Jul 21, 2021 | bullion, coins, silver, US Mint

This is the first article of three regarding the recent problems at the U.S. Mint.

Economic analysts believe there is a silver shortage but that it is not critical. According to the supply chain reports, a sufficient supply of industrial silver for manufacturers to keep up with production. The reduction in computer chip production because of COVID-based plant shutdowns is the greatest threat to manufacturing.

Economic analysts believe there is a silver shortage but that it is not critical. According to the supply chain reports, a sufficient supply of industrial silver for manufacturers to keep up with production. The reduction in computer chip production because of COVID-based plant shutdowns is the greatest threat to manufacturing.

Jewelry and other businesses that use silver for their beauty are experiencing a slowdown but not to the extent of the computer chip industry. The industry has been able to use recycled silver fueled by people cashing in their scrap silver. One silver refiner reports that they have more work than they can process.

Although manufacturers have silver to maintain production, the U.S. Mint announced on May 28, 2021, that “The global silver shortage has driven demand for many of our bullion and numismatic products to record heights.”

On June 2, the U.S. Mint clarified their statement by saying, “In a message released Friday, May 28, we made reference to a global shortage of silver. In more precise terms, the silver shortage being experienced by the United States Mint pertains only to the supply of silver blanks among suppliers to the U.S. Mint.”

Why is the U.S. Mint different from the other industries?

The short answer is that the U.S. Mint is just another government agency subject to federal law.

The U.S. Mint is required to buy silver mined in the United States within one year of its mining (31 U.S. Code §5132(a)(2)(D)). Under this law, the U.S. Mint cannot use recycled silver or silver that the government has not purchased from the mines.

The U.S. Mint discontinued assay operations shortly after the passage of the Coinage Act of 1964. Since then, the bureau has bought the metals from other manufacturers, either sheets or already formed planchets. When the American Eagle Program started, the law required the U.S. Mint to use the silver in the Strategic and Critical Materials Stockpile. The U.S. Mint manufactured the planchets in West Point.

When the program depleted the Strategic Stockpile, Congress updated the law to require the U.S. Mint to use freshly mined silver. They found that it was more cost-effective to have a commercial vendor manufacture the planchets.

Hiring a commercial vendor to do work for the federal government is different from a business-to-business transaction. The government requires all contracts and contractors to follow the Federal Acquisition Regulations (FAR) to purchase goods and services.

For the government to contract with any company, a bidding and vetting process can last from weeks to years. The agency has to produce requirements, selection criteria and evaluate the proposals, called source selection.

Congress purposely made the process challenging to promote fairness in the bidding process and ensure the government pays a fair price. Unfortunately, the process is expensive and fraught with problems.

For the U.S. Mint, the problem is that FAR does not allow the latitude to find alternate vendors when there are supply issues.

The U.S. Mint has contracts with four vendors to make silver planchets. They have vetted the contractors, their processes and have contractual quality control measures to ensure the planchets comply with the Treasury’s legal and quality requirements. If the vendors cannot fulfill the U.S. Mint’s order, the law prevents them from looking for immediate alternatives.

According to the U.S. Mint, the suppliers of silver planchets had production slowdowns because of COVID-19 operating precautions. In addition to manufacturing issues, the mining operators also experienced slowdowns because of the same operating precautions. Every industry is experiencing supply chain interruptions.

Where the U.S. Mint could have done better was to order the planchets sooner. The U.S. Mint reported that agency attorneys refused to allow their purchasers to order planchets before the law was signed. The bill, H.R. 6192, was sent to the president on December 24, 2020. The president signed the bill into law on January 5, 2021 (Public Law No. 116-286).

When a law is signed, the White House will tell the appropriate Departments. If that does not happen, the agencies receive notice from the Government Printing Office (GPO) who publishes the laws. Like everything else, the GPO has experienced interruptions because of pandemic protocols.

According to a government attorney that works for the Inspector General’s office in a non-Treasury department, agencies have the latitude to work on anticipated laws. An example cited is that the IRS works on drafting forms and regulations based on the bills in progress to be ready for the filing season.

Although Congress did not do the U.S. Mint a favor by passing the bill on Christmas Eve, the White House did not do the U.S. Mint a favor by not letting the Treasury know they signed the bill. However, the leadership of the U.S. Mint allowed the lawyers to dictate operations. The lawyers are supposed to be advisors, not the last word.

