Independence Day 2022

The decision to go to war to confirm independence was not something the English colonies in the New World took likely. After many years of trying to convince King George III, and over the objection of Benjamin Franklin, Thomas Jefferson began to author what was effectively a declaration of war.

The decision to go to war to confirm independence was not something the English colonies in the New World took likely. After many years of trying to convince King George III, and over the objection of Benjamin Franklin, Thomas Jefferson began to author what was effectively a declaration of war.

To convince Franklin and other skeptics to support the fight for independence, Jefferson presented the preamble of what would become the beginning of the Declaration of Independence to the Continental Congress. It passed on May 15, 1776.

As a result, the Continental Congress appointed a “Committee of Five” to draft a declaration. Committee members were John Adams of Massachusetts, Benjamin Franklin of Pennsylvania, Thomas Jefferson of Virginia, Robert R. Livingston of New York, and Roger Sherman of Connecticut. They completed the draft on June 28, 1776.

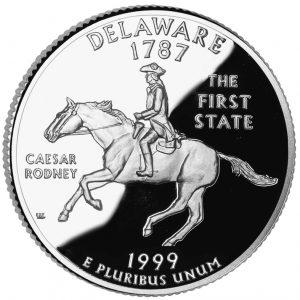

The Continental Congress debated the draft on July 1-2, 1776. New York and South Carolina were still holdouts, and the two Deleware representatives were deadlocked. This led to the historical ride of Caesar Rodney, who rode 80 miles to Philadelphia to vote in favor of independence.

The Continental Congress debated the draft on July 1-2, 1776. New York and South Carolina were still holdouts, and the two Deleware representatives were deadlocked. This led to the historical ride of Caesar Rodney, who rode 80 miles to Philadelphia to vote in favor of independence.

After Thomas Jefferson made the final agreed upon corrections to the document, the Continental Congress approved the draft on July 4, 1776, with 12 votes. Only New York abstained since they did not have the authority of their government.

The final signatures were added on August 2, 1776. Since New York approved the resolution of independence on July 10, the New York delegation is included among the signatures.

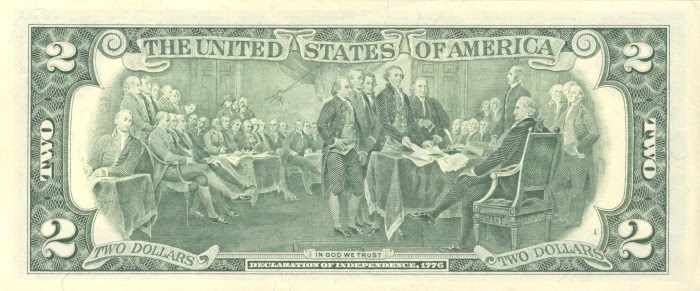

Reverse of the Series 1976 $2 Federal Reserve Note features an engraved modified reproduction of the painting The Declaration of Independence by John Trumbull.

Although we celebrated the nation’s birth in 1776, the new country was not recognized until 1783, when the two nations signed the Treaty of Paris.

Remembering Harvey G. Stack – 1928-2022

My thoughts will be below the announcement.

It is with great sadness we announce the passing of our friend and founder, Harvey G. Stack on January 3, 2022. His leadership over the years spearheaded our operations and his kindness and mentorship to staff, collectors, dealers, numismatic organizations and colleagues will never be forgotten.

Harvey was born in Manhattan on June 3, 1928, the son of Morton M. Stack and Muriel Stack. He grew up in Bronx and Jamaica, New York and attended NYU. His life revolved around his family and around numismatics, as generations of the Stack family built upon the rare coin business founded in 1933 by Harvey’s father, Morton, and his uncle Joseph at 690 Sixth Avenue in Manhattan. Presenting their first public auction in 1935, Stack’s quickly progressed to larger premises and a growing reputation. Although as a youngster Harvey worked after school and during vacations at the firm’s Manhattan coin store, it wasn’t until 1947 that he went to work full time for Stack’s Rare Coins, a career that would last more than 70 years. As one of the second generation of family members to join the firm, Harvey worked alongside his father, uncle, and cousins Norman and Benjamin, supported by a staff of experts that comprised many of the most well-known professional numismatists of the 20th century.

In 1953 Stack’s moved to a gallery at 123 West 57th Street, a location that would be home to the firm for more than 60 years and become a popular destination, known as the “clubhouse” for collectors from all over the world. As a family member, Harvey’s responsibilities were wide ranging, assisting clients in the store, traveling to pick up collections and attend conventions and coin shows, cataloging auction lots, auctioneering, and any other work that needed to be done. He became an expert in many areas of numismatics and was able to translate his warm and jovial personality into long-term relationships with the collectors and dealers he worked with over his career.

The decades following World War II were times of great growth for Stack’s. Besides opening a new and improved location, they were tapped to present at auction many important collections including Anderson-Dupont, Davis-Graves, Charles A. Cass (“Empire”), R.L. Miles, Massachusetts Historical Society, Samuel Wolfson, and George Walton, as well as conducting public auctions in conjunction with major numismatic shows including the American Numismatic Association and the Metropolitan New York conventions. In the 1970s, Harvey’s son Larry and daughter Susan joined the firm, bringing in a third generation.

Harvey and the Stack family were instrumental in building some of the greatest collections of their time, including the cabinet of gold coins assembled by Josiah K. Lilly, chairman of the Eli Lilly & Co. pharmaceutical company. After Lilly’s death in 1966, his collection of over 6,000 coins became part of the National Numismatic Collection at the Smithsonian, a process aided by Harvey and other members of the Stack family. Over the decades, Harvey and the Stack family also built a relationship with Louis E. Eliasberg, Sr., who accumulated the only complete collection of United States coins ever formed. In 1976, when the nation was celebrating its Bicentennial, Harvey and the firm helped facilitate the display of Eliasberg’s incomparable collection at the United States Mint in Philadelphia.

Harvey Stack’s role in numismatics was not purely business. He fought for clearer import regulations on coins from overseas and testified before a congressional subcommittee leading up to the Hobby Protection Act of 1973. He worked with the American Numismatic Association and other professionals in the effort to develop a standardized grading system for coins. In 1996 he appeared before the U.S. House Banking Committee to propose the 50 State Quarters Program, which brought countless new collectors into the hobby. Harvey Stack served on the board of the Professional Numismatists Guild for nearly a decade and acted as its president for two years beginning in 1989. In 1993 he received the PNG’s Founder’s Award, their highest honor, for his dedication to the hobby. Over the years, Harvey was a great supporter of the American Numismatic Association, the American Numismatic Society, and the Smithsonian Institution. He was a long-term member of the International Association of Professional Numismatists, as well as numerous other numismatic societies.

As the 20th century turned to the 21st, Harvey Stack and Stack’s were still going strong, as Larry and Harvey brought to auction the incredible John J. Ford, Jr. Collection, and many other famous name cabinets. In addition, they partnered with Sotheby’s in the record-breaking sale of the first 1933 Saint-Gaudens double eagle to cross the auction block. In 2011, Stack’s merged with Bowers and Merena to create Stack’s Bowers Galleries, one of the top numismatic auction firms in the country and a company that continues the Stack family’s legacy of presenting important numismatic cabinets and realizing record-breaking prices. Harvey remained involved in the new business until the very end, telling the company’s history, mentoring staff members, and maintaining his relationships within the hobby. Most recently he and Larry worked with the estate of long-time friends and clients Mark and Lottie Salton to bring their outstanding collection of world and ancient coins to market. It is unfortunate that Harvey will not be there to see the fruits of his labor as this remarkable cabinet crosses the auction block in 2022 and 2023.

