Jul 30, 2022 | advice, coins, education

The ad appearing on Facebook

(click image to see a larger version)

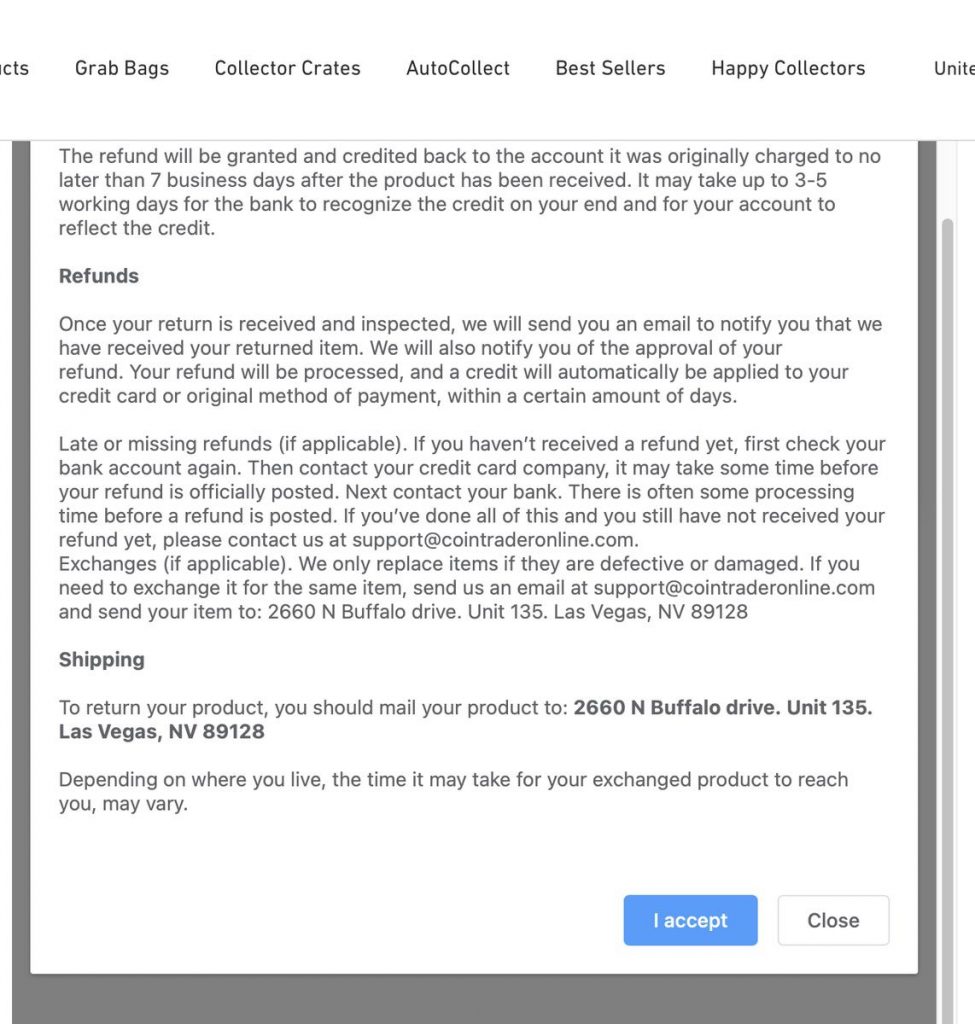

A site called cointraderonline.com (I purposely did not make it a link; please do not visit the site) began advertising heavily on Facebook. The ad, whose image appears here, says that the purchaser will buy a “US Vault Bag” that is “Packed With Unsearched US Coins.” The ad and the site say that there is a 60-Day Return policy.

I have been advising people not to purchase from this site. Unfortunately, some did not seek advice before purchasing. When they received their bag, the results were less than satisfying.

Buyers of the Vault Bags report that they received bags that contain at least 50-percent copper coins with the rest common silver coins. Buyers describe the coins as being heavily circulated, some with scratches and dings, along with very worn and dateless Buffalo Nickels. Although the owner of this site may not have searched the hoard they used to fill the bags, the product appears to lack key or semi-key dates and higher-grade material based on reports from several people.

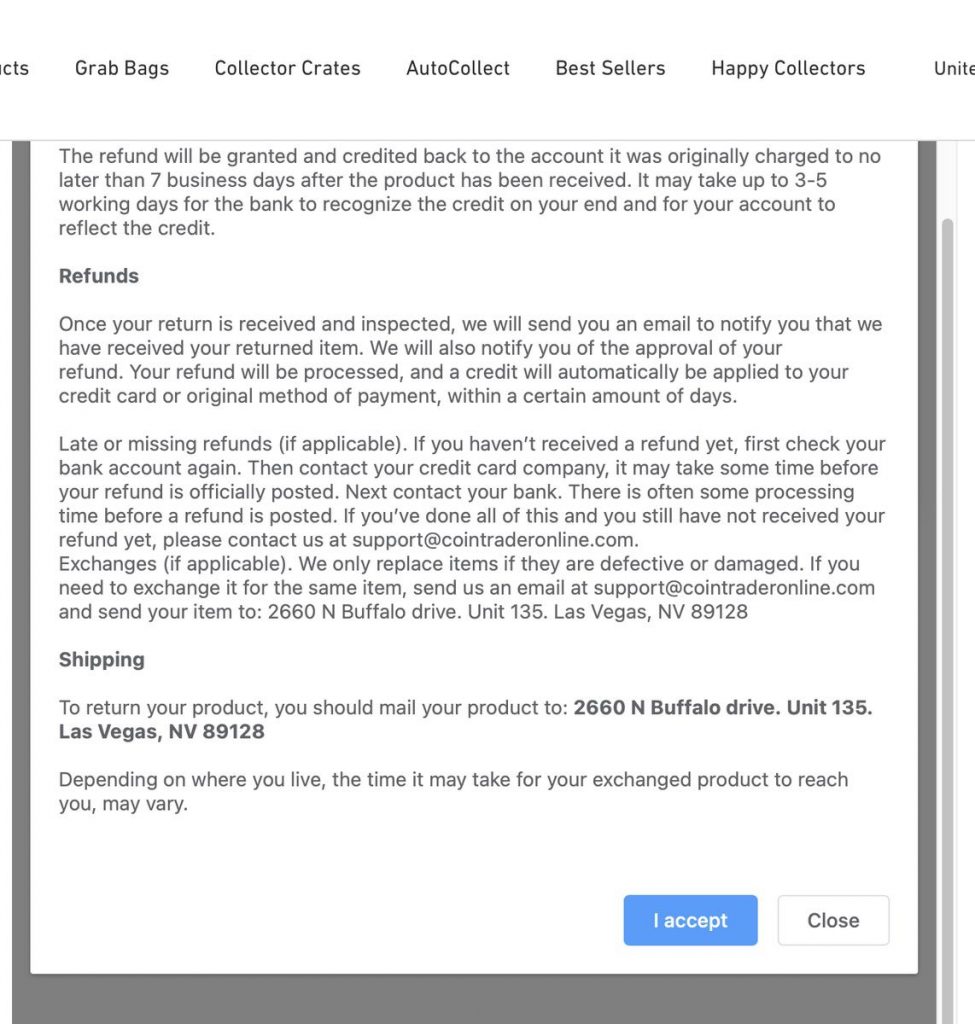

One person tried to return the coins on their 60-day return policy. The buyer mailed the coins to a Las Vegas address with tracking from the US Postal Service. The package was delivered, but the person did not receive a refund.

