May 23, 2011 | commentary, gold, policy, silver

In recent months, there has been a call to either push for a gold standard or watch as states introduces bills coin their own money in response to the economy. On the extreme, Rep. Ron Paul (R-TX) introduced a bill that proposes repeal legal tender laws that will essentially bring the country back to the chaos of the United States pre-constitutional economies. Many of these arguments are interesting with some good and bad ideas, but they do not take into consideration issues of basic math.

If a proposal to move the United States to either a gold, silver, or bi-metal standard passes, we will probably see the biggest economic contraction in history because there is not enough gold or silver in the country’s storage in order to cover the total money supply.

First, in calculating the country’s value of gold and silver holdings, we find that according to the 2010 United States Mint Annual Report [PDF], there are 245,262,897 troy ounces of gold stored in the United States Bullion Depository in Fort Knox, Kentucky. This amount has not changed in recent memory. In the Mint facility at West Point, nicknamed the “Fort Knox of Silver,” the country owns 7,075,171 troy ounces of silver. But what they worth?

Determining the worth of the metals in storage is an interesting exercise. If we valued the government’s total holdings in accordance with statutory requirements, gold is valued at $42.22222 per fine troy ounce (see 31 U.S.C. § 5117(b)) and silver is values at least $1.292929292 per fine troy ounce (see 31 U.S.C. § 5116(b)(2). Although these values are much lower than what the markets value these metals, when the federal government counts its assets, gold and silver is based on numbers written into law.

Valuing these metals based on their market value, gold is worth $1,514.20 per troy ounce and silver is $35.16 per troy ounce (New York prices when the market closed on May 20, 2011). These values significantly raise the value of the government’s holdings. Using these numbers we can calculate the United States’ total holdings as:

|

Gold Statutory Value |

Gold Market Value |

Silver Statutory Value |

Silver Market Value |

| Inventories (troy ounces) |

245,262,897 |

245,262,897 |

7,075,171 |

7,075,171 |

| Valuation per Troy Ounce |

42.2222 |

1,513.20 |

1.292929292 |

35.16 |

| Total Value (in millions) |

$ 10,355 |

$ 371,205 |

$ 9,148 |

$ 247,985 |

| Total Statutory Value: |

$ 10,365 million |

| Total Market Value: |

$371,453 million |

This means that the amount of money the economy can have is over $371 billion. This seems reasonable until we look at the total amount of money that in economy.

Economists have several ways of calculating the money supply in an economy. The Federal Reserve used M1 and M2 as their basis of analysis. M1 is a narrow measure of money’s function as a medium of exchange. In other words, it is the purchase power of all liquid or near liquid assets. M2 is a broader measure that reflects money’s function as a store of value. For the Federal Reserve, M1 is basically the supply of ready cash. M2 consists of M1 plus other deposits that are not as readily available, such as savings and retirement accounts. The economists at the Federal Reserve are constantly updating these numbers to determine how well the economy is doing.

According to the Money Stock Measures published by the Federal Reserve on May 19, 2011, at the end of April 2011, the seasonally adjusted M1 money supply was $1,901 billion meaning that there is just under $2 trillion of ready cash in the economy. The M2 money supply, the count of all cash, is $8,945.7 billion.

When calculating what is needed to back the United States currency with precious metals, this is where basic mathematics shows the potential failure of the policy. If such a policy requires the instant conversion of all ready cash (M1) to be backed by metals, only the first $371 billion of the nearly $2 trillion could be converted. In other words, in order to back every dollar with the country’s store of metals, we are over $1.6 trillion dollars short. To cover the entire money supply (M2), there is a $7.2 trillion shortfall. Simply, there is only enough gold and silver to cover about 5-percent of all cash and equivalents in the United States economy.

In order to break even on the conversion, the country would either have to acquire precious metals on the open market, issue $7.2 trillion in bonds that had to be backed by precious metals to a world that does not have those kind of assets, or find a way to revaluate the dollar so that the total money supply can be covered by the $371 billion in physical assets.

And this only covers current assets. It does not account for any growth!

Regardless of how the metals advocates justify their positions, it would be impossible to back the entire economy with down payment of 5-percent.

Apr 24, 2011 | coin design, commentary, nclt, US Mint

I’m bored with the America The Beautiful Quarters Program.

I’m bored with the commemorative coins that is produced by the U.S. Mint.

I’m bored with soap opera surrounding what U.S. Mint is going to do with the American Eagle coins.

I’m bored with many of the designs that the U.S. Mint has produced while ignoring the best efforts of the Citizens Coinage Advisory Committee and the U.S. Commission of Fine Arts to tell them otherwise.

I’m bored with what is coming out of the U.S. Mint and looking at the interesting collector coins coming out of other mints who are being more innovative with their designs. Where the U.S. Mint has produced one ultra-high relief coin, the Royal Canadian Mint has three high-relief coin designs for 2011.

I’m bored with the themes of the coins coming out of the U.S. Mint. While the Medal of Honor Commemorative is a worthy coin and one of the few good designs to come out of the U.S. Mint, but I am fascinated by what some of the other mints are doing. The Mongolia 2011 500 Tugrog Endangered Wildlife silver commemorative features the Ural Owl struck in high relief with an antique finish and Swarovski Crystal Eyes. This is part of the same series that produced the 2007 Wolverine coin that was named the 2009 Coin of the Year. It also was a high relief coin with an antique finish and Swarovski Crystal eyes. We have great artists in the United States, why can’t the U.S. Mint create coins like this?