Harvey was predeceased by his parents, his uncle Joseph, his cousins Norman and Ben. He is survived by his wife, Harriet, children Larry (Loretta) and Susan (Larry), grandchildren Rebecca (Jimmy) and Matthew (Tanya), and five great-grandchildren: Bryce, Avery, Dylan, Brielle and James.

Services will be private. In lieu of flowers, donations can be made to the Leukemia & Lymphoma Society, the American Numismatic Society or a charity of choice.

Personal Remembrance

I met Harvey Stack for the first time in 1971 at their 57th Street store in Manhattan. There was no formal “take your child to work” program in those days. My father would take me into the city with him one day a year, and they would give me busy work to do when I was not doing my homework. But the fun was around lunchtime.

After grabbing a sandwich, we would walk over to Stack’s to look at the coins and buy a few. It did not matter if you were coming with your father, an experienced collector, or even if you were a change picker. Everyone was welcome at Stack’s.

The first time I visited the store, there was a lot of activity. A lot of people were talking about and looking at coins. I remember that Harvey Stack was presiding over the gaggle. When he saw my father and me, he came over to help us. Aside from helping me pick out two Roosevelt Dimes for my collection, he taught me what to look for in a good dime. It was the first time I saw a Buffalo nickel.

We left that day with the dimes, a few Buffalo nickels, a Whitman Classic Album for the nickels, and a new Red Book. It was more than my father wanted to pay, but he knew it would keep me occupied all afternoon.

We lived in New York for two more years before moving. I continued to visit Stack’s when I was in the area. The store always had a lot of activity, but Harvey Stack had slowed down in the last few years.

Stack’s was the first dealer I visited, and I will never forget Harvey Stack for helping me get started.

Weekly World Numismatic News for January 2, 2022

We like to speculate on many things that will happen in the future. Sports bettors have been watching the bowl games to see how their prognostications will make money, and market prognosticators bet the winners and losers of companies.

Prognostication is not something that is pulled out of a hat. Past performance and the environment are some of the information used to make the decisions.

At the end of August, the Accredited Precious Metals Dealers (APMD) predicted that at year-end, gold would close at $1,897, silver $28, and platinum $1,153. The APMD is a professional organization of precious metals dealers with a mission to educate and promote market integrity. These are the people within the market and have the background to understand the nuances.

On the other end of the weekend’s prognostication were the oddsmakers who earn their living predicting the outcome of football games. For the Alabama vs. Cincinnatti Cotton Bowl game, the oddsmakers made Alabama a -13.5 point favorite. For those not aware of sports betting, that means the oddsmakers believe that Alabama would win by 13.5 or more points. If Alabama loses or wins by 13-points or less, you lose the bet.

The Cotton Bowl’s over-under was 57.5 points. If the gambler believes that the game’s combined score would be more than 57.5 points, you will bet the over.

For the Orange Bowl, Georgia was a -7.5 favorite over Michigan with an over-under of 46 points.

Who did better?

In the Cotton Bowl, Alabama beat Cincinnatti 27-6. Although Alabama beat the spread, only those who bet the under won money. The story was similar in the Orange Bowl where Georgia blasted Michigan 34-11, beating the spread and going under the predicted 46 point total.

How did the APMD do? As we check their results, the comparison also includes the London Bullion Market Association (LBMA) consensus prediction is included to compare results. The LBMA is the operator of the London markets that set the worldwide price of precious metals. Using the prices at the close in the New York Metals Market on Friday as reported by Kitco:

| Medal | August 31 Prediction | December 31 Close | Difference (Pct) | LBMA Consensus |

|---|---|---|---|---|

| Gold | $1,897.00 | $1,815.20 | -81.80 (-4.31%) | $2,072.00 |

| Silver | $28.00 | $23.20 | -4.80 (-17.14%) | $32.00 |

| Platinum | $1,153.00 | $963.00 | -190.00 (-16.47%) | $1,205.00 |

The difference between the markets is that the gambling bookmakers make their living on being right about the odds, and precious metals dealers make money on their premiums on selling coins and bullion.

Bookmakers have to make the correct predictions daily. An incorrect prediction on a big game will cost the bookmakers millions of dollars, and too many bad odds predictions could bankrupt a sportsbook.

Bullion dealers can adjust the premiums as the metals rise and fall, and they have to promote their product and let the buyers come. Bullion inventory usually turns over faster than the changes in the market, limiting the price risks. As long as the dealer is selling within the spread of the spot price and the premium, their incentive to be correct in their metals predictions is reduced.

All investments are a gamble, and the difference amongst the markets is what stake the prognosticators have on the outcome. You would have made more money by betting on Alabama and Georgia to win their games than most precious metals predictions.

Georgia opens as a -2.5 favorite over Alabama for the National Championship in Indianapolis on January 10, 2022. The over/under is 51.5, according to Draftkings, and Sports Illustrated published a trends analysis for the betting line.

It’s your money. Bet wisely.

GO DAWGS!

And now the news…

→ Read more at dailymail.co.uk

→ Read more at dailymail.co.uk

→ Read more at mining.com

→ Read more at mining.com

→ Read more at the-sun.com

→ Read more at the-sun.com

→ Read more at livescience.com

→ Read more at livescience.com

→ Read more at thefirstnews.com

→ Read more at thefirstnews.com

HAPPY NEW YEAR 2022!

