BOOK REVIEW: A Necessary Reference for your Library

Over the last few months, I have been on another book buying binge. Most of the books I have been buying are references. Many of these references help fill in some of the gaps in my knowledge. One of those gaps is how to date some foreign coins especially those of the eastern world whose language is not Latin-based.

Over the last few months, I have been on another book buying binge. Most of the books I have been buying are references. Many of these references help fill in some of the gaps in my knowledge. One of those gaps is how to date some foreign coins especially those of the eastern world whose language is not Latin-based.

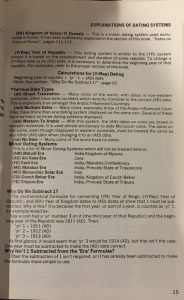

Although the Standard Catalog of World Coins has a basic reference to help figure out the date of a coin, it is not detailed enough. While there are websites on the Internet to help, there is not a single good resource. I wanted a good resource to help me grade these coins. Then I stumbled across the Illustrated Coin Dating Guide of the Eastern World by Albert Galloway.

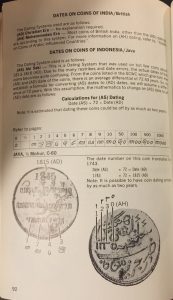

Published by Krause Publications, it features the tables and descriptions that are in the Standard Catalogs on steroids plus much more information. The absolute best part of this book are the images with the guides pointing to each element to help identify the date coin.

Some coins are not dated but contain the number of years of the current ruler or dynasty. Coins from Israel use the date on the Hebrew Calendar while many Islamic countries include the date of the Islamic or Hijri Calendar.

And it helps in more ways than figuring out the dates. If you are not familiar with the pictograph-style writing of some East Asian countries, having in the information in front of you can help identify the difference between a Korean coin from a Japanese coin, something that recently helped me.

Also, the book points out how to identify elements like mintmarks, privy marks, coiners marks, and other identifying varieties on these coins. As we know, a mintmark or other distinguishing mark can make a difference in a coin’s value.

The book was first published in 1984 and republished in 2012. Both versions appear to be the same with a color variation of the cover—the 1984 publication has a predominantly red cover.

The only complaint about the book is that it should be spiral bound so that the book could lay flat on the table. I have not had the book long and I have already bent the spine. At this rate, the book may not last long. For that reason, I give the book a grade of MS-69. If you are searching through lots of foreign coins, this book is a must-have for your numismatic library.

Illustrated Coin Dating Guide for the Eastern World

By Albert Galloway

ISBN 10: 0873410467

ISBN 13: 9781440230882

144 pp, 6×9 Paperback with 250 Black & White Illustrations

ANA Weighs-In on Cent Debate

In August, the American Numismatic Association (ANA) emailed their membership to obtain their opinion as whether or not to eliminate the Lincoln Cent. The ANA was prompted to take this poll came after it was reported that the mint said that it cost more to mint the coin than its face value. The following was sent to members in the monthly “ANA September Newsletter” via email.

ELIMINATE THE U.S. CENT?

1,040 E-mails!

When the ANA asked members their opinions about the possible elimination of the United States one-cent coin, that’s just how many responses were received. The emails ranged from one-word “Yes” or “No’s” to passionate, detailed responses.

Overall, the respondents were evenly split on the issue. Below are a few excerpts from member responses:

- I say keep the Penny. I think to get rid of it would precipitate creeping inflation in retail prices. – Wm Fulco

- There is simply no point in maintaining the illusion that the cent is a useful component in commerce. It is now just a historic relic of America’s past.– David Lange

- It is not possible to ever administer a sales tax without pennies…. There exists no paper or electronic substitute that will ever function in all areas especially rural except the penny. – John Parkyn

- Yes, the cent should be retired…. The United States is far behind the international trend in adjusting our currency issues to the needs of the population. – Tom Maringer

Thank you to all of those who offered responses. The ANA will continue to ask for member opinions concerning a wide array of numismatic topics.

Interestingly, the uproar is centered around the price of the metal even though the report said that the rise was because of the production costs. Although the cost of copper did rise, the cent is made of 99.2-percent zinc and coated with eight-tenths percent copper. Should the economy change, including the cost of energy, would the production costs be lower?

WARNING: Liberty Dollar is NOT Legal

The US Mint issued a press release warning consumers that the Liberty Dollar medallions, marketed by the National Organization for the Repeal of the Federal Reserve Act and the Internal Revenue Code (NORFED) “are not genuine United States Mint bullion coins, and not legal tender.” Consumers are warned that the Justice Department has determined that the use of these “medallions as circulating money is a Federal crime.”

NORFED is marketing these medallions as “Real Money” and that the associated notes are “America’s Inflation Proof Currency™.” Their web site even has links to reproduced articles that says the government claims that it is legal. Aside from not being able to verify the source of the articles from on-line resources, both articles say that these items are NOT legal tender and are legal.