If you like what you read, share, and show your support

Jul 20, 2021 | coins, Eagles, US Mint

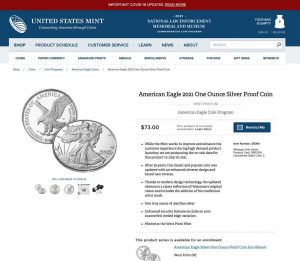

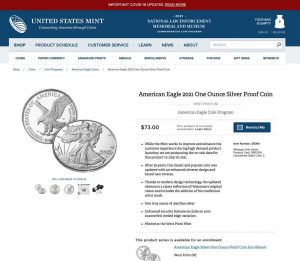

I was able to order the 2021-W American Silver Eagle one-ounce proof coin today with only minor issues.

I was able to order the 2021-W American Silver Eagle one-ounce proof coin today with only minor issues.

Like every other time I ordered new releases from the U.S. Mint, I logged into my account before the sale. I verified that the credit card I had registered was the correct card. The card was in front of me just in case something went wrong.

As the time closed in at noon, I tapped the refresh button. As soon as the button changed from “Remind Me” to “Add to Bag,” I began tapping.

When the page did not respond immediately, I panicked and tapped again. Of course, I should know better. But I am an anxious collector who cares what my background is. After tapping more than once, the coin appeared in my bag, and I pressed checkout.

I did not look at the contents of my bag as I scrolled down to my payment option. I selected my stored credit card then watched as it took too long to fill the form. As it took time, I was pressing buttons faster than the website responded. After the system finally filled in the form, I forgot to enter the CVV for my card. Then another tap.

Once the confirmation page appeared, I took a screenshot of the information for safekeeping. That is when I realized my nervous tapping added more than one coin to my bag. It looks like I ordered three coins. It also may explain an error I received during the tapping on the link when the system thought I was overfilling my bag.

As I type this, the coin sold out. I do not know how long it was before the coin sold out because I had to put down my iPad and go back to work. It looks like if you missed the opportunity to order, then you would have to purchase one on the secondary market.

A quick search on eBay suggests that the presale for graded coins is averaging $135-150.

Jul 20, 2021 | Canada, coins, fun

With everything going on, it is nice to find something amusing. Over the weekend, I wanted to listen to a couple of podcasts. I reached into my pocket for the case containing my wireless earbuds and found something came along for the ride.

With everything going on, it is nice to find something amusing. Over the weekend, I wanted to listen to a couple of podcasts. I reached into my pocket for the case containing my wireless earbuds and found something came along for the ride.

Stuck to the magnetic closure was a coin. A closer look found the coin is a 1978 Canada 10-pent coin. Or that is what the coin appears to be.

The Canada 10-cent coin is slightly larger than the U.S. dime (18.03 mm versus 17.91 mm), and today, the Canadian coin is made of plated steel. But this is a 1978 coin and may not be steel. While investigating the coin’s specification, it is supposed to be made of nickel. I thought nickel was not magnetic. Time to review my basic science

-

-

My earbud case magnetized the Canada 10¢ coin made of nickel.

-

-

The Canada 10¢ coin is very slightly larger than the U.S. dime.

Nickel is one of the transition metals, an element used to form bonds with other elements. While I let you explore the chemistry on your own, let us say that it mixes well with other elements to create valuable compounds. In numismatics, nickel provides the silver color on many base metal coins.

But that does not explain why the coin stuck to my wireless earphone case.

I found that nickel is a ferromagnetic metal, meaning that it can become magnets or be attracted to magnets. Nickel is not naturally attracted to magnets or easily magnetized. But nickel is one of only four elements that can be magnetized easily at room temperature. The other three are cobalt, iron, and gadolinium.

For help, I turned to a high school chemistry teacher to refresh my memory. During the refresher lesson, I flashed back to the high school chemistry demonstration on magnetism, creating a magnet from a ferromagnetic item.

While the coin was in my pocket, the coin rubbed next to the magnet. The rubbing caused the nickel atoms to become orderly that turned the coin into a magnet. The Canadian ten-cent coin that stuck to the earbud case could pick up a straight pin to test the theory.

But why won’t any of my United States coins turn into a magnet in my pocket?

Since U.S. coins are made up of an alloy of 75-percent copper and 25-nickel, the copper and the nickel’s strong bond with the copper stops the ferromagnetic process. It would take a very strong magnet to order the nickel atoms in a U.S. coin to turn it into a weak magnet.

Not only can coins teach history, but they can also teach chemistry.

If you like what you read, share and show your support

Jul 18, 2021 | coins, news, US Mint

The U.S. Mint announced the new ordering procedures for upcoming silver products and that there will be changes to the bulk purchase system. Most collectors met both news items with a collective yawn.

