Jul 30, 2022 | advice, coins, education

The ad appearing on Facebook

(click image to see a larger version)

A site called cointraderonline.com (I purposely did not make it a link; please do not visit the site) began advertising heavily on Facebook. The ad, whose image appears here, says that the purchaser will buy a “US Vault Bag” that is “Packed With Unsearched US Coins.” The ad and the site say that there is a 60-Day Return policy.

I have been advising people not to purchase from this site. Unfortunately, some did not seek advice before purchasing. When they received their bag, the results were less than satisfying.

Buyers of the Vault Bags report that they received bags that contain at least 50-percent copper coins with the rest common silver coins. Buyers describe the coins as being heavily circulated, some with scratches and dings, along with very worn and dateless Buffalo Nickels. Although the owner of this site may not have searched the hoard they used to fill the bags, the product appears to lack key or semi-key dates and higher-grade material based on reports from several people.

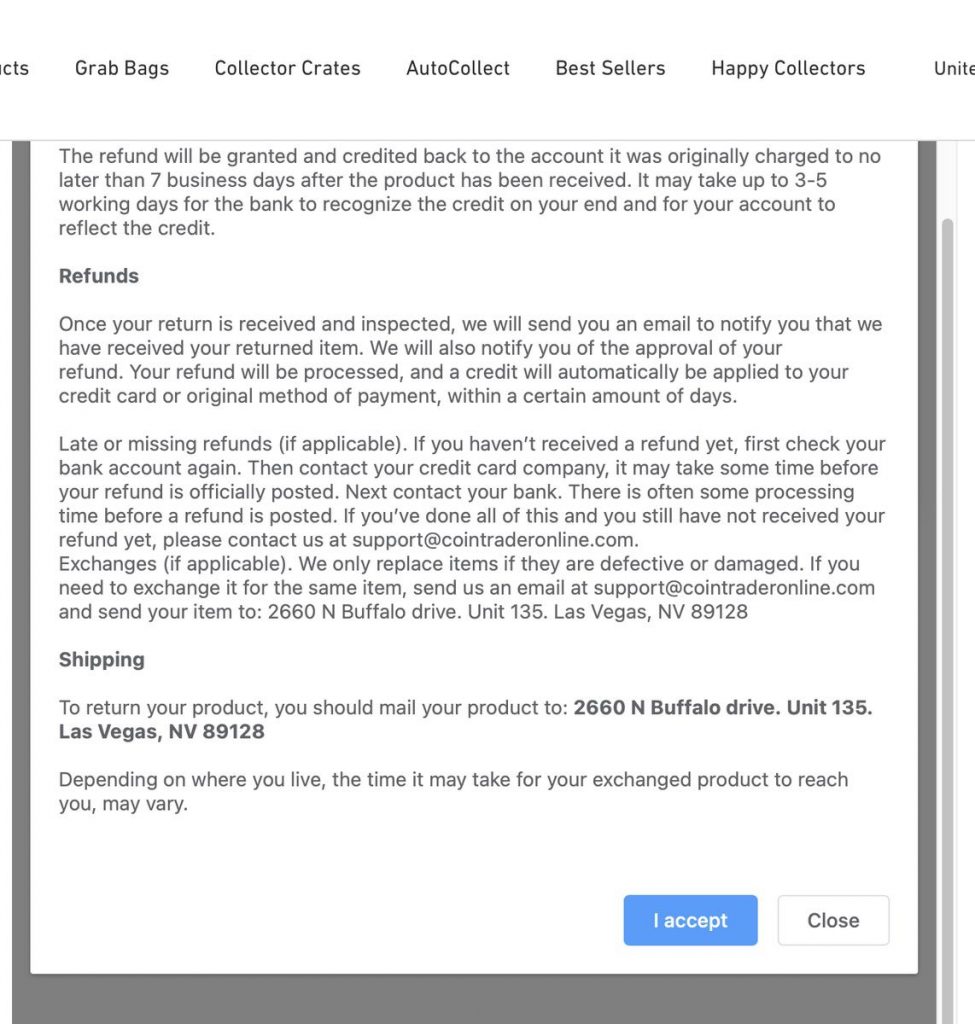

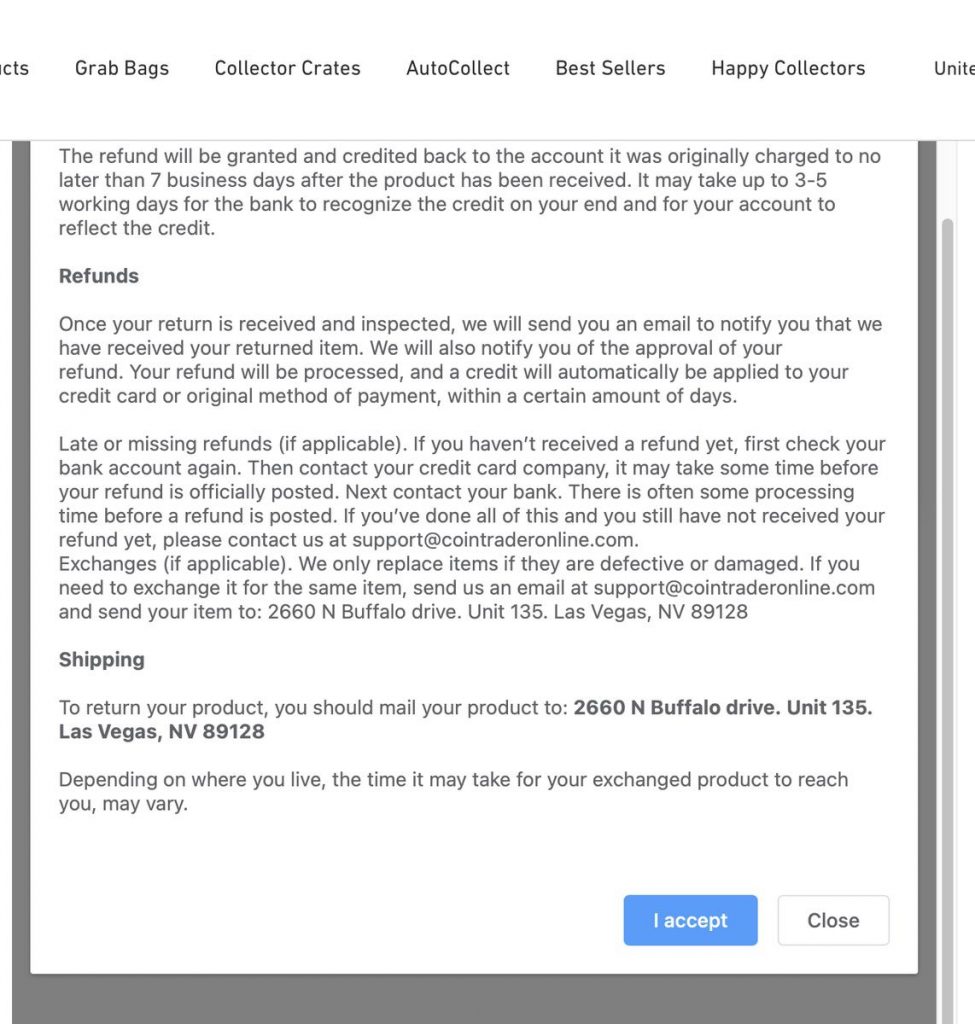

One person tried to return the coins on their 60-day return policy. The buyer mailed the coins to a Las Vegas address with tracking from the US Postal Service. The package was delivered, but the person did not receive a refund.