Why can’t the U.S. Mint celebrate the history of auto making in the United States the way Tuvalu celebrates Classic Sports Cars or great American motorcycles the same way Somalia did in 2007?

My late mother was a fan of impressionism. She could tell you anything about the artists and the art of that era. One day, I showed here the 2007 Niue Island Van Gogh rectangular silver dollars and thought the design was one of the neatest things she saw. Every time I see on online I am reminded of her interest in a coin when she was not a coin collector. Could we interest others artists if the U.S. Mint created coins honoring American artists? Can you imagine what could be done with Georgia O’Keeffe’s flowers, Andy Warhol’s pop art, or even Louis Comfort Tiffany’s glass designs? These could become popular collectibles and generate significant seignorage for the U.S. Mint.

The reason why the U.S. Mint is behind the rest of the world is because of congress. Congress has taken its power to coin money and has clutched it in such a pedantic manner that it has turned the U.S. Mint into a tired looking organization that is falling behind the rest of the world. Although as a factory for circulating coin, the U.S. Mint produces more coins than any other world mint, they are losing the potential seignorage and artistic prestige to other mints that are producing interesting coins that people want to collect.

There is nothing in the constitution that says the U.S. Mint has to be structured the way it is. All we have is 219 years of “this is the way we wrote the law” that binds the United States to a system that is questioned every few years.

One idea is the model an independent U.S. Mint after the operating model of other world mints. One example that could be adopted is to model a new public corporation after the Royal Canadian Mint. While the RCM is required to produce circulating coinage for the Bank of Canada, they have a little more freedom to produce a portfolio of non-circulating legal tender coins that appears to have a broad appeal. Since many of these NCLT coins are made of precious metals, collectors and investors have been purchasing the RCM’s coins as investments.

As a public corporation, the U.S. Mint would continue to be required to supply circulating coins to the Federal Reserve, maintain the American Eagle Bullion program, and the current commemorative program. As a public corporation, they could add support for additional NCLT coins coins that could compete with other world mints to sell coins with great designs.

I realize that this is a very high-level idea of a new future for the U.S. Mint that requires additional details but it would be a waste of time to pursue this further. Given the personalities in congress who would have to approve such a measure, the chance of this happening is the same as the chance of ending the printing of the one-dollar note.

Apr 20, 2011 | commentary, currency, policy, video

Should the United States stop producing $100 bills? According to Timothy Noah, a senior writer at Slate and contributor to CBS Sunday Morning, thinks so. Here is the report that Noah filed for CBS Sunday morning on April 3, 2011:

While a compelling argument but it is not a viable one. Because the U.S. Dollar is the most stable currency even considering our current economic situation, $100 notes will be hoarded overseas and will continued to be counterfeited. It has been reported that rogue nation states like North Korea have successfully counterfeited the $100 note which is why the Bureau of Engraving and Printing is working on its redesign. Having these note continue in circulation could endanger the U.S.

Further, it is doubtful the European Union will discontinue the $euro;500 note even though it is nicknamed “the Bin Laden.” The EU central bank would love to have the euro become the standard currency, the currency all economies are based. It would give more clout in the world markets and provide more incentives for the EU bankers to convince the worldwide commodity markets to price their goods and trade in euros, not dollars.

It is a different world from 1969 when the U.S. government ceased production of the $500 note. Between new counterfeiting measures and the technology to better investigate criminals, the U.S. Secret Service is better able to bring counterfeiters to justice and work with other law enforcement organizations to stop criminals. It is not a perfect system, but making any move that could lower the U.S.’s financial status with the rest of the world will not be well received in Washington.

Apr 7, 2011 | coin covers, commentary, US Mint

In May 1977, Bert Lance was the Director of the Office of Management and Budget under President Jimmy Carter. He was interviewed for Nation’s Business, the news letter for the U.S. Chamber of Commerce. Lance was quoted in the article saying:

Bert Lance believes he can save Uncle Sam billions if he can get the government to adopt a simple motto: “If it ain’t broke, don’t fix it.” He explains: “That’s the trouble with government: Fixing things that aren’t broken and not fixing things that are broken.”

Someone forgot to remind the U.S. Mint of Lance’s axiom.

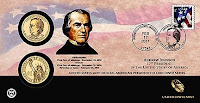

Last month, the U.S. Mint announced the availability of the availability of 2011 Andrew Johnson $1. I am a fan of the coin covers. I have the covers from the 50 State Quarters, D.C. & Territories, Westward Journey Nickels, and the 2000 Sacagawea Dollar covers. I also own the four covers produced by the U.S. Mint produced in the years leading to the American Revolution Bicentennial. However, I was reminded of Bert Lance when I saw the new cover.

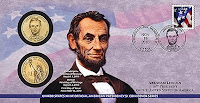

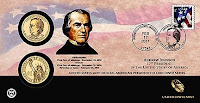

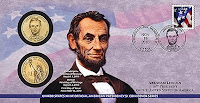

Starting in 2007, the covers had a large image of the president being honored with the president’s name, term, and a postmarked current stamp. On the reverse is a short blurb about the president. Embedded in the cover are two uncirculated coins, one from Philadelphia and the other from Denver, from the first day the coins were struck. It is the only way to know on which date the coins were struck. The entire cover was beautiful in its simplicity.