Refund policy page containing the address to a Las Vegas-area apartment.

The Investigation

Finding information about the company from their website was difficult. The “About Us” page contains very little useful information about the company. Still, the page uses a few images from elsewhere on the Internet. A random sample of images found several duplicates on other sites using a Google Image search. Many are stock images that the web designer could have purchased from legitimate sources. However, the number of images used to make the website pretty without being functional is an area I find concerning.

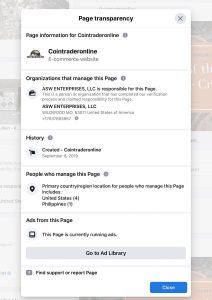

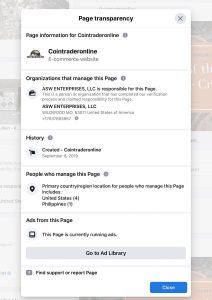

Facebook’s Page Transparency section

(click image to see a larger version)

One tool Facebook provides is a “Page Transparency” section. You must go to the company’s main page to find the information. According to the information on the page, Facebook reports that “ASW ENTERPRISES, LLC” was verified as responsible for the page. ASW Enterprises is in Wildwood, Missouri, with a telephone number that has a 703 area code. The 703 area code maps the Northern Virginia suburbs of Washington, DC.

Hotfrog, a collector of business information, has the phone number listed on Facebook on record but also a St. Louis-area telephone number.

The information found at Hotfrog

Using the St. Louis-area telephone number, a reverse search found a listing at hub.biz for an address in Baldwin, Missouri. The address is for a 4 bedroom, 4 bathroom, 2880 square foot home that Zillow says is worth $576,300 with what looks like it has a three-car garage. I wish I had a three-car garage!

