Weekly World Numismatic Newsletter for September 1, 2019

Gregory Martin wrote to the editor for KendallCountyNOW.com that he would ” like to bring to mind the concept of starting your young ones on starting a coin collection.”

In three of the four paragraphs, Martin shows his passion for both collecting and how it relates to history. He mentions the 3-cent nickel and the 1943 steel cents as gateways into understanding what was happening in our country’s history.

Martin may have touched on something that today’s teachers can use to explain history. For example, the story of westward expansion was more about economics than exploration. People left the east for better opportunities, to find gold, discover silver, or for 40 acres and a mule. These stories can be taught using the money of the times.

As collectors, we know about fractional currency, postage stamp money, and why arrows periodically appear on minor coinage of the time. However, using these tangible items as props, a teacher can explain the history and show the results by using the money of the time.

Every coin, currency, and token is a reflection of the times when and where produced. A teacher can use the history of the San Francisco Mint to teach about the Gold Rush and the Great Earthquake of 1906.

The New Orleans Mint had its place in the Civil War.

The Carson City Mint is as much a story about the old west as it is about the economic battles, including the Crime of ’73.

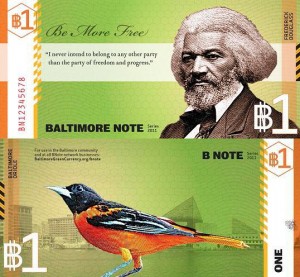

Trade and sales tax tokens can show how stores, states, and municipalities tried to work through the Great Depression. Transportation tokens show how transportation had grown in the 20th century. And how some cities, like Baltimore, issue its own “currency” to help promote local business.Using numismatics to learn about history goes beyond the United States’ borders. After becoming interested in Canadian coins, I learned more about the British monarchy and the decline of the monarch’s power by studying the transitions from Queen Victoria to Queen Elizabeth II.

After finding three banknotes from the State of Chihuahua, I learned more about the Mexican Revolution after trying to understand why currency for a three-year state existed.

Maybe it is time to take the saying “history in your hand” and turn it into something tangible. After all, a handful of trade and sales tax tokens may have more of an impact than just reading about the Great Depression.

And now the news…

A Utah businessman paid $1.32 million for a dime last week at a Chicago coin auction. It wasn't just any 10-cent piece; the 1894-S Barber Dime is one of only 24 that were ever made, according to Stack's Bowers Galleries, which held the auction Thursday night.  → Read more at cnn.com

→ Read more at cnn.com

TREASURE-hunters have dug up a hoard of ancient silver coins dating back to the Battle of Hastings in 1066 – worth an impressive £5million. A metal-detecting couple made the lucky find while searching an unploughed field on a farm in north-east Somerset.  → Read more at thesun.co.uk

→ Read more at thesun.co.uk

Such a hobby does not take a lot to start and can be rewarding in so many ways. To start with you learn about money and in it's many denominations, including the Civil War 3 cent nickel! In American collecting you can observe the way our country grew and developed, gaining a perspective on people and actions of this great nation.  → Read more at kendallcountynow.com

→ Read more at kendallcountynow.com

For the first time in almost half a century the Treasury has ordered the Royal Mint to stop producing any 1p or 2p coins. The crackdown on coppers comes at a time when all our cash is under threat – with banks preferring that we pay for goods online or with cards because it saves them money.  → Read more at thisismoney.co.uk

→ Read more at thisismoney.co.uk

Bullion Market Sizzles

When I started writing this blog in 2005, gold was around $470 per ounce and silver was around $7.75 per ounce. The economy was going strong and the numismatic market starting to really move lead by the strong housing market. For collectors, we wondered how high gold and silver would climb and how much more our collections would be worth.

As the economy is collapsing under the pressures caused by the failures of large financial institutions, gold opened the year at $846.75 per ounce, climbed to a high of $1,006.75 on March 18, and closed at $813.00 as I write this on September 18. After the some predictions of gold closing the year over $1,000.00, gold is now down for the year by over $30.

Additional pressure on the market will be the sale of $40 billion in 35-day bonds that will help the Federal Reserve fund the AIG bailout. While some see this as good for the government, there are others who think investors will run away from the market and look to gold as a safe haven.

Overnight, it is being reported that Morgan Stanley is talking with China about cash investments and mergers.

This has made all markets a bit skittish and looking for “safer” investments. Those looking to buy American Eagle bullion coins has been having a difficult time finding coins since the Mint admitted that they have a shortage of gold and silver.

While researching a future post, I visited the Kitco website and found the following note on their front page:

In order to reflect the current strong demand for Silver Maples and Silver Eagles, Kitco is temporarily increasing its current bid (buyback) price for these particular products. Please visit our Selling to Kitco page for more details.

The good news for those buying bullion, the prices are probably the best in a year. For example, the current price for American Eagles at Kitco are selling with a 6½-percent premium for gold and 11.2-percent premium for silver. These are better prices than purchasing from the US Mint.

Given the current environment, it is difficult to say where the financial markets are going and how it will affect the market for coins. We do know that generic gold and silver (common date) coins and bullion will rise and fall with the market. But it makes it difficult to consider what will happen in the collectible market. I will have some thoughts in a few days.

Alan Herbert New ANA Governor

Author of The Answer Man for Krause Publications and former governor of the American Numismatic Association Alan Herbert has been appointed to the current Board of Governors. Herbert replaces Dr. Radford Sterns who died late last month.

