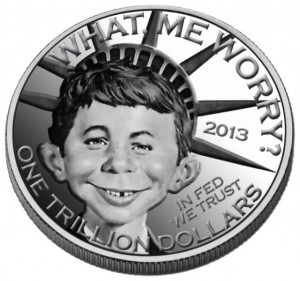

The $1 Trillion Coin Will NEVER Be Struck

(Image courtesy of Heritage Auctions)

Also turning up are all pundits, politicos, reporters, and sycophants explaining why the U.S. Mint should or should not strike the coin. The problem is that EVERYONE IS WRONG!

Let’s look at the FACTS.

FACT: Before a coin leaves the U.S. Mint, the purchaser must pay for the coin.

The Federal Reserve purchases business strike coins at face value. The money is deposited in the U.S. Mint’s Public Enterprise Fund.

Collectors pay for collector coins through the U.S. Mint’s retail and e-commerce operations. When the money is collected, they deposit the funds in the U.S. Mint’s Public Enterprise Fund.

FACT: The United States Mint has successfully argued in court that a coin is not legal tender until it is paid for.

After the U.S. Mint discovered the existence of several 1933 Double Eagle coins that were supposedly melted, the Secret Service investigated and seized several coins. Through the 1950s, government lawyers argued that the coins were government property since the coin was never monetized.

During the case of the Farouk-Fenton double eagle coin, the government used the same argument. Even though there was an export license for the coin issued to King Farouk of Egypt, the government maintained that the lack of monetization made the coin illegal.

As part of the $7,590,020 paid for the 1933 Double Eagle in 2002, $20 of the purchase price was paid to the U.S. Government to monetize the coin. When Sotheby’s sold the coin in June for $18,872,250, the coin came with a certificate from the U.S. Mint declaring its Legal Tender status.

If the U.S. Mint does not monetize a coin until someone or entity buys it, then how will striking a $1 trillion coin help anything?

Even as crazy as government generally accepted accounting principles (GAAP) may appear to the commercial market, Government GAAP still requires double-entry bookkeeping. In double-entry bookkeeping, if an asset is added to one part of the ledger, there must be a debit on another.

Forget the political arguments about the debt. When the government needs money, it sells bonds to finance its obligation. The bond is the created asset, as the coin. The asset is purchased, adding cash to the general treasury. In bookkeeping terms, an asset entry and an associated debit entry.

Who is going to buy the coin?

The Federal Reserve is not going to buy the coin. Bonds, warrants, and other investments have tangible returns. The investments have value and can be traded on the equity markets keeping the books balanced. What happens if $1 trillion is tied up in a non-investing asset?

If the Federal Reserve buys the coin, the general treasury may see a $1 trillion windfall, but the Federal Reserve will have $1 trillion less economic power. It is $1 trillion less in short-term loans to large financial institutions and quantitative easing that is keeping the economy in control.

If the Federal Reserve buys the $1 trillion coin, it will create a $1 trillion hole in the economy.

The U.S. Gross Domestic Product (GDP), the monetary value of all goods and services, is estimated at $22.675 trillion. Taking $1 trillion out of the economy will reduce the economy by 4.4-percent.

As the Great Recession of 2008 raged, the GDP lost 1-percent of its value by 2009. If a one percent drop caused the most significant economic calamity since the Great Depression, what will happen if the GDP contracts by more than 4-percent?

Of course, Congress can pass a law that changes how the U.S. Mint determines the legal tender status of coinage they manufacture. But the likelihood of that happening is about the same as the U.S. Mint striking a $1 trillion coin.

An interesting Peace

While browsing on eBay, I noticed a few auctions of what I thought were philatelic (stamp collecting) cachets with Morgan and Peace dollars honoring different aspects of history. Not knowing much about them, I placed some bids based on the estimated values of the coins.

The difference between a First Day Cover (FDC) and a cachet is that the FDC is stamped on the first day of issue usually with a special commemorative postmark. A cache is a souvenir cover that is not postmarked as the first day of issue.

Another interesting collectible that combines philately and numismatics is called a Philatelic Numismatic Cover (PNC) or sometimes just coin cover. The U.S. Mint has produced coin covers for the 50 State Quarters, Westward Journey, and Presidential Dollars series as well as the first Sacagawea dollar. These are fun collectibles and something I will talk about in the future.