The U.S. Mint announced the new ordering procedures for upcoming silver products and that there will be changes to the bulk purchase system. Most collectors met both news items with a collective yawn.

For many years the U.S. Mint has promised improvements for the collector and access to their products. During that time, the collecting public held their collective breaths hoping that they will get it right. After failing to show progress, collectors are not optimistic.

According to the U.S. Mint, the problems are a low supply of planchets and Internet robot ordering on a broken ordering system. The supply issue has acceptable reasons external to the Mint. The broken ordering system and managing against the bots is the direct responsibility of the U.S. Mint.

Even if they fix the ordering and distribution systems for the upcoming product, it will take a long time for the U.S. Mint to gain the trust of collectors.

And now the news…

July 13, 2021

The association says the suspension of the program has been a burden to scrap recyclers across the country. The Washington-based Institute of Scrap Recycling Industries (ISRI) is urging the U.S. government to reinstate its mutilated coin redemption program, which was suspended in 2019.

→ Read more at

recyclingtoday.com

July 14, 2021

When the first modern Olympics were held in Athens in 1896, winners did not get gold medals as they will later this month when the Tokyo games get underway. Instead, they got silver, while runners-up got bronze. There were no medals for third place.

→ Read more at

thenationalherald.com

July 14, 2021

A rainstorm in London has led to the discovery of a hoard of more than 300 coins dated to the first century B.C.

→ Read more at

smithsonianmag.com

July 15, 2021

A German federal court on Tuesday rejected the appeal of two defendants who had been jailed for stealing a massive gold coin from Berlin's Bode Museum. The court in the city of Leipzig concluded that there were no "legal errors to the disadvantage of the defendants" in their February 2020 sentencing and, as such, their prison terms were found to be legally binding.

→ Read more at

dw.com

July 15, 2021

A Viking era "piggybank" of silver coins has been discovered on the Isle of Man by a metal detectorist who made another startling discovery last year.

→ Read more at

bbc.com

July 16, 2021

THE Bangko Sentral ng Pilipinas (BSP) issued a new warning to the public about the supposed "Brilliant Uncirculated 20-Piso" coin being sold online.

→ Read more at

manilatimes.net

If you like what you read, share, and show your support

Jul 11, 2021 | coins, counterfeit, currency

From 2019: An example of a $100 Federal Reserve Note printed on a bleached $5 note (Image courtesy of Prescott Police Department via AOL.com)

Stories that do not appear on the front page of the printed edition or the top of a website rarely receive the attention of the headline writers. Unless there is a murder or other major crime, most local crime stories do not earn over-the-top headlines. This week’s news has three examples of mundane headlines that display a concerning pattern about counterfeit coins and currency.

Counterfeit money has been a problem since its invention. Governments try to stop criminals from counterfeiting, but their efforts almost seem inevitable. The new trend appears to be the small-time criminals caught trying to make money from selling fake money to survive.

Recent stories about the arrest of counterfeiters report that the people are not career criminals trying to get rich. Those who are getting arrested are using the counterfeits for survival. The world economy has deteriorated to the point that buying and selling counterfeit money was worth the risk to buy a scooter to use as primary transportation.

The people caught passing counterfeit money admit it is not a mistake. In the statements to the police, they admit to using counterfeits to fill to earn a survivable living. Authorities continue to look for the distributors of the counterfeits.

And now the news…

July 4, 2021

An extremely rare 22-carat gold coin from the reign of Henry VIII, considered the origin of the pound, is set to go under the hammer this month for £50,000.

→ Read more at

dailymail.co.uk

July 7, 2021

In a major crackdown against the illegal counterfeit currency trade going on in the city, the district police arrested six persons and seized Rs1.47 lakh fake notes in denominations of Rs2,000 and Rs500.

→ Read more at

tribuneindia.com

July 7, 2021

ST. LOUIS, Mo. – Have you ever gone to the zoo or a museum and received a stretched coin as a souvenir? Well, the “The King of Elongated Coins” from the 1904 World’s Fair is up for auction and the lot including two other coins could be worth up to $4,000.

→ Read more at

fox2now.com

July 8, 2021

A team of French, Australian, and Israeli scientists has collected evidence proving there was an active and thriving silver trade network in the eastern Mediterranean region in the Late Bronze Age and Iron Age (approximately 1200 BC to 400 BC).

→ Read more at

ancient-origins.net

July 8, 2021

The Niger State Police Command has arrested a Catholic Church Catechist and two others for engaging in the sale of counterfeit currency of about N15,800,000. The trio of Emmanuel Akazuwa, 42, Catechist Sabastine Dabu, 48 and Umar Mohammed, 50, were arrested in a hotel in the Kontagora area of the state while trying to get a buyer for the N15.8million in their possession.

