How to Create A Price Guide

What does it take to create, publish, and maintain a price guide for coins?

Readers who downloaded my first edition of the Coin Collectors Handbook: American Eagle Coins have asked about the lack of a price guide. I hesitated to add a price guide for American Eagle coins because, with very few exceptions, the spot price of metals affects the prices. Market watchers know that spot prices are volatile. Are there differences in prices that might make working on a price guide a good time investment?

Readers who downloaded my first edition of the Coin Collectors Handbook: American Eagle Coins have asked about the lack of a price guide. I hesitated to add a price guide for American Eagle coins because, with very few exceptions, the spot price of metals affects the prices. Market watchers know that spot prices are volatile. Are there differences in prices that might make working on a price guide a good time investment?

To better understand pricing and price guides, I asked several dealers what they use for pricing guidance. Most of them said the Greysheet and what the coins were selling on eBay. A few larger dealers will start their eBay auctions at $1 and sell the coins regardless of the final bid. High-volume dealers say they are rarely disappointed with the results.

Smaller dealers will subscribe to a service that will automatically adjust the prices based on the spot price and the results of the eBay inventory. Depending on the service level these dealers have with the service, the price for coins can change every day.

The pricing service can query eBay for list prices, and the prices realized to come up with their formula.

In the past, I tried to ask the people who write the Greysheet how they come up with prices. The harsh rejection at that time prevented me from asking again. It was time to look at other guides to determine how they create their prices.

Information from PCGS’s website is clear that their price guides are for coins only in their holders. In the past, PCGS noted their price guides use the prices on the Certified Coin Exchange market, which Collector’s Universe, PCGS’s parent company, owns.

Similarly, NGC notes on its website that they base their prices on the market of NGC-graded coins only. Neither service considered the market perception of CAC-certified coins. Although the Greysheet has a publication that publishes guidance for CAC-certified coins, that information is available only to subscribers.

One of the price guides not affiliated with a grading service is Numismedia. They are similar to Greysheet in that they offer a range of publications that span the market. Although their website does not disclose how they determine prices, their Fair Market Value guide has been more comprehensive and closer to retail market values than I have experienced with the Greysheet’s retail guides.

Other price guides found around the web have different concerns. A few are crowd-sourced, meaning that collectors provide input based on what they paid. Although crowd-sourced prices report real-world transactions, the information is limited to what users report and not a market survey.

Then there is the Red Book, A Guild Book of United States Coins. For 75 years, it has been the bible of coin values for many collectors. Unfortunately, the Red Book has several problems. First, it is published once a year and released in April. It means that production for the Red Book must begin before then.

A few years ago, I volunteered to work as a pricing contributor for the Red Book. I felt prices for modern coins were too low for the market, and I tried to bring them up to reality. It was challenging to make the edits using the poorly design web form. Even with my effort, much of my input did not make the book. The following year’s pricing entry was a spreadsheet, but my attempts at aligning the prices with the market did not affect the published prices.

Another problem with the Red Book is that the contributors are not given sufficient time to provide input. The process should be ongoing rather than giving the pricing editors a few weeks to edit the prices, so there is no rush before closing the edition.

Although I was not involved with the Blue Book (Handbook of United States Coins) pricing, I suspect it has similar issues.

It appears that every method used to create a price guide is flawed. Publicly accessible price guides are too generic to be taken seriously. Unless the public is willing to pay high prices for the wholesale guides, there is an opaqueness in how the industry prices coins.

Creating price guides is a difficult task. Over the next few weeks, I will continue my market survey while compiling the price guide for the American Eagles Handbook. I will share what I find here on the blog. Stay tuned!

Have you bought your Palladium Eagle?

Quick update for those interested in the new Palladium Bullion Coin that was sold to authorized purchasers on Monday.

The U.S. Mint added a link for the Palladium Bullion Coin to the American Eagle Coin Program web page. The web page provides scaled image of the coin and the design information.

If you want to find an authorized seller, the U.S. Mint has a web page to let you find one based on your location.

Rather than using the images that were reviewed by the Citizens Coinage Advisory Committee, the U.S. Mint also posted full-sized color pictures of the coins.