When the auctions were over, I won one with the 1926-S Peace dollar. Although the description seemed in order, I did not know what to expect. When it arrived I think it is more interesting than advertised.

First, the item is not an envelope by a heavy stock card that is 9-inches long by 4.875-inches wide. It is to honor the anniversary of the United States agreeing to join the World Court on January 27, 1926. The card includes a 5-cents stamp commemorating International Cooperation Year that was issued on June 26, 1965, and a 33-stamp that was in use when this was created in 2001. It is postmarked on January 27, 2001 in Washington, D.C., the 75th anniversary of the event.

The Peace dollar is definitely circulated and would probably grade in the Very Fine range if sent to a third-party grading service. It is encased in plastic which is sandwiched between two panels of cardboard to make up the card. The back of the card has a longer narrative of the history.

Originally, I was only interested in it for the coin since I am a fan of the Peace dollar. But seeing the card makes me wish I would have bid higher for more of them. The other problem is that I do not know who made them. This card looks similar to ones described as being from the Postal Commemorative Society. However, I have seen several different descriptions to make me unsure.

If anyone can provide more information, please post it as a comment below. I would like to learn more!

Weekly World Numismatic News for Mother’s Day

Chocolate coins in honor of the 150th anniversary of the historic Coin Press No. 1 are on sale at the Nevada State Museum’s store. (Courtesy of Jeanette McGregor via the Nevada Appeal)

Chocolate is one of the most complicated flavors, evident by the inability to produce artificial versions.

Scientists have discovered that The smell of chocolate increases theta brain waves, which triggers relaxation. And dark chocolate has been found to have health values including containing antioxidants, widens the arteries to increase the flow of blood and prevent the buildup of plaque, has anti-inflammatory powers, and when eaten daily can reduce the risk of heart disease by one-third.

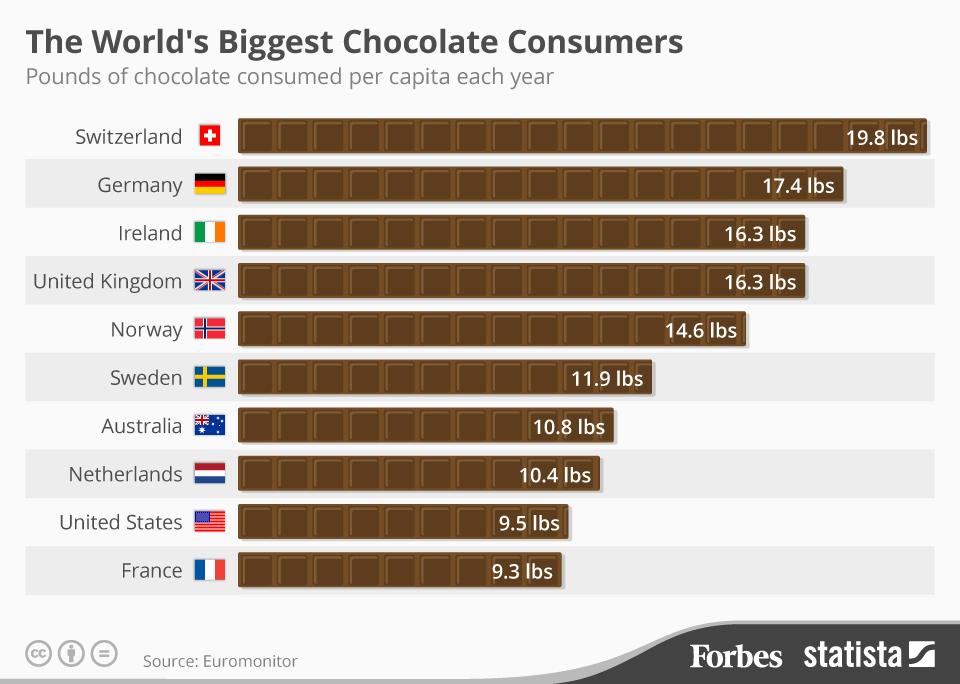

Every second, Americans collectively eat one hundred pounds of chocolate. But Americans are only ninth when considering the per capita pounds of chocolate consumed by country. The top honor goes to the Swiss people who consume an average of 19.8 pounds of chocolate each. Americans only consume an average of 9.5 pounds.