→ Read more at

saharareporters.com

July 9, 2021

Officers seized approximately $1,700 in counterfeit currency during an arrest on Thursday, July 8, 2021.

→ Read more at

sootoday.com

July 9, 2021

Byzantine coins were discovered last month at the port of Caesarea, a town in Northern Israel between Tel Aviv and Haifa.

→ Read more at

greekreporter.com

If you like what you read, share, and show your support

Jul 2, 2021 | coins, US Mint, video

As more people come out of their pandemic bubble, some areas continue to report a coin shortage. Although it appears to be a shortage in circulating coinage, there is a reduction of coin available for merchants to give change. Although the situation has improved, the problem is that coins are still not circulating.

In a video by U.S. Mint Director David Ryder, he reports that the Mint has increased production during the last year. Typically, the U.S. Mint supplies less than 20-percent of the coin in circulation. Last year, the U.S. Mint increased production to add 30-percent of the coins in circulation.

Given the situation with the pandemic that caused the West Point Mint to shut down and pause Philadelphia, the fact that the U.S. Mint was able to produce more coins than ever is a significant accomplishment. Regardless of your opinion as to how the U.S. Mint has handled the sale of collector coins, no other mint in the world could accomplish this feat.

In 2020, the U.S. Mint struck 14.774 BILLION coins. But in 2019, a year where the economy was doing very well, the U.S. Mint produced 11.942 BILLION coins. They produced 23.7 more coins while taking precautions during a pandemic.

Nearly every industry reported a reduction in demand and the ability to produce products. And the supply chain continues to affect production in some industries, including tech, where there is a shortage of computer chips. But the U.S. Mint was able to add over 14 BILLION coins to the economy. Amazing!

Jun 20, 2021 | bullion, coins, news

Farouk-Fenton 1933 Saint-Gaudens $20 Double Eagle was sold by Sotheby’s for $18,872,250 in a June 2021 auction. (Picture Credit: PCGS)

The gold market is very active, and the prices are rising, but not because of the sale of the Double Eagle. The demand for physical metals caused by economic uncertainty has driven up the prices for gold and silver coins.

While discussing the demands for precious metals with dealers, they say that the demand is for coins. Their customers are buying American Eagle coins causing the supply of coins to decrease. When customers cannot buy American Eagles, they look to purchase silver coins from other state mints. Canada’s Maple Leaf and Mexico’s Libertad are popular alternatives to the American Eagle.

Investors are looking to purchase physical assets that have some backing. They are not buying bullion or contracts. As a result, the price of bars and other bullion products is reasonable compared to higher-priced coins. Contracts are paper-based trading of bullion. Many smaller investors traditionally do not like to trade based on paper. They are looking for something physical, like coins.

Bullion investing increases when investors perceive there are uncertainties in the markets. The current market run started last year during the beginning of the pandemic and has not stopped.

The markets are not responding to the sale of the 1933 Double Eagle. It is the only 1933 Double Eagle coin that is legal to own and has a story that inspired two books. Using this coin as an example of a reason to invest in gold coins is not representative of the reality of the bullion coin market. Beware of those who will try to sell you bullion based on the sale of this coin.

And now the news…

June 14, 2021

BOSTON — The wife and brother-in-law of a Cranston coin dealer convicted of laundering millions for a Mexican drug cartel struck out again in challenging $136-million forfeiture rulings against them.

→ Read more at

providencejournal.com

June 15, 2021

Beginning tomorrow, the Federal Reserve will begin its FOMC meeting for June, which will conclude on Wednesday. Following the conclusion, the Federal Reserve will release a statement, which a press conference will follow by Chairman Jerome Powell.

→ Read more at

kitco.com

June 17, 2021

Ultra rare stamps and a unique coin have sold at auction for a total of $32 million. Sotheby’s in New York played host to the record-breaking event. What were the lots?

→ Read more at

thevintagenews.com

June 18, 2021

In the article “Watermarked Paper First Series”, published in Pattaya Mail on Friday February 12, 2021, I wrote about problems with the watermarked paper.

→ Read more at

pattayamail.com

June 19, 2021

The 2021 platinum bullion American Eagle 1 oz coin has achieved the second highest sales on record, with sales of 75 000 oz for the five months to May 31, industry organisation the World Platinum Investment Council (WPIC) reports.

