Weekly World Numismatic News for June 5, 2022

The college-age child of a friend accepted a summer job in London and went early to witness the Queen’s Platinum Jubilee. Earlier today, I joined my friend on a video talk with the group of U.S. students staying in a London hotel.

The college-age child of a friend accepted a summer job in London and went early to witness the Queen’s Platinum Jubilee. Earlier today, I joined my friend on a video talk with the group of U.S. students staying in a London hotel.

During the discussion about the atmosphere around the streets of London, I asked about coins and medals that they encountered. All of the students found a 50 pence coin issued by the Royal Mint, and almost every shop and street vendor carried the coin they included in making change.

Other souvenirs the group collected are aluminum tokens with images commemorating the jubilee. The tokens were reminiscent of Mardi Gras tokens. Some found tokens that were the size of the old large penny with images of the Queen at various ages.

A few found currency-looking commemoratives, and they were designed as £70 notes with images of the Queen. The reverse has the name and address of a London business using the notes as an advertising opportunity.

The jubilee celebration is over, but the collectibles will live on.

And now the news…

→ Read more at arabnews.com

→ Read more at arabnews.com

→ Read more at hardwoodparoxysm.com

→ Read more at hardwoodparoxysm.com

→ Read more at outsiderclub.com

→ Read more at outsiderclub.com

Royal Mint to Celebrate Collect Week 2021

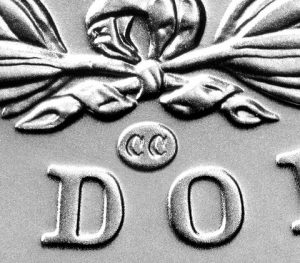

One of the more fascinating events of Collect Week is the auction for Die Trial Pieces. Die Trial pieces are coins struck before the production run as a test. The Royal Mint has a good description of Die Trials on its website.

The list of die Trial Pieces includes gold and silver strikes from 2019 and 2020. Each coin has a hallmark attesting to the quality of the strike as defined by the Royal Mint. The Royal Mint published a list of 60 Die Trial Pieces that will be in the auction.

There are also webinars held during the week. You may have to adjust your sleep pattern to attend if you are interested, but it might be worth your time. The list of webinars advertised are:

- The Importance of Die Trial Pieces — September 20

- Making the Grade: Coin Grading and Slabbing Webinar — September 21

- Investing in Gold from The Royal Mint — September 22

- How to Start a Collection — September 23

If I get up in the middle of the night to attend a webinar, I will attend “The Importance of Die Trial Pieces.” The description makes it sound like they will discuss the minting process from the Royal Mint’s perspective.

“Making the Grade” may be worth an extra pot of coffee to see how the UK views grading.

Learning more about collecting is fun, and it is good to hear from different voices.

How to Create a Price Guide — Planning

Whether you are putting together a price guide or anything to covey information, you must first determine what data you want to report. As I look at the American Eagle series, reporting prices is not the same as a price guide with grades across the top and rows for each year and prices on each row. It is not how American Eagles are collected.

American Eagle coins are collected either in their original mint packaging, also called their original government packaging (OGP), or graded by a third-party grading service and housed in a holder. Based on a quick, non-scientific survey, it does not appear that many people are collecting American Eagle bullion coins and filling holes in albums.

The first decision was easy. American Eagle coins struck for the numismatic market would be priced based on whether the collector had the OGP or not. While using the data from eBay to see if there was a price difference, there was a $10-20 difference for proof coins and an $8-15 difference for other strikes, like the burnished American Silver Eagle coins.

Many people believe that eBay is not a good source of data. Although there is a bias against eBay, the information learned by analyzing the buying trends from such a diverse market can tell a story. I will not base the prices on a survey of only eBay. The book will include a survey of dealer prices and other markets.

The first two columns of prices will be if the coin is in its OGP or not in its OGP. The rest of the table will have columns for graded coins.

Prices for graded coins have different considerations. At what point does the difference between grades become irrelevant? Using the eBay survey, it seems that the numismatic premium is significant for a 70 grade and lesser for 69. When the grade is 68 or lower, the average appears to be bullion cost plus a smaller numismatic premium.

Bullion coins do not come in packages, but there are other considerations. The U.S. Mint packs the bullion coins in special rolls that seem to affect prices. Rolls get packed in monster boxes for shipping to authorized purchasers. Those monster boxes also have a different price structure.

