May 29, 2022 | news

National Purple Heart Hall of Honor 2022 Three-Coin Proof Coins (U.S. Mint Image)

Memorial Day took on national significance following World War I when the nation began to recognize all those who gave the ultimate sacrifice during all conflicts. By the end of World War II, most of the celebrations were renamed to Memorial Day. Memorial Day did not become an official holiday until 1967 with the passage of the Uniform Holidays Act (sometimes referred to as the Monday Holiday Bill). The law set Memorial Day to the last Monday in May, changing it from the traditional May 30.

The modern Memorial Day is a holiday celebrating the lives of those sacrificed in defense of the United States and its ideals at home and abroad. We honor the memories of those who paid the ultimate sacrifice so that we can collect what we like. They have gifted us the freedom so that I can write this blog and you can read and share it with others.

And now the news…

May 24, 2022

The Modiin haul. The seizure featured a historically significant silver shekel.

→ Read more at

news.artnet.com

May 25, 2022

The Royal Mint has created the largest ever coin in its 1,100-year history in celebration of the Queen's Platinum Jubilee.

→ Read more at

penarthtimes.co.uk

May 23, 2022 | coins, news

Sorry… we are one day late for many reasons including just being tired. More to come.

One of the cans found as part of the Saddle Ridge Gold Coin Hoard

Of course, the metal detectorists are looking for treasures. Few save any of the coins they find. They will consign the coins to an auction and collect the payment. The coins will end up in the hands of collectors and museums that will enjoy them for years to come.

I have never been interested in exploring with a metal detector. In the United States, most finds are limited to the 200-300 years. Detectorists find belt buckles, watches, rings, some coins, and other items dropped along the way. But nothing compares to finding coins from over 1,000 years ago or medieval coins from 500 years ago.

These unburied coins are sometimes the only record of history. Recently, a hoard revealed a problem with inflation during the Roman Empire that taught historians about ancient economics.

I am not saying that there are no exciting finds in the United States. The Saddle Ridge Gold Hoard is a recent example, but the finds in England and the rest of Europe can change our knowledge of history.

I do not know if I will be able to go to Europe to see if I can find a treasure, but it is interesting to watch from afar.

And now the news…

May 13, 2022

One of only three known gold examples of the “Eid Mar” aureus A small but potent piece of history is up for sale in Zurich this month, when Numismatica Ars Classica offers one of only three known examples of the “Eid Mar” aureus, celebrating the “liberation” of Rome after the bloody assassination of the dictator Julius Caesar on the Ides of March in 44BC.

→ Read more at

ft.com

May 18, 2022

Britain’s Royal Mint unveiled a special new commemorative rainbow-colored 50 pence coin on Wednesday as a tribute to celebrate the 50th anniversary of the Pride UK movement. The coin, designed by east London artist and LGBTQ activist Dominique Holmes, uses state-of-the-art printing technology to emboss it with the colors of the Pride progress flag.

→ Read more at

nbcnews.com

May 20, 2022

When it comes to buying silver , coins are one of the most popular places to start. A coin collector or investor who is used to buying gold may like the idea of taking that same investment strategy and applying it to silver.

→ Read more at

menafn.com

May 20, 2022

About 1,800 antique coins, jewellery and stamps, pottery plates with inscriptions, and an ancient bronze figurine were seized this week at the home of a resident of the city of Modi’in in the centre of the country, the Israel Antiquities Authority (IAA) announced Thursday.

→ Read more at

jwire.com.au

May 15, 2022 | news

It has been an interesting week. I tried to keep up with the news and the collecting world, but a health issue sidelined me. Unfortunately, I was diagnosed with COVID. I am feeling better, but it does affect my breathing. I am glad I am fully vaccinated.

It has been an interesting week. I tried to keep up with the news and the collecting world, but a health issue sidelined me. Unfortunately, I was diagnosed with COVID. I am feeling better, but it does affect my breathing. I am glad I am fully vaccinated.

I was not completely sidelined. While trying to breathe, I was able to go online and find some interesting items online. The purchase taught me something about an area of numismatics that I did not know existed. It will be something I write about when I receive the new purchase.

During the week, the U.S. Mint mailed a package that arrived in my mailbox containing the Negro Leagues Baseball Commemorative Proof Set. The coins look better in hand than the U.S. Mint’s website images.

As the Paxlovid works to get me back in the game, it will take a few days to get everything back together, and I will be ready to get back to collecting.

Life is short. Have fun collecting.