The ANA press release said, “In accordance with ANA bylaws, any vacancy on the Board of Governors is offered to the person who failed to be elected as a Governor by the least number of votes in the most recent election. Herbert received 2,243 votes in the 2007 election, the most votes of any unsuccessful candidate.”

Herbert, an ANA life member, had previously served on the Board in 1999-2000 and 2003-2007. He should be able to step in with out problems.

Market Fall is not Driving Precious Metals

When I woke up this morning, I found that Lehman Brothers filed for Chapter 11 Bankruptcy protection on Sunday. Merrill Lynch, another venerable Wall Street institution, is being purchased by Bank of America. Insurance giant AIG is asking the Federal Reserve for a bridge loan to weather its own fiscal issues. As the Dow Jones Industrial Average index drops 300 points after the markets open, it is not surprising that there are worries about the fundamentals of the economy.

Those of us in numismatics, we watch the prices of precious metals for indication as to how our market is going. In recent weeks, gold, silver, and platinum have been falling to levels not seen since early 2007. As I write this, gold is up $11.80 to $775.50 per ounce (1.5-percent) while silver is up only 20-cents and platinum is down $38.00.

The general rule of thumb is that when there are problem in the capital markets, investors try to convert their cash to precious metals. While gold is the most popular investment, the relatively stable prices and average trading volumes suggest that investors are not running away.

For the collector, this means that collectibles tied to the prices of precious metals should not move much. Even though the U.S. Mint has not changed its prices during this declining market, those using American Eagle and 24-karat Gold Buffaloes as investments can find coins from previous years at lower prices.

If you are collecting rare coins, the PCGS3000 Index (a market basket price of 3,000 rare coins) shows that prices are up $4.65 for the day (0.01-percent). The PCGS3000 index has trended upward since November 2007.

As a collector and not an investor, I will take the advice of Dave Harper and wait to see what happens to the market. The currents are much to rough for a collector to jump in head first!

Get Ready for COTY

Last Friday, Numismatic News editor, Dave Harper reported that the Coin of the Year panel began meeting in Iola, Wisconsin.

Winners of the 2008 Coin of the Year include the 300th Anniversary of the Birth of Ben Franklin for Most Historically Significant and the Nevada State Quarter as the Most Popular and Best Trade Coin.

Winners of the 2008 Coin of the Year include the 300th Anniversary of the Birth of Ben Franklin for Most Historically Significant and the Nevada State Quarter as the Most Popular and Best Trade Coin.

Because of timing, only coins minted in 2007 are considered for Coin of the Year honor.

Image courtesy of Numismaster.com

Defence of Fort McHenry

The War of 1812 had been running for two years when the fighting escalated in Baltimore Harbor around Fort McHenry. American Prisoner Exchange Agent Colonel John Stuart Skinner sent by the War Department to negotiate the release of Dr. William Beanes. Dr. Beanes was allegedly mistakenly arrested with a group of rowdies as he walked to his home.

The War of 1812 had been running for two years when the fighting escalated in Baltimore Harbor around Fort McHenry. American Prisoner Exchange Agent Colonel John Stuart Skinner sent by the War Department to negotiate the release of Dr. William Beanes. Dr. Beanes was allegedly mistakenly arrested with a group of rowdies as he walked to his home.

On Skinner’s way to meet Vice Admiral Alexander Cochrane, Rear Admiral Sir George Cockburn, and Major General Robert Ross on the HMS Tonnant, he stopped at the home of noted lawyer Francis Scott Key and asked for his assistance.

Col. Skinner and Key were welcomed by the British command on September 13, 1814 and was invited to stay for dinner. After secure the release of Dr. Beanes but were not allowed to return to Baltimore. The British felt that Col. Skinner and Key had learned too much about the British forces. Col. Skinner, Key, and Dr. Beanes were provided guest accommodations on the HMS Tonnant.

The Battle of Baltimore began after dinner and raged overnight through the next morning. On September 14, 1814, when the smoke cleared, Key saw the Stars and Stripes still flying over Fort McHenry. Following the battle. Col. Skinner, Key, and Dr. Beanes were allowed to return to Baltimore on their own boat. During the trip, Key wrote a poem entitled “The Defence of Fort McHenry”

On September 20, 1814, Key had the poem published in the newspaper Patriot. After publication, Key set the poem to the tune of John Stafford Smith’s “The Anacreontic Song,” a popular drinking song written for London’s Anacreontic Society. The combination was renamed “The Star Spangled Banner.”

“The Star Spangled Banner” was first recognized by the Navy in 1889. In 1916, President Woodrow Wilson signed an executive order to recognize “The Star-Spangled Banner” as the national anthem. Finally, President Herbert Hoover singed a congressional bill officially making the song the United State’s National Anthem (36 U.S.C. §301).

In June 2007, Rep. Dutch Ruppersberger (D-MD) introduced H.R. 2894, Star-Spangled Banner and War of 1812 Bicentennial Commemorative Coin Act. The bill calls for the minting of 350,000 silver $1 coins “in commemoration of the bicentennial of the writing of the Star-Spangled Banner and the War of 1812.”

The bill calls for the “design of the coins minted under this Act shall be emblematic of the War of 1812 and particularly the Battle for Fort McHenry that formed the basis for the ‘Star-Spangled Banner’.” A $10 surcharge (total of $3.5 million) will be paid to the Maryland War of 1812 Bicentennial Commission.

H.R. 2894 passed the House of Representatives on May 15, 2008. It was received by the Senate on May 19, 2008 and eferred to the Committee on Banking, Housing, and Urban Affairs.

Image of Fort McHenry courtesy of the Maryland Office of Tourism