As the Mint points out, these are medallions that are made to look like genuine US coins and currency. Devices like “USA” instead of spelling out “United States of America” and “Trust In God” rather than the legally required “In God We Trust” can make this confusing to an ordinary citizen.

NORFED is yet another scheme to capitalize on the “our money is not real money” because it lacks precious metals and that the US Constitution defines money in those terms. The fallacy of the arguement is that when the constitution was written, the price of precious metals were fixed by governments and varied based on a number of other economic factors. Today, the prices fluctuate based on market conditions. Therefore, when silver jumped to $15 per ounce, the $10 silver medallion would have 33-percent less buying power than $15 United States dollars. This is the consequence of a market-based economy.

A point made on the site is that private transaction can be bartered using anything of value to both parties. While this is true, if a business wants to do any business within the United States, the Uniform Commercial Code requires all negotiable instruments (represtatives of money) to be backed by legal tender. In other words, it is not legal to write a check or other promisory note using Liberty Dollars as its backing.

NORFED is a commercial (for-profit) venture started by Bernard von NotHaus who was the superintendent of the Royal Hawaiian Mint, a private mint located in Honolulu (the mint has no connection with the Hawaiian government). NORFED makes no guarantee that their Liberty Dollars would be widely accepted or be converted into United States currency. To further the illusion of hypocracy, it is reported that von NotHaus submited the design of the Liberty Dollar to the US Mint as a design for the Golden Dollar coin. This reminds me of the Flat Earth Society an organization formed in the sixtheenth century that continues to try to convince us that the world is flat.

Jail Time for Noe

Tom Noe, the indicted coin dealer who was charged with allegedly bilking the Ohio Bureau of Worker’s Compensation (BWC), was sentenced to 27 months in jail. This sentence was handed down in federal court for his guilty plea to three counts of federal campaign finance violations. Noe was charged with using friends and associates to funnel $45,400 to President Bush’s re-election campaign. Noe will have to pay $136,000 in fines in addition to his jail sentence.

Noe will remain free on bond until his trial for 46 felony counts from Ohio for allegedly stealing over $50 million from the Ohio BWC rare coin fund. His case is scheduled for trial next month.

Remembering 9/11 Five Year Later >>>MOVED<<<

This posting has been moved to the Centre of the Aisle blog. To read it and other political-related postings, feel free to visit centreaisle.blogspot.com.

I received a number of positive comments (and a few negative comments) about the post. But the one consistent comment was that it has nothing to do with numismatics. I respect that concern and removed the posting from this blog.

Thank you for your feedback!

My Thoughts On FIRST STRIKE Grading

Lately, I have been reading and participating in the discussion forum at the NGC and Collectors’ Society website. One of the discussion talked about the “FIRST STRIKE” designation being added to the grade of slabbed bullion coins by the major grading services. Although they may have slightly different guidelines, both NGC and ANACS post their policies on the web that are very similar. Basically, to gain the FIRST STRIKE designation, the coins must be submitted in the original Mint packaging with all the official Mint documentation that shows the coins were struck in the first month of their run. This designation has nothing to do with the first coins that are struck from a die pair or coins that were struck from the first used die pairs. These are just coins struck during a particular month.

According to the Consumer and Business Awareness page from the US Mint, the Mint does not track the order which coins are minted. Coins that are produced are packaged as convenient, thus that coin that is marked as FIRST STRIKE could be the last coin struck by that die set. If the mint strikes 1,000 coins from a die pair, does that 1,000th coin deserve FIRST STRIKE designation? The Mint does not support this designation.

This situation borders on consumer fraud. Not only does the US Mint not keep records on the number of coins they strike on the first day, but the shipping records are not as detailed as to determine how many are actually shipped as FIRST STRIKE. Also, the term FIRST STRIKE is not properly defined. For example, the ANACS site says proof “coins must be submitted to ANACS within the first month of release by the Mint” and that bullion must be “sealed in the original Mint packaging and have full and proper Mint documentation inside the sealed Mint packaging proving that the coins were struck no later than January 31 of the year of issue.” The subtle difference shows an inconsistency that could be troubling to an unsuspecting market.

The capitalist in me has no problems with the grading services coming up with a new way to expand their market. However, without a consensus on what FIRST STRIKE means and without tying it to something real that proves that the coin is a FIRST STRIKE, the confusion will cause long-term damage to a hobby where some outsiders worry about being taken advantage of. This is not good for the hobby.

I am putting together a set of uncirculated American Silver Eagles that have a minimum grade of MS-69. All are NGC graded. I will not add a FIRST STRIKE coin unless the price is comparable to other coins, because the designation does not make sense when I can purchase an MS-69 that is just a beautiful but not minted in the first month.

P.S. You can also read a similar opinion on the Coin Collecting (and other Numismatic Interests) Through the Eyes of a Beginner blog. The blogger, Arlington, wrote an entry First Strikes: A Marketing Gold Mine that you may want to read.