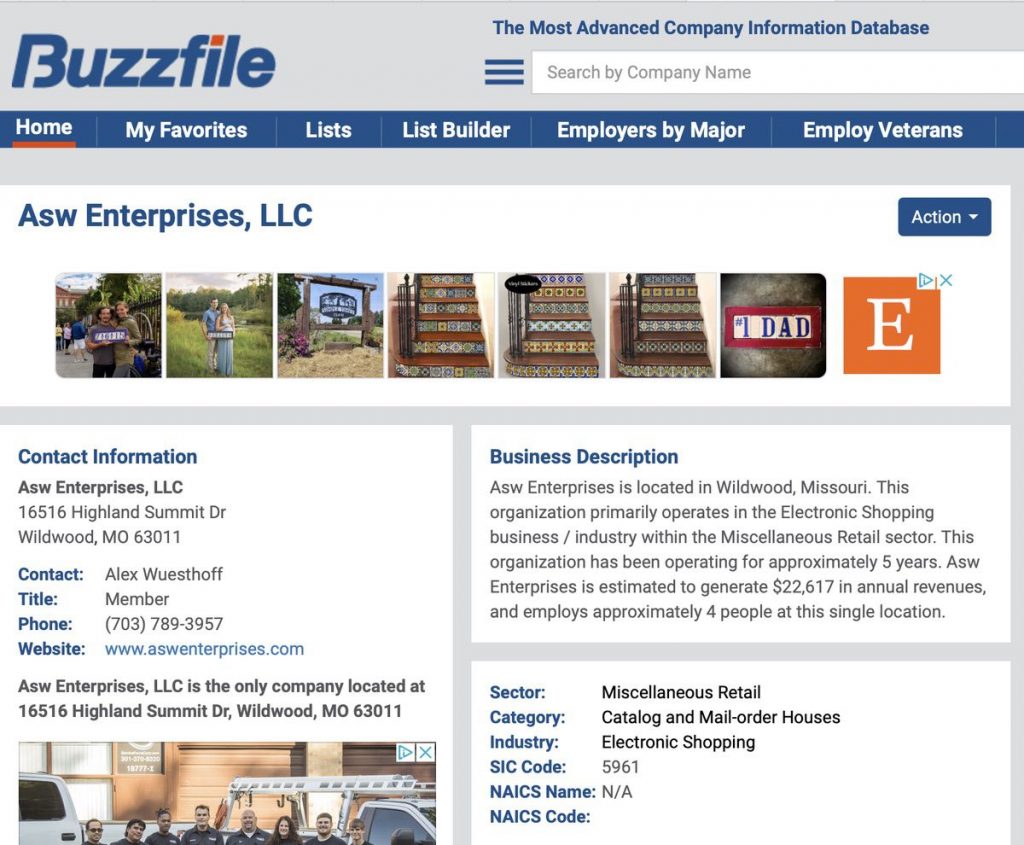

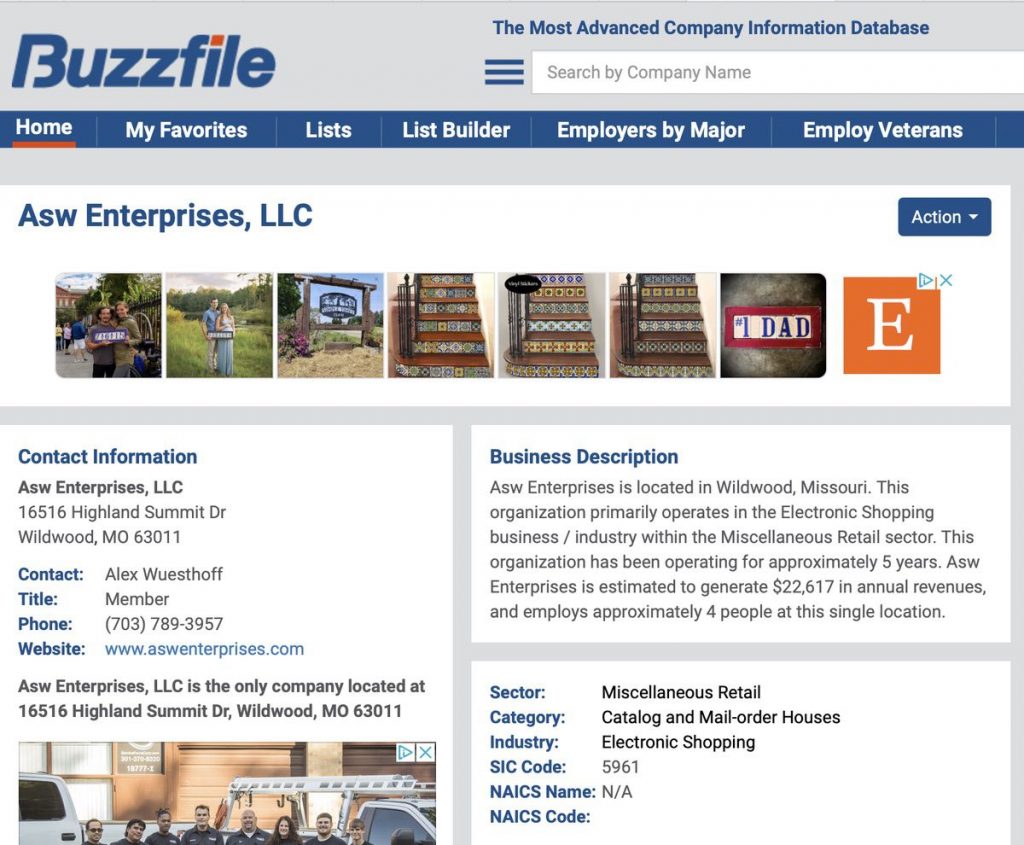

A reverse lookup of the address and telephone number finds information about ASW Enterprises on Buzzfile. This information provides a person’s name that, when plugged into the ANA Dealers” directory, does not find a record. Although the site says that this person/business is a member of the ANA, he is not listed as a registered dealer in the ANA database they use for the Find a Dealer page.

Buzzfile provides addresses and telephone number.

The website on the Buzzfile page is for a company selling preparation materials for a Texas-based spelling competition. There is every indication that the website has nothing to do with the cointraderonline.com business.

The About page also says they are a National Silver Dollar Round Table member. Neither the company name nor the name of the person listed as the principal of ASW Enterprises is listed on the NSDRT membership page. I did not consult with the Certified Collectors Group (NCG/PCGS) to verify the membership claim.

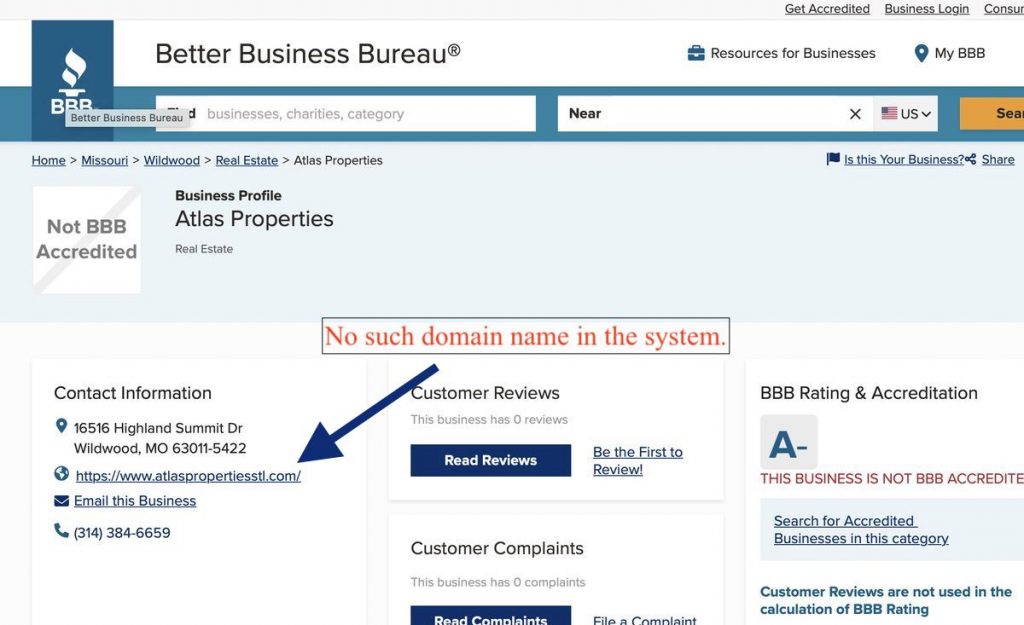

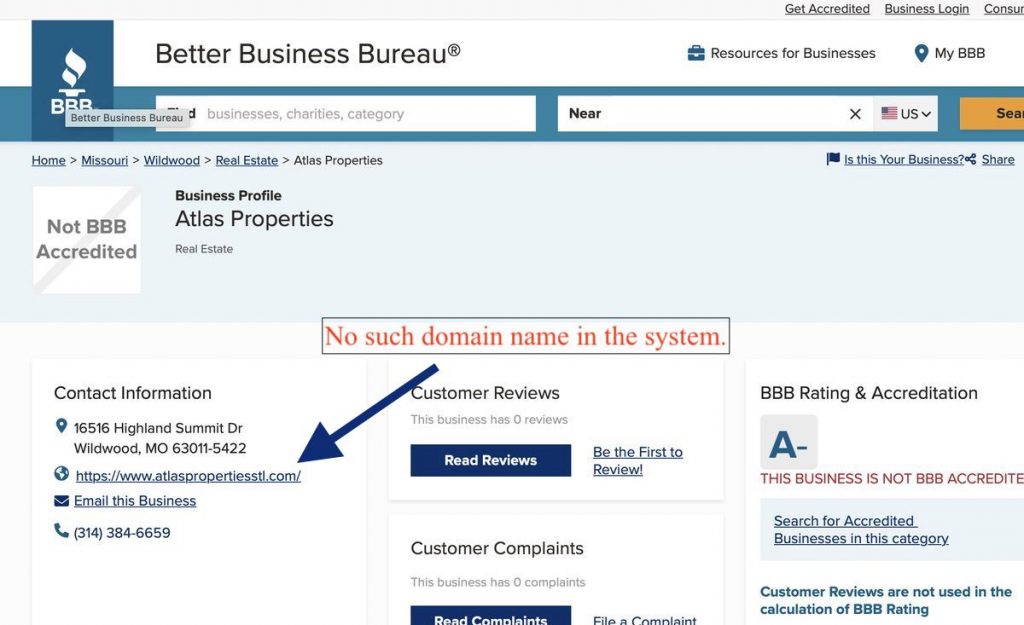

Finally, a reverse search of the person’s name suggests that this is not his only business venture. A Better Business Bureau entry suggests he is also involved with real estate. The finding was supported by a posting to a public message board looking for fellow investors in the St. Louis area.

The Better Business Bureau has a listing that includes a bogus website name.,

There appears to be no connection between the owner listed on the Facebook Page Transparency page and the operation in Las Vegas.

