Stop me if you’ve heard this before…

Some like gold. Others like copper. I like silver.

Since 1986, I have been collecting American Silver Eagle Proof coins. It is a collection my later father started for me and, until 2019, purchased the individual proof coins. I supplemented the collection with the special sets that the U.S. Mint issued, but it is a nearly complete set of proof coins in their original government package.

Although I have to find the 1995-W anniversary set for the elusive 1995-W American Silver Eagle, I have been trying to keep the collection up to date. It is why I hung up on a business call to make sure I was logged in to the U.S. Mint website to purchase the Reverse Proof Two-Coin Set.

By 11:58 AM, I was on the page for the set. As the time counted down to noon, I refreshed the page waiting for the Add-to-Bag button.

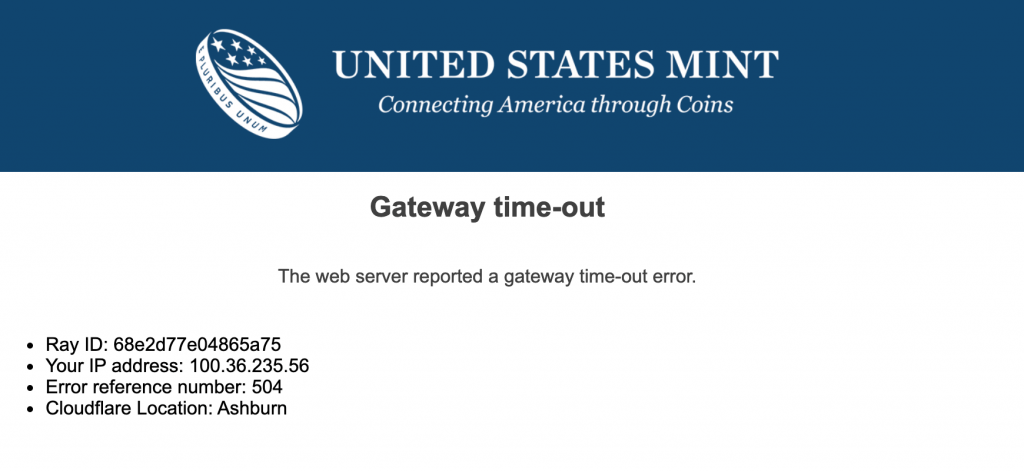

I am probably not the only one pushing the refresh button two minutes until noon. Until the Add-to-Bag button appeared, the system was responsive. Of course, the page was likely cached by Cloudflare or my ISP (Comcast), but it was responsive. At the stroke of noon, all that ended.

The first thing we notice is that someone rebranded the Cloudflare gateway error page. Although I do not have inside information, I would bet that Cloudflare told the U.S. Mint to make it so that they don’t get blamed.

I wonder if Cloudflare demanded the U.S. Mint rebrand their gateway error page so that they don’t get the blame?

Another change is the HTML file that appeared as a text file. Under Safari, the file type kept downloading the information to my Downloads folder. Under Firefox, one of the systems in the chain treated me to a small HTML file.

Somehow, a set made it into my bag, and I made it to the checkout page. I couldn’t use my stored credit card because I would see the Bad Gateway error. The card was next to me, and I furiously typed.

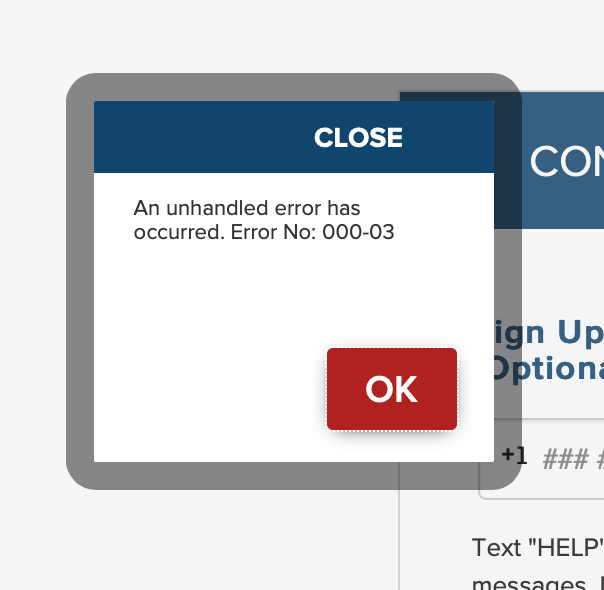

Suddenly, there was a new error. I don’t know what it means, but the U.S. Mint’s programmers did not know how to handle that error. How do I know that? The error message provided said so.