Starting in 2007, the covers had a large image of the president being honored with the president’s name, term, and a postmarked current stamp. On the reverse is a short blurb about the president. Embedded in the cover are two uncirculated coins, one from Philadelphia and the other from Denver, from the first day the coins were struck. It is the only way to know on which date the coins were struck. The entire cover was beautiful in its simplicity.

In trying to deal with its new branding, the U.S. Mint altered the cover that reduced the cover and added a black bar across the bottom of the cover. The black bar is empty except for a small version of the official U.S. Mint logo on the left and the new branding logo on the right. As a result, the portrait of the president is made smaller. The space taken up by that garish black bar causes the rest of the cover to look cluttered.

In trying to deal with its new branding, the U.S. Mint altered the cover that reduced the cover and added a black bar across the bottom of the cover. The black bar is empty except for a small version of the official U.S. Mint logo on the left and the new branding logo on the right. As a result, the portrait of the president is made smaller. The space taken up by that garish black bar causes the rest of the cover to look cluttered.

Rather than trying to find a more subtle way to add their branding to the cover, like on the reverse without the tacky black bar, the U.S. Mint broke one of their better presentations.

After this debacle, maybe the CCAC Blueprint Report should have added packaging design to the list of functions that should be reviewed!

Images courtesy of the U.S. Mint

Mar 8, 2011 | coins, commentary, dollar

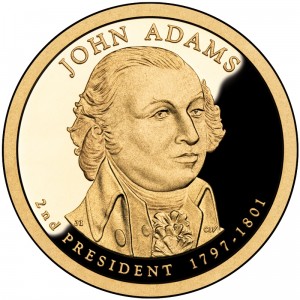

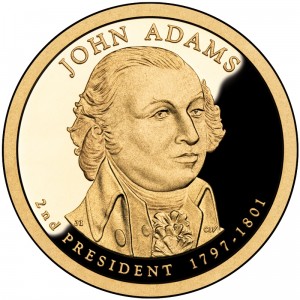

Did you know that the Presidential $1 Coins are “vanishing from circulation at an alarming rate” because they are being hoarded by collectors? Did you also know that the Presidential $1 Coins were “highly coveted coins every produced by the U.S. Mint” and that they are “vanishing from circulation at an alarming rate?”

Did you know that the Presidential $1 Coins are “vanishing from circulation at an alarming rate” because they are being hoarded by collectors? Did you also know that the Presidential $1 Coins were “highly coveted coins every produced by the U.S. Mint” and that they are “vanishing from circulation at an alarming rate?”

This piffle was detailed on a half-hour infomercial entitled DCN Coin Talk starring a pitchman with an official sounding voice and his vapid female sidekick both acting from a script that would have made Phineas Taylor Barnum proud.

Rather than lying awake in the wee hours of the morning, I treated myself to a snack and sat down on the couch in front of the television. After removing the dog’s bone from under my behind, I started channel surfing to find something interesting. I guess cable television does not think anyone would be awake at 5:00 A.M. since the hundreds of stations were filled with bad reruns and infomercials. I found the end of something interesting and watched. After the closing credits, I was greeted with the opening to DCN Coin Talk.

After the opening banter between the pitchman and his muse, they spoke to their correspondent on the scene somewhere in a white room with only a bank vault-like door. The correspondent standing there in a pitch silent room holding his ear as if he holding an IFB in his ear regurgitating his score that ensured he agreed with the pitchman anchor.

To prove this is a legitimate offer, the pitchman anchor introduces David Ganz, “The Father of the 50 State Quarters Series.” Ganz, a long time numismatic author, former President of the American Numismatic Association, lawyer, and Bergen County (NJ) Freeholder, was presented as their numismatic expert as to the potential value of the coins. If you listened carefully, Ganz really did not endorse the product or the claims of their potential price. Ganz did talk about the worth of Morgan Dollars, which were large coins made from 90-percent silver whose population is lower than modern coins. Ganz did not equate the Morgan Dollar to the current Presidential Dollars, but the pitchman anchor really spun what Ganz said into something so positive that it bordered on overreaching.

“You can pay up to six time face value for some of these coins,” the anchor pitchman announced with a smile almost suggesting you could realize a similar profit as well.

After reaching into my pocket for my iPhone, I opened the browser and searched for an article that was familiar sounding. I found an article written by Ganz for Numismatic News that described his experiences making this informercial.

However, the Danbury Mint can help! For $34.95, the Danbury Mint will sell you a roll of 12 “gem uncirculated dollar coins” encased in a plastic roll. Surrounding the roll is an official-looking paper seal that looks like the type placed over the cap on liquor bottles.

But wait, there’s more. In addition to the roll of 12 gem uncirculated dollar coins, you will also receive an additional coin encased in a capsule so that you can have one to admire that is not in the roll. You will receive one roll a month to catch up on the program. All you do is pay $34.95 plus shipping and handling. And since you need to be able to store you new collection, you will also get a beautiful wood case with a tray to hold the capsules above a drawer to hold the rolls. There is a limited supply. Act now before it’s too late!

While the show was entertaining in its absurdity, I am shocked at the chutzpah. What is even more shocking is that I am sure someone is going to buy into this program. I understand that the coins, materials, case, and infomercial costs money, and the purchaser does not care and wants their investment in these coins to appreciate over time. While nobody can predict the future costs of these coins, the truth is that it is doubtful that the buyer would recover the purchase price!