(Courtesy of Forbes)

Why this obsession with chocolate on the Coin Collectors Blog?

Aside from being Mother’s Day, the Friends of the Nevada State Museum has created a chocolate coin in tribute to the 150th anniversary of Coin Press No. 1. The Museum, located in Carson City in the old CC Mint building, continues to use Coin Press No. 1 to strike medals for visitors as part of demonstrations.

On your next visit to Carson City or the area, stop by the Museum, strike your own silver medal, and buy one of their commemorative chocolate coins. I have heard they were described as “wicked good!”

And now the news…

Rare collectible coins can be worth far more than their face value – and the rarest 50p design regularly sells for 160 times what it’s worth. But which coins should you look out for in your change? Which?  → Read more at which.co.uk

→ Read more at which.co.uk

Recycling flows defy price rise because jewelry holdings 'already depleted'… GOLD COIN and small-bar investors in the West have begun selling metal while household sales of 'scrap' jewelry have fallen to 10-year lows according to new data.  → Read more at bullionvault.com

→ Read more at bullionvault.com

Philip Foreman, 51, started his collection a year ago  → Read more at kentlive.news

→ Read more at kentlive.news

While Joel Kimmel may not be attending the wedding of Prince Harry and Meghan Markle on May 19, the Ottawa-born illustrator’s connection to the soon-to-be royal couple will be forever etched …  → Read more at ottawacitizen.com

→ Read more at ottawacitizen.com

" /> <meta property=  → Read more at globenewswire.com

→ Read more at globenewswire.com

The Friends of the Nevada State Museum, in tribute to the upcoming 150th anniversary of the Museum’s historic Coin Press No. 1, have “minted” chocolate coins for sale at  → Read more at nevadaappeal.com

→ Read more at nevadaappeal.com

Archaeologists digging in an historic part of central Moscow have found all sorts of objects in recent months, but perhaps nothing as interesting as the oldest example of a pickpocket's coin to come to light in the city.  → Read more at bbc.com

→ Read more at bbc.com

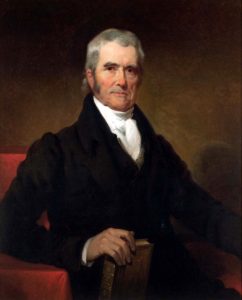

I’ll take On Big Money for $200

A few weeks ago while watching Jeopardy!, I noticed they had a category “On Big Money.” The premise was to name the person whose portrait is on high denomination currency—notes with a face value of $500 and greater.

I wrote down the questions and decided to create my own version of Jeopardy! How many can you answer, or ask correctly? Remember, in Jeopardy! you have to answer in the form of a question.

It’s Saturday… let’s have a little fun!

Click on the image to see the question.

How well did you do?

For those unsure of the questions that coincide with the answers, click on the value of the question in the tab to see the explanation.

The $200 Answer

William Marbury

The $400 Answer

Chief Justice John Marshall

The $600 Answer

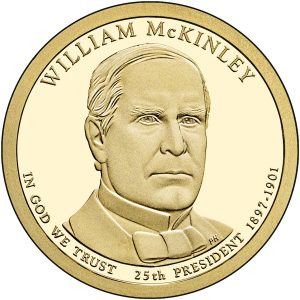

2013 William McKinley Dollar

Later that day, Theodore Roosevelt was sworn in as the 26th President at the Ansley Wilcox House in Buffalo. This made Roosevelt the youngest person (42 years, 322 days) to be inaugurated as President.

The $800 Answer

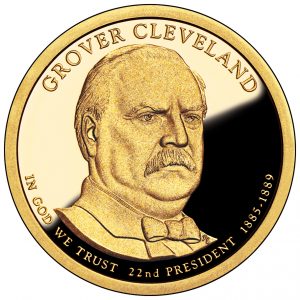

2012 Grover Cleveland First Term Dollar

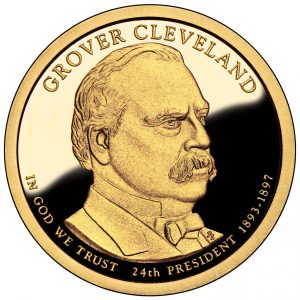

2012 Grover Cleveland Second Term Dollar

The $1000 Answer

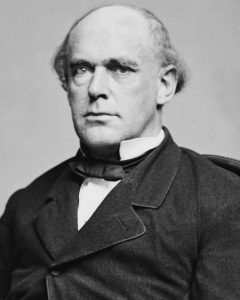

Salmon P. Chase, 6th Chief Justice of the Supreme Court

What do you think? Is this something you would like to see more of? Let me know!