This is a new error. In my days as a programmer, we would be chastised for this type of error message!

According to several reports, the website crashed at the beginning of the process. It was difficult to tell, but the U.S. Mint admitted there were problems. They announced that there were products available at 1:19 PM on social media.

We are starting to see more orders successfully come in via our website. If you had issues ordering 21XJ we encourage you to try your purchase again. https://t.co/LPQedjAoDl

— United States Mint (@usmint) September 13, 2021

After stubborn persistance, I received the confirmation of my order at 12:48 PM.

I asked the U.S. Mint for comment. I will let you know what they say.

My new Rosy Medal

In 1980, it was a big deal to pack the Redcoat Marching Band into seven busses and travel to New Orleans for the sUGAr Bowl. We thought it was great to spend New Year’s Eve on Bourbon Street and then play in the Superdome, what we called the World’s Largest Mushroom.

I can only imagine what the current Redcoats felt like when they climbed aboard a chartered 757 out of Atlanta to fly cross-country to attend the Rose Bowl. In 1980 there were 300 total members including auxiliaries and support staff. Today, there are almost 300 musicians in the band.

The last bowl game I went to as a member of the Redcoat Marching Band was the January 1, 1983 sUGAr Bowl where we lost to Penn State. I was not happy then but time moves on. Now that we are 35 years later, age has caught up with me and my distance from Athens means I watch the games from the comfort of my living room. The last game I attended was Homecoming in 2012. I have to try to get down there for Homecoming this year!But that Rose Bowl game was something else. No matter who I talk with about the game, it was the most exciting game they have seen, especially for a Rose Bowl. It was the first time a Rose Bowl went to overtime. Needless to say, I was happy with the outcome!

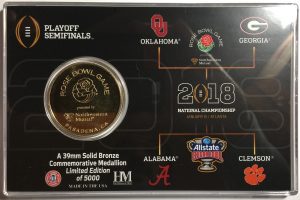

Previously, I mentioned I was interested in obtaining a copy of the coin used in the coin toss. In the video, it appeared to be silver in a plastic capsule with the school logos on either side. When I received an answer from someone associated with the Rose Bowl committee, I was told that it was indeed a silver coin, specially struck for the game. Only a limited number are struck and given to VIPs. The game-used coin is saved as part of a Rose Bowl museum. There are no extras struck and none are for sale.

I decided to find an alternative.

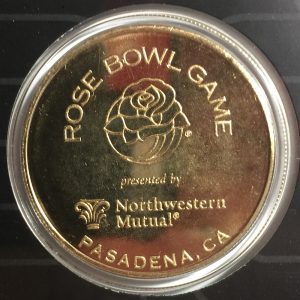

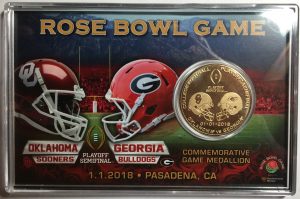

The Highland Mint, in cooperation with the College Football Playoff, struck souvenir medals for each of the games. Medals were struck in brass and placed in a plastic holder with the matchup. They also offer a silver-plated brass medal in a capsule and a velvet-covered case.

A medal in a case is pedestrian. It can be mistaken for just about any collectible, even those from the U.S. Mint. I would rather have the commemorative plastic holder with the information about the game. It makes more of a statement and can be displayed on my desk.

- Front of the 2018 Rose Bowl Medal display case

- Back of the 2018 Rose Bowl Medal display case

As I work to open my new business, I am planning on having this medal in my new office. It will remind everyone that if there is an early kickoff next fall, we will close on-time at noon so that I can rush home to my television and watch the game. Hopefully next year I will buy one that says National Champions!