The problem is that the rolls and monster boxes have a limited shelf-life. Although there appear to be some rolls and monster boxes from previous years, most of the rolls for sale are from the current year.

One more consideration is that some collectible American Eagles are only available as part of sets. Sets in their OGP will be priced based on market factors while providing only the price for graded coins in the main tables.

For now, the price tables will look like this:

| Year | Mintage | OGP | <69 | 69 | 70 |

|---|---|---|---|---|---|

| 1986-S | 1,446,778 | 45 | 55 | 72 | 350 |

| 1987-S | 904,732 | . . . | |||

| Year | Mintage | Bullion | <69 | 69 | 70 |

|---|---|---|---|---|---|

| 1986 | 5,393,005 | 35 | 45 | 66 | 220 |

| 1987 | 11,442,335 | . . . | |||

If you have another idea, please leave it as a comment below.

Stop me if you’ve heard this before…

Some like gold. Others like copper. I like silver.

Since 1986, I have been collecting American Silver Eagle Proof coins. It is a collection my later father started for me and, until 2019, purchased the individual proof coins. I supplemented the collection with the special sets that the U.S. Mint issued, but it is a nearly complete set of proof coins in their original government package.

Although I have to find the 1995-W anniversary set for the elusive 1995-W American Silver Eagle, I have been trying to keep the collection up to date. It is why I hung up on a business call to make sure I was logged in to the U.S. Mint website to purchase the Reverse Proof Two-Coin Set.

By 11:58 AM, I was on the page for the set. As the time counted down to noon, I refreshed the page waiting for the Add-to-Bag button.

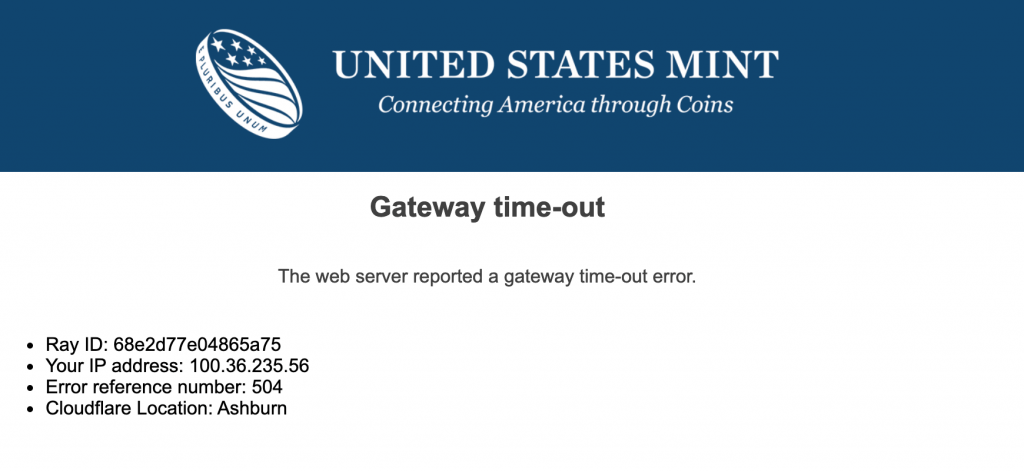

I am probably not the only one pushing the refresh button two minutes until noon. Until the Add-to-Bag button appeared, the system was responsive. Of course, the page was likely cached by Cloudflare or my ISP (Comcast), but it was responsive. At the stroke of noon, all that ended.

The first thing we notice is that someone rebranded the Cloudflare gateway error page. Although I do not have inside information, I would bet that Cloudflare told the U.S. Mint to make it so that they don’t get blamed.

I wonder if Cloudflare demanded the U.S. Mint rebrand their gateway error page so that they don’t get the blame?

Another change is the HTML file that appeared as a text file. Under Safari, the file type kept downloading the information to my Downloads folder. Under Firefox, one of the systems in the chain treated me to a small HTML file.

Somehow, a set made it into my bag, and I made it to the checkout page. I couldn’t use my stored credit card because I would see the Bad Gateway error. The card was next to me, and I furiously typed.

