported that they have seen a few of these notes were deposited into accounts at their bank.

Sources have not confirmed the source of this recent uptick in prop money usage but noted that the currency can be purchased online. Although eBay rules do not allow for this type of currency to be sold on its site, a recent search yielded several listings offering prop money. There is no restriction on Etsy where searches lead to over 300 listings of all types of prop or replica money.

Why was the criminal in the in the Dateline video attached to my post “How easy is it to pass counterfeit currency” so successful? Like he said, nobody pays attention!

Prop Movie Money

It is not a surprise to economic and market watchers that there is a perceived coin shortage. The problem is not just in the United States, but worldwide central banks are trying to fix their circulation issues.

It is not a surprise to economic and market watchers that there is a perceived coin shortage. The problem is not just in the United States, but worldwide central banks are trying to fix their circulation issues. → Read more at americanbanker.com

→ Read more at americanbanker.com

→ Read more at croatiaweek.com

→ Read more at croatiaweek.com

→ Read more at lcsun-news.com

→ Read more at lcsun-news.com

→ Read more at newschainonline.com

→ Read more at newschainonline.com

→ Read more at cnn.com

→ Read more at cnn.com

→ Read more at bbc.com

→ Read more at bbc.com

The

The

With the discovery of every new technology, there are the inevitable predictions that it will make the old ways obsolete. Although the automobile reduced the reliance on horses, the basics of the internal combustion engine have not changed in over 100 years. Take away the electronics around the engine, the technology increasing the air intake, and cleaning up the exhaust, and you still have an engine block with pistons that go up and down in the classic suck-bang-blow rhythm that was used in the Model T.

With the discovery of every new technology, there are the inevitable predictions that it will make the old ways obsolete. Although the automobile reduced the reliance on horses, the basics of the internal combustion engine have not changed in over 100 years. Take away the electronics around the engine, the technology increasing the air intake, and cleaning up the exhaust, and you still have an engine block with pistons that go up and down in the classic suck-bang-blow rhythm that was used in the Model T.

Here we go again. Another

Here we go again. Another