- Coin images courtesy of the U.S. Mint.

- All other images courtesy of Wikimedia Commons.

Small Cash and a Pill

Sometimes it can be fun to search through junk boxes or bags of foreign coins. While you can see a lot of the same coins accumulate in these bags there are others that look interesting.

During our local coin club meeting, members bring in coins to sell to other members. One member, a very prolific collector, had a large plastic bag of circulated foreign coins. I was first drawn to the back by some of the shapes I found. I grabbed a handful and one coin fell on the table that really caught my eye.

It was a small coin. A very small coin. Nobody had a caliper but it was really small. Even though I was looking at the different shapes, I found this very small round coins intriguing. What was it?

Although I should become better at recognizing languages that are not based on the Latin alphabet, I asked my fellow club member if they could help identify the coin. He said that he could not identify the coin but recognized the lettering as being from India.

With that knowledge, I did not have to search the entire Standard Catalog of World Coins to figure it out. Start at the beginning of the Indian coins and see what we could find.

After a few minutes of looking, I found the listing. Then I found a second one that was very similar. Which coin did I have and where did it come from?

The coin is from the Princely State of Travancore. It was located in the southwest of the Indian subcontinent. Travancore became its own state in 1729 when it passed under Muslim control. Its economy was driven by making an alliance with the East India Company to freely use its ports for trade. Because of this arrangement, Travancore was never a part of the British Empire and continued to remain independent until 1949 when India was united as one country.

Only two rulers issued coins in the State. Rama Varma VI lead from 1885 through 1924 and Bala Rama Varma II ruled from 1924 through the end of the kingdom in 1949. Coins were issued by the kingdom to make up for lost revenues when the British became distracted by other world events.

Regardless of which version of the coin, it is a “ONE CASH” coin made of copper. The obverse is a sankha (conch shell) in an 8-pointed star with the reverse reading “Onu Kasu’ (one cash).

One version, under the rule of Rama Varma VI, was .65 grams of copper (KM #40) and the other, under the rule of Bala Rama Varma II, is .48 grams of copper (KM #57). Since my scale is not that sensitive, I had to find another way to diagnose this coin.

According to the SCWC, KM #57 was struck on a thin planchet that measures .8 mm. After making sure that my digital caliper can measure 1 mm, using a piece of metal that is 1 mm thick, I would be reasonably certain I could determine which coin I have.

Measuring both coins, the caliper read 1.02 mm giving evidence that this is the early version of the coin (KM #40)

Given the difference of only .22 mm, the only way to tell the difference would be either to weight the coins or use a caliper.

Since I had the caliper out, I measured the diameter and found it to be 10.72 mm.

For fun, I had to determine whether it was smaller than the 1904 Panama 2½ Centesimos coin, better known as the Panama Pill. Previously, I wrote that the Panama Pill was 10 mm in diameter. After finding the coin and measuring it, it was 10.12 mm in diameter making it than a little more than a ½ of a millimeter smaller than the Travancore One Cash coin.

Travancore One Cash coin from the early 20th century versus the 1904 2½ Centesimos coin, better known as the Panama Pill.

On a quick look, it appears that the most common “small” coin size is 15 mm. Some are slightly larger but not many smaller. The only other coin I found is a British 1½ pence coin that was struck for Ceylon, British Guiana, British West Indies and Mauritius that is 12 mm in diameter, I cannot find any smaller.

Surrounding the United States Dime is a 1904 Panama 2½ Centesimos coin (Panama Pill) and a 1901-1910 Travancore One Cash coin.

If anyone knows of smaller coins, please let me know.

Weekly World Numismatic News for May 6, 2018

As taxpayers, we like to see some efficiency in our government even though the government is not designed for efficiency. We expect government organizations that have an income to maximize their profits when they can. This is one of the reasons why people have complained to near apoplectic proportions about how the U.S. Mint loses money on every one-cent coin it produces.