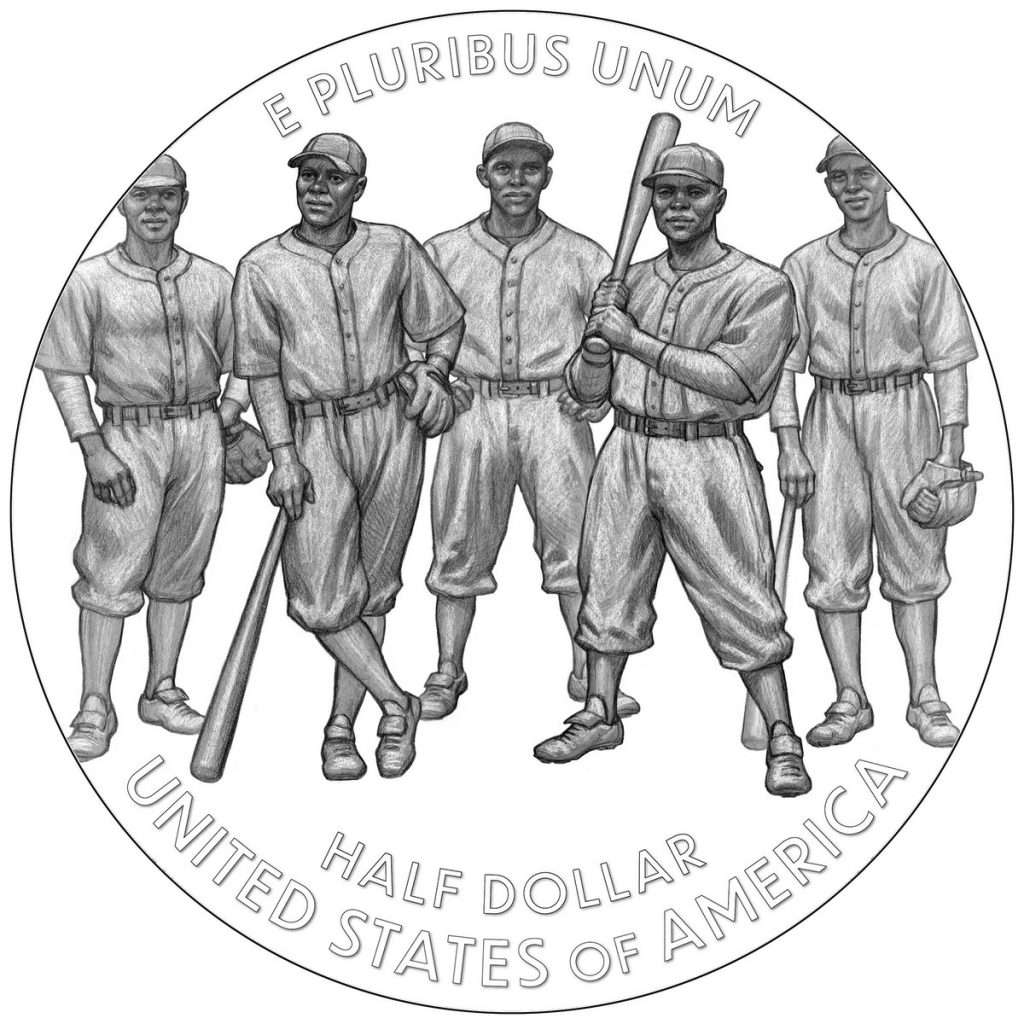

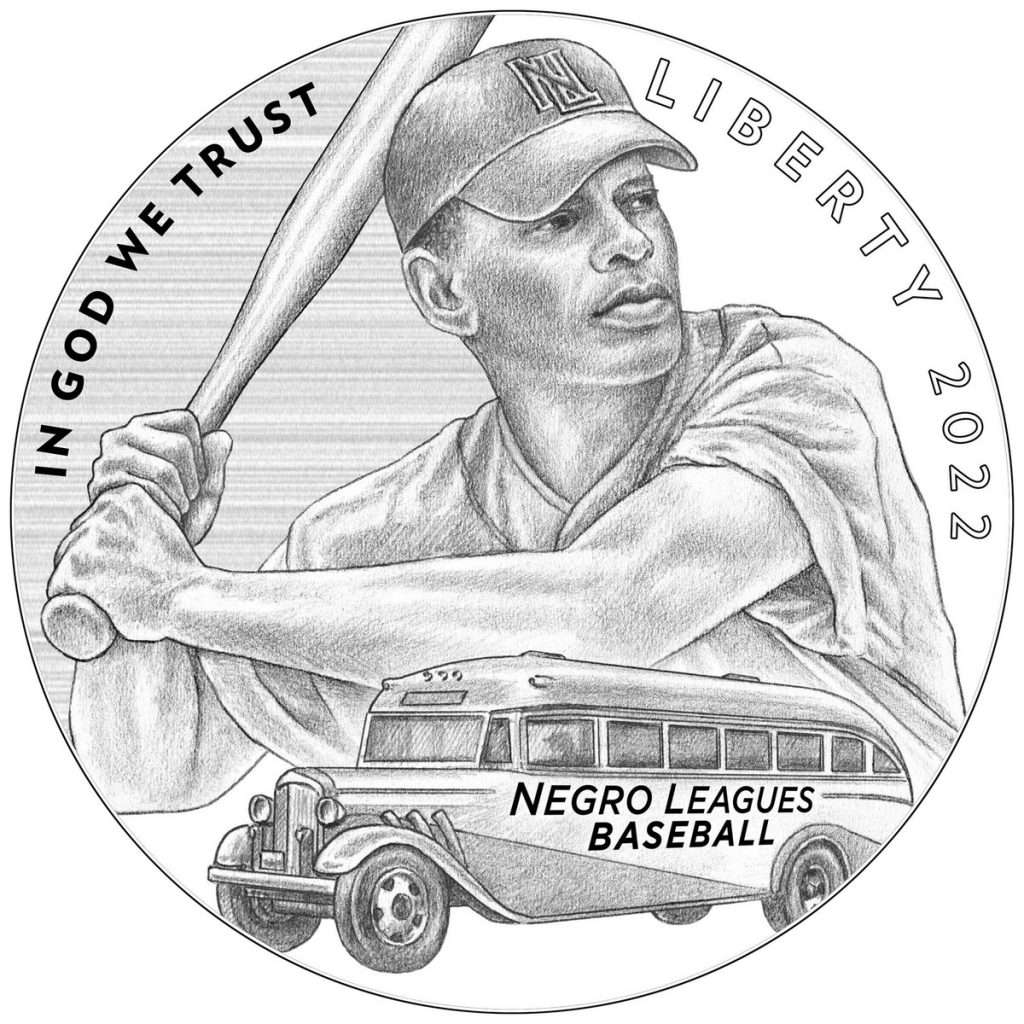

- 2022 Negro Leagues Baseball Commemorative clad half-dollar reverse

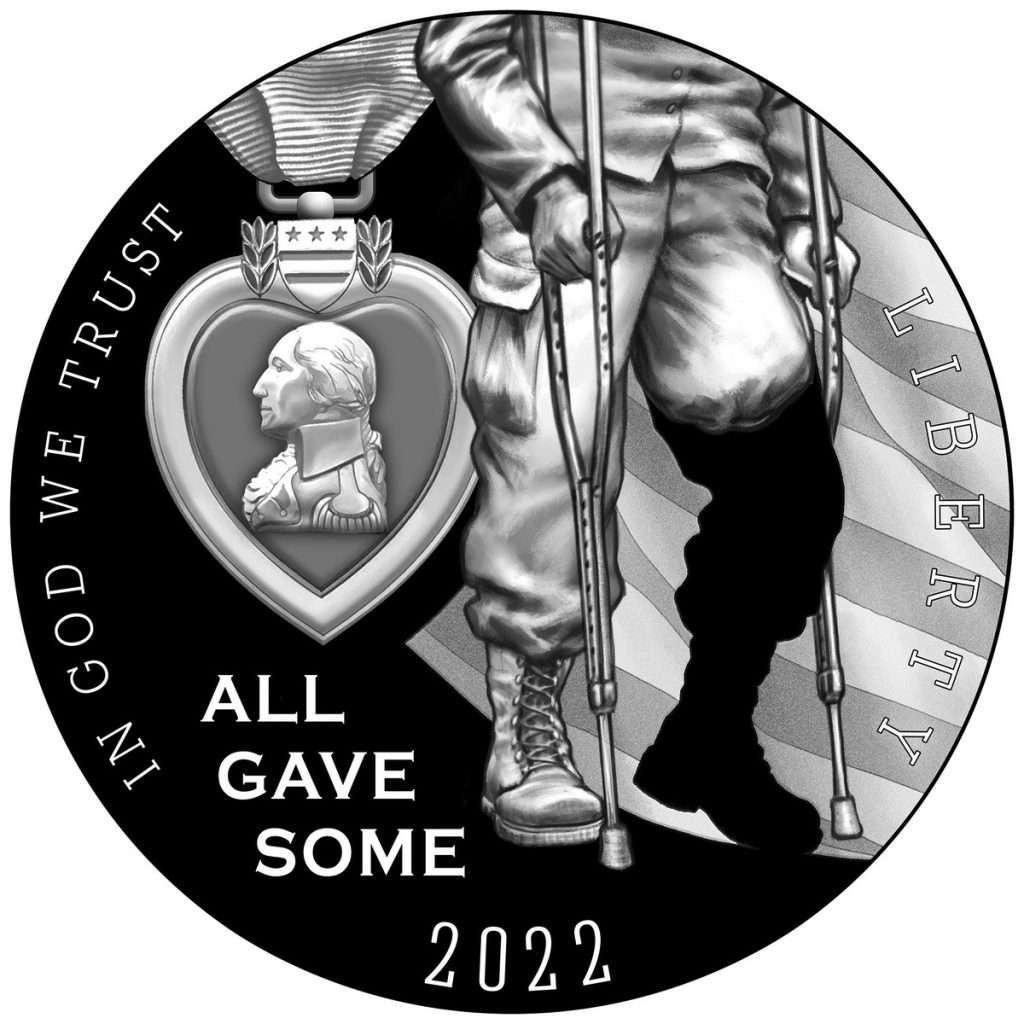

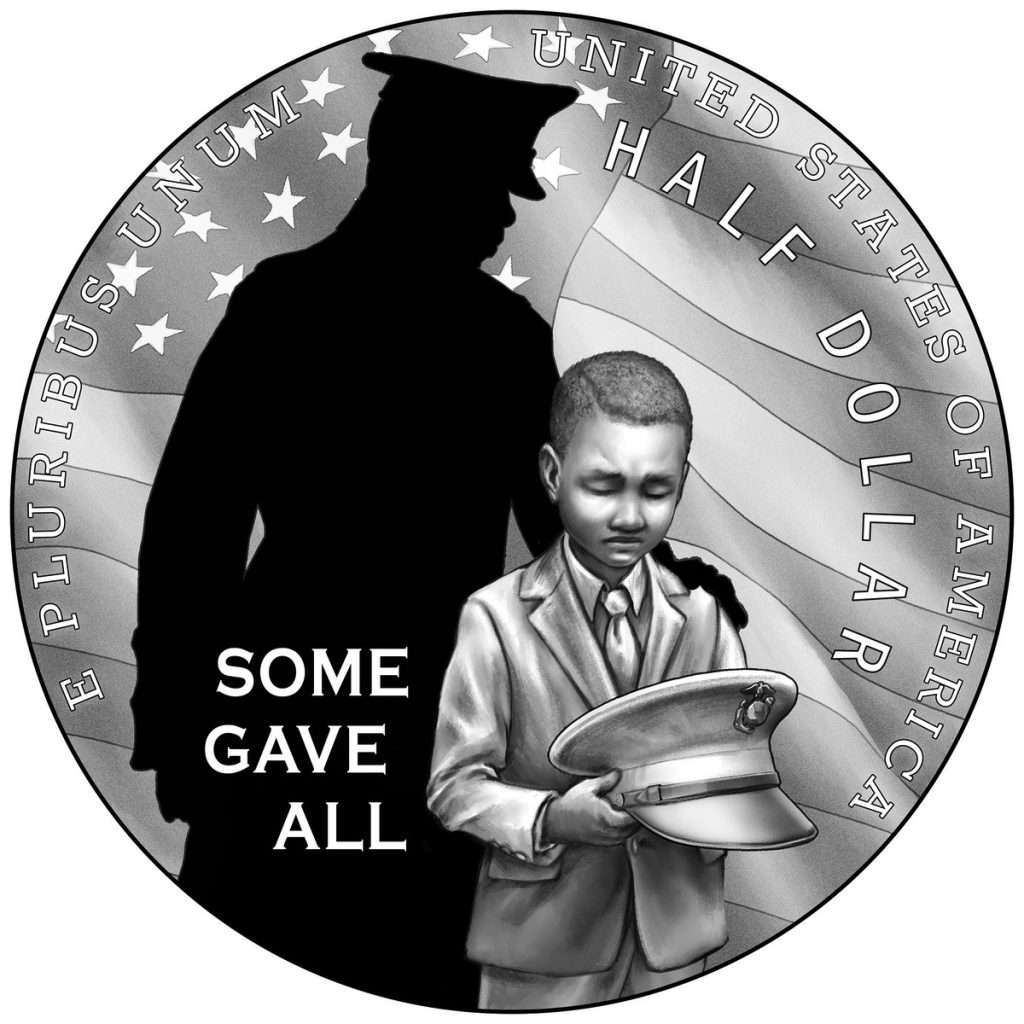

- 2022 National Purple Heart Hall of Honor Commemorative clad half-dollar obverse

- 2022 Quarter Obverse design by Laura Gardin Fraser

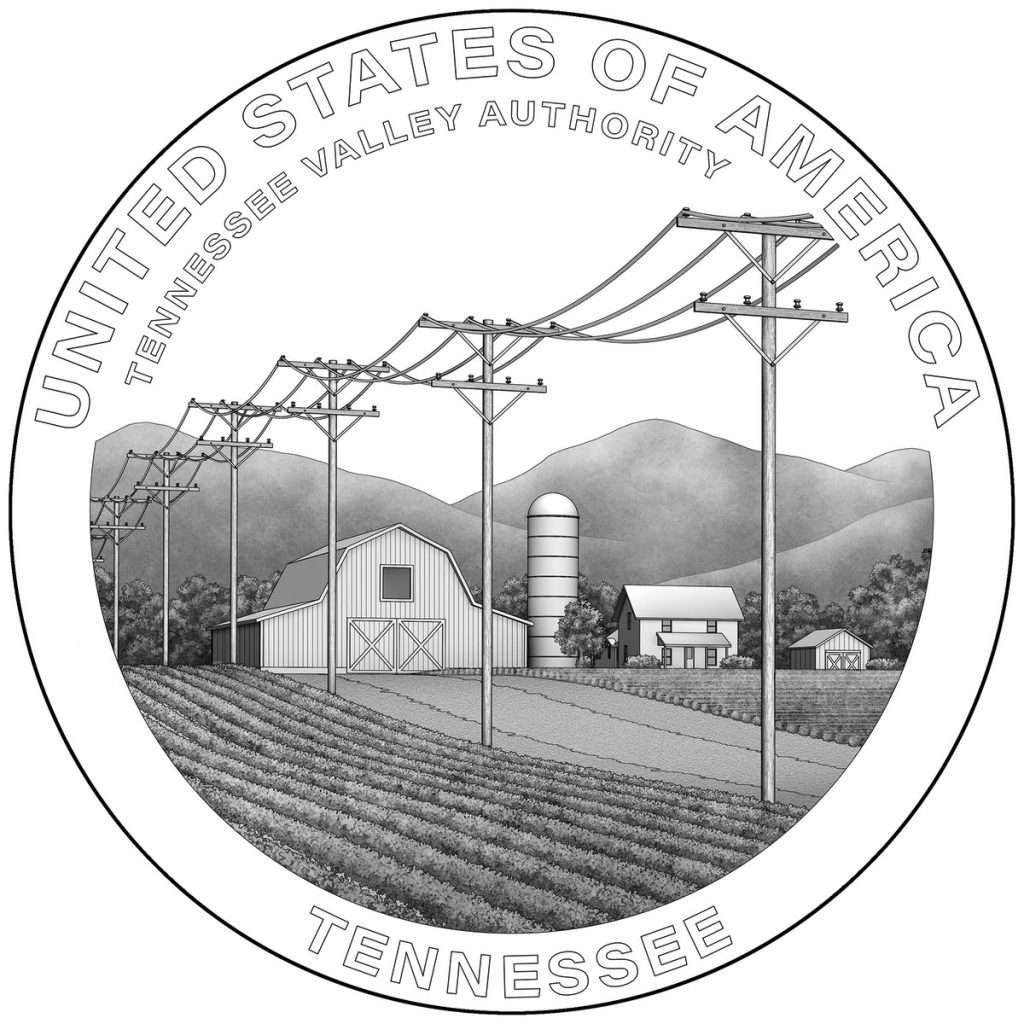

- 2022 Tennessee Dollar

A Numismatic Look Forward to 2022

Bullion

The year will start with the U.S. Mint shipping 2022 American Silver Eagle bullion coins to authorized resellers. The first bullion coins will likely hit the streets within a week, and graded coins will take about a month to be processed by the grading services. Bullion dealers are selling these coins in advance of receiving inventory.

- 2021 American Gold Eagle Type II Reverse

- 2022 American Silver Eagle Type II reverse

In 2022, the American Silver Eagles and American Gold Eagles will feature Type II reverses introduced in 2021.

2022 American Platinum Eagle Proof reverse celebrating the First Amendment right of Freedom of Speech

During some press briefings, the U.S. Mint has suggested that American Eagle coins will be released with different finishes. There has been no formal announcement for these options.

Commemorative Coins

The U.S. Mint will release two commemorative coin sets starting at the beginning of January. Both sets will consist of a $5 gold coin, silver dollar, and clad half-dollar.