The truth is quite different than what is claimed by this infomercial.

The largest hoards of Presidential $1 Coins are in the coin rooms of the 12 Federal Reserve branches. According to the testimony during a hearing held in July 2010, the representative from the Fed testified that there were $1.1 billion worth of dollar coins waiting to be circulated. When asked why there were so many coins, then U.S. Mint Director Ed Moy testified that even though they have tried to educate the public on the benefit of the coin, most people prefer to use the paper dollar. The hoard is the result of statutory requirements that regulate how many coins are produced.

Rolls purchased from the bank, dealers, or the U.S. Mint’s Direct Ship Program contains 25 coins. Rolls purchased from a bank or the U.S. Mint are sold at face value. Most dealers are selling the rolls at a $8-12 premium including rolls of dollars that are no longer in circulation. You can also purchase older rolls at banks at face value. Visit your bank branch and ask what they have available.

Roll collectors I have spoken with are not interested in short rolls, especially at the retail price of a full roll. Further, roll collectors want to know that the coins within the rolls are from a specific mint. From what I could tell, it is not possible to determine the mint mark on the coins in the Danbury Mint rolls.

If the roll collector wants to collect encased rolls, they usually opt for PCGS Certified Rolls. The PCGS service only accepts rolls from Mint-sealed packaging and places the coins in sonically sealed rolls with their label and tamper evident hologram. These rolls contain 25 coins and dealers have been selling for $50-65.

I have informally polled several online dealers and found that the only Presidential Dollar coins that cost more than $6 are error coins, specifically those with edge errors. Even the most expensive dealer was selling both P & D as a set for $5.75. The most expensive single coin I found was for the uncirculated Lincoln Dollar for $3.50.

While you can buy capsules to hold the coins for around 50-cents each, the coin tubes you can buy holds 25 coins, a full roll. All companies that sell capsules have a storage system that can be displayed on your credenza and easily stored. Some companies make special albums and folders that display the Presidential Dollars well for a fraction of the cost.

Unless you like the display format and do not care about the long term value of the set as sold by the Danbury Mint, then I would not recommend anyone buy into this offer.

Mar 3, 2011 | ANA, commentary, technology

While I unbury myself from “real work,” I have been fielding questions and comments over my postings on electronic publishing. The comments have run the gamut from skeptical to enthusiastic for more electronic publishing.

I bring this up now because as part of the introduction of Apple’s new iPad 2, Apple CEO Steve Jobs announced that Radom House, Inc., the largest trade book publisher in the U.S., has made its catalog of 17,000 electronic books on Apple’s iBookstore.

Apple says that the iBookstore sells ebooks from more than 2,500 publishers and all six major trade publishers. This does not include specialty applications sold in the iTunes app store.

I wonder how difficult it would be to create an ebook version of The Numismatist? While the reader that the American Numismatic Association uses to display The Numismatist on the computer screen, the program uses Adobe Flash, which is not available on the iPad. It also requires that the computer be connected to the Internet reducing its portability.

I wonder of Apple or Amazon.com wants to help pioneer working with not-for-profit organizations by supporting subscription downloads. Amazon.com would be a good partner because they offer the Kindle reader and apps that can read Kindle formatted ebooks for many devices, including the Apple iPad. Imagine waking up one morning and the current version of The Numismatist on your favorite device. Pick up your device and just go!

Since I will not buy the first release of any product, it was difficult to wait for the iPod 2. The iPad 2 is faster, lighter, has new cameras, and more for the same price as the first generation product with a cool Smart Cover, it was worth the wait. Although I will not stand on line in front of an Apple Store when it will will go on sale at 5:00 P.M. on March 11, I will buy one before the end of the month.

Once I buy my iPad 2, I want content. Dear ANA: please sell me content!

Here I am telling the ANA that I will pay my dues for the content they provide in the form of The Numismatist in a form that would be cheaper to produce. I am not asking for something for nothing. In fact, I will pay the current paper version in order to be able to download The Numismatist to my iPad 2 so that I can consume this media how I want. So why isn’t the ANA looking outside of the box to figure out how to do this?

Feb 24, 2011 | ANA, commentary, technology

I received the March 1, 2011 edition of Numismatic News in today’s mail. In a front page, top right article, NN reported that American Numismatic Association membership is down to 28,500 members. This is the low end of the 20 year average of 28,000 to 32,000. It was reported that Kim Kiik, ANA Senior Administration Manager, told the board that an aggressive membership campaigned will be announced shortly.

In the February 2011, ANA President Cliff Mishler wrote in The Numismatist that ANA Governor Wendell Wolka wants to make the ANA library and museum more accessible to ANA members. Wolka wants the library to wants to make it easier for members to reserve books from the library by making the process electronic. He also wants to have rare and popular books digitized so that they may be electronically accessed by members.

On May 21, 2010, when I posted a follow up to my post “ANA versus Technology: The ANA is Losing!,” I wrote that the ANA is doing very little to make the association accessible to the potential 20-something and 30-something members. Then, during my January discussion of electronic publication, I wrote:

Numismatics is dominated by many people over 50. If there is a second age group, it is younger than 18. Missing in the demographic are those from 18-50 who might have been a Young Numismatist but dropped out in college and did not return until after their children have grown. This situation is unacceptable if the hobby is to survive!

