Dec 23, 2018 | auction, financial documents, news, scripophily

Imperial Russian Government, 1917 Specimen 4% Savings bond sold at auction for $12,810 (Image courtesy of Archives International)

This past week, Archives International announced that a 1917 Imperial Russian Government 4% Savings Bond Specimen that was estimated at $400-600 sold for $12,810 with buyer’s premium. It was a record for Russian Specimen bonds.

Archives International is not the standard numismatic auction house many have come to recognize. They specialize in all types of financial paper from around the world. From 2007 to 2011 the firm handled American Bank Note Archives Auctions, Parts I through VIII, which included their entire archives of samples and other financial paper ephemera from the worldwide customer base of ABN through history.

Recognizing this accomplishment is not only good for Archives Internation but for the numismatic industry. It shows everyone that there is more to collecting numismatics than coins. It shows that you can take an interest in collecting currency, bonds, stock certificates, and other scripophily and still be a numismatist.

Somewhere in grandpa or grandma’s belonging may be a stock certificate for The Haloid Photographic Company, Computing-Tabulating-Recording Company, or Minnesota Mining and Manufacturing Company that may not be worth anything financially, but what a wonderful piece of history would be added to your collection!

And now the news…

December 16, 2018

KARACHI: The State Bank of Pakistan (SBP) on Monday issued Rs50 commemorative coin with regard to International Anti-Corruption Day, ARY News reported. The federal government had authorised the central bank for issuing the coin, which was made available at the exchange counters of all the field offices of SBP Banking Services Corporation.  → Read more at arynews.tv

→ Read more at arynews.tv

December 17, 2018

(ArtfixDaily.com) FORT LEE, N.J. – Archives International Auction’s “50th Milestone Auction” held on December 3rd & 4th, 2018 was highlighted by a 1917 Imperial Russian Government 4% Savings Bond Specimen estimated at $400 to $600 and hammering for $12,810 smashing all previous records for Russian Specimen bonds on December 3rd, 2018, the first day of a two day sale, held at the historic Collectors Club in New York City.  → Read more at artfixdaily.com

→ Read more at artfixdaily.com

December 17, 2018

Editor's Note: Kitco News has officially launched Outlook 2019 – Rush To Safety – the definitive reference for precious metals investors for the new year. We chose this year's theme as financial markets face growing uncertainty.  → Read more at kitco.com

→ Read more at kitco.com

December 18, 2018

NATIONAL Police warn the public to keep an eye out for coin scam going around Europe once again.  → Read more at euroweeklynews.com

→ Read more at euroweeklynews.com

December 19, 2018

A Tudor coin hoard found in Shropshire which features Henry VIII and all his children is on display at Ludlow Museum.  → Read more at shropshirestar.com

→ Read more at shropshirestar.com

December 21, 2018

CBK lauded over new currency that is friendly to the blind  → Read more at standardmedia.co.ke

→ Read more at standardmedia.co.ke

BONUS

I named three very significant companies above. If you have not guessed who they are today and have read this far:

- The Haloid Photographic Company

- Founded in Rochester, NY in 1906 as a company that manufactured photographic paper and equipment. In 1938, Chester Carlson invented a process for using an electrically charged dry powder that could be transferred to paper by pressing it on a roller. It took nearly 20 years to perfect before it became a product. The company coined the term “xerography” from two Greek words meaning “dry writing.” In 1961, the company was renamed Xerox.

- Computing-Tabulating-Recording Company

- Formed in 1911 to be the holding company for four companies: The Tabulating Machine Company, International Time Recording Company, Computing Scale Company of America, and the Bundy Manufacturing Company. The four companies made a range of products from time-keeping systems, scales, meat slicers, and punch card equipment. Thomas J. Watson Sr. was hired by CTC in 1914 after he was fired from NCR. He became company president in 1915. In 1924, Watson renamed the company the International Business Machines Corporation (IBM).

- Minnesota Mining and Manufacturing Company

- The company was founded in 1902 in Two Harbors, Minnesota to attempt to mine corundum in Minnesota and provide manufacturing support. When the mines turned out to be a failure, the company moved to Duluth and began to manufacture sandpaper. Over the years, the company found new products to manufacture and diverged from its mining roots. The name was too cumbersome to put in packages so they used the trade name “Three-M.” Later it was shortened to 3M and in 2002, the company officially changed their name to 3M.

As Paul Harvey used to say, “Now you know the rest of the story.”

Apr 23, 2014 | history, scripophily

If education is a lifelong project, then numismatics is the perfect vehicle for continuing education. If you are only collecting the metal, the plastic surrounding the metal, or the paper without understanding the stories behind them, then you are missing the richness of the story behind those objects. These stories makes those coins, paper, medals, and tokens come alive.