Refund policy page containing the address to a Las Vegas-area apartment.

The Investigation

Finding information about the company from their website was difficult. The “About Us” page contains very little useful information about the company. Still, the page uses a few images from elsewhere on the Internet. A random sample of images found several duplicates on other sites using a Google Image search. Many are stock images that the web designer could have purchased from legitimate sources. However, the number of images used to make the website pretty without being functional is an area I find concerning.

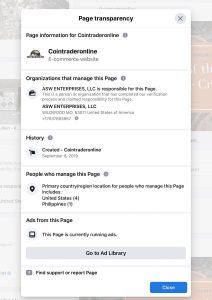

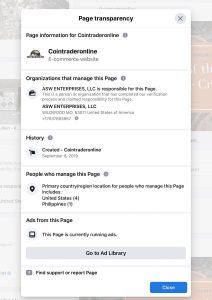

Facebook’s Page Transparency section

(click image to see a larger version)

One tool Facebook provides is a “Page Transparency” section. You must go to the company’s main page to find the information. According to the information on the page, Facebook reports that “ASW ENTERPRISES, LLC” was verified as responsible for the page. ASW Enterprises is in Wildwood, Missouri, with a telephone number that has a 703 area code. The 703 area code maps the Northern Virginia suburbs of Washington, DC.

Hotfrog, a collector of business information, has the phone number listed on Facebook on record but also a St. Louis-area telephone number.

The information found at Hotfrog

Using the St. Louis-area telephone number, a reverse search found a listing at hub.biz for an address in Baldwin, Missouri. The address is for a 4 bedroom, 4 bathroom, 2880 square foot home that Zillow says is worth $576,300 with what looks like it has a three-car garage. I wish I had a three-car garage!

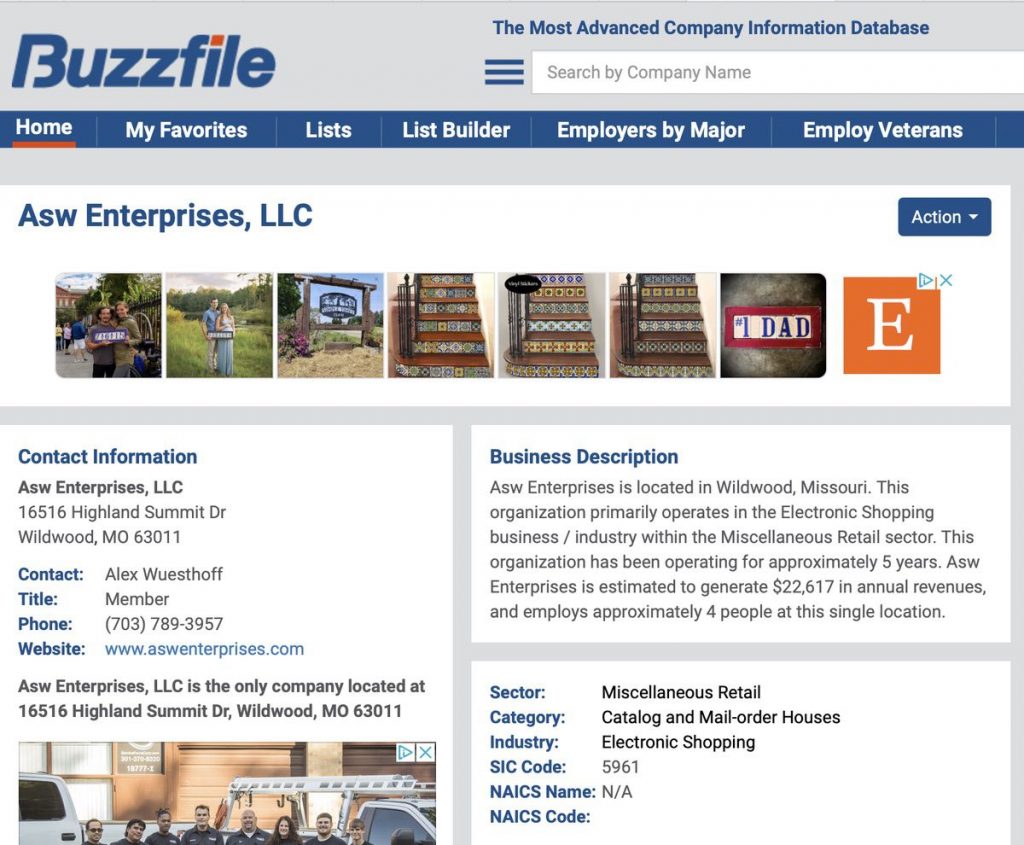

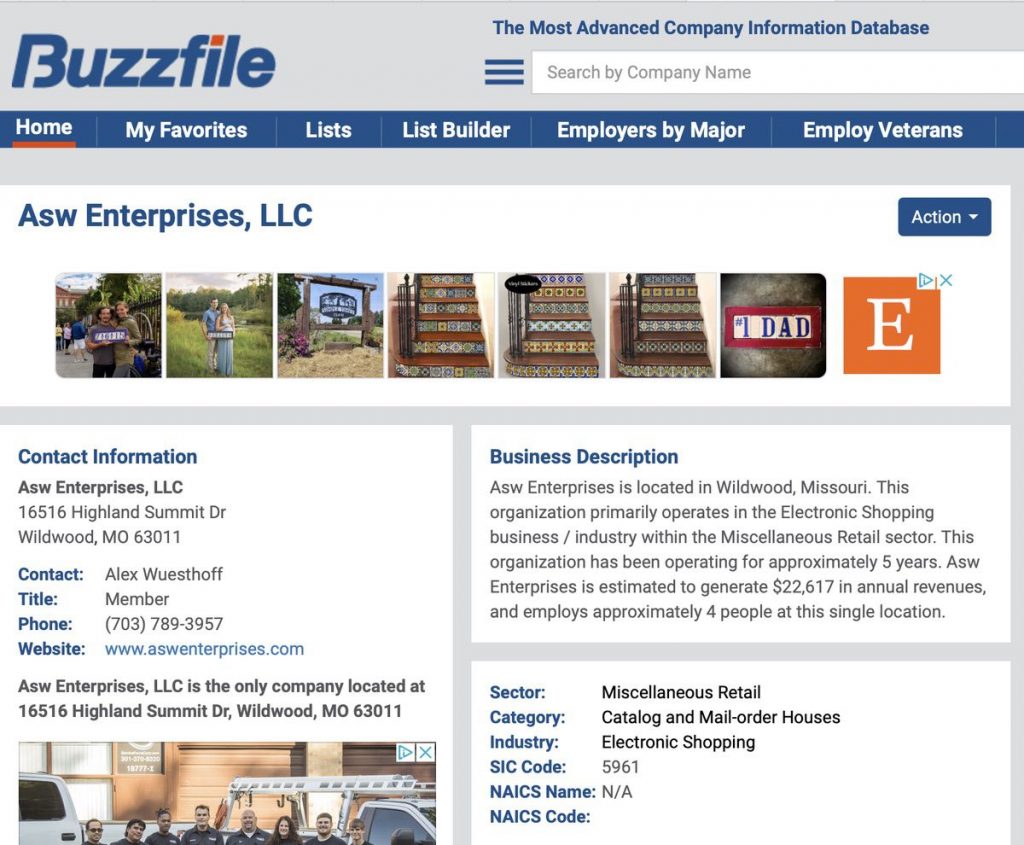

A reverse lookup of the address and telephone number finds information about ASW Enterprises on Buzzfile. This information provides a person’s name that, when plugged into the ANA Dealers” directory, does not find a record. Although the site says that this person/business is a member of the ANA, he is not listed as a registered dealer in the ANA database they use for the Find a Dealer page.