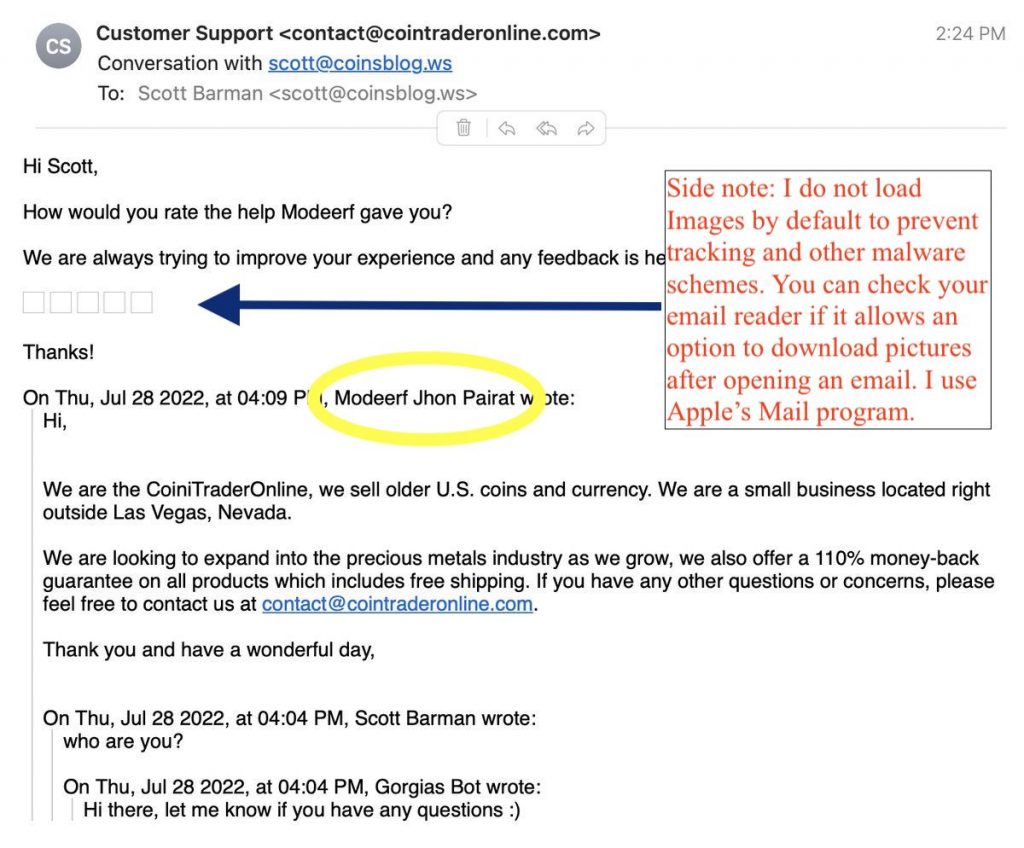

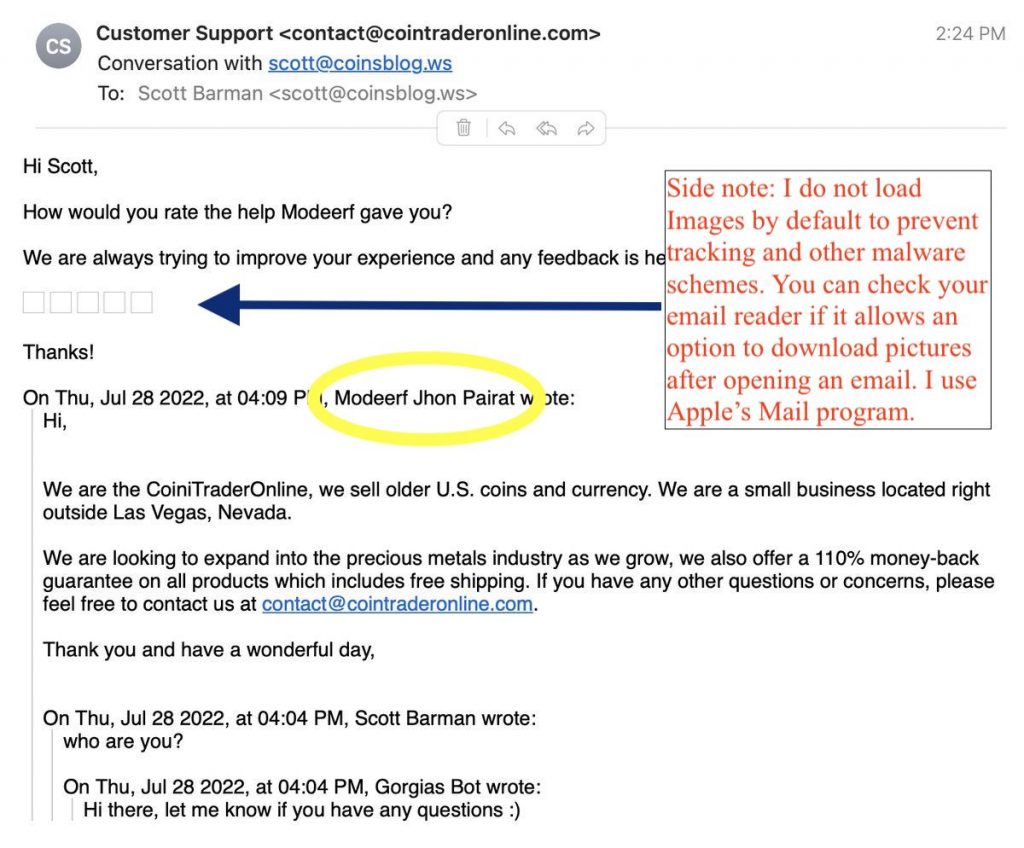

I tried to send a message to the site owner via the chat option on the website. After receiving a response via email, I asked several follow-up questions that have been unanswered at this point. If they answer my questions, I will add the information here and in a new post.

I received an automated message from their system. It was formatted as a reply and included the name of the person that replied to my chat request. When I looked up the name in the email, I found public interactions of someone from the Philippines.

The email telling me who my correspondence is with.

Having a support contract with someone offshore should not raise a concern. Still, when the return address is Las Vegas, and the company’s background information leads to the St. Louis area, it creates concern.

Should You Buy From this Site

My investigation suggests that the person behind the site may be an inexperienced young adult. The diverse information indicates that he is trying to find a way to earn a living. However, he must understand that online sellers have cheated too many coin collectors and that he should opt for transparency rather than pretty pictures on a website.

If you want to support someone trying to start a business, you may want to buy from this company. However, reports suggest that you will not receive value for your money.

Why Publish The Investigation Detail

An old proverb says, “Give a Man a Fish, and You Feed Him for a Day. Teach a Man To Fish, and You Feed Him for a Lifetime.” Rather than providing my opinion, showing you how to investigate sites you are unsure about will help you fight online fraud.

Scams with online shopping are a problem beyond numismatics. Although legitimate small businesses are selling online, there are many scammers. The above processes can help you investigate someone before spending your money.

Suggestions for Small E-Commerce Businesses

For small businesses, I would highly recommend that you be as transparent as possible. You should publish contact information and respond as quickly as possible. Let your buyers know a little about you. Who are you, and why are you in the business? Do you have a passion for what you are selling? Do you have a compelling story about why you are in business? I understand you are communicating with customers, but customers also want to have a connection with the people they do business with.

You have to generate a sense of trust with the customer, which gives you an advantage over a large online retailer. Give me a reason to trust you over the next-day shipping behemoth, and I could become a regular customer. Let the customers know they will deal with another person, not a big corporation riding down a South American river.

Finally, pretty websites are nice but if you are going to use stock photographs, use them sparingly. Stock photographs of coins, people supposedly looking the part they playing on your page might look good, but they come off as fake and as valuable as a cleaned coin. Do not fill up a page with images. Clear, concise, and accurate information is better than pictures.

