HAPPY HOLIDAYS!

May the holidays find you happy, hopeful, and healthy.

Since I missed posting the news from Sunday: and now the news…

→ Read more at securingindustry.com

→ Read more at securingindustry.com

→ Read more at baltimorepostexaminer.com

→ Read more at baltimorepostexaminer.com

→ Read more at bbc.com

→ Read more at bbc.com

→ Read more at forbes.com

→ Read more at forbes.com

→ Read more at dailymail.co.uk

→ Read more at dailymail.co.uk

This Was A Fun Challenge

I had the opportunity to give a talk on privacy issues to the wonderful people at United States Visitor & Immigrant Status Indicator Technology (US-VISIT) program. US-VISIT is part of the Department of Homeland Security that provides visa-issuing posts and ports of entry with the biometric technology that enables the U.S. government to establish and verify your identity when you visit the United States. In short, US-VISIT are a dedicated group of people trying to do a difficult job to help make the U.S. safer.

After spending an hour discussing privacy from a different perspective, the manager of the group sponsoring my talk handed me a token of their appreciation. The token is a Challenge Coin made specially for US-VISIT.

This beautiful challenge coin is 42mm in diameter with US-VIST logo on the obverse where the agency name is enameled in blue and red. The reverse is a great interpretation of the of the Department of Homeland Security’s logo. I was handed the challenge coin in a ringed Air-Tite holder.

This beautiful challenge coin is 42mm in diameter with US-VIST logo on the obverse where the agency name is enameled in blue and red. The reverse is a great interpretation of the of the Department of Homeland Security’s logo. I was handed the challenge coin in a ringed Air-Tite holder.

The manager told me that US-VISIT restricts the distribution of these challenge coins. They are given to visitors and dignitaries as a sign of appreciation. US-VISIT also gives them to retirees. Very few have been made and even fewer have been distributed.

It was an honor to talk about privacy issues to the members of the US-VISIT program and it is really an honor to have received one of their Challenge Coins. I appreciate both opportunities.

Former US Mint Director Jay Johnson Dies at 66

Jay Johnson, who served as the 36th Director of the US Mint, died of an apparent heart attack on Saturday, October 17. He was 66 years old.

Johnson, a Wisconsin native, was a television commentator turned politician. He was elected to one term congressman from Wisconsin’s 8th District in 1996. In 1999, Johnson was nominated as Director of the US Mint by President Bill Clinton. He served a Mint Director from May 2000 to August 2001. Succeeding Philip Diehl as Mint Director, Johnson managed the bureau during the height of production. Diehl and Johnson were able to maintain high production levels of American Eagle coins while starting the 50 State Quarters program. Coin production in 2001 continues to hold the record for most coins struck by the Mint.

After serving as Mint Director, Johnson remained in the Washington, DC metropolitan area and continued to work in numismatics. He formed Jay Johnson Coins and Consulting to work with investment banks and brokerages on investing in coins. Recently, Johnson worked for Goldline International and appeared on television as a spokesman.

Johnson is survived by his wife, JoLee, and two stepchildren.

Proof Eagles Have Been Grounded

I am sure you heard that the US Mint has announced that they will not produce American Eagle gold and silver proof coins “[because] of unprecedented demand for American Eagle Gold and Silver Bullion Coins.” Is there really an unprecedented demand?

What We Should Have Learned

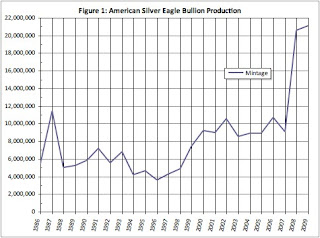

In an analysis posted here last April, production totals for 2008 showed that the US Mint experienced an extraordinary increase in demand for American Silver Eagle bullion coins striking over 20 million ounces of silver for the first time. This was a 128-percent increase over the 2007 production and almost twice as large as 2006, the second highest production total.

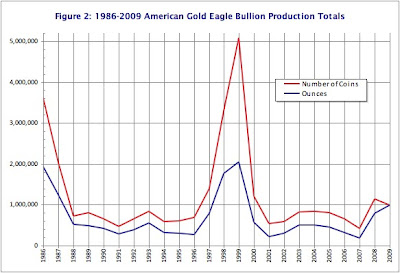

Gold production totals revealed a different story. There was an unprecedented demand in 1998-1999 where the number of American Gold Eagle coins and the ounces of gold used has not been matched by the US Mint. In addition to striking over 5 million coins using over 2 million ounces of gold, the US Mint also struck over 4.4 million 50 State Quarters in the program’s first year of issue. The production of 1.1 million coins using 788,500 ounces of gold was only a bit above average but the most in the 21st century.