Buzzfile provides addresses and telephone number.

The website on the Buzzfile page is for a company selling preparation materials for a Texas-based spelling competition. There is every indication that the website has nothing to do with the cointraderonline.com business.

The About page also says they are a National Silver Dollar Round Table member. Neither the company name nor the name of the person listed as the principal of ASW Enterprises is listed on the NSDRT membership page. I did not consult with the Certified Collectors Group (NCG/PCGS) to verify the membership claim.

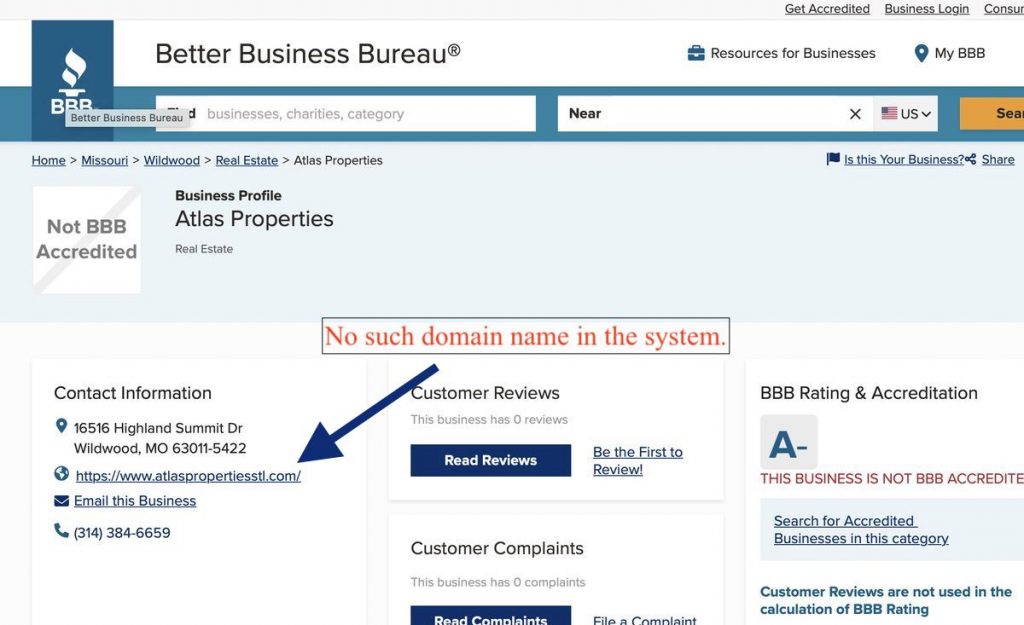

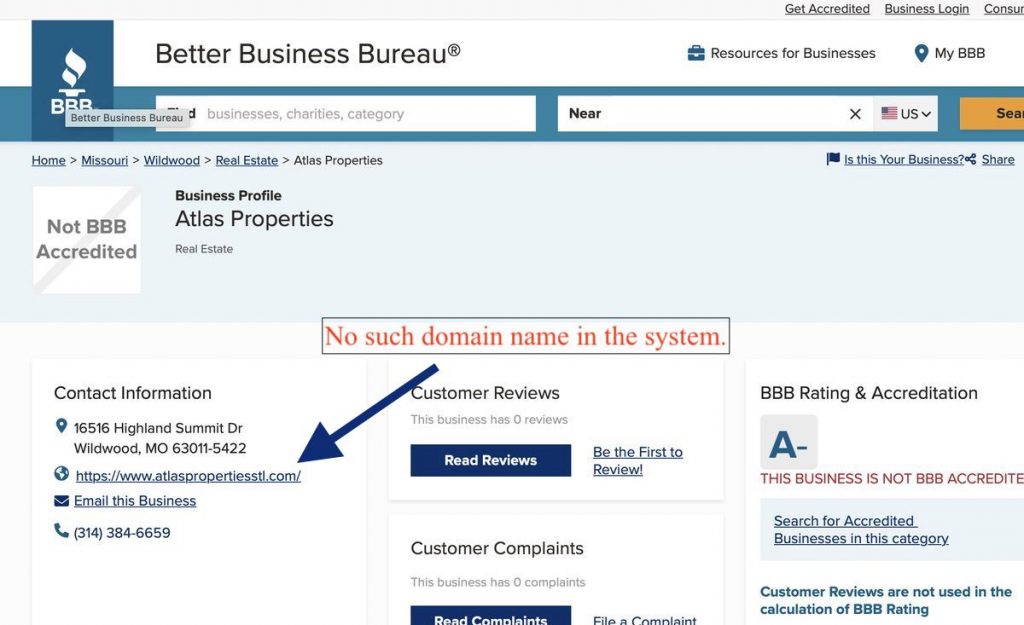

Finally, a reverse search of the person’s name suggests that this is not his only business venture. A Better Business Bureau entry suggests he is also involved with real estate. The finding was supported by a posting to a public message board looking for fellow investors in the St. Louis area.

The Better Business Bureau has a listing that includes a bogus website name.,

There appears to be no connection between the owner listed on the Facebook Page Transparency page and the operation in Las Vegas.

