April 2020 Numismatic Legislation Review

Although the calendar passed May the Fourth (be with you) and Cinco de Mayo, the days are running together that the one thing I forgot was the end of April. Days are blurring together to the point that I forgot that Thursday was senior day at some local stores. I do not mind the label of a senior citizen. It means that I survived to wear that moniker.

Although the calendar passed May the Fourth (be with you) and Cinco de Mayo, the days are running together that the one thing I forgot was the end of April. Days are blurring together to the point that I forgot that Thursday was senior day at some local stores. I do not mind the label of a senior citizen. It means that I survived to wear that moniker.

So that I can correct this senior moment, it is time to talk about the one numismatic-related bill introduced in the House of Representatives in April.

H.R. 6555: United States Semiquincentennial Quarter Series Act

The United States Semiquincentennial Quarter Series Act (H.R. 6555) would create a five quarters program to celebrate the U.S. Semiquincentennial (250 years) in 2026. If the bill passes, the U.S. Mint will “issue quarter dollars in 2026 with up to five different designs emblematic of the United States semiquincentennial. One of the quarter dollar designs must be emblematic of a woman’s or women’s contribution to the birth of the Nation or the Declaration of Independence or any other monumental moments in American History.”

According to the bill, the Secretary “may” mint “$1 coins with designs emblematic of the United States semiquincentennial.”

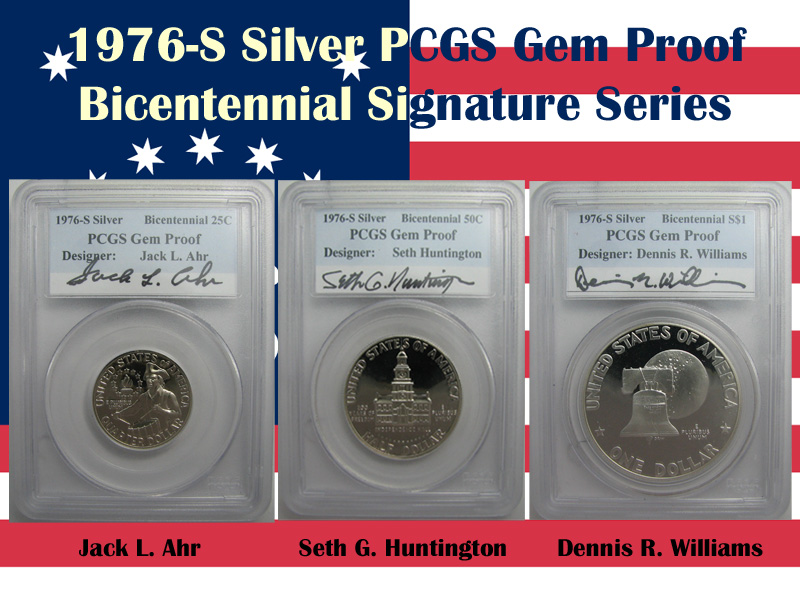

H.R. 6555 takes a different approach than the Bicentennial coinage. For the Bicentennial, the program lasted two years, 1975-1976. The coins were dated 1776-1976, and the reverse of the quarter, half-dollar, and dollar coins were redesigned. The previous designs returned in 1977.

The country is busy with other issues rather than being concerned with the nation’s semiquincentennial. But it is nice to think about a celebration than the worries we are going through today.

You Want a Gold Standard?

In recent months, there has been a call to either push for a gold standard or watch as states introduces bills coin their own money in response to the economy. On the extreme, Rep. Ron Paul (R-TX) introduced a bill that proposes repeal legal tender laws that will essentially bring the country back to the chaos of the United States pre-constitutional economies. Many of these arguments are interesting with some good and bad ideas, but they do not take into consideration issues of basic math.

If a proposal to move the United States to either a gold, silver, or bi-metal standard passes, we will probably see the biggest economic contraction in history because there is not enough gold or silver in the country’s storage in order to cover the total money supply.