“Let’s be careful out there.”

Feb 14, 2022 | advice, Eagles, education, scams

RANTHY<dot>COM IS A SCAM

Two counterfeit American Silver Eagles purchased from a company based in China who advertised on Facebook.

NO LEGITIMATE DEALER IS SELLING BULLION COINS FOR BELOW THE SPOT PRICE!

The current price of silver is $23.86 per troy ounce. If anyone is selling American Silver Eagles for less, they are likely selling counterfeit coins.

Questions about the site sent today noted that the scammers advertised these coins on Facebook.

These scammers are not selling 2022 American Silver Eagle counterfeits because the Chinese manufacturers of the fakes have not created bogus Type 2 reverses. Remember, legitimate dealers will sell coins with the Type 1 reserve. They will also sell the coins with the Type 2 reverse.

IF YOU PURCHASED COINS FROM THESE SCAMMERS, contact your credit card company and dispute the charge. If you received the coins and they are counterfeit, contact your credit card company and dispute the charge.

IF THERE ARE ANY QUESTIONS ABOUT A WEBSITE, THEN DON’T PURCHASE FROM THEM!

Dec 16, 2021 | advice, coins, counterfeit

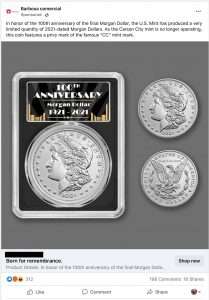

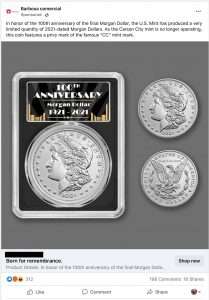

Advertisement for fake Morgan Dollars from Facebook

Within the hour, I found ads for three different scammers trying to sell 2021 (CC) Morgan Dollars with images in a PCGS slab for $19.95.

First, you cannot trust any of the pictures. All of the pictures were copied from around the Internet, including the PCGS sample slab. These pictures appear in many places when performing an image search. Some of the images are edited versions from the U.S. Mint’s website.

When I entered the serial number on the image of the slab on the PCGS website verification form, they reported it as an invalid number.

No legitimate merchant will sell a newly released coin below the introduction and spot prices. The U.S. Mint sold the coin for $85 each, and the spot price closed at $22.13 today. Anyone selling a highly desirable coin for $19.95 is trying to scam you.

Within an hour, Facebook sent a report saying that they reviewed my reports from the ads. Facebook removed all of the ads. But I know this is a case of whack-a-mole, and more ads will appear soon. I encourage anyone using Facebook to report these ads when they appear on your timeline. If we work together, we can limit the impact of these scammers on the hobby.

Jul 31, 2020 | advice, counterfeit, education, news

Want more information about American Eagle Coins?

The Coin Collectors Handbook: American Eagle Coins has more information and is fully illustrated. Read more →

here;

Two counterfeit American Silver Eagles purchased from LIACOO, a company based in China.

- The scammers are in Shenzen, China

- It may be more than one person behind the scam, but they are working together.

- There appears to be a pocket of these scammers in the Middle East. Early analysis suggests they are in Doha, Qatar.

- All email addresses are either on Gmail or use Google’s professional services that allow Gmail to look like a real domain.

- Any of these sites that have a U.S.-based telephone number are using burner phones. For those not familiar with the term, a burner phone is one on a pay-as-you-go plan. The phones are cheap, easily disposed of, and are difficult to trace.

- Any of these sites that use a U.S.-based physical address use a dropbox service from a logistics company. The dropbox service is a locker that the company pays as a way to manage shipping remotely. There are legitimate uses for these dropbox services, but these scammers use them to make it look like they are located in the United States.

- The scammers are using branded gift cards to pay for these services.

While investigating these sites, I learned that there are five tips that, if followed, you will avoid being scammed.

- NO LEGITIMATE DEALER IS SELLING BULLION COINS FOR BELOW THE SPOT PRICE!

The current price of silver is $23.43 per troy ounce. If anyone is selling American Silver Eagles for less, they are likely trying to sell counterfeit coins.

- IF THE DEAL IS TOO GOOD TO BE TRUE, IT LIKELY IS NOT A GOOD DEAL!

When purchasing bullion and coins from dealers, the price between the spot price and the price the dealer will sell the coins for is called the spread. The spread can change based on inventory, availability, and other market forces. It is rare when the spread is less than 5-percent. Some of the largest dealers will lower their spread for their better customers or as a special to lure other customers. A good deal is when the spread is less than 5-percent. However, the spread is rarely less than 2-percent. If a legitimate dealer sells metals for less than 2-percent over the spot price, that is a good deal. These companies are not in business to lose money. Be very worried if someone is trying to sell bullion coins for less.

- IF THE DEALER DOES NOT IDENTIFY THEMSELVES ON THEIR WEBSITE, THEY ARE LIKELY HIDING SOMETHING.

On every website that is likely selling counterfeit coins, they have a wonderfully written “About Us” page that says nothing. The Of the four websites that readers have sent to ask if they were legitimate, all of the “About Us” pages were copies. A web search using sample passages from the page yielded thousands of results.

- IF THE CONTACT PAGE DOES NOT HAVE LEGITIMATE CONTACT INFORMATION, THEY ARE LIKELY HIDING SOMETHING.

One of the indicators of a site owned by Chinese scammers is if they give you hours in HKT or Hong Kong Time. These scammers are not in Hong Kong but are in Shenzen, which is in the same time zone.

- IF THE SITE IS “POWERED BY SHOPLAZZA,” IT IS LIKELY A SCAMMER SITE.

Go to the bottom of any page. If there is a copyright statement followed by “Powered by Shoplazza,” then run away. Shoplazza is a newly created service out of China that seems to be a Shopify clone made by reading Shopify’s HTML. While looking at the HTML code, there are indications that the site was created quickly. During a quick look at three sites highly suspected of selling counterfeit American Silver Eagle coins, I was able to confirm that their sites are hosted on Shoplazza.

IF THERE ARE ANY QUESTIONS ABOUT A WEBSITE THEN DON’T PURCHASE FROM THEM!

Since my first post about these Chinese scammers, I have received at least five notes per week saying they bought ten coins from these websites. Everyone that received the coins and was able to weigh them found they weigh only 25 grams. A real American Silver Eagle coin should weigh 31.103 grams.

Yes, I bought two coins from one of the sites, but I did so for educational purposes. I suspected that these would be counterfeit, and I wanted the coins to learn more about them. I believe they are silver plated. As for what is under the silver plate, I have to wait until I can visit a dealer with one of those devices that can analyze coins.

Please do not buy from them.

-

-

The font for LIBERTY is too thin. Also, the stars in her flag draped over the shoulder are too small.

-

-

Aside from the rims being to thin, look at the U in United and the dash between SILVER and ONE. These are not correct for the 2020 ASE.

If you like what you read, share and show your support

Jul 6, 2020 | advice, coins, Eagles, news

Want more information about American Eagle Coins?