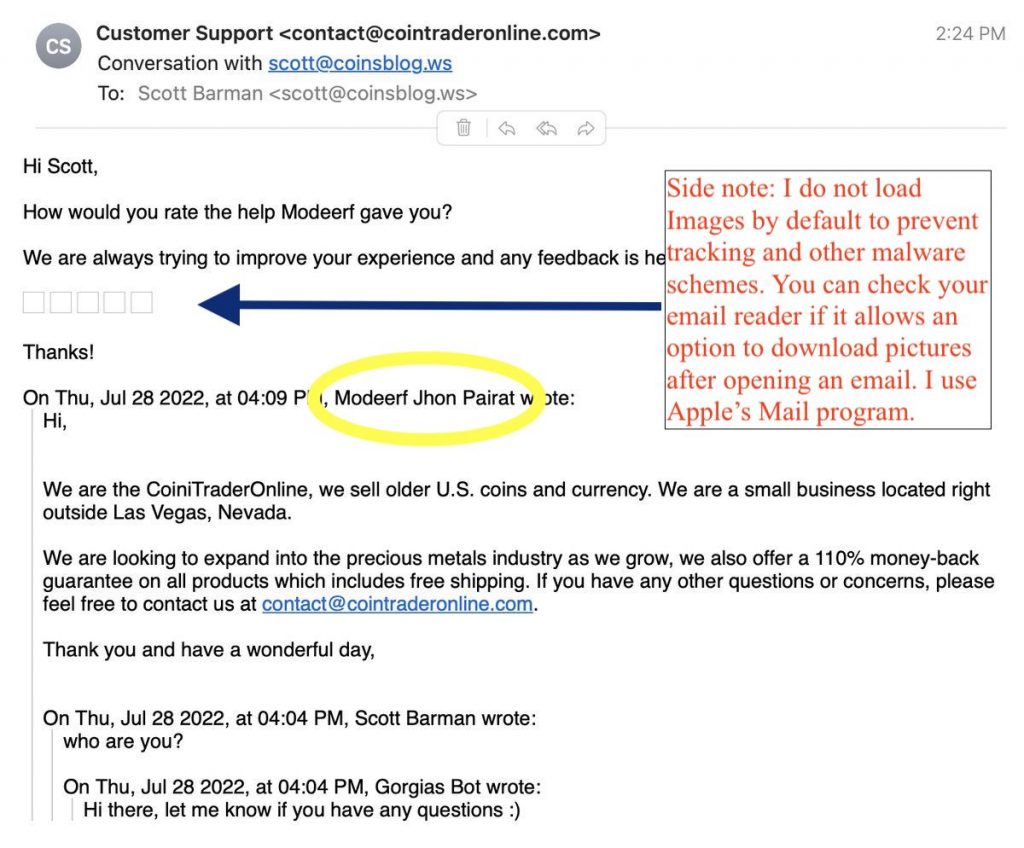

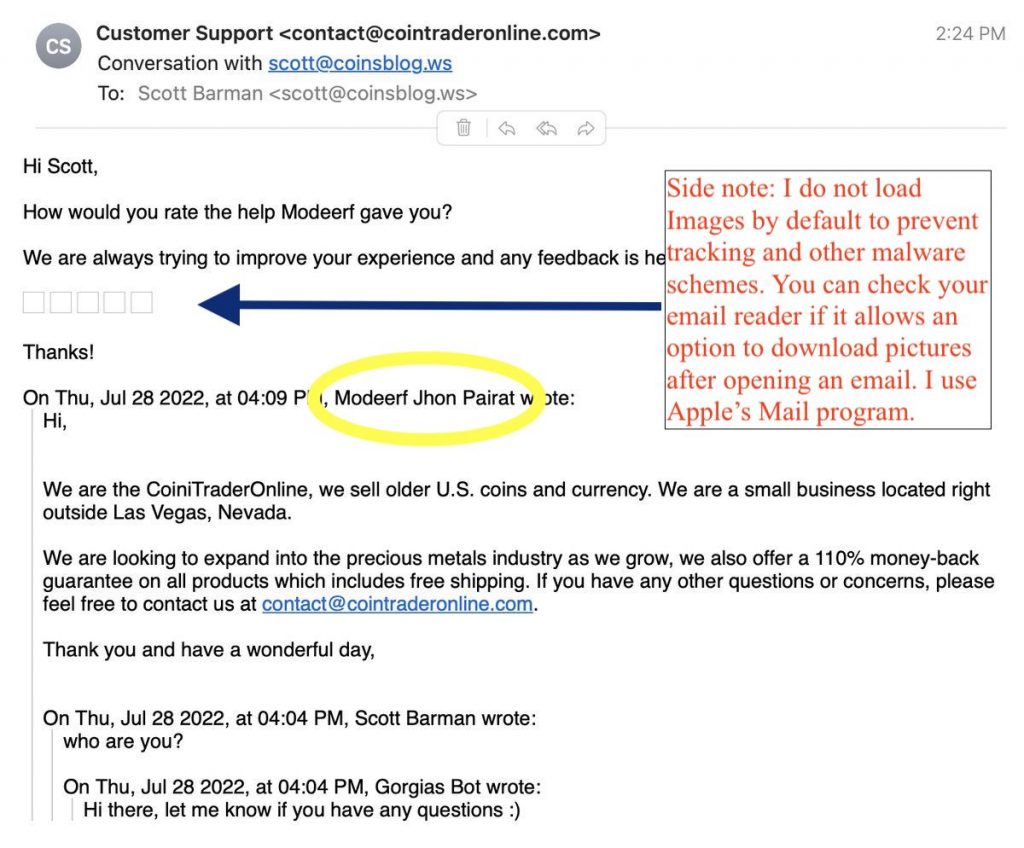

I tried to send a message to the site owner via the chat option on the website. After receiving a response via email, I asked several follow-up questions that have been unanswered at this point. If they answer my questions, I will add the information here and in a new post.

I received an automated message from their system. It was formatted as a reply and included the name of the person that replied to my chat request. When I looked up the name in the email, I found public interactions of someone from the Philippines.

The email telling me who my correspondence is with.

Having a support contract with someone offshore should not raise a concern. Still, when the return address is Las Vegas, and the company’s background information leads to the St. Louis area, it creates concern.

Should You Buy From this Site

My investigation suggests that the person behind the site may be an inexperienced young adult. The diverse information indicates that he is trying to find a way to earn a living. However, he must understand that online sellers have cheated too many coin collectors and that he should opt for transparency rather than pretty pictures on a website.

If you want to support someone trying to start a business, you may want to buy from this company. However, reports suggest that you will not receive value for your money.

Why Publish The Investigation Detail

An old proverb says, “Give a Man a Fish, and You Feed Him for a Day. Teach a Man To Fish, and You Feed Him for a Lifetime.” Rather than providing my opinion, showing you how to investigate sites you are unsure about will help you fight online fraud.

Scams with online shopping are a problem beyond numismatics. Although legitimate small businesses are selling online, there are many scammers. The above processes can help you investigate someone before spending your money.

Suggestions for Small E-Commerce Businesses

For small businesses, I would highly recommend that you be as transparent as possible. You should publish contact information and respond as quickly as possible. Let your buyers know a little about you. Who are you, and why are you in the business? Do you have a passion for what you are selling? Do you have a compelling story about why you are in business? I understand you are communicating with customers, but customers also want to have a connection with the people they do business with.

You have to generate a sense of trust with the customer, which gives you an advantage over a large online retailer. Give me a reason to trust you over the next-day shipping behemoth, and I could become a regular customer. Let the customers know they will deal with another person, not a big corporation riding down a South American river.

Finally, pretty websites are nice but if you are going to use stock photographs, use them sparingly. Stock photographs of coins, people supposedly looking the part they playing on your page might look good, but they come off as fake and as valuable as a cleaned coin. Do not fill up a page with images. Clear, concise, and accurate information is better than pictures.

“Let’s be careful out there.”

May 9, 2022 | books, coins, education, poll

I am getting ready to open the next chapter of my life, and I was thinking about how I can leverage my knowledge and experience to enhance the collecting community. As an experienced collector of all types and a dealer in areas other than numismatics, I learned a lot about collectors and their habits that could benefit a general audience.

I am getting ready to open the next chapter of my life, and I was thinking about how I can leverage my knowledge and experience to enhance the collecting community. As an experienced collector of all types and a dealer in areas other than numismatics, I learned a lot about collectors and their habits that could benefit a general audience.

As I was thinking about sharing my experiences, I wondered where most people learned about their collectibles. But the resources I had are different than those available today. Even the way we take in and understand knowledge is different. I thought it would be interesting to ask the numismatic community how they learn about collecting.

So let’s ask the question:

Loading ...

Mar 7, 2022 | coins, education, Red Book

One of the more difficult things to explain to a new collector is how much a coin is worth. A common misconception is that an older coin is worth more than one struck later. Although I wrote two blog posts about coin pricing (links to Part I and Part II), the next question is, ”How much is my coin worth?”

One of the more difficult things to explain to a new collector is how much a coin is worth. A common misconception is that an older coin is worth more than one struck later. Although I wrote two blog posts about coin pricing (links to Part I and Part II), the next question is, ”How much is my coin worth?”

Collectors will turn to price guides to understand how much the coin is worth. Two popular price guides are the Guidebook to United States Coins (the Red Book) and the Coin Dealer’s Newsletter (the Greysheet). The Red Book is a book and requires the collector to purchase one. But for under $20, collectors can have the complete price guide of all United States Coins in their hands.

The Red Book does not have the most up-to-date coin values as a physical publication. But it gives the collector an idea of the value of their coins and is an excellent general reference.

Until recently, the Greysheet offered collectors their retail price guide to anyone visiting their website. While the website’s interface was more artistic than usable, the information was available to collectors.