- 2017 American Palladium Eagle One Ounce Bullion Coin Obverse using the Mercury Dime design by Adolph A. Weinman

- 2017 American Palladium Eagle One Ounce Bullion Coin Reverse using the design 1907 American Institute of Architects (AIA) Gold Medal reverse by Adolph A. Weinman

A quick check of online auctions shows that the American Palladium Eagle coin is averaging $1,100 per coin when buying one graded and encapsulated coin or $1,080 when buying an ungraded coin. Multiple coin lots are averaging between $1,070 and $1,080 each.

As I type this, the current price of palladium is $928.73. Dealers are paying 6.25 percent over the spot price (approximately $986.79) plus shipping costs. Graded coins also incur fees paid to the third-party grading service.

Weekly Numismatic World News for September 24, 2017

On Monday, the U.S. Mint will begin selling palladium bullion coins to authorized purchasers. The opening price will probably be $976.44 per coin, which is 6.25-percent over the spot price of $919 per troy ounce.

On Monday, the U.S. Mint will begin selling palladium bullion coins to authorized purchasers. The opening price will probably be $976.44 per coin, which is 6.25-percent over the spot price of $919 per troy ounce.

Metal prices have not followed a path that market watchers are familiar with. Platinum is usually more expensive per troy ounce than gold but has been less while palladium usually tracks at half of the price of gold.

With all of the turmoil in the world, the price of gold is relatively flat with spikes for various activities in the news. But an investor who bought at the beginning of the year “complains” that the price is up only 12-percent for the year despite fundamentals that suggest a larger gain. Recent events have caused the price to jump, but one investor told me that gold is a safe bet but it is not a good bet if you are looking to make money.

A dealer that sells silver has called the market schizophrenic. There are swings in the prices that defy market logic. With stricter regulation, higher demand, and flat production growth, the price of silver should be climbing. But it is relatively flat for the year with a 6.4-percent grown.

Some are even suggesting that the silver market is being manipulated.

I do not know if the market is being manipulated, but the experts are telling me that something is not right.

Even coin production mints make mistakes. If you have a coin that’s a product of one of these mistakes, it’s probably worth way more than face value.

Summary There is considerable evidence that silver is subject to considerable manipulation. Revelations of manipulation from regulatory investigations and lawsuits in recent years have led to the introduction of stricter regulations and oversight.

The second batch of commemorative coins minted for the funeral of His Majesty the late King Bhumibol Adulyadej have proved very popular after being available for reservations on Monday. Long queues were seen since early in the morning at designated venues nationwide.

HYDERABAD: Hyderabad of yore had carved a niche of its own in the spheres of culture, commerce, language and festivals.

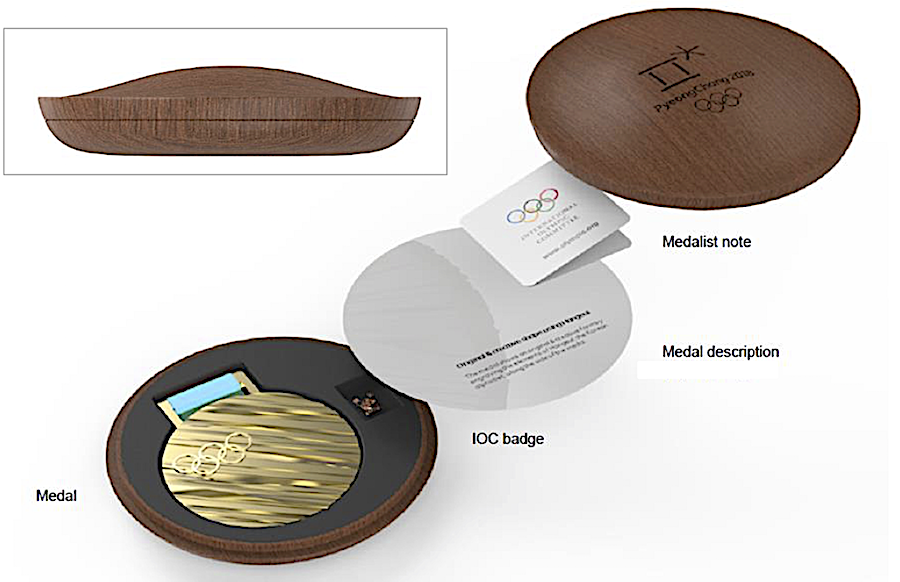

2018 Winter Olympics Medals Unveiled

On Thursday, September 21, 2017, the PyeongChang Olympic Committee unveiled the design of the medals that will be awarded during the 2018 Winter Olympics.