The ANA can offer better outreach to this connected demographic by the appropriate use of technology. This does not have to cost a lot of money. It takes a little imagination to figure out where these potential members congregate online and deliver new content.

Based on the reporting of NN and the reporting in the February 2011 edition of The Numismatist, the ANA Board of Governors, the majority who are older than 50, are sticking their proverbial toes in the technology waters where rest of the world has lapped them several times in the race for the attention of the ANA’s lost demographic.

Rather than try to be democratic about providing advice, I am going to be very specific in my recommendations:

- While there is still time to plan, the open sessions at the World’s Fair of Money should be live streamed on a service like uStream. The ANA can start with Board Meetings and other open meetings involving the organization. How about broadcasting some of the Numismatic Theater talks on the Internet?

- What about using something like GoToWebinar to broadcast Numismatic Theater presentations with electronic slides and audio available to anyone who wants to log in at the time of the event. The online portion can be saved so that members can view later on demand.

- Borrow, lease, or buy any number of what is called “prosumer” video products that includes sound capture and tripod setup to record video, find a member with basic editing tools to add titles and do some minor editing, and upload the video to YouTube for anyone to watch. For a lesser expensive option, I have been very impressed with the Flip Ultra HD. For $199.99 (list price), with two hours of high definition video and other amenities, it is a fine camera to mount on a tripod in a room and create a video. Find someone with a Mac that has iLife preloaded (like your blog host, an ANA member), and you have the beginnings of a basic editing studio.

- Going further into the electronic video publishing environment, uStream can be used to set up pay-per-view, on-demand video. While I would love to attend the Summer Seminar, I have found that my work schedule has not been flexible enough to take the time to attend. However, if some of the courses were available online, I would pay to watch the videos. This is the ultimate money maker that can be used to support the video production environment. Create the video from the Summer Seminar and offer it online after the World’s Fair of Money at a price for one-third of the on-site course. For the price, the watcher gets the information but does not have the ability to interact with the instructor and other students.

- If you search Google Books, you can find some of the books that are in the ANA library in the electronic catalog. There are also a few copies of The Numismatist available. These are all books and journals that have been scanned by university libraries in conjunction with Google. Has someone contacted Google to scan books whose copyrights have expired or out of print books (available through their court settlement with authors and publishers that will allow them to scan “orphaned” books) making them available for the entire numismatic community? Google provides much of the resources to do this and may welcome a different source of content for their vast online library.

In order to convince the ANA Lost Demographic to maintaining their membership, the ANA should add more electronic resources and consider price breaks for this demographic. First, create a new tier what I will call the Lost Demographic. The Lost Demographic member would be potential member who older than 23 but not older than 32, was a registered YN member at any time prior to turning 23, applied for the ANA’s Basic Membership—it would not be available for Regular Membership. Lost Demographic Basic Membership dues would be half of the difference between a Regular and YN membership. For example, the Basic one-year membership for YN is $14 and Regular members $28. For the Lost Demographic Basic Membership would be $21 per year.

Finally, I am not one to sit on the sideline and throw stones by telling others what to do. Once again, I am willing to volunteer my services as an ANA member and a computing professional. Although I have offered my voluntary services to the ANA many times in the past, I am using my personal soap box to offer my services. However, continued frustration will reduce my desire to help. Act now before it is too late!

Feb 12, 2011 | CCAC, coin design, commentary, US Mint

Before commenting on the CCAC Blueprint Report, I would like to note that the report has not been formally published by the U.S. Mint. It appears that the report was sent via email to a number of people who requested a copy. When I received a copy, I posted it here for the public to see. It appears as if the U.S. Mint takes an arms-length approach to the CCAC with regard to its support which shows in the lack of public information disseminated about the CCAC. While I appreciate the U.S. Mint Public Affairs Office sending a copy of this report, they should be more proactive in providing information about the CCAC to the public.

Also, it is not known whether the CCAC is accepting comments about the report. Page iii indicates that this is a final report and was transmitted to the Secretary of the Treasury. This is a shame since the document should clearly have been reviewed by others before its transmittal. While they could reject comments, accepting reviews from another perspective may have been helpful to tighten their sound recommendations.

Since they have not indicated whether they are accepting public comment, I am providing my commentary in this blog post. I will be contacting those CCAC members whose email address I know and point them to this commentary. I ask that they share this with the other CCAC members. They are invited to provide commentary to this blog post or contact me privately for further clarification. I am willing to help in anyway I can.

As with all my blog posts, comments from my readers are always appreciated!

Introduction

In 2007, speaking before the delegates at the International Art Medal Federation (Fédération Internationale de la Médaille d’Art or FIDEM) in Colorado Springs, then U.S. Mint Director Edmund Moy announced his vision “to spark a neo-renaissance for coin design and achieve a new level of design excellence.” But during design reviews by the United States Commission of Fine Arts and Citizens Coinage Advisory Committee during 2010, it was noted that the U.S. Mint was falling short of Director Moy’s goals.

In response, the CCAC formed the Subcommittee on Design Excellence to address the design quality issues. The subcommittee was chaired by CCAC Chairman and included CCAC members Roger W. Burdette, Mitch Sanders, Donald Scarinci, and Heidi Wastweet.

The subcommittee’s work is document in the report, A Blueprint for Advancing Artistic Creativity and Excellence in United States Coins and Medals that was approved by the CCAC as their official position on January 19, 2011. This 62-page report, of which the first 22-pages is the report with the balanced supporting Appendices, describes the reason the CCAC felt it needed to write this report, their findings investigating the issues, and recommendations for improvement.