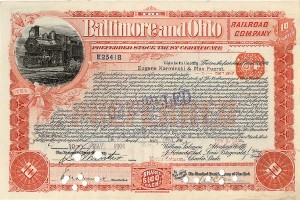

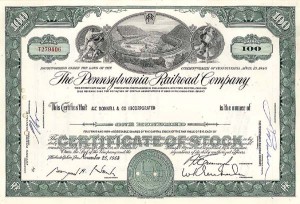

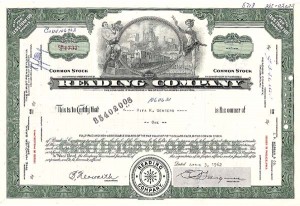

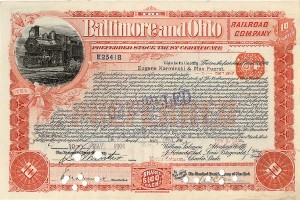

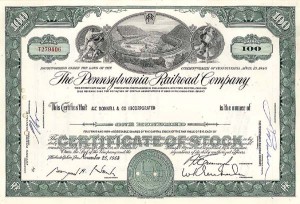

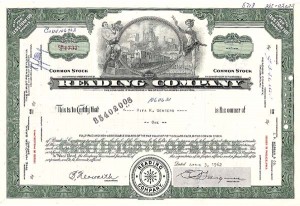

Let’s take the story of some paper, but not just any paper. This paper are of stock certificates of companies gone by. But not just any companies. These are railroads that are featured on the board game Monopoly.

Let’s take the story of some paper, but not just any paper. This paper are of stock certificates of companies gone by. But not just any companies. These are railroads that are featured on the board game Monopoly.

The railroads in the game are based on real railroads that had an effect on Atlantic City, New Jersey in one form or another. The Reading Railroad and Pennsylvania Railroad served Atlantic City. Although the Baltimore and Ohio (B&O) Railroad did not serve Atlantic City, it was a major feeder railroad to both the Reading and B&O.

But the game has one railroad, the “Short Line” which was claimed to never exist but was a combination of rail lines. But that story bothered me, so I went on a search for what was the real Short Line Railroad.

After several web searches and reading various references, I was lead to the book Monopoly: The World’s Most Famous Game And How It Got That Way by Philip E. Orbanes. According to many, it is the definitive book about Monopoly.

I purchased the book and learned that the Short Line was really a railroad. Well, it was actually the shortened name of a service called the Shore Fast Line, an electric streetcar that ran between Atlantic City and Ocean City. It was one of such short rail services operated by a company named the Atlantic City and Shore Railroad.

Shore Fast Line Ticket

(image courtesy of sjrail.com)

The railroad was founded in 1906 when the West Jersey and Seashore Railroad electrified their main line with the financial help of the Stern and Silverman Syndicate. The new company was chartered as the Atlantic City and Shore Railroad. Although the first cars began to run in 1906, the full line became operational in 1907. The company was dissolved in 1945 after its sale to the Atlantic City Transportation Company, who were buying the small railroads in New Jersey. The new company continued to operate the Shore Fast Line until 1948. Atlantic City Transportation Company stopped running all trains in 1955. They continued to operate busses until 1985 when New Jersey Transit took over the service.

Numismatists who collect scripophilly (the study and collection of stock and bond certificates) who knew about the B&O, Pennsylvania, and Reading railroads and wanted to create a Monopoly collection can start to look for the stock certificate of the Atlantic City and Shore Railroad to properly complete the set. The problem is that the stock certificate for the Atlantic City and Shore Railroad is rare as compared to the other three meaning it can cost significantly more to obtain.

I found an unissued stock certificate for the Atlantic City and Shore Railroad at the site for George H. LaBarre Galleries, Inc., a company in Hollis, New Hampshire. For such a rare stock certificate in excellent condition, the $75 price tag seems reasonable. LaBarre also sells the “Monopoly Game Board Set” with the B&O, Pennsylvania, and Reading Railroad stock certificates.

I found an unissued stock certificate for the Atlantic City and Shore Railroad at the site for George H. LaBarre Galleries, Inc., a company in Hollis, New Hampshire. For such a rare stock certificate in excellent condition, the $75 price tag seems reasonable. LaBarre also sells the “Monopoly Game Board Set” with the B&O, Pennsylvania, and Reading Railroad stock certificates.