Last week, Greysheet CEO John Feigenbaum sent an email to subscribers of their mailing list that announced the end of the free access to the retail price guide.

To access the retail price guide, collectors will have to create an account on their site to access up to 10 prices per month. After making 10 free queries, users will have to subscribe to their service for $7.99 per month, a price Feigenbaum says is “about the same as a Starbucks Frappucino — and a lot less calories.“ I prefer a tall three-shot latte that costs less and has fewer calories.

The fallacy of Feigenbaum’s argument is that they collect and publish the data regardless of the way they grant access. What has changed is that the cost of printing has risen. Instead of raising the prices for the printed version of the Greysheet and sister publications for the old dealers that are past their prime, the company passes the costs to collectors.

The Greysheet is a private company and can do what they want. As a collector who does not benefit from paying a monthly subscription to access retail price guides, it is time to add other online coin guide pricing tools. There are alternatives for the average collector. For example, NGC and PCGS publish price guides for coins in their holders. Find these price guides at:

When the need is for general online coin guidance, here are two good resources:

Even if the Red Book is not immediately accurate, it should be part of your library. As an essential reference, there is no comparable book.

Thank you to the Greysheet for providing the service in the past. But as it is time for you to move on, it is time for the ordinary collector to find other resources.

Feb 14, 2022 | advice, Eagles, education, scams

RANTHY<dot>COM IS A SCAM

Two counterfeit American Silver Eagles purchased from a company based in China who advertised on Facebook.

NO LEGITIMATE DEALER IS SELLING BULLION COINS FOR BELOW THE SPOT PRICE!

The current price of silver is $23.86 per troy ounce. If anyone is selling American Silver Eagles for less, they are likely selling counterfeit coins.

Questions about the site sent today noted that the scammers advertised these coins on Facebook.

These scammers are not selling 2022 American Silver Eagle counterfeits because the Chinese manufacturers of the fakes have not created bogus Type 2 reverses. Remember, legitimate dealers will sell coins with the Type 1 reserve. They will also sell the coins with the Type 2 reverse.

IF YOU PURCHASED COINS FROM THESE SCAMMERS, contact your credit card company and dispute the charge. If you received the coins and they are counterfeit, contact your credit card company and dispute the charge.

IF THERE ARE ANY QUESTIONS ABOUT A WEBSITE, THEN DON’T PURCHASE FROM THEM!

Aug 16, 2021 | coins, Eagles, education

What does it take to create, publish, and maintain a price guide for coins?

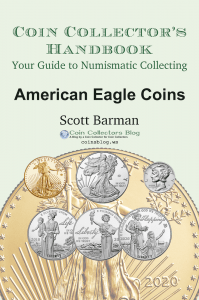

Readers who downloaded my first edition of the Coin Collectors Handbook: American Eagle Coins have asked about the lack of a price guide. I hesitated to add a price guide for American Eagle coins because, with very few exceptions, the spot price of metals affects the prices. Market watchers know that spot prices are volatile. Are there differences in prices that might make working on a price guide a good time investment?

Readers who downloaded my first edition of the Coin Collectors Handbook: American Eagle Coins have asked about the lack of a price guide. I hesitated to add a price guide for American Eagle coins because, with very few exceptions, the spot price of metals affects the prices. Market watchers know that spot prices are volatile. Are there differences in prices that might make working on a price guide a good time investment?

To better understand pricing and price guides, I asked several dealers what they use for pricing guidance. Most of them said the Greysheet and what the coins were selling on eBay. A few larger dealers will start their eBay auctions at $1 and sell the coins regardless of the final bid. High-volume dealers say they are rarely disappointed with the results.

Smaller dealers will subscribe to a service that will automatically adjust the prices based on the spot price and the results of the eBay inventory. Depending on the service level these dealers have with the service, the price for coins can change every day.

The pricing service can query eBay for list prices, and the prices realized to come up with their formula.

In the past, I tried to ask the people who write the Greysheet how they come up with prices. The harsh rejection at that time prevented me from asking again. It was time to look at other guides to determine how they create their prices.

Information from PCGS’s website is clear that their price guides are for coins only in their holders. In the past, PCGS noted their price guides use the prices on the Certified Coin Exchange market, which Collector’s Universe, PCGS’s parent company, owns.

Similarly, NGC notes on its website that they base their prices on the market of NGC-graded coins only. Neither service considered the market perception of CAC-certified coins. Although the Greysheet has a publication that publishes guidance for CAC-certified coins, that information is available only to subscribers.

One of the price guides not affiliated with a grading service is Numismedia. They are similar to Greysheet in that they offer a range of publications that span the market. Although their website does not disclose how they determine prices, their Fair Market Value guide has been more comprehensive and closer to retail market values than I have experienced with the Greysheet’s retail guides.

Other price guides found around the web have different concerns. A few are crowd-sourced, meaning that collectors provide input based on what they paid. Although crowd-sourced prices report real-world transactions, the information is limited to what users report and not a market survey.

Then there is the Red Book, A Guild Book of United States Coins. For 75 years, it has been the bible of coin values for many collectors. Unfortunately, the Red Book has several problems. First, it is published once a year and released in April. It means that production for the Red Book must begin before then.

A few years ago, I volunteered to work as a pricing contributor for the Red Book. I felt prices for modern coins were too low for the market, and I tried to bring them up to reality. It was challenging to make the edits using the poorly design web form. Even with my effort, much of my input did not make the book. The following year’s pricing entry was a spreadsheet, but my attempts at aligning the prices with the market did not affect the published prices.

Another problem with the Red Book is that the contributors are not given sufficient time to provide input. The process should be ongoing rather than giving the pricing editors a few weeks to edit the prices, so there is no rush before closing the edition.

Although I was not involved with the Blue Book (Handbook of United States Coins) pricing, I suspect it has similar issues.

It appears that every method used to create a price guide is flawed. Publicly accessible price guides are too generic to be taken seriously. Unless the public is willing to pay high prices for the wholesale guides, there is an opaqueness in how the industry prices coins.

Creating price guides is a difficult task. Over the next few weeks, I will continue my market survey while compiling the price guide for the American Eagles Handbook. I will share what I find here on the blog. Stay tuned!

Jan 28, 2021 | coins, commemorative, education, news

The crew of the space shuttle Challenger honored us by the manner in which they lived their lives. We will never forget them, nor the last time we saw them, this morning, as they prepared for their journey and waved goodbye and “slipped the surly bonds of earth” to “touch the face of God.”

