Apr 20, 2011 | apps, BEP, review, technology

The Bureau of Engraving and Printing will announce today that they have developed EyeNote,™ an app for iOS devices (iPhone, iPod Touch, iPad) that will help the assist the blind and visually impaired determine the value of the U.S. currency they are holding.

The Bureau of Engraving and Printing will announce today that they have developed EyeNote,™ an app for iOS devices (iPhone, iPod Touch, iPad) that will help the assist the blind and visually impaired determine the value of the U.S. currency they are holding.

According to the press release received this morning, EyeNote uses image recognition technology to determine a note’s denomination. The mobile device’s camera requires 51 percent of a note’s scanned image, front or back, to process. In a matter of seconds, EyeNote can provide an audible or vibrating response, and can denominate all Federal Reserve notes issued since 1996. The app will be updated as new notes are issued.

“Research indicates that more than 100,000 blind and visually impaired individuals currently own an Apple iPhone,” according to the BEP.

The EyeNote app is one of a variety of measures the government is working to deploy to assist the visually impaired community to denominate currency, as proposed in a recent Federal Register notice. These measures include implementing a Currency Reader Program whereby a United States resident, who is blind or visually impaired, may obtain a coupon that can be applied toward the purchase of a device to denominate United States currency; continuing to add large high contrast numerals and different background colors to redesigned currency; and, raised tactile features may be added to redesigned currency, which would provide users with a means of identifying each denomination via touch.

The app is only available for iOS devices. According to a representative from the BEP, “Future phone offerings cannot be definitely specified at this time, but there are tentative thoughts to make EyeNote available on other phones from other vendors once the iOS effort is launched.”

REVIEW

After downloading the free app from the iTunes App Store, it was installed on my iPhone and I tried it. I had two notes nearby, a $20 note and a torn $1 note. When the app starts, there is a page with brief instructions. Interestingly, for an app that is supposed to help the visually impaired, the instruction text is a bit small that cannot be expanded using the iPhone pinch motion. For those who cannot read it, it says:

After downloading the free app from the iTunes App Store, it was installed on my iPhone and I tried it. I had two notes nearby, a $20 note and a torn $1 note. When the app starts, there is a page with brief instructions. Interestingly, for an app that is supposed to help the visually impaired, the instruction text is a bit small that cannot be expanded using the iPhone pinch motion. For those who cannot read it, it says:

Tap to begin. After beep, steady note 6 to 8 inches in front of the camera. Tap; shutter clicks; await result. Double tap to replay. Swipe left of right for spoken or privacy mode. In Voice OVer, single tap is double; double tap is triple. Switch out of VoiceOver to change spoken of privacy…

It seems the BEP needs to fix the grammar a bit.

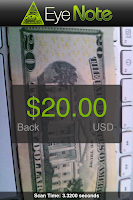

On my iPhone 4, the LED flash was turned on, I positioned a $20 note reverse in front of the camera, tapped the display, and the camera sound played as it took the picture. After a few seconds, a woman’s voice told me that it saw the back of the $20 note. I found a $10 and $50 note. Both were identified on both sides with no problems.

On my iPhone 4, the LED flash was turned on, I positioned a $20 note reverse in front of the camera, tapped the display, and the camera sound played as it took the picture. After a few seconds, a woman’s voice told me that it saw the back of the $20 note. I found a $10 and $50 note. Both were identified on both sides with no problems.

After passing those tests, I tried the only $1 note I had: one that was used as a chew toy by one of my dogs. No matter how I positioned the camera, the app could not identify the note. While the app is impressive it would have been amazing if the app could have identified my torn note!

After passing those tests, I tried the only $1 note I had: one that was used as a chew toy by one of my dogs. No matter how I positioned the camera, the app could not identify the note. While the app is impressive it would have been amazing if the app could have identified my torn note!

It is very rare that an app’s first release is as impressive as EyeNote. However, it is not perfect. The opening screen needs to either have a voice over or larger text. The instruction text needs work and the controls need to be better explained. I grade this app MS68+*. Yes, it gets the plus rating for being excellent in what it does and the star because once you figure out the controls, it has great eye appeal. I am very impressed with the effort. I hope the BEP fixes the issues I found.

Click on any picture to see a larger version. Use your browser’s back button to return to the blog page.

Apr 8, 2011 | BEP, legislative, policy, US Mint

If congress cannot settle on a budget to keep the federal government operating past midnight on Friday, April 8, the U.S. Mint and the Bureau of Engraving and Printing will continue to operate. Even though both agencies are bureaus under the Department of the Treasury, both are funded through their respective Public Enterprise Funds. The Public Enterprise Funds contains the seignorage (profits) made from the manufacture of the money.