With all four certificates, you can add the cards from a real Monopoly game, $200 in Monopoly money for each, plus $200 for the rent that would have to be paid if someone landed on your railroad. You should also find the “Take a Ride on the Reading” and “Advance token to the nearest Railraod and pay owner Twice the Retal…” cards. Put it all together in a frame and hang it in your game room.

Baltimore & Ohio Railroad.

Pennsylvania Railroad stock certificate with famous horseshoe curve train scene.

Reading Company, owner of the Reading Railroad.

Atlantic City and Shore Railroad, operator of the Shore Fast Line (Short Line in Monopoly)

And with that, you can have a lot of fun with the part of numismatics known as scripophilly!

I have no connection with

George H. LaBarre Galleries. Since I am using their images, I think it is only fair to give the company credit and, hopefully, steer some business their way. So if you are interested in these or other scripophilly items,

shop their online catalog!

Oct 13, 2011 | coins, fun, scripophily, video

Those watching television in the evening had the opportunity to watch two shows were numismatics played a role in the story. On Monday night, CBS’s Hawaii Five-0 had a story that included Spanish gold escudos and the Hawaii over-print dollars.

After a child found a disembodied hand floating in the water, the fingerprints identified its former owner. When they went to search his home, the Five-0 team found Spanish gold coins soaking in a tank of water. McGarrett and Danny Williams went to a local museum to learn that a Spanish galleon carrying a cargo of gold coins sunk near the islands. Being good detectives, Five-0 traces the search for the galleon to a diving company that specializes in searching for lost treasure. As part of looking for the rest of the body, Five-0 and the Coast Guard finds an abandoned boat—or what they thought was abandoned. This leads them to go diving to see what was below the surface.

In an underwater wreckage, they find a body. When the body was examined, the wallet contained currency that was washed out. Using whatever forensic techniques they used to identify the note, they enhanced the image to find that it was a Series 1934A Federal Reserve Note issued in 1942. The forensic scientist explains how the Hawaii overprint notes were issued in case the notes were captured by the Japanese during an invasion. If that happened, the notes could be demonetized, making them useless.

The note was used to help identify the body and the gold escudos were used to trace who was responsible for the murder.

To see the full episode of “Mea Makamae,” you can watch it on CBS’s website here.

One of my favorite shows is History Detectives on PBS. For those who have not seen the show, History Detectives explores the history behind artifacts that people find or are handed down by family members to discover its history and the history behind the objects. Anyone who loves history may want to add History Detectives to your must see list.

This past week, Gwen Wright, who is also a professor of architecture at Columbia University, investigate a stock certificate issued by the Harlem Associated Heirs Title Company.

The person who initiated the investigation was a collector of stock and bond certificates, a part of numismatics called scripophily. Those who collect these certificates have interests in financial history, the signatures, or artwork on the certificates. Early certificates were hand autographed by the presidents and treasurers of the companies making them more desirable. Today, stock certificates are a thing of the past since stocks are transacted electronically.

In this investigation, Wright traces the certificate to the history of Harlem. Originally, the area we know as Harlem was a remote area of Manhattan island, far away from what we know today as downtown where most of the people lived. The area was dotted with exclusive vacation homes of the rich with a section of land that was granted to a group of people. By the end of the 19th century and into the early 20th century, New York City grew so much that Harlem was no longer a remote area and the city worked with developers to develop the land regardless of alleged ownership. The Harlem Associated Heirs Title Company was a group who tried to reclaim the property after the turn of the 20th century.

Of course I left out some details. Watch the segment from this week’s show:

May 16, 2011 | advice, education, exonumia, notaphily, scripophily

Numismatics is the collecting and study of items used in the exchange for goods, resolve debts, and objects used to represent something of monetary value. The dominant area of numismatics is the collection and study of legal tender coins with United States coins being the most collected. But numismatics is more than collection coins. It includes the collecting and study of:

- Exonumia—the study of tokens, medals, or other coin-like objects that are not considered legal tender. Those involved in exonumia collect elongated and encased coins, badges, counterstamped coins, wooden money, credit cards, and the like. Military medals are also collected as exonumia. And do not forget Love Tokens and Hobo Nickels, former legal tender coins with special engravings and carvings.

- Notaphily—is the study and collection of banknotes or legally authorized paper money. Notes can be collected by topic, date or time period, country, paper type, serial number, and even replacement or star notes (specific to the United States). Some consider collecting checks part of notaphily. Checks are collected by issuing bank, time period, and the signature.

- Scripophily—is the study and collection of stock and bond certificates. This is an interesting subset of numismatics because of the wide variety of items to collect. You can collect in the category of common stock, preferred stock, warrants, cumulative preferred stocks, bonds, zero-coupon bonds, and long term bonds. Scripophily can be collected by industry (telecom, automobile, aviation, etc.); autographs of the officers; or the type of vignettes that appear on the bonds.