→ Read more at

miningweekly.com

If you like what you read, share, and show your support

Jun 13, 2021 | coins, news, personal

Before unveiling my father’s grave marker, it was covered with an appropriate towel. After 12 years, he is next to my mother, again.

Last Friday was my father’s unveiling. For those not familiar with the custom, Jewish descendants celebrate the life of the deceased by dedicating the grave marker where the loved one is buried. The marker is covered then revealed at the end of the service.

As a die-hard and always suffering Mets fan, my father’s marker was covered with a Mets towel until the end of the service. Later that night, the family went to Citi Field to attend a Mets game in his honor. Jacob deGrom pitched a phenomenal six innings and the Mets won.

It was my first time attending a game at Citi Field. The stadium is quite different from Shea Stadium where my father and I saw many games together. In 1972, we attended more games than he expected because I kept winning tickets. That year I was delivering Newsday when it was an afternoon newspaper. To boost the number of subscribers, Newsday would give out prizes to the paperboys who sold the most subscriptions. When Newsday started a Sunday paper, there would be more opportunities to win prizes. I chose the Mets tickets whenever it was an option.

In those days, the paperboys collected directly from the subscriber. On Saturday, we would pay the distributor for the week’s newspapers and hand in orders for the next week. One week I almost did not have enough money to pay the bill because several people paid using silver coins. The silver coins went inserted into the blue folders. My father helped me make up the difference.

By the end of my three years delivering Newsday, I had a nearly complete set of Roosevelt dimes picked from pocket change and from the people who paid for newspapers. Shortly before we moved from New York, my father and I went to a local coin shop and we purchased 12 dimes to almost complete the set. A few days later, he came home from work with the one dime that the local coin shop did not have and a Whitman Deluxe album. Later, I learned he bought the coin and the album from Stack’s in Manhattan.

Although this chapter is over, the memories and the album of Roosevelt dimes remain.

And now the news…

June 10, 2021

“Treasure of Chianti,” now on view through Sept. 3 at the Museum of Santa Maria della Scala in Siena, Italy. A treasure trove of ancient Roman silver coins discovered by a team from Florida State University is now on display to the public for the first time in Italy.

→ Read more at

news.fsu.edu

June 11, 2021

June 13, 2021

If you like what you read, share, and show your support

Jun 8, 2021 | auction, coins, gold

On June 8, 2021, Sotheby’s auctioned the Stuart Weitzman Collection. The auction consisted of three of the rarest items in the world, including the Farouk-Fenton 1933 Saint Gaudens Double Eagle. It is the only 1933 Double Eagle coin that anyone who can afford it can legally own.

The coin sold for $18,872,250!

Although not confirmed by Sotheby’s, the price realized suggests that it includes the buyer’s premium. Sotheby’s has not disclosed the buyer’s name.

Farouk-Fenton 1933 Saint-Gaudens $20 Double Eagle was sold by Sotheby’s for $18,872,250 in a June 2021 auction.

(Picture Credit: PCGS)

Arguably, the most famous coin in the world, the price was over the auction estimate of $10-15 million but under what the numismatic industry expected. The price is significantly more than the $7,590,020 paid in 2002 for the coin, including $20 to monetize the coin officially. The auction included the U.S. Mint’s monetization certificate.

U.S. Mint’s Certificate of Monetization for the Farouk-Fenton Double Eagle (Picture Credit: Sotheby’s)

Also included in the auction was The Inverted Jenny Plate Block sold for $4,860,000 (estimated at $5-7 million), and The British Guiana One-Cent Black on Magenta stamp that sold for $8,307,000 (estimated at $10-15 million).

Numismatists may want to save the catalog link for the sale of this coin. Sotheby’s catalog listing includes the coin’s history with an updated history of the other 1933 Double Eagle coins. The update includes the ten coins “discovered” by Joan Langbord, daughter of Israel Switt, and her family’s fight to retain ownership. Documentation from court filings adds to the story.

David Tripp wrote the original catalog description for the first Sotheby’s/Stack’s auction. In 2004, Tripp published his research in Illegal Tender. Given the new information, would it be worth updating the book?

May 18, 2021 | coins, commentary, nclt

The evolution of coin collecting is here. It is all around you, and if you are collecting using blue and brown folders or plastic holders, you are not part of the evolution or at the periphery of the evolution.

The evolution of coin collecting is here. It is all around you, and if you are collecting using blue and brown folders or plastic holders, you are not part of the evolution or at the periphery of the evolution.

New collectors are collecting based on a coin’s theme. They are not interested in date or mintmark series of coins but want a connection to their collectible. The coins must have a meaning.