— President Ronald W. Reagan, Address to the Nation, January 28, 1986

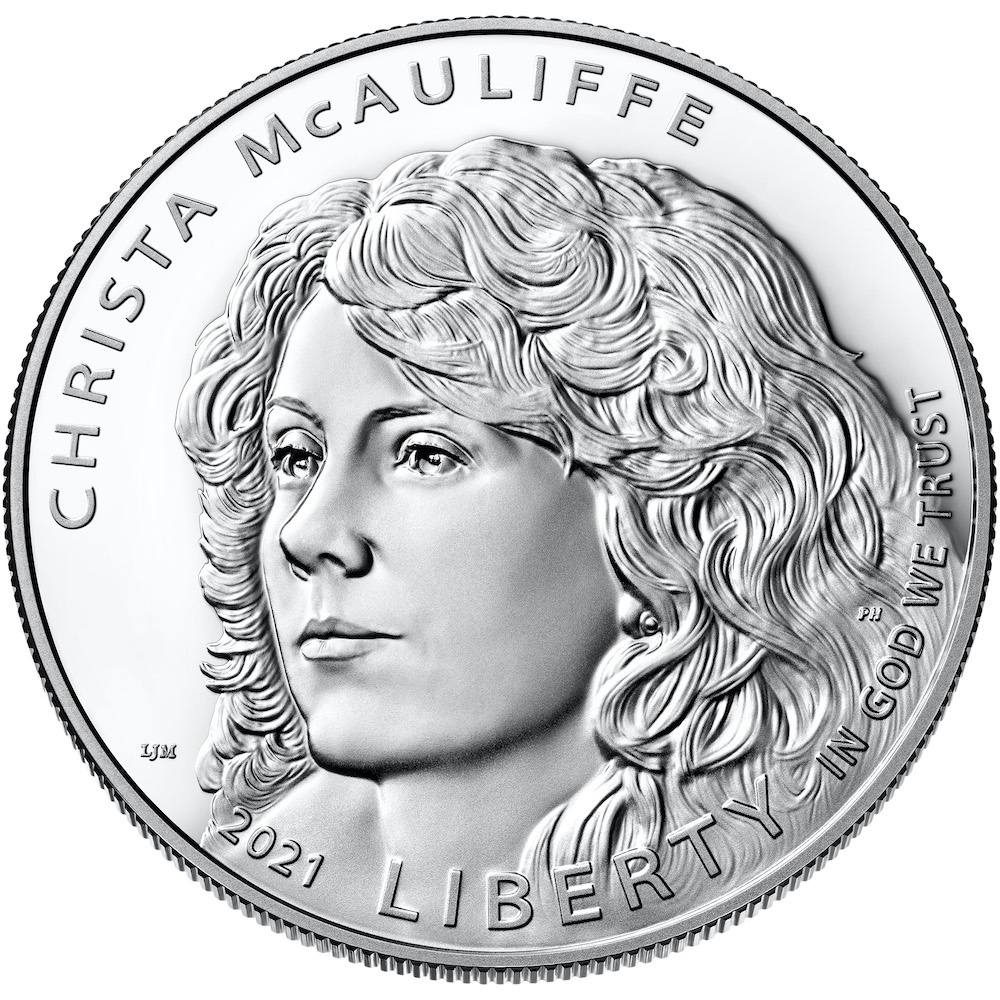

The U.S. Mint announced the launch of a “pre-order system and begin accepting pre-orders for its 2021 commemorative coin programs.” Sales begin today. In addition to the National Law Enforcement Memorial and Museum Commemorative Coins, the U.S. Mint will begin selling the Christa McAuliffe Commemorative Silver Dollar.

NASA selected Christa McAuliffe to be the first member of the Teacher in Space Program. The space agency would train teachers to travel to space and hold lessons from the space shuttle. Unfortunately, 73 seconds into the flight, the Space Shuttle Challenger disintegrated, killing all seven members aboard.

The crew members of the Challenger for Mission STS-51L were Commander Dick Scobee, Pilot Michael J. Smith, Mission Specialists Ellison S. Onizuka, Judith A. Resnik, and Ronald E. McNair, and Payload Specialists Gregory Jarvis and Christa McAuliffe.

The pre-order price of the silver dollar is $69.00. The price includes a $10 surcharge paid to the FIRST® (For Inspiration and Recognition of Science and Technology) robotics program to promote leadership in science, technology, engineering, and mathematics (STEM).

The STS-51L crewmembers are: in the back row from left to right: Mission Specialist, Ellison S. Onizuka, Teacher in Space Participant Sharon Christa McAuliffe, Payload Specialist, Greg Jarvis and Mission Specialist, Judy Resnik. In the front row from left to right: Pilot Mike Smith, Commander, Dick Scobee and Mission Specialist, Ron McNair.

Jul 31, 2020 | advice, counterfeit, education, news

Want more information about American Eagle Coins?

The Coin Collectors Handbook: American Eagle Coins has more information and is fully illustrated. Read more →

here;

Two counterfeit American Silver Eagles purchased from LIACOO, a company based in China.

- The scammers are in Shenzen, China

- It may be more than one person behind the scam, but they are working together.

- There appears to be a pocket of these scammers in the Middle East. Early analysis suggests they are in Doha, Qatar.

- All email addresses are either on Gmail or use Google’s professional services that allow Gmail to look like a real domain.

- Any of these sites that have a U.S.-based telephone number are using burner phones. For those not familiar with the term, a burner phone is one on a pay-as-you-go plan. The phones are cheap, easily disposed of, and are difficult to trace.

- Any of these sites that use a U.S.-based physical address use a dropbox service from a logistics company. The dropbox service is a locker that the company pays as a way to manage shipping remotely. There are legitimate uses for these dropbox services, but these scammers use them to make it look like they are located in the United States.

- The scammers are using branded gift cards to pay for these services.

While investigating these sites, I learned that there are five tips that, if followed, you will avoid being scammed.

- NO LEGITIMATE DEALER IS SELLING BULLION COINS FOR BELOW THE SPOT PRICE!

The current price of silver is $23.43 per troy ounce. If anyone is selling American Silver Eagles for less, they are likely trying to sell counterfeit coins.

- IF THE DEAL IS TOO GOOD TO BE TRUE, IT LIKELY IS NOT A GOOD DEAL!

When purchasing bullion and coins from dealers, the price between the spot price and the price the dealer will sell the coins for is called the spread. The spread can change based on inventory, availability, and other market forces. It is rare when the spread is less than 5-percent. Some of the largest dealers will lower their spread for their better customers or as a special to lure other customers. A good deal is when the spread is less than 5-percent. However, the spread is rarely less than 2-percent. If a legitimate dealer sells metals for less than 2-percent over the spot price, that is a good deal. These companies are not in business to lose money. Be very worried if someone is trying to sell bullion coins for less.

- IF THE DEALER DOES NOT IDENTIFY THEMSELVES ON THEIR WEBSITE, THEY ARE LIKELY HIDING SOMETHING.

On every website that is likely selling counterfeit coins, they have a wonderfully written “About Us” page that says nothing. The Of the four websites that readers have sent to ask if they were legitimate, all of the “About Us” pages were copies. A web search using sample passages from the page yielded thousands of results.

- IF THE CONTACT PAGE DOES NOT HAVE LEGITIMATE CONTACT INFORMATION, THEY ARE LIKELY HIDING SOMETHING.

One of the indicators of a site owned by Chinese scammers is if they give you hours in HKT or Hong Kong Time. These scammers are not in Hong Kong but are in Shenzen, which is in the same time zone.

- IF THE SITE IS “POWERED BY SHOPLAZZA,” IT IS LIKELY A SCAMMER SITE.

Go to the bottom of any page. If there is a copyright statement followed by “Powered by Shoplazza,” then run away. Shoplazza is a newly created service out of China that seems to be a Shopify clone made by reading Shopify’s HTML. While looking at the HTML code, there are indications that the site was created quickly. During a quick look at three sites highly suspected of selling counterfeit American Silver Eagle coins, I was able to confirm that their sites are hosted on Shoplazza.

IF THERE ARE ANY QUESTIONS ABOUT A WEBSITE THEN DON’T PURCHASE FROM THEM!

Since my first post about these Chinese scammers, I have received at least five notes per week saying they bought ten coins from these websites. Everyone that received the coins and was able to weigh them found they weigh only 25 grams. A real American Silver Eagle coin should weigh 31.103 grams.

Yes, I bought two coins from one of the sites, but I did so for educational purposes. I suspected that these would be counterfeit, and I wanted the coins to learn more about them. I believe they are silver plated. As for what is under the silver plate, I have to wait until I can visit a dealer with one of those devices that can analyze coins.