First, in calculating the country’s value of gold and silver holdings, we find that according to the 2010 United States Mint Annual Report [PDF], there are 245,262,897 troy ounces of gold stored in the United States Bullion Depository in Fort Knox, Kentucky. This amount has not changed in recent memory. In the Mint facility at West Point, nicknamed the “Fort Knox of Silver,” the country owns 7,075,171 troy ounces of silver. But what they worth?

Determining the worth of the metals in storage is an interesting exercise. If we valued the government’s total holdings in accordance with statutory requirements, gold is valued at $42.22222 per fine troy ounce (see 31 U.S.C. § 5117(b)) and silver is values at least $1.292929292 per fine troy ounce (see 31 U.S.C. § 5116(b)(2). Although these values are much lower than what the markets value these metals, when the federal government counts its assets, gold and silver is based on numbers written into law.

Valuing these metals based on their market value, gold is worth $1,514.20 per troy ounce and silver is $35.16 per troy ounce (New York prices when the market closed on May 20, 2011). These values significantly raise the value of the government’s holdings. Using these numbers we can calculate the United States’ total holdings as:

| Gold Statutory Value | Gold Market Value | Silver Statutory Value | Silver Market Value | |

|---|---|---|---|---|

| Inventories (troy ounces) | 245,262,897 | 245,262,897 | 7,075,171 | 7,075,171 |

| Valuation per Troy Ounce | 42.2222 | 1,513.20 | 1.292929292 | 35.16 |

| Total Value (in millions) | $ 10,355 | $ 371,205 | $ 9,148 | $ 247,985 |

| Total Statutory Value: | $ 10,365 million |

| Total Market Value: | $371,453 million |

This means that the amount of money the economy can have is over $371 billion. This seems reasonable until we look at the total amount of money that in economy.

Economists have several ways of calculating the money supply in an economy. The Federal Reserve used M1 and M2 as their basis of analysis. M1 is a narrow measure of money’s function as a medium of exchange. In other words, it is the purchase power of all liquid or near liquid assets. M2 is a broader measure that reflects money’s function as a store of value. For the Federal Reserve, M1 is basically the supply of ready cash. M2 consists of M1 plus other deposits that are not as readily available, such as savings and retirement accounts. The economists at the Federal Reserve are constantly updating these numbers to determine how well the economy is doing.

According to the Money Stock Measures published by the Federal Reserve on May 19, 2011, at the end of April 2011, the seasonally adjusted M1 money supply was $1,901 billion meaning that there is just under $2 trillion of ready cash in the economy. The M2 money supply, the count of all cash, is $8,945.7 billion.

When calculating what is needed to back the United States currency with precious metals, this is where basic mathematics shows the potential failure of the policy. If such a policy requires the instant conversion of all ready cash (M1) to be backed by metals, only the first $371 billion of the nearly $2 trillion could be converted. In other words, in order to back every dollar with the country’s store of metals, we are over $1.6 trillion dollars short. To cover the entire money supply (M2), there is a $7.2 trillion shortfall. Simply, there is only enough gold and silver to cover about 5-percent of all cash and equivalents in the United States economy.

In order to break even on the conversion, the country would either have to acquire precious metals on the open market, issue $7.2 trillion in bonds that had to be backed by precious metals to a world that does not have those kind of assets, or find a way to revaluate the dollar so that the total money supply can be covered by the $371 billion in physical assets.

And this only covers current assets. It does not account for any growth!

Regardless of how the metals advocates justify their positions, it would be impossible to back the entire economy with down payment of 5-percent.

The Revival of the Paper v. Coin Debate

Last March, the Government Accountability Office, the investigative research arm of the legislative branch, issued a report with the alliterative title “Replacing the $1 Note with a $1 Coin Would Provide a Financial Benefit to the Government” (GAO-11-281 [PDF]). The report opens by saying that “According to GAO’s analysis, replacing the $1 note with a $1 coin could save the government approximately $5.5 billion over 30 years. This would amount to an average yearly discounted net benefit—that is, the present value of future net benefits—of about $184 million.”