A midwest club of sports collectors invited me to speak about coins with sports themes. They had heard of the Basketball Hall of Fame coin but wanted to know more. I gathered my information and joined them via Zoom.

For this talk, I made a list of commemorative coins celebrating sports. This list includes the Baseball Hall of Fame coins, the many Olympic commemorative coins, and the Jackie Robinson commemorative coins.

As part of the discussion, they asked why collectors did not like the colorized Basketball Hall of Fame coins. One club member tried to buy the colorized clad proof from a local coin shop and was shamed by the shop’s owner for wanting this coin. The shop owner said that it was a damaged coin and that it will not be worth much in the future. Rather than selling the collector the colorized coin, he tried to sell a regular proof.

Unfortunately, the “traditional” numismatic feeling is that a coin is a legal tender flat metal disc with a denomination with a date, and some have mintmarks. Within the collection of the flat discs, there may be variation in how the coin was struck, changes in dies, and other unintended alterations the hobby calls errors. But that is not what interests today’s collectors.

One of the club members has been collecting the Super Bowl coins from the Highland Mint. He loves football, and the Highland Mint produces the coins for the Super Bowl coin toss. They sell replicas to collectors. The Highland Mint also sells commemorative replica sets for all of the Super Bowls’ coins. For the years before the Highland Mint’s involvement, they created a coin that may have been appropriate for the game.

After listening to the story and the information about the coins, I called him a numismatist. I told him that he did not have to collect legal tender coins to be a numismatist. By having a niche collection of numismatic-related items and learning everything about them, I said that is what numismatics is all about.