And now the news…

May 10, 2022

On May 9, the Greater Toronto Area (GTA) Trans-National Serious and Organized Crime Section (TSOC) charged an Ontario resident with uttering counterfeit money and possession of counterfeit money after the Royal Canadian Mounted Police (RCMP) identified and seized approximately 10,000 counterfeit toonies.

→ Read more at

cottagelife.com

May 14, 2022

Remember when no one wants to touch the bills or coins for fear of getting caught COVID-19 (new coronavirus infection)Would you like to replace what was considered contaminated cash with a credit card?

→ Read more at

worldakkam.com

May 8, 2022 | coins, commentary, news

Reverse of the Royal Canadian Mint 2015 Superman $20 for $20 coin featuring “The Man of Steel”

After reading yesterday’s blog post, the comics dealer asked me how to become a coin dealer to sell comics-themed coins.

My reader knows that the comics industry is exploding and that the publishers are dabbling in non-fungible tokens (NFT) to see if they can extend the market. Those skeptical of the NFT market are looking for alternatives. A comics dealer that expanded to other publications, toys, and other collectibles understands that extending his market with coins will be profitable.

Walk into any hobby shop and see how every hobby has evolved. Comics, sports, and antiques have seen a rise in collecting, and all have seen the benefit of cross-collecting. A sports dealer is also selling comics and other collectibles with sports themes. Comics dealers are collectible cards and souvenirs from the ComicCons, the same as the sports dealers are selling game tickets.

Coin dealers extend their business into metals and jewelry, and their stores look the same as they did 10 years ago. The dealers may be making a living, but it is not expanding the hobby. But is it their job to expand the hobby or make a living? Unfortunately, this attitude is typical with the dealers trying to set ANA policy and is not helping the hobby’s growth.

And now the news…

May 4, 2022

The most successful artistic design of the Croatian national side of the €1 coin has been selected, the Croatian National Bank (HNB) said in a press release.

→ Read more at

croatiaweek.com

May 5, 2022

Found in Switzerland, some of the buried Roman coins were minted during a time of relative political stability, between 332 and 335 C.E.

→ Read more at

smithsonianmag.com

May 1, 2022 | BEP, currency, news

The Bureau of Engraving and Printing announced that they negotiated a transfer of land from the U.S. Department of Agriculture to build a new facility in the Maryland suburbs of Washington, D.C.

The Bureau of Engraving and Printing announced that they negotiated a transfer of land from the U.S. Department of Agriculture to build a new facility in the Maryland suburbs of Washington, D.C.

The USDA will transfer the 104-acre Beltsville Agricultural Research Center northwest of the Capital Beltway for the new printing facility. The BEP plans to begin construction in 2023 and complete the facility by 2027. The new printing facility will employ at least 850 people.

The BEP used to be the security printer for the United States government. The BEP printed security documents, including bonds and deed certificates, and stamps, other than printing currency.

Legally, the primary mission of the BEP is to print currency for the Federal Reserve. They would offer other printing services as long as they continued to supply the Fed with currency. Beginning in the 1970s, the BEP reduced the number of stamps they printed until ending stamp printing in the early 1990s. When the Treasury ended the Series E savings bond program, they contracted printing to other contractors.

The economic expansion of the 1980s led the BEP to end almost all security printing to print currency. Before opening the Fort Worth printing center in 1991, Treasury officials explored using commercial printers to supplement the BEP’s capabilities.

In 2022, the Federal Reserve ordered the printing of over 6.9 billion notes. Although this is less than last year’s order, the BEP is approaching its maximum capacity between the Washington and Fort Worth sites. And even though bonds and stamps have become electronic assets, the U.S. government still has a security printing requirement. Although a source at the BEP would not elaborate on the printing requirement, they said that government officials want to make security printing a government function.

And now the news…

April 27, 2022

It will house a new state-of-the-art and environmentally conscious production facility to print U.S. paper currency and other federal security products.

→ Read more at

nbcwashington.com

April 30, 2022

COIN collecting was once a hobby for Stephanie Sabin – now she lives her dream by steering the ship for a major grading service firm. Mrs Sabin, who is the president of Professional Coin Grading Services (PCGS), has been into collecting since she was a child thanks to her family’s numismatic background.

→ Read more at

the-sun.com

Apr 24, 2022 | coin design, coins, news

I am sponsoring

GOLD memberships for new and renewing memebers of the American Numismatic Association. This is a limited-time offer to celebrate

National Coin Week and the 131st anniversary of the American Numismatic Association. The offer expires on April 25, 2022. Call (800) 514-2646 or visit

info.money.org/ncw-2022-barman to take advantage of this offer. Be sure to apply code

NCW22SB at checkout!