The Coin Collectors Handbook: American Eagle Coins has more information and is fully illustrated. Read more →

here;

Two counterfeit American Silver Eagles purchased from LIACOO, a company based in China.

THE COINS ARE COUNTERFEIT! FAKES!

I ordered the coins on June 4, the day I posted the article. The coins were shipped from China to California to New Jersey to my office. LIACOO used the services of Newgistics, which is now a subsidiary of Pitney-Bowes. By using a logistics company in this manner, they can hide behind the anonymity of the service.

Contacting Pitney-Bowes is nearly impossible. I left a very public message on Twitter. Let’s see if they respond.

When the coins arrived, I opened the package and started to examine the contents. The coins are in a slab-like holder similar to the Coin World holders but without the Coin World logo. At first glance, they look fine, and then a closer look revealed problems.

My first impression was that there are almost no rims on the coin. A closer look at the obverse, and the font is too thin for the LIBERTY around the coin. Then I turned the coin over to focus on the U in United. It is missing the tail on the right side of the U. I did not need to see any more to be convinced this was a fake coin.

-

-

The font for LIBERTY is too thin. Also, the stars in her flag draped over the shoulder are too small.

-

-

Aside from the rims being to thin, look at the U in United and the dash between SILVER and ONE. These are not correct for the 2020 ASE.

Finally, I removed the coin to weigh it. An American Silver Eagle is supposed to weigh just slightly more than one troy ounce because it is only .999 silver. Since my scale only measures grams to the tenths of ounces, it should have weighed 31.1 grams. It weighed 25 grams.

The coin is not magnetic.

I will investigate further, but I wanted to report my initial findings.

DO NOT BUY CHEAP EAGLES FROM RANDOM WEBSITES!

I bought these coins to prove my point. I knew I was potentially buying fakes. I spent less than $30 for education aids.

Unfortunately, two correspondents wrote to tell me they each bought ten coins from different dealers. They spent $19.95 per coin. Both lost over $200 with the shipping costs.

IF YOU CANNOT IDENTIFY THE DEALER, THEIR EXACT LOCATION, AND THEIR BUSINESS STATUS, THEN DO NOT BUY THEIR COINS!

LIACOO is a scam. It is a company based in China. DO NOT BUT FROM THEM!

May 24, 2020 | advice, bullion, markets, news

When talking about markets, the central theme is that investors hate instability. Whether the conversation is with the professional market maker or the individual investor, there is much uncertainty in the current marketplace.

When talking about markets, the central theme is that investors hate instability. Whether the conversation is with the professional market maker or the individual investor, there is much uncertainty in the current marketplace.

When equity markets become unstable, investors run to cash or cash equivalents. Cash equivalents include investments like bonds, especially those issued by stable governments. The other investment they run to is precious metals.

Gold is the primary safe-haven for investors. As a society, we have given this mineral an intrinsic value and trade it for a premium. With the panic of the U.S. Mint closing the West Point Mint for a short time, investors started buying platinum. The most popular form to purchase these metals is in coins where we saw the South African Platinum Elephant coins sell out its 2,000 coin production.

With the markets scrambling, it has opened up the door to scammers trying to cash in on the panic buying. Scammers use tactics like selling overpriced and overhyped coins, counterfeits, and not delivering coins after purchasing.

These scams are not new. Last year, the Accredited Precious Metals Dealer (APMD) program warned against scammers as the prices jumped. Unfortunately, the problem has only become worse.

Please do not fall for these scams. If you have any questions, contact a reputable dealer from the APMD, Professional Numismatists Guild (PNG), Industry Council for Tangible Assets (ICTA), or the American Numismatic Association dealer directories. You will be glad you did!

And now the news…

May 18, 2020

Nervous investors have been pouring into the gold and silver markets over the past two months. Money Metals Exchange is proud to have helped almost 20,000 new customers with a precious metals purchase in recent weeks, many of whom came over from other dealers struggling with inventory shortages and ridiculous delivery delays.

→ Read more at

fxstreet.com

May 19, 2020

While the covid-19 pandemic has had a negative effect on the platinum market — including price, demand and supply — results for Q1 2020 show the net effect is less than feared, and the outlook for 2020 is better than expected, according the latest quarterly report by the World Platinum Investment Council (WPIC).

→ Read more at

mining.com

May 21, 2020

Investors seeking a haven from the economic turmoil created by the coronavirus pandemic are snapping up platinum coins engraved with African wildlife.

→ Read more at

ca.finance.yahoo.com

May 22, 2020

Kakinada: Cyclonic storm Amphan may have caused heavy damage in parts of Odisha and West Bengal, but the rains it brought in its wake helped unearth a treasure trove of silver coins of British India era in a village in north coastal Andhra.

→ Read more at

timesofindia.indiatimes.com

May 6, 2020 | advice, books, education

Even as some areas of the country are easing quarantine restrictions, the best way to prevent the spread of COVID-19 is to stay home. Although the United States has 4.25-percent of the world’s population, it has 33.19-percent of the reported cases of the disease with a death rate of 5.77-percent.

Even as some areas of the country are easing quarantine restrictions, the best way to prevent the spread of COVID-19 is to stay home. Although the United States has 4.25-percent of the world’s population, it has 33.19-percent of the reported cases of the disease with a death rate of 5.77-percent.

The dangers of the novel coronavirus are not only to older people, who dominate the hobby, reports that younger people who may not have shown symptoms have experienced strokes. Even the youngest children are showing symptoms that resemble Kawasaki disease.

I know it is a financially and mentally tough situation. The business I worked hard to build was beginning to break through when Maryland ordered non-essential companies to close. When I am not working alone to organize a warehouse, I am finding solace in numismatics.

During the last few weeks, I have been reducing the to-be-read pile of books. But I am beginning to run out of books. I am looking for something different. Since I like history and tying history with numismatics, I am looking to learn something new. With a tight budget, I am also looking for something new that does not cost much.

I found four entries to my Quarantine Reading List that are interesting and have taught me something. The best thing about each of the books is that each is available online.

U.S. Mint Modern Era

Other than the formation of the U.S. Mint, there is no single seminal event that marks its history than the elimination of silver from circulating coinage. It is the dividing line between what is considered classical coinage and the modern era.

Other than the formation of the U.S. Mint, there is no single seminal event that marks its history than the elimination of silver from circulating coinage. It is the dividing line between what is considered classical coinage and the modern era.

When you find information about the era, it discusses the discussion and the result that created clad coinage. But when you dig into the policy, there is a bigger story. As with a lot of history, the details help us understand the road to where we are today.

The road to modern coinage began with changes in the laws and policies at the U.S. Mint. The one place that every law and policy announcement documented is in the “Annual Report of the Director of the Mint Fiscal Year June 30, 1965.”

What makes this over 300-page document interesting to read are the details that are no longer present in present-day Annual Reports. The text reprints congressional testimony, reports, announcements, policies, and the laws that affected the U.S. Mint. Since this report covers the last half of calendar year 1964 and the first half of calendar year 1965, it is ideally situated to document the government’s action from silver to clad coinage.

The first numbered page begins with the text of the Coinage Act of 1965.