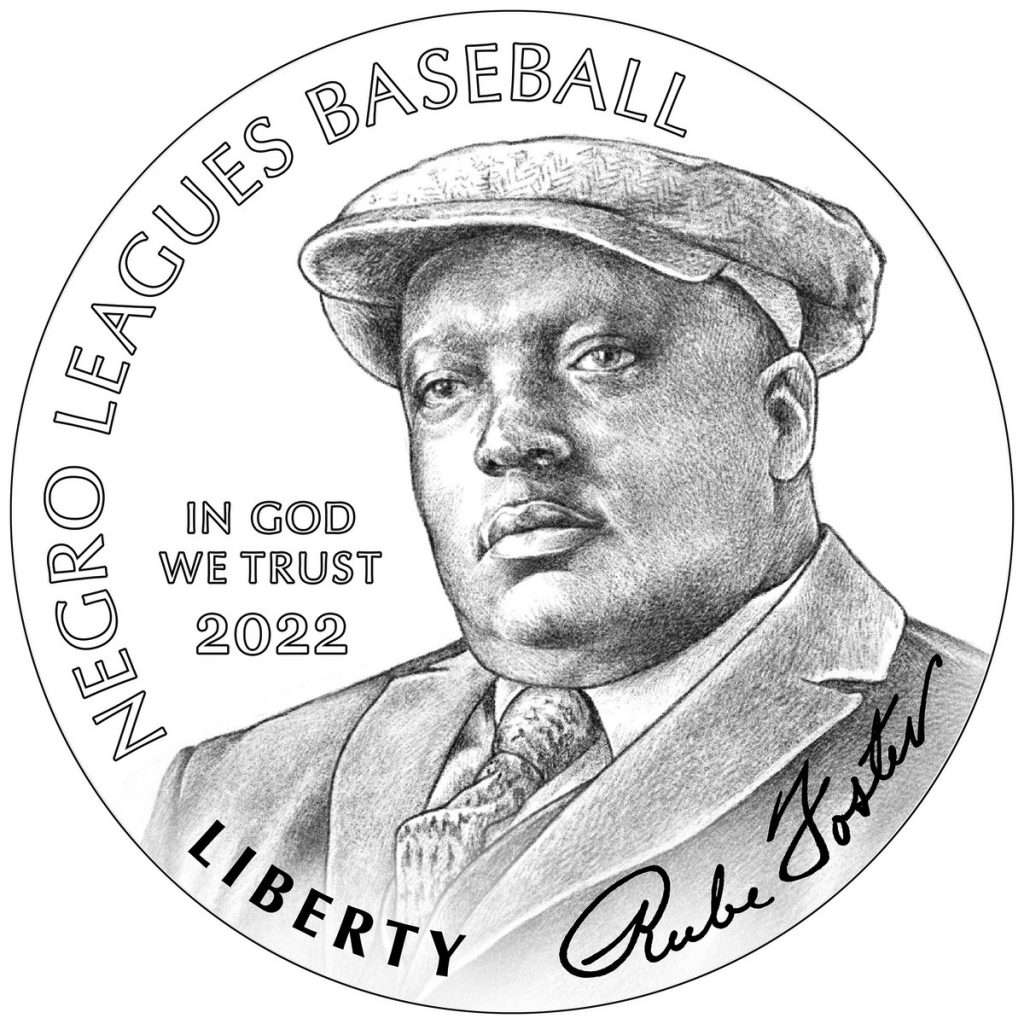

The Negro Leagues Baseball Commemorative Coin Program celebrates the Negro Baseball League. Money raised from the sale of the coins will be paid to the Negro Leagues Baseball Museum in Kansas City.

- 2022 Negro Leagues Baseball Commemorative $5 Gold coin obverse

- 2022 Negro Leagues Baseball Commemorative $5 Gold coin reverse

- 2022 Negro Leagues Baseball Commemorative Silver Dollar coin obverse

- 2022 Negro Leagues Baseball Commemorative Silver Dollar reverse

- 2022 Negro Leagues Baseball Commemorative clad half-dollar obverse

- 2022 Negro Leagues Baseball Commemorative clad half-dollar reverse

The other commemorative three-coin set will be the National Purple Heart Hall of Honor Commemorative Coin Program. The museum honors the recipients of the oldest medal in the United States. General George Washington created the medal to honor the service of those injured in battle. Money raised by the sale of the coins will benefit the Purple Heart Hall of Honor in New Windsor, New York. As part of the museum’s mission, they are trying to reconstruct records destroyed in a fire several years ago.

- 2022 National Purple Heart Hall of Honor Commemorative $5 gold coin obverse

- 2022 National Purple Heart Hall of Honor Commemorative $5 gold coin reverse

- 2022 National Purple Heart Hall of Honor Commemorative Silver Dollar obverse

- 2022 National Purple Heart Hall of Honor Commemorative $5 old coin obverse

- 2022 National Purple Heart Hall of Honor Commemorative clad half-dollar obverse

- 2022 National Purple Heart Hall of Honor Commemorative clad half-dollar reverse