Please do not buy from them.

-

-

The font for LIBERTY is too thin. Also, the stars in her flag draped over the shoulder are too small.

-

-

Aside from the rims being to thin, look at the U in United and the dash between SILVER and ONE. These are not correct for the 2020 ASE.

If you like what you read, share and show your support

Jun 4, 2020 | coins, counterfeit, Eagles, education, silver

Want more information about American Eagle Coins?

The Coin Collectors Handbook: American Eagle Coins has more information and is fully illustrated. Read more →

here;

UPDATE: I BOUGHT TWO COINS FROM THIS COMPANY. THEY ARE FAKE, AS SUSPECTED. Read more →

here!

If a deal is too good to be true, it probably is.

Device that could metallic analysis of a coin below the surface

The company is named LIACOO. Please note the two “ohs” because there is a legitimate company spelled with a single “oh.” LIACOO appears to be selling knock-off products made in China and representing them as genuine for less than market value.

A reader purchased five of these coins. After they arrived, this person said that something looked wrong and asked for help. The images that were sent makes the coins appear to be cast copies of American Silver Eagle coins. COUNTERFEITS!

First, you will NEVER find a legitimate seller sell American Silver Eagle for less than the wholesale price. You may be able to find someone who will round down your cost to the nearest dollar as a loss leader, but the price will never be more than 1-2% less than the spot price. The current spot price of silver is $17.84. If you find someone selling legitimate American Silver Eagle for $17.00-17.50, they will probably sell the coins to convince you to do further business with them. Otherwise, you may want to check the company further.

In this case, an examination of their website has no information about who they are.

- There was no physical address.

- There was no telephone number listed.

- The site did not have a privacy policy required to do business with most of the world.

- The site did not have any policies for shipping, returns, or customer service.

- The pictures of legitimate monster boxes and roll containers were “borrowed” from another site.

There are two places where they provide contact information. On their FAQ page is an email address that uses a different domain. Contact information for the company’s domain name appears on one page that listed an email address, and that customer service was available between 9a and 5p HKT. HKT is the time zone abbreviation for Hong Kong Time.

If that was not enough to convince you that this deal is too good to be true, further research went into their Internet presence.

Their domain name registration shows that the name was purchased from a company in Guangdong, China, that appears to service small businesses. This service provider is reselling the services offered by Baidu. Baidu is a Chinese state-controlled search engine, sometimes called the Google of China. The Chinese government heavily regulates Baidu.

The website is hosted on servers owned by Alibaba. Alibaba is a China-based e-commerce conglomerate whose ties with the Chinese government is uncertain. Although founder Jack Ma has claimed to have no government ties, it is essential to remember that the Chinese government regulates everything and censor Internet traffic inside its borders.

Everything regarding their Internet presence confirms that they are a China-based company. Remember, many of the worst counterfeit coins have origins in China.

I provided the details of the clues I was looking for to help you understand how to spot a scammer. I went further by looking into their Internet presence since I have the background to understand the under-the-hood workings of the Internet. However, my examination of the website was enough to convince me not to buy the coins.

If anything about the offer makes you uneasy, then do not buy the coins. If you want me to look at the site, leave a message in the comment section below, or send me a note. “Let’s be careful out there.”

May 6, 2020 | advice, books, education

Even as some areas of the country are easing quarantine restrictions, the best way to prevent the spread of COVID-19 is to stay home. Although the United States has 4.25-percent of the world’s population, it has 33.19-percent of the reported cases of the disease with a death rate of 5.77-percent.

Even as some areas of the country are easing quarantine restrictions, the best way to prevent the spread of COVID-19 is to stay home. Although the United States has 4.25-percent of the world’s population, it has 33.19-percent of the reported cases of the disease with a death rate of 5.77-percent.

The dangers of the novel coronavirus are not only to older people, who dominate the hobby, reports that younger people who may not have shown symptoms have experienced strokes. Even the youngest children are showing symptoms that resemble Kawasaki disease.

I know it is a financially and mentally tough situation. The business I worked hard to build was beginning to break through when Maryland ordered non-essential companies to close. When I am not working alone to organize a warehouse, I am finding solace in numismatics.

During the last few weeks, I have been reducing the to-be-read pile of books. But I am beginning to run out of books. I am looking for something different. Since I like history and tying history with numismatics, I am looking to learn something new. With a tight budget, I am also looking for something new that does not cost much.

I found four entries to my Quarantine Reading List that are interesting and have taught me something. The best thing about each of the books is that each is available online.

U.S. Mint Modern Era

Other than the formation of the U.S. Mint, there is no single seminal event that marks its history than the elimination of silver from circulating coinage. It is the dividing line between what is considered classical coinage and the modern era.

Other than the formation of the U.S. Mint, there is no single seminal event that marks its history than the elimination of silver from circulating coinage. It is the dividing line between what is considered classical coinage and the modern era.

When you find information about the era, it discusses the discussion and the result that created clad coinage. But when you dig into the policy, there is a bigger story. As with a lot of history, the details help us understand the road to where we are today.

The road to modern coinage began with changes in the laws and policies at the U.S. Mint. The one place that every law and policy announcement documented is in the “Annual Report of the Director of the Mint Fiscal Year June 30, 1965.”

What makes this over 300-page document interesting to read are the details that are no longer present in present-day Annual Reports. The text reprints congressional testimony, reports, announcements, policies, and the laws that affected the U.S. Mint. Since this report covers the last half of calendar year 1964 and the first half of calendar year 1965, it is ideally situated to document the government’s action from silver to clad coinage.

The first numbered page begins with the text of the Coinage Act of 1965.

For those that like charts and data, you can go to page 201 to read the section on “The World’s Monetary Stocks of Gold, Silver, and Coins in 1964.” It is a look at circulating coinage of the entire world for 1964. It is a fascinating view that the U.S. Mint stopped doing in 1972.

Download your copy of this Annual Report → here.

Colonial Currency

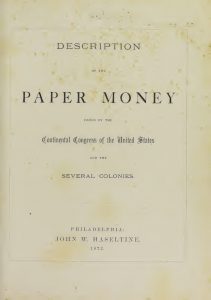

While looking for records about colonial currency, I stumbled on an electronic copy of Description of the Paper Money Issued by the Continental Congress of the United States and the Several Colonies by John W. Haseltine, published in 1872. Haseltine was a dealer, auctioneer, and cataloger of many collectibles, including coins. Many of his catalogs were sparsely illustrated, but the listings have proven invaluable.

While looking for records about colonial currency, I stumbled on an electronic copy of Description of the Paper Money Issued by the Continental Congress of the United States and the Several Colonies by John W. Haseltine, published in 1872. Haseltine was a dealer, auctioneer, and cataloger of many collectibles, including coins. Many of his catalogs were sparsely illustrated, but the listings have proven invaluable.

Paper Money Issued by the Continental Congress is one of those catalogs. Its contents are nothing more than lists of colonial currency issued in the 18th century. It is a useful reference for anyone with interest in the currency of that era. Download a copy → here.

If you want a colonial currency reference that is more extensive, you can download The Early Paper Money of America by Eric P. Newman → here.

Branch Mints and Gold Coins

Did you know that the Charlotte Mint was the first branch mint outside of Philadelphia? Authorized in 1835 following the gold strike at the Reed Gold Mine, it became operational in 1838. The Charlotte branch mint was closed when the building was seized in 1861 by the Confederacy during the Civil War.