While reading the documented investigation into the process’s of the U.S. Mint, it reads like the U.S. Mint is a typical federal government agency whose entrenched processes created many years ago are continued today because “that’s the way we’ve always done it.” The biggest flaw is that the Sales and Marketing Department is in charge of the coin design process. While this might have made sense many years ago, as the report points out, there is a conflict between the goals of the Sales and Marketing Department and the artistic nature of the coins produced by the U.S. Mint. Further complicating the situation is that the Sales and Marketing Department does not include someone with an artistic background overseeing the decisions.

Another part of the U.S. Mint bureaucracy is the Design Working Group (DWG) whose function was to coordinate manufacturing time tables and interface with stakeholder groups. Since the creation of the Artistic Infusion Program (AIP), the DWG has managed those artists and coordinating with the U.S. Mint Sculptor-Engravers. However, the report notes that the DWG does not include anyone with an artistic background.

CCAC’s Recommendation #1

The CCAC’s first recommendation is to remove the Sales and Marketing Department from the design process and abolish the DWG. Rather than these groups controlling the artistic design process, the report recommends that the U.S. Mint forms an Coin and Medal Design Department (CMDD) whose Division Chief has an artistic and management background. The CMDD would include all artists and include the management of AIP artists, management of stakeholder relations, and management of the die creating functions (Dies, Tools and Digital Control). While some may see this as the proverbial “shuffling of deck chairs,” it makes sense for the U.S. Mint to combine these functions under one manager and eliminate potential interdepartmental issues that occur within government agencies.

Although this is a sound recommendation, it appears that the recommendation continues to promote a bureaucratic approach for this new organization by creating three Associate Division Chiefs (ADC) to manage each of the major functions. While the ADC of Designing and Engraving should be the “Chief Engraver of the United States Mint” and the ADC of Dies, Tools and Digital Control should be a technical oriented person, it is questionable that the ADC for Stakeholder Relations is necessary. All the report says about the current stakeholder relations is that it is part of the Sales and Marketing Department without describing the basic job function and the level of effort to perform that job. Unless the CCAC and U.S. Mint can justify that the level of effort would require a full-time ADC, it would seem that the external contact and the person best suited to for this function would be the CMDD Division Chief. In fact, it should be recommended that this function be taken on by the CMDD Division Chief until such time as the level of effort is too great for this person to handle.

The report recommends that the DWC be replace by an interdisciplinary group to coordinate artistic and manufacturing schedules, a group referred to as the Timetable Task Force (TTF). According to the report, the TTP would be made up of representatives of Office of Chief Counsel, Sales and Marketing Department, and the Manufacturing Department and “should perform the scheduling function and advise the Art Director on historical, legal and technical matters.” This is absolutely the wrong approach to “fixing” what is wrong with the design issues. The design process already has too many inputs into the process. In order to provide more artistic freedom for the artists to create good designs, it is highly advisable to remove as many obstacles as possible. All design decisions including consulting with outside stakeholders (including the Office of Chief Counsel) should remain within the CMDD and managed by the Division Chief and Chief Engraver. The TTF should only concern itself with the timetable necessary to that will take the law passed by congress and have it manufactured, marketed, and sold to the public. The TTF should be limited to one representative of each department with the authority to speak for that department. Having worked in a federal government environment, having a large group of stakeholders meet is unwieldily and leads to a bad decision making process.

CCAC’s Recommendation #2

The CCAC’s recommendation to provide more artistic freedom for the U.S. Mint Sculpture-Engravers and improve the requests for proposals (RFP, the “call for artists”) for the Artistic Infusion Program is a necessary change the U.S. Mint needs to implement. The report rightly calls for the end of the practice U.S. Mint artists call “trace and bake” where artists are given materials to reproduce rather than rely on the artists talents.

It was surprising to learn that the U.S. Mint artists are not offered addition professional training, the opportunity to attend seminars or workshops, and are not allowed to attend artistic exhibits of coin and medallic art. The CCAC recommends that this change to allow U.S. Mint artists to advance themselves and promote their fine work. Funding must be set aside to support continuing education and promotion of the U.S. Mint’s talented artists. However, the recommendation does not include members of the AIP. Although the AIP artists are technically contract workers to the U.S. Mint, they should be afforded some opportunities to attend seminars and workshops that would benefit their work as part of the Artistic Infusion Program. While these opportunities would be offered on a lower scale than those offered to the full-time Sculpture-Engravers, it would benefit the U.S. Mint for these artists to be able to participate.

Although left out of the Summary section (Section 5), the recommendation for changes in working conditions in Section 4.3 is a key issue for artistic creativity. While the U.S. Mint should provide better working conditions by removing the cubicle farm and creating a studio-like design, the CCAC should have recommended that artists be given the opportunity to participate in a telework program. Missing from the report’s recommendation is how the U.S. Mint would implement “Telework Enhancement Act of 2010” (Public Law 111-292; 124 STAT. 3165) the could help improve the working environment of the U.S. Mint’s artists. Signed by President Obama on December 9, 2010—prior to the publishing of this report—the law calls for agency to “establish a policy under which eligible employees of the agency may be authorized to telework” within 180 days of enactment. The CCAC’s report should recommend that the U.S. Mint Sculptor-Engravers be allowed to telework in their own studios away from their current office at the Philadelphia Mint with a requirement to work at the Philadelphia facility for a certain amount of time to ensure appropriate collaboration. Not only would this provide the artists an opportunity to work comfortably, but it would help the U.S. Mint comply with the new law and begin compliance with the Presidential Memorandum “Accountable Government Initiative” of September 14, 2010.