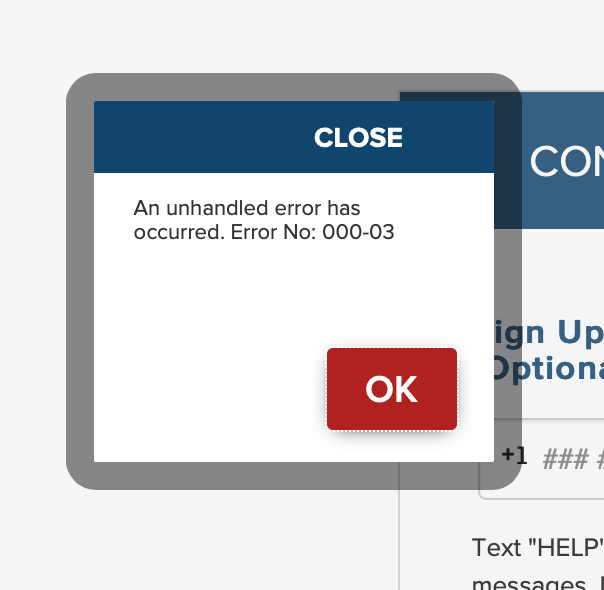

Suddenly, there was a new error. I don’t know what it means, but the U.S. Mint’s programmers did not know how to handle that error. How do I know that? The error message provided said so.

This is a new error. In my days as a programmer, we would be chastised for this type of error message!

According to several reports, the website crashed at the beginning of the process. It was difficult to tell, but the U.S. Mint admitted there were problems. They announced that there were products available at 1:19 PM on social media.

We are starting to see more orders successfully come in via our website. If you had issues ordering 21XJ we encourage you to try your purchase again. https://t.co/LPQedjAoDl

— United States Mint (@usmint) September 13, 2021

After stubborn persistance, I received the confirmation of my order at 12:48 PM.

I asked the U.S. Mint for comment. I will let you know what they say.

Weekly World Numismatic News for September 12, 2021

According to Coin World, the coins have several issues, but the primary problem is that the U.S. Mint has not shipped any coins. How can you buy a coin that the manufacturer has not shipped?

Another scam you can find on eBay is that some sellers are offering MS-70 coins for “pre-sale.” How can a seller sell a coin graded MS-70 that has not been released or graded by the grading service? How will these sellers guarantee that the coins they receive from the U.S. Mint will grade MS-70 unless they pay off the grading service?

I know many collectors want to add these coins to their collection. You may want to wait until the coins are issued, the grading services see the coins in hand, and the suckers get out of the market. If you want to see what I mean, look at the 25th Anniversary American Silver Eagle Set. After they were released, the prices climbed to $500-700 with limited availability. Although the price numbers have not changed, the value of $500 is less than in 2011 and is generally available.

And now the news…

→ Read more at smithsonianmag.com

→ Read more at smithsonianmag.com

→ Read more at indianexpress.com

→ Read more at indianexpress.com

Weekly World Numismatic News for September 6, 2021

Welcome to the Labor Day Edition of the Weekly World Numismatic News!

The story that caught my eye is that the members of Accredited Precious Metals Dealers (APMD) of the Professional Numismatists Guild (PMG) predicted their end-of-year prices for precious metals.

The story that caught my eye is that the members of Accredited Precious Metals Dealers (APMD) of the Professional Numismatists Guild (PMG) predicted their end-of-year prices for precious metals.

According to the APMD members, the year-end predictions are as follows:

- Gold: $1,897

- Silver: $28

- Platinum: $1,153

Their estimates are the “mean averages of price predictions made by 25 accredited dealers” of the APMD. Members of the APMD “based their forecasts on years of being on the front lines of the bullion markets.” In other words, their predictions are as reliable as those that predict the pro football and basketball drafts.

With all due respect to the APMD and their members, every forecast I have heard while carefully watching the markets as a buyer has been bullish. It is very rare to hear anyone that is involved with this market make a bearish prediction.

Let’s have some fun with this. In the next few days, I will make my predictions along with the logic behind my prediction. Then I will create a graph to monitor the markets compared to our predictions. Let’s see how we do after the market closes on December 31!

And now the news…

→ Read more at haaretz.com

→ Read more at haaretz.com

→ Read more at goodmenproject.com

→ Read more at goodmenproject.com

→ Read more at poconorecord.com

→ Read more at poconorecord.com

→ Read more at timesofindia.indiatimes.com

→ Read more at timesofindia.indiatimes.com

→ Read more at cbc.ca

→ Read more at cbc.ca