Since the start of the current economic crisis that experts say began in December 2007, it was clear that the US Mint was unprepared when investors turned to purchasing American Eagle coins looking for safe investments. In fact, the US Mint admitted that the US Mint knew they were experiencing shortages as early as June 2008. By October, the US Mint had to announce that there is a shortage of bullion because the US Mint could not purchase enough material at market prices to meet the demand. After a year, the US Mint announced that “the United States is lifting the allocation process,” ending the rationing of bullion issues.

Whoever said no news is good news has never met the politicians running the US Mint.

Where We Stand Today

With the announcement by the US Mint, I downloaded the 2009 bullion production totals and added it to the previous analysis to see if there has been an unprecedented demand.

If the demand for silver in 2008 was any indication, it would be matched or exceeded by the demand in 2009. Through the first week in October, the US Mint has struck over 21 million one-ounce American Silver Eagle bullion coins. That is more coins than the 20.5 million struck in 2008. Figure 1 shows that if the trend continues, 2009 will exceed all silver production totals for American Silver Eagle coins.

Although there was a dip in the monthly production for September (see Figure 2), trends show that American Silver Eagle coins struck in the fourth quarter (the first quarter of the fiscal year) can outpace production in earlier in the year. It is possible that the US Mint could produce another 10 million silver coins by the end of the year, especially if collectors plan to buy bullion coins to fill in the whole made by the 2009 discontinuance of the proof coin.

Gold Glitters, But…

Although production for the 2009 American Gold Eagle is outpacing production for 2008, this cannot be said about gold. While gold will surpass last year’s production totals, the US Mint will not produce the amount of coins or strike the amount of gold that they did in 1998 and 1999 (see Figure 3). And while the US Mint may strike more than the 1.3 million coins that marked 1997, they will do so by striking only one-ounce coins.

Even with the production increases in 2009, the combined unit production of the gold and silver American Eagle coins will be less than it was a decade ago.

So What Is The Mint Doing?

At the end of April, it was reported that US Mint ceased production of nickels and dimes that would last for six months because of the reduced demand from the Federal Reserve. They continued the production of other coins with changing designs, such as the Bicentennial Lincoln Cent, DC & Territories Quarters, and Presidential Dollars. Recent reports show that the US Mint has not continued striking nickels and dimes while producing fewer quarters than any series since the start of the 50 States Quarter program began in 1999.

The Philadelphia Mint has also ceased production of Kennedy Half Dollars. In fact, Denver has out produced Philadelphia by 26.5 million coins.

As part of the announcement of the temporary cessation of production, the US Mint said that workers will participate in a six-month productivity maintenance program and capital maintenance in order to keep the rank-and-file workers employed.

According to the US Mint’s Annual Reports, American Eagle coins are struck at both Philadelphia and West Point. Bullion issues do not include mint marks making it difficult for collectors to determine where the coins were struck.

If there are idle coin presses at the Philadelphia Mint and employees not working on the production of business strikes, why has management not allocated the appropriate resources to meet the demand for bullion as well as the demand for collector American Eagle coins?

Between 1998 and 2001, the US Mint was running at full production including the new 50 State Quarters and was able to meet the bullion and collector demand for American Eagle coins. In fact, between the two years, the US Mint was producing half-dollars for regular circulation and changed the production of dollars from the Susan B. Anthony dollars to the Sacagawea design. Even with the economic slowdown, the US Mint produced a record number of coins in 2001.

With coin presses silent and the lack of sell outs for this year’s commemorative coins, why can’t the US Mint keep up with the investor and collector demand for American Eagles?

It Does Not Make Sense

Even though there was a coin shortage in the mid-1960s, production at the US Mint exceeds what it is today. In order to find production totals as low as they are this year, we would have to look over 50 years ago when the Philadelphia Mint was in its third building and only producing five types of coins with no commemoratives.

Today, the Philadelphia Mint is in a larger building with more state of the art equipment. The same facility that helped produce record numbers of coins less than ten years ago while striking bullion that included platinum American Eagle coins.

The only answer is the incompetence of the US Mint’s management.

It is very clear that the leadership of Director Edmund Moy and Deputy Director Andrew Brunhart must be questioned. Moy was a patronage appointee who has no experience managing a manufacturing operation or in any other type of position where workflow and resource management is critical. Brunhart, who was hired for his “expertise in organizational change,” appears to be changing the US Mint the same way he changed the Washington Suburban Sanitary Commission (WSSC), for the worse.