CCAC’s Recommendation #3

The CCAC recommends that they and the CFA be more integral in the design and review process. After commenting on reducing the bureaucracy in Recommendation #1 (above), this recommendation by the CCAC will only increase it in the name of alleged oversight. First, the CCAC does not say how it will change its process in order to work within the schedule the U.S. Mint might require. Instead, the CCAC recommends that “[production] timelines should be designed to recognize the role of these groups.” Unfortunately, the CCAC does not recognize the will of congress that could force a change in normal scheduling practices by passing a coin-related bill the same year as the coin is produced. While this situation does not effect current production, it has happened in the past and is not recognized by the CCAC.

Routinely, the CCAC decries the U.S. Mint’s scheduling and how designs are thrusted upon them for their approval in order to meet production requirements. What the CCAC has not considered is that their own schedule of monthly meetings that may not fit an active manufacturing process. While all the employees are working daily to manufacture the coins and medals, the CCAC meets once per month in a scheduled three-hour morning session to conduct its business. Waiting for the CCAC to meet in order to gain their concurrence has to wreak havoc with production scheduling. It places the CCAC on the schedule’s critical path of the U.S. Mint’s design and manufacturing process. The CCAC should not be on the critical path. If the report is to hold the U.S. Mint accountable for improving its process, the CCAC must consider their own process improvement to support the changes. As part of these reforms, the CCAC should support Telework Enhancement Act of 2010 and consider holding virtual meetings as necessary to aid the U.S. Mint in its production process. In fact, as a public committee, the CCAC should extend their use of this technology to make the meetings and discussions more accessible to the public rather than requiring interested parties to travel the the U.S. Mint’s headquarters in Washington, D.C.

Further, the CCAC does not include verification from the CFA that they would be willing to participate in this process or has the flexibility to work within the U.S. Mint’s schedule for manufacturing the coin or medal. It should not the CCAC’s place to volunteer the CFA’s time and effort without their concurrence.

Second, the CCAC recommendation asserts itself too far into the design process. For most of the commemorative and bullion designs, the narrative is provided in the law passed by congress. Thus, there is no reason for the CCAC or CFA to be involved in those discussion. Where a narrative is necessary, it should be held with the stakeholders are previously recommended. Inserting the CCAC and CFA will add to bureaucratic process. Once the narrative is created, having the designs reviewed by the CCAC and CFA should remain part of the process. Reviews should be in the form of recommendations and not mandates. Artists should have the ability to reject recommendations for artistic (fitting the narrative) or technical reasons (ability to strike the coin properly) remembering that the law says the final decision rests with the Secretary of the Treasury—and by extension the Director of the U.S. Mint. However, as it was stated above, the CCAC and CFA must become more flexible in their scheduling so as to support the timeline requirements of the U.S. Mint.

The goal of this recommendation is to reduce the bureaucracy giving the artists freedom to be creative and not change the bureaucratic structure.

Additional Recommendation

It is unfortunate the the CCAC report does not properly address the bureaucratic nature of the design process and seek to reduce it or its impact on coin designs. While the above commentary attempts to reduce the bureaucracy there is one aspect of the coin design process that the CCAC does not discuss: why does it require two external committees to review coin and metal designs?

The CFA was established in 1910 to give expert advice to the “Federal and District of Columbia governments on matters of design and aesthetics, as they affect the Federal interest and preserve the dignity of the nation’s capital.” Their work consists of monitoring architectural development to historic buildings, statues, monuments, memorials, and other artwork in the public spaces in and around Washington, D.C. They also provide “advice to the U.S. Mint on the design of coins and medals.” In fact, their review of the coin and medal design is their only review that does not include physical development in Washington, D.C.

The CCAC was established in 2003 to provide a dedicated committee review all coin and medal designs replacing the Citizens Commemorative Coinage Advisory Committee, which only reviewed commemorative coins.

It seems that if both committees are doing the same work, it makes sense to consolidate the work into one committee. Since the CCAC is dedicated to advising the Secretary of the Treasury on coin and medal design and is only a part of what the CFA does, it makes sense to eliminate the review of coin and medal design from the CFA’s jurisdiction. This consolidation would also comply with the president’s Accountable Government Initiative.

Eliminating the CFA’s role in coin and medal design should not require an act of congress. The law that governs the CFA (40 U.S.C. §§ 9101–9104) does not mention coin and medal design as part of its jurisdiction. However, the Code of Federal Regulations (CFR) does include coin and medal design under the section for Statutory and Executive Order Authority (45 C.F.R. § 2101.1(d)). Since coin and medal design review is not a statutory requirement for the CFA, it should be recommended that the Secretary of the Treasury request that the President issue an Executive Order to remove this requirement from the CFR as part of the Accountable Government Initiative and reduce the bureaucracy.

A Final Thought

I have never hidden the fact that my professional experiences involve working with the federal government. Although I have never worked with the U.S. Mint, I am familiar with the bureaucracy of other bureaus within the Department of the Treasury. Using my understanding of the bureaucratic nature of these agencies and my background in public policy, I hope the CCAC will consider my recommendations to help improve the subcommittee’s report so that they reach their goal of improving coin and medal design at the U.S. Mint.