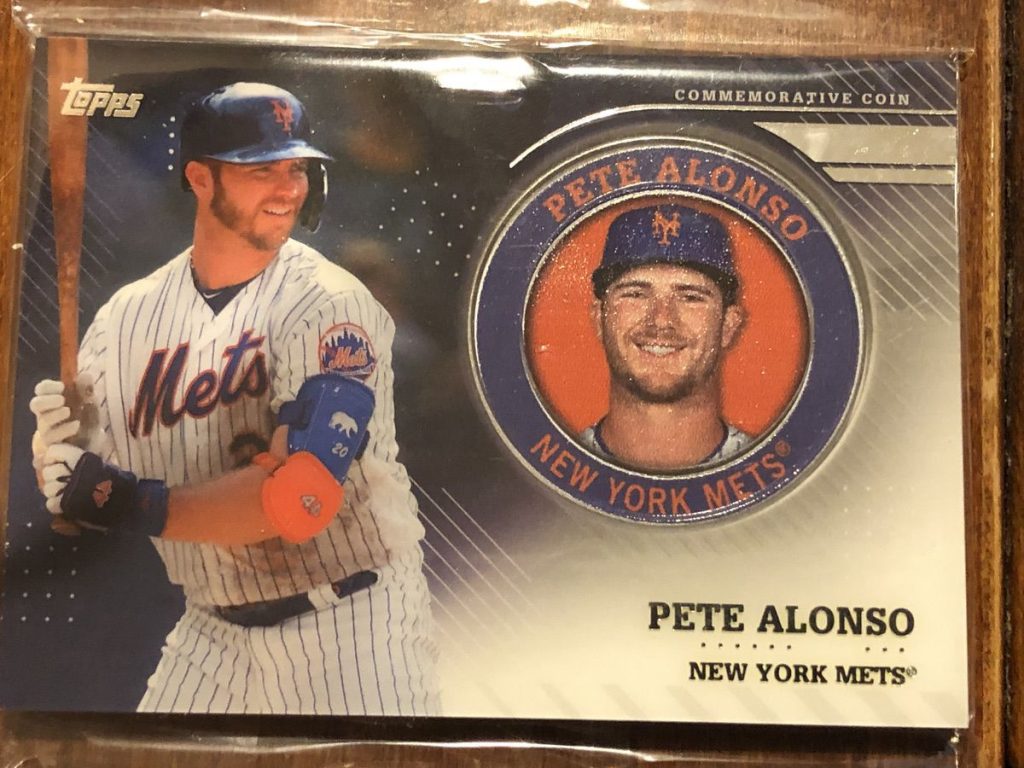

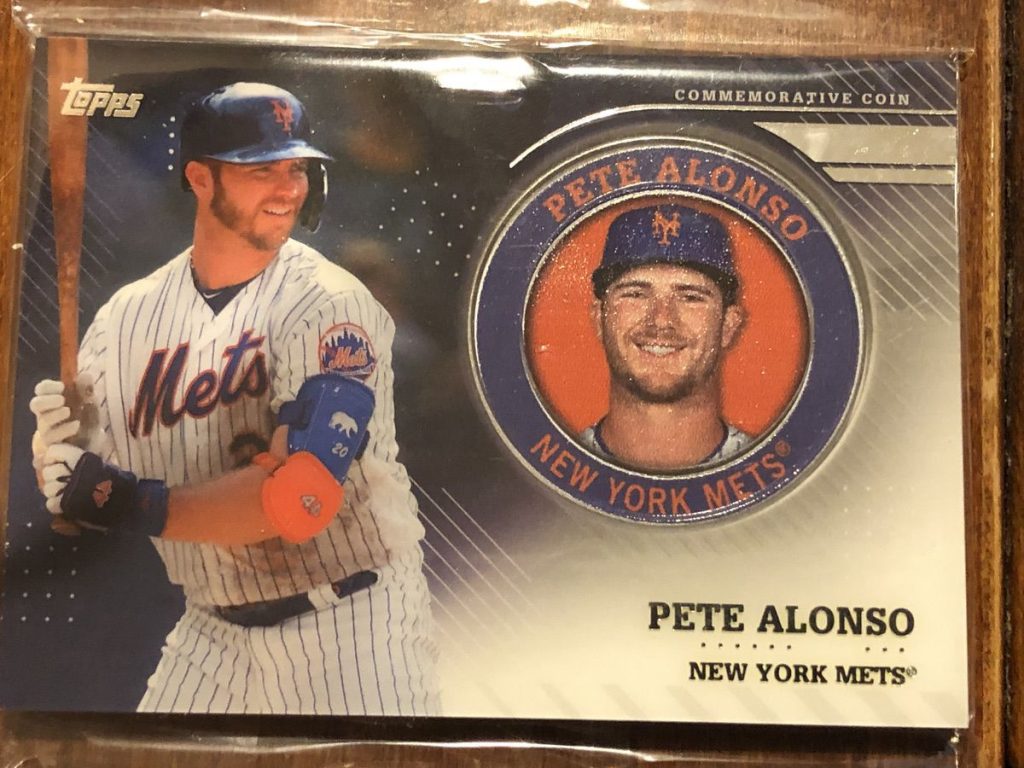

In the process, club members told me about coins that Topps made as a promotion in 2020. Inside special packs, there was a thicker card with a coin inserted honoring the player. Following a quick search, I purchased the two versions of the coin card with New York Mets ace Jacob deGrom and slugger Pete Alonso.