Although Treasury Department has not made any official announcements, the U.S. Mint did send a note to their employees in February. U.S. Mint employees were told that “unless specifically instructed otherwise, United States Mint employees are required to report to work as usual even if there is a government-wide shutdown.”

Regardless of what the non-federal political leaders say, the Washington, D.C. area is a essentially a company town. In addition to the agencies based in the District, there is a significant federal presence in Maryand and Virginia that will impact the communities where they are located. A shutdown will affect the area as far north as Baltimore, Fredericksburg to the south, and many border towns in West Virginia that host “remote” federal facilities. This does not include the commercial contractors that provide support and services to many federal agencies. I saw one estimate that said 80-percent of the DC Metro Area would be affected by a government shutdown.

I know I am not objective on this subject because it is personal. Not only will a government shutdown hurt the economy of everyone in the region, but it can affect me personally. Since my current project is essential in the long term it is not essential for the short term operations of the government. This means I could be furloughed with my colleagues a lot of other people in a similar situation.

Television news shows us stories about the small towns that lost its mill, plant, or factory and its economy crashes. The stories are all the same, the facility closes and the small town of a few thousand is devastated—almost to the point of turning it into a ghost town. If that happened to an area with over 5.5 million people, what will be the economic impact to the entire nation?

While I agree that we need to fix the budget, get rid of government waste, and figure out how to get out of debt for the overall economic health of the nation, drastic measures are not the way to do it. Very few people can kick any habit “cold turkey” and neither can the government. It will just bring pain and suffering to the people who will not have the money manufactured by the U.S. Mint and BEP to circulate in the economy necessary to promote growth.

Jan 18, 2011 | BEP, US Mint

It is not often a member of the federal government’s Senior Executive Service makes the news for changing jobs. But when that person is Andy Brunhart, it has the numismatic media noticing. CoinWorld is reporting in its January 31, 2011 edition that Brunhart left the U.S. Mint four days after Ed Moy’s last day.

Brunhart is now working for the Bureau of Engraving and Printing and will oversee quality and strategic integrated production issues. His arrival at the BEP comes after the mainstream media picked up on the production problems plaguing the printing of the new $100 federal reserve note.

CoinWorld reports that the Treasurer of the United States Rosie Rios will carry out the duties of the Director until a new director is appointed by President Obama.

Jan 16, 2011 | BEP, history, video

When I returned to coin collecting a few years ago from my hiatus that began before I went to college I discovered there was more to collecting than buying shiny objects of copper and silver. I found that there was a confluence of history and politics that was also an interest. My return to numismatics coincided with my returning to school to get a masters degree that included public policy as part of the curriculum. It was perfect for a political junkie. So when something is written or broadcast that adds to my quest to learn about history that includes numismatics, my interest piques.

At the end of November, I was channel surfing and found a documentary on one of the C-SPAN channels about the History of U.S. Currency. The show featured an interview with Franklin Noll, Consultant in the Bureau of Engraving and Printing Historical Resource Center. It was a different look at the BEP since it did not go into the process of printing money but the final result and the evolution of the BEP.

Using pieces of the BEP’s archive, Noll traces the history of the bureau from its founding in 1861 to the modern small currency. Noll begins by showing some of the pre-BEP printed notes and how the government needed to control its currency in order to help fund the Civil War. He showed the first notes that were printed by a “New York Printer” under the authority of the new bureau. Noll does not mention that the New York printer was the American Banknote Company.

One think I learned was that Franklin Delano Roosevelt was the only president who had a direct influence on any aspect of currency design. When presented with the proof for the small one dollar Federal Reserve Note, FDR requested that the BEP switch the Great Seal and the Heraldic Eagle so that the eagle is on the right side of the note. FDR felt that this would be better since the eagle’s head would face the center of the note. Otherwise, the eagle’s head would be facing off the note. Noll showed the actual proof sheet that FDR wrote his request.

The video of the History of U.S. Currency can be viewed online in the C-SPAN Video Library. Not only can your watch the video, but there is an option to purchase a DVD. Just click here to see the video. Enjoy!

Dec 14, 2010 | BEP

If you are going to be in Washington, DC and can get to the Bureau of Engraving and Printing, Treasurer of the United States Rosie Rios will autograph currency between 10:00 AM and 11:45 AM on Thursday, December 16, 2010. There is a limit of two signed notes per person and older currency can be exchanged for new notes.

If you are going to be in Washington, DC and can get to the Bureau of Engraving and Printing, Treasurer of the United States Rosie Rios will autograph currency between 10:00 AM and 11:45 AM on Thursday, December 16, 2010. There is a limit of two signed notes per person and older currency can be exchanged for new notes.

The BEP is located at 14th and C Streets, SW, just north of the 14th Street Bridge and next to the United States Holocaust Memorial Museum. Detailed directions can be found at www.moneyfactory.gov/wdcdirections.html.