National Coin Week wraps up this weekend, celebrating coin designs. One thing that has been constant throughout the 21st century is changing coin designs. It started with the 50 State Quarters program and has affected every circulating coin except the half-dollar and the dime.

National Coin Week wraps up this weekend, celebrating coin designs. One thing that has been constant throughout the 21st century is changing coin designs. It started with the 50 State Quarters program and has affected every circulating coin except the half-dollar and the dime.

Although the design has lasted more than 25 years, it is not likely that the Treasury Department will change the design. The story of the JFK assassination continues to resonate with a significant sector of the population, and Kennedy’s popularity remains.

Franklin D. Roosevelt’s appearance on the dime is different. Roosevelt helped create the March of Dimes, and following his death, Congress decided that adding his portrait to the dime was the best way to honor the late president. Since its release in 1946, the dime’s design has not changed.

The Roosevelt Dime is the smallest coin produced by the U.S. Mint. Changes to the design may not display as well. When John Sinnock designed the coin’s reverse, the similarity with the Mercury dime was not a coincidence. Aside from the symbolism, the U.S. Mint knows the design will strike well on a small planchet.

While the ability to strike the designs continues to be a concern, modern technology could help produce a suitable design. The problem is, what would make an appropriate design?

Until someone in Congress proposes a bill to change the dime’s design, it will remain the longest-running design on U.S. coins.

And now the news…

April 17, 2022

“The Romans had been used to extremely fine silver coinage, so they may well have lost confidence in the denarius when it ceased to be pure,” Matthew Ponting, one of the archaeologists involved in the research, said in a media statement.

→ Read more at

mining.com

April 17, 2022

An approximate amount of $1 has been received. The U.S. economy is estimated to grow by $5 trillion over the next five years. Coins with physical characteristics. The 11th quarter accounts for about 80% of this value. A billion-dollar note is $100 worth 5 billion. 70 percent of new bills are written to replace older notes as they go out of circulation each year.

→ Read more at

malaysiandigest.com

April 18, 2022

Nearly 1,300 priceless 4th-century AD Roman coins, all in a pot, were found in September 2021 near Bubendorf, Basel County, Switzerland by amateur archaeologist volunteer, Daniel Ludin.

→ Read more at

ancient-origins.net

April 20, 2022

A family's new truffle-hunting puppy is already worth its weight in gold after digging up 15 sovereign coins worth £6,000 on its first walk.

→ Read more at

dailymail.co.uk

April 22, 2022

Out on his daily constitutional, a dog in Poland unexpectedly struck gold, or rather, silver.

→ Read more at

ancient-origins.net

Apr 17, 2022 | ANA, news, quarter

Welcome to National Coin Week 2022!

I am sponsoring

GOLD memberships for new and renewing memebers of the American Numismatic Association. This is a limited-time offer to celebrate

National Coin Week and the 131st anniversary of the American Numismatic Association. The offer expires on April 25, 2022. Call (800) 514-2646 or visit

info.money.org/ncw-2022-barman to take advantage of this offer. Be sure to apply code

NCW22SB at checkout!

For the next week, the theme of National Coin Week is Dynamic Designs, Artistic Masterpieces celebrating the designs on coins. I cannot think of any numismatic topic that will lead to a more heated discussion than coin designs. Whether it is about the design selected for a quarter, commemorative coin, or classic versus modern designs, coin designs can be a polarizing topic. Even the topic of colorization has caused some to have a visceral reaction.

This week, I will be celebrating coin designs. During the week, I will celebrate coin designs from my collection, and they will be designs that I find appealing and the reason why I like them.

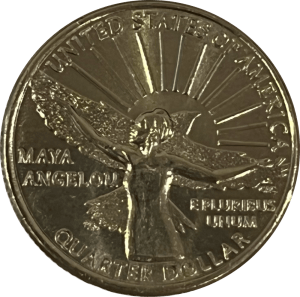

Today I start with the newest design that has piqued the interest of collectors and potential new collectors, the Maya Angelou Quarter. Angelou appears on the first issue of the American Woman Quarters program, a four-year program celebrating the contributions and accomplishments of women in United States History.

Maya Angelou’s appearance on the quarter also marks the first time an African-American woman has appeared on a U.S. coin. Her first famous book, “I Know Why the Caged Bird Sings,” inspired the design. It is the first time the general public has talked about a U.S. coin since the beginning of the 50 State Quarters program.