Did you know that the Charlotte Mint was the first branch mint outside of Philadelphia? Authorized in 1835 following the gold strike at the Reed Gold Mine, it became operational in 1838. The Charlotte branch mint was closed when the building was seized in 1861 by the Confederacy during the Civil War.

When I wanted to learn more about the Charlotte Mint, I was pleasantly surprised to discover that Charlotte Mint Gold Coins, 1838-1861 by Douglas Winter is available to read online or to download. The book is an easy read with illustrations, and a catalog of the coins struck at the mint. You can find the book → here.

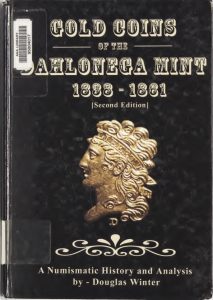

The branch mint in Dahlonega, Georgia, opened after Charlotte also to mint gold coins from a nearby gold strike. Dahlonega was also seized by the Confederacy in 1861 and did not reopened.

Gold coins minted at Dahlonega carry the “D” mintmark. Since Dahlonega only struck gold coins and gold coins were not struck in Denver, this has not been an issue. To read about the colorful history of this branch mint, read Gold Coins of the Dahlonega Mint 1838-1861, Second Edition, by Douglas Winter. The book is similar in format to Winter’s Charlotte book. You can find this book → here.

Gold coins minted at Dahlonega carry the “D” mintmark. Since Dahlonega only struck gold coins and gold coins were not struck in Denver, this has not been an issue. To read about the colorful history of this branch mint, read Gold Coins of the Dahlonega Mint 1838-1861, Second Edition, by Douglas Winter. The book is similar in format to Winter’s Charlotte book. You can find this book → here.

Winter did write books about the gold coins struck at the New Orleans and Carson City Mints, but I had not read either book at the time of this writing. These books and more free resources are available through the Newman Numismatic Portal.

Apr 23, 2020 | advice, education

Contrary to popular belief, you can put metal in your microwave oven. It will not make your oven explode or catch fire. But that does not mean it is a safe thing to do.

Microwaves work by shooting electrons at whatever it finds. The electrons create friction as it passes through the surfaces and generates heat. These electrons cannot pass through a metal surface. When you try to microwave metal, you will see sparks as the electrons skip over the metal surface.

Some chefs have discovered ways of using aluminum foil to direct the electrons to use the skipping electrons to add extra heat to one area of the food. As part of the process, the electrons speed up before finding someplace to go. Another technique is to cover areas to minimize the reaction.

Regardless of how you try to control the flow of electrons, they have to find someplace to go. The reaction is the basis of chemistry. A free electron looks to bond with an atom that has more protons than electrons. It balances the equation.

This basic science lesson is to help explain why you do not want to microwave your currency.

You might have heard that using your microwave oven would help kill the COVID-19 virus. Some research says it is plausible, but the idea is for food. If you have any questions about whether your takeout order is safe, put it in your microwave. You can also heat your food in an oven or on your stovetop. As long as you cook the food to over 140°F (60°C), you will kill most pathogens.

But what happens when you put money in your microwave? It will burn!

The Bureau of Engraving and Printing has produced currency notes with a security thread to thwart counterfeiting since 2003. The security thread is a thin ribbon of metal embedded into the currency paper. Hold the currency up to the light, and it will tell you what the denomination should be. On the $100 note, it is a wider strip with a distinct look.

When you microwave money, the electrons will strike the metal thread, pick up speed, and look for a place to land. The next softest material is the currency paper around the security thread. The increase in friction on the currency paper will cause the paper to burn.

Think of it like this: rub your hands together for a few seconds. You will feel your skin begin to heat. Now multiply your hand rubbing by the speed of an electron flying by, and the friction will burn your hands. That is what is happening to the paper.

If you do burn currency paper, bring all the pieces to your bank. The bank will exchange the notes for ones that are not burned and will send them back to the Federal Reserve for disposal.

CLEANING MONEY

First, if you are working with collectibles, DO NOT CLEAN YOUR COLLECTIBLE COINS AND CURRENCY! Cleaning collectible coins, currency, tokens, and medals will reduce their collector value. Just don’t do it!

There are many ways you can clean your circulating pocket change. You can wipe them with a disinfectant, including 70% rubbing alcohol or a household wipe that contains alcohol and Dimethylbenzyl Ammonium Chloride (Clorox and Lyson bleach-free wipes contain this chemical). Another method is to wash coins using warm water and a dish cleaning detergent. Finally, leave coins in your pocket when you wash your pants. The only problem with washing coins with clothes is the racket your dryer will make, and you may dent the drum. Currency may require a warm iron to make flat again.

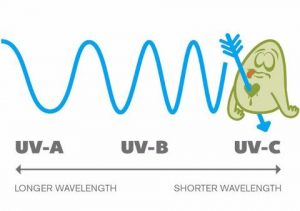

Another method is using ultra-violet (UV) light.

Image courtesy of Phonesoap, a smartphone cleaning device that uses UV-C light.

The short wavelength of UV-C light will penetrate cell walls and kill the DNA within the cells. We are protected from the Sun’s UV-C light by the Ozone Layer of the Earth’s atmosphere. By destroying the Ozone Layer, we let the Sun’s UV-C light penetrate the atmosphere increasing skin cancers.

While UV-C is altering your DNA to create cancers, it is also killing germs using the same properties to alter its DNA.

You can buy lightbulbs that generate UV-C light. However, if you create a UV-C disinfecting station, be careful. Shining UV-C light randomly will cause skin damage worse than a tanning bed. A tanning bed mixes the spectrum of UV light and filter most UV-C light. But a dedicated UV-C light is not good for your body.

Since UV-C light does not generate a lot of heat, you can create an enclosed disinfecting station using almost any material. One example is to create a box using poster board with the edges sealed with duct tape. Cut a hole in the top for the light and then seal the hole with the duct tape. Place your currency inside the box and leave it for 15 minutes.

If you spend a little more money, you could purchase a wall timer. Set the time for the light to turn on after you leave the room and to turn off 15 minutes later. Do not go into the room until the process completes.

There are commercially made devices made with sealed chambers and timers.

Finally, if you want the safest way to disinfect your money, place it in a plastic bag that seals. Close the bag most of the way. Leave about an inch unsealed. Then let the bag sit in a sunny area for about 24 hours. The natural UV-C light will disinfect the money. When you are ready, remove the money and throw the bag away. Use a clean bag for the next round.

Of course, you can avoid all of this by using a credit card that you can clean with a disinfecting wipe when you get home. Contactless payments, like Apple Pay, Google Pay, and Samsung Pay are also alternatives to paying with cash.

I am getting ready to open the next chapter of my life, and I was thinking about how I can leverage my knowledge and experience to enhance the collecting community. As an experienced collector of all types and a dealer in areas other than numismatics, I learned a lot about collectors and their habits that could benefit a general audience.

I am getting ready to open the next chapter of my life, and I was thinking about how I can leverage my knowledge and experience to enhance the collecting community. As an experienced collector of all types and a dealer in areas other than numismatics, I learned a lot about collectors and their habits that could benefit a general audience. One of the more difficult things to explain to a new collector is how much a coin is worth. A common misconception is that an older coin is worth more than one struck later. Although I wrote two blog posts about coin pricing (links to

One of the more difficult things to explain to a new collector is how much a coin is worth. A common misconception is that an older coin is worth more than one struck later. Although I wrote two blog posts about coin pricing (links to

Even as some areas of the country are easing quarantine restrictions, the best way to prevent the spread of

Even as some areas of the country are easing quarantine restrictions, the best way to prevent the spread of