Dec 8, 2010 | BEP, currency, Federal Reserve

Following up on something reported here in October, mainstream media has caught up with the news that the Bureau of Engraving and Printing and the Federal Reserve will delay the release of the redesigned $100 Federal Reserve Note because of production issues. The announcement said that the BEP has identified a problem with sporadic creasing of the paper during printing of the new $100 note that did not appear during pre-production testing.

Following up on something reported here in October, mainstream media has caught up with the news that the Bureau of Engraving and Printing and the Federal Reserve will delay the release of the redesigned $100 Federal Reserve Note because of production issues. The announcement said that the BEP has identified a problem with sporadic creasing of the paper during printing of the new $100 note that did not appear during pre-production testing.

What added to the urgency was the report that the BEP said that about one-third of the 1.1 billion notes produced for the formal release may be creased and otherwise not usable. BEP is attempting to salvage what it can from the previous production run.

Sources confirm that these new notes are the most expensive to produce at 12-cents per note. Production costs using the older paper was 7-cents per note.

The BEP is working with Crane & Co., the exclusive currency paper supplier since 1879, to resolve the issue.

Dec 1, 2010 | BEP, US Mint

If you happen to be in the area of Capital Hill in Washington, D.C., the U.S. Mint and Bureau of Engraving and Printing are holding a sale at the Rayburn House Office Building today (December 1) in Room 2200 from 10:00 AM until 4:00 PM. The building is open to the public (your representative to congress may have an office in the building) and requires airport-style screening, sans the pat down!

If you happen to be in the area of Capital Hill in Washington, D.C., the U.S. Mint and Bureau of Engraving and Printing are holding a sale at the Rayburn House Office Building today (December 1) in Room 2200 from 10:00 AM until 4:00 PM. The building is open to the public (your representative to congress may have an office in the building) and requires airport-style screening, sans the pat down!

Both agencies will have their 2010 offerings for purchase at regular prices. The difference between purchasing it from a clerk instead of mail order is you do not have to pay postage or worry about your order being cancelled. Besides, you never know who you will meet in the hallway, especially since congress is in session.

Also, Treasurer of the United States Rosie Rios will be there to autograph products from Noon until 2:00 PM.

The Rayburn Building is located at 45 Independence Ave SW, Washington, D.C. between First Street, SW, and South Capital Street, SW. The closest Metro stop is the Federal Center SW or Capital South stations. Both are on the Orange and Blue lines.

Click image to enlarge.

Oct 2, 2010 | BEP, currency, Federal Reserve

On October 1, the Federal Reserve announced that they will delay the release of the redesigned $100 Federal Reserve Note because of production issues. The release was planned for February 10, 2011.

The announcement said that the BEP has identified a problem with sporadic creasing of the paper during printing of the new $100 note that did not appear during pre-production testing. While the BEP is working to resolve the issue, the Federal Reserve will not have enough notes to begin worldwide distribution causing the delay. No date was announced.

Sep 22, 2010 | BEP, video

As a follow up to their previous video, the Bureau of Engraving and Printing has released Part II of their educational series about the new $100 Federal Reserve Note.

This month’s video is “How to Detect A Counterfeit, Part II.” The 12-minute video shows consumers how to recognize the watermark, security thread, color-shifting ink, raised printing, and microprinting security features on the new note. The video includes a demonstration by Kelley Harris of the United States Secret Service, head of the Washington, DC counterfeit lab. Harris also shows examples of counterfeit attempts. Interestingly, she talks about the small letters and numbers located on the notes that show the plate and position codes of the notes.

Here is the BEP’s video:

UPDATE:

Yesterday’s release announcement was for the third video podcast of the BEP’s $100 Note Podcast series. Rather than read the release, I used the information from other sources. Sorry! The new video is “The Art of the Banknote Design.” The video features Larry Felix, Director of the Bureau of Engraving and Printing, and Michael Lambert, Assistant Director of the Board of Governors of the Federal Reserve System. Felix and Lambert discusses the thoughts behind the creating of the new $100 Federal Reserve Note.

Here’s video three:

Sep 11, 2010 | BEP, cents, commentary, Federal Reserve, legal, US Mint

It looks like the pundits have run wild with the malarky that gins up crowds for an issue that should not be an issue. This one was started by John Green, someone with the credibility of a camera who posts videos for something he and his partner calls Vlog Brothers. Apparently, the vlog (video blog) is about whatever comes to their minds whether it is right or not.

In Green’s latest screed posted on YouTube he ruminates about how the “penny” is worthless and the U.S. Mint should not be producing them. In the comments to the video, he claims that he read two articles, one from The Washington Post and another from Consumer Affairs, about the alleged opportunity costs of the coin. In fact, The Washington Post article is an opinion piece and has limited value in the argument. What Green did not say is that both articles are over four years old. Apparently, he could not find anything more recent or factual.