The obverse features a portrait of George Washington designed by Laura Gardin Fraser in 1932. When the U.S. Mint moved to change the quarter’s design to honor the bicentennial of George Washington’s birthday. A competition was held for the design. Fraser’s design was selected by the Commission of Fine Arts (CFA) as the best representation of Washington for the coin. Unfortunately, Treasury Secretary Andrew Mellon, a known misogynist, rejected Fraser’s design and selected the art of John Flannigan instead.

The 1999 George Washington $5 gold commemorative coin featured Laura Gardin Fraser’s design. The American Women on Quarters program will feature her design. To sum up the impact of the design, the following is from the 1932 letter from the CFA to Secretary Mellon:

This bust is regarded by artists who have studied it as the most authentic likeness of Washington. Such was the skill of the artist in making this life-mask that it embodies those high qualities of the man’s character which have given him a place among the great of the world…Simplicity, directness, and nobility characterize it. The design has style and elegance…The Commission believes that this design would present to the people of this country the Washington whom they revere.

And now the news…

April 11, 2022

The research, conducted by researchers at the University of Warwick and the University of Liverpool in England, revealed a debasement of the currency far greater than historians had thought.

→ Read more at

news.abplive.com

April 13, 2022

FINDING valuable coins may not be too difficult – and an expert has revealed a way to do this. Should a coin be in a high grade or have a low reported mintage, the piece could be quite valuable.

→ Read more at

the-sun.com

Apr 11, 2022 | coins, news, quarter

Over the last few weeks, I received emails from people finding quarters celebrating Maya Angelou on the reverse in their change. When I reply by explaining the Women on Quarters program, the writers are surprised that this program exists.

Over the last few weeks, I received emails from people finding quarters celebrating Maya Angelou on the reverse in their change. When I reply by explaining the Women on Quarters program, the writers are surprised that this program exists.

A woman wrote and asked if I would confirm that Sally Ride would appear for a quarter. When I confirmed that the quarter was next in the series, she wanted to know where to find the quarters so she could give them to her daughter, who wants to be a rocket scientist.

I have never seen this type of reaction to a coin program. Students are talking about the coins as they relate to history. Parents are talking about using the coins to influence their daughters.

The unsung design element that numismatists appreciate is the adaptation of Laura Gardin Frasier’s portrait of George Washington. Frasier, the wife of James Earle Frasier, created an acclaimed design that the Committee on Fine Arts picked twice in a competition of artists. Unfortunately, Treasury Secretary Andrew Mellon, a known misogynist, rejected the design and selected the art of John Flannigan instead. Laura Gardin Frasier’s design has taken its rightful place on the coin’s obverse.

A coin that makes everyone excited. That’s a winning combination!

And now the news…

April 10, 2022

The 'heads' of a contemporary coin, with a head of the god Bacchus, that was sampled as part of the project. Credit: University of Warwick

→ Read more at

phys.org

Apr 3, 2022 | news, personal

The text of this week’s post does not contain any numismatic content. The numismatic content is below the story.

The love of a dog can never be measured. When you bring one into your home and heart, the bond is instantaneous and enduring. Bring in two, and it is a house full of barking, messes, love, and affection. My wife and I raised two puppies, a brother, and a sister, from different litters.

The love of a dog can never be measured. When you bring one into your home and heart, the bond is instantaneous and enduring. Bring in two, and it is a house full of barking, messes, love, and affection. My wife and I raised two puppies, a brother, and a sister, from different litters.

When the youngest has been with you for 13 years and 7 months, it may be a long time, but it feels like yesterday. We raised Tessa from a puppy from the day we picked her up in November 2008.

We used to say that if Tessa was human, she’d be a party girl. Tessa was a fun-loving dog who was very intelligent but would rather play. She did not have a short attention span, but it was short when she was not playing.

Aside from annoying her (late) brother, Boomer, Tessa’s favorite pastime was eviscerating toys. Any stuffed toy would not last more than a few moments, and she would attack, and the stuffing would be all over the house. If the toy had a squeaker, Tessa would chew it until it stopped squeaking.

Tessa slowed down a lot over the last two years, and age was catching up with her. Amongst her ailments, Tessa had arthritis in her hips. We bought a doggie stroller to bring her around the neighborhood. Since I had some time off on Monday, Tessa and I went for a long walk. The image on this post is from that walk. It was the last time we had quality time together.