According to the PyeonChang Olympic Committee, the design of the metals is inspired by Korean culture and traditions. The texture of the metals are intended to symbolize tree trunks representing the trees symbolizes the work that has gone into developing Korean culture. Edge lettering includes did the games in both English and Korean.

The ribbon that will be used on the medals has been created using Gapsa, a traditional Korean fabric that is used to make Hanbok. Hanbok is a type of traditional Korean dress.

The medals were designed by Lee Suk–woo, serves as a Director of Dongwon Metal Co., Ltd. Lee is the company’s General Manager and creative director. He is a graduate of Eastern Michigan University.

Medal Specifications

- GOLD: 586 grams made from .999 silver and plated with 6 grams of gold

$566.55 melt value with a silver spot price of $16.87 and gold spot price of $1289.30 - SILVER: 580 grams made from .999 silver

$317.84 melt value with a silver spot price of $16.87 - BRONZE: 493 grams made from .900 copper and .100 zinc

$2.97 melt value with a copper price of $2.8837 per pound and zinc price of $1.3932 per pound

- All medals are 92.5 mm in diameter period

- Medals range in thickness from 4.4 mm at its thinest to 9.42 mm at its thickest

Medal Design

Uses consonants of Hangeul, the Korean alphabet system extended across the face of the medal from its side

- Obverse: Olympic rings

- Reverse: Discipline, event, and PyeongChang 2018 emblem

- Edge: Official title of the PyeongChang 2018 Games in the Korean consonants

Medal Case

- Wooden cased designed with curves witnessed in Korean traditional architecture as the motif translated into a modern concept

- Contains the medal, medal description, the IOC badge, and medallist note

Medal Production

Quantity: total 259 sets

- 222 to be awarded to athletes (102 medal events)

- 5 sets as contingency in case of tie

- 25 sets to be submitted to the IOC

- 7 sets for display in Korea

Produced by the Korea Minting, Security Printing & ID Card Operating Corporation (KOMSCO)

POLL: Looking for Palladium Eagles after September 29

After seven years since the law was passed (American Eagle Palladium Bullion Coin Act of 2010, Pub. L. 111-303), these coins Will begin their sale. There is no indication whether the U.S. Mint will offer collectable versions or just release the bullion coins.

The coin will have a $25 face value and require that “the obverse shall bear a high-relief likeness of the ‘Winged Liberty’ design used on the obverse of the so-called ‘Mercury dime’” making it yet another bullion coin that will feature a design from the early 20th century. For the reverse, the law says that the coin “shall bear a high-relief version of the reverse design of the 1907 American Institute of Architects medal.” Both the Mercury Dime and 1907 AIA medal designed by Adolph A. Weinman, whose Walking Liberty design is used on the American Silver Eagle coins.

No price has been announced but the current Price of Palladium is $911.63. As a reference the current spot price of metals are as follows:

The U.S. Mint does not publish the bullion and bulk sale prices the way it does for collector coins but it is likely that these coins are sold to distributors at a premium over their spot price. I guess we will find out how much these coins will cost for investors and collectors purchase when they hit the market.

For today’s poll, are you going to buy one?

American Liberty Four Silver Medal Set Price Announced

The American Liberty Four Silver Medal Set are four silver medals featuring the gold 225th Anniversary American Liberty Gold design struck in silver and without a denomination. Each medal will contain one troy ounce of silver and consist of one medal from each of the active mints with different finishes:

- Philadelphia Reverse Proof

- San Francisco Proof

- West Point Enhanced Uncirculated

- Denver Uncirculated

It was previously announced that the set will go on sale at noon on October 19, 2017.