I bring this up because a friend was asking about what to collect. He was under the impression that numismatics were coins only. I explained it was more than coins—it is anything that represents money or money-like items or even medals that represent worth. This is how military medals are considered part of numismatics. A medal representing the achievement shows the worth of the soldier as a warrior.

Showing him my collection, I showed how I have items that cover all of the areas of numismatics. New York City subway tokens and various medals are all part of exonumia. My recent interest in Maryland colonial currency and the purchase of some of the special collectibles from the Bureau of Engraving and Printing are part of notaphily. I cannot forget my small collection of stock certificates that represent the railroads in the original Monopoly game is a modest dive into scripophily.

I told my friend like I tell everyone else: why collect what everyone else collects. I collect what I like. I collect based on the “oh, neat!” factor. This is why I have a set of the Somalia Motorcycle Coins and looking for a set of the Somalia classic muscle car coins.

In other words, collect what you like and like what you collect!

Jul 5, 2009 | currency, economy, policy, scripophily

While the study of coins can be a lesson in history, the study of paper currency can present a lesson in economics that may be relevant today. With the state of California printing and distributing IOUs to meet its financial obligations, I am reminded of how the colonies used similar arrangements to finance the fighting of the Revolutionary War.

During the colonization of the New World, charters were granted to companies to set up businesses and trade the natural resources they found back to England and the rest of the known world. We may be more familiar with the East India Company from popular movies, the first settlement at Jamestown was colonized by the Virginia Company of London. These and other companies were originally chartered by King James I to set up trading centers on the shores of the new world to make it easy to goods back to Europe.

As the companies became successful, the English government became more interested in expanding its empire. The Royal Navy was sent to the new world to protect shipping lanes. As threats from other countries and Native Americans endangered the colonists, the King began to revoke charters to make the companies Crown colonies. Governors were install with Army garrisons at their ready to expand holdings against other nation’s settlers and to fend off Indian attacks.

Following the French and Indian War, the British government was in considerable debt. When they added the cost of keeping a regular army in the colonies, the extra expense was more than King George III wanted to endure. Beginning with the Stamp Act of 1765, Parliament tried many ways to have the colonies pay the debt and for their protection. With no representation in Parliament, the colonies began the road to independence proclaiming “No Taxation Without Representation!”

In order to maintain their control over the colonies, the King and Parliament only allowed minor, non-precious metal coins to be used for commerce in the New World. Colonist adopted by accepting silver coins from other countries as legal tender. The most common coins was the Spanish 8 Reales or Pillar Dollar. But the Pillar Dollar was not enough to fight against the powerful British Army, who was attempting to keep order.

The first currency issued in the New World was issued by the Massachusetts Bay Colony in the 1690s. Later in the eighteenth century, other colonies began to issue currency, many times surreptitiously without the knowledge of the colonial governor, to raise money. When colonial assemblies issued currency, they were issued as indented bills of credit with a plan to repay the loans.

Colonial assemblies issued two types of currency. One type of issue were indented bills of credit which were not considered legal tender but could be used to pay fees or taxes. These notes contained one or more receipts or payment slips that were redeemed at specific intervals for hard currency. Legal tender currency were allowed to circulate for commerce. Both types of notes usually were printed with a denomination, value basis for the denomination, the interest rate of return, and when the note can be redeemed for hard currency. The value basis for the denomination was usually expressed as “Bill of Exchange in London for Gold and Silver” and a rate of exchange. However, that exchange rate was different from colony to colony which made inter-colony transaction difficult. Value was also based on the trustworthiness of the colony to repay these notes.

As the Revolutionary War continued, colonial assemblies found themselves without the ability to raise enough money to pay off their currency. One way around the problem was to issue enough currency to cover the last issue plus a little more to cover current expenses. Not only did this create a big debt for the colonies, but that debt made the paper worth less than is printed value which made it difficult for the colonies to purchase supplies.

After the war, both the Continental Congress and the new states were competing with each other generate revenues and to pay off their debts. This continued until the US Constitution was ratified in 1789 and the federal government took over the minting and issuing of money. Because this demonetized the currency from each state, a compromise was made to trade the currency at the rate of 100 state dollars for one dollar of the new United States currency—which at that time was being paid in Spanish Milled Dollars.