In 2008, I posted a similar analysis of the benefit of using “Paper v. Coin Dollars” with the political reasons of that time as to why the paper dollar would continue to be printed. Although the political landscape have changed, the will of the politicians to make this change does not exist.

Last month, a coalition that includes Brink’s, Inc., independent car wash operators, and public transportation officials responded against the GAO report citing the alleged logistical issues and increased costs in handling a dollar coin versus paper.

On their side opposing the sole use of a $1 coin is the Department of the Treasury and the Federal Reserve. They cite the differences in the weight and the public’s attachment to the paper dollar. In a USA Today/Gallup poll conducted in 2006 found that while 54-percent thought the Presidential $1 Coin thought the program was a good idea, 79-percent said that they do not want the coins to replace the paper dollar.

On their side opposing the sole use of a $1 coin is the Department of the Treasury and the Federal Reserve. They cite the differences in the weight and the public’s attachment to the paper dollar. In a USA Today/Gallup poll conducted in 2006 found that while 54-percent thought the Presidential $1 Coin thought the program was a good idea, 79-percent said that they do not want the coins to replace the paper dollar.

The political and economic environment has change. The GAO’s report bolstered the Dollar Coin Alliance, who has reportedly spent $250,000 to lobby congress since December. With the emphasis on the budget, a plan to find ways to generate revenues with little political risk has the concept of eliminating the paper dollar being taken seriously. This has the anti-coin dollar coalition worried.

The political and economic environment has change. The GAO’s report bolstered the Dollar Coin Alliance, who has reportedly spent $250,000 to lobby congress since December. With the emphasis on the budget, a plan to find ways to generate revenues with little political risk has the concept of eliminating the paper dollar being taken seriously. This has the anti-coin dollar coalition worried.

Another factor working against the anti-coin dollar advocates is the loss of a major ally in congress. The late Senator Ted Kennedy (D-MA) did not want to see the paper dollar eliminated because it would hurt the Dalton, Mass. based Crane & Co.. Crane is the sole supplier of currency paper that the Bureau of Engraving and Printing uses to produce the one dollar note. John Olver (D-MA) represents the the Massachusetts First Congressional District that includes Dalton.

Although the political environment favors the elimination of the paper dollar, the risk adverse members of congress will look at the 2006 poll and probably not vote to eliminate the paper dollar. Unless key congressional leaders agree that ending the printing of the one-dollar note is in the best interests of everyone, including their political careers, the political reality is that printing of the dollar note is here to stay.

Dollar note image courtesy of the Bureau of Engraving and Printing

Dollar coin image courtesy of the U.S. Mint

Gettysburg Quarter Ceremony Video

Catching up a bit, the U.S. Mint introduced the first 2011 coin in the America the Beautiful Quarters Program to honor Gettysburg National Military Park. The event was held at the park’s Museum and Visitor Center and was hosted by U.S. Mint Director for Sales and Marketing B.B. Craig; Gettysburg National Military Park Superintendent Bob Kirby; and Barbara Finfrock, vice chair of the Gettysburg Foundation.

The Battle of Gettysburg, the Union victory in the summer of 1863 that ended General Robert E. Lee’s second and most ambitious invasion of the North, was a turning point in the Civil War. Often referred to as the “High Water Mark of the Confederacy,” it was among the war’s bloodiest battles. It also provided President Abraham Lincoln with the setting for his most famous speech. Established by concerned citizens in 1864, the Gettysburg Battlefield Memorial Association set out to preserve portions of the battlefield as a memorial to the Union troops that fought in the battle. In 1895, the land was transferred to the federal government and Gettysburg National Military Park was established.