For those that like charts and data, you can go to page 201 to read the section on “The World’s Monetary Stocks of Gold, Silver, and Coins in 1964.” It is a look at circulating coinage of the entire world for 1964. It is a fascinating view that the U.S. Mint stopped doing in 1972.

Download your copy of this Annual Report → here.

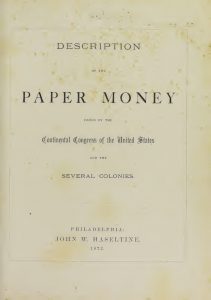

Colonial Currency

While looking for records about colonial currency, I stumbled on an electronic copy of Description of the Paper Money Issued by the Continental Congress of the United States and the Several Colonies by John W. Haseltine, published in 1872. Haseltine was a dealer, auctioneer, and cataloger of many collectibles, including coins. Many of his catalogs were sparsely illustrated, but the listings have proven invaluable.

While looking for records about colonial currency, I stumbled on an electronic copy of Description of the Paper Money Issued by the Continental Congress of the United States and the Several Colonies by John W. Haseltine, published in 1872. Haseltine was a dealer, auctioneer, and cataloger of many collectibles, including coins. Many of his catalogs were sparsely illustrated, but the listings have proven invaluable.

Paper Money Issued by the Continental Congress is one of those catalogs. Its contents are nothing more than lists of colonial currency issued in the 18th century. It is a useful reference for anyone with interest in the currency of that era. Download a copy → here.

If you want a colonial currency reference that is more extensive, you can download The Early Paper Money of America by Eric P. Newman → here.

Branch Mints and Gold Coins

Did you know that the Charlotte Mint was the first branch mint outside of Philadelphia? Authorized in 1835 following the gold strike at the Reed Gold Mine, it became operational in 1838. The Charlotte branch mint was closed when the building was seized in 1861 by the Confederacy during the Civil War.

Did you know that the Charlotte Mint was the first branch mint outside of Philadelphia? Authorized in 1835 following the gold strike at the Reed Gold Mine, it became operational in 1838. The Charlotte branch mint was closed when the building was seized in 1861 by the Confederacy during the Civil War.

When I wanted to learn more about the Charlotte Mint, I was pleasantly surprised to discover that Charlotte Mint Gold Coins, 1838-1861 by Douglas Winter is available to read online or to download. The book is an easy read with illustrations, and a catalog of the coins struck at the mint. You can find the book → here.

The branch mint in Dahlonega, Georgia, opened after Charlotte also to mint gold coins from a nearby gold strike. Dahlonega was also seized by the Confederacy in 1861 and did not reopened.

Gold coins minted at Dahlonega carry the “D” mintmark. Since Dahlonega only struck gold coins and gold coins were not struck in Denver, this has not been an issue. To read about the colorful history of this branch mint, read Gold Coins of the Dahlonega Mint 1838-1861, Second Edition, by Douglas Winter. The book is similar in format to Winter’s Charlotte book. You can find this book → here.

Gold coins minted at Dahlonega carry the “D” mintmark. Since Dahlonega only struck gold coins and gold coins were not struck in Denver, this has not been an issue. To read about the colorful history of this branch mint, read Gold Coins of the Dahlonega Mint 1838-1861, Second Edition, by Douglas Winter. The book is similar in format to Winter’s Charlotte book. You can find this book → here.

Winter did write books about the gold coins struck at the New Orleans and Carson City Mints, but I had not read either book at the time of this writing. These books and more free resources are available through the Newman Numismatic Portal.

Apr 23, 2020 | advice, education

Contrary to popular belief, you can put metal in your microwave oven. It will not make your oven explode or catch fire. But that does not mean it is a safe thing to do.

Microwaves work by shooting electrons at whatever it finds. The electrons create friction as it passes through the surfaces and generates heat. These electrons cannot pass through a metal surface. When you try to microwave metal, you will see sparks as the electrons skip over the metal surface.

Some chefs have discovered ways of using aluminum foil to direct the electrons to use the skipping electrons to add extra heat to one area of the food. As part of the process, the electrons speed up before finding someplace to go. Another technique is to cover areas to minimize the reaction.

Regardless of how you try to control the flow of electrons, they have to find someplace to go. The reaction is the basis of chemistry. A free electron looks to bond with an atom that has more protons than electrons. It balances the equation.

This basic science lesson is to help explain why you do not want to microwave your currency.

You might have heard that using your microwave oven would help kill the COVID-19 virus. Some research says it is plausible, but the idea is for food. If you have any questions about whether your takeout order is safe, put it in your microwave. You can also heat your food in an oven or on your stovetop. As long as you cook the food to over 140°F (60°C), you will kill most pathogens.

But what happens when you put money in your microwave? It will burn!

The Bureau of Engraving and Printing has produced currency notes with a security thread to thwart counterfeiting since 2003. The security thread is a thin ribbon of metal embedded into the currency paper. Hold the currency up to the light, and it will tell you what the denomination should be. On the $100 note, it is a wider strip with a distinct look.

When you microwave money, the electrons will strike the metal thread, pick up speed, and look for a place to land. The next softest material is the currency paper around the security thread. The increase in friction on the currency paper will cause the paper to burn.

Think of it like this: rub your hands together for a few seconds. You will feel your skin begin to heat. Now multiply your hand rubbing by the speed of an electron flying by, and the friction will burn your hands. That is what is happening to the paper.

If you do burn currency paper, bring all the pieces to your bank. The bank will exchange the notes for ones that are not burned and will send them back to the Federal Reserve for disposal.

CLEANING MONEY

First, if you are working with collectibles, DO NOT CLEAN YOUR COLLECTIBLE COINS AND CURRENCY! Cleaning collectible coins, currency, tokens, and medals will reduce their collector value. Just don’t do it!

There are many ways you can clean your circulating pocket change. You can wipe them with a disinfectant, including 70% rubbing alcohol or a household wipe that contains alcohol and Dimethylbenzyl Ammonium Chloride (Clorox and Lyson bleach-free wipes contain this chemical). Another method is to wash coins using warm water and a dish cleaning detergent. Finally, leave coins in your pocket when you wash your pants. The only problem with washing coins with clothes is the racket your dryer will make, and you may dent the drum. Currency may require a warm iron to make flat again.

Another method is using ultra-violet (UV) light.

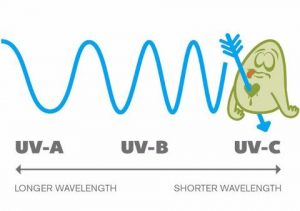

Image courtesy of Phonesoap, a smartphone cleaning device that uses UV-C light.

The short wavelength of UV-C light will penetrate cell walls and kill the DNA within the cells. We are protected from the Sun’s UV-C light by the Ozone Layer of the Earth’s atmosphere. By destroying the Ozone Layer, we let the Sun’s UV-C light penetrate the atmosphere increasing skin cancers.

While UV-C is altering your DNA to create cancers, it is also killing germs using the same properties to alter its DNA.