Ryder nomination on hold

Sen. Chuck Grassley (R-IA)

According to the notice filed in the Congressional Record:

consent request at the present time relating to the nomination of David J. Ryder, of New Jersey, to be Director of the Mint, PN1355 .

I will object because the Department of the Treasury has failed to respond to a letter I sent on September 29, 2017, to a bureau within the Department seeking documents relevant to an ongoing investigation by the Senate Committee on the Judiciary. Despite several phone calls between committee staff and Treasury personnel to prioritize particular requests within that letter, the Treasury Department has to date failed to provide any documents.

My objection is not intended to question the credentials of Mr. Ryder in any way. However, the Department must recognize that it has an ongoing obligation to respond to congressional inquiries in a timely and reasonable manner.

Charles E. Grassley is a seven-term Republican Senator from Iowa. Grassley has a history of abusing† the Department of the Treasury to make it look like he’s doing something to keep his seat in the Senate. It is common for Grassley to have something to complain about without substance regardless of the ramifications of his actions.

In the meantime, the U.S. Mint remains without a permanent director while Grassley has his hissy fit.

PN1355: David J. Ryder — Department of the Treasury

Weekly World Numismatic News for January 21, 2018

One of the more interesting news items is that the Royal Canadian Mint is suing the Royal Australian Mint.

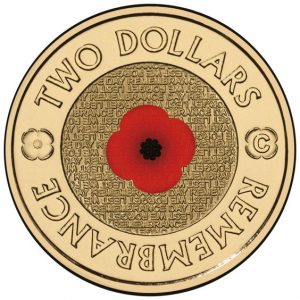

The Royal Canadian Mint alleges the Royal Australian Mint infringed on its patents when creating the 2012 Remembrance Day $2 coin.

Reports state that the two sides have tried to discuss the matter over the last two years. When no agreement had been reached, the Royal Canadian Mint decided to sue for relief. The Royal Canadian Mint is demanding that Australia hand over all 500,000 of the Remembrance Day coins struck or “destroyed under supervision.”

Since the Royal Canadian Mint is a crown corporation, it is an independent entity of the Canadian government. It has its own corporate and governance structure mandated by law. For those in the United States, it is similar to the relationship that Fannie Mae and Freddy Mac have with the United States government. On the other hand, the Royal Australian Mint is an agency in the Australian government in the same manner that the U.S. Mint is an agency in the United States government. Therefore, the Royal Canadian Mint is suing the Commonwealth of Australia.

“The applicant has suffered, and will continue to suffer, loss and damage by reason of the acts of the respondent pleaded above,” the statement of claim filed by the Royal Canadian Mint reads. Really? The Royal Canadian Mint has suffered because the Royal Australian Mint created a coin with a colored poppy for sale and distribution in Australia?

If the Royal Australian Mint infringed on the Royal Canadian Mint patent then there may be a case for relief owed for using the technology. But if the Royal Canadian Mint is trying to make a case based on the suffering of damages from sales of circulating versus commemorative coins, I think that the Royal Canadian Mint may be royally going in the wrong direction.

And now the news…

“At a time when our national debt is over $20 trillion, it is more and more difficult to find money for important things like cancer research,” – Congresswoman Carolyn Maloney.  → Read more at womensenews.org

→ Read more at womensenews.org

Online dealer sold 30kg of gold Tuesday, worth more than $1m Bitcoin tumbles below $10,000 for first time since December Amid the wild Bitcoin ride that’s wiped more than 40 percent off the cryptocurrency’s price in a month, a pattern may be emerging: sellers are switching out of digital gold and into the real thing.  → Read more at bloomberg.com

→ Read more at bloomberg.com

Gold’s liquidity and stability have made it an attractive option for investors in recent years. There are many ways to invest in gold. Investopedia lists gold futures, investing in old companies, gold EFTs, gold mutual funds, gold bullion, gold jewelry, and, of course, gold coins.  → Read more at newsmax.com

→ Read more at newsmax.com

After more than a year, visitors to the Nevada State Museum can watch the museum's historic Coin Press No. 1 carry on a mission it started nearly 150 year ago in the same building. The venerable press — which churned out millions of dollars in silver and gold coins during stints at U.S.  → Read more at nevadaappeal.com