The following is the B-Roll video from the quarter’s release:

Video courtesy of NewsInfustion

Collect What You Like

Numismatics is the collecting and study of items used in the exchange for goods, resolve debts, and objects used to represent something of monetary value. The dominant area of numismatics is the collection and study of legal tender coins with United States coins being the most collected. But numismatics is more than collection coins. It includes the collecting and study of:

- Exonumia—the study of tokens, medals, or other coin-like objects that are not considered legal tender. Those involved in exonumia collect elongated and encased coins, badges, counterstamped coins, wooden money, credit cards, and the like. Military medals are also collected as exonumia. And do not forget Love Tokens and Hobo Nickels, former legal tender coins with special engravings and carvings.

- Notaphily—is the study and collection of banknotes or legally authorized paper money. Notes can be collected by topic, date or time period, country, paper type, serial number, and even replacement or star notes (specific to the United States). Some consider collecting checks part of notaphily. Checks are collected by issuing bank, time period, and the signature.

- Scripophily—is the study and collection of stock and bond certificates. This is an interesting subset of numismatics because of the wide variety of items to collect. You can collect in the category of common stock, preferred stock, warrants, cumulative preferred stocks, bonds, zero-coupon bonds, and long term bonds. Scripophily can be collected by industry (telecom, automobile, aviation, etc.); autographs of the officers; or the type of vignettes that appear on the bonds.

I bring this up because a friend was asking about what to collect. He was under the impression that numismatics were coins only. I explained it was more than coins—it is anything that represents money or money-like items or even medals that represent worth. This is how military medals are considered part of numismatics. A medal representing the achievement shows the worth of the soldier as a warrior.

Showing him my collection, I showed how I have items that cover all of the areas of numismatics. New York City subway tokens and various medals are all part of exonumia. My recent interest in Maryland colonial currency and the purchase of some of the special collectibles from the Bureau of Engraving and Printing are part of notaphily. I cannot forget my small collection of stock certificates that represent the railroads in the original Monopoly game is a modest dive into scripophily.

I told my friend like I tell everyone else: why collect what everyone else collects. I collect what I like. I collect based on the “oh, neat!” factor. This is why I have a set of the Somalia Motorcycle Coins and looking for a set of the Somalia classic muscle car coins.

In other words, collect what you like and like what you collect!

Canada Goes Polymer, Why Not US?

This week, the Bank of Canada announced that they will be converting their banknotes from paper to using the polymer substrate. The Bank of Canada will begin to issue C$100 notes in November 2011. A C$50 note will be issued in March 2012 and the remaining denominations (C$20, C$10, and C$5) will be issued in 2013.

The polymer “paper” was developed by the Reserve Bank of Australia to enhance the durability of the notes and to incorporate security features not possible with paper or rag-based paper. RBA has been distributing polymer notes since 1992. While the polymer substrate costs little more and the production is only marginally more expensive, the benefit will come from the reduction in counterfeiting and the durability of the note. Polymer will last three-to-six times longer than rag-based paper.

On April 21, 2010, the government unveiled the new $100 note design. The new note, still made of rag-based paper, would incorporate new security features such as a different use of color shifting ink and a 3-D security ribbon. The note would continue to use security features first introduced in U.S. currency in 1996. The new notes were scheduled to be issued on February 10, 2011.

However, on October 1, 2010, the Federal Reserve announced that the issue of the redesigned $100 note will be delayed. It has been reported that the notes are folding during the printing process making a number of them unusable. It was further reported that the BEP is working with its paper provider, Crane & Co., to fix the issue.

I had asked a BEP Media Relations representative about the status of the new notes. I was told there was no additional information available.

With the new $100 note having printing problems, why has the BEP not looked into using the polymer substrate for U.S. currency? Why does the Federal Reserve, BEP, and Secret Service cling to 19th and 20th century printing technologies in the 21st century? Or is this a matter of “not invented here” to avoid alleged controversy by using a something invented by a foreign central bank?

It may be time for the Federal Reserve, BEP, and Secret Service to face reality that the old ways of doing things are not working and to look to the future for something better.