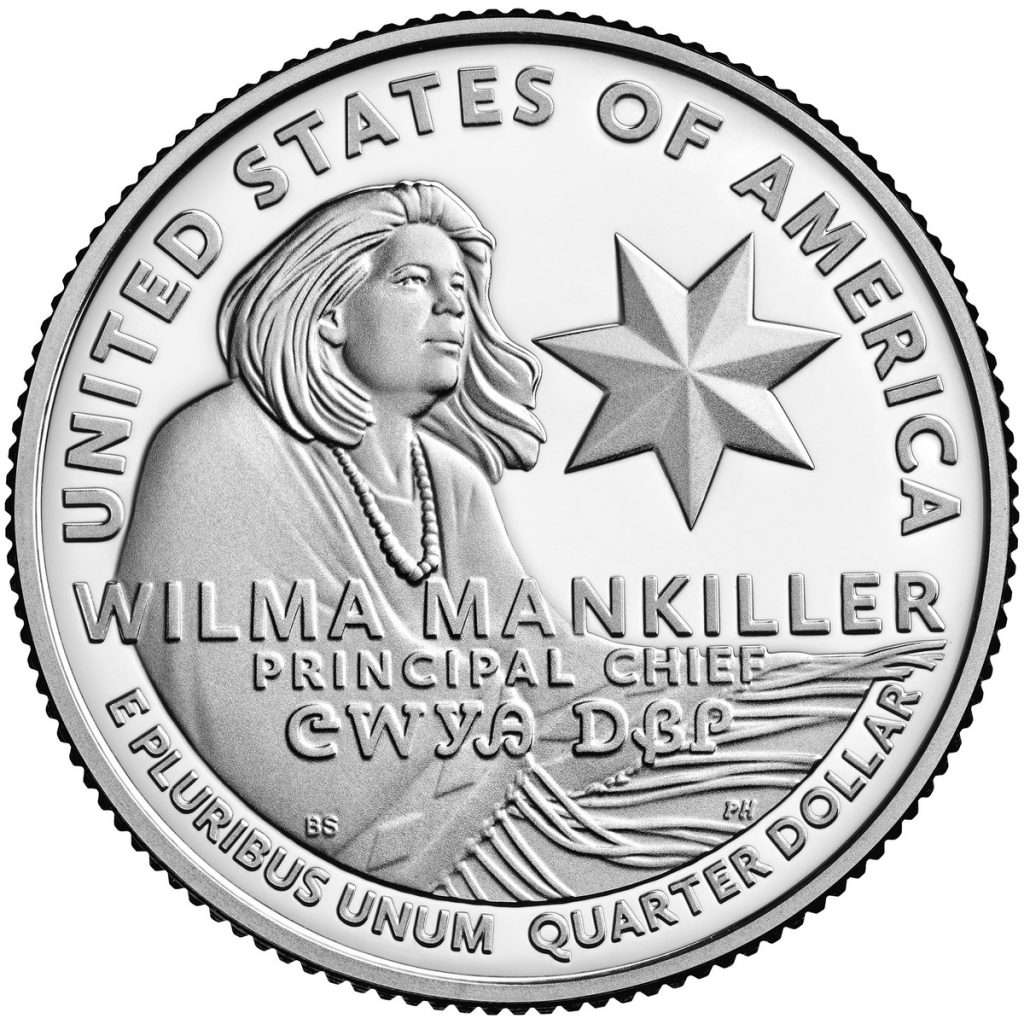

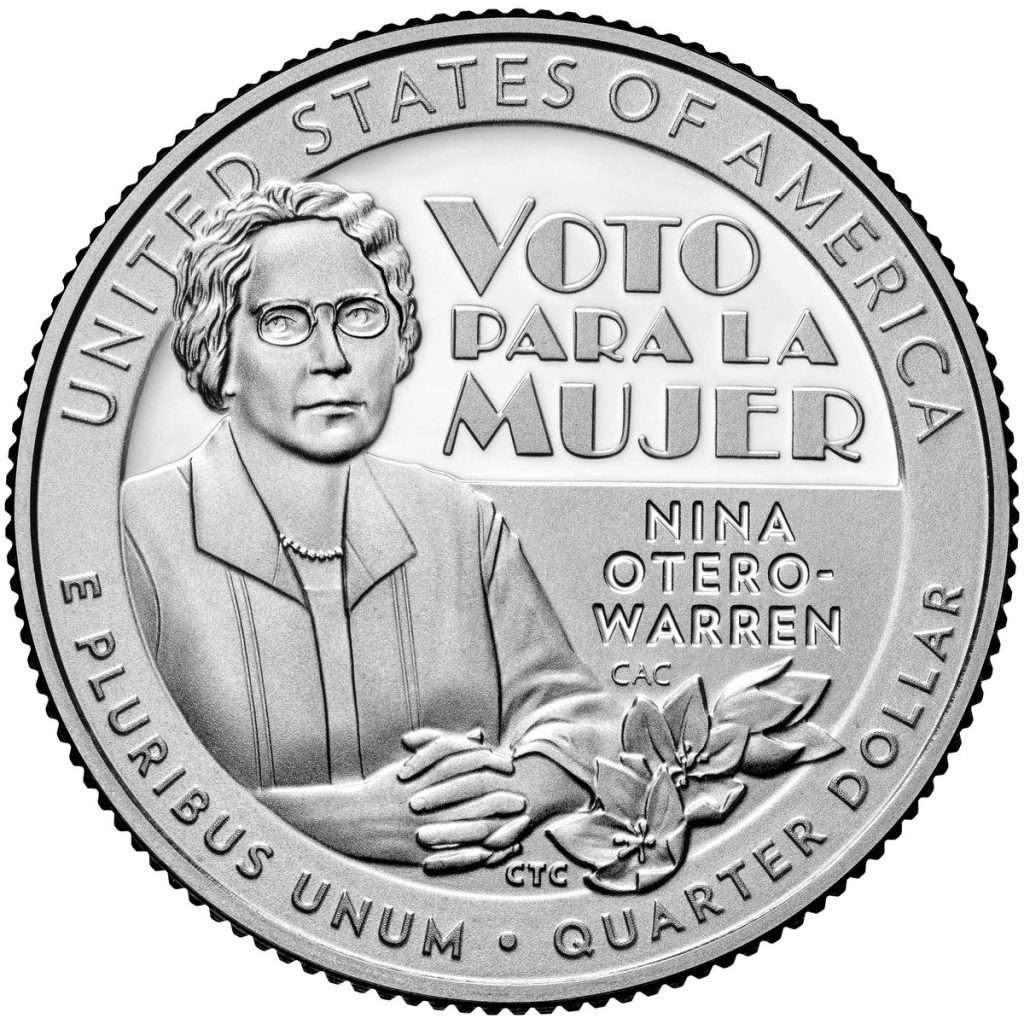

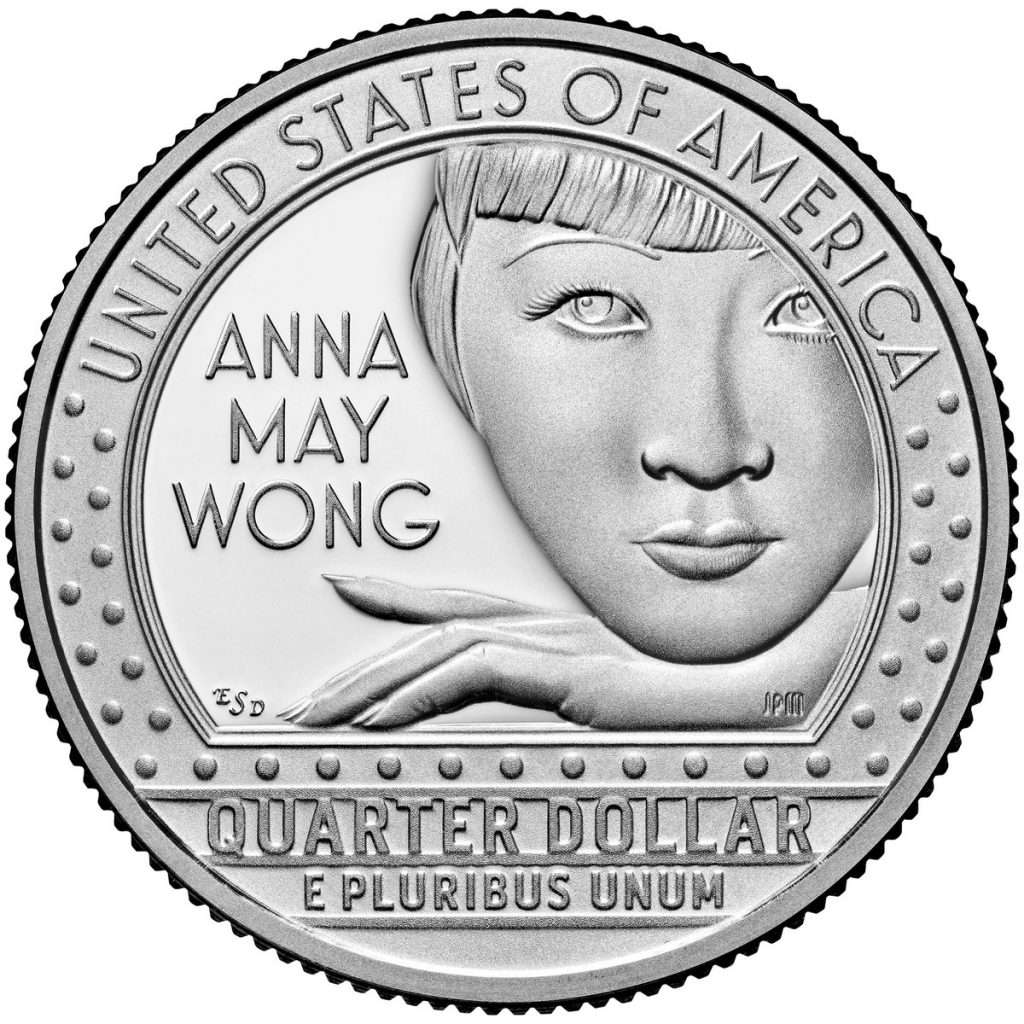

American Women Quarters Program

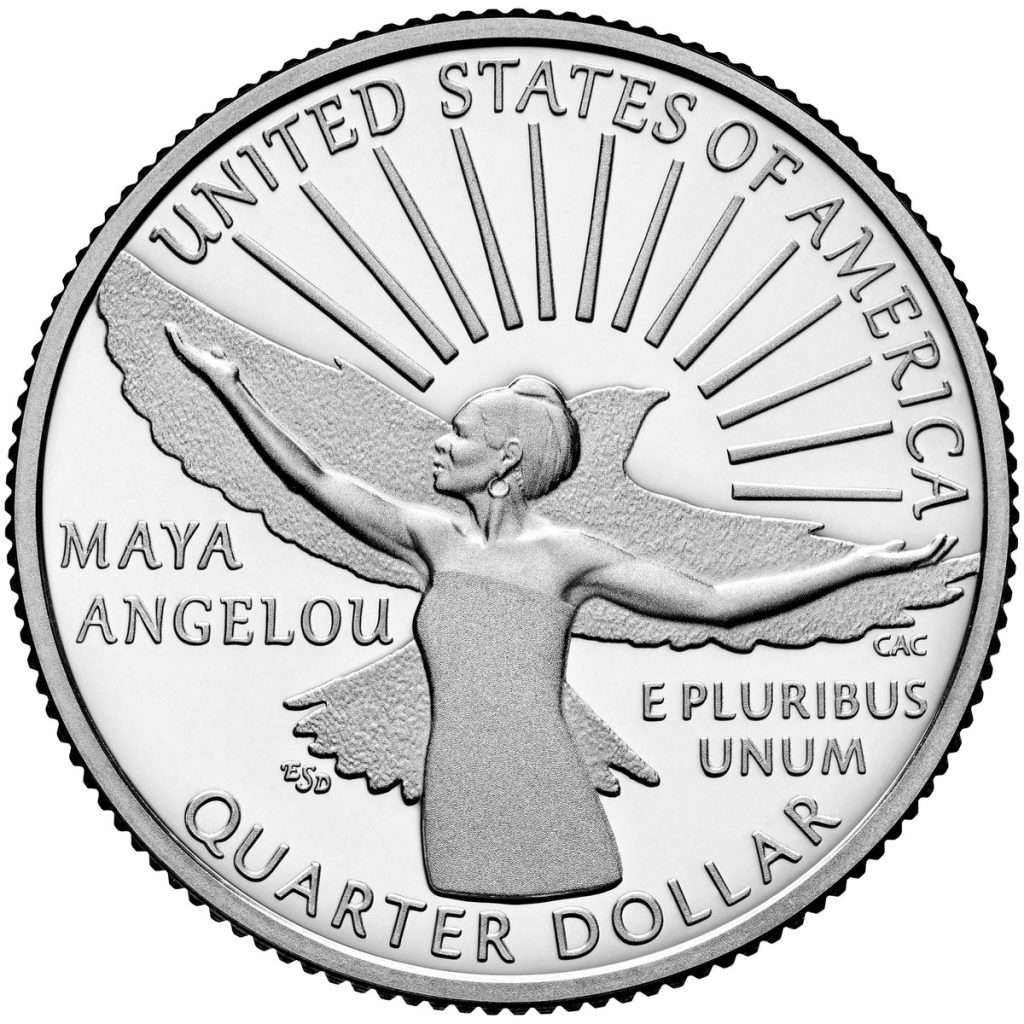

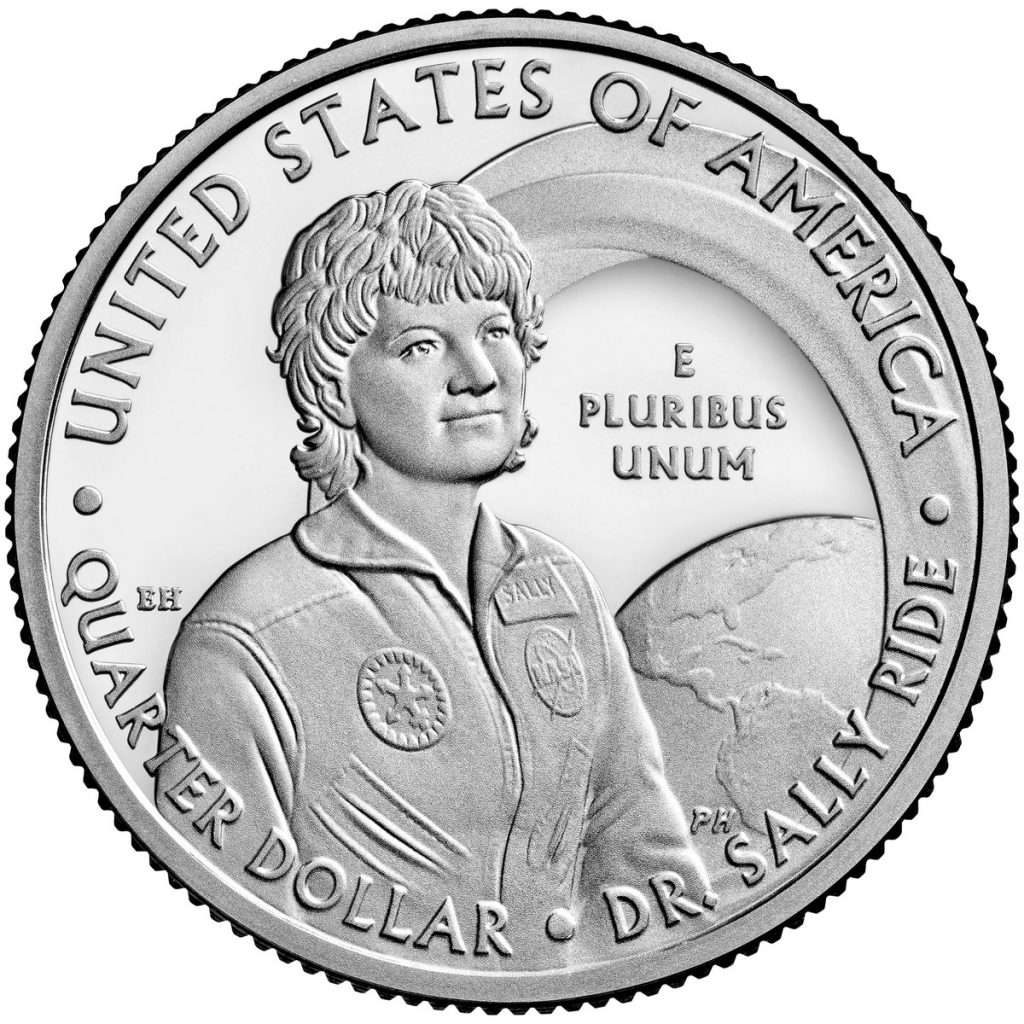

The American Women Quarters Program starts in 2022 and will run for four years. Each year will feature the accomplishments and contributions made by women to the nation’s development. In 2022, the five women that will be honored are as follows:

- Maya Angelou – celebrated writer, performer, and social activist

- Dr. Sally Ride – physicist, astronaut, educator, and the first American woman in space

- Wilma Mankiller – first female principal chief of the Cherokee Nation

- Nina Otero-Warren – a leader in New Mexico’s suffrage movement and the first female superintendent of Santa Fe public schools

- Anna May Wong – first Chinese American film star in Hollywood

- 2022 Maya Angelou Quarter

- 2022 Dr. Sally Ride Quarter

- 2022 Wilma Mankiller Quarter

- 2022 Nina Otero-Warren Quarter

- 2022 Anna May Wong Quarter

The authorizing law (Public Law 116-330) allows the U.S. Mint to produce the quarters as five-ounce bullion coins, nicknamed the “hockey puck.” The law also allows the U.S. Mint to issue fractional bullion coins. Although some media outlets announced the possibility of a smaller 2.5-ounce puck, the U.S. Mint has not announced new products.

The law allows the U.S. Mint to create five-ounce bullion coins of half-dollars that feature new designs in future programs.