On Saturday, Tessa went into respiratory failure, and we rushed her to the veterinary hospital. For a while, it seemed that she was stable and could get better, but she took a turn for the worse. We had no choice but to help her end this journey and lead her on to her next journey across the Rainbow Bridge.

I hope Tessa finds her brother Boomer, and they are running around like they did so many years ago. Sweet dreams, my baby-baby sweetheart. You will be missed.

And now the news…

March 29, 2022

Who wants dead presidents and royalty on their money when Star Wars and Lord of the Rings are an option?

→ Read more at

gizmodo.com

April 1, 2022

There’s a new reason to break open your piggy bank. Pocket change is in short supply – again. While some will call it the great coin shortage of 2022, America is facing a coin circulation problem.

→ Read more at

usatoday.com

April 1, 2022

TAMPA, Fla. (WFLA) — Amid war in Ukraine and market chaos, nickels are now worth more in melted metal than their face value. But before you empty the piggy bank and fire up a smelter in the yard, there are a few things you should know.

→ Read more at

nbc4i.com

April 2, 2022

EVERYONE likely has a circulated coin somewhere around them – and it might shock you to learn that it could be valuable. A circulated coin could mean a few things, but generally, it is a type of condition that collectors refer to.

→ Read more at

the-sun.com

April 2, 2022

This rare silver coin shows a portrait of Charlemagne that was made during his lifetime.

→ Read more at

livescience.com

Mar 27, 2022 | awards, exonumia, medals, news

Medals, awards, casino chips, and a Challenge Coin

Medals come in many forms, from those that can be pinned to clothing to something equivalent to a token. They can be shaped, round, or a multilayered object presented to winners, participants, or for significant achievements.

Some people collect medals but may not consider themselves numismatists. Michael Phelps may not consider himself a numismatist but has one heckuva collection of Olympic medals, and Katie Ladecky is building quite a collection.

Challenge coins are a type of award. In its original intent, challenge coins are passed to someone deemed worthy of being honored by the issuer. Collectors take pride in collecting challenge coins like Brian Williams. During a segment of Nightly News, Williams showed off his collection. Over the last 10-15 years, challenge coins expanded beyond military service and civilian agencies. City agencies, law enforcement, and many others now issue challenge coins. It has opened the market to new collectors. Challenge coin collectors do not consider themselves numismatists, but they are as dedicated to collecting challenge coins as a Morgan dollar collector searching for VAMs.

As time progresses, there are new opportunities to collect awards and medals. Collections of medals and awards are now selling in estate sales and auctions. Families do not know what their loved ones collected and are selling below value. It is a tremendous opportunity to join this area of the market.

Awards and medals create an opportunity to expand collections and welcome more collectors to the community.

And now the news…

March 18, 2022

Princeton University Library’s (PUL) Numismatic Collection nearly tripled its Byzantine coin collection when it acquired 11,256 Byzantine coins from the estate of Dr. Chris B. Theodotou on March 8, 2022.

→ Read more at

infodocket.com

March 21, 2022

The United States' first woman to fly into space has lifted off a new mission, this time to orbit the nation in the form of a new circulating coin.

→ Read more at

collectspace.com

March 21, 2022

“Working with our partners Excir, we have introduced world-first technology to the UK capable of recovering precious metals from electronic waste in seconds." The Royal Mint is to have a go at a 21st-century approach to alchemy, turning electronic waste into gold.

→ Read more at

proactiveinvestors.co.uk

March 23, 2022

Fans in Samoa can start their own Justice League Silver Coin collection with 12 officially-licenced DC Comics coins celebrating their most legendary heroes & villains.

→ Read more at

supermanhomepage.com

March 23, 2022

The 2,000-year-old gold piece, perhaps worn by one of the murderers, could sell for $2 million

→ Read more at

smithsonianmag.com

March 26, 2022

The rising price of metals including nickel and copper has led to a unique valuation of the metal contained inside common U.S. coins. What Happened: The price of nickel has soared in 2022.

→ Read more at

benzinga.com

→ Read more at news.artnet.com

→ Read more at news.artnet.com

→ Read more at penarthtimes.co.uk

→ Read more at penarthtimes.co.uk

It has been an interesting week. I tried to keep up with the news and the collecting world, but a health issue sidelined me. Unfortunately, I was diagnosed with COVID. I am feeling better, but it does affect my breathing. I am glad I am fully vaccinated.

It has been an interesting week. I tried to keep up with the news and the collecting world, but a health issue sidelined me. Unfortunately, I was diagnosed with COVID. I am feeling better, but it does affect my breathing. I am glad I am fully vaccinated.