Jan 31, 2011 | ANA, commentary

I have never had a reaction to anything I wrote as I have regarding electronic publishing. Not only have I heard from numismatic publishers, but on the E-Sylum newsletter from the Numismatic Bibliomania Society. The editor of the E-Sylum electronic newsletter has been posting excerpts from my postings regarding electronic publishing and responses from other readers.

One of the responders is David Lange, Research Director at Numismatic Guaranty Corporation and author of many excellent books. His latest book, Coin Collecting Boards of the 1930s & 1940s, opens the history of how coin boards changed the collecting habits of millions of collectors—a book I recommend. However, in response to my request for more electronic publication, Dave writes:

The problem I have with doing a book solely in electronic format is one which many numismatic authors and publishers may have encountered—ours is a hobby that caters mostly to older people. I know that the buyers of my current book and the subscribers to my price lists and newsletters are mostly my age and older.

Not to pick on Dave, but his response is an endemic problem with the hobby. Numismatics is dominated by many people over 50. If there is a second age group, it is younger than 18. Missing in the demographic are those from 18-50 who might have been a Young Numismatist but dropped out in college and did not return until after their children have grown. This situation is unacceptable if the hobby is to survive!

One question I have: where is the American Numismatic Association in this discussion?

Sure, the ANA now offers editions of The Numismatist online, but where is the rest of their outreach? Twitter and Facebook are only outreach tools, they are not delivery platforms. The ANA has wonderful programs for Young Numismatists to bring those under 18 into the hobby, but what programs do they have to keep them engaged? Even though the YN program extends to 22, keeping those in college or trying to start careers interested as they mature into their lives is severely lacking.

The ANA can offer better outreach to this connected demographic by the appropriate use of technology. This does not have to cost a lot of money. It takes a little imagination to figure out where these potential members congregate online and deliver new content.

For example, hometown coin clubs may not be accessible to collectors at college. What about virtual coin clubs? The ANA can create “Numismatic Counsellors” to hold periodic meetings that members could access from anywhere. Presentations can be given online by anyone or the meeting can consist of videos, show and tell, and discussion amongst members. And for an average cost of $4,000-5,000 per year, it could be the least expensive outreach the ANA could do.

Has the ANA ever thought to using this service to bring the Coins in the Classroom program on line? When teachers register for the seminar, Education Department could send the materials via regular mail. When the seminar is held teachers can login to the online classroom to support this program. It would reduce travel, lodging, and room rental costs for those taking the online seminar. And the ANA can hold more of these seminars to further the outreach to a new audience.

I have many more examples of how the ANA could reach out to more people—like using a streaming video service during the ANA conventions. However, the last time I wrote to the ANA Board to discuss a previous post, I was disappointed with the response. I volunteered my services as someone with over 30 years in the computing industry and have not heard back from anyone mentioned in various email notes. DISCLAIMER: Shortly after writing my note my work assignment changed limiting my time, but I could help in smaller ways.

However, if something happened to limit my time, an organization should never ignore a member who is volunteering to help. Not only do I have experience in this area, you never know when my situation will change that will allow me to participate further.

I think the hobby is losing a lot of potential members by not using technology to keep members interested after they are YNs. Especially over the last ten years, as YNs grow up and transition to young adults, they are very comfortable with technology. They are very heavy consumers of electronic content. If the ANA provides its outreach online where these potential members are, maybe the age demographic of the hobby will be more distributed than it is today.

Jan 18, 2011 | books, commentary, technology

I am amazed at the response I have received over the topic of digital books. For those who wrote to me directly echoing my call for more, I wish you would add them as comments to my posts. I think the numismatic publishers would like to see your comment—especially since I have been contacted by both the publishers at Whitman Books and Krause Publications, they are reading and paying attention!

Roger deWardt Lane reports that his book Encyclopedia Small Silver Coins: Brother Can You Spare A Dime about modern dime-sized silver coins of the world can be purchased in both paper form and as a download. Roger also said that he gave permission to Google Books to add it to their digital database.

Thijs Verspagen wrote to let me know that he maintains the Digital Library Numis that links to many electronic numismatic books and articles that can be freely downloaded. The site has quite a list of a variety of downloadable numismatic publications.

I also heard from Scott Tappa, Publisher at Krause Publications. Scott reports that two Krause books are now available on the Kindle. Scott writes:

This year you will see more and more KP books available for e-reader devices like the iPad, Kindle, Nook, etc. For instance, here are links to Kindle editions of two recent releases, Warman’s U.S. Coin Collecting and Canadian Coin Digest. (click on the titles to view the listings at Amazon.com)

Numismatic books face certain challenges in formatting for e-readers. In particular, our catalogs are image-heavy, which makes them very large files, which can make them difficult to download. Thus, expect to see KP create e-reader specific products that are smaller and more focused than our large catalogs.

Our parent company, F+W Media, has made e-books a top priority. In fact, we are hosting the second annual Digital Book World conference in New York City starting January 24, and are keenly focused on staying at the front of this market revolution.

Numismatic publishing is a niche business. While it is a large niche, publishers are competing for the best content, the best authors, and access to the same distribution sources. These companies have to be responsive to what their readers want. I am sure that these publishers welcome your feedback.