You can buy lightbulbs that generate UV-C light. However, if you create a UV-C disinfecting station, be careful. Shining UV-C light randomly will cause skin damage worse than a tanning bed. A tanning bed mixes the spectrum of UV light and filter most UV-C light. But a dedicated UV-C light is not good for your body.

Since UV-C light does not generate a lot of heat, you can create an enclosed disinfecting station using almost any material. One example is to create a box using poster board with the edges sealed with duct tape. Cut a hole in the top for the light and then seal the hole with the duct tape. Place your currency inside the box and leave it for 15 minutes.

If you spend a little more money, you could purchase a wall timer. Set the time for the light to turn on after you leave the room and to turn off 15 minutes later. Do not go into the room until the process completes.

There are commercially made devices made with sealed chambers and timers.

Finally, if you want the safest way to disinfect your money, place it in a plastic bag that seals. Close the bag most of the way. Leave about an inch unsealed. Then let the bag sit in a sunny area for about 24 hours. The natural UV-C light will disinfect the money. When you are ready, remove the money and throw the bag away. Use a clean bag for the next round.

Of course, you can avoid all of this by using a credit card that you can clean with a disinfecting wipe when you get home. Contactless payments, like Apple Pay, Google Pay, and Samsung Pay are also alternatives to paying with cash.

Apr 2, 2020 | advice, coins

It’s that time of year, boys and girls. It’s scam time!

All the

little suckers collectors are home captivated by what’s on televison. Let’s see if we can

suck them in catch their eyes to

separate them from their money sell them

common material great coins at

inflated great prices!

Since being ordered to stay-at-home, the number of queries about deals for coins from television commercials, infomercials, and the home shopping channels has risen. The number of readers for my article “DON’T BUY COINS ON TELEVISION” has quadrupled in the past week.

The questions are all the same: is it a good buy?

Usually, the answer is NO!

In “DON’T BUY COINS ON TELEVISION,” I compared the offer of a date run of 31 American Silver Eagles each graded NGC MS-69 to a full 34 coin set. I found that the television markup was 50-80% over other alternatives.

The experience with this television con came less than a week after someone came into my shop with a box of overpriced items that he purchased from a home shopping television show and places like the National Collectors Mint. In “The Sad State of Television Numismatics,” I wrote about this experience and some more things to watch out for, including gold-plated tributes that have less than 1-cent worth of gold.

So that you know that this is not new, back in 2011, I wrote about another infomercial that claimed the Presidential $1 Coins were “vanishing from circulation at an alarming rate” because collectors are hoarding them. It was another show where the statements made the overpriced items appear too good to be true.

The worst part of both television pitches is that they both used respected numismatic authors as props. While neither endorsed the products the announcer was pitching, their presence was an effort to give the pitch an air of legitimacy.

I know it is difficult for some to be home during the day. Many of us are used to working and not having this much time on our hands. But it is not the time to stop thinking about getting the best value out of your collection. If you see a pitch for coins on television that intrigues you, then stop, take notes, and do some research before picking up the phone or visiting that URL.

What do the price guides say about the price? If the items are in slabs, go to the price guides for NGC or PCGS and find out what they say the coins should be worth. Want an independent opinion? Check the prices with the Greysheet Price Guide or the Numismedia Fair Market Value Price Guide.

Are there other purchasing options? Use a search engine to search for others who may be selling the same items. Check online auction sites, like eBay.

If you do a little due diligence, you may find that you can purchase the same or similar numismatics at a better price. You might be able to find something with a better grade also at a lower price.

Please do not overpay for your collectibles. If you regret your purchase, then it takes the fun out of collecting. We have enough problems, don’t compound them. Relax and enjoy your collection!

Mar 26, 2020 | advice, other, technology

With most of the country in some a state of quarantine, there may be time to expand our numismatic knowledge. Collecting can be fun, but learning about your collection will give it more meaning.

With most of the country in some a state of quarantine, there may be time to expand our numismatic knowledge. Collecting can be fun, but learning about your collection will give it more meaning.

If you continue to watch cable news, you are going to think the world will end tomorrow. While the situation is serious and deserves attention, you need to find time to think about something else.

Keeping Up With The News of Numismatics

When you turn off the television, here is where you can read about the latest in numismatics:

- news.coinsblog.ws – full press releases and pictures from news sources without commentary.

- coinworld.com – Coin World magazine online

- numismaticnews.net – Numismatic News online; look on the right side of the page for the links to their other (former Krause Publication) magazines.

- CoinNews.net – One of the oldest online news sites that does a good job in covering numismatic-related news.

- CoinUpdate.com – A news site that is more of an aggregator of numismatic-related news.

- CoinWeek.com – A good, comprehensive site on numismatic-related news.

- CoinsWeekly.com – Germany-based website (in English) with more international news. You should subscribe to their newsletter. You will receive an email summary of the world’s numismatic news every Thursday.

Precious Metals Market News

If you want to read about the markets, there are many news sites to read. However, if you are only looking for news from a source that concentrates on the metals market, then Kitco (kitco.com) is the proverbial 800-pound gorilla in this space. Kitco employs analysts and writers to look at the market from different angles.

Amazingly, the wealth of information Kitco provides is free. The free data, including the free charts and graphs that many websites use, is supported by advertisements, selling bullion, and a premium news service for the serious investor.

Podcasts

Podcasts have been around for many years dating back to the release of Apple’s iPod. In the beginning, podcasts were simple audio files passed around the Internet by maverick content creators to share knowledge, entertain, educate, or have fun. There are also video podcasts for on-demand viewing.

Today, podcasting is a big business. Many media outlets are producing podcasts. There are also companies whose business model is to create podcasts. There is at least one podcast for every taste. There are also many ways to listen to podcasts. Rather than discuss it here, search for “how to listen to a podcast” to learn more.

Here are three numismatic-related podcasts for your listening pleasure:

- Coin Show Radio – The oldest of the numismatic-related podcasts. The Hosts, Mike & Matt, have a little fun bringing the news and talking coins.

- CoinWeek Podcast – Although it has been around a while, I keep forgetting to subscribe when I pick up my phone, so I did it now. I will let you know what I think at some point.

- Coin World Podcast – The newest entry in the numismatic-related podcast world has become one of my favorite podcasts. One of the reasons to listen to this podcast is for the interviews. Jeff Stark and Chris Bullfinch are good interviewers and deserve a listen.

That should keep you busy for a while. Next time, I will look at other resources.

BOOKMARKS

Do you want to add these links to your browser’s bookmarks? Right-click (or Mac users can CTRL-Click) on the button to the right and select whatever option your browser requires to save the file to hard drive. Import the file as an “HTML Bookmark” file to add these links to your browser’s bookmarks.

→ Read more at

→ Read more at  Even as some areas of the country are easing quarantine restrictions, the best way to prevent the spread of

Even as some areas of the country are easing quarantine restrictions, the best way to prevent the spread of

All the

All the  With most of the country in some a state of quarantine, there may be time to expand our numismatic knowledge. Collecting can be fun, but learning about your collection will give it more meaning.

With most of the country in some a state of quarantine, there may be time to expand our numismatic knowledge. Collecting can be fun, but learning about your collection will give it more meaning.