-

-

Topps Jacob deGrom first issue card and coin

-

-

Topps Pete Alonso second issue card and coin

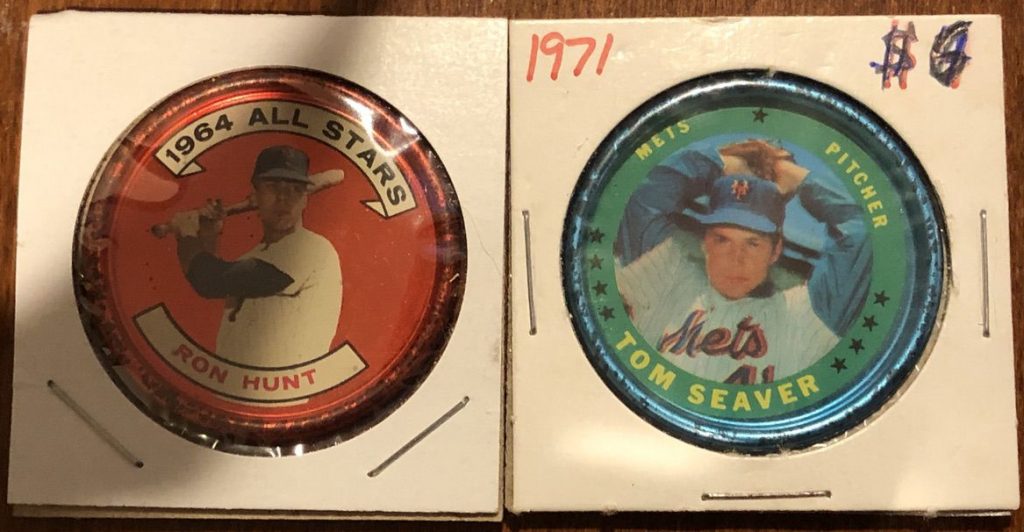

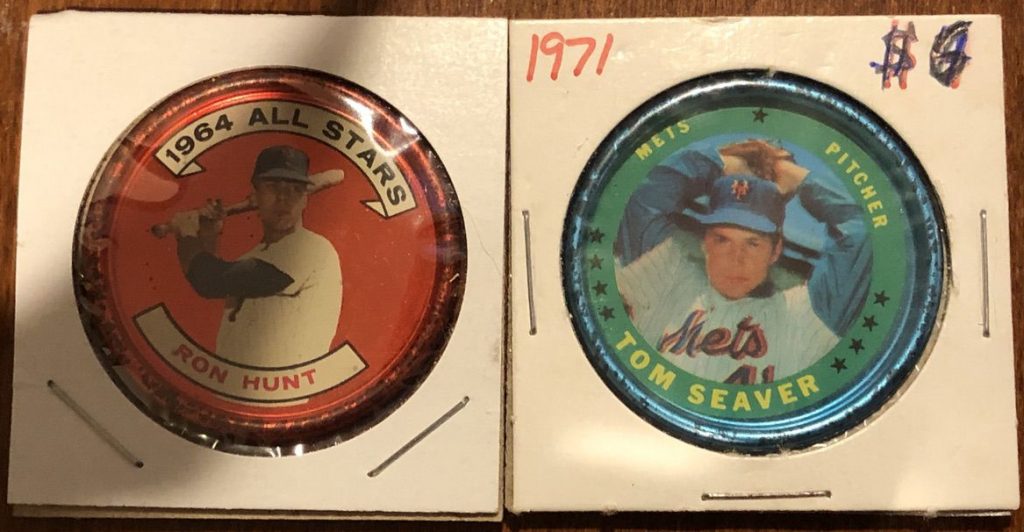

I also found a few 1964 and 1971 aluminum coins, sometimes referred to as pogs, for a few previous members of the Mets, including “The Franchise,” the late Tom Seaver. I think I just started a new collection!

1964 Topps Ron Hunt (left) and 1971 Topps Tom Seaver (right)

Towards the end of the meeting, someone asked if I knew anything about the new Rolling Stones Coin. The Crown Mint produces a silver 10 gram, 1-ounce silver, and 12-gram gold coin using the tongue and lips logo for Gibraltar. The silver coins feature colorized highlights.

As we talked about the coins, I picked up my philatelic numismatic cover (PNC) with the Queen coin from the Royal Mint and put it in front of the camera. I also mentioned that the Royal Mint produced a commemorative for Elton John. Although the coin covers are sold out at the Royal Mint, I went to the Royal Mail website and found Elton John and other commemoratives, including coin covers for James Bond.

Queen Coin Cover is created in cooperation with the Royal Mint and Royal Mail (Image courtesy of the Royal Mint).

After the meeting, I was thinking about themed coins and wondered if the numismatic community can partner with other collectibles to create a more dynamic show.

For example, why not partner with the New Zealand Mint, Perth Mint, Royal Canadian Mint, and others that produce licensed comic-related coins and the publishers to create a Coin and ComicCon. The coins will be the centerpiece of the event but invite the fans to add a different flair.

There are so many themed coins that the hobby can set up CoinCons that bring in different themes with the coins as the centerpiece. A Sports CoinCon would feature sports on coins, and the grading services can sponsor autograph signings of the labels. Coin dealers could set up next to sports dealers to sell coins. And the coins do not have to be limited to a sports theme. If the dealer can sell investor coins or other themed coins, they can gain from the experience.

Outside of numismatic circles, silver and mixed metal non-circulating legal tender (NCLT) coins are popular. The mixed metals are not limited to ringed coins. Using metals like gold and niobium to highlight features is as popular as colorized coins.

Other possible CoinCon themes include advertising, art, nature, history, science, and almost anything else. An International CoinCon could set up conference rooms with different themes connected by a single hall to allow collectors to go between rooms to experience other collectibles. The CoinCon can invite auctioneers of each theme to hold auctions during the show, especially if their lots have coins to feature. How much fun could it be to have a science and technology theme in a CoinCon and hold an auction with space-related coins and souvenirs?

A CoinCon is not collecting as we knew it yesterday. Today’s collectors want a connection to what they collect. All hobby businesses must understand that this is the present and future of collecting.

Economic analysts believe there is a silver shortage but that it is not critical. According to the supply chain reports, a sufficient supply of industrial silver for manufacturers to keep up with production. The reduction in computer chip production because of COVID-based plant shutdowns is the greatest threat to manufacturing.

Economic analysts believe there is a silver shortage but that it is not critical. According to the supply chain reports, a sufficient supply of industrial silver for manufacturers to keep up with production. The reduction in computer chip production because of COVID-based plant shutdowns is the greatest threat to manufacturing.

→ Read more at

→ Read more at