I found the video on the The New York Times block of Stephen J. Dubner, a co-author of the Freakonomics books and journalist who like some of his other The New York Times brethren has issues with facts (e.g., Duke lacrosse case).

Starting with the grossly obvious: The United States Mint does not strike “pennies.” The coin is one cent and not a penny. The penny is the lowest denomination of the current British monetary system. Back when Alexander Hamilton devised the U.S. monetary system, the lowest British denomination was the Farthing, ¼ penny. Rather, Hamilton called the coins “cents” to distinguish the United States coins from the British coins.

But the name of the coin is a basic issue. The real measure of the alleged journalist’s muster is if he could look beyond the salacious drivel to discover the truth that may actually cause real thought and consideration from the public. If Green and Dubner would do their homework they will know that:

NO TAX DOLLARS ARE USED IN THE MANUFACTURE OF COINS AND FEDERAL RESERVE NOTES IN THE UNITED STATES!

“Wait,” you might interrupt. “Aren’t these government agencies that are funded by congress?”

Yes, both the U.S. Mint and the Bureau of Engraving and Printing are bureaus under the Department of the Treasury whose budgets are approved by congress. However, the money that congress allocates to these bureaus are NOT taken from the general fund.

Both the U.S. Mint and the BEP are profit making bureaus. After manufacturing the money, it is sold at face value to the Federal Reserve for distribution to member banks and then to the public. The difference between the face value of the money and the cost to manufacture the money is the profit—called seigniorage. Even though the one cent and five cent coins cost more to manufacture than their face value, the U.S. Mint continues to generate profit from the sale of all coins sold to the Federal Reserve in addition to the sales of bullion and collectible coins.

According to the 2009 U.S. Mint Annual Report (covering Fiscal Year 2009: October 2008–September 2009), they earned $98.1 million in seigniorage. That is a profit of $98.1 million in a down economy!

When the U.S. Mint is paid by the Federal Reserve for the coins, a collector purchases collectibles directly from the U.S. Mint, or a bullion dealer buys bullion coins, the seigniorage is deposited into a special account called the United States Mint Public Enterprise Fund (PEF) as required by law (see 31 U.S.C. §5136). As sales are deposited in the PEF, the law requires that the U.S. Mint use the money in the PEF for budgetary reasons like to manufacture coins, maintain facilities, pay employees, etc. No tax money is deposited in the Public Enterprise Fund and the PEF is managed like all general accounts by the Treasury Department. In fact, excess profit is required to be deposited in the Treasury general fund.

There is a similar fund for the Bureau of Engraving and Printing (see 31 U.S.C. §5142).

If the money that the U.S. Mint uses for all its operations is withdrawn from the PEF and if the PEF does not contain any tax receipts, then how does it hurt taxpayers if the U.S. Mint continues to manufacture one and five cent coins?

More philosophically, it is “[the] primary mission of the United States Mint is to produce an adequate volume of circulating coinage for the nation to conduct its trade and commerce.” This is done by striking coins that are ordered by the Federal Reserve System for placing into commerce. If the Federal Reserve only orders coins they need to sell to member banks, then why is does Federal Reserve Currency and Coin Services order so many one cent coins? If they are useless and cannot buy much, why do they keep ordering more cents?

It is unfortunate that a journalist chose to support his fact deprived argument using an editorially questionable YouTube video.

The Bureau of Engraving and Printing will announce today that they have developed EyeNote,™ an app for iOS devices (iPhone, iPod Touch, iPad) that will help the assist the blind and visually impaired determine the value of the U.S. currency they are holding.

The Bureau of Engraving and Printing will announce today that they have developed EyeNote,™ an app for iOS devices (iPhone, iPod Touch, iPad) that will help the assist the blind and visually impaired determine the value of the U.S. currency they are holding.After downloading the free app from the iTunes App Store, it was installed on my iPhone and I tried it. I had two notes nearby, a $20 note and a torn $1 note. When the app starts, there is a page with brief instructions. Interestingly, for an app that is supposed to help the visually impaired, the instruction text is a bit small that cannot be expanded using the iPhone pinch motion. For those who cannot read it, it says:

On my iPhone 4, the LED flash was turned on, I positioned a $20 note reverse in front of the camera, tapped the display, and the camera sound played as it took the picture. After a few seconds, a woman’s voice told me that it saw the back of the $20 note. I found a $10 and $50 note. Both were identified on both sides with no problems.

After passing those tests, I tried the only $1 note I had: one that was used as a chew toy by one of my dogs. No matter how I positioned the camera, the app could not identify the note. While the app is impressive it would have been amazing if the app could have identified my torn note!