→ Read more at nevadaappeal.com

OTTAWA — The Royal Canadian Mint is suing its Australian counterpart over the way it prints red poppies on its commemorative Remembrance Day coins. Documents filed in Australia’s Federal Court in December allege The Royal Australian Mint used without permission a printing method patented by the Canadian mint — which is now demanding that Australia’s 500,000 commemorative $2 coins, in circulation since 2012, either be turned over to them or “destroy(ed) under supervision.”  → Read more at nationalpost.com

→ Read more at nationalpost.com

Money manufacturing continues during a shutdown

The last time the government shutdown, because Congress did not do their job, was on September 30, 2013. Over the weekend, the major impact will be the recreational-based activities including the National Parks and the Smithsonian Museums—although many of these agencies will remain mostly open using what is called “carry-over funding” which are services whose bills are paid but the agencies are owed the services. It is an accounting trick that can help some agencies up to 72-hours during a shutdown depending on the amount of money and to whom it is paid.

The last time the government shutdown, because Congress did not do their job, was on September 30, 2013. Over the weekend, the major impact will be the recreational-based activities including the National Parks and the Smithsonian Museums—although many of these agencies will remain mostly open using what is called “carry-over funding” which are services whose bills are paid but the agencies are owed the services. It is an accounting trick that can help some agencies up to 72-hours during a shutdown depending on the amount of money and to whom it is paid.

Thankfully, the Washington, D.C. government will pick up the trash and provide basic cleanup services on the National Mall and other areas that would normally be taken care of by the National Parks Service.

Should the shutdown last through Monday, both the U.S. Mint and Bureau of Engraving and Printing will be operational. Both organizations are funded from their profits (seigniorage) which is held in their respective Public Enterprise Funds. The only responsibility that Congress has in their funding is to authorize the spending of the money. That authorization is not impacted by the shutdown because these are not (technically) taxpayer funds.

Since the U.S. Mint and Bureau of Engraving and Printing are self-funded, they are also not subject to the debt ceiling issues.

Although the U.S. Mint and Bureau of Engraving and Printing has not made a formal announcement, it is likely that facility tours will be suspended during the shutdown. This is because the security personnel are Treasury employees and not direct employees of the bureaus. Some will be designated as “essential personnel” and continue to work to help maintain security at all U.S. Mint and Bureau of Engraving and Printing facilities.

Security for the Bullion Depository at Fort Knox, Kentucky will not be impacted by the shutdown.

Since the Federal Reserve is an independent organization and not subject to congressional appropriations, they will remain open during a shutdown. The Office of the Comptroller of the Currency (OCC) will probably also remain open. OCC is funded by the Federal Reserve to help regulate banks.

All independent government organizations not subject to congressional appropriations will continue to operate including the United States Postal Service.

Representatives of these agencies may contact me to provide additional information. Government employees who work for these agencies that want to provide additional information may also contact me. Please note that I do respect the confidentiality of all sources!

U.S. Mint to resume Mutilated Coin Redemption Program

The recycling industry has complained to the Department of the Treasury and their members of Congress over the U.S. Mint’s inaction with providing new rules to restart the program. After publishing two draft rules and making adjustments based on the comments, the Final Rule was published in the Federal Register (82 FR 60309) on December 11, 2017.

The Final Rule that makes adjustments to the regulations for “Exchange of Paper Currency and Coin” (31 CFR Part 100 Subpart C) in order to add additional clarity and oversight to the process. This includes depositing worn or heavily scratch coins in a bank or other authorized depository. Bulk submission over one pound must be separated by denomination and must be identifiable. Each denomination is considered one submission and must be over one pound (e.g., one pound of nickels and one pound of dimes and one pound of quarters, etc.). Dollar coins also have to be separated by type (e.g., Eisenhower, Sacagawea, Presidential, etc.). The updated program restricts the redemption of fused, unsorted, and unidentifiable coins. Coins made of gold and silver are not accepted as part of this program.

Those needing more detailed information should consult the “Mutilated Coin Redemption Program” webpage on the U.S. Mint website (see http://bit.ly/Mutilated-Coin).