Morgan and Peace Dollars

The U.S. Mint announced that they plan to continue the Morgan and Peace dollar programs in 2022 and beyond. Although the products have not been finalized, there may be different finishes and the production of the coins at other mint facilities.

Dollars

The two underrated dollar programs will continue into 2022. The Native American Dollar will feature Ely Samuel Parker, a U.S. Army officer, engineer, and tribal diplomat who served as military secretary to Ulysses S. Grant during the U.S. Civil War.Also continuing is the American Innovation $1 Coin Program that features the contributions from the following states:

- Rhode Island – Reliance yacht naval innovation

- Vermont – Snowboarding

- Kentucky – Bluegrass music

- Tennessee – Tennessee Valley Authority and rural electrification

- 2022 Rhode Island Dollar

- 2022 Vermont Dollar

- 2022 Kentucky Dollar

- 2022 Tennessee Dollar

New U.S. Mint Director?

U.S. Mint Director David J. Ryder resigned as of September 30, 2021. After being appointed by two different administrations, Ryder served as the 34th and 39th Director. His confirmation came the position was vacant for over seven years following the resignation of Edmund Moy.

In October, Ventris Gibson was appointed as Deputy Director of the U.S. Mint. Gibson will also serve as Acting Director. By law, Gibson can serve as Acting Director for 180 days. It will be up to the president to appoint a new director for senate confirmation. Given the state of politics, it is fair to question whether the president will make an appointment and if he does, will it be confirmed by the Senate.

Hopefully, the U.S. Mint will have a little better 2022!

Top 5 Numismatic Stories of 2021

The last two years have been a wild ride. Anyone who predicted what would have happened should be picking lottery numbers. For the rest of us, the predictable (i.e., the U.S. Mint) became unpredictable. The positives had a lot of negatives and what used to be extraordinary is now ordinary.

Without further ado, here are the top five numismatic stories for 2021.

5. Return of the coins shows

It isn’t easy to have any retrospective of 2021 without acknowledging how COVID-19 has affected the industry. At the beginning of 2021, there were cancelations of shows and other events. As the vaccines became more available and the infection rates declined, the shows returned.

It isn’t easy to have any retrospective of 2021 without acknowledging how COVID-19 has affected the industry. At the beginning of 2021, there were cancelations of shows and other events. As the vaccines became more available and the infection rates declined, the shows returned.

Smaller shows found hotels willing to lease larger rooms to allow the setup of a socially distance bourse. Like the World’s Fair of Money, Larger shows changed to provide for social distancing and limiting contact. Collectors that attended these shows called them a success. Still, the reports may be more emotional satisfaction after a year off.

Coins shows are adapting to an alleged new normal, and collectors are happy to get what they can. While it makes collectors happy, the looming threat of new variants may slow down the shows at the start of 2022.

4. The Positives and Negatives of the U.S. Mint

The U.S. Mint is the source of the items we collect and the biggest frustration experienced by the community. On the one hand, the manufacturing business of the U.S. Mint made it the biggest success story of 2021. Compared to the rest of the manufacturing sector, the U.S. Mint has been running in overdrive since mid-2020. The only manufacturer of United States coinage has produced more money than any three mints in the world combined.Even with the COVID issues, the U.S. Mint could produce the coins required by law, including the 2021 Morgan and Peace Dollars. Unfortunately, selling these coins revealed collectors’ frustrations with the U.S. Mint.

The U.S. Mint’s online order processing system may work without product release. Still, a major product release causes the system to fail. The product release was a perfect storm of a limited supply and a high collector demand. The result exposed how PFSWeb, the U.S. Mint’s contractor, created a system that could not handle the rush.

The U.S. Mint became more communicative with the numismatic press. During this communication, it was clear that Director David Ryder wanted to talk more about the successes. Unfortunately, the failures of the ordering system overshadowed any success. Ryder resigned as Director effective October 1, 2021.

The e-commerce system at the U.S. Mint is broken and needs to be replaced. Unfortunately, the open communications from the U.S. Mint indicate that they are planning to install a bandaid to cover up the system’s problems. Unless the U.S. Mint and PFSWeb make major changes to their online order system, the issues will continue into 2022.

3. 2021 Morgan and Peace Dollars

Numismatists know that 2021 marked the end of the Morgan Dollar series and the introduction of the Peace Dollar. Morgan Dollars may be the most collected coin in U.S. numismatics. The Peace Dollar was the coin promoted by former ANA President Faran Zerbe with support from the ANA. In 1921, the U.S. Mint produced both coins. What better way to celebrate the centennial is by creating tributes to both coins.

Numismatists know that 2021 marked the end of the Morgan Dollar series and the introduction of the Peace Dollar. Morgan Dollars may be the most collected coin in U.S. numismatics. The Peace Dollar was the coin promoted by former ANA President Faran Zerbe with support from the ANA. In 1921, the U.S. Mint produced both coins. What better way to celebrate the centennial is by creating tributes to both coins.

The tribute idea was popular by collectors suggesting that it would be a high-demand product. But the U.S. Mint found a way to destroy the movement. In a series of missteps, the U.S. Mint allowed its lawyers to restrict their ability to do its job. As a result, the U.S. Mint could not purchase enough planchets to satisfy collector demand.

It is difficult to call the program a success given its problems. But the coins were a sellout, and they continue to do well on the secondary market. The U.S. Mint announced that the program will continue in 2022, and hopefully, it will go better than the 2021 releases.

2. Million Dollar Coins No Longer a Surprise

1804 Class I Original Draped Bust dollar, PCGS Proof-68 and the finest known of its kind, acquired for a client by GreatCollections for $7.68 million. (Photo credit: Professional Coin Grading Service.)

The numismatic market is very active, and the price increase of significant rarities results from the active market. Although the market favors United States coins, the collectors extend their collections to coins made elsewhere. Of the ten-million-dollar coins sold in 2021, four were not U.S. coins.

Here are the coins that sold for more than $1 million in 2021:

| Sale Price | Coin Sold | Date Sold |

|---|---|---|

| $18,900,000 | 1933 Saint-Gaudens Double Eagle (King Farouk provenance) | June 8, 2021 |

| $9,360,000 | 1787 Brasher Doubloon – EB on Wing (ex: Stickney-Ellsworth-Garrett-Partrick) | January 21, 2021 |

| $8,400,000 | 1822 Half Eagle (ex: Pogue) | March 25, 2021 |

| $7,680,000 | 1804 Bust Dollar – Class I (one of 15 known) | August 18, 2021 |

| $5,280,000 | 1804 $10 Proof Eagle (Finest of Three known) | January 20, 2021 |

| $4,750,000 | 1907 Saint-Gaudens Ultra High Relief Double Eagle | April 6, 2021 |

| $2,640,000 | 1825 Russia Ruble Pattern with would-be Emperor Constantine | April 6, 2021 |

| $2,280,000 | 1928 China Pattern Dollar featuring the warlord Zhang Zuolin | April 6, 2021 |

| $2,280,000 | 1937 Edward VIII 5 Pounds Pattern (one of six known) | March 26, 2021 |

| $2,160,000 | 1928 China Pattern “Mukden Tiger” Dollar (one of ten known) | December 11, 2021 |

1. The Double Eagle That Flies Higher

Farouk-Fenton 1933 Saint-Gaudens $20 Double Eagle was sold by Sotheby’s for $18,872,250 in a June 2021 auction. (Picture Credit: PCGS)

Since that sale, several coins sold for more.

On June 8, 2021, Sotheby’s auctioned the Stuart Weitzman Collection, including rare Inverted Jenny Plate Block and the British Guiana One-Cent Black on Magenta stamps. The coin sold for a record $18,872,250.

It answers the question, “What is a coin worth?” What are you willing to pay for it?