Even though the states lost the rights to print and distribute money, they continued to have the right to issue non-legal tender bills of credit in order to raise money. These bills of credit were issued in the form of bonds that were either redeemable on the date of maturity or had a periodic payment option. Bonds are usually issued to pay for capital improvement projects. They are associated with a source of revenue that would be used to reimburse the bond holders, such as a tax. This practice continues today with every states’ debt being backed by many bond issues. And with technology, most bond issues are not printed. Rather, they electronic records noting ownership of the bonds.

The paper issued by the colonies, the Continental Congress, and the United States under the Articles of Confederation are very collectible. Aside from being a lesson in history, it is a lesson in the state of the art of printing in the colonial times and a lesson in colonial economics. Finding colonial currency is not easy, a nice collection can be awe inspiring. One such collection is in the Colonial Currency Collection at the University of Notre Dame’s Department of Special Collections.

The State of California is in serious economic trouble. Their fiscal year began on July 1 without a budget and a significant deficit between the government’s income and their legal obligations to provide services to the citizens of California. Governor Arnold Schwarzenegger declared a fiscal emergency and order the printing of IOUs to pay state debt obligations. Initially, 28,750 IOUs worth $53.3 million will be issued mainly for personal income tax refunds. The IOUs will carry a 3.75-percent interest rate redeemable by October 2 or earlier if a budget agreement is reached.

The financial term for the IOUs are “registered warrants.” For the citizens receiving these IOUs, most of California’s in-state and nationally-owned banks said that they will accept the IOUs as deposits for a limited time.

California last issued IOUs in 1992 during a similar budget crisis.

Records of the how many of the IOUs were redeemed do not seem to be publicly available and I did not find an auction record for the paper issued in 1992. However, it stands to reason that the paper IOUs will be highly collectible. Opportunists have been using online classified websites to offer to purchase these warrants as souvenirs (see an ad).

Although registered warrants are not legal tender, people may elect to trade and barter these IOUs for goods, services, and even legal tender money. We can only wonder if the paper will become more valuable as a collectibles as the Zimbabwe notes after their government devalued Zimbabwean Dollar because of hyperinflation. That ball is in the court of the California legislature. But they will make interesting collectibles.

Jan 18, 2007 | auction, notaphily, scripophily

An area of numismatics that some find interesting is scripophily and notaphily. Scripophily is the collection of study of stock and bond certificates. Notaphilly is the collection of paper money or bank notes. Checks, while commonly classified as scripophilly is actually a part of notaphilly. Both areas spotlight the beauty of the engraving and the originality of the vignettes that adorn these paper items.

Just like other areas of numismatics, there is no “correct way” to collect scripophilly. Collectors look for items based on theme, age, historical significance, signatures, printer of the paper, paper quality, type of engraving, the beauty of the engraving, and so on. Themes can be developed for any collector to appreciate. For example, I own examples of the Monopoly railroad stock set. Other popular themes are automobile companies, high tech companies, popular food service companies, beverage companies, and more.

I was introduced to other areas of notaphilly when someone gave me US Military payment certificates (MPC) that would be used in the on-base post exchanges (PX). While historically interesting, I was intrigued by seeing a check signed by then New York Governor Theodore Roosevelt to pay a bill from an Albany-area merchant.

A common theme of these paper examples were the use of fine engraving to better secure the documents. The fine engraving attempted to discourage hand copying and be too fine for the evolving technology of photography from being able to image this paper. The idea was why create mundane designs when they can be made beautiful. This resulted in people wanting to collect these items for their beauty, history, and the function they represent.

The American Banknote Company is this country’s oldest security printing company. Tracing its history back over 200 years, ABN produced the country’s first postage stamp, US and world banknotes, and stock certificates for many companies. Some of the most beautiful and interesting security printing was created by ABN. ABN has maintained an archive of the items they have printed over the years. Now with the advent of new technologies, including digital printing services, ABN has been selling its archive in public auctions.

This week, H.R. Harmer, the auctioneer who sold Franklin D. Roosevelt’s stamp collection, announced they will be auctioning the final lots from the ABN archive. The auction will consist of over 1,400 lots of stock certificates and samples from world bank notes that will include examples from many well know companies.

The auction will be held January 31, February 1 and 2 in West Caldwell, New Jersey and as a live auction on eBay. You can view the items for auction on eBay or via H.R. Harmer’s catalog website. This should be fun!

→ Read more at arynews.tv

→ Read more at arynews.tv → Read more at artfixdaily.com

→ Read more at artfixdaily.com → Read more at kitco.com

→ Read more at kitco.com → Read more at euroweeklynews.com

→ Read more at euroweeklynews.com → Read more at shropshirestar.com

→ Read more at shropshirestar.com → Read more at standardmedia.co.ke

→ Read more at standardmedia.co.ke