I know that the country has issues that may be more important than who is running the US Mint. But the US Mint is a profit center for the federal government and those profits (seignorage) are being hurt by its leadership’s inability to manage its resources properly. Therefore, it is time that President Obama set aside a few moments to replace these political hacks before they destroy one of America’s oldest bureau.

Will You Help?

If you are a collector, investor, or have an interest in seeing the US Mint successfully carry out its mission, I ask that you write a letter (addressed to 1600 Pennsylvania Ave NW, Washington, DC 20500-0001), send an email, or go to the White House website contact form and tell President Obama that Director Moy and Deputy Director Brunhart are damaging this venerable institution.

Hopefully, we can convince the President to act now before US Mint management tries something insipid, like blame collectors for their problems as they tried to do in the mid-1960s.

Counterfeit Coin Advisory Issued

Leaders of the American Numismatic Association, the Industry Council for Tangible Assets, Numismatic Guaranty Corporation, Professional Coin Grading Service, and the Professional Numismatists Guild have issued a joint advisory warning consumers of the millions of dollars spent on fake US coins from China. Counterfeit coins have been sold through online auctions, flea markets, and swap meets.

“Millions of dollars already have been spent on these fakes and potentially

millions more may be unwittingly lost by consumers who mistakenly think they’re

getting a genuine rare coin,” warned Paul Montgomery, PNG President.

The advisory notes that copied and replica coins sold in the United States that are not marked as “COPY” are in violation of the U.S. Hobby Protection Act. However, reports of Chinese fakes that do not include “COPY” stamped somewhere on the coin has been appearing in greater numbers.

The sophistication of Chinese counterfeiters have been documented with pictures showing the use of modern coining equipment and expertly engraved dies that can fool everyone not an expert in counterfeit detection.

One problem with the attempt at enforcement are complications with Chinese Law. While it is illegal to counterfeit Chinese money (Renminbi) the law does not cover foreign money as long as it is not used as a medium of exchange and sold as souvenirs. This allows the counterfeiters to manufacture Morgan and Trade dollars for sale as collectibles but they cannot try to cash them into a local currency exchange to convert them into Renminbi.

The best way to combat Chinese counterfeits is with education. Read the article by Susan Headley and her other articles about Chinese counterfeiters at about.com. You should know about the coin you are buying so you should read the book before buying the coin. If you are buying expensive rare coins, work with a reputable dealer, one who is a member of the organizations that sponsored this advisory.

One resource is the booklet, What You Should Know Before You Buy Rare Coins. To purchase a copy, send $1 to the Professional Numismatists Guild, 3950Concordia Lane, Fallbrook, CA 92028.

Buying certified coins is an answer but there has been cases where the slabs have been counterfeited, too. It is incumbent on the buyer to do your homework before spending money on a coin with questionable authenticity. Remember, if the deal sounds too good to be true, it probably is not true!

Neat Coin Drop in Boston

Matthew Hinçman is what some people call a guerilla artist. Guerilla Art, sometimes called Street Art, is unsanctioned art that is developed and displayed in public places. Guerilla art is more than graffiti. It is art designed to surprise and make the public think and sometimes participate.

One of Hinçman’s newest projects is the creation of Pomme de Terre (French for “Potato“) and Pomme en l’Air (“Apple in the Air“) tokens. Hinçman describes them as “loosely based on mid-19th century Hard Times Tokens.” He had 1,200 copper tokens minted and will drop them on the streets of Boston by the end of the year.

One of Hinçman’s newest projects is the creation of Pomme de Terre (French for “Potato“) and Pomme en l’Air (“Apple in the Air“) tokens. Hinçman describes them as “loosely based on mid-19th century Hard Times Tokens.” He had 1,200 copper tokens minted and will drop them on the streets of Boston by the end of the year.

Those in the Boston are may want to follow Hinçman on Twitter @metchew for clues as to where he drops the token.

Hinçman also had 50 silver tokens minted but has not announced plans for those tokens.

Interestingly, this is the second time I found an artist making a statement about or with money using art. Rather than the existing bureaucracy, maybe we should include more of these artists in the process. They seem to come up with better ideas.

Image courtesy of Matthew Hinçman.

As we celebrate the holidays and the new year, I hope we can remember those less fortunate who might need our help. Helping a neighbor is the best gift we can give and a sign of love beyond measure.

As we celebrate the holidays and the new year, I hope we can remember those less fortunate who might need our help. Helping a neighbor is the best gift we can give and a sign of love beyond measure.