As taxpayers, we like to see some efficiency in our government even though the government is not designed for efficiency. We expect government organizations that have an income to maximize their profits when they can. This is one of the reasons why people have complained to near apoplectic proportions about how the U.S. Mint loses money on every one-cent coin it produces.

Last week, the Royal Canadian Mint issued its financial reports for 2017. The headline of the report said that the Royal Canadian Mint paid $93.2 million ($72.553 million USD) in dividends to the government of Canada in 2017. To compare this with the U.S. Mint, whose fiscal years end on September 30th, paid a total of $265 million back to the government.

Numismatic sales are an important part of the Royal Canadian Mint’s sales. This is evident by visiting their website to see the number of programs they have for sale. With all of the options, the Royal Canadian Mint revenue for those numismatic items was $25.7 million ($20 million USD). Even with the complaints about how horrible the U.S. Mint is and its programs are not priced according to someone’s perception of the market, they sold $1.755 billion in numismatics. This number includes about $2.4 million in numismatic sales of circulating coins, such as bags and rolls.

Finally, even though bullion sales have decreased as the economy strengthened and both mints saw a reduction in sales. The Royal Canadian Mint had a net revenue of $1.35 billion ($1.05 billion USD), representing a 40.7-percent decrease in sales from 2016. The U.S. Mint had revenues of $1.378 million representing a decrease of 33.8-percent from 2016.

There may be some who like to complain about the U.S. Mint, this government bureau continues to be the world’s largest manufacturer of circulating and collectible coinage. Although bullion sales have decreased and the Royal Canadian Mint has performed well in the bullion markets in recent years, when it comes to whom the market turns to, the U.S. Mint continues to outperform other world mints.

And now the news…

A new 50 cent coin featuring a red poppy will be issued by the Reserve Bank in October to commemorate Armistice Day. Reserve Bank governor Adrian Orr said the coin would have significance for those whose relatives served in the First World War.  → Read more at stuff.co.nz

→ Read more at stuff.co.nz

The CBM has been selling gold coins in weights of one tical, half-tical and quarter-tical since 1991. One tical is equivalent to around 16 grams. Currently, one-tical coins bear a single star, while the half and quarter-tical coins have a ploughing farmer and logging elephant engraved, respectively.  → Read more at mmtimes.com

→ Read more at mmtimes.com

Cebu City — The Bangko Sentral ng Pilipinas (BSP) will launch the New Generation Currency (NGC) series during its anniversary in July. Leonides Sumbi, regional director of BSP in Central Visayas, said the release of the new coins is not meant to create confusion as BSP will soon demonetize the old coins.  → Read more at news.mb.com.ph

→ Read more at news.mb.com.ph

Ian Vogler/Mirrorpix/Newscom With less than three weeks before the royal wedding, Britain’s Royal Mint today released a special commemorative coin to mark the occasion. A new British five-pound coin (about $6.88) celebrates Prince Harry and Meghan Markle’s upcoming wedding May 19.  → Read more at abcnews.go.com

→ Read more at abcnews.go.com

LISBON, May 2 (Xinhua) — The Bank of Portugal bought 272 million 1 and 2 cent coins from the Bank of Ireland in 2017, the Publico newspaper reported on Wednesday. Specifically, the Bank of Portugal purchased 148.8 million 2 cent coins and 123.2 million 1 cent coins.  → Read more at xinhuanet.com

→ Read more at xinhuanet.com

Getty Images Overall global gold demand fell to its lowest first-quarter level since 2008, driven by a slump in demand for gold bars and exchange-traded funds backed by the precious metal, according to a report from the World Gold Council released Thursday.  → Read more at marketwatch.com

→ Read more at marketwatch.com

OTTAWA, May 3, 2018 /CNW/ – The Royal Canadian Mint (the "Mint" or the "Company") is pleased to release its 2017 financial results, which provide insight into our activities, the markets influencing our businesses and our expectations for the year ahead.  → Read more at markets.businessinsider.com

→ Read more at markets.businessinsider.com

While credit cards were once reserved for large purchases across Australia, more people than ever are using plastic for items as cheap as a morning coffee.  → Read more at dailymail.co.uk

→ Read more at dailymail.co.uk

A late revolt bronze coin discovered where rebels sought refuge in a cave near Modiin indicates geographically widespread Jewish backing of the ultimately bloody Jerusalem uprising  → Read more at timesofisrael.com

→ Read more at timesofisrael.com